When the entry is applied: Debit 43 Credit 43

Let's consider several situations.

Example 1

LLC "Choco Land" is engaged in the production of chocolate. When finished chocolate arrives from production to the warehouse, an entry is made in accounting: Debit 43 Credit 20 - means capitalization of finished products in the warehouse

The posting is registered on the basis of the invoice for the transfer of finished products to storage locations.

More information about how the invoice should be drawn up correctly is described in the article “Unified form No. MX-18 - form and sample.”

Example 2

Let’s say that during the crisis, plain chocolate began to be bought less frequently. Then Shoko Land LLC decided to produce chocolate with game inserts. To do this, we had to open additional production for the production of gaming inserts.

In this case, after receiving the main and additional products, the following postings are made:

- Dt 43 (subconto “Chocolate”) Kt 20 - ready-made chocolate arrived from the main production;

- Dt 43 (subconto “Inserts”) Kt 20 - manufactured gaming inserts were received from additional production to the warehouse.

Due to the fact that chocolate and inserts for it are planned to be sold as one product, a summary entry is made: Dt 43 (sub-account “Chocolate”) Kt 43 (sub-account “Inserts”), i.e. the cost of manufactured inserts is reflected in the main products - chocolate.

When you should not use wiring Dt 43 Kt 43

Organizations often use posting Dt 43 Kt 43 to account for deviations of the actual cost from the planned one.

IMPORTANT! You should not use this method of accounting for deviations, since it does not comply with the requirements of the order of the Ministry of Finance of Russia “On approval of the Chart of Accounts” dated October 31, 2000 No. 94n.

Reflection of deviations between actual and planned costs of production using account 43 must comply with regulatory requirements.

Example 3

Shoko Land LLC sold part of the chocolate in the middle of the month, when the actual cost of the products had not yet been calculated. If the accounting policy does not provide for the use of account 40, entries are made:

- Dt 43 Kt 20 - chocolate is transferred to the warehouse at the planned cost;

- Dt 90 Kt 43 - the planned cost of chocolate is written off as expenses after its sale.

At the end of the month, when all production expenses are closed and the results for them are summed up, similar adjustment entries are made to the above entries for the amount of the difference between actual costs and the planned price. There is no need to make any internal postings to account 43.

IMPORTANT! As part of finished products, semi-finished products of your own production and movements along them cannot be taken into account in a separate subaccount. Account 21, provided for in the Chart of Accounts, is intended for this.

Accounting for finished products 43 account

From our point of view, accounting for finished products and various production operations in general are among the most interesting in company accounting. It is for this reason that a lot of time is devoted to them in our video courses for the 1C: Accounting program, as well as in online courses.

The issue of accumulating production costs across product groups is discussed in detail in the video course and online classes.

In most cases, product accounting does not cause difficulties if the enterprise is small. For medium and large companies, the situation is somewhat different, since the composition of the product range and types of expenses, as well as other features of large production, make accounting more difficult.

But in general, the information discussed in this article is basic and can be applied without much difficulty in any production. If you have your own examples related to the use of account 43 in accounting for finished products, write a comment after the article. This will help other aspiring accountants as this question is quite popular.

Account 20. accounting of production costs: postings

Show at any time.

- Price: 8,899,999 RUB.

- Price per m²: 110,422 RUB.

- Type: Apartment

- Rooms: 3

- Building material: Panel

- Floor: 8/25

- Object type: Secondary

- Area: 80.6 m²

- Kitchen area (m²): 14 m²

- Living area (m²): 45 m²

- Ad update date: 11/04/2018

- Ad publication date: 02/20/2017

- Catalog number: 178629296

Nedorubova street building 20 building 1, Nekrasovka, Moscow Nekrasovka Create a note Write down what is useful to remember about this object.

You'll see all your notes when you sign in. Cancel Save This offer Similar offers Average price index for apartments, rub.

Accounting entries for main business transactions with account 90

- Receipt of funds from the buyer for sold products, works, services:

Dt50 Kt90.01 – cash payment;Dt51 Kt90.01 – through a current account;

Dt52 Kt90.01 – receipts in foreign currency;

- Display of sales revenue:

- Cost display:

Dt90.02 Kt20 – cost of work, services;Dt90.02 Kt41 – accounting price of goods.

- Reversal of trade margins at retail enterprises:

- VAT and excise taxes included in the cost of goods sold:

Dt90.03 Kt68 – VAT;Dt90.04 Kt68 – excise taxes.

- Financial result for ordinary activities:

Dt99 Kt90.09 – loss;Dt90.09 Kt99 – profit.

Victor Stepanov, 2017-12-04

Accounting for finished products (account 43): postings, example

Author of the article Olga Lazareva 15 minutes to read 3,974 views Contents Account 43 is used in accounting by enterprises in the production sector to reflect transactions with finished products.

This product is called a semi-finished product and is included in Dt 21 - Kt 21 reflects its disposal.

In the article we will talk about the specifics of using account 43, and also look at typical transactions and examples of operations with finished products. To reflect the receipt of finished products (GP) of our own production, we use Dt 43. When writing off finished products (expenses, defects, shipment, transfer, etc. .p.) make entries according to Kt 43. Acceptance of GP for accounting can be carried out in several ways.

