01.07.2019

0

317

4 min.

Paying taxes is an obligation that applies to every employed member of society. The existing system of collecting fees is a product of gratuitous contributions by individuals and organizations to ensure the functionality of the state, municipalities and the maintenance of disabled categories of citizens. Employees who decide to quit often ask their employer the question: is compensation for vacation subject to an insurance premium or not?

For officially employed people, the employer automatically makes monthly contributions to the inspectorate. Taxable income includes salary, bonuses and vacation payments, work on holidays and overtime, sick leave, compensation for unused vacation upon dismissal.

Basic Concepts

An employee employed at an enterprise pays personal income tax, calculated by the accounting department of the institution in relation to the amount of his salary - 13%. Article 217 of the Tax Code establishes the types of income that are not subject to taxation.

These include:

- benefits received in connection with pregnancy and childbirth;

- compensation for harm to health;

- expenses for advanced training of specialists;

- payments upon dismissal, except compensation for vacation;

- financial assistance to relatives of a deceased employee, as well as to victims of natural disasters;

- compensation in connection with sanatorium-resort treatment;

- gifts, the cost of which does not exceed 4 thousand rubles;

- payment for medical services;

- compensation for payments on loan obligations in connection with the purchase of housing.

Vacation compensation in case of dismissal is not included in their number, therefore the employer must make a contribution to the inspectorate from this amount. This payment is understood as the accrual of funds to an employee if he submitted a letter of resignation of his own free will, but during the worked calendar year did not have time to rest 28 days, or less than part of the vacation. This responsibility falls on the organization in accordance with Article 127 of the Labor Code. He has the right to resolve this issue differently, for example, before dismissal, use state-guaranteed rest, but in this case the employee will receive money in the form of vacation pay, based on the number of days and salary.

Attention! Article 422 of the Tax Code describes the amounts of income that are not subject to collection by the Social Insurance Fund. Clause 2 contains information about the absence of fees regarding payments upon dismissal, with the exception of compensation for unused rest days.

Insurance premiums and personal income tax

The procedure for levying insurance premiums and personal income tax depends on the type of payment in the final settlement. Compensation for unused vacation is subject to insurance contributions and personal income tax in full (clause 2, clause 1, article 422 and clause 3, article 217 of the Tax Code of the Russian Federation). And other types of compensation upon dismissal will be subject to contributions depending on their size. If the amount of payments, including severance pay and average monthly earnings, does not exceed the amount of the three-month average salary of the resigning employee, then they are exempt from insurance contributions and personal income tax in full (clause 2, clause 1, article 422 of the Tax Code of the Russian Federation). From the amount of compensation payments to a former employee that exceeds three times the amount of wages, it is necessary to calculate and pay insurance contributions to the budget, and personal income tax must be withheld from them.

IMPORTANT!

Severance pay, retained income during employment, and other compensation upon dismissal are taxed if their total amount exceeds three times the employee’s average monthly earnings. And vacation compensation upon dismissal is always subject to insurance contributions and personal income tax.

Compensation payments upon dismissal

According to current legislation, the procedure for leaving a job is preceded by the employee filing an application as a notification to the manager 2 weeks before he leaves the organization. The specialist has an obligation to work 14 calendar days for the director to find a new employee. This rule applies if he does not belong to a preferential category of the population. The next step is to issue a dismissal order, in which the person signs, which is considered to be his familiarization with the issued document. The contract with the employee is terminated. On the last day, a work book with the corresponding entry is issued and payments are calculated.

Mandatory ones include:

- wages due to the employee for the days he worked during the last month;

- compensation for unused vacation days (if he was on vacation for 28 calendar days, this payment is not provided).

Calculation and accrual upon dismissal is carried out by the accounting department, the amount depends on the number of days worked and the average salary.

For example, a citizen has a monthly income of 50 thousand rubles. The employee wrote a letter of resignation on April 5, taking into account 14 days of work, his last working day is considered to be the 18th. Thus, during the month, the citizen performed his official duties for 14 shifts out of 22. Dividing the salary by the number of days worked, we get the accrued salary in the amount of 35 thousand 700 rubles.

To determine the amount of compensation for unused vacation, the accountant needs to know how much the average earnings of the dismissed person are for the last 12 months of work. It is calculated using the formula: the amount received by the employee during 1 year / 12 months / 29.3 (average number of calendar days in a month). To obtain the payment amount, average earnings per day * number of vacation days. For example, 50 thousand rubles / 12 / 29.3, we get 1706. 1706 * 28 days of rest = 47781 - compensation for unused vacation.

Compensation for unused vacation

Every year, the employer is obliged to provide an employee with leave of 28 calendar days while maintaining average earnings (Article 114 of the Labor Code of the Russian Federation). If at the time of dismissal the vacation has not been taken off completely, these days must be compensated (Article 127 of the Labor Code of the Russian Federation). If vacation is provided in advance, then the amount previously paid for excessive vacation days is withheld from the employee. Whether compensation upon dismissal is subject to insurance contributions is regulated by Article 422 of the Tax Code of the Russian Federation. In paragraphs Clause 2, paragraph 1 of this article states that compensation for vacation pay cannot be excluded from the object of taxation with insurance contributions.

