How much?

The Labor Code establishes a minimum duration of 28 calendar days.

Important! 28 days of vacation time are due for each year worked at work.

Moreover, the working year is taken minus the following periods:

- absenteeism;

- inadmissibility to work due to the fault of the employee;

- child care time up to 3 years;

- leave without pay in excess of two weeks.

To calculate how many vacation days are due for each month worked, you need to use a simple formula.

Formula:

Vacation for 1 month = Total duration for the year / 12 months.

That is, the annual duration is divided by the number of months in the year.

In most cases, for employees who do not belong to special categories with an increased length of vacation time, they have the right to count on 2.33 days of rest per month (28/12).

It is this rounded number that is used by the personnel specialist when calculating the required number of vacation days at a specific point in time.

An employee does not always request leave clearly after the end of the working year. He may ask for rest time earlier or later. In this case, you must first find out how many days he is entitled to for the time worked, and for this the number of vacation time per month will be useful.

This indicator is also useful when calculating compensation upon dismissal, when the vacation period in months is determined, which is then multiplied by the required number of vacation days per month. As a result, the total duration of vacation time for the entire period is determined.

Then it is enough to subtract the number of days already used, and the result is the duration for which you need to pay monetary compensation.

An example of using the indicator 2.33

Conditions:

The employee was hired on January 10, 2021, and will go on annual leave from September 1, 2018. How many days of vacation should he be provided and paid for?

Calculation:

- The total length of service giving the right to paid rest is established: 7 months. and 23 d. 23 are rounded up to a full month, for a total of 8 months of experience.

- The number of allotted rest days is calculated = 8 * 2.33 = 18.64.

- Vacation pay is calculated: earnings for the period worked are divided by the amount of time worked and multiplied by the required vacation duration.

For an incomplete monthly period

With an annual duration of 28 days, for an incomplete monthly period of work, either 2.33 vacation days are due, or no vacation is provided at all. There can be no other cases.

If an employee worked less than 15 days in a month, then this period is not the basis for assigning vacation time.

If 15 or more hours are worked, then it is recognized as a full month and is compensated by 2.33 days of rest.

This point is usually interesting when an employee is dismissed, when it is necessary to calculate compensation for unused time, as well as when vacation is taken for an incompletely worked year.

Example:

Condition:

The employee will resign on February 7, 2021. Vacation experience is 2 years, 4 months and 16 days. During work, 42 days of rest were used. It is necessary to establish for what period compensation must be paid upon dismissal.

Solution:

- Vacation experience is calculated in full months (16 days are taken as a month, since more than half of it has been worked), the total length of service is 29 m.

- The allotted vacation time for this period is calculated: 29 * 2.33 = 67.57.

- The number of unused days is determined: 67.57 - 42 = 25.57 - it is during this time that monetary compensation must be calculated.

Who is entitled to a longer rest?

Those categories of persons who are entitled to receive additional paid leave under the Labor Code of the Russian Federation and other legislative acts can calculate the monthly parameter by dividing the annual duration, taking into account the main and additional components, by 12.

The following persons may be included in this category:

- minors;

- disabled people;

- doctors;

- teachers;

- police officers;

- judges;

- working in dangerous and harmful conditions;

- civil servants;

- workers with irregular work schedules, as well as a number of others.

How to calculate compensation upon dismissal for unused additional leave

In certain cases, for certain categories, the law makes it possible to take additional leave:

- for those employed in hazardous and hazardous industries;

- in case of irregular working hours;

- for those employed in the Far North;

- for the special nature of the work.

In addition to the above, local acts provide benefits for Chernobyl victims, civil and government employees (up to 30 days in accordance with Articles 45, 46 of the Federal Law “On State Civil Service”).

The length of the main and additional periods is calculated in calendar days and there is no maximum limit for it. Non-working days are not included. When calculating, all the allotted time is summed up, that is, it is considered as a single time. (Article 120 of the Labor Code).

The algorithm for calculation is the same as described above, only instead of the standard duration of 28 days. take the enlarged one. One month will “give” 1/12 of the duration of rest (clause 29 of the Rules).

Example

Allowed 54 calendar days. per year, accordingly, the employee is entitled to 4.5 days. rest for every month. (54:12 = 4.5). Calculus example. The citizen has 10 years of experience. He was entitled to a total of 36 days (main and additional periods). holidays annually. In the last year he was registered for 8 months. at the enterprise, if counted from the date of the last vacation. At the same time, he used it in a shortened form - the remainder was 14 days.

