Author of the article: Anastasia Ivanova Last modified: January 2021 46411

Any employee has the right to change his place of work for various reasons. And he has the right to initiate such a process. It is necessary to find out what payments are due upon dismissal of one's own free will. These include not only earnings for time worked, but also other types of accruals. Knowing your rights will allow you to receive the full amount of funds required by law.

Rules for dismissal at the initiative of an employee

The procedure assumes that the initiator of termination of the employment agreement is the employee himself. To enable the employer to resolve the personnel issue in this case, labor legislation obliges the employee to work for 14 days after submitting his resignation letter. By mutual agreement of the parties to the employment agreement, the working period may be reduced.

During this period, the administration of the organization is obliged to find a qualified replacement and take over the affairs of the resigning person. In addition, a settlement with him must be prepared.

The employee must notify the administration of the enterprise of his desire to resign by submitting an appropriate application. In the next two weeks, all payments must be calculated and the necessary documentation prepared.

The resigning person should know that he can withdraw his application at any time before the end date of his service. This possibility is established by law and the employer cannot refuse him, even if he has found a new applicant for the vacant vacancy. In this case, the employee must also notify the employer in writing, which in the future may become the basis for recognizing a violation of his rights in the event of forced termination of the contract.

Expert commentary

Kamensky Yuri

Lawyer

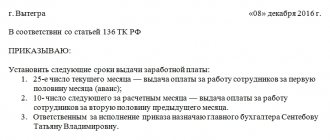

Based on the submitted application, a dismissal order is prepared, which is considered official evidence of termination of the employment relationship. On the last day of work, a work book with an entry is given along with other documentation stored in the company. For example, a document confirming higher education.

Necessary documents for registration

List of documents that are the basis for launching the dismissal procedure:

- An employee's statement of desire to resign.

- Agreement between employee and employer on termination of employment relationship.

- Notice of termination of a fixed-term employment contract.

This is also important to know:

Certificates upon dismissal of an employee in 2021: what certificates does the employee receive?

List of documents for the dismissal procedure:

- Order from the authorities according to f. N T-8, T-8a with designation:

- reasons for employee leaving work,

- articles of the Labor Code.

- Work record book with a note about the reasons for leaving the enterprise.

- Note-calculation according to f. No. T-61 with a list of amounts paid.

- Personal card of the employee by f. N T-2 with a note of dismissal.

Dismissal after completing a probationary period

The period during which the head of the company must evaluate the professionalism of an employee in a specific position, and the employee evaluates his expectations about job responsibilities with reality.

The main feature of the end of the working relationship during this period is the short period for consideration of the application. The application must be signed within three days and the employer does not have the right to increase it. The duration of the probationary period is established by the employment contract or an amendment to it. It cannot exceed three months. For management employees, it can increase to six months. For fixed-term contracts valid for up to 2 months, such verification is not provided in principle, and for 6-month agreements - no more than 2 weeks.

In any of the situations, the employee upon dismissal is not obliged to provide the reasons for the decision and has the right to terminate the employment relationship at any time. While undergoing a probationary period, employees have the same rights to benefits as regular company employees.

Reasons for termination of the contract

There are several grounds for dismissing an employee. The grounds for dismissal are:

- Absenteeism. When an employee does not attend the workplace for a long time without a good reason.

- An employee arriving drunk or under the influence of drugs.

- Violations of safety regulations.

- Theft of company property.

- Immoral offense.

All of these reasons are valid arguments for dismissal. But first, any employee is reprimanded and only then, if he does not improve, is he fired.

Retrenchment as punishment

There are times when an employer fires an employee under an article. In fact, legally there is no such wording. Under this concept, only a manager, accountant or deputy can be fired. It is prohibited to dismiss all other positions under the article.

Often, dismissal under Article 81 occurs due to incompetence and when the employee does not pass certification for his position. In addition, this reduction has its own characteristics. For example, if the manager was repeatedly pointed out about his mistakes and even punished for poor quality work. If the offending employee has valid reasons why he could not properly perform his duties, they must be provided as evidence.

Removal from position for embezzlement

Embezzlement and theft of other people's money or property of an enterprise are the main reasons for dismissal under this article. But before removing an employee from office, you need to draw up a special act and attach to it evidence of the employee’s guilt. In rare cases, it happens that a boss feels sorry for a subordinate and invites him to resign of his own free will. After all, if someone finds out about this situation and it becomes public, it could harm the reputation of the entire enterprise.

