Nuances of accounting for state duties in 2020-2021

State duty, according to Art.

13 of the Tax Code of the Russian Federation, is recognized as a collection at the federal level. Recently, no adjustments have been made to this area, therefore in 2020-2021, as before, an account is used to reflect accounts for its accrual and payment. 68 (subaccount “State duty”). Read more about the classification of taxes and fees in the Russian Federation here.

At the same time, the type of corresponding account when calculating state duty depends on its type. State duty may be paid in connection with:

- with the acquisition of certain property assets;

- carrying out business operations related to the main activities of the company;

- carrying out operations that are not related to its main activities;

- participation of the company in legal proceedings.

Let's look at how state duties are recorded and what transactions are necessary to record the operation to accrue the corresponding amounts in the listed situations.

You will find an algorithm for filling out the details of a payment order for payment of state duty in the Ready-made solution from ConsultantPlus. Get trial access and proceed to expert explanations.

How to reflect the state duty in income tax returns and the simplified tax system

In the income tax return, the state duty paid by the organization (except for that included in the initial cost of fixed assets) is reflected on line 041 of Appendix No. 2 to Sheet 02 on an accrual basis in the total amount of taxes and fees accrued in the reporting (tax) period.

In the tax return under the simplified tax system in Section 2.2, in the total amount of expenses incurred, the amounts of state duty (except for those included in the initial cost of fixed assets) paid during:

I quarter - on line 220;

half a year - on line 221;

9 months - on line 222;

year - on line 223.

Still have questions about accounting and taxes? Ask them on the accounting forum.

State duty charged when purchasing property: which accounting account is used

The state duty paid upon the acquisition (creation) of property objects relates to an increase in their actual value (clause 8 of PBU 14/2007, clause 8 of PBU 6/01):

Dt 08 Kt 68/state duty.

Such records will be used, for example, when paying state fees in connection with the registration of an acquired fixed asset.

Read about fixed asset accounting in this material.

Typical entries for the debit of account 80 UK

When making a founder's contribution in kind, you should remember: if the nominal value of the LLC participant's share, paid in kind, is more than rubles, an independent assessment of the transferred property must be carried out, which also entails additional costs for paying for the services of an appraiser.

Debit 91-2 Credit 68, assigned to the subaccount “State Duty” - state duty for the judicial consideration of the case has been charged.

If the founder is a legal entity and makes a contribution to the Authorized Capital as a fixed asset, then VAT can be deducted on the basis of an invoice.

Settlements with employees for amounts issued to them for reporting on administrative, business and operating expenses are reflected in account 71 “Settlements with accountable persons.”

Let us note that a different procedure for recording VAT amounts presented by the seller when transferring advances is also possible, reflecting the presented VAT on account 19 “Value added tax on acquired assets”.

When an item of fixed assets arrives at an enterprise, we first collect all the costs associated with this receipt in the debit of account 08 (D08 K75). Only after this the object is put into operation by wiring D01 K08. That is, both wirings need to be done.

This indicator is constantly indexed (prescribed in the budget of the corresponding year). Open joint stock companies – 1000 minimum wages.

It is mandatory to change the amount of capital in the statutory documents. It is necessary to fill out an application form P13001, edit the Charter, pay the state fee, and then submit documents to change the authorized capital. In addition, if you have an LLC, then there must also be a protocol of the general meeting (a decision of one participant), which must reflect the decision to increase capital.

Accounting for state duties in accounting: entries for transactions related to the main activity

In case of payment of state duty for certain actions necessary for carrying out the current work of the enterprise, its amount is charged to expenses for ordinary activities (clauses 5, 7 of PBU 10/99). Accounting for state duties will be structured in such a way that the debit of the entry for calculating state duties will include one of the expense accounts:

Dt 20 (25, 26, 44...) Kt 68/state duty.

Examples of such expenses: certification of the company’s working documentation and its copies, registration of contracts, certification of employee signatures, correctness of translation from one language to another, etc.

Is it possible to reflect in accounting the founder’s expenses for paying the state duty for registering a legal entity? The answer to this question was given by 2nd class adviser to the State Civil Service of the Russian Federation I. O. Gorchilina. Get free trial access to the ConsultantPlus system and get acquainted with the official’s point of view.

For information on the main cost items, see the material “List of the most frequently used cost items in accounting .

