Under what conditions are excess daily allowances subject to insurance premiums?

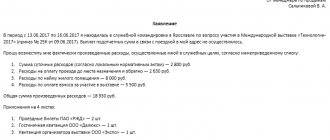

From the text of paragraph 3 of Art. 217 of the Tax Code of the Russian Federation, it is clear that not the entire amount of travel expenses is subject to taxation. Documented travel and accommodation costs, daily payments within 700 rubles. for trips around the country and 2,500 rubles. on a business trip abroad are not subject to personal income tax.

For information on what to do if an employee does not report on a business trip on time, read the material “What to do if the accountable person does not report on time.”

If the costs of accommodation and transportation expenses during a business trip have not been documented and there is no way to confirm them, then they will be subject to personal income tax, with the exception of daily allowances within the amounts specified above. Fiscal authorities can also take into account funds spent and not documented in excess of the standards in the base for calculating personal income tax (resolution of the Federal Antimonopoly Service of the West Siberian District dated December 23.

2013 No. A27-1862/2013). The validity of the payment of the daily allowance itself within the limits established by law in the event of the loss of travel documents can be confirmed by local documents of the enterprise - orders for sending on a business trip, time sheets, reports on the completion of official assignments.

For information on what actions to take if there are no documents on residence, read the article “What to do with personal income tax if there are no documents on residence on a business trip?”

Insurance premiums are not charged on daily allowances if such daily allowances do not exceed the above limits (clause 2 of Article 422 of the Tax Code of the Russian Federation). Accordingly, daily allowances in excess of the norm are subject to insurance premiums in 2021.

In other words, when traveling within the Russian Federation for daily allowances over 700 rubles, insurance premiums will need to be calculated. And for business trips abroad, insurance premiums are calculated from daily allowances exceeding 2,500 rubles per day of business trip.

Please note that for one-day business trips, insurance premiums must be calculated from the entire amount. This is due to the fact that payments for one-day business trips cannot be recognized as daily allowances, and therefore they are not exempt from contributions (clause 11 of the Regulations, approved by Government Resolution No. 749 dated 13.10.2008, Letter of the Ministry of Finance dated 02.10.2017 No. 03- 15-06/63950).

Although, if such payments for one-day business trips are formalized not as daily allowances, but as reimbursement of expenses associated with the business trip, they will not be subject to contributions. But the expenses incurred will need to be confirmed with primary documents.

Speaking about insurance premiums up to this point, we meant contributions for compulsory health insurance, compulsory medical insurance and VNIM, paid in accordance with the requirements of the Tax Code of the Russian Federation. As for insurance premiums for injuries, daily allowances are not fully subject to them. In this case, it does not matter whether the daily allowance threshold established by the employer exceeds 700 rubles or 2,500 rubles (Clause 2 of Article 20.2 of the Federal Law of July 24, 1998 No. 125-FZ, Letter of the Social Insurance Fund of November 17, 2011 No. 14-03-11/ 08-13985).

Let's consider a number of features under which excess daily allowances are subject to insurance premiums. The first feature has a legislative background and is enshrined in Federal Law No. 212. According to it, the insurance premium must be charged on any payments made in favor of individuals, including remuneration.

In this matter, one controversial condition arises that is in force today: if the duration of a business trip is 1 day, then the daily allowance is not subject to insurance contributions. There is ongoing discussion regarding this rule between the FSS and the Supreme Arbitration Court of the Russian Federation. The first organization does not agree with this rule and believes that amounts issued for one day should be taxed.

The issue of taxing insurance premiums for one-day business trips remains on the agenda to this day. Therefore, if the company does not impose a contribution on this kind of payment, it faces disapproval from the FSS inspector, which may subsequently lead to legal proceedings.

In addition to the payment of daily allowances, which are paid in the amount established by the employer for each day of a business trip, the Labor Code of the Russian Federation provides for reimbursement of travel to the place of business trip, rental housing, and also, by agreement with the employer, other expenses of the employee. Moreover, the employer can establish the amount and procedure for reimbursement of travel expenses by its internal regulations or collective agreement (Article 168 of the Labor Code of the Russian Federation).

The current law on insurance premiums dated July 24, 2009 No. 212-FZ does not establish a specific amount of non-taxable daily allowances, but simply says that they are not subject to taxation along with documented expenses for travel to the destination and baggage transportation, airport taxes, payment on a business trip, rental accommodation, etc. (Clause 2 of Art.

- At one time, each of the funds explained in their letters that only part of the daily compensation is exempt from contributions, which does not exceed the norms established by the employer himself by his internal regulations (order, collective agreement, regulations on business trips, etc.), which is completely complies with the provisions of Article 168 of the Labor Code of the Russian Federation (letter of the Pension Fund of the Russian Federation dated September 29, 2010 No. 30-21/10260; letter of the Ministry of Health dated August 6, 2010 No. 2538-19; letter of the Social Insurance Fund dated November 17, 2011 No. 14-03-11/08-13985).

