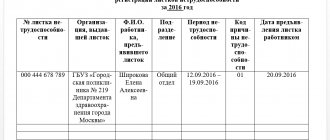

Order to assign temporary disability benefits in full

Read about the topic in the electronic journal The text of the order itself consists of two parts.

In the first, administrative, the manager orders the accounting department to accrue and the cashier to pay the allowance. In addition to the full name of the employee to whom the benefit is paid, his position, structural unit, date of birth of the child and his full name are indicated. Labor legislation regulates the procedure for organizing working time and rest for personnel. The Labor Code of the Russian Federation does not regulate sick leave and the process of issuing or registering it, but rather determines the periods of incapacity for work of an employee and the procedure for their payment. Let's look at exactly what guarantees are provided by this regulatory legal act:

- Art. 81 protects an employee from dismissal during illness at the initiative of the employer.

- Art. 124 provides for the extension or transfer of the main vacation to another period if the employee falls ill while on vacation.

- According to Art. 183 of the Labor Code of the Russian Federation in 2021, an employee’s sick leave is paid by the employer based on average earnings for the entire period of incapacity.

- If an employee receives an injury (mutilation) during work, then according to Art. 184 of the Labor Code in 2021, sick leave, as well as all costs associated with treatment, are paid by the employer in full.

- Art. 255–256 require the employer to allow a pregnant woman to go on maternity leave (B&P) upon providing the latter with a certificate of incapacity for work, and subsequently, at the request of the employee, to provide her with maternity leave.

The procedure for payment and calculation of benefits is regulated by the Sick Leave Act. Let's consider its provisions in more detail.

Law 255-FZ regulates the conditions, amounts and algorithm for providing sick persons with benefits. Chapter 1 describes the general provisions of this law, and also defines the order of relations in the circle “employee - employer - Social Insurance Fund”. According to Art.

All conditions for providing benefits, as well as its amount, are determined by Chapter 2 of the law. According to this section, benefits are paid when:

- loss of ability to work by an employee due to injury or illness, including within a month after dismissal;

- caring for a sick child or other relative;

- wearing prosthetics or being in quarantine.

The amount of the benefit is determined based on the employee’s length of service (SS):

- for SS up to 6 months, the benefit amount is calculated according to the minimum wage;

- for SS from 6 months to 5 years - 60% of earnings;

- from 5 to 8 years - 80% of earnings;

- over 8 years - 100% earnings.

P = D / Kd × %O, where

D - income for 2 years preceding the day of the insured event;

Kd - the conditional number of calendar days for the previous 2 years taken into account, Kd = 730;

%O - percentage of payment determined according to the employee’s SS.

Chapter 3 of this law defines the algorithm for calculating and paying benefits for the BiR and for child care up to 1.5 years. According to this section, the B&R benefit is paid at 100%, regardless of length of service.

Chapter 4 describes the procedure for determining the SS, and also establishes the deadlines for paying benefits and the algorithm for their assignment and calculation.

As noted above, the employer pays benefits only on the basis of the certificate of incapacity for work provided by the employee. The bulletin must be issued in accordance with the rules provided for by Order of the Ministry of Health and Social Development dated June 29, 2011 No. 624n. Let's consider the basic norms of this legal act.

- Contract of carriage, chartering, transport expedition

- Agreement of transfer, alienation

- Contract: household, construction, subcontract

- Contract of agency, contract of guarantee

- Supply agreement, contracting

- Rental agreement: household, construction

- Life annuity agreement, life maintenance

- Loan agreement, free provision of services

- Insurance and reinsurance agreement

- Employment contract with the employee

- Agreement on assignment of rights and transfer of debt

- Student agreement with employee

- Foundation agreement, agreement on joint activities

- Agreement of storage, liability

- Other agreements

Treaties by tags Quote for centuries Civilization is a terrible plant that does not grow and flourish until it is watered with tears and blood. (A.