Some nuances arise when reflecting in accounting the state duty paid for licenses obtained for a certain period of time, usually for several months (for example, licenses for the retail sale of alcohol). Today there are several options for accounting for such state duty:

- Its amount can be written off as expenses at a time (letter of the Ministry of Finance of the Russian Federation dated April 12, 2013 No. 03-03-06/1/12248).

- There is also an opinion that such costs should be previously taken into account in the expenses of the future period, and only then they are written off as expenses (letter of the Ministry of Finance of the Russian Federation dated January 12, 2012 No. 07-02-06/5).

Then the following entries will be used in postings for the state duty for issuing a license:

Dt 97 Kt 68/state duty - state duty has been charged;

Dt 44 Kt 97 - part of the state duty is charged to expenses.

The last entry will be made in accordance with the procedure used by the company to account for future expenses, until the state duty on expenses is completely written off.

- There is also a position that such licenses form intangible assets (clause 3 of PBU 14/2007, clauses 4, 9, 17 IAS 38). In this case, the amount of state duty will be written off as expenses as depreciation:

Dt 08 Kt 60, 76 - the amount of the state duty for the license is included in the cost of the intangible asset;

Dt 04 Kt 08 - license has been capitalized;

Dt 44 Kt 05 - depreciation has been accrued.

IMPORTANT! For intangible assets with an indefinite useful life, depreciation is not charged (clause 23 of PBU 14/2007).

It is worth understanding that each of the listed methods of organizing accounting entries for state duty has its pros and cons. Of course, the chosen method of accounting for such expenses must be fixed in the company’s accounting policy.

Key points on accounting for state duties

In the Tax Code of the Russian Federation (hereinafter referred to as the Tax Code of the Russian Federation), Chapter 25.3 is reserved for the regulation of state duties. Article 333.16 establishes the definition of the term “state duty” - this is a fee that is levied when a person applies to state bodies and other bodies, or to officials who are authorized in accordance with the legislation of the Russian Federation to carry out actions in relation to the applicants, enshrined in this chapter and having legal significance, except for the activities of consular offices of the Russian Federation.

Depending on the purpose of a certain fee, the procedure for its accounting is formed.

Taking into account the purposes of transferring the amount to the budget, the following is carried out in accounting:

- In the main activity accounts, expenses are written off.

- If operations are not related to core activities, they are charged to other costs.

- Inclusion in the acquired property.

Inclusion in expenses in tax and accounting often differs. This happens due to various regulatory documents: in taxation - this is Chapter 25.3 of the Tax Code of the Russian Federation, in accounting - accounting regulations.

For example, when purchasing and forming the initial value of property, its value can be classified as fixed assets, but the periods of classification as fixed assets in accounting and taxation are different:

- The initial action in tax accounting will be property registration. Attribution to the OS will be only the second step.

- In accounting, a reserve is created to include the amount in the operating system. Thus, the state duty can be taken into account before payment and registration of property rights.

Accounting for state duties on transactions not related to the main activity

The state duty for carrying out actions not related to the main activity of the company should be charged to other expenses (clause 11 of PBU 10/99):

Dt 91.2 Kt 68/state duty.

Such an entry will be used, in particular, when calculating the state duty paid upon the alienation of certain types of assets (clause 11 of PBU 10/99).

The state duty paid for participation in the trial is taken into account in the same way.

For tax accounting of other expenses, see our material.

Postings for common expense transactions in 2021

To write off state fees, postings are used that use the expense account.

For state duty with purpose:

- Transactions classified as core activities - posting: Debit 20 (44) Credit 68

- Transactions not classified as core activities - posting: Debit 91 Credit 68

- Purchase of property - posting: Debit 08 Credit 68

- Making changes to the constituent documents - posting: Debit 20 (44) Credit 68

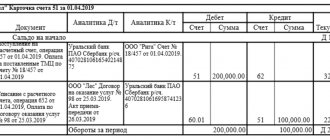

Calculation and payment of state duty: postings

In the records of payment of state duties in the postings, invoice correspondence is used. 51 and 68:

Dt 68/state duty Kt 51.

