Documents for calculation and payment of remuneration

An enterprise can use several types of statements. It is important to correctly reflect their use in accounting policies. Pay slips in form T-51 are used to calculate wages.

5 information that is reflected in the statement:

- first name, last name, patronymic of the employee;

- Personnel Number;

- speciality;

- salary amount;

- the amount of time worked according to the accounting sheet.

It is also written what reward has been accrued and how much of it is withheld. The amount due to the specialist is indicated. Payments for wages are certified by the signature of the company's accountant.

Important! In small companies, the same person often calculates and pays salaries, so it makes sense to combine labor accounting documents into one statement. The T-49 form is used.

Primary documents are also signed by the responsible employee.

Payslips

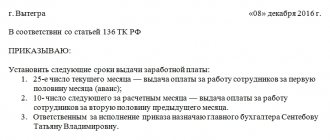

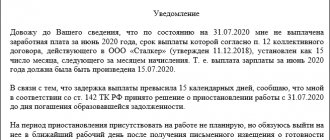

The law obliges the employer to issue pay slips to employees along with their wages, which clearly indicate what the amount received by the employee consists of. Salaries are received at least twice a month, however, it is more reasonable to issue a pay slip once, when paying wages for the month, and not when paying wages for the first half of the current month, since in the second case the calculation indicated in the slip may be incomplete and does not reliably reflect the origin of the amount paid.

The payslip does not have a regulated form, so the organization must independently develop it, based, for example, on forms T-12 or T-51. Or create your own form entirely, which should be fixed in the accounting policy. The payslip must indicate all parts of the salary: salary, bonus, allowances, bonuses, sick leave payments, and so on. It is necessary to indicate all deductions: personal income tax, alimony, fines, etc. As a result, the amount to be paid should be obtained, which the employee receives in his hands along with the pay slip.

The payslip, upon agreement with the employee, can be issued both in paper form and electronically, by sending it to the employee’s email.

The form of the pay slip is approved by order of the enterprise. A sample order and the payslip itself can be found in the ready-made solution “ConsultantPlus”. If you don't already have access to the system, get a free trial online.

Documents for issuing salaries

The accountant is responsible for documenting accrued wages.

When money is issued in person, a statement in form T-53 is used. Often funds are transferred to bank cards. On the day the reward is issued, the statement is handed over to the cashier. The statement is closed no later than five days. Local acts state on what days wages are paid. After the registration is completed, the statement is transferred to the accountant.

The storage period for payment documentation is quite long. Personnel documentation should be kept for fifty years. The deadline is approved by Art. 22.1 of the Law “On Archival Affairs”.

Salary project

At the moment, the most common way to receive wages is to transfer it to the employee’s bank card. This can happen either individually or on an ongoing basis and for all employees at the same time. There are two options for receiving money on a card: transferring it to each employee separately or registering a salary project with a credit institution.

To receive wages on a bank card, the employee must write a statement about this and attach to it the card details for transferring funds.

If the organization has entered into an agreement with a credit institution on a salary project, then the employee signs an application for the issuance of a card within the framework of this project or writes an application attaching the details of the card he already has.

If the employee does not want to receive wages on the card, he does not sign any statements and continues to receive money at the organization’s cash desk.

The method for employees to receive wages on a bank card or at the organization’s cash desk must be specified in the collective, labor agreement or in an additional agreement to it.

Basic documents for accounting

Several documents are important for accounting purposes. Documentation of labor costs implies correct registration of the number of hours worked and accrued wages.

Table of basic documents for remuneration

| Name | Subtleties of drafting | Person responsible for compiling |

| A timesheet that records working hours | The T-13 form is used. The report card is prepared by the structural unit. Twice a month the time sheet should be submitted to the accountant. The report card is submitted before the advance payment and salary are paid. The timesheet is executed in the form of a table, allowing you to control the amount of time worked by each specialist. | Responsibility for registration lies with the head of the structural unit or accountant. |

| Documents for piecework nature of work | The work order, route sheets, and other information are used. Data should be provided to determine the nature of the activity being performed. The hours of work, the number of products manufactured, the nature of the work activity, and the amount of remuneration earned by each specialist are written down. Only duties actually performed are paid. | Compilation is carried out by the immediate head of the department. Next, the document is submitted to the director for signature, then to the accounting department. |

| Payroll and Payroll | Form T-51 for the settlement document is filled out. Form T-49 is suitable for payroll. Information about the specialists, the number on the report card, the amount of deductions and amounts due for payment are written. | The accounting employee maintains the list. The document is signed by the chief accountant and the head of the company. |

Accrual in 1C

Before paying a salary, the employee must make sure that he has been hired. If not, then you need to perform the procedure in 1C 8.3.

To generate an accrual document, you must:

- Go to “Accruals” in the “Salary” section.

- In the document log, click “Create” and select “Payroll” in the list that appears.

- You must indicate the details in the header: organization and division, indicate the month of accrual, then click the “Fill” button.

- The employee for whom accruals are made appears in the tabular section; his salary is taken into account based on his salary.

- The salary can be seen in the “Result” column.

- If it has not fully worked for a month, correction is necessary.

- This should be done through the information in the general information about the employee.

- In the “Accruals” tab, you need to adjust the number of days or hours worked.

- Deductions are also reflected in this tab.

- Next, you need to mark the tab with personal income tax and contributions.

- After making adjustments and checking the deductions of contributions and personal income tax, you should click “Post and close”.