Thus, until the end of 2021, a provision will be in force according to which employers must charge insurance premiums on daily allowances in excess of the norm, based on the limits that they themselves set. In fact, it is possible to issue an internal document to the employer in relation to any amount of daily allowance, also providing for special cases when the amount can be increased, thereby completely avoiding the accrual of contributions on them.

For details, see the publication “On what date should the foreign currency daily allowance for deposits be recalculated?” Keep in mind that for the purpose of withholding personal income tax, daily currency allowances must be recalculated to another date.

Read more about this in the material “And again - about personal income tax on foreign currency daily allowances.” Thus, from 2021, not only the income tax of individuals should be withheld from the amount of excess daily allowance, but also insurance premiums for pension, medical and social insurance (OPS, compulsory medical insurance and compulsory social insurance (in terms of disability and maternity insurance)) should be charged.

If the payer of contributions does not have the right to use reduced tariffs for them, then until the maximum value of the bases for contributions is reached, he will have to accrue an amount of insurance premiums amounting to 30% of the amount of excess of the current limit for the amount of excess daily allowance (including 22% for compulsory insurance). , 5.1% for compulsory medical insurance and 2.9% for compulsory social insurance).

Basic accounting entries - examples

Art. 168 of the Labor Code of the Russian Federation contains a list of travel expenses that must be reimbursed by the employer to its employee. The list of expenses exempt from contributions includes (Part 2, Article 9 of Law No. 212-FZ):

- daily allowance;

- targeted expenses, including expenses:

- renting accommodation;

- for travel to and from your destination, as well as for baggage transportation, this also includes station and airport fees and various types of commissions;

- to pay for the services of communication institutions;

- for obtaining a service passport and visas;

- to receive foreign currency or issue a bank check for foreign currency.

Insurance premiums are not charged provided that these expenses are documented. From January 1, 2015, this is directly provided for in the law, and before this date it followed from the explanations of officials (see letter of the Ministry of Health and Social Development of Russia dated May 26, 2010 No. 1343-19). At the same time, there is no difference between domestic and foreign business trips.

To learn about whether it is necessary to levy contributions on expenses for which there are no supporting documents, read the material “Was it necessary to charge insurance premiums before 01/01/2015 to compensate for the costs of renting housing on a business trip in the absence of supporting documents?”

Daily allowances, as part of travel allowances, are classified as expenses for ordinary activities (clauses 5, 7 of PBU 10/99, approved by order of the Ministry of Finance of Russia dated May 6, 1999 No. 33n).

Travel expenses are taken into account on the date of approval of the advance report by the head of the company.

- a day of stay on a work trip across Russia (700 rubles);

- trip to another country (2500 rubles).

- payment for accommodation in another locality;

- transportation costs (the general director of the organization determines its type);

- expenses for additional personal needs.

- registration of a foreign passport and visa;

- use of lounge services at airports and train stations;

- Internet and cellular communications;

- currency exchange commission.

- for a cultural event – RUB 14,000.00;

- for an excursion – 5,000.00 rubles;

- for buffet service (cultural event) – RUB 20,000.00;

- for the purchase of gifts and souvenirs – RUB 20,000.00.

Personal income tax is withheld in cases where the amount of compensation exceeds the specified standards.

If a company reimburses an employee for per diem in excess of the norm, his income is subject to taxes. It is recognized regarding the last day of the month on which the advance report is approved, which is sent by the employee returning from a business trip.

Personal income tax is payable after the following payments are made to the employee; this requirement also applies to salary. Payment must be made on the first business day following the listed payments to the official. This procedure is regulated by the Tax Code of the Russian Federation, Article 226.

Compensation for other expenses is made to the official with his daily allowance, which is provided by the company management. The amount may be increased by appropriate decision of the company’s management.

While on a work trip, the employee does not incur financial losses. The company must cover all the official's expenses that arise during the trip when paying the very first salary. The state levies certain taxes on these and other payments.

Calculation of entertainment expenses according to the example:

- The amount of entertainment expenses included in the list taken into account when calculating income tax: 70,000.00 15,000.00 10,000.00 = 95,000.00 rub.

- Of these, an amount of no more than 4% of labor costs is taken into account - RUB 60,000.00.

- The amount of other expenses for a representative reception not included in the list is: 14,000.00 5,000.00 20,000.00 20,000.00 = 59,000.00 rub.

- The accounting policy stipulates the use of direct costing when accounting for indirect costs.

Accounting for entertainment expenses posting: Date Account Dr Account Kt Amount, rub.

InfoK travel expenses include:

- Travel expenses;

- Housing rental expenses;

- Daily expenses;

- Other expenses with the permission of the employer.