In connection with these unpleasant circumstances, the question arises: are they paid if they are fired under the article? The conditions for dismissal are the same almost everywhere, as are the payments. Before dismissal under the article, management notifies the employee two months in advance and on the last day they pay payroll and compensation for vacation. In addition, they may pay the amount for sick leave, if any.

Many managers do not pay payouts, operating on the fact that if an employee is fired under an article, he cannot receive payouts. That is why during the employment period it is necessary to study all the rights and obligations of both the manager and the employee, so that no controversial situations arise.

Payments accrued upon dismissal

The employee must be paid on the last working day, handing over the entire calculated amount required by law. It includes not only earnings, but also compensation for unused vacation days, as well as other types of compensation provided for by the organization’s local documents.

Based on the requirements of the regulatory framework of the Russian Federation, the resigning person must be given:

- Salary for the period worked. It includes not only the established salary, but also all allowances, bonuses and other income provided for in the contract or internal regulations.

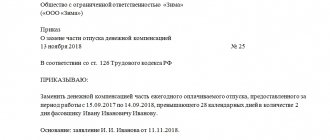

- Compensation for vacation not taken. In this case, the employee can either agree to receive money or take vacation days with further dismissal. If an employee decides to go on vacation, then the payment is issued and the work book is returned before he leaves. Sometimes there are situations when during the vacation period a worker takes sick leave. In this case, he must be paid benefits during temporary disability, but the end of the vacation is not transferred to sick days.

Expert commentary

Platonov Alexander

Lawyer

Attention! The company may adopt a collective agreement that provides for other types of payments to resigning employees. But not many employers can boast of this. Labor law does not provide for the issuance of severance pay upon dismissal on one's own initiative. It is issued only when the company goes through a liquidation procedure or its staff is reduced.

Dismissal of an employee who has worked for 2 weeks, 1 month, 5 months, 6 months, 11 months

There are situations when an employee has to be fired at his own request or on the initiative of the employer, when he has worked very little, or has worked for less than a full month, or has not stayed at the enterprise until the end of the working year.

In such cases, the employer must competently carry out the dismissal procedure, otherwise the employee’s rights will not be respected. Most often, the dismissal of an employee who has worked only 2 weeks occurs:

- on their own initiative,

- based on the results of the probationary period (option for those dismissed after 2 weeks and 1 month of work).

This is also important to know:

Order of dismissal for absenteeism: sample and form

If it was decided to formalize the dismissal of an employee as having failed the test, you need to remember that for this a probationary period had to be assigned, and it could last no more than a month. Labor legislation does not establish an employer’s obligation to prescribe tests, and therefore, if the company’s policy does not provide for any testing of a candidate’s abilities for a job, then it will be possible to fire him only for absenteeism and violations, or at will.

If a decision is made to formalize the dismissal as a resignation of one’s own free will, the employee is obliged to notify about this 2 weeks in advance, which will subsequently have to be worked out if the employer requires it (if desired, the parties can agree on dismissal on any day without working out the required period). It happens that work is not possible due to the employee moving to another region, pregnancy, etc.

Payments upon dismissal at one's own request:

- issue wages for the time actually spent at work;

- make calculations and accrue compensation for vacation that could have been used, but which never came to pass (on average, for a month of work, the right to 2 days of rest arises, therefore, for 2 weeks of work and for 1 month of work, 1-2 days should be compensated non-vacation).

Dismissal after 5, 6 and 11 months of work can be motivated as follows:

- The employee himself wished to leave the workplace.

- The duration of the urgent contact has expired.

- An employee is transferred to a new position in another company.

- Staff reduction.

- Liquidation of the enterprise.

- Allowing employees to regularly violate labor discipline.

Even when an employee has not worked for a full six months or a year, he will be entitled to compensation for unused rest days. And if there has been a reduction in staff, or the employee’s departure from work was initiated by the employer for another reason, the employee is entitled to other types of compensation for early termination of employment.

Salary for less than a month of performance of official duties is calculated:

- By the nominal number of days in a month (the average number of days in a month is determined by regulatory documents, in 2021 it is 29.4 days):

Salary = full salary: 29.4 x ChOD, where

- Salary - salary calculated based on the nominal number of days,

- FZP - actually assigned salary,

- CHOD - number of days worked.

- Based on the actual number of days in a month:

ZP = FZP: KDM x CHOD, where

- Salary - salary calculated based on the actual number of days in the month,

- FZP - actual salary of the employee,

- KDM - number of days in a month,

- CHOD - number of days worked.

