Instructions 02 count

Instructions for using the chart of accounts for accounting financial and economic activities of organizations in accordance with Order No. 94n dated October 31, 2000.

Account 02 “Depreciation of fixed assets” is intended to summarize information on depreciation accumulated during the operation of fixed assets.

The accrued amount of depreciation of fixed assets is reflected in accounting under the credit of account 02 “Depreciation of fixed assets” in correspondence with the accounts of production costs (sales expenses). The lessor organization reflects the accrued amount of depreciation on leased fixed assets as a credit to account 02 “Depreciation of fixed assets” and a debit to account 91 “Other income and expenses” (if rent forms other income).

Upon disposal (sale, write-off, partial liquidation, transfer free of charge, etc.) of fixed assets, the amount of depreciation accrued on them is written off from account 02 “Depreciation of fixed assets” to the credit of account 01 “Fixed assets” (sub-account “Disposal of fixed assets”). A similar entry is made when writing off the amount of accrued depreciation for missing or completely damaged fixed assets.

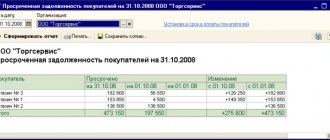

Analytical accounting for account 02 “Depreciation of fixed assets” is carried out for individual inventory items of fixed assets. At the same time, the construction of analytical accounting should provide the ability to obtain data on the depreciation of fixed assets necessary for managing the organization and drawing up financial statements.

Typical postings for account 02

By debit of the account

| Contents of a business transaction | Debit | Credit |

| Write-off of depreciation on fixed assets disposed of as a result of sale, liquidation, gratuitous transfer to reduce the original cost | 02 | 01 “Disposal of fixed assets” |

| Depreciation on a fixed asset item included in property intended for rental was transferred to a separate subaccount | 02 | 02 |

| Depreciation on property previously intended for rental and transferred to fixed assets was transferred to a separate subaccount | 02 | 02 |

| Depreciation on retired fixed assets intended for rental is written off to reduce its original cost | 02 | 03 |

| Depreciation of exploration assets transferred to fixed assets or intangible assets is written off as a reduction in initial cost. | 02 | 08 |

| Depreciation on fixed assets transferred to a branch allocated to a separate balance sheet was written off (posting in the accounting of the head office) | 02 | 79-1 |

| Depreciation on fixed assets transferred to the head office was written off (posting in the branch accounting) | 02 | 79-1 |

| Depreciation on fixed assets transferred to trust management was written off (in the accounting of the management founder) | 02 | 79-3 |

| Depreciation on fixed assets previously received for trust management and returned to the founder of the management was written off (on a separate balance sheet of the trust) | 02 | 79-3 |

| The amount of depreciation is reduced when the value of fixed assets decreases as a result of revaluation | 02 | 83 |

By account credit

| Contents of a business transaction | Debit | Credit |

| Depreciation has been accrued for fixed assets used in the reconstruction or modernization of other fixed assets | 08 | 02 |

| Depreciation has been calculated on fixed assets used to create intangible assets | 08 | 02 |

| Depreciation was accrued for fixed assets used during the construction of the facility for the organization’s own needs | 08-3 | 02 |

| Depreciation was calculated on fixed assets used in the main production | 20 | 02 |

| Depreciation was calculated on fixed assets used in auxiliary production | 23 | 02 |

| Depreciation has been accrued on fixed assets for general production purposes | 25 | 02 |

| Depreciation has been accrued for general purpose fixed assets | 26 | 02 |

| Depreciation was calculated on fixed assets used in service production | 29 | 02 |

| Depreciation was accrued on fixed assets intended to support the sales process | 44 | 02 |

| Depreciation has been calculated on the fixed assets of a trading organization | 44 | 02 |

| Depreciation was taken into account on fixed assets received from the head office of the organization, allocated to a separate balance sheet (posting in the branch accounting) | 79-1 | 02 |

| Depreciation on fixed assets received from a branch allocated to a separate balance sheet is taken into account (posting in the accounting of the head office) | 79-1 | 02 |

| Additional depreciation was accrued on fixed assets, the cost of which increased as a result of revaluation | 83 | 02 |

| Depreciation has been accrued on fixed assets leased (renting is not the subject of the organization’s activities) | 91-2 | 02 |

| Depreciation has been accrued on fixed assets used in the performance of work, the costs of which are taken into account as deferred expenses. | 97 | 02 |

