VAT for the agent on the sale of goods, works, services under an agency agreement

The method of registering VAT under an agency agreement with an agent when performing taxable transactions under a product sales agreement depends on the specifics of the action under the contract.

If the action under the agreement is performed on behalf of the principal, the accrual and invoicing is carried out only from the consideration, the invoice is recorded in the sales ledger in the usual manner. These are all the actions of a person as a representative. The principal then charges a fee on the products sold and issues invoices to consumers.

If the action is performed on one’s own behalf, then it is required to issue and register an invoice for the sold goods of the principal, who has the obligation to pay a fee upon receipt of an advance. A fee must be assessed and an invoice issued against the fee.

There is a certain algorithm for the actions of the intermediary when issuing and registering an invoice for products sold. First, documentation is issued for the buyer on his own behalf. Two copies are compiled, and a limited time is given for this - 5 days.

The document must necessarily reflect the account number, name of the person, address, TIN and KPP information. The allocated fee in the document to the buyer for the principal's products does not need to be included in the budget.

The buyer is given one copy of the document, the principal is given a copy of the invoice. The transfer period is not specified, but can be specified in the contract of assignment. The invoice issued to the buyer must be recorded in the accounting register. The received document is recorded in the second part of the accounting journal.

Upon receipt of an advance payment for products from the buyer, it is necessary to issue and register the relevant invoices in the manner applicable for the shipment of products.

Agent VAT on payments to foreign companies

The principal fully funds the agent to carry out his instructions, since the agent always acts on behalf of the principal.

In most cases, an agency agreement implies the possibility of the agent concluding a subagency agreement. That is, the agent can shift his obligations under the contract to a third party (the exception is contracts in which such a possibility is excluded by agreement of the parties). As for the advantages of an agency agreement, they include a wide scope of its application. After all, such an agreement, which took the most functional parties from the commission agreement and the agency agreement, is almost universal, since within its framework it is possible to provide not only legal, but also many other services, for example, to engage in the sale of goods (while the goods remain the property of the principal until it is sold to end customers), services, real estate, etc. Limitations It is worth noting that an agency agreement cannot be applied in some areas of commercial activity. These areas include the food trade sector (this means that stores do not have the right to take products for sale with the opportunity to return them at any time), the energy supply and gas supply sector (agency in these areas is unjustified, since consumers in a specific place, like are usually deprived of the opportunity to choose a resource supplying organization).

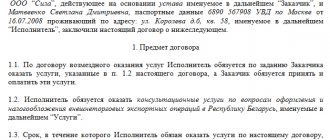

How to draw up an agency agreement?

When drawing up an agency agreement, you need to take into account several important points that should be present in it: the clause “subject of the agreement” - this means that the document must indicate what exactly the agent will do (this can be legal services of various types, as well as other actions: services for the sale/purchase of goods, real estate, services); an indication on whose behalf the agent is acting: on his own or on behalf of the principal (or you can choose a mixed option; the “term of the agreement” clause: fixed-term or without indicating the validity period; the procedure for reporting the agent for all actions taken (the terms, procedure and type of reporting should be indicated , as well as documents that will confirm the agent’s expenses); the amount and procedure for paying remuneration under the contract (in the absence of such a clause, remuneration will be paid according to the average market cost of similar services); a clause limiting the rights of the parties (for example, you can indicate that the agent does not have the right enter into a similar agreement with another principal); it is worth remembering that the principal cannot by agreement determine the range of customers for the agent; a clause on the possibility or impossibility of concluding a subagency agreement (if the possibility of concluding a subagency agreement is provided for, then you need to remember that the subagent will be able to enter into transactions with third parties only in case of sub-trust, and if such a condition is unacceptable, then it is better to indicate that the agent must perform all actions personally and not resort to the services of subagents); reasons why the contract can be terminated (here you can simply list all possible options for terminating the contract: from the desire of the principal or agent to the death of the agent).

Agency agreement and taxes

In matters of taxation under an agency agreement, everything seems to be clear: for the agent, the tax base consists of the amount of remuneration, and for the principal, payment expenses are other expenses that are associated with the production and sale of goods and services. But, at the same time, tax authorities consider some agency agreements to be a tool for optimizing income tax. And therefore, their special attention is drawn to such moments as: acting as an agent of a foreign company; the agent has shell companies; use of a special tax regime by the agent. At the same time, in order to confirm the real agency relationship and the business purpose of concluding an agreement, the agent can work with those categories of third parties (buyers, etc.) that cannot be covered by the principal himself, or help expand the territory of the principal’s presence.