A business trip can also be considered a one-day departure or travel of a remote worker to the company’s office. Important! All travel expenses, except for daily allowance, must be documented and economically justified. When transferring accountable amounts to a card for travel expenses, for documentary confirmation you must:

- Receipts display the use of funds from this particular card with the obligatory indication of the last name;

- When paying in cash, have ATM receipts for withdrawals for travel expenses.

Payment for business trips is based on average earnings.

Other payment is also possible, for example, salary, but not less than the amount of average earnings. How such expenses are reflected in accounting, what applies to them, how they should be executed and what transactions are generated for them - we will consider further. Table of contents

- 1 How to account for travel expenses in accounting

- 2 Personal income tax and travel expenses

- 3 What are daily expenses for a business trip

- 4 Typical entries for travel and daily expenses

- 5 Accounting for entertainment expenses 5.1 Typical entries for entertainment expenses

- 5.2 Entertainment expenses - how to arrange them using an example

How to take into account travel expenses in accounting Costs associated with travel and entertainment expenses of enterprises are included in other expenses associated with production and sales. In this case, the following entries are made: Debit Credit Name of transaction 50.3 76 A ticket was purchased for a posted employee. 71 50.

We suggest you read: What documents are needed for an insurance company?

3 A ticket was issued to an employee 20, 23, 25, 26, 29 (44) 71 The costs of purchasing a ticket 68. VAT were written off 19 VAT on travel expenses was sent for deduction Example of accounting for travel expenses Employee Ivanov is sent on a business trip for 5 days, he was issued a report amount 20,000 rub. Ivanov’s daily allowance is 1000 rubles. Upon return, he provides an advance report with attached documents:

- round trip train tickets totaling 8,000 rubles. (including VAT 1220 rubles, see how to calculate VAT from the amount here, follow the link to find an online calculator for calculation), VAT is highlighted on a separate line.

- invoice from the hotel on strict reporting form in the amount of 5,000 rubles.

Fresh materials

- Balance sheet of JSC Accounting (financial) statements of enterprises 39,149.84 billion rubles — JSC VTB CAPITAL 4,892.93 billion…

- Tax planning Tax planning in an organization Tax planning can significantly affect the formation of the financial results of an organization,…

- Exemption from VAT Notification of the use of the right to exemption from VAT Notification of the use of the right to exemption from VAT...

Excess daily allowance: insurance premiums and taxation

Info

PFR, FFOMC and FCC of the Russian Federation. In this case, contributions for injuries are excluded. For this reason, the number of chapters in the Tax Code has increased.

A new one has appeared, 34. It is she who prescribes exactly how contributions should be calculated and paid. A limit has been established on the amounts that are not required to be subject to insurance premiums.

This issue is regulated by Article 217 and Article 422 of the Tax Code of the Russian Federation. Now to the specifics:

- In the event that an employee located in the Russian Federation spends no more than seven hundred rubles daily.

- When an employee is sent on a business trip abroad, the norm is two and a half thousand rubles daily.

Before the changes, excess daily allowances were not subject to insurance premiums. Of course, if this possibility is not implied by a local regulation or collective agreement of the organization.

Attention

Check that Form 4-FSS is filled out correctly using a checklist developed by our experts. Results Since 2021, for insurance premiums transferred under the control of the tax service, the rules in force regarding the exemption from taxation of daily allowances paid during business trips have changed.

This change has led to the fact that previously non-taxable (regardless of their amount) daily allowances from 2021 received a limit on the size of the non-taxable amount. Exceeding this amount (excess daily allowance) entails the imposition of insurance premiums.

The changes in 2021 did not affect the contributions for injuries in any way; daily allowances are still not subject to these charges, regardless of what their amount turned out to be.

This can be explained by the effect of Article No. 168 of the Labor Code, which provides for the determination in the specified papers of the amount of reimbursement of expenses that may be associated with business trips. As a result, if the contracts specify the payment of daily allowance in the amount of, for example, 2 thousand rubles, then this amount must be paid in full, without deducting any contributions.

The administration of the settlement procedure, as well as the payment of insurance premiums, excluding those made “for injuries”, has been carried out by the Federal Tax Service since 2021. As a result of this change, a new chapter No. 34 “Insurance premiums” appeared in the Tax Code. In this chapter you can find that on business trips, daily allowances are not subject to insurance contributions, which are provided for in paragraph 3 of Article 217 of the Tax Code of the Russian Federation.

https://www.youtube.com/watch?v=3X0Su89breE

So, when sending an employee on a business trip, you should reimburse:

- Money spent on travel.

- Money used to rent a home.

- Expenses related in one way or another to paying for accommodation, since it is not possible to stay at a permanent place of residence.

- Other expenses that the employee made with the approval of the employer.

- Additional expenses.