>Account 02 “Depreciation of fixed assets”

Characteristics of account 02 “Depreciation of fixed assets”

Account 02 is used by all business entities that have expensive property: offices and production workshops, machinery and equipment. Its characteristics include the following:

- The account shows the depreciation of the company's fixed assets, i.e. elements of property that are acquired by it for its own use for at least 12 months, belong to the right of ownership and are used in many production cycles;

- within its framework, sub-accounts are opened in which depreciation is collected separately for each asset owned by the legal entity;

- sch. 02 corresponds with accounts that show different types of expenses of a business entity;

- it plays the role of a “transit zone”: the amounts collected on it upon disposal of fixed assets (regardless of the reason) are written off to the credit account. 01 and reduce the initial cost of the asset.

Account 02 “Depreciation of fixed assets” is passive. This means that the depreciation charge is shown on his loan. It reduces the value of the property and is written off when it is sold (liquidated). Thus, accounting reflects the process of transferring the value of the enterprise’s assets to finished products and assigning them to cost.

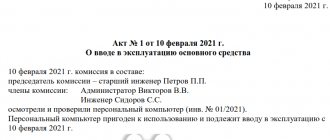

Account 01 in accounting

Postings

Depreciation accrued to account 02 is reflected on the loan. At the same time, it corresponds with items reflecting production/sales expenses. The lessor company transfers amounts to account 02 on credit and debits them. This entry is made when fees for the loan of assets are recognized as operating income. In case of write-off, sale, gratuitous transfer, partial liquidation and other disposal, the amount is transferred to the credit account. 01. A similar entry is made when writing off accruals for completely damaged or missing OS. It is advisable to carry out analytical accounting of depreciation charges on the same registers where analytics on fixed assets are maintained. If the financial policy of an enterprise provides for two rates of accruals, then the specialist performs, respectively, 2 types of calculations.

Typical transactions for account 02

Accounting account 02 “Depreciation of fixed assets” is used in the following standard transactions:

- D 20 – K 02 – calculation of depreciation on objects used for the production of goods (rendering services).

- D 23 - K 02 - a similar operation for an OS object used in auxiliary production (for example, in a boiler room, laundry at an enterprise, etc.).

- D 25 - K 02 - depreciation on property used for general production needs (for example, a bus that takes workers to the enterprise from the metro every day).

- D 26 - K 02 - a similar operation for assets used for general business purposes (an expensive computer for a company programmer, an office where managers sit, etc.).

- D 29 - K 02 - depreciation of objects used in the service departments of the enterprise.

- K 91 - D 02 - a similar operation for property leased to third parties (if the rental is not systematic).

- K 83 - D 02 - additional depreciation if the cost of fixed assets has increased as a result of revaluation.

How is account 02 “Depreciation of fixed assets” closed? The accountant needs to make an entry so that the amounts accumulated in his credit for the assets of the enterprise are debited, and the balance becomes zero. This operation is performed in the following cases:

- sale of an asset;

- his donation;

- transfer to a separate unit;

- liquidation if the asset is no longer capable of providing economic benefits to the company.

In these situations, the accountant reduces the cost of the object by the amount of depreciation accrued during the period of its use. This is reflected by the following entries:

- D 02 – K 01 – for OS used for own needs;

- D 02 – K 03 – for assets leased out (provided on lease);

- D 02 – K 79 – for property transferred to the branch.

When the accountant has closed account 02 “Depreciation of fixed assets,” he writes off the residual value of the asset as part of the enterprise’s other expenses. For this, wiring is used: D 91 - K 01.

If you find an error, please select a piece of text and press Ctrl+Enter.

Features of transferring amounts to account 02

Fixed assets can be used in a variety of ways. However, regardless of this, when calculating amounts, a number of rules established by regulations must be followed. In particular, the charge to account 02:

- Starts with the month that follows the period in which the object was capitalized.

- Performed regardless of the results of the enterprise.

- Terminates on the 1st day of the month following the month of final repayment of the cost or write-off of the object.

- It is not interrupted during the period of useful operation, except for the cases provided for by regulatory enactments.

Features of depreciation accounting

Accrued depreciation charges (AM) are accumulated in special account 02 in accounting. Depreciation accounting is carried out for each property of the company. It is unacceptable to make accounting entries without detailing the accounting objects.