No. 514″ (registered by the Ministry of Justice of the Russian Federation on December 1, 2008 No. 12774); Order of the Ministry of Health and Social Development of the Russian Federation dated December 18, 2008

We invite you to read: Which powers of attorney require mandatory notarization

No. 737n “On amendments to the Procedure for issuing certificates of incapacity for work by medical organizations, approved by Order of the Ministry of Health and Social Development of Russia dated August 1, 2007 No. 514” (registered by the Ministry of Justice of the Russian Federation on January 28, 2009

No. 13205).Minister T.GOLIKOVAAppendix (as amended by Order of the Ministry of Health and Social Development of Russia dated January 24, 2012 No. 31n, dated July 2, 2012 No. 348n)I. General provisions1. Sick leave certificates are issued to insured persons who are citizens of the Russian Federation, as well as foreign citizens and stateless persons permanently or temporarily residing in the territory of the Russian Federation (hereinafter referred to as citizens), specified in Article 2 of the Federal Law of December 29, 2006.

N The work is permanent, urgent (underline as appropriate).

As they explained to me at the FSS, the protocol must be drawn up by a commission (the composition is determined by the head by order) for the assignment of benefits. The commission makes a decision to pay the bill or not to pay and for what reason.

The protocol is transferred to the accounting department.

How to apply for sick leave to the Social Insurance Fund

The FSS of the Russian Federation allocates funds for the payment of insurance coverage if the organization prepares the documents correctly. Let's consider how to prepare an application to the Social Insurance Fund for sick leave to receive payment and what nuances to take into account in 2021.

Rules for registration and content of an application for sick leave

The primary authority that deals with the payment of sick leave benefits is the legal entities themselves. To receive benefits from your employer, you do not need to write official statements and/or contact any third authorities: usually everything is resolved verbally to the accounting department.

So many workers never face the need to apply to the Social Security Fund at all.

Sample order for payment of sick leave for temporary disability

It is with the help of a sick leave certificate issued by a medical institution in the manner prescribed by law that an employee can prove that he was absent from work for a good reason. From the article you will learn: How is sick leave issued?

Registration date: 10.20.2010 An order from the manager is needed to assign benefits.

We argued and went to an appointment with the leadership of the local Social Insurance Fund. Useless. I had to write orders 3 years in advance. Since then we have been writing them, because... Due to the fact that our employees correctly understand the demographic policy of the party, they have to apply for compensation to the Social Insurance Fund several times a year.

And every time we attach copies of all sick leave and orders for desk checks.

If anyone manages to receive compensation from the Social Insurance Fund without orders, please share your experience.

I have not found a similar thing anywhere for an order for payment of a b/l. Can you tell me if there is such a form? And if not, then who formulates such orders (links to which articles of 255-FZ, is the period of illness written, number of days, etc.)?

“Based on the documents submitted (sick leave certificates).

I order the granting of benefits. according to b/l XX No. XXXXXXX dated . “By the way, how do you then understand Part 1, Article 15, 255-FZ?

). I order the granting of benefits.

according to b/l XX No. XXXXXXX dated . “Um, it’s not you who appoint him, the employee is entitled to it, these are social guarantees.

It’s another matter if YOU pay extra up to average earnings. Student 777, I’ll still return to my question 1 then.

The employee brings a certificate of incapacity for work. 2. Within 10 calendar days, an order must be issued to assign temporary disability benefits to the employee.

Hence (The employee will sign in this order that he is familiar with it: familiarization with signature with all orders relating to accruals is a requirement of the Labor Code of the Russian Federation) 3.

The accounting department makes calculations based on this order and the sick leave certificate. 4. On the next day of salary payment (by the way, it turns out that this can be 30 days after the employee gave the salary to the employer), the employee is paid according to the salary. The correctness of registration and calculation according to the sheet is controlled by the FSS.

Without this protocol, no refund will be given. It is possible that other regions have different requirements. In addition, you yourself write that the employer is OBLIGED, what does the order have to do with it?

If there is already an obligation. The employer is obliged to pay wages on time, so every half month, issue an order to do this?

What does this mean? I repeat: what are 10 days given for?