Here are some of them: Debit Credit Description Document 4320, 23, 29 Receipt of SE from production to the warehouse of the enterprise (main/auxiliary/service production). Receipt invoice 4376 Receipt of SE as part of the enterprise Acceptance and transfer certificate 4380 SE accepted as a contribution to the authorized capital Protocol of the board's decision 4398 SE taken into account as a discount provided to the buyer Commodity invoice (understand how to keep accounting records 72 hours in advance)

Wiring Dt 43 and Kt 43, 20 (nuances)

Accounting Expand the list of categories Subscribe to a special free weekly newsletter to keep abreast of all changes in accounting: Join us on social media.

networks: VAT, insurance premiums, simplified tax system 6%, simplified tax system 15%, UTII, personal income tax, penalties We send letters with the main discussions of the week > > > Tax-tax December 05, 2021 Debit 43 Credit 43 is a posting that does not affect the indicators in the general ledger. Movement within an account can only be traced in analytical summary statements. What internal posting to account 43 means, in what cases it is used and when it should not be used, we will tell you in our article.

Posting Debit 43 Credit 43 means changes in finished goods within account 43. But this movement does not affect the order in which account 43 balances are reflected in the balance sheet.

Finished products in warehouse: invoice and accounting rules

Recording of transactions involving finished products is carried out using 43 accounts. Debit balances on it indicate that the enterprise has a certain stock of products released from production. Credit turnover shows the disposal of consignments. Analytics separates accounting data by storage location.

When finished products are delivered to the warehouse, the posting looks like:

D43 – K20 (23, 29).

The entry is made on the basis of the invoice. The transfer of products from the warehouse is formalized by crediting account 43 in correspondence with debiting 45, 80, 44. If shortages are detected, account 94 will be debited for their amount.

For example, Faya LLC produces kefir. In January, 2500 liters of kefir product were produced. At the same time, expenses were incurred by the main production department in the amount of 17,500 rubles, and by the auxiliary unit - 8,000 rubles. At the end of the technological cycle, the finished products were delivered to the warehouse. Reflection of all transactions in accounting:

- D20 – K10 (70, 69) – the amount of basic production expenses is shown in the amount of 17,500 rubles.

- D23 – K 10 (70, 69) – expenses incurred by the auxiliary workshop are reflected: 8,000 rubles.

- D20 - K23 - costs of the auxiliary workshop are included in the production cost estimate of 8,000 rubles.

- Finished products are credited to the warehouse - postings are made between D43 and K20 in the amount of 25,500 rubles. (17,500 + 8,000).

Basic accounting entries - examples

> > > Tax-tax January 09, 2021 Accounting entries record each business transaction of an enterprise.

They must be done correctly, otherwise you will distort your accounting records. False reporting may result in a fine. Also, incorrect information about the financial situation can jeopardize the company’s relationship with investors or lead to a refusal of a loan or credit. Other adverse effects are also possible. To prevent this from happening, read our article.

Every commercial company is created for the purpose of making a profit.

At the same time, she makes various transactions every day, the accounting of which is very easy to get confused without a clearly organized accounting structure. Moreover, according to Art. 2 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ, all legal entities are required to maintain accounting records.

Typical wiring

Attention

Other methods of evaluating products ready for sale In addition to actual and pre-calculated (normative) prices, the company has the right to use other types of cost. For example:

- Wholesale – involves calculating the difference between actual prices and the cost of wholesale supplies. The stability of wholesale prices allows us to reliably estimate the volume of products produced and most accurately draw up production plans for the following periods.

- Free including VAT - applicable for accounting for products or work that are carried out to order individually.

Free market - used to evaluate products that are sold through retail.

All valuation methods, with the exception of the use of actual cost values, require the calculation of deviations of estimated amounts from production amounts.

Dt 90, 45 Kt 43

This greatly simplifies accounting.

Accounting at wholesale trade enterprises can generally be reflected by a combination of the following entries.

Accounting for sales of goods in wholesale trade

| № P/P | Account correspondence | Contents of a business transaction | |

| Debit | Credit | ||

| 1 | 60 | 51 | Payment has been made to the supplier of goods |

| 2 | 41 | 60 | Goods are taken into account at the purchase price excluding VAT |

| 3 | 19 | 60 | VAT on purchased goods is reflected |

| 4 | 68 | 19 | The amount of VAT on paid goods has been accepted for deduction |

| 5 | 76 | 51 | Paid to transport companies for delivery of goods |

| 6 | 44-P | 76 | Delivery costs (RD) of goods excluding VAT are taken into account |

| 7 | 19 | 76 | VAT is reflected on the costs of delivery of goods |

| 8 | 68 | 19 | The amount of VAT on paid delivery of goods has been submitted for deduction |

| 9 | 44-K | 10,76 | Material costs taken into account |

| 10 | 44-K | 70 | Staff wages accrued |

| 11 | 44-K | 69 | The amount of unified social tax from personnel remuneration is taken into account |

| 12 | 44-K | 02 | Accrued depreciation of fixed assets |

| 13 | 44-K | 05,68, 69,76 | Other expenses are taken into account, including taxes, insurance costs, advertising costs, depreciation of intangible assets |

| 14 | 45 | 41 | Goods were shipped to the buyer without transfer of ownership |

| 15 | 90 | 45 | Sold goods written off at purchase prices |

| 16 | 90 | 45 | A part of goods previously (in previous periods) shipped to customers was written off after the transfer of ownership to them |

| 17 | 90 | 44-P | Direct expenses written off to sales minus the share attributable to the balance of unsold goods |

| 18 | 90 | 44-K | All indirect costs are written off for sales |

| 19 | 62 | 90 | Invoices presented to customers |

| 20 | 90 | 68 | VAT accrued on sales of goods |

| 21 | 90 | 99 | Financial result (profit) determined |

Go to page: 12

34

What typical transactions does account 41 involve?