Taking into account the peculiarities and specifics of its activities, each company has the right to open additional sub-accounts to account 02. Such detailing is carried out by the types of property assets owned by the company. For example, the company uses subaccounts: 02-01 - depreciation for buildings; account 02-02 - depreciation of machinery and equipment; 02-03 - AM on vehicles.

A complete list of subaccounts used should be determined individually for each company and fixed in the accounting policy.

Let us note that the property must be owned, because assets accepted for temporary safekeeping are not accepted on the balance sheet and are subject to accounting off the balance sheet, on the books. account 002. For assets capitalized on off-balance sheet accounts, depreciation is not accrued. However, there are exceptions. For example, objects received for rent or under leasing agreements, which, according to the terms of the agreement, must be taken into account on the balance sheet of the lessee.

Assets received free of charge

Order of the Ministry of Finance No. 34n dated July 29, 1998 established a list of the company’s fixed assets for which depreciation is not charged. This list is valid from January 1, 2001. It includes:

- Objects whose consumer characteristics do not change over time. These include, in particular, land plots.

- Housing fund. Here it is necessary to take into account that for objects that are operated by an enterprise to make a profit and are reflected in the account for accounting for profitable investments in material assets, depreciation is calculated according to general rules.

- Landscaping and forestry facilities.

- Productive livestock, deer, oxen, buffalo.

- Road infrastructure facilities.

- Perennial plantings that have not reached operational age, etc.

Before the approval of Order No. 31n, which amended the above list, depreciation was not accrued on objects received in accordance with donation agreements and free of charge during privatization. They were included in the list on January 1, 1998. Depreciation was not accrued for fixed assets received free of charge and under donation agreements only from January 1, 1998 to December 31, 1999. Currently, discussions are ongoing regarding objects acquired before January 1, 2000 .

Accounting structure and typical postings

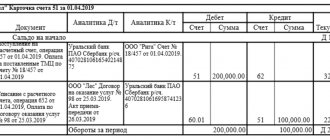

As we noted earlier, accounting account 02 is used to maintain accounting records for the amounts of calculated AM in the context of each property and tangible asset.

02 which account: passive or active? Accounting account 02 is passive, since the amounts of accrued depreciation on property objects are reflected as a credit, and the write-off of the calculated AM is reflected as a debit.

Account structure:

- the credit balance at the beginning of the reporting period shows the amount of calculated depreciation at the beginning of the reporting period;

- credit turnover for the period reflects the amount of accrued AM for the selected period of time;

- debit turnover in accounting account 02 indicates the amount of written-off depreciation charges for retired objects (written off, sold, transferred to third parties);

- The credit balance at the end of the reporting period is the amount of accumulated depreciation charges at the end of the reporting period.

Typical wiring:

| Operation | Debit | Credit |

| Depreciation calculated: | ||

| According to OS of main production | ||

| By property used in auxiliary workshops | ||

| For OS objects operated for general economic and general production needs | ||

| Accrued depreciation on the property of a trading company (AM is included in sales expenses) | ||

| For assets leased or leased | ||

| AM was additionally accrued due to the revaluation of fixed assets | ||

Depreciation of fixed assets in accounting and tax accounting

During use, OSs lose their value due to wear and tear. Depreciation is the inclusion by fixed assets of their value over a certain period of time in finished products, works, and services.

Fixed assets in accounting and tax accounting have different criteria for classifying objects according to their value.

In addition, not all methods of calculating depreciation can be used in tax accounting. For this reason, there may be discrepancies in the amount of depreciation in accounting and when determining taxes.

For tax accounting purposes

The Tax Code of the Russian Federation establishes that fixed assets will be objects with a long service life and a price of 100,000 rubles and more.

Depreciation of fixed assets is calculated based on the original cost and the depreciation rate, which is determined based on the period of operation of the object.

Objects priced below 100,000 rubles must be shown in accounting as materials, so their price is immediately included in the cost of finished products.

The same objects that are defined as basic in tax accounting must be depreciated either linearly or nonlinearly.

The first of them involves determining the depreciation rate based on the useful life. The depreciation rate per year is calculated by dividing the unit by the useful life and multiplying by 100%. This method can be applied in tax accounting to all fixed assets.

Attention! The nonlinear method is applied only to operating systems whose application period does not exceed 20 years (group 1-7). Depreciation is determined based on the residual value of the object and the depreciation rate, which is determined for each group based on the period of use of the asset.

