Why calculate the average number of employees?

The existence of any business requires analysis and evaluation of its results. In addition, the existence of the vast majority of businesses requires the involvement of hired labor.

From this point of view, indicators such as labor productivity, average wages, labor intensity ratios, work efficiency, etc. should be analyzed for the period taken for analysis (month, quarter, year). Employee data presented only at the beginning and end of the period provides little information.

For example, at a manufacturing enterprise there were 100 people at the beginning of the year, but at the end of the year there were 50. Is this good or bad for the enterprise? Unclear. Such headcount indicators may mean that things are going very badly and people are forced to quit en masse, or that the company has modernized its production facilities, developed unique technologies and now requires a small number of workers, but with high qualifications, to service the production process.

To draw the correct conclusion, it is necessary to analyze the change in the number of employees during the year in relation to the indicators of changes in fixed assets, intangible assets and payroll.

The average headcount is precisely the appropriate indicator for such an analysis. By the way, for the same reason, information about the average number of employees is submitted to the regulatory authorities. After all, statistics, tax specialists, and funds do analytics, each in relation to their needs.

In addition, how to submit other reports (paper or only electronic) depends on the average headcount indicator. The possibility of applying special tax regimes also depends.

Who is included in the average number

To correctly calculate this indicator, you need to understand who is included in the average number of employees.

Not included in:

- company owners who do not receive a salary;

- people working under an apprenticeship contract and receiving a scholarship;

- expectant mothers on vacation related to pregnancy and childbirth;

- people on maternity leave;

- employees who are on vacation without pay during their studies;

- persons working under civil contracts;

- workers sent abroad;

- persons who submitted a letter of resignation stopped going to work earlier than the day of dismissal;

- external part-time workers.

The remaining persons working in the organization are included in the average payroll. Accordingly, they are reflected in the annual report.

To calculate the SCH, employees are taken into account, which is recorded daily in time sheets and the order of acceptance/dismissal

General rules for calculating the average number of employees

Step 1

Prepare information about personnel for the period for which you are going to calculate the average payroll.

You need to understand:

- how many employees did you have under employment contracts in each month (external part-time workers, civil servants, while people on educational and maternity leave are not taken into account);

- how many people worked in full for the month, and how many partially (for example, they quit);

- which of your employees worked part-time and how many hours they worked.

Step 2

Select all employees who are on your payroll full time. Calculate the indicator for them:

Please note: the formula is quite universal, since it takes into account a possible change in the number of employees during the month (if someone got a new job or quit).

Step 3

Deal with those who work part-time.

For this:

- Calculate the total number of hours worked by part-time workers. This can be done using the formula:

Hours worked = Standard hours at part-time rate * Number of days worked

- Calculate the payroll average for these employees for each month you had them.

Step 4

Calculate the final average headcount indicator (SCH):

- Add up the NAV of full-time and part-time employees for each month of the period. Round the result to a whole number.

- Divide the resulting value by the number of months in the period. Round again to a whole number.

Deadlines for submitting the average headcount report

Let us note once again that reporting is provided to both existing and new organizations. The reporting deadlines are as follows:

- For newly organized organizations (individual entrepreneurs are not included here) - no later than the 20th day of the month following the one in which the LLC was registered

- For operating organizations and entrepreneurs who have employees, information is provided once a year - before January 20 of the year following the reporting year.

- When liquidating an LLC or closing an individual entrepreneur, these reports must be submitted before the established date of deregistration or liquidation

How to calculate the average headcount for the tax office?

The Federal Tax Service should submit data on those employees who are in one way or another on the employer’s payroll. Moreover, they are included in the calculation regardless of the fact of being at the workplace. Employees may be absent due to illness, vacation, or in connection with the performance of government duties. When included in the headcount, all persons are taken into account, maintaining the average salary. Only certain categories of persons are not subject to registration in the average tax list.

Penalty for failure to submit the average number

If a company or entrepreneur did not submit a report on average headcount on time or did not submit it at all, the tax office may impose a fine of 200 rubles for each document (according to the Tax Code of the Russian Federation).

In addition, through the court, a fine of 300-500 rubles may be imposed on the guilty official for the same violation. (according to the Administrative Code).

However, even if the fine has been paid, the company or entrepreneur is still required to file it.