Every month gives 3 days. (36: 12), a total of 24 days. (3 x 8). Next, we sum up the balance with the required number of days for 8 months: 24 + 14 = 34 days. This is the amount of time for compensation. This method is based on Rostrud letters No. 5921-TZ and No. 1920-6.

How much does it cost for six months of work?

Another popular question that interests workers is how many days of vacation they can get in six months of work.

A period of six months is the minimum period that must be worked in the organization in order to receive annual paid leave.

This is written in Article 122 of the Labor Code of the Russian Federation.

If this period has been fully worked out, then you can apply for the full annual duration of vacation, but in agreement with the employer.

Important! During this period, a minimum of 14 days of rest is required, but the law allows you to take off all 28 days off during the working year.

The date of rest must be agreed upon with the employer by submitting an application. The staff vacation schedule is drawn up at the end of the previous year, so employees hired in the current year are not included in the schedule.

Some organizations have the practice of drawing up an addition to the schedule for newly hired employees, setting specific rest dates for them after six months of work, then problems do not arise. There is no need to agree on anything, just like writing an application for vacation.

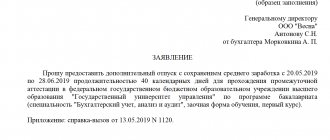

If the employee is not included in the schedule, then a statement must be written according to the sample, which can be downloaded in this article. Next, the date of departure and duration of rest are agreed upon. You cannot leave the workplace without the consent of management; this will be considered absenteeism.

Pregnant women, minors and those who have adopted a child may not agree on the time of rest.

The employer cannot refuse to provide rest after six months; the employee has the right to take at least 14 calendar days off according to the law after 6 months of work.

As for the full annual duration of 28 days, the employer can also provide this number. However, you need to remember that they will be given to the employee in advance; vacation pay will also be paid, taking into account that the employee still needs to work this time.

If a worker decides to quit before the end of the working year, then the overpayment of vacation pay will not be deducted. You can discuss this issue with the employee so that he voluntarily deposits the required amount into the organization’s cash desk, but it is impossible to force him to do this, just as it is impossible to withhold money from the calculation upon dismissal.

Therefore, the employer needs to be careful when providing vacation in advance.

Useful video

How many days of vacation accrue for each month worked - see the answer in the video:

An employee with a minimum vacation length of 28 days can receive 2.33 for each month worked. If the duration of rest is longer, then the monthly duration increases. You can calculate the allotted rest time by dividing the total annual number of main and additional days by 12.

After six months from the date of hiring, you can apply for at least 14 vacation days, and by agreement with the employer you can receive a full annual vacation in advance. However, you need to be careful with overpaying vacation pay, since in the event of a possible dismissal before the end of the year, it will be quite problematic to keep the money.

| Didn't find the answer to your question in the article? Get instructions on how to solve your specific problem. Call now: +7 ext.445 — Moscow — CALL +7 ext.394 — St. Petersburg — CALL - if you live in another region. It's fast and free! |

© 2021 ABC of Labor Law · Privacy Policy · Copying of site materials is permitted only if there is an active link to the source · The site is for informational purposes only. The website contains unofficial editions of the texts of laws and regulations. The author and co-authors of azbukaprav.com do not guarantee the accuracy, relevance or completeness of the information provided. To obtain accurate legal information, you must consult primary sources and officially published documents.

How many days of vacation are due for each month worked?

Home / Articles / How many days of vacation are due for each month worked?

A competent answer to the question of how many days of vacation are due for each month worked is of great importance both from the point of view of compliance with the labor rights of employees and from the point of view of taxation. The problems that arise in the process of calculating the duration of vacation are very numerous and cause heated discussions in the economic and legal community. The calculation procedure in this case is significantly influenced by circumstances such as absenteeism, the use of leaves without pay and for childcare purposes, employees’ lack of permission to work due to intoxication, as well as positive results of medical examinations, TB checks, and psychiatric examinations.

Currently, professionals attach great importance to correctly calculating the number of vacation days during dismissal. Depending on their number, employees are accrued full or proportional compensation. The amount of personal income tax paid depends on the specifics of their calculation (by virtue of clause 3 of Article 217 of the Tax Code of the Russian Federation).

According to clause 2 of clause 1 of Article 238 of the Tax Code of the Russian Federation, days of unused vacation paid to resigning employees are not subject to UST taxation, which is regulated by letter No. 04-04-04/103 of the Russian Ministry of Finance dated September 17, 2003. At the same time, days of unused vacation paid according to applications of employees continuing to work in the organization are subject to standard UST taxation (in accordance with letter No. 03-05-02-04/13 of the Russian Ministry of Finance dated 02/08/2006). All these issues require a competent approach to calculating the duration of paid vacations.