For accounting purposes

PBU establishes that fixed assets in accounting include objects with a price of 40,000 rubles or more. Subjects have the right to charge objects with a price less than the established criterion as expenses as materials. For objects that are priced as fixed assets, depreciation charges must be calculated.

In this case, companies and individual entrepreneurs have the right to use one of certain methods:

- Linear - by multiplying the original cost by the depreciation rate calculated based on the useful life.

- Declining balance method (non-linear) - by multiplying the residual value by the depreciation rate calculated based on the useful life.

- Proportional to the number of remaining years of use - the initial cost is multiplied by a coefficient defined as the number of years of use of the OS by the sum of the number of years of use.

- Proportional to the volume of products produced - the initial cost is multiplied by the number of products produced and divided by the planned volume of products that can be produced at the facility for the entire period of its use.

Account 01. Fixed assets

Account 01 is an active accounting account in which the value of fixed assets of a commercial organization is recorded. Account 01 reflects the full range of information about property objects - their receipt, movement, disposal from the assets of the enterprise.

Fixed assets: concept and nuances

Generalized information about fixed assets (FPE) of an enterprise is collected on account 01 of any commercial organization that has such funds. PBU 06/01 gives several signs by which a tangible asset can be classified as fixed assets:

- The useful life of such an asset must exceed 12 months from the date of commissioning.

- The enterprise uses this asset to obtain economic benefits.

- An asset classified as a fixed asset must be used by the enterprise in production or management or for rental.

- The object is not intended for subsequent resale.

- The asset must have a value of more than RUB 40,000.

At the same time, the limit on the value of assets is 40,000 rubles. is not required for accounting purposes. If all the above 4 parameters are met, then the asset can be classified as fixed assets, even if its cost is less than 40,000 rubles. The main condition is that the parameters for classifying an asset as fixed assets must be clearly specified in the accounting policy. It is necessary that the first 4 criteria are met, according to which an asset is classified as fixed assets.

Assets with a value of less than 40,000 rubles can be reflected as part of inventories, if for some reason it is more convenient for the enterprise to account for them in this way (clause 5 of PBU 06/01). Then the write-off of such assets classified as inventories is carried out as part of the expenses of the period.

IMPORTANT! Clause 5 of PBU 06/01 only allows for the possibility of classifying assets worth up to 40,000 rubles. to the composition of reserves, without making this condition mandatory. For accounting purposes, an enterprise has the right to independently resolve this issue within the framework of its accounting policies.

Accounting for fixed assets on account 01 is carried out divided into groups, depending on the period of use. Inside, each group is divided into subgroups in accordance with the types of operating systems (buildings, equipment, mechanisms, vehicles, etc.). From January 1, 2021, changes are being introduced to the classification of fixed assets (Resolution of the Government of the Russian Federation dated July 7, 2016 No. 640 “On introducing amendments to Resolution of the Government of the Russian Federation dated January 1, 2002 No. 1”, hereinafter referred to as Resolution No. 640).

Fixed assets

The OS includes:

- production equipment and machinery;

- buildings and constructions;

- roads;

- transmission networks (heating networks, electrical networks, etc.);

- means of transport;

- power machines and equipment;

- various equipment and tools;

- working and breeding livestock;

- other OS.

In addition, fixed assets include capital investments in leased fixed assets, in land improvement, and the land plots themselves. Fixed assets, as non-current assets, participate in the production process as a means, not an object.

Conditions for recognizing an object as a fixed asset

To recognize an OS object, the following conditions must be present simultaneously:

- purpose - use in the production activities of the organization;

- expected SPI over 12 months;

- promising economic benefits;

- not intended for resale.

OS costing less than 40,000 rubles. can be taken into account as part of inventories and immediately written off as costs.

Accounting Features

Assets are taken into account at historical cost (excluding VAT and other refundable taxes). In this case, the cost of fixed assets should not be less than:

- 40,000 rubles – for financial accounting;

- 100,000 rubles – for tax accounting.

The initial cost includes:

- price of purchase/transfer of property;

- associated costs - delivery, installation, construction, configuration, etc.

The receipt of fixed assets or their increase in price is recorded by debit transactions. If the value of property assets decreases or they are completely disposed of, this is reflected in the credit turnover.

Fixed assets accounted for in account 01 are divided into three groups:

- subject to depreciation;

- non-depreciable;

- depreciated, but continue to be used (the cost is transferred to expenses).