Additionally, holidays, weekends, days of absence are taken into account with the same salary.

Calculation of payments

Let's look at how the amounts payable are calculated in the event of voluntary dismissal.

Wage

The size of the salary directly depends on the payment system adopted in the organization:

- Time-based payment provides for the payment of funds for working days worked. For example, if the salary is 20 thousand rubles, and out of 22 days in a month only 12 were worked, then the amount of earnings will be: 20,000 / 22 * 12 = 10,909 rubles.

- The piecework system is characterized by the results of labor, measured in specific indicators, for example, in the number of products made. Let’s say that during the month when the employment contract is terminated, the worker produced 20 pieces of products, the cost of each of them is 400 rubles. The earnings due to him will be calculated as: 20*400 = 8,000 rubles.

In addition, other payment systems can be used, for example, piecework-bonus, progressive, bonus, etc.

In addition, a person dismissed by decision of the owner of the property of the head of the organization, when the termination of the employment relationship is not related to his activities, on the basis of Art. 279 of the Labor Code of the Russian Federation, a special reward is issued.

Article 279 of the Labor Code of the Russian Federation - Guarantees to the head of the organization in the event of termination of the employment contract

In the event of termination of an employment contract with the head of an organization in accordance with paragraph 2 of part one of Article 278 of this Code, in the absence of guilty actions (inaction) of the manager, he is paid compensation in the amount determined by the employment contract, but not less than three times the average monthly salary, except for the cases provided for this Code.

Compensation for unused vacation

The amount of compensation depends on many indicators and, as a rule, special software is used to calculate it.

The calculation algorithm is carried out in the following order:

- The length of service is determined to determine the number of vacation days. To do this, you will need to subtract the date of entry to work from the date of dismissal. From the resulting period it is necessary to exclude time of rest at your own expense for more than 14 days. The result obtained must be rounded according to the following principle: count the number of months and round down the remainder of less than 15 days, round up more than 15 days;

- The required number of days is calculated depending on the length of service and the points of the agreement;

- The number of unused vacation days is established by subtracting those actually taken off from the total period;

- Average earnings per day are calculated. The salary for the last year is divided by the actual days worked over a specified period of time.

Example of compensation calculation:

If a citizen started working on August 13, 2015, and quit on September 16, 2016, and he did not take vacation at his own expense, then his length of service at the enterprise will be 13.1 months. To calculate the amount of compensation, we round the figure and get 13. In accordance with the contractual obligations of the employer and employee, he must be provided with 36 vacation days per year. Thus, we divide 36 by 12 and multiply by 13, we get 39 days. In fact, they were given 15 days off work. Therefore, subtracting 15 from 39 will leave 24 unused days.

Salary for the previous 12 months is 460,000 rubles. Except for vacation, all working hours were worked out. In this case, the average daily income is equal to:

460,000 / (29.3*11 + 29.3*15) = 1365.19 rubles, where:

- The average number of working days per month is 29.3;

- Number of days for 06.2016 – 30;

- The actual period worked in June 2021 is 15 days.

24 unused days are subject to reimbursement in the amount of: 1365.19 * 24 = 32,764.56 rubles.

Calculation terms

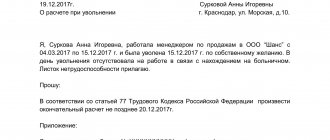

Labor legislation establishes the obligation to pay all necessary amounts to a citizen resigning at his own request on his last working day.

Important! Payments after dismissal at the initiative of the employee are made on the day the order to terminate the employment contract comes into force. It is impossible to demand funds immediately on the day of submitting the application, since during the period of service the person may change his mind and withdraw it.

For failure to comply with this requirement, penalties are provided in the amount of 1/300 of the refinancing rate established by the Central Bank of Russia for each missed day. Currently the rate is kept at 10%.

If we consider the above example, when an employee was not given vacation compensation on time, for each overdue day he would be entitled to a penalty amount from the organization in the amount of: 10% / 300 * 32764.56 = 10.92 rubles.

Of course, if the employer does not want to pay the debt at all, it is unlikely that he will apply sanctions to himself. To collect the debt with a penalty, you will need to contact an authorized body, for example, the labor inspectorate. But they can only issue an order to pay the amount owed if it is established that the employer violated the requirements of labor legislation and the rules for making settlements upon dismissal.