Also, failure to submit a report may be considered by the tax authorities as an aggravating circumstance if other similar violations occur. This, in turn, will entail double fines in the future.

How to calculate the average number of employees for the Social Insurance Fund?

Unlike tax authorities, policyholders in the Social Insurance Fund want to see all employees to whom you paid taxable income during the calculation period as part of the Social Insurance Fund. To do this, to the indicator calculated for tax authorities, add all excluded persons (according to the table from the previous section) to whom payments subject to contributions to the Social Insurance Fund were made during the period.

The calculation must be made for each group separately, but according to the same principles as for full-time employees. For example, calculate the SCH of external part-time workers using the same formulas that were used for internal ones. Consider employees under GPC contracts in the same way as employees under full-time employment contracts.

Average headcount as part of the calculation of contributions for 2021

In a letter dated January 22, 2021 No. BS-4-11 / [email protected] , the tax service explained how to apply the innovation requiring information on the average number of employees to be reflected in the calculation of insurance premiums

(hereinafter referred to as calculation).

According to tax legislation (clause 7 of Article 431 of the Tax Code of the Russian Federation), payers of insurance premiums (organizations, individual entrepreneurs, citizens who are not individual entrepreneurs making payments and other remuneration to individuals) submit calculations for insurance premiums no later than the 30th day of the month following settlement (reporting) period. Thus, based on the results of 2021, the calculation must be submitted no later than February 1

, since January 30 falls on a day off (Saturday).

The calculation is represented by:

- to the Federal Tax Service at the location of the organization (place of representation code 214) and at the location of its separate divisions (code 222), for which the organization has opened bank accounts and which accrue and make payments and other remuneration in favor of individuals;

- at the place of residence of the citizen making payments and other remuneration to individuals (for individual entrepreneurs - code 120, for a person who is not an individual entrepreneur - code 112).

An excursion into the recent past

One of the innovations in the current reporting campaign on insurance premiums is an amendment requiring the inclusion of information on the average number of employees in the calculation.

In letter No. BS-4-11/ [email protected], the tax service reminded that the changes were made by Federal Law No. 5-FZ of January 28, 2020. He brought to life the idea of reducing the number of reports submitted to the Tax Code of the Russian Federation. Having adjusted Article 80 of the Tax Code of the Russian Federation (paragraph 6, clause 3), the law established in it the rule according to which insurers must provide information on the average number of employees as part of the calculation of insurance premiums. Prior to this, taxpayers provided information on the average payroll number in a form that was approved by order of the Federal Tax Service of Russia dated March 29, 2007 No. MM-3-25/ [email protected] This document became invalid on January 1, 2021.

But this is not the only addition to Article 80 of the Tax Code of the Russian Federation. The average headcount is information that does not affect the calculation and payment of insurance premiums. Well, perhaps with the exception of individual cases related to the use of reduced contribution rates. And paragraph 7 of Article 80 of the Tax Code of the Russian Federation does not allow the Federal Tax Service of Russia to include in the tax return (calculation) form, and the tax authorities - to require taxpayers (payers of fees, payers of insurance premiums, tax agents) to include in the tax return (calculation) information not related to calculation and (or) payment of taxes, fees, insurance premiums. Thus, applying the norm regarding the average number of employees would be problematic. But, as you know, in some prohibitions, no, no, and an exception will slip through. So, paragraph 7 of Article 80 of the Tax Code of the Russian Federation contains several exceptions. And, in order not to violate the law with one amendment, the Duma members made a corresponding change to paragraph 7 of Article 80 of the Tax Code of the Russian Federation, adding subparagraph 7 to it. This subparagraph clarified the list of positions that constitute an exception. Now the average headcount is an indicator that, although not involved in the calculation of contributions, does not violate the norms of the Tax Code of the Russian Federation.

Realities of the reporting campaign – 2020

Clause 3 of Article 80 of the Tax Code of the Russian Federation (as amended by Law No. 5-FZ) applies to legal relations related to the submission of reports on insurance premiums based on the results of the 2021 billing period.