Property assets are reflected in the balance sheet at their residual value. It is equal to the difference between the original cost and depreciation expenses. Depreciation is accrued from the month following the commissioning, and accruals cease from the next month after the cost of the object has been completely written off.

Main correspondence of account 01

Typical correspondence of the fixed assets accounting account is presented in the table:

OS upgrade

Modernization of fixed assets is the transformation of the operating system, which led to an improvement in its characteristics.

An increase in the cost of fixed assets due to the modernization or reconstruction of an object is reflected by standard posting:

| Dt | CT | Operation description |

| 01 | 08 | Cost increase amount |

Increase in value after revaluation:

| Dt | CT | Operation description |

| 01 | 83 | Revaluation amount |

Depreciation of fixed assets

Depreciation of fixed assets in accounting refers to the gradual transfer of their value to the cost of manufactured products.

There are categories of property that are not subject to depreciation:

- land;

- environmental management facilities;

- livestock;

- non-production housing facilities;

- forestry, road management;

- external landscaping.

If repairs last more than one year, and conservation of objects lasts more than three months, then depreciation is suspended.

In the balance sheet, fixed assets are reflected at their residual value: original cost minus accumulated depreciation. Non-depreciable property is reflected in the balance sheet at historical cost.

Depreciation starts from the month following the commissioning date. The accrual will stop in the next month after the cost has been completely written off.

The procedure for determining the useful life of property

When determining the period of use of an OS object, a business entity must be guided by the following rules:

- First of all, it is necessary to use the approved OKOF classification. It is a table that lists all kinds of OS groups and the corresponding period of use. Typically the period is specified as an interval (for example, 10 to 15 years). A business entity has the right to choose any number of years included in this period.

- If an OS object is not assigned to any group according to the classifier, then it is necessary to establish the time of its use based on technical documentation or recommendations of the manufacturer (an indication of this is established by the Tax Code);

- If this information cannot be obtained, then you must contact the Ministry of Economic Development.

Attention! The established useful time must be secured at the disposal of the manager, or recorded in the transfer and acceptance certificate OS-1.

When determining the period of use for an OS that has already been in use, it is necessary to determine its period according to the group and subtract from it the time of operation at the previous place of work.

If the last period cannot be determined, then the company sets the time of use independently, but taking into account safety requirements. The law establishes the conditions under which it is possible to change the period of use of the OS after its commissioning.

This can be done in the following cases:

- Upon completion;

- When retrofitting;

- During reconstruction;

- During modernization.

Attention! The main conditions for extending the period are the fact that the characteristics of the OS object have changed so that it can be used longer than the previously determined period. However, the application time can only be extended to the previously accepted time of use.

Characteristics of account 02

To account for the amounts of calculated depreciation of fixed assets, account 02 “Depreciation of fixed assets” is used. It is passive, i.e., the calculated depreciation amounts on it are shown as a credit, and their write-offs are shown as a debit.

The account has the following structure:

- Initial loan balance - shows the amount of accumulated depreciation at the beginning of the billing period;

- Debit turnover - shows the amount of depreciation written off due to disposal of fixed assets, sale, etc.;

- Loan turnover - shows the amount of accrued depreciation;

- Final loan balance - shows the amount of accumulated depreciation at the end of the billing period.

The final balance is determined using the following algorithm: credit turnover is added to the initial balance and debit turnover is subtracted.

For reliable and complete reflection of information, analytical accounts are opened for each asset object.

The balance of this account is not reflected directly in the balance sheet. The balance on it reduces the balance on account 01.

Attention! Account 02 is closed only when an asset is completely written off from the balance sheet - upon sale, liquidation, etc. Until this point, the balance should always be there and show the amount of wear and tear on the asset at the current time. The account is closed by writing off the balance to account 01 or 91.

Accounting for depreciation

To reflect information on the total values of depreciation of an enterprise's property, the standard chart of accounts provides for account 02 02. The rules for maintaining records within its framework are the same for all organizations. From the concept of depreciation, the reader already knows that these are amounts that serve as a source for the acquisition of new fixed assets after the completion of the operation of the property in question. Based on this, account 02 “Depreciation of fixed assets” is passive. Accrual will be carried out on credit, and write-off on debit.

Analytical accounting can be carried out for certain types of property. The names of subaccounts, as a rule, correspond to the types of 01 accounts, since they directly interact with them.