How exactly the money spent during a field trip to complete a service assignment will be returned is decided by local regulations or a collective agreement. But there is a certain norm. But what to do with excess daily allowances in 2018? Excess daily allowances are subject to insurance premiums in 2021. Key changes occurred in 2021.

General points The daily allowance standard for different regions of our country is common. This means that this year there are no restrictions on daily allowances in various regions of Russia.

The amount of daily allowance must be fixed in local acts of the organization’s management. Thus, the company itself determines the daily allowance standard, accepting it as expenses under the simplified taxation system.

Last year, in 2021, no daily allowance limits were introduced. Standards and accounting In 2021, travel allowances can be of any size, regardless of whether the employee goes abroad or remains in the Russian Federation.

In other words: there is no rationing for daily allowances for employees traveling or on business trips. As a result, the organization has every right to independently set the daily allowance rate for its employees.

The main thing is to fix their amount in a local act from the employer. When located in Russia, the non-taxable limit is 700 rubles, and abroad the amount must be equivalent to 2,500 rubles. The base for insurance payments and their calculations for payers are determined by the employer at the end of each month as the total amount of all payments, as well as other remunerations that are accrued separately for each individual after the start of the billing period.

Add to favoritesSend by email Insurance premiums for daily allowances in 2018 will have to be calculated if the amount of daily allowances exceeds the norm established for such payments in order to apply the exemption for them. Let's consider what this norm is and exactly what contributions will need to be accrued.

How has the taxation of daily allowance contributions changed since 2021 Which daily allowances should be considered issued in excess of the norms Are excess daily allowances subject to “unfortunate” contributions Results How has the taxation of daily allowance contributions changed since 2021 Since 2021, insurance premiums intended for the Pension Fund of the Russian Federation, the Compulsory Medical Insurance Fund and the Social Insurance Fund (in terms of disability insurance and motherhood), changed their administrator, coming under the control of the tax authorities. The rules for calculating these contributions are now contained in a separate chapter of the Tax Code of the Russian Federation dedicated to them.

The concept of excess daily allowance comes into play when the employer pays to an employee an amount of daily allowance that exceeds the norm established by law. Separately, you should pay attention to those expenses that are not considered daily subsistence allowance, but must also be paid by the employer:

- Travel expenses using any transport (car, bus, train, plane, etc.).

- Accommodation costs for the entire period of the business trip (hotels, guest houses, hostels, rental housing, etc.).

- Other types of expenses related to needs and arising as a result of the employee living away from home.

Any other expenses are called daily allowances, which must be paid by the employer. If necessary, these daily allowances can be increased by the employer himself, and in situations where the amount paid exceeds the permissible norm, they will be considered excess. Excessive daily payments, as a rule, should be subject to tax contributions established by the legislative framework. If taxes are not made, the matter could take a serious turn, even leading to trial.

| ★ Best-selling book “Accounting from Scratch” for dummies (understand how to do accounting in 72 hours) purchased by {amp}gt; 8000 books |

The law on the taxation of excess daily payments with insurance premiums comes into force in 2021. From that moment on, the employer must transfer a certain percentage of any excess daily allowance to the following organizations:

- Russian Pension Fund;

- Social Insurance Fund (in case of temporary disability of an employee or pregnancy);

- MHIF.

Please note that this list does not include so-called “injury” contributions. Tax legislation will not apply to these contributions, so these contributions will need to be accrued only on that part of the daily payments that exceeds the established limit. This rule still applies today, i.e. the changes will not affect it.

This innovation is based on the fact that from 2021 the Federal Tax Service will directly administer the procedure for calculating and paying insurance premiums to the organizations listed above. In addition, based on this innovation, a new chapter has appeared in the Tax Code, this is chapter No. 34 “Insurance premiums”. In the chapter you can find both general information on the introduction of insurance premiums and more detailed information (for example, the limit on daily allowances, etc.).

Excessive daily allowances must be reflected in the accounting reports. They should indicate not only direct payments, but also insurance premiums (if any) and personal income tax. In order to consider this issue in detail, consider the following example.

| Number | Debit | Credit | Payment amount | the name of the operation | Execution date |

| 1 | 208.12 | 201.34 | 8799 | Issuance of cash payment from the cash desk for daily expenses | Daily allowance payment date |

| 2 | 401.20 | 208.12 | 8799 | The daily payment is reflected in expenses by the date of approval of the advance report | Date of approval of the advance report |

| 3 | 302.11 | 303.01 | 507 | Withholding personal income tax from the employee’s salary (8799 – 700*7) * 0.13 = 507 | Date of next salary payment |

These rules for indicating expenses and payments made are specified in the Instructions for the Application of Budget Accounting Charts, which was approved by the Russian Ministry of Finance in 2010. According to this instruction, the debit of the corresponding analytical accounting account should be displayed, and the credit of the account for increasing accounts payable for taxes established on the income of an individual.