In order to understand the meaning of entries using postings Dt 41, Kt 41, let's look at a few examples.

Example 1

On March 10, 2016, Luna LLC purchased goods from Zvezda LLC worth RUB 283,200. (including VAT RUB 47,200). On March 14, Luna LLC transferred the payment.

Luna LLC is engaged in retail trade. Zvezda LLC sells goods wholesale.

Let's consider how the implementation of Zvezda LLC will reflect:

- Dt 62 Kt 90 - revenue from the sale of goods in the amount of 283,200 rubles.

- Dt 90 Kt 68 - VAT is charged on revenue of 47,200 rubles.

- Dt 90 Kt 41 - the cost of goods sold is taken into account: 200,000 rubles.

- Dt 51 Kt 62 - payment received for goods in the amount of 283,200 rubles.

Let's look at the accounting of Luna LLC. Note that retail accounting of goods by the buyer has some features. He can lead it:

- at the purchase price (typical for retail and wholesale trade);

- sales price using trade margins (applicable for retail in accordance with clause 13 of PBU 5/01).

Accounting for receipt of goods at purchase prices:

- Dt 41 Kt 60 - the purchase price of the goods is reflected in the amount of 236,000 rubles.

- Dt 19 Kt 60 - input VAT 47,200 rub.

- Dt 60 Kt 51 - paid for goods in the amount of 283,200 rubles.

Accounting for receipt of goods at sales prices.

The markup percentage is 30%.

The cost of goods without markup is reflected in the same way: Debit 41 Credit 60 - 236,000 rubles.

Next, you need to calculate the size of the trade margin: 236,000 × 30% = 70,800 rubles. and reflect it with wiring: Dt 41 Kt 42.

Postings for VAT and payment for goods will be similar to those we discussed above:

- Dt 19 Kt 60 — VAT 47,200 rub.

- Dt 60 Kt 51 - payment 283,200 rub.

Sales of purchased goods with a trade margin:

- Dt 50 Kt 90 - revenue from sales of goods 306,800 rubles. (236,000 + 70,800).

- Dt 90.3 Kt 68.2 — VAT 51,133.33 rub.

- Dt 90 Kt 41 - cost written off in the amount of RUB 306,800.

- Dt 90 Kt 42 - the markup of 70,800 rubles was reversed.

Example 2

Luna LLC returned the low-quality goods to the supplier Zvezda LLC (continuation of example 1).

Luna LLC will make the following entries:

- Dt 41 Kt 60 - goods worth 236,000 rubles were returned. (reversible).

- Dt 42 Kt 41 - write-off of trade margin in the amount of 70,800 rubles. (an entry is made if the organization applied a markup).

- Dt 19 Kt 60 — VAT 47,200 rub. (reversible).

Example 3

Luna LLC identified a defective product (continuation of example 1).

The following entries will be made in the accounting of Luna LLC:

- Dt 94 Kt 41 - write-off of defects in the amount of 236,000 rubles.

- Dt 42 Kt 41 - the markup is written off in the amount of 70,800 (the posting is typical when using a markup).

Example 4

Luna LLC carried out a markdown of goods (continuation of example 1).

Please note that the markdown of goods can be either lower or higher than the markup.

Situation 1. The markdown was 10% of the sale price of the goods. The selling price from example 1 is RUB 306,800. (236,000 + 70,800).

Dt 42 Kt 41 - markdown of goods due to a markup of 30,680 rubles. (306,800 × 10%).

Situation 2. The markdown amounted to 40% of the sale price of the goods.

Dt 42 Kt 41 - markdown of goods due to a markup of 70,800 rubles.

Dt 91.2 Kt 41 - excess markdown of 51,920 rubles. ((306,800 × 40%) – 70,800).

For information on the rules for drawing up a markdown document, see the article “Unified Form No. MX-15 - Form and Sample.”

Account 20. accounting of production costs: postings

D02 K01- Reflects the amount of accumulated depreciation on retiring fixed assets D01 K02- Reflects accrued depreciation on used fixed assets received free of charge D02 K03,79,83- Writes off the amount of accrued depreciation D08,20,23,25,26,29,44 ,91,92,96,97 K02- Accrued depreciation on fixed assets D01K08- A fixed asset object was put into operation D08 K02- Accrued depreciation on fixed assets D08 K10- Recorded write-off of materials D08 K20,23,25,26,29- Written off costs of main production D08 K60- Reflects the actual costs associated with the acquisition and creation of fixed assets D08 K70- Accrued wages to employees involved in the process of investing in non-current assets D04 K04- Write-off of the initial cost upon disposal of intangible assets in cases of alienation, etc.

Account 43 - Finished products

Here you can add your version of the Accounting transaction and after verification we will add it to the site.