How to calculate the number of vacation days

To answer the question of how to calculate the number of vacation days, you need to have an idea of the individual working year and personal vacation history. By virtue of Art. 122 of the Labor Code of the Russian Federation in the first year of employment, the right to use vacation arises after six months of continuous work of an employee with a particular employer. Moreover, by agreement of the parties, the provision of paid leave may take place before the expiration of this period. Vacations for subsequent years of employment can be granted at any time during the working year according to the established schedule. Accordingly, each employee has an individual working year. In this case, the number of vacation days for the period worked is calculated taking into account the so-called vacation experience, which provides the right to vacation. If during the individual year there were periods to be excluded from the calculation of vacation experience, then the end of the individual working year is postponed.

If you need to calculate vacation days, then you need to ensure that the following is included in your vacation experience:

- Time of actual work.

- The time when the employee did not work, but his job was retained in accordance with labor legislation, including periods:

- holidays;

- annual leaves subject to pay;

- days off;

- rest time provided to employees in accordance with the Labor Code of the Russian Federation;

- unpaid rest periods (less than two calendar weeks during an individual working year);

- removal of employees from work due to the inability to undergo mandatory medical examinations through no fault of theirs;

- forced absenteeism.

The following periods are not subject to inclusion in the vacation period:

- leaves granted to care for children until they reach the age specified by law;

- absence of an employee from the workplace without valid reasons (including removal from the performance of labor functions on the basis of Article 76 of the Labor Code of the Russian Federation);

- unpaid vacations lasting more than 2 calendar weeks.

It should be taken into account that the vacation period, which provides the right to annual additional leave, subject to payment as a result of the employee’s work in harmful conditions, includes exclusively the period actually worked in the mentioned conditions.

The labor legislation of the Russian Federation does not provide for the possibility of providing annual paid leave in an incomplete amount proportional to the period worked. Thus, the annual basic paid leave must be provided in full (of the established duration, which, by virtue of Article 115 of the Labor Code of the Russian Federation, is 28 calendar days).

It should be taken into account that in the process of calculating the total duration of annual paid vacations, the summation of the main vacations with additional vacations is made, which is regulated by Art. 120 Labor Code of the Russian Federation. To calculate vacation days for which compensation is due upon dismissal on the basis of Art. 127 of the Labor Code of the Russian Federation, the following algorithm is used:

- The vacation period for granting vacation is calculated. The calculation is carried out in full months for the entire period of the employee’s employment in the organization. Moreover, if there are less than 15 days in an incomplete month, they are not taken into account, and if there are more than 15, then the period must be rounded up to the whole month.

- The total number of vacation days due to the employee for the period worked in the organization is calculated.

- The total number of days of vacation actually granted to the employee for the entire period of work is calculated.

- The number of vacation days that were not used is calculated (the calculation is carried out by subtracting point 3 of this algorithm from point 2).

How to file a resignation immediately after a vacation

The procedure for dismissal after voluntary leave is no different from dismissal for the same reason at any other time.

In order to resign on his own initiative, the employee must submit a written application to the employer. Starting from the day following the delivery of this petition to the head of the enterprise and until the expiration of the two-week period, the employee must go to work, with the exception of cases of being on sick leave or using vacation days not taken off before dismissal.

Submitting an application

In his petition, the employee must indicate the basis for dismissal - in our situation this is clause 3, part 1, art. 77 of the Labor Code of the Russian Federation - and the date of termination of the employment contract. It is necessary to take into account that the employee must inform the employer of his intention to resign no later than two weeks before the expected date of termination of the employment relationship. Read about what work-off is in our article “Work-off period upon dismissal” of your own free will."

However, situations are possible when an employee may insist on immediate dismissal on his own initiative due to the inability to continue to perform his job duties in the future. Then the application should indicate such a valid reason and be prepared that personnel officers will be able to ask for documentary evidence of these circumstances. Such valid reasons include retirement or entering a university for full-time study.

Issuance of an order

After a two-week period has passed after receiving a statement from the employee about his intention to resign, the employer issues a corresponding order, with which he acquaints the dismissed person with his signature. It is undesirable to issue an order earlier, since the employee may change his mind during these two weeks and withdraw his application (Part 4 of Article 80 of the Labor Code). An exception may be cases when the employer has already sent a written invitation to work in the place of the dismissed person to another employee .

Refusal of application

If the employee changes his mind and refuses to sign a document acknowledging the dismissal order, but the two-week period has already expired or another person has been invited to his position, then a corresponding note is made in the order. Despite this, on the last day of the two-week period, the dismissed person must be issued a work book and all due payments must be settled.