Who orders what to whom? In addition, you yourself write that the employer is OBLIGED, what does the order have to do with it? If there is already an obligation.

The employer is obliged to pay wages on time, so every half month, issue an order to do this?

Don't take just one word out of context. “Obliged to assign benefits” within 10 days.

And he is “obliged to pay benefits” on the next payday after the appointment.

I’m not saying anything about the order to pay benefits (as you draw an analogy with the payment of wages). Please look at my post #7.

There is a quote from 255-FZ. It follows from it that a sick leave certificate is only, I quote, a “necessary document” for receiving benefits. But not enough. In addition, documents for payment of benefits (consumables, statements) are already signed by the head of the organization.

If you want, you can make orders, no one forbade you.

But to say that this is necessary is wrong. By the way, in the law you mentioned there are no words “insufficient” 4.

On the next day of salary payment (by the way, it turns out that this can be 30 days after the employee gave the salary to the employer), the employee is paid according to the salary. As mentioned above, the employer is obliged to pay sick leave.

You don't need any order. And you must pay wages according to the Labor Code at least twice a month - so you won’t be able to do 30 days.

We invite you to familiarize yourself with: Sample of filling out an application for a weapons license

Maximum 15 days. Not certainly in that way. Let the advance be on the 15th, salary on the 1st. They brought sick leave on the 7th, assigned benefits on the 16th, then we will pay benefits only on the 1st.

Rules for issuing sick leave by an employer based on the 2021 model

Let’s analyze how to issue a sick leave note, observing the norms and procedures for document execution provided for by law. In general, the set of general rules is the same for everyone, but there are certain nuances that need to be taken into account when registering.

Issue rules

certificate of incapacity for work is such that the employee must bring to the employer a certificate issued at the medical institution where he was treated.

Next, it must be filled out by employees of the organization

authorized to carry out this procedure, namely:

- employer;

- director;

- Chief Accountant;

- Head of HR Department

The employee responsible for processing sick leave must ensure that it is filled out correctly

document at the medical institution and

check

:

- Company name;

- Full name of the citizen;

- period of sick leave;

- doctor's signature;

- seal.

When errors are found

The sick leave is returned back for a duplicate.

Next, an authorized employee of the company where the employee works needs to fill out special fields, following the rules for drawing up a certificate of incapacity for work according to the sample. To do this, it is necessary in the subsection “ To be completed by the employer

»:

- Enter the name of the organization.

- Put a mark in the document field about the nature of the employee’s work: main place of employment or part-time schedule.

- Enter the registration number of the organization assigned by the Social Insurance Fund (SIF) and the code of subordination - all this information is recorded in the notice issued when registering the company with the FSS.

- Fill in the fields provided for the citizen’s TIN and SNILS.

- If there are specific disease factors, enter a special code in the “ Accrual conditions

” cell:

- 43 — irradiation occurred;

- 44 - work in difficult climatic conditions of the Far North;

- 45 - the employee has a disability group;

- 46 - a fixed-term employment agreement was concluded with the employee for a period of up to six months;

- 47 - the employee was ill after dismissal (but no later than 30 days after that);

- 48 — violations of hospital regulations for valid reasons;

- 49 - duration of illness of a disabled employee longer than 4 months in a row;

- 50 - the total period of illness of a disabled employee more than 5 months per calendar year;

- 51 - the employee has a part-time work schedule.

If the listed factors were not present, then the form field remains blank.

- When registering disability due to an industrial injury, the date of its registration is entered in the cells “ Act of Form N-1

”. If there was no injury, then the field remains empty. - Next, the start date of work is indicated if the employment agreement with this employee was canceled - for example, the employee was employed, but did not start working due to illness. The employer has the right to cancel the contract

with this person (

Article 61 of the Labor Code

).

It is better to entrust further filling out the certificate of incapacity to a specialist who understands the intricacies of accounting. accounting, i.e. accountant or personnel officer.