From January 1, 2021, Law No. 212-FZ will cease to apply and will be replaced by a new chapter of the Tax Code of the Russian Federation - Chapter 34 on insurance premiums. In 2021, employers will have to forget about independently rationing daily expenses.

Article 422 of the Tax Code of the Russian Federation establishes a new procedure: now daily allowances are subject to insurance contributions if they exceed the limits established for personal income tax, as evidenced by a direct reference to clause 3 of Art. 217 Tax Code of the Russian Federation. The size of these limits will depend on where the employee is sent - on a business trip in Russia or abroad. Now there is no need to charge insurance premiums on daily allowances if their amount does not exceed:

- 700 rubles per day – when the employee is on a business trip within the Russian Federation,

- 2,500 rubles per day – when the employee is on a business trip abroad.

Non-taxable expenses

When sending an employee on a business trip, the management of the enterprise is obliged to reimburse him for all expenses for accommodation, travel and daily allowances. Also, for each day of a business trip, the employee must be paid an average salary.

Travel expenses to the place of business trip are paid to the employee in full. Personal income tax is not withheld from this amount. These costs include travel by any type of transport to your destination, as well as travel by taxi or public transport to the station or airport.

Tax on these expenses will not be withheld if these expenses are documented. If there are no supporting documents, then the tax will be withheld in full from the entire amount that was spent on travel to the destination and back. Tickets can be provided as proof of travel costs.

If for some reason they have not been preserved, then you can request a certificate from the carrier, which will indicate the direction, type of transport and cost of travel.

Expenses for renting residential premises are not fully taxed. Personal income tax is not withheld only if the employee has supporting documents. They could be a receipt for a hotel room or an apartment rental agreement.

If the employee does not have documentary evidence, then the tax-free amount is 700 rubles per day when traveling on business in Russia. If the work trip is abroad, then this amount should not exceed 2,500 rubles. If living expenses exceed the specified amounts, then personal income tax is paid on the amount in excess of the norm.

The standards are set by the state. The employer has the right to set a different daily allowance. This amount may be many times greater than the amount approved at the legislative level. However, this fact is not a basis for exemption from personal income tax. All expenses in excess of established standards are subject to mandatory taxation.

The concept of “per diem”

In situations where a company employee goes on a business trip in Russia or abroad, the employer undertakes to pay him a certain monetary remuneration, which is calculated per day - these are the so-called daily allowances. At the same time, there are only 3 main situations in which the employer is obliged to pay per diem.

To study the issue more accurately, let’s look at how the law interprets business trips. A business trip is a business trip, the terms and conditions of which are determined by the employer. In this case, the place where the work will be carried out must be remote from the established one.

Per diems are not part of the housing payment when working remotely and are taken into account as additional expenses for the employee’s daily needs. As a rule, the further away the remote work location is, the greater the amount the employer pays.

Payment of daily allowances for days spent on the road

According to para. 3 hours 1 tbsp. 168 of the Labor Code of the Russian Federation, the employer compensates expenses for each of the following periods:

- for all weekdays on a business trip

- for weekends and public holidays

- for days on which the journey to the place of business trip and back fell in whole or in part, this also includes periods of forced stops

Let's say an employee went on a business trip on Sunday and returned the following Saturday. In this case, he is entitled to daily allowance for seven days - five weekdays and two weekends.

What are the daily allowance premiums in 2018?

Important

Compensation for unused vacation: ten and a half months count for a year When dismissing an employee who has worked in the organization for 11 months, compensation for unused vacation must be paid to him as for a full working year (clause 28 of the Rules, approved by the People's Commissariat of Labor of the USSR on April 30, 1930 No. 169) . But sometimes these 11 months are not so spent.

When paying for “children’s” sick leave, you will have to be more careful. A certificate of incapacity for caring for a sick child under 7 years of age will be issued for the entire period of illness without any time limits. But be careful: the procedure for paying for “children’s” sick leave remains the same! {amp}lt; ...

Daily allowance rates in 2021

To date, the procedure for calculating daily allowance remains unchanged compared to last year.

However, it is worth noting that a new concept has recently been introduced: resort fee. Now, employees who, in accordance with their job duties, are in the territory of the “resort” regions of the Russian Federation for more than a day, are paid additional compensation.

The fee is calculated using the following formula:

Number of days of stay, excluding the day of arrival

× amount of the resort fee

You can also read:

Tutu Business Travel is a convenient and transparent service for organizing business trips. More details

The vast majority of companies have business partners. They can be in our country or abroad.

To maintain strong business relationships and to develop their own business and production, enterprise managers send employees on business trips. The purposes of the trip can be different: concluding agreements and signing contracts, searching for new partners and providing various types of services.