Applying while on vacation

If an employee’s application for dismissal was submitted while he was on paid leave, dismissal is also made two weeks after the employer receives the said application, despite the fact that the vacation has not yet ended.

If an employee did not go to work on the day of his dismissal to receive a paycheck and documents (work book and others ordered by the employee), because he was still on vacation, then the employer sends him a corresponding notification about the need to appear and receive documents, or to give consent to send them by mail (Part 6 of Article 84.1 of the Labor Code of the Russian Federation).

How many days of vacation are required for 1 month of work?

To determine how many days of vacation are due for 1 month of work, you should use one of the generally accepted methods. Its essence is as follows. In accordance with the methodology used, 2.33 days are accrued per month of work, which fall on the main paid leave. This value is obtained as follows: 28 days : 12 months = 2.33 days. Thus, in accordance with the calculation using the mentioned method, the number of vacation days, depending on the number of months worked, will be:

- I. - 2.33

- II. — 4.66

- III. — 6.99

- IV. — 9.32

- V. - 11.65

- VI. — 13.98

- VII. — 16.31

- VIII. — 18.64

- IX. — 20.97

- X. - 23.30

- XI. — 28

- XII. — 28

This technique is easy to use and is justified by clause 29 of the current Rules, introduced by Decree No. 169 of the People's Commissariat of Labor of the USSR dated April 30, 1930.

4.20 No comments. Free consultation Question and answer The employee’s right to compensation upon dismissal due to conscription into the army When an employee must be given a paycheck upon dismissal The right to compensation upon dismissal from the police Legal advice Can the head physician transfer nurses to the positions of technicians without their consent Can it be considered resignation from work due to a conflict like absenteeism Should an employer pay an employee a salary if he quits before concluding an employment contract

Calculation of vacation days in 2021

Home / Articles / Calculation of vacation days in 2021

Every officially employed citizen has the right to annual paid leave of 28 calendar days. Vacation is paid based on the average earnings of the employee for the last calendar year. This does not mean a calendar year, but a working year, and the countdown begins not from January 1, but from the date of concluding an employment contract with a specific employer.

The right to take annual leave arises for an employee after six months of working for a given employer. If the parties to the contract reach an agreement, the leave may be granted earlier. If an employee quits without working for even six months, the employer is obliged to pay him compensation for unused vacation days. How to calculate how many vacation days an employee has accumulated? The formula for calculating vacation pay is not that complicated. You need to know which periods are taken into account for the length of service that gives you the right to leave.

Starting from the second year of fulfilling his labor duties, the employee’s vacation is provided in accordance with the schedule, which must be approved at each enterprise before December 15 of the current year for the next year. Every employee should be familiar with the methodology for calculating vacation pay.

Vacation pay is calculated using the formula:

OTP = (Salary / (12 * 29.3))* number of vacation days, where:

- OTP – the amount of compensation received for vacation;

- Salary is the salary of a given employee for the entire period worked; 12 – number of months in a year;

- 29.3 – average number of days in a month. This value is set at the Government level.

Calculation and payment of vacation pay must be made no later than 3 calendar days before the start of the employee’s vacation. It is more difficult to use the above formula if the employee has not completed a full working year.

To calculate how many vacation days a given employee has earned, you must use the formula:

(29.3 / 12) * total number of months worked. 29.3 / 12 = 2.44 days each employee has for the month actually worked.

When calculating vacation pay, the following periods are taken into account, according to Art. 121 Labor Code of the Russian Federation:

- actual work time;

- days when the employee was actually absent from the workplace, but it remained with him. Such cases are given in the Labor Code of the Russian Federation and other regulations;

- days of forced absence;

- other periods specified in Art. 121 Labor Code of the Russian Federation.

For example, an employee got a job on November 2, 2015, and quit on April 28, 2021. He worked the entire period in full, without any omissions. Thus, he “accumulated” 5 months of experience for vacation. Since April has “passed” the halfway point, it is considered fully. Therefore, the employee has “accumulated” 2.44 * 5 = 12.2 vacation days. According to the rounding rules - 12 calendar days.

Vacation followed by dismissal: when to pay

When an employee wants to resign under such conditions, the employer must be guided by the provisions of Art.

127 of the Labor Code of the Russian Federation and some regulations (listed below). Firstly, this request must be formalized in a written statement from the employee, for example this one.

Secondly, the deadlines for settlements with the employee must be met. In our case, the day of dismissal will be the last day of rest. Therefore, calculations must be made before going on vacation, because... upon its completion, the obligations of the parties will cease to be valid.

