What is accounts receivable and how to avoid writing it off?

Accounts receivable (RA) are the debts of counterparties (legal entities and individuals, including company employees) for delivered products (goods, services).

The occurrence of DZ is due to a number of reasons, including:

- sales of products with deferred payment;

- purchase of raw materials and other property on an advance payment basis with a delay in delivery;

- insolvency of counterparties or their dishonesty;

- other similar reasons.

Receivables are funds diverted from circulation, and it is important for a company to properly structure work with such debts so that diverted funds are returned to circulation in a timely manner, and hopeless funds and those with expired statutes of limitations are written off on time.

In order not to lose finances, not to “delay” payment relationships with debtors and not to divert resources to processing the write-off of debt, it is necessary to properly organize comprehensive work with receivables, including:

- debt planning (dividing debts into critical and working);

- organization of work with defaulters (formation of regulations for working with contractors on debt claims, setting deadlines for sending reminders to debtors about debt repayment, appointment of responsible persons for representing the interests of the company in collecting debt claims in court, etc.).

Writing off receivables in tax accounting has its own peculiarities. ConsultantPlus experts explained in detail how to correctly reflect write-offs in tax accounting. Full trial access to the K+ system can be obtained for free.

Financial specialists and accounting employees perform their functions in this set of activities, including:

- monitoring the timing of payment of debt in accordance with concluded agreements in order to form a reliable amount of the reserve for doubtful debts;

- regular inventory of debts;

- timely identification of debts with expired statute of limitations and bad debts.

If, as a result of working with the receivable, it was not possible to collect or reclaim some of the debts, they must be written off from the accounting accounts in a timely manner. What kind of transactions accompany the write-off of accounts receivable will be discussed in the next section.

On our forum you can clarify the correct solution to any problem that you encounter during accounting. For example, here they will help you understand how to write off the advance payment received from the buyer after the statute of limitations has expired.

Find out more about the types and accounting nuances of financial statements (including from the standpoint of IFRS) from the materials on our website:

- “Accounts receivable are...”;

- “Accounting for accounts receivable according to IFRS.”

Account 62 “Settlements with buyers and customers”

ACCOUNT 62 “PAYMENTS WITH BUYERS AND CUSTOMERS”

Account 62 “Settlements with buyers and customers” is intended to summarize information on settlements with buyers and customers, as well as related organizations - for sold: finished products, animals, goods; work performed and services provided; received advances and prepayments.

Account 62 “Settlements with buyers and customers” is debited in correspondence with accounts 90 “Sales”, 91 “Other income and expenses” for the amount of the presented settlement documents.

Account 62 “Settlements with buyers and customers” is credited in correspondence with the accounts for accounting for cash, settlements for the amounts of payments received (including the amounts of advances received), etc. In this case, the amounts of advances received and prepayments are taken into account separately.

Sub-accounts can be opened to account 62 “Settlements with buyers and customers”:

62-1 “Settlements under government contracts”;

62-2 “Settlements with procurement and processing organizations of the agro-industrial complex”;

62-3 “Settlements on bills received”;

62-4 “Calculations for advances received”;

62-5 “Intra-group settlements of interrelated organizations”;

62-6 “Settlements with other buyers and customers.”

Subaccount 62-1 “Settlements under government contracts” is intended to summarize information on settlements with government agencies for sold products and livestock.

As sales are recognized for the fulfillment of government orders, the debt of authorized bodies is reflected in the debit of this subaccount in correspondence with account 90 “Sales”. If the shipment of agricultural products was made to repay a previously received commodity loan, then at the same time an entry is made in the debit of accounts 66 “Settlements for short-term loans and borrowings”, 67 “Settlements for long-term loans and borrowings” and the credit of subaccount 62-1 “Settlements for government contracts "

Subaccount 62-2 is intended to summarize information on payments for sold agricultural products, animals and services provided for their delivery, in the order of fulfillment of contracts. As sales to procurement organizations are recognized, the debt is reflected in the debit of this subaccount in correspondence with account 90 “Sales”, subaccount 1 “Revenue”. If an agricultural organization and a procurement organization are part of an interrelated group, then such settlements should be taken into account in subaccount 62-6 “Intra-group settlements of interrelated organizations.”

Subaccount 62-3 “Settlements on bills received” reflects information about the debt of buyers and customers secured by bills received.

If interest is provided on the received bill of exchange securing the debt of the buyer (customer), then as this debt is repaid, an entry is made to the debit of account 51 “Currency accounts” or 52 “Currency accounts” and the credit of account 62 “Settlements with buyers and customers” (on amount of debt repayment) and 91 “Other income and expenses” (by the amount of interest).

Subaccount 62-4 “Settlements on advances received” is used to reflect information on settlements on advances received in accordance with contracts for the supply of inventories or for the performance of work performed for customers on partial completion.

The amounts of advances received and prepayments are reflected in the credit of account 62-4 “Calculations for advances received” in correspondence with cash accounts.

Funds received in advances and prepayments, offset when the buyer or customer presents settlement documents for delivered products, are reflected in the debit of subaccount 62-4 “Settlements for advances received” and the credit of subaccounts: 62-2 “Settlements with procurement and processing organizations of the agro-industrial complex”, 62 -6 “Settlements with other buyers and customers.”

Subaccount 62-5 “Intra-group settlements of related organizations” reflects information on settlements of related organizations (holdings, financial and industrial groups, etc.) for products sold, animals, work performed and services rendered. The information from this sub-account is used to determine the adjustments necessary for the preparation of summary (consolidated) statements.