In addition, tax authorities are more trustworthy of those agents (we are talking about individual entrepreneurs and organizations) who conduct their activities independently and have the necessary competence and resources for this. Not least important are timely reports from agents that correspond to the actual relationships between the parties, which are a demonstration of real work for the principal.

The agency agreement between the principal and the agent, under which the agent takes the goods for sale, deserves a special comment regarding taxes. In fact, the transfer of goods to an agent is not a sale (the final sale is considered a sale), since funds for the goods when transferred to the agent are not transferred to the principal’s account, and the agent can return the goods at any time. Consequently, an invoice is not issued and the seller of the goods is the principal, although he acts through an intermediary. This means that all revenue for goods must be taken into account when calculating income tax and VAT.

The agent will receive his remuneration from the income of the principal. And the tax base for the agent will be his remuneration and expenses not compensated by the principal. And if, during the sale, the goods were sold for a higher price than the minimum price set by the principal, then the additional benefit is divided equally between the parties to the contract (although the contract may provide for another division). In this case, the agent’s share, which he will receive from more profitable trade, is still considered part of the principal’s revenue and must be taken into account when calculating VAT and income tax.

In practice, the principal often does not take into account the difference between the recommended price and the selling price as part of the tax base, which is a violation, because there is arrears in income tax and VAT.

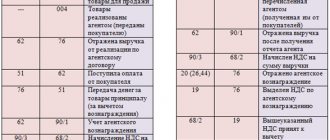

Agency agreement accounting for the principal and agent, VAT optimization through the agency agreement

In the accounting and tax accounting of a person acting on behalf, income from intermediary activities is considered revenue from ordinary types of work. In accounting, the amount of revenue from intermediary services is reflected in account 90, subaccount 90-1 is used, correspondence accounts will be 76-5.

Based on the subject of the surety contract, the accounting procedure may vary. Transactions under agency agreements with VAT can be divided into two types. The contract may be for the sale of the principal’s goods and the conclusion of agreements with suppliers of goods and materials.

According to Article 249 of the Tax Code of the Russian Federation, income from the sale of intermediary services for the purpose of imposing deductions will be revenue from services. If payers determine taxable income using the cash method, the date of receipt of income will be the day the money is received in bank accounts.

Expenses are expenses that are supported by documents, provided that they were carried out to carry out activities for the purpose of income. If there are no documents, it is impossible to prove this fact.

Thus, the income that a person acting on behalf of in the execution of a contract receives in the form of remuneration is taken into account when forming taxable profit.

According to Article 251 of the Tax Code, funds received by the agent as compensation for additional expenses under the contract are not taken into account when taxing profits if the conditions are met.

The principal can reflect revenue only after receiving a report on the person’s fulfillment of the intermediary duties specified in the contract. The report confirms the fulfillment of the conditions for recognizing income in accounting.

To reflect the goods that were registered for sale, the principal applies 45 accounts. After the transfer of ownership of goods to the buyer, revenue is reflected by the principal using accounts 90 and 90-1.

Is paid agency VAT refundable?

The amount of agent VAT paid can be claimed for deduction in the same quarter in which it was paid. This happens when preparing a quarterly VAT return. The amount paid in this way to the tax authorities will reduce the current VAT payable. Or it can be returned from the budget if the amount of deductions for the quarter exceeds the accrued VAT.

However, it will be possible to deduct VAT only if the services are actually provided and accepted by the customer. In the Russian Federation, this fact is confirmed by the joint signing of a certificate of services performed . This document is drawn up in free form, but must contain the following necessary data:

- list of services provided and their quantitative indicators,

- cost of services,

- date of acceptance of work (usually coincides with the date of drawing up the act),

- signatures and seals of both parties.

The document must be drawn up in Russian (it can be bilingual or with a separate version in Russian).

If an advance is paid for the provision of services, agency VAT must be paid, but it can only be claimed for deduction in the quarter when the services are actually provided.

Connect with us

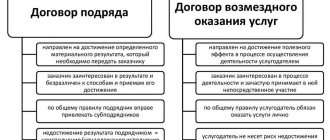

Intermediary agreements allow legal entities to defend their legal rights and interests with the help of third-party organizations. An agency agreement, along with a commission and assignment agreement, is one of the most common forms of written agreements. However, for a specific situation, it is very important for the company’s management, and sometimes even for an ordinary person, to choose the right form of transaction that will most closely match the situation and protect against possible abuses.

Advance VAT on agent fees

There are different types of mediation agreements that are concluded between interested parties, including agency agreements. Under this agreement, the intermediary receives a remuneration that is fixed or depends on the cost of goods purchased or sold for the principal.