After completing all the accruals for non-cash payments, you should create a statement to the bank, in the “Salaries and Personnel” section, fill out the header and tabular part. Next, process the document and issue the salary.

More details about the calculation procedure in 1C are in the video.

Salary payment algorithm

Accrual and payment of wages is a responsible matter.

But in many, payment and documentation of wage transactions is carried out by one person. It is necessary to correctly prepare statements and time sheets to avoid claims from labor inspectors. Wage calculations are made in accordance with Chapter 21 of the Labor Code.

Calculation algorithm

- Analyze the information included in payroll records.

- Calculate payments for employees working under employment and civil law contracts.

- Calculate and withhold personal income tax in accordance with Chapter 23 of the Tax Code of the Russian Federation,

- Calculate insurance premiums.

- Make documentation of accounting using standardized forms.

It is important to correctly prepare the primary documents, since they are the basis for payments. Forms of statements and other documentation are approved by the State Statistics Committee. Resolution No. 1 is dated January 2004.

What to do with salary accruals?

The credit in account 70 is used to calculate the remuneration actually earned by each employee. Typically, payments are made monthly. The choice of account that corresponds to the 70th depends on the person’s place of work.

For example, the 20th debit is used for those who make up the main production. to accounts 25 or 26 when payments are made to management personnel.

Account 44 – for sellers and other workers involved in the sale of finished goods. Account 08 was created for those employed in the construction industry.

How to do accounting for an individual entrepreneur? You will find the answer at the link.

The same Credit 70 account is applied when registering other income, from the “other” section. But the debit in this case is defined as 91-2. It is allowed to make transfers related to additional funds to the same account.

When dispensing money from the cash register

In some cases, salaries are withdrawn from current accounts. In others, it is carried out at the expense of revenue. Those who chose the first option should reflect the purpose of their spending on their receipts.

Receipt cash orders are used to document any monetary transactions. An expense cash order is needed for payment. The signature of the manager and cashier is required to confirm the authenticity of the document.

The Central Bank does not set a maximum amount that can be kept in the cash register. The management of the organization itself sets the amounts that it considers most convenient.

Can't cope with filling out the payslip? Then this article will help you.

Funds can be issued through the cash desk within five days.

Basic posting accounts for payroll.

It happens that there is an excess of cash limits. Salaries are issued in the following order:

- The cashier counts out the amount he must pay.

- The employee puts his signature on the salary slips.

- The amount of earnings is calculated jointly by the employee and the accountant.

- The salary is handed over to the person.

Expense cash orders are issued for total amounts. It is possible to carry out operations without the relevant statements. But then you will have to prepare a separate order for each employee.

The cashier puts an o if after five days the employee does not receive the amount due to him.

Why are primary documents needed?

Each document performs its own function and is part of office work.

2 timesheet functions:

- reflect the number of hours worked by each specialist;

- justify the costs of paying remuneration.

Enterprises that use electronic systems to recognize the time of arrival and departure for work of employees use the T-13 form.

These documents on labor accounting and payment are kept for five years. In hazardous industries, storage time increases to seventy-five years.

6 rules for working with payment documents:

- When remuneration is paid to employees' bank cards, use a payment form.

- When using the T-49 form, do not use other forms.

- The records should be kept for five years. In the absence of personal accounts, the storage time increases to seventy-five years.

- Maintain a payroll register to reflect information about payments made to employees throughout the year.

- For settlements with vacationers, use a special receipt-report.

- Use acceptance certificates to record work performed under fixed-term contracts. Calculations should be made on the basis of these acts.

Taxes and withholdings

Taxes and insurance premiums are calculated from the full salary at the end of the month on its last day.

There is no provision for income tax deduction on the advance payment.

The tax must be transferred on the day the salary is paid, if there is a non-cash payment, or the next day when the salary is issued from the cash register.

The state strictly regulates the procedure and amount of deductions from workers' wages; the employer has the right to make one deduction in the month in which the damage due to the employee's fault or overpayment occurred.

Deductions are possible:

- In case of failure to make deductions from the advance payment.

- In case of untimely return of funds issued according to one-time papers for the execution of various orders.

- In case of erroneously overpaid funds towards salaries.

- In case of overpayment of funds towards vacation or dismissal.

- Recovery of damages from the employee, however, it cannot be more than 70% in cases of alimony payments or at the request of the court for compensation for damage to health.

In addition, the penalty is not deducted from the following payments:

- Compensation for damage to health in the process of injury, injury, death.

- At the birth/adoption of a child, disabled people of the first group, single mothers and large families.

- For working under harmful and dangerous working conditions.

- Various compensations.

How to properly develop documentation at an enterprise

The company can develop its own forms, the main thing is to include all the necessary details.

6 main document details:

- Date of preparation;

- name of the form;

- company name;

- the meaning of the operation being performed;

- payment for performing actions;

- signatures.

In addition to the approved forms, the organization maintains other documents. Regulation is carried out by the Labor Code and the Law “On Personal Data”. Maintaining work records is also subject to certain rules. Special instructions on labor protection are adopted.

Responsibility for violations

Sanctions for employees are established by Art. 5.27 of the Code of Administrative Offences. Officials are fined from one to five thousand. Penalties for companies range from thirty to fifty thousand.

The company's activities can be stopped for up to ninety days.

Confidential information about employees cannot be distributed. Violators are fined and subject to disciplinary action.

Labor inspectors can conduct scheduled and unscheduled inspections. Workers turn to inspectors and the prosecutor's office to protect their rights.