Replacing an employee during sick leave

2.0 kb Save document: Download document » Sample document: (name of employer) Order No. on the assignment of temporary disability benefits with a reduction in its amount.» » g. Based on an explanatory note (or on the basis of an act on the employee’s refusal to provide a written explanation of the reason for the violation of the treatment regimen), a certificate of incapacity for work, (position, full name.

For this purpose, an additional agreement to the employment contract is concluded. No entries are made in the work book.

Order for replacement during sick leave: sample You have the right to develop your own form of order for replacement, but you can use the already existing unified forms: T-5 or T-5a (approved.

Important

Resolution of the State Statistics Committee of the Russian Federation dated January 5, 2004 N 1). A sample of filling out the unified T-5 form when substituting for sick leave can be viewed here.

When it is not necessary to issue a replacement order This does not need to be done if the employee’s employment contract directly states that during the absence of another employee (for example, due to illness), he will replace him.

Is it possible to hire a new employee during this period?

During a person’s illness, the manager has the right to hire another specialist to work. This is not about substitution or combination. In this case, you can conclude a new employment contract. Labor relations with this category of workers have distinctive features.

The basis for hiring a person to replace an absent specialist is the latter’s illness. It gives the manager the right to hire another employee for the position. Such employment relationships will be temporary. They will be limited only to the illness of the primary specialist. The applicant himself must meet general criteria - health status and special education, if required for appointment to the position.

How to apply?

The procedure for receiving a primary specialist during illness does not have any distinctive features:

- the applicant submits an application to the head of the company, who considers it;

- after this, an order for employment is issued and an employment contract is drawn up;

- Finally, a corresponding entry is made in the person’s work book.

In any case, the basis for starting the hiring procedure is the application of the applicant. It is drawn up in writing and sent to the head of the organization. It indicates the details of the organization, the employee, and also that the person wishes to enter into an employment contract for the duration of the treatment of the absent specialist.

In case of a positive result, a fixed-term employment contract is concluded with the person under Article 59 of the Labor Code of the Russian Federation. It is drawn up according to the general rules in writing, one copy for each of the parties. In addition to the mandatory conditions, the contract must contain information about the validity period. In this case, they are conditioned by the occurrence of certain circumstances, namely, the departure of the main employee. The contract term is not tied to a specific date.

After the conclusion of the contract, an order must be issued, signed by the manager. It indicates all the required details, as well as the fact that the person is hired only for the duration of the illness of the main employee.

The hiring procedure to replace a sick employee involves filling out some personnel documents:

- First of all, this is a work book. It must contain a record of employment for the period of illness of the main specialist.

- It is also necessary to fill out a personal card for the person.

Order for payment of sick leave

Hello! Please tell me what type of production orders need to be drawn up to pay for an employee’s sick leave? What should be included in them? Is there a sample of such an order?

Why is such an order needed? This is the first time I’ve heard of sick leave being paid by order. So I was very surprised, but the Glabkh says that sick leave without an order will not be accepted in fact. To my question, where does such information come from that an order is needed, the answer is: it is needed. Soon he will ask for an order to pay wages.

paying for sick leave is the employer’s responsibility. You can show her this information: You are not being paid for temporary sick leave. The fact is that paying for temporary sick leave is the employer’s responsibility. In legal language this is called temporary disability benefits.

That's the whole order: payment for sick leave is already provided for by law, and no additional orders are required for this.

The state guarantees any sick person insured against temporary disability to retain their job and average earnings. The main document that confirms the length of time an employee is on sick leave and serves as the basis for calculating benefits is a certificate of incapacity for work.

- Labor Code.

- Order of the Ministry of Health and Social Development “On approval of the procedure for issuing certificates of incapacity for work” dated June 29, 2011 No. 624n.

- Law “On compulsory social insurance in case of temporary disability and in connection with maternity” dated December 29, 2006 No. 255-FZ.

Let us consider the provisions of the above-mentioned legal acts in more detail.