If the inspection order is not fulfilled, it is necessary to go to court. This may be preceded by an appeal to the prosecutor's office. Such actions can speed up the resolution of the issue by the employer in favor of the employee.

Expert commentary

Leonov Victor

Lawyer

If a dispute arises about the amount of payments, then on the day of termination of employment obligations, the resigning person must be given the amount that was accrued by the organization. Payments for disputed payments will be made after a court decision is made.

If the amount received does not satisfy the citizen, he has the right to contact the labor inspectorate to check the calculation for compliance with the norms of current law.

Types of compensation for dismissed employees

What is paid upon dismissal?

- Compensation for dismissal of an employee due to poor health.

- Payments upon dismissal at the initiative of the employee.

- Payments upon dismissal by agreement of the parties.

- Payments upon dismissal of an employee due to staff reduction.

For any reason for staff leaving the enterprise, the employer must make payments for annual leave that the workers did not have time to take. When leaving work occurred on the initiative of the authorities, those dismissed are also entitled to severance pay (in addition to payment for the time actually spent at the workplace while performing official duties).

Free legal consultation We will answer your question in 5 minutes!

Ask a Question

Free legal consultation

We will answer your question in 5 minutes!

Ask a Question

Compensation for early termination of an employment contract

Dismissal in case of early termination of an employment contract must be preceded by notification by the employer to the employee 2 months before the date of his actual departure from work. The employer does not have the right to force an employee to write a letter of resignation of his own free will, since this is beneficial exclusively to the employer, who will not have to pay his employee severance pay.

When reducing staff, the law generally prohibits specifying the reason for dismissal as “personal desire of the employee,” since two grounds for leaving work cannot arise simultaneously. In addition, an entry in the work book upon dismissal due to staff reduction is more beneficial for the worker both in terms of finding a new job and in terms of obtaining various benefits.

This is also important to know:

Dismissal of a pregnant woman under a fixed-term employment contract: important nuances

The procedure for such dismissal is as follows:

- The employee receives a notification and agrees to it.

- The employer instructs the accounting department to pay the employee for the amount of compensation for unprovided vacation and severance pay.

- The employee receives a compensation payment for early termination of his employment contract.

Additionally, compensation is assigned for the period remaining until the end of the notice period. In total, the fired person will receive his due salary with all allowances, compensation for rest that was not given, severance pay and compensation salary for the time that he could still work before the dismissal, but agreed not to work.

The purpose of imposing an obligation by law on an employer to pay severance pay is to provide a means of livelihood for an employee who, through no fault or unwillingness, has lost a source of income while he is looking for a new employer.

It is worth keeping in mind that any misconduct in the workplace that would not have been taken into account before, before dismissal, can serve as a reason for manipulation on the part of the employer in order to force the employee to resign of his own free will. At such a time, you should not allow lateness or other, even minor, disciplinary violations.

Compensation for vacation that the employee did not have time to take

For whatever reason, an employee leaves work, among the obligatory payments for him will be compensation for annual leave not provided before the date of dismissal. Moreover, if he had the right to vacation twice, but did not go on vacation for two years in a row, he will receive double compensation.

However, working for 2 years in a row without rest is illegal, and therefore the employer must give an explanation about this, except in cases where the employee has done something wrong. The procedure is this because compensation for unused vacation is not paid if the employee is fired for serious violations. The day of actual departure from the enterprise will be the last day of rest, and before that the employee will already be given all the compensation due to him for unused vacations.

Employee compensation for staff reductions

The dismissal of employees when reducing the company's staff is recognized by law as independent of the wishes of management and subordinates. Extra-budgetary funds are involved in the implementation of social programs aimed at providing for citizens who have lost their jobs through no fault or initiative.

Dismissed employees receive wages with the allowances and bonuses they are entitled to for the time actually spent at work, compensation for annual rest not provided (if any), severance pay, which is certainly paid in two cases:

- upon closure of the enterprise,

- when staffing is reduced.

The average salary is retained by a dismissed employee only until (but not more than 3 months, and only after such a decision is made by the Employment Service) he signs a contract with a new employer. And if we are talking about a part-time worker who still has a second job, then he is not entitled to severance pay at all.

If there is no part-time job, the dismissed employee contacts the Employment Service within 14 days and leaves an application to find a new job. And in the event that the Employment Center does not find a suitable position at another enterprise, it will receive from the former employer the amount of its average earnings for 3 months instead of the standard two.