Documents are transferred in the same order: a work book and some other documents (for example, a pay slip, a 2-NDFL certificate, a certificate of form 182n, an extract from the SZV-STAZH form, etc.), which the employer is obliged to issue to the employee on the last day of work .

IMPORTANT!

The most important points are calculating the amount of vacation pay and calculating vacation days upon dismissal; the online calculator on our website will help you avoid mistakes. You can use it completely free.

Vacation pay formula

What does the formula for calculating average earnings for vacation pay look like:

Srzar = Zarpl / (12 * 29.3), where:

- srar is the average salary for 1 day of work for a specific employee;

- Salary is the entire accrued salary of a particular employee for the last working year;

- 12 – number of months in a year;

- 29.3 – average number of days in 1 month.

For example, an employee got a job on June 2, 2021, and from June 1, 2021, he has the right to go on vacation. During this period he received 578,000 rubles. Thus, his average wage for 1 day of work is:

578,000 / (12 * 29.3) = 1,638.32 rubles.

The formula for calculating days according to the vacation calendar is as follows:

(29.3 / 12) * total number of months worked. Each employee has 29.3 / 12 = 2.44 days for the month actually worked. For example, an employee worked a full 7 months for this employer. Therefore, upon dismissal, he has the right to receive compensation for 7 * 2.44 = 17 calendar days of vacation.

When fully paid

The compensation amount is reimbursed in proportion to the amount of time worked; sick leave, free vacations, forced downtime are not included in the period of time worked, which means these days are not taken into account when calculating payments.

If an employee has used allotted rest days throughout the year, then compensation is provided only for days not taken off.

When leaving, there are 2 options :

1. Payment without going on vacation.

2. Termination of employment relations with the right to go on vacation.

Important! Employees who have worked a full 11 months, counted towards their total length of service, can receive 100% compensation, regardless of the reasons for termination of the contract.

In addition, full payments are due to persons who have worked for less than six months, but subject to one of the following cases: liquidation of the enterprise, reduction of staff, or entry of an employee into military service. Payment of vacation pay upon dismissal at one's own request or according to an article does not have any fundamental differences in the calculation procedure.

Calculation formula

The formula for calculating vacation days looks like this:

Average earnings of a given employee * number of vacation days.

Each employee has the right to independently split his vacation, but with the condition that one half of it will be at least 14 calendar days. He has the right to divide the remaining days. But you need to reach an agreement with the employer, since splitting the vacation is out of the general schedule, and this may affect the rest of other employees.

Average earnings for 1 day of work are calculated using the following formula:

All earnings for the last calendar year / 12 * 29.3

Vacation pay in 2021 is calculated taking into account the Regulations on the procedure for calculating average earnings, approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922. New calculation rules have not been developed or approved for several years.

The amount of money that an employee will receive during his vacation period is influenced by the following factors:

- the period for which the calculation is made;

- average employee earnings. It is for the purposes of calculating this indicator that it is necessary to obtain a corresponding certificate from the previous employer. This will prevent you from “losing” some amounts and periods;

- work experience;

- the number of days of rest that the employee wishes to use. The maximum amount of compensation will be paid for 28 calendar days of vacation.

Only those employees who officially work under an employment contract have the right to leave. If a civil contract has been concluded with an employee, then such an employee does not have the right to leave. The standard duration of vacation is 28 calendar days. But there are some categories of workers who, due to their profession and position, may qualify for additional days of rest.

The first leave is granted after six months of work, then according to the schedule. There are employees who can go on vacation at a time convenient for them, despite a previously approved document:

- women who will soon go on maternity leave;

- employees who have officially adopted a child under three years of age;

- minor workers.

Important! Each employee, by agreement with the employer, has the right to receive leave without pay. In this case, there is no need to calculate anything, since management does not have to pay for these days. But if you take such a vacation for more than 14 days, this will affect indicators such as length of service and length of the working year.

Number of days in the period

In order to correctly calculate the amount due to a specific employee for the vacation period, you need to know what period you need to take for the calculation.

To calculate vacation pay, you must take the previous 12 months and the actual time worked in them. The company may set a different billing period (for example, six months or a quarter). But this norm must be enshrined in a collective agreement or other regulatory act. The employee must be familiarized with this provision by signing upon entry to work.

A self-determined period should not worsen the employee’s position as if a “standard” period were used in the calculation.

If an employee decides to take a vacation after six months, then the time actually worked is taken into account for the calculation. When calculating, you need to know which periods are excluded. These include the days the employee was on sick leave (for various reasons) and on unpaid leave (more than 14 days).

