Remuneration according to the Labor Code of the Russian Federation

The Labor Code of the Russian Federation defines basic criteria related to accrual and payment for all work performed by an employee. The following key points are worth highlighting here:

- Payment for hired labor consists of several components - salary (rate), as a base one (its main part), constant additional payments, allowances, bonuses (additional part of income), as well as various compensation payments provided for by law or local documents (compensation part). Each of these elements must be described in detail in the remuneration system, which is an integral part of the enterprise’s collective agreement.

- Salaries are usually paid in cash. In exceptional cases provided for by federal laws or employment contracts, payment for labor may be made in kind. The procedure for such payments must be clearly stated in the collective agreement.

- Payment of wages can be carried out in cash or by bank transfer. If an employee receives money for work in cash, such distribution is carried out in places determined by the administration. When making non-cash payments, the worker has the right to independently choose the organization through which he will transfer funds.

- You must pay the money you earn twice a month. First, the first, advance payment for the first half of the month is paid. At the end of the month, you must complete the full payment and pay the missing amounts (or retain the excess).

- Payments are made personally to the worker. You can issue money to third parties only in cases provided for by current legislation.

- Salaries must be paid in full, with the exception of taxes and mandatory contributions to state funds. Other deductions are possible only if they are expressly provided for by law.

Remember, the full-fledged activity of an officially employed citizen must be paid no less than the minimum established by the state. The duration, size, form, and place of such payment are established by the employer on the basis of the Labor Code of the Russian Federation.

What documents are needed?

To calculate salaries, primary documents are required, such as:

- staffing schedule;

- work order, route sheet and other reporting documents on the work done;

- time sheet.

- To reflect the amount of salary, a payroll slip is required.

This document is a reflection of information about various types of accruals for a specific worker, provided for by the wage fund, as well as incentive and compensation payments.

It is this document that reflects the amount of the advance issued for the first part of the month.

In addition to the standard form, there is also a consolidated payroll sheet, which displays information in the same order as in the first one, but for the entire enterprise.

It should be remembered that it is not necessary to use standard statements; it is enough to use independently developed documentation, but in compliance with the basic recommendations and with approval as local internal documentation.

Periods and terms of payments

The legislator clearly established that it is necessary to pay the money earned by a worker at least 2 times a month. From this norm it follows that the accrual and payment of income can be daily. But you shouldn’t delay payments for more than 15 days - this can be regarded as a violation, for which administrative sanctions are provided.

Another important point is that at the end of the reporting month, the employer has all 15 days to fully pay the employee for his work.

There are several key features to highlight:

- An employee should be paid for his work every 15 days (after half a month). Exceeding this period may already be considered a violation. For example, if an employer fully paid for the previous month before the 7th, then he must make the next payment no later than the 22nd.

- It is not a violation if the salary is finally accrued and paid on the 15th of the next month. However, the next payment will need to be made no later than the 1st day of the next month. Otherwise, you can receive an administrative fine of up to 50 thousand rubles, and if repeated - up to 100 thousand rubles.

- The specific dates for salary payments in the company should be determined by the collective agreement. If there is a date offset, a gap of 15 days must be taken into account, which must not be exceeded. Here it is important to be tied to a specific date so that the period defined by law is clearly maintained.

- If the payment date falls on a holiday or weekend, the company must make such payments the day before. In this case, the subsequent payment date may not be shifted.

- The administration is obliged to transfer (issue) the average income to vacationers no later than 3 days before the start of the vacation. If an employee resigns, he must be paid in full on the last working day (usually in the second half).

Remember, the terms and periods of salary payments are clearly established by law. Violation of them promises the companies and their managers whose fault this occurred will face substantial penalties. Serious violators may be subject to criminal prosecution.

Types of fines for late payment of wages

The employer faces fines and administrative liability.

If the employer for some reason delays the payment of wages, then according to the law established by the Labor Code of the Russian Federation, for each overdue day a percentage equal to one three hundredth of the current refinancing rate of the Bank of Russia must be added to your salary.

The more your employer does not pay you, the higher his debt to you grows. Both employees and employers must be clearly aware of this.

Moreover, if an official receives a complaint about late payment of wages, he is subject to administrative punishment in the form of a fine of 500 to 5 thousand rubles, if a complaint is received against an individual, then he is fined in the amount of 30 to 50 thousand rubles.

If the employer does not correct himself and continues to delay payment of wages, then he may be deprived of his position and the right to work in a managerial position for a period of 1 to 3 years. Isn’t this a reason to think about it and not offend your employees by late payment of wages?