Compensation for police officers upon dismissal

Police officers are entitled to full compensation for each vacation not used on time until January 1 of the year in which the dismissal took place (the reason does not matter). Compensation amounts for rest that the police officer did not take during the year of dismissal will be paid:

- upon length of service at which the right to pension payments arises, upon reaching the age limit, upon dismissal due to staff reduction or deterioration of health (for annual leave in full, and for other types of rest - in proportion to the length of service in the year of departure from service in the amount of 1/12 of the vacation for 1 full month of work);

- for all other reasons (for each entitled type of rest in the amount of 1/12 of the duration of leave for 1 full month of service based on the average salary).

This is also important to know:

Notice of job reduction: sample, procedure for drawing up the document

When a police officer leaves service, he is entitled to:

- Salary for the entire period of service.

- Quarterly bonus calculated based on actual time served.

- Compensation equal in value to at least two salaries for the year (if it was not paid in the relevant year).

- A one-time financial incentive based on the results of 12 months is proportional to the time actually spent in service.

- Compensation for vacation not provided before dismissal.

- One-time benefit in the amount of:

- 5 average monthly salaries (dismissal due to age, health reasons, staff reduction, illness, after 10 years of service),

- 10 average monthly salaries (with 10-14 years of service),

- 15 average monthly salaries (with 15-20 years of service),

- 20 average monthly wages (with more than 20 years of service),

- 40% of the transferred amounts (if dismissed for other reasons),

- the transferred amounts + 2 salaries (if the policeman was awarded an order during his service or was awarded an honorary title).

The salary is the one that was assigned at the time of dismissal. Years of service are not rounded to full years. If dismissal occurs upon re-employment, payments are calculated with the offset of previously paid amounts for length of service. If the total length of service was less than 15 years, and the policeman was dismissed without the right to a pension, his salary is retained for 12 months after leaving service (annual indexation is taken into account).

When retiring

When retiring, an employee can receive not only compensation for vacations and wages.

He may also be entitled to additional payments. But only if the collective agreement specifies special conditions under which accruals are made to employees leaving due to retirement age. Sick leave after dismissal in 2021, according to the Labor Code, must be paid by the employer within a month.

Sick leave pay after dismissal

A former employee has the right to claim sick leave payment through the company from which he was dismissed, provided that no more than a month has passed from the date of registration of the event. Only those citizens who have not been employed since the termination of their employment contract should contact the head of a business entity. The certificate of incapacity for work must be presented no later than 6 months from the date of termination of the employment relationship. When calculating the amount of payment, length of service is not taken into account, and when determining its size, the salary is adjusted to 60 percent. If the sick leave was issued to a close relative, then it is not payable.

Dismissal during illness

In case of serious illness, the employee may be on sick leave for a long time. During this period, he has the right to resign for his own reasons or by agreement of the parties, due to the initiative of the employer due to the need to perform duties by a constantly absent person and assign them to a new employee.

The procedure for dismissing a person on sick leave is no different from terminating a contract with a working employee. He must notify the employer of his desire, and after two weeks receive a payment. For a dismissed employee with an open sick leave certificate, the payment amount can be calculated only after receiving a closed sick leave certificate issued by a medical institution. Payments are made on the nearest payday.

Responsibility for late payments to a dismissed person

For violation of the deadlines for issuing payments due upon dismissal to an employee, various responsibilities are provided:

| Administrative | Criminal |

| In accordance with the provisions of Art. 5.27 of the Code of Administrative Offenses of the Russian Federation, the conditions for attraction to it are considered to be complete or partial non-payment of payments accrued to the worker under the employment contract. Its goal is to protect and respect workers' rights, and its main function is punitive measures. Therefore, in addition to financial compensation to the employee, a warning to the company or penalties to the state are issued. Officials may be disqualified. It will only be possible to hold you accountable if the employer is proven to be at fault for the delay. | Article 145.1 of the Criminal Code of the Russian Federation defines non-payment of wages as a punishable act. In this case, the organization’s guilt in the delay and a sole or selfish goal, provoked by an impulse to hide incompetence, a desire to achieve a return service or support on a specific issue, must be proven. As a rule, it is defined as the desire to achieve property gain by committing an illegal act. Only an individual - employer, head of the enterprise, chief accountant - can be involved in it |

It should be noted that the resigning citizen must have information about the payments due by law. The ability to calculate the amounts established by law and handle them before the administration of the organization will allow you to protect your interests in any case.