Thank you for your cooperation Dt 001 - Leased fixed assets 002 - Inventory assets accepted for safekeeping 003 - Materials accepted for processing 004 - Goods accepted for commission 005 - Equipment accepted for installation 006 - Strict reporting forms 007 - Written off at a loss indebtedness of insolvent debtors 008 — Security for obligations and payments received 009 — Security for obligations and payments issued 01 — Fixed assets 001-11 — Disposal of fixed assets 010 — Depreciation of fixed assets 011 — Fixed assets leased 012 — Intangible assets received in use 013 - Inventory and household items. accessories put into operation 02 - Depreciation of fixed assets 03 - Income investments in material assets

Accounting entries to account 43

Account 43 corresponds with many other accounts, but the following entries are most often used:

| Debit accounts | Credit accounts | the name of the operation |

| 20, 23, 29 | Finished goods arrived at the warehouse from the production line | |

| Finished products arrived from the enterprise division | ||

| Products taken into account as a discount for the buyer | ||

| Receipt of goods into the authorized capital | ||

| Shipment of products to other enterprises | ||

| Transfer of products under a simple partnership agreement | ||

| Write-off of identified shortages | ||

| Consumption of products for commercial purposes | ||

| The cost of finished goods written off against future expenses. The goods are used for the company's own needs |

The actual cost of finished products can only be determined at the end of a certain period, when all costs are accounted for and combined.

Examples of transactions on account 43

Example 1. Accounting for finished products at actual cost

Milk LLC produces milk. In October, 145 liters of milk were produced. The expenses of the main production amounted to 3,625 rubles, and auxiliary ones - 870 rubles.

The following entries were made for account 43:

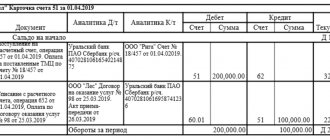

| Dt | CT | Amount, rub. | A document base | |

| 20 | 10, 70, 69 | Costs of main production are reflected | 3 625 | Bill of lading, certificate of completion of work, payroll, etc. |

| 23 | 10, 70, 69 | Auxiliary production costs taken into account | 870 | Same as in main production |

| 20 | 23 | The cost of production takes into account the costs of auxiliary production | 870 | Costing |

| 43 | 20 | The batch of milk has been received into the warehouse | 4 425 | Purchase Invoice |

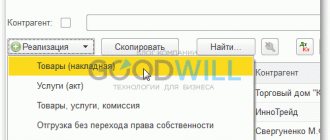

Example 2. Sales of products at retail or wholesale

Pishchevik LLC is engaged in the production of sausages and has its own store for selling products. At the end of October, 3,000 sticks of premium raw smoked sausage were produced; production costs for this volume amounted to 744,000 rubles; 1,500 sticks of sausage were given to the store for sale; retail price of one stick is 450 rubles, incl. VAT 68.64 rub.; commercial expenses amounted to RUB 25,800.

The list of products (approved by Decree of the Government of the Russian Federation dated December 31, 2004 No. 908), taxed at a VAT rate of 10%, includes raw smoked sausages except the highest grade, so in this case the VAT rate will be equal to 18%.

Here is a table of transactions for account 43:

| Dt | CT | Amount, rub. | A document base | |

| 43 | 20 | A batch of premium raw smoked sausages has arrived at the warehouse of Pishchevik LLC from production | 744 000 | Purchase Invoice |

| 43.1 | 43 | Part of the finished products was transferred for sale (1,500 * (744,000/3,000)) | 372 000 | Sales Invoice |

| 50 | 90.1 | Revenue from sales through the retail network is taken into account | 675 000 | Implementation report |

| 90.3 | 68.1 VAT | VAT on sales | 102 966 | Implementation report |

| 90.2 | 43.1 | The cost of products sold through the distribution network is written off as expenses | 372 000 | Costing |

| 90.2 | 44 | Sales costs written off | 25 800 | Expense report |

| 90.9 | 99 | Profit from the sale of sausages through the retail network is reflected (675,000 - 102,966 - 372,000 - 25,800) | 174 234 | Turnover balance sheet |

The remaining 1500 pcs. the enterprise sold wholesale (the wholesale price of one stick of sausage is 350 rubles; sales costs are 15,400 rubles):

| Dt | CT |

Accounting: account 43 “Finished products”. Characteristics of account 43:

Account 43 “Finished products” was created to reflect data on the quantity and cost of products produced for sale. MRZ move into the “ready” category after delivery to the warehouse. The process is accompanied by the preparation of relevant documents. Let's look at the characteristics of account 43 and the procedure for organizing accounting on it.

What is “finished product”?

To carry out accounting operations, it is necessary to clearly understand what is hidden behind the term “finished products”. These are assets included in the inventory, which are the final result of production and are intended for sale.

At the same time, they are properly modified, are fully equipped and meet all the requirements put forward by customers.

How is account 43 used in accounting?

The main task when using account 43 is to account for the products produced by the enterprise. It does not matter where the goods and materials will be distributed - for our own needs or for sale to consumers. Like any active account, the balance on account 43 can only be a debit one. The following rules apply here:

- The amount in the debit of the account is the balance of finished products for a specific period of time.

- When products arrive at the warehouse, the account is always debited.

- After the sale of goods or transfer of inventory items for your own needs (another write-off option), the account is credited.

Finished products must be accounted for in monetary and natural units. This increases the accuracy of accounting and simplifies the further inventory process. The cost price in this format is also easier to determine.

33. Analytical and synthetic accounting of finished products

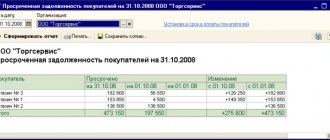

Within a month, the warehouse received GP at planned prices in the amount of 750,000 rubles. The amount of costs for the production of GP recorded on account 20 is 900,000 rubles. The balance of the work in progress is estimated at RUB 120,000. The planned cost of products sold is 500,000 rubles.