The provision of intermediation services is subject to VAT if the intermediary is its payer. Thus, the agent has the obligation to charge VAT on agency fees, as well as on other income from work in this area. If the activity of an intermediary is related to the sale of non-taxable objects, he must pay deductions from the price of his services.

The intermediary charges a fee on the amount of remuneration for the time when the obligations under the contract are fulfilled. Most often, when taxing, the usual tariff of 20% is applied, but goods may have different rates or not be taxed at all.

There are cases where payment under a contract to an intermediary is withheld from funds received from buyers or from the principal. Then a fee is charged on the remuneration allocated from the total amount, as with the advance payment. An invoice will be required within 5 days after receiving the money. Once the report is approved, it will be possible to issue a VAT refund on the advance payment.

In what cases and when is it necessary to withhold agent VAT?

Agency VAT is paid in cases where the place of supply of work or services is recognized as the Russian Federation, but the taxpayer company (in our case, the parent company) is not a VAT payer in our country. In such a situation, the customer (in our case, a subsidiary) when paying for services, independently withholds 18% of the remuneration amount and transfers it to the tax authorities on the same day when the remuneration is paid.

All situations where the Russian Federation is recognized as the place of sale of services are listed in Article 148 of the Tax Code of the Russian Federation. Determining the place of sale depends on what services are provided. The key document in which this should be spelled out is the contract. Therefore, in order to accurately determine the need to pay agency VAT, the services provided must be clearly and in detail specified in the contract.

For example, agency VAT must be paid if a non-resident company provides consulting, legal, accounting, auditing, engineering, advertising, marketing, and information processing services to a Russian company. It is also common for a non-resident company to provide services related to the property of its subsidiary in Russia, for example, assembly, installation or repair of equipment at a plant.

VAT from the principal on the sale of goods, works, services under an agency agreement

The features of charging fees and issuing invoices for the principal differ depending on on whose behalf the goods were sold - on their own behalf or under an agency agreement for the provision of intermediary services for finding clients.

If an agreement has been concluded with further payment of agency fees including VAT, invoices are drawn up by the agent, and he gives copies to the client. Based on these copies, deductions are calculated and invoices are issued to the agent, but not to the buyer.

You must first obtain a copy of the invoice from the agent that he issued to the buyer. You need to ensure that you receive up-to-date data on unloading of goods and other actions in a timely manner.

The fee is charged at the time the goods are shipped to the buyer by the agent. An invoice is issued to the agent within 5 days from the time of shipment. This document must be recorded in the sales ledger. The accrued payment is included in the total amount of the fee based on the results of ¼ of the year when the shipment was made.

Features of taxation of intermediary agreements

The amount of remuneration in the contract can be established as a fixed amount, a percentage of the cost of the goods sold, or as the difference in its price.

For the intermediary services provided, the principal is obliged to pay the attorney a remuneration if this is provided for by law, other legal acts or agency agreement (Article 972 of the Civil Code of the Russian Federation). According to paragraph 1 of Article 990 of the Civil Code of the Russian Federation, under a commission agreement, one party (the commission agent) undertakes, on behalf of the other party (the principal), for a fee, to carry out one or more transactions on its own behalf, but at the expense of the principal. Under an agency agreement, the agent, on behalf of the principal, performs legal and other actions for a fee on his own behalf, but at the expense of the principal (Clause 1 of Article 1005 of the Civil Code of the Russian Federation).

Thus, the income of an attorney, commission agent and agent is remuneration for the services they provide to the principal, principal or principal. This provision also applies to individual entrepreneurs providing services under contracts of assignment, commission or agency agreements, since the business activities of individual entrepreneurs, like the business activities of organizations, are regulated by civil legislation (clause 3 of Article 23 of the Civil Code of the Russian Federation).

Income received by an individual entrepreneur from intermediary activities is subject to personal income tax in the usual manner provided for by Chapter 23 of the Tax Code of the Russian Federation, that is, at a rate of 13 percent.

Consequently, for personal income tax purposes, remuneration received by an individual entrepreneur from the provision of services under an agency agreement, commission or agency agreement, in accordance with Article 210 of the Tax Code of the Russian Federation, is considered as income.

The receipt of property under an intermediary agreement is not recognized as income of the intermediary - an individual entrepreneur. The Ministry of Finance of Russia, in letter dated May 24, 2005 No. 03–03–02–05/23, recommends that when determining the income of individual entrepreneurs subject to taxation, one should be guided by civil legislation. In accordance with Articles 971, 990, 1005 of the Civil Code of the Russian Federation, the intermediary undertakes to carry out certain legal actions and transactions at the expense of the other party (principal, principal, principal).