When sending its employee on a trip, the organization is obliged to pay travel allowances in accordance with the legislation of the Russian Federation. When sending on a business trip, the company is obliged to pay travel and daily allowances to its employees.

Expert opinion

Korolev Dmitry Viktorovich

Lawyer with 10 years of experience. Specialization: family law. Extensive experience in document examination.

They are accrued for each day of a work trip. The daily allowance amounts are established and are not subject to taxation.

If the amount exceeds the preferential amount, then taxes must be assessed in the prescribed manner.

Procedure for levying insurance premiums on daily allowances

Employees who go on business trips must be paid per diem. Many people are interested in the question of whether it is necessary to charge insurance premiums for such payments. According to Tax Legislation and Law No. 125-FZ, insurance premiums must be calculated on daily allowances. The exception is contributions for injuries, which since 2017 have remained within the competence of the Social Insurance Fund. Others were transferred to the control of the Tax Authorities.

The maximum daily allowance amounts for which insurance premiums are calculated (except for contributions for injuries) have been established:

- business trips within the territory of the Russian Federation – 700.00 rubles per day;

- business trips abroad – 2500.00 rubles per day.

They are charged personal income tax, contributions to compulsory pension, medical and social insurance.

Useful posts:

- Personal income tax is not assessed What income is not subject to personal income tax in 2019 Article 217 of the Tax Code of the Russian Federation contains all the names of payments...

- Maternity pay is subject to personal income tax. How to calculate the amount of benefits under BiR? The procedure for calculating the amount of benefits under the BiR is determined by federal law...

- Is the bonus subject to taxes? Is the bonus subject to insurance contributions? A bonus is a remuneration to an employee, issued by decision of management for the purpose of motivation...

- Travel allowances in excess of the norm Amounts and procedure for calculating tax At the legislative level, the amounts of travel allowances are established, which are exempt from taxation. Defined...

The latter do not agree with this condition and believe that even one-day amounts should be taxed. The Supreme Arbitration Court of the Russian Federation, on the contrary, classifies this kind of payment as compensation and believes that one-day wastewater does not need to be subject to an insurance premium.

Daily allowance for business trips in Russia and abroad

The amount of daily allowance is not limited by law (with the exception of employees of government agencies). Managers of private companies determine this parameter independently. The established value must be fixed in internal regulatory documents - for example, in a collective agreement.

We recommend that you take into account that clause 1 of Art. 217 of the Tax Code of the Russian Federation provides for maximum daily allowances that are not subject to personal income tax. Namely:

- up to 700 ₽ for each day of a business trip in Russia

- up to 2500 ₽ for each day of business trip in other countries

We also list the items of expenses that the organization is obliged to reimburse in case of a foreign business trip:

- visa and passport processing

- consular and airport fees

- entry or transit fees for vehicles

- registration of medical insurance policy

- other obligatory payments

Accounting for excess daily allowances. Example

Four schemes from the Federal Tax Service for avoiding paying VAT, but I missed the code!!! I also missed it in some databases. I didn’t notice it right away, I didn’t expect it like this... Accountants are complaining that 1C incorrectly puts the tariff code in the RSV simplified tax system, 01 - Japanese policeman! And the year in section 3 was 2021, but I noticed it there, but missed the code!!! Accountants are complaining that 1C incorrectly puts the tariff code in the RSV id157773611, there will be a deduction for the online cash register: new details from the tax authorities Trout, you wrote: Handed over on April 20, 43 tax office, Moscow. There is a receipt and notified...

Moscow tax officials ignore the movable property tax exemption introduced by Moscow law. Those who have nothing to hide do not suffer. All drug addicts are on Telegram About the money for accountants Nad.K, you wrote: tinka10_03, this is a check about the financing of terrorism. Let the employee in...

The legislative framework

| Code | Information about excess daily allowances |

| Labor Code | 1. According to Art. 168, the employer is obliged to reimburse the employee’s expenses related to living outside his place of permanent residence. 2. The employer can independently determine the amount of daily allowance, fixing it in a local regulation or in a collective agreement. 3. A business trip is work carried out by an employee for a specified period outside the place of work and involving residence in a place remote from his permanent home. If the work officially involves traveling, then such a trip is not considered a business trip. At the same time, while on a business trip, an employee cannot lose the established salary or lose his job: his working conditions must remain the same throughout the entire period of the business trip. |

| tax code | 1. Daily allowances that exceed the norm established by the Government do not make the income tax base smaller (Article 264). 2. Article No. 217 limits the amount of daily allowance paid to an employee, which is not taxed. 3. Compensation payments established by local, regional, district, and federal legislation, the amount of which does not exceed the norms established by law, are completely exempt from taxation (Article 217). 4. Article No. 226 specifies the procedure for withholding personal income tax from daily allowances, which it is recommended that the accountant adhere to. |

In addition, it is important to refer to two decrees of the Government of the Russian Federation that address the issue of daily allowances. The first of them, No. 93, contains information about the rate of daily allowance paid and some of their features. Second, No. 729 includes the amount of reimbursement of travel expenses within budgetary organizations.