STATE UNITARY ENTERPRISE OF THE CITY OF MOSCOW TREST "MOSOTDELSTROY No. 1" ORDER on payment of temporary disability dated "___"__________ 2009

No. ____g. Moscow In connection with the temporary disability of the head of the HR department B.A. Prigozhin, confirmed by the certificate of incapacity for work VH No. 3664292 dated October 26, 2009, issued by the State Institution Polyclinic No. 115 of Moscow, I ORDER: 1. To pay for the temporary disability of B.A. Prigozhin.

(personnel number 4017) based on 100% of average monthly earnings.

Head _____________ Yu.P. Sorokin signature The order has been reviewed by: Head of HR Department B.A.

Prigogine

To determine the average daily earnings, the resulting amount must be divided by 730.

If the employee’s insurance period is less than 6 months, no more than one minimum wage is paid for each month; from January 1, 2019, the minimum wage is 9,489 rubles. The final step is to determine the total amount of the temporary disability certificate.

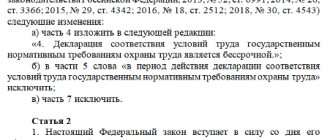

Commencement of a new procedure for registering sick leave

From December 14, 2021, the Procedure for issuing certificates of incapacity for work, approved by Order of the Ministry of Health and Social Development of Russia dated June 29, 2011 No. 624 n, ceases, and a new Procedure comes into force.

At the same time, a decision must be made on the validity period of the temporary rules established by Government Decrees No. 294 dated March 18, 2020 and No. 402 dated April 1, 2020, as well as Federal Law No. 104-FZ dated April 1, 2020. Initially, their validity was limited to 2020. But some provisions (for example, registration of electronic sick leave) have already been transferred from temporary to permanent by inclusion in the new procedure approved by order 925 n. Others should obviously either be extended into 2021 or should also become permanent.

If you are interested in my publications, click on my photo or on the author's name, and you will be taken to my page with a list of all my publications.

Order of the Ministry of Health and Social Development dated June 29, 2011 no. 624n

Safe share of VAT deductions A high share of VAT deductions can lead to close attention from inspectors.

Attention

How is the safe percentage of VAT deductions calculated, where can I find its value and how is it applied? <...

Info

Home → Accounting consultations → Sick leave Current as of: February 9, 2021

If an employee is sick and his work cannot stand downtime, then it makes sense for the employer to involve another employee in this work.

Replacing a sick employee In this case, the employee replacing the sick person temporarily forgets about his work responsibilities and performs exclusively the work of the sick colleague.

We invite you to read: Payment of state fees under a court order - Your lawyer

Those.

What to do to be able to work with electronic sick leave

To have those. opportunity to work with ELN sheets, it is necessary to take certain actions indicated in the table below.

| № | Employer's actions | Explanations |

| 1 | Have tech. opportunity to draw up an ENL sheet | The employer must install the appropriate program on the computer |

| 2 | Pay for a qualified digital signature | An EDS signature can be purchased from a company that has a CA Accreditation Certificate, certificate and FSB Certificate of Conformity |

| 3 | Log in to the personal account of the insured employee | Only in the LC the organization receives a message from the medical institution about the receipt of ELN. The subsection of the sheet “To be completed by the employer” is drawn up by an authorized employee of the company (enterprise) |

Important! To use ELN sheets, the local clinic and company (enterprise) are required to have technical information. opportunity for this (PC, special program, Internet).

How the Labor Code regulates periods of incapacity (Articles 124, 183, 255, etc. of the Labor Code of the Russian Federation)

Order 624 on sick leave regulates the algorithm for issuing ballots to sick persons. What other regulations regulate the procedure for issuing and paying for certificates of incapacity for work will be discussed in the article.

Let us consider the provisions of the above-mentioned legal acts in more detail.

The benefit is calculated according to the formula: D - income for 2 years preceding the day of the insured event; Kd - the conditional number of calendar days for the previous 2 years taken into account, Kd = 730; %O - percentage of payment determined according to the employee’s SS.

Order 624n on sick leave also establishes an algorithm for filling out the ballot by the employer.