Accountants sometimes have questions regarding accounting for holidays that fall during an employee’s rest period. Should they be taken into account? According to the explanations of the Ministry of Labor (letter dated April 15, 2016 No. 14-1/B-351), these days “automatically” extend the vacation, but they are not paid.

What if the period is excluded completely? For example, a woman was on leave to care for her child. Then for the calculation you should take the period that was fully worked out, even if it was several years ago. If this period is completely excluded, then you need to take the billing month and the days actually worked in it.

Downtime caused by the employer is also excluded from the billing period. This period is paid from the wage fund at the rate of 2/3 of average earnings. But neither the amount nor the days are taken into account when calculating vacation days.

Payments taken into account when calculating

To correctly calculate average earnings, you need to know what payments are taken into account in the calculation. Government Decree No. 922 states that the employer must take into account all amounts that relate to wage payments. These payments must be specified in the relevant local regulations, which the employee must be familiar with upon starting work.

Average earnings are calculated based on the provisions of Art. 139 Labor Code of the Russian Federation. Analyzing this article, we can conclude that all payments (including incentives) that are included in the remuneration system of a given employer and that do not contradict the law are taken into account. It does not matter from what means these payments are made.

The question arises about accounting for bonuses, since they relate to incentive payments. For the calculation, those bonuses that relate to the remuneration system are taken into account. Their list must be specified in one of the following local regulations:

- contract of employment;

- wage regulations;

- regulations on incentives (bonuses);

- collective agreement.

Calculation of vacation pay on weekends

Some workers, wanting to extend their vacation, arrange their vacation so that it covers weekends and holidays. If an employee’s legal vacation includes official non-working holidays, they are not included in the number of vacation days and, as a result, are not paid. In Art. 112 of the Labor Code of the Russian Federation provides an exhaustive list of official non-working holidays in Russia. Most of them fall in January.

Young workers are often concerned about the question of whether weekends are taken into account during the vacation period? According to Art. 119 of the Labor Code of the Russian Federation, annual paid leave in Russia is provided in calendar days. In Art. 120 of the Labor Code of the Russian Federation states that weekends, along with working days, are included in vacation and are subject to payment.

Duration of vacation

In Russia, the minimum duration of annual leave is 28 calendar days. All officially employed citizens can count on such vacations. These include persons working under an employment contract. Persons carrying out their activities under a civil contract cannot count on the annual provision of 28 days of rest. Such guarantees are given only to officially employed persons.

In Russia, certain categories of workers have been identified who have the right to extended rest. The number of additional days is provided by law. In addition, the employer has the right to independently “throw in” a few days of vacation. But this provision must be spelled out in a local regulatory act.

How to calculate vacation pay when dismissing an employee in 2019

Who is entitled to vacation compensation upon dismissal?

The Labor Code of the Russian Federation provides for the dismissal of an employee on the following grounds:

- at the employee’s own request; - at the initiative of the employer; - by agreement of the parties.

Regardless of the grounds for dismissal, the employee is paid wages for the time he worked, as well as compensation for the vacation that he did not have time to take off (Article 127 of the Labor Code of the Russian Federation).

Alternatively, the employee can write a statement requesting leave, and then resign.

ATTENTION.

The employer legally (Part 8 of Article 11 of the Labor Code of the Russian Federation) will not compensate for vacation to an employee who works under a civil contract. For example, those who work under a contract or paid services.

Employees who have worked less than 14 calendar days also cannot count on vacation compensation. Basis - letters of Rostrud dated 06/08/07 No. 1920-6 and dated 07/26/06 No. 1133-6.

Calculation example

In order to understand how to correctly calculate vacation pay, it is necessary to give several examples.

Example 1. Employee N. wrote an application for annual leave from 04/02 to 04/30. His salary is 56,000 rubles. Before the New Year, all employees, including employee N., were given a bonus in the amount of 18,000 rubles. Every month, employee N. receives compensation for gasoline in the amount of 5,000 rubles and for mobile communications in the amount of 1,000 rubles. The period was worked out completely by N.

- The billing period from 04/01/2017 to 03/31/2018 is fully worked out.

- Payments that must be taken into account when calculating vacation pay:

- employee salary – 56,000 * 12 = 672,000 per year;

- New Year's bonus – 18,000 rubles;

- compensation payments are not taken into account, since they do not relate to the wage system.

- N.'s average earnings for the billing period are: (672,000 + 18,000) / 12 = 57,500 per month.

- Calculation of vacation pay: (57,500 / 29.3) * 28 = 54,948.5 rubles.

- N. will receive in his hands: 54,948.5 – (54,948.5 * 13%) = 47,805.2 rubles.