In addition, employees have the right to refuse to perform their duties until the debt is paid, with the exception of workers at facilities of special, vital importance, which are also described in the Labor Code.

In addition, workers can go on strike, or write a collective complaint to the higher authorities, which were mentioned earlier (Prosecutor's Office, Court, and so on). However, we should not forget that the employer may also face difficult, emergency situations, which should be treated with understanding.

It is always easier to resolve a conflict peacefully, without involving third-party authorities and forces. Especially if a misunderstanding or problematic situation arises for the first time, or if it happens very rarely (less than once a year).

Informing the employee about salary payment

Before each payment of wages, the administration is obliged to inform employees about the amount of income accrued to them. The information should contain the following data:

- breakdown by elements of accrued income for the period worked

- other amounts calculated in addition to the basic and additional salaries, including compensation for late payment

- the amount of amounts withheld by the employer and the grounds for such withholding

- the total amount of payments due to the employee (withholding)

All this information is entered into the pay slip, which is provided by the employer to the employee. It does not have a standardized form (only filling requirements). It is developed individually by each employer.

Is it prohibited or not to pay wages in cash in 2018?

For workers who are citizens of Russia, there is no such prohibition in Russian legislation. Payment of wages in cash for Russians in 2021 is not prohibited.

The employee himself has the right to choose in what form he wants to receive his earnings: in cash or by transfer to a bank account (card). Moreover, the employer does not have the right to force an employee to use the services of a particular bank. He is obliged to transfer funds to an account in the credit institution indicated by the employee. The employer may be punished for violating this requirement.

If wages are paid in cash, the procedure for such payments prescribed by law must be followed, including the time of their making, the execution of accounting entries, etc.

Of course, from the point of view of the law, it is prohibited to pay wages in cash or by bank transfer if the earnings are “gray”.

In practice, however, the state, at least for now, turns a blind eye to such facts. The practice of paying wages “in an envelope” is the norm for the private sector of the economy - employers thereby save on social contributions for employees.

Photo: pxhere.com

Payment methods and location

The Labor Code of the Russian Federation provides that the procedure and method of payment of wages must be determined by the administration of the enterprise and established in the collective agreement. In this case, a mandatory condition is to comply with the norms provided for at the legislative level regarding the determination of specific dates and time intervals through which payments will be made.

It is important to consider the following points:

- money is paid in proportion to the time worked

- payment can be made through a cash desk, bank, post office, or by delivery directly to the facility. Individual characteristics of employees are taken into account

- when part of the remuneration is made in goods or other non-monetary form, this must be indicated in the collective agreement, as well as the employment agreement, and communicated to the employee before signing the employment contract

- the obligation to familiarize the new employee with the terms of the collective agreement, periods, methods and places of payment of wages is entirely the responsibility of the administration

- It is not allowed to pay wages in shops, beer stalls, bars, and other entertainment establishments

- The entire amount for the period worked is paid at once (advance payment in full for the month). If the money is not issued (transferred) in full, this may be regarded as a delay in the payment of wages, and the employer will be obliged to pay the employee a penalty in the form of a penalty.

Remember, the company must indicate all the nuances in the process of calculating and paying wages in the collective agreement and inform the citizen at the time of his employment.

Payroll is calculated 2 times a month in proportion to the time worked

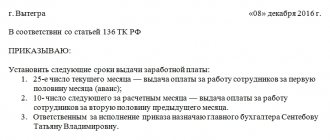

In accordance with Article 136 of the Labor Code of the Russian Federation (hereinafter referred to as the Labor Code of the Russian Federation), the Company makes wage payments twice a month. The amount of payment is determined in proportion to the time worked. Is it necessary to make accounting entries for payroll and personal income tax twice a month? Is the Company obligated to calculate and transfer insurance premiums from each payment?

An employee's wages are taken into account as expenses for ordinary activities during the period of accrual , regardless of the time of actual payment (clauses 5, 8, 16, 18 of the Accounting Regulations “Expenses of the Organization” PBU 10/99[1]).

Labor legislation does not regulate the rules for calculating wages - Article 136 of the Labor Code of the Russian Federation defines only the procedure for its payment.

The term “advance” is not used in the Labor Code of the Russian Federation. However, in practice, it is in this way (as an advance) that the payment of wages for the first half of the month is classified. For example, the accounting policy of the organization establishes that, according to the terms of the collective agreement, paid twice a month: for the first half of the month (from the 1st to the 15th) - no later than the ____ date of the current month and for the second half of the month - no later than the ____ date of the next month . Payroll for the first half of the month is calculated in proportion to the days worked in that month. In this case, calculated once a month (payment for the first half of the month is reflected as an advance).