Home / Labor Law / Vacation

Back

Published: 05/28/2016

Reading time: 8 min

0

1947

The right of employees to receive the next annual paid leave is established by labor legislation, namely Art. 114 Labor Code of the Russian Federation . During vacation, the employee does not have to go to work and can go to any place without notifying the employer.

However, in some cases, the latter may need to have a subordinate present at work, after which his recall from vacation is formalized.

When this is possible and what the employer should do about it - answers to these questions will be given below.

- In what cases is it allowed? Having a good reason

- Availability of employee consent

- Providing unused portion of vacation in the future

- Compliance with guarantees for certain categories of workers

- Proper documentation of the procedure

- Service memo

Recalculation of vacation pay

Vacation pay must be paid to the employee no later than three days before the start of the vacation (Part 9 of Article 136 of the Labor Code of the Russian Federation). The employee is accrued amounts in proportion to the number of days of vacation granted. If an employee is recalled from vacation early, the number of vacation days actually used by him is less than the number of days paid in advance. Amounts that fall on unused vacation days are considered overpayments. It is impossible to leave overpayment amounts to the employee in the expectation that he will later use the corresponding vacation days. Firstly, no one knows when the employee will be able to take them out. Secondly, there will be a separate order for the remainder of the vacation, which means that vacation pay will be calculated anew, and from the new billing period (Article 139 of the Labor Code of the Russian Federation). In accounting, excessively accrued vacation pay is reversed and the posting is made in the month in which the employee was recalled from vacation. Excess amounts of vacation pay cannot be deducted from the employee’s salary or required to be deposited into the cash register. Cases when such actions are allowed are strictly limited in Article 137 of the Labor Code of the Russian Federation. The accountant must offset the amount of overpaid vacation pay against the employee's future salary. That is, he will receive the salary for the month in which the employee was called back from vacation minus the amount of overpaid vacation pay. We recommend that you specify the procedure for crediting unused vacation pay in the proposal for recall from vacation (sample 2 on p. 59). The corresponding condition must be indicated in the order to recall the employee from vacation (sample 3 on p. 60).

In what cases is it allowed?

The possibility of recalling a subordinate from vacation is established by Art. 125 Labor Code of the Russian Federation. For these actions to be legal, several conditions must be met:

Having a good reason

Since the Labor Code of the Russian Federation does not indicate which reason is valid, inaccuracies often arise in this matter. Most managers or HR employees, when filing a review, indicate production necessity as the reason. However, this concept is too broad , so it is recommended to use a more precise and specific formulation.

Examples of compelling reasons for recall from vacation may include the following events:

- preventing downtime;

- resolving urgent or urgent organizational issues;

- preventing a serious accident or eliminating its consequences;

- preventing damage to company property or third parties, as well as possible injuries or accidents.

Availability of employee consent

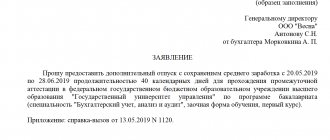

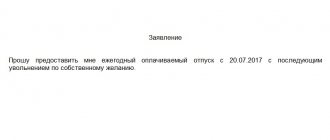

An employee’s return to work is possible only with his consent to this, confirmed in writing.

Providing unused portion of vacation in the future

At the employee's discretion, he can receive those vacation days that he spent at work at any time of his choice.

Compliance with guarantees for certain categories of workers

According to Art. 125 of the Labor Code of the Russian Federation, recall is allowed for not all employees. Some of them cannot be returned to work early, even if they agree to it.

Proper documentation of the procedure

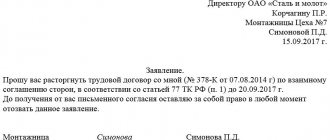

This includes preparing documents related to the employee’s return, as well as obtaining written consent from him.

In addition, some changes are also made to personnel documentation and certain financial recalculations are carried out.