Example 2. Employee N. wrote an application for annual leave lasting 14 calendar days in the period from 04/01 to 04/15. N.'s salary is 42,600 rubles. N. was hired on October 1, 2017. In December, he was on sick leave for 7 days and received 12,000 rubles during this period. In December, he also received a salary of 27,000 rubles.

- The billing period from 10/01/2017 to 03/31/2018 has not been fully worked out.

- Before his vacation, N. worked a full 6 months, that is, 6 * 29.3 = 175.8 days.

- Together with sick leave in December - 29.3 * 23 / 31 = 21.7 days. Total 175.8 + 21.7 = 197.5 days.

- Payments taken into account for calculation:

- for 6 full months and part of December, excluding sick leave - (6 * 42,600) + 27,000 = 282,600 rubles;

- Sick leave is not taken into account.

- Calculation of vacation pay: (282,600 / 197.5) * 14 = 20,032.4 rubles.

- N. will receive in his hands: 20,032 – (20,032.4 * 13%) = 17,427.84 rubles.

Example 3. Employee N. wrote an application for leave from 04/01/2018 to 04/15/2018. He worked for this employer for 5 years. Monthly salary – 68,000 rubles, monthly bonus – 5,000 rubles. At the end of 2021, a bonus of 30,000 rubles was paid. In March, N. was on sick leave for 7 days, the amount of payments was 27,000 rubles, the salary for March was 40,000 rubles.

- The billing period is from 04/01/2017 to 03/31/2018.

- In March, he worked 29.3 * (31 – 7) / 31 = 22.7 days.

- Amount of payments for March to calculate average earnings:

- according to the production calendar in March there are 21 working days;

- N. actually worked 16 days;

- premium for March (5,000 / 21) * 16 = 3,809.5 rubles;

- the total amount for March is 40,000 + 3,809.5 = 43,809.5 rubles.

- Due to the fact that N. was on sick leave, he worked part of the pay period. Therefore, the bonus at the end of the year must be recalculated according to the days actually worked. For N. it is 244 days. And according to the schedule - 249 days. Prize amount: (30,000 / 249) * 244 = 29,397.6 rubles.

- Total for December – 68,000 + 29,397.6 = 97,397.6 rubles.

- Vacation pay calculation:

- at the end of the year (68,000 * 11) + 97,397.6 = 845,397.6

- number of days for calculation 29.3 * 11 + 16 = 338.3

- vacation pay amount – (845,397.6 / 338.3) * 14 = 34,985.4 rubles.

- N. will receive 34,985.4 – (34,985.4 * 13%) = 30,437.3 rubles.

3.75 No comments. Free consultation Question and answer The employee’s right to compensation upon dismissal due to conscription into the army When an employee must be given a paycheck upon dismissal The right to compensation upon dismissal from the police Legal advice Can the head physician transfer nurses to the positions of technicians without their consent Can it be considered resignation from work due to a conflict like absenteeism Should an employer pay an employee a salary if he quits before concluding an employment contract

How to calculate salary (examples)

It is important to consider all the variables and the exact period of time worked. It is more difficult to make calculations if there were unpaid vacations or sick leave during the period.

Example No. 1 : Calculation period 1 year, amount of income 300,000 for 12 months. The amount of average daily earnings is determined as 300,000/12/29.3 = 853.24 rubles. The number of vacation days is 28, the amount of payments (28*853.24) is 23,890.78 rubles .

29,3 – this is the average number of working days per year, taking into account a 6-day working week. This indicator is established at the legislative level; the formula has not changed since 1993.

Example No2 Calculation period - 8 months, total income 240,000 rubles, number of days worked - 8 * 29.3 = 234. Number of vacation days – 19 (2.33*8). The amount of compensation is = 240,000/234*19 = 19,487 rubles .

Example No3 Calculation taking into account sick leave – 15 days. The term of work is 12 months, of which 11 are full-time and 1 is part-time. The amount of earnings is 325,000 rubles, 15,000 rubles were reimbursed from the social insurance fund for the certificate of incapacity for work, but this amount is not included in the amount of average earnings. We calculate the number of days for which the employer paid for sick leave - 29.3/30*15=14.65 (rounded up to 15 days). For 11 months, the number of days worked is 322 (11 * 29.3). In this case, the average number of days worked is added to the total number of working days (322+15=337), this total indicator is inserted into the formula. For 1 year, vacation is 28 days. The amount of compensation is 325,000/337*28 = 27,002 rubles .