Thus, property (including funds) received by an individual entrepreneur in connection with the fulfillment of obligations under an intermediary agreement, as well as for reimbursement of expenses incurred by him for the principal (committee, principal), if such expenses are not subject to inclusion in their expenses, are not considered income from business activities.

There are two options for the intermediary to receive his remuneration:

- transfer from the current account of the principal (principal, principal) on the basis of a report and (or) an act on the provision of intermediary services (where the amount of this remuneration is usually fixed). This option is applied in the case where such a requirement is contained in the commission agreement or if all payments are made through the accounts of the principal (committent, principal);

- the intermediary withholds his remuneration from the amounts due for transfer to the principal (principal, principal). The amount of remuneration in this case is also determined based on the report and (or) act on the provision of services. Moreover, this option should also be reflected in the mediation agreement.

When calculating the tax base, income received from business activities is reduced by the amount of actually incurred and documented expenses directly related to the extraction of income (professional tax deductions). In addition, the expenses also include the paid unified social tax (see the resolution of the Federal Antimonopoly Service of the North Caucasus District dated April 17, 2006 in case No. F08-1488/2006-610A).

In this case, the composition of these expenses accepted for deduction is determined by the taxpayer independently in a manner similar to the procedure for determining expenses for tax purposes established by Chapter 25 of the Tax Code of the Russian Federation “Organizational Income Tax.”

The expenses of an individual entrepreneur for the implementation of an intermediary agreement are compensated by the principal (committent, principal). At the same time, if an intermediary, within the framework of an intermediary agreement, incurs expenses that are not reimbursed by the principal (principal, principal), then the intermediary has the right to include such expenses in professional deductions for personal income tax (resolution of the Federal Antimonopoly Service of the Volga-Vyatka District dated October 12, 2004 in the case No. A79–2020/2004-SK1–20200). A similar position is stated in letters of the Ministry of Finance of Russia dated July 24, 2006 No. 03–03–04/2/604, dated February 16, 2006 No. 03–03–04/1/117. At the same time, these expenses must meet the requirements of Article 252 of the Tax Code of the Russian Federation on justification and documentary evidence.

For example, a commission agreement provides for the obligation of the committing organization to reimburse the individual entrepreneur-commission agent for expenses associated with storing goods. The rent amounts transferred by the principal to the lessor on the basis of a warehouse lease agreement concluded by the commission agent cannot be considered as the income of the commission agent. These amounts are not subject to personal income tax taxation, since the individual entrepreneur-commission agent, who entered into a warehouse lease agreement on his own behalf, did not receive these amounts from the committing organization.

If an individual entrepreneur is not able to document his expenses related to his business activities, a professional tax deduction is made in the amount of 20 percent of the total amount of income received from business activities (Article 221 of the Tax Code of the Russian Federation).

In the event that an individual entrepreneur is a principal (principal), the tax base for personal income tax from the sale of goods using an intermediary is formed for him in the usual manner. The amounts of remuneration paid to intermediaries are taken into account as part of professional deductions for personal income tax.

Filling out the declaration by a VAT agent

According to the new laws, the value added tax declaration is issued electronically. The title page and sections 1 and 2 are required to complete the document.

The list of persons who are required to submit declarations is specified in Article 174 of the Tax Code of the Russian Federation. However, the obligation to file a declaration is assigned not only to persons obliged to pay this tax, but also to tax agents in accordance with Article 161 of the Tax Code, as well as organizations that are intermediaries.

If the sale of intermediary services was carried out on the territory of the Russian Federation, an object of taxation appears. The basis for the provision of services are contracts of assignment and agency contracts. The tax base will be the amount of remuneration under the agency agreement.

How much agent VAT must be withheld?

The question often arises: how much of the remuneration should be retained? Should I charge 18% on top or use a rate of 18/118%?

Here everything is decided by the text of the contract. It is most convenient to write down the amount of remuneration to be received and indicate that this amount is after all necessary taxes have been withheld. In this case, agency VAT will be 18% of the paid remuneration.

If the remuneration is paid in foreign currency, then the tax amount must be calculated at the exchange rate of the Central Bank of the Russian Federation on the date of transfer.

Results

Accounting for agency agreements has its own specifics and differs depending on whether the intermediary is involved in the calculations or not. Funds and property received by the intermediary in connection with the execution of the order are not taken into account by him in the balance sheet and do not become his income.

In order not to make mistakes with transactions under an agency agreement, it is necessary to study its terms - on the basis of which documents to reflect transactions in accounting, what algorithms are used to calculate agency fees, etc.

The main account for recording transactions is 76 “Settlements with various debtors and creditors” in correspondence with accounts 51 (for payments), 68/2 (for VAT accounting), 44 (for registering purchased goods), etc.