Solution:

Actual cost: 900,000D 20 – 120,000WIP = 780,000 rub.

Then the amount of deviations for GP transferred to the warehouse during the reporting month: 780,000 fact. cost price of goods received at the warehouse – 750,000; standard cost of goods received at the warehouse = 30,000.

Percentage of deviations for GP: (5,000 deviation at the beginning + 30,000 deviation for the period) / (240,000 planned prices at the beginning + 750,000 planned prices for the period) = 3.54%.

Amount of deviations attributable to shipped products: 500,000 planned cost of shipped * 3.54% deviation percentage = 17,700 =>

The actual cost of shipped products will be: 500,000plan. selfest. +17 700 off. = 51 7700.

The balance of GP at the end of the month at actual cost is 507,300, including:

Planned cost: 240,000 at the beginning of the month. + 750,000 yield within a month. – 500,000sold = 490,000.

Amount of deviations: 5,000beginning of month. + 30,000 per period – 17,700 per shipment. products = 17,300

490 000 + 17 300 = 507 300.

Account entries:

| D43 K20 | 750 000 | Released from GP production at planned cost |

| D43 off. K20 | 30 000 | The deviation of the actual cost from the planned cost is reflected |

| D90 K43 | 500 000 | The planned cost of the GP was written off |

| D90 K43otkl. | 17 700 | Deviations of actual costs from planned costs attributable to products sold were written off |

Using count 40

According to D 40, the actual production cost of products is taken into account in correspondence with cost accounts, and according to K 40 - the planned cost of the state enterprise, which is written off in D 43.

At the end of the month, when the actual cost of production is fully formed, a comparison of debit and credit turnover on account 40 reveals the amount of deviations of the actual cost from the planned one.

If the debit turnover on account 40 exceeds the credit

, i.e.

the actual cost exceeds the planned cost and there is an overrun

, then an entry is made for the amount of the deviation: D90 K40.

If the credit turnover on account 40 is greater than the debit turnover

, i.e.

the actual cost is less than the planned cost, there is a saving

, then an entry D90 K40 is made for the amount of the deviation.

Thus, account 40 is closed monthly and has no balance at the end of the month.

Account entries:

D43K40 – planned accounting prices

D40K20 – actual cost

D90K40 – excess of actual cost over planned or

D90K40 – excess of planned cost over actual

EXAMPLE:

Balance of GP in the organization's warehouse at the beginning of the month: 240,000 rubles. at planned prices. Within a month, GP was received at the warehouse at planned prices for 750,000 rubles. The amount of production costs recorded in the account is 20 - 900,000 rubles. The balance of the work in progress is 120,000 rubles. The planned cost of goods sold is 500,000 rubles.

Solution:

| D20 K10,02,70,69 | 900 000 | Costs of the current period are reflected |

| D43 K40 | 750 000 | Accepted for accounting of state enterprises at planned accounting prices |

| D40 K20 | 780 000 = 900 000 – 120 000 | The actual cost of the GP is reflected |

| D90 K43 | 500 000 | Planned cost of goods sold is written off |

| D90 K40 | 30,000 = 780,000D40 – 750,000K40 | The amount of identified deviation is included in the cost of production |

The main disadvantage of using count 40

– imaginary simplicity, deviations are written off entirely, without distribution => by 1 rub. sold may cost 30,000 rubles. deviations => the tax office will not be happy, so for tax accounting purposes it is better to keep records without using 40 accounts.

ORGANIZATION OF GP ACCOUNTING IN WAREHOUSES AND IN ACCOUNTING

The transfer of the GP to the warehouse is formalized by a primary document, which confirms the fact that the WIP object has been transferred to the GP category. As a rule, the M-11 form is used.

The entire GP is submitted for reporting to the financially responsible person.

Primary accounting documents received at the warehouse during the month and grouped by storage location and type of state of enterprise are sent to the accounting department, where they are checked and taxed (taxation is the monetary valuation of transactions that are recorded in primary documents in physical units). After this, on their basis, the accounting department draws up a state production statement, which is necessary for operational control of the daily implementation of the production plan in the context of product names in quantitative and cost terms, incl. and on a cumulative basis over the course of a month or other reporting period accepted by the enterprise.

Date: 2015-10-18; view: 167; Copyright infringement

| Did you like the page? Like for friends: |

Accounting for manufactured products at standard cost

What kind of wiring should be used to reflect the standard cost of manufactured products? For the posting carried out at the time of release - finished products are released from the main production - there are two options for its correspondence (the choice of these options is reflected in the accounting policy):

- with a direct correlation between the main production cost account (account 20) and account 43, intended for accounting for finished products;

- using an interim account 40, which operates only during the month and must be closed after its completion.

In the first case, the posting will look like Dt 43 Kt 20, and in the second - Dt 43 Kt 40. That is, in the first option, writing off during the month will lead to intermediate red balances on account 20. The second option does not affect account 20.

In any of the options, each type of created product at the standard cost (or other accounting price) and in the actual quantitative assessment will be reflected in account 43. In the case of shipment in the month of production, based on these indicators, the debit of account 90 will show the cost of products sold: Dt 90 Kt 43.