Read more about how electronic sick leave works here. This innovation eliminates the possibility of employees providing fake sick leave.

Be the first to know about important tax changes

New law on sick leave in Russia in 2019

In 2021, no amendments were made to the sick leave law. Notable amendments to 255-FZ were made in July 2021.

In December 2021, the State Duma adopted in the 1st reading the bill on electronic sick leave, on March 10, 2021, the project was approved in the 2nd reading, and on May 1, 2021, the corresponding law No. 86-FZ was signed, thanks to which from July 1, 2017 years, electronic sick leave ceased to be an experiment and was introduced everywhere in Russia. The essence of the transition to electronic document management is that the attending physician enters all the information and draws up a certificate of incapacity for work in a special program to which the territorial office of the Social Insurance Fund and the employer are connected. Immediately after the doctor signs the sick leave with his electronic signature, the file is sent to the FSS department. The employer, having connected to the program, can enter data for payment directly into the information system.

Read more about how electronic sick leave works here.

This innovation eliminates the possibility of employees providing fake sick leave.

Find out how to identify a fake sick leave in the material “How can an employer check the authenticity of a sick leave.”

Order 624 n on sick leave with amendments

Thirty-six changes have been made to the current regulatory act. The innovations concerned:

- specialists who can issue certificates of incapacity for work;

- specifying the actions of medical personnel when issuing sick leave in cases where the patient is employed by several employers;

- opening time (at the time of circulation or closing), etc.

We publish the current version of Order 624n with amendments on our website. The latest changes were made by Order of the Ministry of Health dated July 2, 2014 No. 348n in connection with the adoption and entry into force of the Decision of the Supreme Court of the Russian Federation dated April 25, 2014 No. AKPI14-105.

The amendment made concerned the ability to care for a sick child under the age of seven for the entire period of his illness, and not just for the period of acute illness or exacerbation of a chronic one. In addition, it was added that in connection with the adoption of the law on electronic sick leave in the current and subsequent years, additional changes will likely be made to Order 624n, sick leave will most likely receive an electronic form.

You can read more about electronic sick leave in the article “Electronic sick leave has been approved.”

No. 514" (registered by the Ministry of Justice of the Russian Federation on January 28, 2009 No. 13205). Appendix to the order of the Ministry of Health and Social Development of the Russian Federation dated June 29, 2011.

Typical mistakes on the topic “New procedure for issuing sick leave. What an employer needs to know"

Error: I am an individual entrepreneur. I can get full access to an employee’s personal information sheet after I find out his sick leave number.

No, that's not entirely true. You are given partial access to the ENL. You will not know the employee’s diagnosis.

Error: The employer can receive electronic sick leave.

No, that's not true. After contacting the local clinic, the employee receives only a coupon with the number of the ELN sheet. The employer uses this number when working in the insured’s personal account.

What documents regulate the issuance and payment of sick leave?

___________________________________________________ (name of employer) Order No. ______ on the assignment of temporary disability benefits “__”________ ___ Based on the explanatory note __________________________________, (position, full name of the employee) certificate of incapacity for work, minutes of the meeting of the social insurance commission No. __ dated “__”________ ___, as well as clause 1, part 1, art. 7 of the Federal Law “On compulsory social insurance in case of temporary disability and in connection with maternity” I order: To assign _____________________________________ a temporary (position, full name of the employee) disability benefit in full. Head __________________/______________ (full name) (signature)

___________________________________________________ (name of employer) Order No. ______ on the assignment of temporary disability benefits with a reduction in its amount. ________________________________, certificate of incapacity for work, (position, full name of employee) art. 8 of the Federal Law “On compulsory social insurance in case of temporary disability and in connection with maternity” and clause 22 of the Regulations on the specifics of the procedure for calculating benefits for temporary disability, pregnancy and childbirth to citizens subject to compulsory social insurance, approved by the Decree of the Government of the Russian Federation of June 15, 2007 N 375, I order: To assign temporary disability benefits to _____________________ (position, __________________, with a reduction in its amount, starting from “__”________ ___, full name of the employee) to “__”________ ___, Manager __________________/______________ (Full name) (signature)

Do I need to make an order for payment of maternity benefits?