When is the daily allowance excessive?

The concept of excess daily allowance comes into play when the employer pays to an employee an amount of daily allowance that exceeds the norm established by law. Separately, you should pay attention to those expenses that are not considered daily subsistence allowance, but must also be paid by the employer:

- Travel expenses using any transport (car, bus, train, plane, etc.).

- Accommodation costs for the entire period of the business trip (hotels, guest houses, hostels, rental housing, etc.).

- Other types of expenses related to needs and arising as a result of the employee living away from home.

Any other expenses are called daily allowances, which must be paid by the employer. If necessary, these daily allowances can be increased by the employer himself, and in situations where the amount paid exceeds the permissible norm, they will be considered excess. Excessive daily payments, as a rule, should be subject to tax contributions established by the legislative framework. If taxes are not made, the matter could take a serious turn, even leading to trial.

How are daily allowances calculated? The norm of daily payments according to the law

When one-day business trips occur, compensation payments to employees are not considered daily allowance. Such costs should be classified as other expenses (Article 168 of the Labor Code of the Russian Federation). However, such compensation payments are subject to personal income tax according to the same standards - 700 rubles. in the Russian Federation, and over 2,500 rubles. - outside the territory of the Russian Federation. This is confirmed by officials (“The Ministry of Finance explained how to assess personal income tax on “one-day” daily allowances”).

In some cases, business trips take place within the same locality. When an employee travels outside the workplace specified in the employment contract to separate divisions of the organization or the head office, the trip is also considered a business trip (clause 3 of the Decree of the Government of the Russian Federation of October 13, 2008 No. 749). At the same time, trips should not be permanent, and the employee’s activities cannot be associated with a traveling schedule.

About the peculiarities of personal income tax assessment of payments for the traveling nature of work, read the material “Payments to traveling workers: when can personal income tax not be withheld?”

For a one-day business trip outside the state, daily allowance is paid in the amount of 50% of the standard expenses outside the Russian Federation (clause 20 of the Decree of the Government of the Russian Federation of October 13, 2008 No. 749).

Such daily allowances are also not subject to personal income tax within generally accepted limits.

When sending employees on a business trip for official reasons, each organization has the right to set the amount of daily payments at its own discretion. The amount or procedure for calculating compensation costs must be established by local regulations. Personal income tax is withheld from payments to employees in excess of established all-Russian norms, that is, from payments of more than 700 rubles. per day for business trips in Russia and for amounts exceeding 2,500 rubles while staying on the territory of foreign countries.

For information on how daily allowances are subject to insurance premiums, read the article “What are the insurance premiums for daily allowances?”

Daily allowances paid in excess of the established standard must be included in the employee’s income in 2019 and personal income tax must be paid on them.

For the calculation and payment of insurance premiums, daily allowances were not standardized until January 1, 2021. Until this moment, Federal Law No. 212-FZ of July 24, 2009 was in force. From January 1, 2021, you must be guided by paragraph 2 of Article 422 of the Tax Code of the Russian Federation.

| Amount of daily payments (norm) | Business trip location |

| 700 rubles | Territory of the Russian Federation |

| 2500 rubles | Foreign territory |

Accordingly, if, for example, a daily payment in the Russian Federation is 1000 rubles, then it will be taxed. This is due to the fact that a large amount is already considered part of the employee’s income (or part of his salary), and is therefore subject to a fixed tax of 13%.

According to current legislation, daily allowances, the amount of which is specified in a local regulation or a collective agreement, do not require insurance contributions. This can be explained by the effect of Article No. 168 of the Labor Code, which provides for the determination in the specified papers of the amount of reimbursement of expenses that may be associated with business trips.

The administration of the settlement procedure, as well as the payment of insurance premiums, excluding those made “for injuries”, has been carried out by the Federal Tax Service since 2021. As a result of this change, a new chapter No. 34 “Insurance premiums” appeared in the Tax Code.

In this chapter you can find that on business trips, daily allowances are not subject to insurance contributions, which are provided for in paragraph 3 of Article 217 of the Tax Code of the Russian Federation. The latter states that income that does not require taxation includes daily allowances that are less than 700 rubles when staying in the country, and less than 2.5 thousand when abroad.

The mentioned “injury” contributions do not fall under the control of tax legislation. In addition, they are also not amended in Article 20.2 of the Federal Law, which provides for a list of payments that are not subject to contributions. Therefore, they must be calculated for that part of the daily allowance that exceeds the amount that is fixed in a local act or a collective agreement.