Accounting for finished products

Without semi-finished method. Cost accounting is carried out by accounting records when transferring semi-finished products of own production from workshop to workshop. The costs of producing semi-finished products are taken into account by workshop, broken down by income items. Added costs are reflected for each processing stage separately, and the cost of raw materials includes the cost of production only for the first processing stage.

D 43 K 20.1 - reflects the actual cost of manufactured products of the first processing stage.

D 43 K 20.2 - in the second redistribution (as many redistributions as there are subaccounts)

D 90 K 43 – at the time of sales the actual cost was written off

Semi-finished method. Accounting is carried out with the transfer of the cost of own production when transferring them from workshop to workshop to the accounting system of accounts. With this option, the cost is determined by the output of each workshop. 21 accounts are used. Transfer from workshop to workshop is reflected in synthetic accounts at actual cost, and in current accounting at standard or planned cost with subsequent adjustment to actual cost.

D 21 K 20 – expenses related to the production of semi-finished products are reflected.

D 20 K 21 – further into production

D 90 K 21 – sale of semi-finished products.

When maintaining analogous accounting, each processing stage corresponds to its own analytical account opened to account 20.

D 20.1 – the first processing stage collects the cost of raw materials and added processing costs.

D 20.1 K 10 - reflects the costs of producing the semi-finished product of the first stage.

D 21 K 20.1 – cost of the semi-finished product of the first stage.

D 20.2 K 21 - reflects the cost of the semi-finished product received for the second processing stage and production costs.

D 21 K 20.2 – cost of the second stage.

D 90 K 21 – semi-finished product of the second stage sold externally.

If there is no implementation of the second stage, it goes to the third stage D 20.3 K 21

D 43 K 20.3 – cost of finished products, taking into account added costs for the third stage.

D 90 K 43 – sale of finished products.

On account 20 there is a double account - intra-factory turnover (of the first and second stages), which must be excluded from the calculation.

Task: When producing products, raw materials go through two stages.

Examples of postings with finished products

| Operation | Account debit | Account credit |

| Revenue from the sale of finished products is reflected | 62 “Settlements with buyers and customers” | 90 “Sales”, sub-account “Revenue” |

| The cost of shipped finished products is written off | 90, subaccount “Cost of sales” | 43 |

| VAT charged on sales of finished products | 90, subaccount “VAT” | 68 “Calculations for taxes and fees”, subaccount “VAT” |

Commercial expenses associated with the sale of finished products are also written off:

| Dt 90, subaccount “Sale expenses” – Kt 44 “Sale expenses” |

Accounting for release using account 40

If the organization decides to use the account. 40, then finished products from production are debited to this account at actual cost (entry D40 K20 (23)). In account 43, products are accounted for at the planned cost (posting D43 K40).

Arose on the account. 40 deviation in cost is attributed to the account. 90 "Sales".

If the actual cost turns out to be higher than the planned cost, then a negative cost deviation arises, which must be written off from the credit account. 40 wiring D90/2 K40. A negative deviation indicates that there was an overrun in production and the technological process should be checked to find out what resulted in the overestimation of the actual cost.

If the actual cost turns out to be lower than planned, then a positive deviation (savings) is observed, which is reversed by D90/2 K40.

As a result of making entries to account for any deviations in the account. 40 is completely closed at the end of the month, and its balance becomes equal to 0.

When is the entry Debit 41 Credit 41 applied?

The debit of account 41 according to the instructions for the chart of accounts is often used with the following accounts:

- 15 “Procurement and acquisition of material assets”;

- 60 “Settlements with suppliers and contractors”;

- 91 “Other income and expenses”, etc.

The credit of this account is often in correspondence with the accounts:

- 10 "Materials";

- 20 “Main production”;

- 90 “Sales”, etc.

In addition, account 41 can correspond with itself, then the posting will look like this: Dt 41 Kt 41. For example, an organization sent purchased goods for processing. It will reflect this action in accounting as follows: Dt 41 Kt 41. If the organization uses subaccounts, then the posting Dt 41 Kt 41 may look like: Dt 41.05 Kt 41.01 (account 41.01 “Inventory in warehouse”, 41.05 “Inventory in processing”).

Debit 90.2 Credit 43

To exercise control over activities and calculate financial results, additional sub-accounts are opened:

- 90.01. Revenue – receipts from customers for goods sold, work performed, services rendered. The subaccount is passive: the loan shows the amount of revenue received in correspondence with the account for mutual settlements with customers.

Note from the author! According to PBU, when maintaining accounting records, the company independently determines whether the resulting income relates to ordinary activities or is it other income.Revenue is recorded in monetary terms and is equal to the assets received from the buyer and (or) the amount of the resulting receivables (for example, in case of incomplete payment for goods or when selling goods or services on a deferred payment basis).

Note from the author! Separate accounting of revenue under the special tax system and under special taxation systems is provided.

To recognize revenue, the following conditions must be met:

there is confirmation of the company’s right to receive this revenue (existence of an agreement);

you can determine the full amount of revenue;

there is confidence that the company will receive economic benefits from this transaction: assets have been received as payment or there is confidence in their receipt in the future;

ownership of the sold products has been transferred to the buyer (the work has been completed and there is confirmation, for example, a document has been signed);

the costs associated with a given operation can be calculated.

- 90.02.