During maternity leave, the employee is entitled to maternity benefits. Nina Kovyazina, Deputy Director of the Department of Education and Human Resources of the Russian Ministry of Health

- Answer: How to pay maternity benefits

Benefit payment period Pay the benefit for the period of maternity leave of the employee (Article 255 of the Labor Code of the Russian Federation). The duration of leave is determined by the doctor (indicated on the sick leave). It depends on the circumstances under which pregnancy and childbirth took place. Typically, maternity leave begins 70 days before the birth and ends 70 days after the birth. If a woman had a difficult birth (including multiple pregnancies), then maternity leave is extended. Childbirth that is considered complicated is listed in the Instruction of the Russian Ministry of Health dated April 23, 1997 No. 01-97. For the duration of vacation, see the table.

How can an employee fill out and submit a form for payment to the Social Insurance Fund?

The application for direct payment to the Social Insurance Fund is filled out by the employee independently and submitted along with the sick leave to the employer. The employer is obliged to submit it to the Social Insurance Fund authorities within five days of receiving such a form.

The form is approved by Order of the Social Insurance Fund of the Russian Federation dated November 24, 2017 N 578. It can be downloaded from the official website of the Social Insurance Fund.

There are certain rules for filling out an application for sick leave payment through the Social Insurance Fund:

- All entries must be black and written using a gel or capillary pen, or typewritten.

- Blots, corrections, crossing out, covering up, etching are not allowed.

- Only those sections for which the applicant has information should be completed.

The procedure for filling out the form to receive direct payment of sick leave benefits for temporary disability:

- In the header, in the appropriate columns, the full name of the territorial body of the Social Insurance Fund is written.

- The header indicates who the application is coming from.

- After the words “In connection with the occurrence of an insured event, I request you to assign and pay (pay)” the type of insured event is indicated with a tick. If the applicant is in doubt as to what type of insured event he is in, this can be clarified on the certificate of temporary incapacity for work.

- In the “payment method” column, put a tick next to either “by postal transfer” or “by transfer to a credit institution.

- If the method of receiving the amount of sick leave benefits “through a credit institution” is selected, then the bank details and passport details field is filled in.

- If the applicant wishes to receive disability benefits by postal order, only personal information and address should be filled out in the application. The transfer will be sent to the post office to which this address belongs. You will need to appear in person to receive the transfer after receiving the relevant notice.

After the form is filled out, it must be taken to the employer along with the original temporary disability certificate.

and sample 2019

A completed example of a document current for 2019 is also provided.

for sick leave payment – excel.

filling out an application for disability benefits - excel.

Is it necessary to file after dismissal?

There is an opinion that after dismissal the employer is not obliged to bear any social responsibility to the employee. This is wrong.

For example, an employee quits, he is not listed on the staff, the employee has a work book in his hands.

In this case, when opening sick leave within 30 days from the date of dismissal, the employee has the right to present a certificate of incapacity for payment.

The period within which sick leave can be filed is limited to 6 months from the date of termination of illness.

If the deadlines are not violated, the employer is obliged to pay temporary disability benefits.

There is no need to write any special statements. The basis for calculating benefits will be a certificate of incapacity for work.

If the policyholder refuses to accept the document for payment, it makes sense to write a statement in any form demanding payment of benefits. This must be done within the period established by law.

As a sample, you can take a form for direct payment to the Social Insurance Fund or use the example below. The last point is to indicate the requirement to issue a written reasoned refusal in case of an unsatisfactory decision.

In order to reduce waiting times, you can specify in the document that the employer issues a document related to the work process. For example, payslips for the last two years.

Such a statement in accordance with Art. 62 Labor Codes are reviewed within three working days.

If you receive a refusal or do not receive a response at all, there is the possibility of challenging it in court or appealing to other authorities.

Design example

applications for payment of benefits from a former employer after dismissal - word.