However, in practice there are often situations when the state duty is paid not from the company’s current account, but in cash through its representative. Are such actions legal? The answer to this question is given to us by the letter of the Department of Tax and Customs Tariff Policy of the Ministry of Finance of the Russian Federation dated 06/01/2012 No. 03-05-04-03/43, in which officials confirmed the competence of such actions. At the same time, when paying the state duty, it is necessary to attach documents to the payment receipt confirming that the funds paid belong to the company performing the action for which the state duty is charged. This may be a power of attorney for the representative, copies of constituent documents, an expenditure order for the issuance of cash to the representative to pay the state duty.

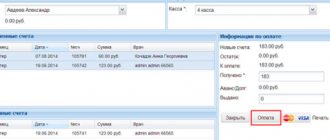

Accounting entries for payment of state duty in this case will have the following form:

Dt 71 Kt 50 - cash was issued for reporting to the representative;

Dt 20 (23, 25, 26, 44, 91.2) Kt 71 - reflects the amount of state duty paid.

Reimbursement of state duty by court decision: postings

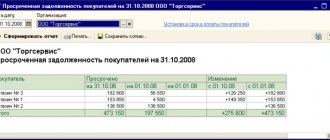

The state duty can be not only paid, but also received by the company as part of legal costs. According to Art. 110 of the Arbitration Procedure Code of the Russian Federation and Art. 98 of the Code of Civil Procedure of the Russian Federation, all legal costs are recovered from the losing party. And since the state fee is part of the legal costs, the company that paid it when filing a claim in court (and won the case) can rightfully expect to be reimbursed by the losing party.

In this case, for state duty subject to receipt by a court decision, the accounting entries will look like this:

Dt 76 Kt 91.1 - state duty for reimbursement by court decision;

Dt 51 Kt 76 - reimbursement of state duty has been received.

How is state duty reflected in tax accounting?

All types of state duties in tax accounting are included in the category of other expenses. Moreover, it should be reflected at the time of accrual (subclause 1, clause 1, article 264 of the NKRF). For different circumstances, this moment may fall either on the date of payment, or on the date of registration documents, etc.

Thus, when registering any actions, the state duty is paid in advance, but it should be included in expenses only after the registration documents are accepted by the authorized body. But when paying the state fee for licensing, it is taken into account at the time of accrual (letter of the Federal Tax Service of Russia dated December 28, 2011 No. ED-4-3/22400). If the state duty is due to the purchase of non-current assets, then the amount of the state duty will be included in the initial cost of the objects, provided that it is paid before their acquisition. If after, then in the category of other expenses.

Results

State duty - posting this payment in accounting has numerous features. The state duty can be attributed to expenses for core activities, other expenses or to an increase in the value of the asset.

When writing off state duty, postings are made using expense accounts in correspondence with the account. 68, to which the corresponding sub-account is opened. The fee for carrying out legally significant actions charged by private notaries is not a state duty, therefore, when carrying out such business transactions in accounting, invoice. 68 is not used.

Sources:

- Fundamentals of the legislation of the Russian Federation on notaries

- Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Accounting for state duties

Issues related to state duty are regulated by Chapter.

25.3 Tax Code of the Russian Federation. According to Art. 333.16 of the Tax Code of the Russian Federation, state duty is defined as a fee required to be paid by individuals or legal entities when they apply to government agencies to perform legally significant actions. Our article is devoted to the formation of entries for state duties in accounting and tax accounting, so we will only talk about state duties paid by organizations. There can be many of them. Starting with the fact that the company must pay a fee upon registration. However, the state fee for registering an organization (by the way, like an individual entrepreneur) cannot be taken into account as expenses in accounting or tax accounting, since such expenses are borne by the person paying it, and not by a legal entity or individual entrepreneur, which does not yet exist at the time of transfer of funds.

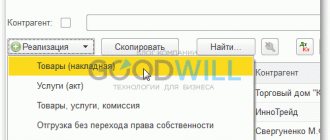

Payment of state duty may be required in situations where it is necessary:

- make changes to the constituent documents of the company;

- perform some actions with the license (receive for the first time or a duplicate, re-issue);

- file a lawsuit;

- perform registration actions in connection with the acquisition of the OS and others.

Such state duties can be taken into account in the accounting and tax accounts of the organization.

See how to fill out a payment form to pay the state duty.

The ready-made solution “ConsultantPlus” describes which BCCs to indicate in payments for payment of state duties. You will receive even more useful information if you sign up for a free trial access to K+.