Cost of sales is an active subaccount. Transactions on this account are displayed simultaneously with the posting of revenue in correspondence with the accounts for assets sold to the buyer (43,41,44,20, etc.).For enterprises engaged in agriculture: when selling products according to Dt90, the planned cost of products during the reporting period is recorded, as well as the resulting difference between the planned and actual cost at the end of the year.

For retail sellers and those who record goods at sales prices: the debit account 90 records the accounting price of products sold. At the same time, the reversal of the amounts of discounts provided (accrued mark-ups on goods) that were related to goods sold in correspondence with account 42 is carried out.

Practical example.

Solnyshko LLC purchased 30 phones from a supplier (the purchase price of the goods was 9.5 thousand rubles per unit, including VAT) for subsequent resale. Accounting for LLC goods is carried out at purchase prices. The selling price of the phone is 11 thousand rubles. per piece This product was purchased for the first time and was fully sold within a month.

Reflection of business transactions:

Dt41 Kt60 – 241.5 thousand rubles – receipt of phones from the supplier.

Dt19.03 Kt60 – 43.5 thousand rubles – accounting for input VAT.

Dt50 Kt90.1– 330 thousand rubles. – revenue received from the sale of phones.

Dt90.3 Kt68 – 50.3 thousand rubles. – VAT payable to the Federal Tax Service.

Dt90.02 Kt41– 241.5 thousand rubles. – write-off of the accounting value of goods sold.

ANALYSIS OF SCH.90 Start Start 50,3 241,5

291,8 Skon. Scon.38.2 Analysis of invoice 90 showed that this markup is enough to cover expenses and make a profit from the sale of phones (More details about calculating the markup in the video).

- 90.03.

VAT: this subaccount records information about value added tax, which the seller must receive from the customer and subsequently transfer to the Federal Tax Service. Note from the author! When filling out a VAT return and calculating the tax payable, the following data compliance must be observed: 90.01 * 18/118 = 90.03 (when selling goods, works, services at a rate of 18%). - 90.04. To reflect information about the amount of excise taxes that is included in the price of sold assets.

- 90.05. Amounts of duties on export of products.

- 90.09. This subaccount is the calculated financial result for the company’s normal activities. It is active-passive: the debit balance reflects the company’s loss in the current period, the credit balance reflects the profit received.

Account 90 “Sales”

Accounting account 90 is an active-passive “Sales” account, used to reflect information related to the sale of finished products for the main activity of the enterprise. The account is one of the most difficult in terms of accounts.

Its peculiarity is that at the end of the period it must be closed without any balance. Using standard postings and practical examples for dummies, we will understand the specifics of using account 90 and consider closing account 90 at the end of the month and at the end of the year.

The financial result from sales from the main activity is reflected on the account monthly. During the year, the account accumulates the financial result of the enterprise's main activities.

The main activity of the enterprise can be:

- sale of finished products and semi-finished products (own production);

- services of a non-productive or production nature;

- sale of purchased goods;

- construction, installation, research, geological exploration, etc.;

- rent;

- transport services;

- transportation of passengers;

- other.

Subaccounts of account 90

Closing a synthetic account is provided at the expense of your own analytical accounts. Some of them are active, some are passive. The difference between the active and passive balance is closed to account 90.09.

Sub-accounts can be opened for account 90:

- 90.1 - “Revenue”. The revenue subaccount reflects the amount of proceeds from sales. This is a passive subaccount;

- 90.2 - “Cost of sales”. Active subaccount reflects the cost of goods sold;

- 90.3 - “VAT on sales”. The VAT account is also active, in correspondence with account 68 it reflects the amount of VAT accrued to the budget;

- 90.4 - “Excise taxes”. The active excise subaccount reflects excise taxes included in the amount of goods sold;

- 90.9 - “Profit (loss) from sales.” The subaccount acts as a regulator; all other subaccounts are closed to it.

At the end of the month, the sales result is formed in subaccount 90.9. It happens like this:

- The balance is calculated for each subaccount.

- The total turnover for all subaccounts (debit and credit) is calculated, and the credit turnover is subtracted from the debit turnover. A positive balance means a loss, a negative balance means a profit.

- The financial result is reflected using account 90.9 and written off to account 99, in accordance with the accounting rules. Profit is reflected by posting Dt 90.9 - Kt 99.1, loss - Dt 99.1, Kt 90.9.

Thus, at the end of the month, each subaccount 90 has a balance, but there should be no balance on the synthetic account.

At the end of the year, each subaccount of account 90.x is closed to 90.9. Debit subaccounts are closed by posting Dt 90.9 - Kt 90.x, credit - Dt 90.x - Kt 90.9.

As a result, the balance of account 90 at the end of the year will be reset to zero. This process is part of the balance sheet reform carried out at the end of each year.

With the beginning of the new year, the account will be opened again, from scratch.

90 accounting account is intended to collect information about the items of income and expenses of the enterprise related to its main type of activity.

At the end of the month, according to debit and credit turnover, the final result from sales is determined from this account - profit or loss - the value of which is important for the effective operation of the company.

Let's consider the structure and characteristics of account 90 and the key points for its use in accounting data.

Regardless of what type of economic activity - production, agriculture or trade - brings profit to the enterprise, the amounts that generate it are recorded in account 90 - “Sales”. This is a very voluminous account, with many cost and income items that are accounted for in separate analytical accounts.

The main function of the account is the primary collection of data on the totality of costs and benefits that accompany the production and sales process.