At the end of the month, a credit balance is formed on the account, the value of which is reflected in the financial statements. There is no separate column for data on depreciation balances in the balance sheet. But when calculating line 120 “Fixed assets”, the credit balance of account 02 is subtracted from the value of the debit balance of account 01.

Accounting entries for account 02

Account 02 is involved in the following standard transactions.

Depreciation calculation based on the degree of participation of fixed assets in the production process

| Debit | Credit | Operation |

| 08 | 02 | Calculated depreciation on operating systems used when upgrading other operating systems |

| 08/3 | 02 | Depreciation was calculated for fixed assets used in the construction of one’s own fixed assets facility |

| 20 | 02 | Depreciation was calculated for fixed assets used in the main production |

| 23 | 02 | Depreciation was calculated for fixed assets used in auxiliary production |

| 25 | 02 | Calculated depreciation for fixed assets for general production needs |

| 26 | 02 | Calculated depreciation for fixed assets for general business needs |

| 29 | 02 | Depreciation was calculated for fixed assets used in maintenance services |

| 44 | 02 | Depreciation was calculated for fixed assets used in servicing the sales process |

| 79 | 02 | Depreciation was calculated for fixed assets received from another division or transferred there |

| 91/2 | 02 | Calculated depreciation for fixed assets leased |

| 97 | 02 | Depreciation was calculated for fixed assets used in processes, the costs of which will be taken into account in future periods |

Write-off of accrued depreciation

| Debit | Credit | Operation |

| 02 | 01/Disposal | Write-off of depreciation on fixed assets that were disposed of, sold, liquidated, etc. |

| 02 | 03 | Write-off of depreciation on fixed assets that were intended for rental |

| 02 | 79 | Write-off of depreciation on fixed assets that was received or transferred to another division |

Depreciation upon revaluation

| Debit | Credit | Operation |

| 02 | 83 | Accrued depreciation when revaluing fixed assets has been reduced |

| 83 | 02 | Additional depreciation was accrued when revaluing fixed assets |

Inventory assets received before the transfer of ownership to the enterprise are reflected in off-balance sheet account 002. Let's consider in what cases account 002 is used in accounting, as well as postings to account 002 using an example.

Infographics. Account 02 “Depreciation of fixed assets”

The figure below shows accounting account 02 “Depreciation of fixed assets” in infographics, showing typical entries and accounting basics (click on it to open the picture in wide resolution).

Account 02 in accounting. “Depreciation of fixed assets” in infographics. Typical postings and accounting

In addition to depreciation on fixed assets, depreciation is charged on intangible assets (account 05); intangible assets include objects that do not have a clearly defined physical form, but generate income: business reputation, patents, copyrights for inventions, etc. For more information about the depreciation of intangible assets, read the article: “Account 05. Amortization of intangible assets: examples, postings.”

Typical transactions for off-balance sheet account 002

| Account Dt | Kt account | Transaction amount, rub. | Wiring Description | A document base |

| 002 | — | 10 000 | Received for safekeeping goods and materials that were found to be defective, non-compliant with quality, assortment and subject to return due to violation of contractual obligations | Invoices TORG-12, 1-T, M-15, certificate of discovery of defects in goods, accounting certificate |

| — | 002 | 10 000 | Inventory items returned to the supplier are written off off-balance sheet | Invoice TORG-12, act of discovery of defects in goods |

| 002 | — | 12 000 | Received for safekeeping of goods and materials, with special conditions for the transfer of ownership, for example, after payment | Invoices TORG-12, 1-T |

| — | 002 | 12 000 | Inventories written off off-balance sheet due to the transfer of ownership to the buyer | Bank statement |

| 002 | — | 15 000 | Goods and materials, paid for but not removed by the buyer, were accepted for safekeeping | Invoice TORG-12 |

| — | 002 | 15 000 | Inventories left by the buyer for safekeeping are written off from off-balance sheet accounting. | Consignment note 1-T |

| 002 | — | 18 000 | Received goods and materials under a storage agreement | Transfer and acceptance certificate MX-1, accounting certificate |

| — | 002 | 18 000 | Return of goods and materials to the owner under a storage agreement | Act MX-3, accounting certificate |

| 002 | — | 20 000 | Inventory and materials were accepted for safekeeping due to the pledgor’s failure to fulfill obligations under the pledge agreement | Pledge agreement, accounting certificate |

| — | 002 | 20 000 | Inventory and materials received under a pledge agreement were sold | Invoice TORG-12 |