Recalculation of personal income tax

In fact, the amounts of overpaid vacation pay are not withheld, but are counted against future wages. Since these amounts remain with the employee, the personal income tax calculated and withheld when paying him vacation amounts is not returned. At the same time, the amount of personal income tax related to excessively accrued vacation pay is taken into account when calculating the tax on the amount of wages attributable to days worked after recall from vacation. In practice, this happens automatically due to the fact that tax agents calculate personal income tax on an accrual basis from the beginning of the year based on the results of each month (clause 3 of Article 226 of the Tax Code of the Russian Federation). At the same time, they offset the withheld tax amount for the previous months of the current year.

Example 6. Seller A.S. Galkina, who works at Salyut CJSC, was granted the next annual paid leave from August 26, 2013 for 14 calendar days. However, the vacation was interrupted with the consent of A.S. Galkina since August 30, 2013. Let's calculate what adjustments need to be made to accounting if the average daily earnings of A.S. Galkina for vacation pay is 1,420.83 rubles. Solution. For 14 calendar days of vacation A.S. Galkina received vacation pay in the amount of RUB 19,891.62. (RUB 1,420.83 x 14 calendar days). Let's assume that she is not entitled to the standard deduction. Personal income tax in the amount of 2,586 rubles was withheld from the amount of vacation pay. (RUB 19,891.62 x 13%). The amount of vacation pay to be paid is RUB 17,305.62. (RUB 19,891.62 - RUB 2,586). But since in fact A.S. Galkina rested for only 4 days (from August 26 to August 29 inclusive), vacation pay needs to be recalculated. For actual days on vacation, the amount of vacation pay to be accrued will be 5,683.32 rubles. (RUB 1,420.83 x 4 calendar days). Personal income tax on vacation pay is 739 rubles. (RUB 5,683.32 x 13%). Excessively accrued amount of vacation pay is RUB 14,208.3. (RUB 19,891.62 - RUB 5,683.32). It needs to be reversed. Also in accounting, the amount of personal income tax related to it is reversed - 1847 rubles. (2586 rubles - 739 rubles). In accounting, the reserve for vacation pay is taken into account in the subaccount “Reserve for vacation pay” opened to account 96 (hereinafter referred to as account 96). The accountant must make entries to adjust vacation pay: Debit 96 Credit 70 - 14,208.3 rubles. — the amount of vacation pay was adjusted in connection with the recall of A.S. Galkina from vacation; Debit 70 Credit 68 subaccount “Personal Income Tax Payments” - 1847 rubles. — excessively withheld personal income tax was reversed. The amount of overpaid vacation pay is RUB 12,361.3. (17,305.62 rubles - (5683.32 rubles - 739 rubles) will be withheld at the next salary payment. Let’s assume that for September A.S. Galkina will receive a salary in the amount of 40,000 rubles, of which withheld personal income tax of 5200 rubles. In accounting, the accountant will make the following entries: Debit 44 Credit 70 - 40,000 rubles - wages for September accrued; Debit 70 Credit 68 subaccount "Personal income tax settlements" - 5200 rubles - personal income tax accrued. Since when paying vacation pay tax was excessively withheld in the amount of 1,847 rubles, in fact only 3,353 rubles were withheld (5,200 rubles - 1,847 rubles). With the offset of vacation pay that A.S. Galkina received in August, the amount of 24,285.70 rubles is subject to payment for August (40 000 RUR - 3353 RUR - 12,361.3 RUR).

Employee recall from vacation

Often, due to operational necessity, employees are recalled from annual paid leave. Is such an action of the administration legal? Who should not be recalled from vacation? How to complete this procedure? You will find answers to these and other questions in the article.

Legal aspects Labor legislation allows interrupting an employee’s vacation due to production necessity (Part 2 of Article 125 of the Labor Code of the Russian Federation).

In this case, the part of the leave unused in connection with the recall must be provided to the employee at a time convenient for him during the current working year. It is also possible to add it to the vacation for the next working year.

An employer cannot categorically tell an employee that his vacation is being interrupted. Part 2 of Article 125 of the Labor Code of the Russian Federation stipulates the main condition for recalling an employee from vacation - his consent. If the employee is against it, the administration is unable to force the vacationer to return to work.