Which documents

The list of documents serving as the basis for making a decision on the allocation (reimbursement) of the necessary funds for the payment of insurance coverage was approved by order of the Ministry of Health of Russia dated December 4, 2009 No. 951n (taking into account changes made by order of the Ministry of Labor of Russia dated October 28, 2016 No. 585n).

So, employers need to submit:

- application for the allocation of the necessary funds for the payment of insurance coverage (in the form provided by the Fund’s letter dated December 7, 2016 No. 02-09-11/04-03-27029);

- Form 4-FSS (for obligations arising before 01/01/2017);

- certificate - calculation and Explanation of expenses.

In addition to the above-mentioned documents, the policyholder immediately submits duly certified copies of documents confirming the validity and correctness of expenses for compulsory social insurance in case of temporary disability and in connection with maternity.

An approximate list of such documents:

- documents serving as the basis for the assignment and payment of benefits (confirming the fact of an insured event);

- documents confirming the correct calculation of benefits (for temporary disability and maternity benefits, monthly child care benefits);

- documents confirming the existence of an employment relationship between the policyholder and the person receiving the benefit.

The list of documents depends on the specific insured event.

Temporary disability benefit

To be reimbursed for sick leave expenses, you must provide:

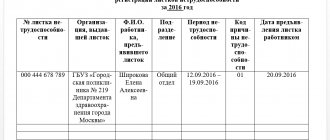

- a certificate of incapacity for work, filled out in the prescribed manner with the benefit calculated;

- certificate(s) about the amount of earnings from another policyholder(s) 182n;

- documents confirming insurance experience;

- cards for individual accounting of the amounts of accrued payments and other remunerations and the amounts of accrued insurance premiums to verify the correctness of determining the taxable base and the calculation of insurance premiums;

- a certificate (certificates) from the place of work (service, other activity) with another policyholder (other policyholders) stating that the appointment and payment of benefits by this policyholder are not carried out if the insured person at the time of the insured event is employed by several policyholders, and in two in previous calendar years was occupied by other policyholders, or by both these and other policyholders (another policyholder).

Pilot project

In accordance with this project, part of the sick leave benefit is reimbursed directly to the employee from the Social Insurance Fund, while the employer pays only that part of the payment that is made at his expense - for the first 3 days.

In order for the fund to transfer the amount for the sick leave insured person, the employer can send the necessary documents himself to the Social Insurance Fund or transfer them to the employee for self-submission.

These documents are submitted to the fund within five days from the moment the employer receives the certificate of incapacity for work.

If the organization uses this method of paying for sick leave, then compensation to the policyholder is not made due to the absence of such a need.

Since 2011, not all regions have been participating in this pilot project, but only a small part.

Maternity benefit

To be reimbursed for the B&R benefit and the benefit for registration in the early stages of pregnancy, the following must be submitted:

- a certificate of incapacity for work, filled out in the prescribed manner, with the benefit calculated;

- application of the insured person for maternity leave;

- order on granting maternity leave and granting benefits;

- certificate(s) about the amount of earnings from another policyholder(s) 182n;

- documents confirming insurance experience;

- cards for individual accounting of the amounts of accrued payments and other remunerations and the amounts of accrued insurance premiums to verify the correctness of determining the taxable base and the calculation of insurance premiums;

- a certificate (certificates) from the place of work (service, other activity) from another insured (other insureds) stating that the appointment and payment of benefits by this insured are not carried out if the insured person at the time of the insured event is employed by several insureds, and in two in previous calendar years was occupied by other policyholders, or by both these and other policyholders (another policyholder);

- a certificate from the antenatal clinic or other medical organization that registered the woman in the early stages of pregnancy (up to 12 weeks).

Refund deadlines

The Social Insurance Fund is obliged to refund the overpayment of insurance premiums in connection with the payment of disability benefits within 10 days from the date of receipt of documents from the policyholder.

If a desk audit is carried out based on the submitted documentation, the return period increases to 3 months, if an on-site audit – up to 2 months.

Checks are not always carried out, but by decision of the Social Insurance Fund, if doubts arise about the correctness of the data provided on accrued, paid contributions, paid sick leave benefits.

If the results of the checks are more positive, then a decision on compensation is made.

Refunds are made within three days.

Birth benefit

When reimbursing funds for the payment of a lump sum benefit for the birth of a child, the following must be presented:

- application for benefits;

- a child’s birth certificate issued by the civil registry office;

- a copy of the child's birth certificate;

- a certificate stating that the benefit was not assigned from the place of work (service) of the other parent, or the social protection body at the place of residence, if the father (mother, both parents) of the child does not work (does not serve) or is studying full-time in professional educational organizations, educational organizations of higher education, educational organizations of additional professional education and scientific organizations, and the other parent of the child works (serves);

- certificate of divorce, if the marriage between the parents is dissolved;

- a copy of the child’s birth certificate issued by a consular office of the Russian Federation outside the territory of the Russian Federation - if the child is born on the territory of a foreign state.

In cases where the registration of the birth of a child is carried out by the competent authority of a foreign state:

- a document and its copy confirming the fact of birth and registration of a child, issued and certified with an “apostille” stamp by the competent authority of a foreign state, with a translation into Russian certified in accordance with the procedure established by the legislation of the Russian Federation - at the birth of a child on the territory of a foreign state party to the Convention abolishing the requirement of legalization foreign official instruments, concluded at The Hague on October 5, 1961;

- a document and its copy confirming the fact of birth and registration of a child, issued by a competent authority of a foreign state, translated into Russian and legalized by a consular office of the Russian Federation outside the territory of the Russian Federation - at the birth of a child on the territory of a foreign state that is not a party to the above Convention;

- a document and its copy confirming the fact of birth and registration of a child, issued by the competent authority of a foreign state, translated into Russian and affixed with an official seal - at the birth of a child on the territory of a foreign state that is a party to the Convention on Legal Assistance and Legal Relations in Civil, Family and Criminal Matters cases concluded in the city of Minsk on January 22, 1993;

- an extract from the decision to establish guardianship over the child (a copy of the court decision on adoption that has entered into legal force, a copy of the agreement on the transfer of the child (children) to a foster family) - for the person replacing the parents (guardian, adoptive parent, adoptive parent);

- a document confirming the cohabitation of a child with one of the parents on the territory of the Russian Federation, issued by an organization authorized to issue it - if the marriage between the child’s parents is dissolved.