Without the existence of this type of information collection, it would be difficult for an enterprise to understand where everything comes from.

Thanks to the generalization of data and their grouping on account 90, an intermediate sales result is formed monthly - profit or loss, which at the end of the year is converted into a total reflected in the financial statements.

Structure

Accounting account 90 reflects both expenses incurred as a result of sales and revenue amounts. What is the account structure? The account in relation to the balance is active-passive.

A credit reflects an increase in income, and a debit reflects an increase in expenses.

It turns out that credit turnover shows the total amount of funds received from the sale of products (services or work), and debit turnover, on the contrary, shows the total costs incurred for the manufacturing and sales process.

Does the account have a closing balance at the reporting date? If this were an account of the final economic result, then, of course, it would have a finite value. But in this case we will talk about the opposite.

From which we can conclude: count. “Sales” has no balance at the end of the month.

Subaccounts 90 accounts

Implementation is a complex process associated with many separate concepts and categories of means. In addition, the company sells more than one type of product. All this leads to the need to maintain more detailed accounting – analytical. The standard chart of accounts provides for the following sub-accounts opened for account 90:

- 90/1 – for accounting for assets received as revenue;

- 90/2 – to reflect the cost of goods sold (work, services) for which revenue was recognized on 90/01;

- 90/3 – to account for VAT amounts that will have to be received from the buyer;

- 90/4 – to reflect the amounts of excise taxes that were included in the cost of excisable goods;

- 90/5 – to collect information on the amounts of export duties;

- 90/6 – for accounting for general business expenses of those organizations whose accounting policies indicate writing off expenses of this type to account 90;

- 90/7 – commercial expenses (for trading enterprises);

- 90/9 - to form and reflect the final result from the sale of goods, work or services for the month in question - profit or loss.

The rules for maintaining analytical accounting always come down primarily to the accounting policies of a particular enterprise. The proposed subaccount numbers are conditional and can be changed in accordance with the organization’s accounting requirements.

In addition, analytical accounting should be maintained for each group of goods sold, as well as for individual sales regions or other structural divisions.

Subaccounts 90 accounts are filled with information throughout the year. If the synthetic account 90 itself does not have a final balance at the end of the month, then balances are formed on the subaccounts:

- subaccount 90.01 has only a credit balance;

- on subaccount 90.02–90.07 a debit balance is formed;

- 90.09 subaccount. has either a debit or credit balance depending on the financial result formed during the month.

Each monthly period, the accountant compares the credit turnover of account 90.01 and the totality of debit turnover of accounts 90.02–90.07. Based on the results obtained, we can talk about the formation of profit or loss. The corresponding turnovers are written off from all subaccounts 90.01–90.07 to the debit 90.09 when a loss is formed at the end of the month, and to the credit 90.09 - the amount of profit.

At the end of the year, all subaccounts of account 90 (except 90.09) are subject to closure by writing off their turnover to account 90.09. This method of organizing accounting is very convenient, since the data for each sub-account corresponds to the columns of the “Profit and Loss Statement” for all items of income and expenses of the enterprise for the main type of activity.

What is revenue? This is the amount of funds due to the organization from buyers or customers of its work (services) for products sold or services (work) performed. When funds of this kind are received, they should be reflected in the credit of subaccount 90.01.

It should be remembered that this account collects information about income only from the main activity. If receipts occurred as a result of other transactions, they are recorded in account 91.01.

If the organization’s charter states that a legal entity carries out any activity not prohibited by current legislation, then the main income is recognized as those amounts that are received regularly and their amount exceeds 5% of the total revenue received during the reporting period.

Reflection of revenue amounts in accounting is accompanied by the preparation of entries. In subaccount 90.01, the receipt of funds is shown in the account credit.

The operation must be carried out immediately after the ownership of the sold product has been transferred to the buyer or the services (work) provided have been accepted by the customer.

Typically, such a right arises when goods are shipped or when the results of work are transferred to the customer.

Accounting entries characterizing the enterprise's recognition of revenue received are drawn up as follows:

- dt 62 kt 90.01 for the amount of funds received;

- if the buyer uses a deferred payment, then the amount of each day of delay (calculated as a percentage of the delivery amount) is also reflected in the company’s revenue account: Dt 62 Kt 90.01.

At the end of the month, information about the accumulated amount of revenue from the main activity is written off to the credit of account 90.09, additionally reflecting the data in the balance sheet.

It does not always happen that the buyer pays the seller in the usual manner. How to take into account revenue with other payment methods that are established by the supply agreement (provision of services or performance of work)? Let's consider some non-standard cases in which ownership of the goods passes a little after shipment:

- In an agreement under which ownership rights are transferred after payment for goods (works, services), revenue is reflected only after receiving funds from the buyer. Until payment is made, such goods are listed on account 45. Accounting entries are made in this case in two stages: Dt “Shipped goods” Cht “Goods”, Dt 62 Cht 90.01.

- In a barter transaction, ownership generally transfers only after both parties have transferred the objects of the contract to each other. Until this moment, accounting of amounts based on the market value of the object of exchange is carried out on account 45.

- When making payments in foreign currency, additional entries are made to adjust the payment amount when exchange rate differences arise. The accountant debits account 90 (subaccount 90.01) to reflect the amount of revenue after shipment of goods at the rate established for the current date. After the buyer pays for the delivery, in the event of exchange rate differences, it is necessary to adjust the amount owed.