For each month worked in full, an employee is entitled to 2.33 calendar days of vacation. Moreover, if in the last month of work an employee worked more than 15 days, then he is considered fully worked and is included in the calculation. If less, then the month is excluded from the calculation.

| Limited Liability Company "Pion" ORDER dated 02/05/2020 No. 111 On payment of compensation for unused vacation upon dismissal In connection with the dismissal of manager Semenov Semen Semenovich on 02/06/2020, in accordance with order No. 110 of 02/05/2020 and guided by Article 127 of the Labor Code of the Russian Federation, I ORDER:

General Director A.V. Voronov |

The amount of compensation for vacation unused on the last day of work is calculated using the formula:

The average daily income is determined similarly to the calculation of vacation pay (clause 10 of the procedure approved by government decree No. 922 of December 24, 2007).

Taxation of vacation compensation upon dismissal

The answer to the question whether compensation for unused vacation is subject to taxes is contained in Article 217 of the Tax Code. 13% is withheld on the day the employee receives the payment. If this period falls on a holiday or weekend, the amount will be credited to the employee and to the tax office on business days. In addition, the company pays contributions and fees to the insurance company and pension fund to form a pension.

Carrying out collections to the tax authority

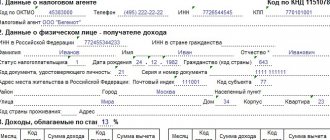

Taxation of compensation for unused vacation upon dismissal is carried out through the employer. The accountant makes payments, sends statements and funds to the current account of the tax office.

The employee does not participate in this accrual option; he receives earnings minus 13%. In labor legislation, there are situations when citizens, if there are grounds, return income tax, or fill out an application at their place of work with a request for no deductions. Such conditions include the sale or purchase of real estate, expenses during the year for treatment or education for yourself and close relatives. If such an application is submitted to the employer, no monthly payment is made to the inspectorate.

Types of mandatory tax payments and contributions

During the period of dismissal, as well as in the case of continued employment, the specialist is a taxpayer, and the company is an agent who transfers money to the recipient’s account. Insurance premiums and taxes are required to be paid on compensation for unused vacation.

These include:

- 13% of income;

- to the pension fund;

- social insurance fund;

- off-budget funds, if citizens' pension savings are in them.

It is important to know! Other compensation payments received by the employee in the event of leaving the position are not subject to tax and insurance contributions.

Which funds should I transfer to and how much?

Since amounts for unused vacation are subject to insurance payments, we will tell you where and how much to pay. From such income, funds are allocated to the following types of insurance:

- pension;

- social (for the period of temporary disability);

- medical;

- from accidents at work and occupational diseases (for “injuries”).

Contributions for health insurance are charged on the total amount of income at a rate of 5.1%, for “injuries” - from 0.2 to 8.5%, depending on which occupational risk class the employer belongs to.

In order to correctly calculate the amounts for pension and social insurance, it is necessary to take into account the total income for the time worked in the current calendar year. The government annually sets the so-called maximum base for calculating payments for future pensions and possible temporary disability. For 2021, it is 1,021,000 rubles for pension insurance and 815,000 rubles for social insurance.

If, taking into account compensation for unused vacation, the employee’s income in the current year did not exceed 1,021,000 rubles, then 22% of the total amount must be allocated to the pension. If an employee earns more than the specified limit, then only 10% needs to be given to the state. As for social insurance, payments are calculated at a rate of 2.9%. Transfers are made until the employee’s income in the current year exceeds 815,000 rubles. When total earnings exceed the limit, no more money is transferred for temporary disability.

Other payment features

There is a type of severance pay in the amount of average earnings for two weeks. This is usually due to the situation if the initiative does not come from the parties to the employment agreement. For example, if an employee is called up to serve in the army. There are other similar justifications listed in the legislation.

An employee can also be fired if he refuses to accept changes to the employment agreement.

Typically, contradictions arise if the document initially indicates conditions that directly violate current legislation. You need to carefully study the dismissal process itself and look at what articles are used . It is recommended, if possible, to seek help from lawyers; they will point out the specifics of a particular situation.

The employer is obliged to transfer severance pay no later than the next day on which wages are paid. The date from which various benefits are assigned, including for registration at the employment center, depends on the time of termination of the employment relationship.

If managers violate the specified deadlines, they are required to pay certain fines. The minimum amount is 1/150 of the Central Bank rate of the unpaid amounts. Interest is charged for each day while there is a delay. The prosecutor's office or the court, the state labor inspectorate considers applications from employees if previous actions and disputes have not led to any result.

The amount of severance payments is usually increased only if the condition was initially specified in the regulations adopted by the organization. When making payments, it is necessary to take into account all the days when the employee performed his immediate duties.

It is also useful to read: Details for paying individual entrepreneurs’ insurance premiums