Subaccount 62-6 “Settlements with other buyers and customers” reflects information with other buyers and customers (legal entities and individuals) on transactions for the sale of finished products, goods, animals, as well as the performance of work and provision of services not provided for in other subaccounts of the account 62 “Settlements with buyers and customers.” In particular, the following calculations may be reflected in the specified subaccount:

- with individual entrepreneurs without forming a legal entity for products sold to them and work performed;

— with agricultural organizations for services rendered (processing of customer-supplied raw materials, work performed by auxiliary production, etc.).

When shipping products, animals, materials; For the execution of work and provision of services, the corresponding primary documents are drawn up: invoices, acceptance certificates for completed work, etc. The main documents for the emergence of settlement relationships between agricultural and procurement organizations are acceptance receipts. The form of receipts depends on the type of products sold: grain, milk, livestock, etc. In accordance with tax legislation, the information reflected in the listed documents is subject to registration in invoices of the established form. When receiving funds in the form of advances or other payments for upcoming deliveries of animal products (performance of work, provision of services), the organization also draws up an invoice.

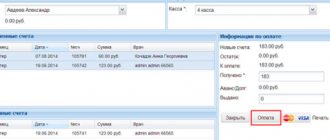

Analytical accounting for account 62 “Settlements with buyers and customers” is maintained for each report presented to buyers (customers), and for settlements using scheduled payments - for each buyer and customer. At the same time, the construction of analytical accounting should provide the ability to obtain the necessary data on: buyers and customers on payment documents for which the payment period has not yet arrived; buyers and customers on payment documents not paid on time; advances received; bills for which the due date for receipt of funds has not yet arrived; bills discounted (discounted) in banks; bills for which funds were not received on time.

Accounting for settlements with buyers and customers within a group of interrelated organizations, the activities of which are compiled consolidated financial statements, is kept on account 62 “Settlements with buyers and customers” separately.

Write-off of overdue accounts receivable – postings

Writing off debt is a process that is necessary and important for any company. It allows:

- generate information about real debts to be repaid or required to be collected;

- reflect it reliably in reporting.

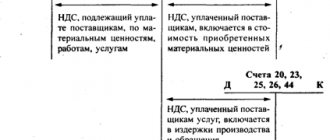

To write off accounts receivable, entries can be of two categories:

Basic:

- Dt 63 Kt 62 (76, 60, 58. 3) - written off DZ due to the reserve for doubtful debts;

- Dt 91-2 Kt 62(76, 60, 58. 3) - DZ not covered by the reserve was written off.

Additional:

Dt 007 - reflection of the written-off DZ on the balance sheet (within 5 years).

Find out what happens with VAT when you write off a property loan from the Ready-made solution from ConsultantPlus. Trial access to the system can be obtained for free.

To reflect the write-off of property in accounting, it is not enough to use the indicated transactions - you must first carry out a number of organizational and design procedures:

- create an inventory commission and, within the time limits established by the order, carry out an inventory of the property, documenting its results in a separate document (for example, in an act form No. INV-17 or another document independently developed by the company and approved in its accounting policy);

- take measures to restore documents confirming the presence, type and size of the remote control if, as a result of the inventory, their absence or insufficiency is revealed (clause 1, article 9 of the law dated December 6, 2011 No. 402-FZ);

- issue an order to write off the receivables (clause 77 of the Regulations on accounting and reporting, approved by order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n).

The material “Inventory of receivables and payables” will help you learn more about the inventory procedure.

Only after all preliminary procedures is it possible to write off the debt from the accounting accounts. In this case, special attention must be paid to the corresponding accounts - write-off of receivables according to accounting standards can occur due to the reserve formed not only for regular receivables reflected in accounts 60, 62 and 76 (sellers, buyers, customers and other debtors), but also in correspondence with account 58.3, which reflects issued loans. For tax accounting purposes, this approach is unacceptable - more on that in the next section.

Account 62 in accounting: postings, subaccounts, examples

Accounting account 62 is a special analytical account that is used to reflect the supplier’s transactions with the buyer and customer. This article will give you an idea of the main transactions on account 62, which is reflected in the debit and credit of account 62, as well as the documents that are the basis for their implementation.

Account 62 - can reflect both our debt to the buyer (credit) and the buyer's debt (debit). Therefore, this account is considered active-passive - it can be included in the balance sheet as a Liability or an Asset.

How to write off bad receivables in tax accounting

It is possible to write off debt in tax accounting in the following order:

- at the expense of the reserve for doubtful debts formed under clause 5 of Art. 266 Tax Code of the Russian Federation;

- reflect the DZ as part of non-operating expenses (subclause 2, clause 2, article 265 of the Tax Code of the Russian Federation).

It should be clarified that not all overdue and unsecured receivables allowed in accounting fall into the tax reserve. For the purposes of tax accounting, only DZ is reserved that is directly related to the sale of goods (works, services).

When writing off receivables, quite a lot of controversial situations arise. You will find a selection of law enforcement practices on many of them in K+. Get free trial access, go to the Encyclopedia of Dispute Situations and find out, for example, whether it is possible to take into account the liability in expenses if you have not taken measures to collect it; or if the debtor is declared inactive and excluded from the Unified State Register of Legal Entities by tax authorities, etc.

In addition, you need to remember the following important nuances:

- writing off debt will directly increase non-operating expenses if the company decides not to create a tax “doubtful” reserve - unlike accounting in tax accounting, this reserve does not need to be created;

- Companies that use the cash method of calculating income tax are forced to write off their income tax immediately as part of non-operating expenses - the formation of a reserve for them is not provided for by law.

Results

Writing off accounts receivable is a multi-stage procedure, including organizational (creating a commission and conducting an inventory), registration (documentation of orders and inventory acts) and accounting (making accounting entries) steps.

It is possible to write off receivables through the reserve for doubtful debts or directly as part of expenses (other - in accounting, non-operating - in tax accounting).

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.