Also, when assigning daily allowances, it is worth paying attention to two government regulations. The first (No. 93) contains information regarding the daily allowance rate, as well as some of their features. The second of them, No. 729, includes reimbursement of expenses incurred on business trips for employees of budgetary organizations.

Daily allowance

The legislation calls per diem expenses for employees sent on a business trip associated with living outside their place of permanent residence (Part 1 of Article 168 of the Labor Code of the Russian Federation).

The amount of daily allowance in commercial companies is fixed in internal local regulations. Insurance premiums are not subject to daily allowance in the amount of 700 rubles/day. for business trips in Russia and 2,500 rubles. /day when traveling abroad (clause 2 of article 422 of the Tax Code of the Russian Federation).

Anything paid in excess of the specified limits is subject to insurance premiums. This rule does not affect only personal injury contributions. They are not subject to daily allowance in the amount prescribed by the employer in the local act.

Let us show with an example how to calculate insurance premiums for travel expenses in excess of the norm in 2021:

Employees of Transport Logistics LLC are paid a daily allowance for domestic business trips in the amount of 1,350 rubles per day. This amount is fixed in the collective agreement.

In March 2021, manager Ilyin A.A. was on a business trip in Kaluga for 5 days. He was paid a daily allowance of 6,750 rubles. (5 days × 1,350 rub./day).

At the same time, for the purpose of calculating contributions to compulsory pension, social and health insurance, the accountant divided the daily allowance into two parts:

- non-taxable contributions in the amount of 3,500 rubles. (5 days × 700 rub./day);

- taxable contributions 3,250 rub. (6,750 rubles ─ 3,500 rubles) or (5 days × (1,350 rubles/day ─ 700 rubles/day)).

Thus, daily allowances as one of the types of travel expenses in excess of the norm are subject to insurance contributions.

Recommendations and answers to pressing questions

Let's consider a number of frequently asked questions that often arise both among company employees and financiers. These questions relate to payments of daily allowance and excess daily allowance, as well as their features:

- When assessing daily income tax with personal income tax, it is recommended to act according to the following algorithm. First, an advance report is received from the employee, then the amount subject to tax is calculated, then personal income tax is calculated and, finally, personal income tax is withheld from the salary.

- To ensure that problems do not arise within the company, as well as during its interaction with organizations such as the Pension Fund or the Social Insurance Fund, it is recommended that the rules for calculating daily allowances and insurance premiums be established in local documents. It is best to fix the rules in a collective labor agreement.

- Not only insurance premiums, but also personal income tax are not charged on the established daily allowance rates. This feature must be taken into account by accountants when working.

To legally work with daily payments in favor of employees, it is necessary to carefully monitor the updating of the current legislative framework, as well as monitor the company’s local documents and their content. At the same time, it is recommended to sometimes consult professional tax employees about documentation, who will help resolve existing shortcomings and avoid problems with various inspections.

When an employee is sent on a business trip, the employer guarantees not only the preservation of his job and average earnings, but also reimbursement of expenses associated with the business trip, which include daily allowances. Per diem can be defined as the employer's financing of additional daily expenses of an employee associated with temporary residence in another location.

According to the Tax Code, personal income tax is not withheld from daily allowances if they are paid within the limits established by Article 217 of the Tax Code of the Russian Federation. And according to what standards should daily allowances be subject to insurance premiums? To understand this issue, we should consider the current provisions of the law, as well as the upcoming changes in the new year.

When daily allowances in excess of the norm are subject to insurance contributions, what are these norms for employers, and also what new is expected in 2017 in connection with the entry into force of new provisions of tax legislation regarding the taxation of daily allowances for business trips in Russia and abroad - about all this in our article.

Determining limits

So, the current legislation does not establish a maximum size of SR. However, officials have determined a certain limit, above which daily allowances in excess of the norm are subject to insurance premiums (2018).

The daily allowance for business trips is set for each company individually. The management of the organization sets limits based on their financial capabilities.

Article 217 of the Tax Code establishes that excess daily allowances are subject to insurance contributions (2018). Also, personal income tax will have to be withheld from amounts exceeding the limit. The limits are set as follows:

- for trips within Russia - 700 rubles per day;

- for foreign business trips - 2500 rubles per day.

In other words, if an institution has established large values for this type of expense, then the amount exceeding the limit is subject to taxation (personal income tax and personal income tax). Please note that this limit only applies to taxation. The company has the right to establish a CP greater than specified in Art. 217 Tax Code of the Russian Federation.

Using a specific example, we will determine whether daily allowances are subject to personal income tax and insurance premiums.

The SR limit that the company has established should be fixed by a separate order or special order of the company management. It is also permissible to stipulate in a local document the key rules for sending specialists on business trips.

Please note that one-day business trips and daily allowances (insurance contributions) are no exception. You will still have to withhold personal income tax on the excess and pay the contribution tax to the budget.