Example No4 Vacation pay upon dismissal during the probationary period. The employee worked for 2 months and 17 days, which means rounding up to 3 months is allowed. The number of allotted vacation days (2.33*3=6.99) is rounded up to 7 days. The monthly salary is 15,000 rubles (3*15,000=45,000). Average number of days worked = 29.3*3=88. The compensation should be - (45,000/88*7= 3,759.54 ). For comparison, you can find out whether such compensation corresponds to the minimum wage, so the amount of payments for 1 day is 511 rubles (3,759/7). The total amount for 28 days will be 14,308, this is above the limit, which means there is no violation of the law.

Analysts believe that it would be much easier to use exact numbers rather than averages, which create a lot of confusion. However, for most people this approach is more convenient. This problem is especially relevant if there is downtime, because the average income for the previous period is taken, and for this it is necessary to raise all the documentation for the previous years.

New changes from May 1, 2021 concern not only the amount, but also the rules for calculating vacation pay. The formula has not changed, but a minimum payment threshold has been established.

Persons working under an employment contract have the right to vacation

All employees of the organization working under an employment contract have the right to paid leave for each year worked (Article 122 of the Labor Code of the Russian Federation). Moreover, an employee can take his first vacation after six months of work, counting from the date of employment. This is a legal requirement.

In principle, you can go on vacation without waiting for six months to expire from the start of work. If the administration of the organization does not mind, then the employee can be provided with leave in advance. Moreover, in most cases, providing leave in advance is the right of the organization. Only in some cases can vacation of up to 6 months of continuous work in a company be granted (for more details, see “Vacation of up to six months of work under the Labor Code of the Russian Federation”).

Let us clarify that vacation is granted specifically for the working year, which, in general, is an annual period starting from the moment of employment. Obviously, the length of service for the purposes of calculating vacation depends specifically on the employee’s working year, and not the calendar year. The fact is that the dates of employment in the organization are different for all employees, and it would be illogical to be tied to the calendar year when calculating the length of service that gives the right to leave.

For more information, see “Granting leave: calendar or working year.”

Employer warning

A very important fact when dismissing an employee is the process of warning the employer. For his part, the employee must understand that by his dismissal he can cause a number of problems in the work of the organization and staffing. Therefore, the employee is obliged to notify the manager that he wants to terminate the contract within a certain time frame.

During the period of employment of the hired worker, the employer will have the opportunity to find a replacement for him. Therefore, the fact of notice of dismissal plays a huge role.

And the dismissed employee himself must make sure that the process for terminating his contract is known to management. That is, he must make sure that his application is accepted for processing.

Otherwise, management, in accordance with labor law, may take measures to cancel the fact of dismissal. In this case, even the decision of the magistrates will not help if the employee approaches them with a claim. By the way, if an employee is fired on the initiative of the enterprise administration, then the employer is also obliged to notify him so that the person has time to find a new job.

For each month worked, vacation days accrue

So, returning to the question of how many days of vacation are due per month of work, we answer: for a month of work in 2021, an employee is entitled to 2.33 days of vacation. This number is obtained by dividing the duration of annual paid leave (28 calendar days) by the number of months in a year (12 months). This algorithm is explained by the fact that 28 days of vacation are due per year of work, that is, for 12 months. This means that there are 2.33 days per month (Part 1 of Article 115 of the Labor Code of the Russian Federation).

It is clear that, using this formula, you can calculate how many days of vacation are due, for example, after 3 or 6 months of work in an organization.

You can divide your vacation as you please. However, dividing vacation into parts of less than 14 days is only possible if one part of the vacation is at least two weeks. In other words, it is imperative to leave 14 days of vacation indivisible (Article 125 of the Labor Code of the Russian Federation). The remaining vacation can be used even one day at a time, provided that the administration does not mind. Thus, the division of vacation into parts is carried out according to an arbitrary scenario, if its two-week part is left untouched.

The division of leave must be agreed upon with the employee. If this responsibility is ignored, the company could get into trouble. For dividing vacation without taking into account the employee’s opinion, the employer may be held administratively liable under Part 1 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation (decision of the Trans-Baikal Regional Court dated March 23, 2015 No. 7-21-73/2015).

Deadline for payment of compensation for unused vacation

Upon dismissal, an employee does not need to write a separate application for vacation compensation. To receive money, a letter of resignation from the company is sufficient.

The timing of payment of compensation for the non-vacation period is specified in Article 140 of the Labor Code of the Russian Federation. The calculation must be made on the day of dismissal, that is, on the employee’s last working day. If this condition is not met, then this is a reason to go to court with a statement of claim.

IMPORTANT.

If an employee used more than his allotted rest days before dismissal, then the amount of overexpenditure may be withheld from him (Article 137 of the Labor Code of the Russian Federation).