In pursuance of the provisions of Law No. 5-FZ, the tax service adjusted the calculation form. By Order of the Federal Tax Service of Russia dated October 15, 2020 No. ED-7-11/ [email protected], the calculation, along with other amendments, included information on the average number of employees. For this information, a field of the same name has been entered in the title page of the calculation. The Tax Code of the Russian Federation does not contain a definition of the concept of “average headcount”. Therefore, in the order of filling out the calculation (clause 3.11 of section III), it is indicated that the average headcount must be determined according to the rules established by Rosstat (clause 76 of the instructions for filling out statistical reporting forms from the appendix to Rosstat order No. 711 dated November 27, 2019 (hereinafter referred to as the instructions))

The average number of employees must be calculated based on the number of employees,

determined as of the last date of the reporting period (December 31, 2020).

The list of employees includes

(clause 77 of the instructions):

- employees who worked under an employment contract and performed permanent, temporary or seasonal work for one day or more;

- working owners of the organization who received wages from this organization.

List of persons who are not included in the payroll

, is given in paragraph 78 of the instructions. This list, in particular, includes:

- external part-time workers;

- persons who performed work under civil contracts;

- persons studying off-the-job, receiving a scholarship, as well as persons with whom an apprenticeship agreement has been concluded with the payment of a scholarship during the apprenticeship period;

- transferred to work in another organization, if their wages are not maintained, as well as those sent to work abroad;

- owners of an organization who do not receive wages, etc.

The average number of employees is calculated on the basis of daily records of the number of employees on the payroll. The payroll number must be clarified on the basis of orders for the hiring, transfer of workers to another job and termination of the employment agreement (contract). The number of employees on the payroll for each day must correspond to the data in the employee working time sheet, on the basis of which the number of employees who showed up and did not show up for work is determined.

The primary sources for determining the number are:

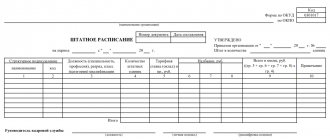

- for staffing levels – staffing table;

- for payroll numbers - orders (instructions) on the hiring, transfer, dismissal of an employee;

- for the average number of employees – payroll number and data from the working time sheet.

Average number of employees per year

is determined by summing the average number of employees for all months of the reporting year and dividing the resulting amount by 12.

Subtleties for separate units (OP)

As we noted earlier, contribution payers submit information on the average number of employees as part of the calculation to the Federal Tax Service at the location of the organization. If an organization has an EP, then the average headcount is calculated based on the number of employees of the organization’s head unit and its EP.

In letter No. BS-4-11 / [email protected] the Federal Tax Service of Russia noted that in the field “Average headcount (persons)” for 2021, OPs indicate the value 0. And starting with reporting for the first quarter of 2021, OPs do not fill out this information

Rounding

It is important to take into account that the value characterizing the average composition of workers is expressed exclusively in whole numbers. This is why there are certain rounding rules:

- the next digit after the decimal point is less than five - all numbers after the decimal point are reset to zero, and the digit before the decimal point remains unchanged;

- the next digit after the decimal point is equal to or greater than five - all numbers after the decimal point are set to zero, and one is added to the digit before the decimal point.

It is necessary to remember that only the last indicator characterizing the MSS is always rounded. Intermediate measurements are not subject to rounding.

Number per month

Next, the average payroll number of fully employed workers for each month is calculated as follows: the monthly indicator is calculated by summing the payroll number for each calendar day, that is, from the 1st to the 30th or 31st (for February - on the 28th or 29th), including holidays (non-working days). ) and weekends, and dividing the resulting amount by the number of calendar days of the month.

EXAMPLE: As of June 1, 2021, an organization had 250 people on its payroll; on the 6th, 10 more people were hired; on the 14th, 5 employees were fired; and on the 26th, 10 more people were hired. Let's determine the average number of workers for June 2021. For the first 5 days, 250 people worked. Next 8 days, from June 6 to June 14, 2016: 250 people. + 10 people = 260 people. From the 14th to the 25th of June 12 days passed. During this time, the number has changed: 260 people. – 5 people = 255 people. The last 5 days of the month worked: 255 people. + 10 people = 265 people. Let's calculate the average headcount for June: (250 people × 5 days + 260 people × 8 days + 255 people × 12 days + 265 people × 5 days) / 30 days. = 7715 people / 30 days = 257 people

The average headcount cannot be zero

In a small company, when calculating the average headcount, after rounding it may turn out to be 0. It is not worth showing 0 in the reporting. It is better to round to 1. Otherwise, inconsistencies in the indicators will appear in your company’s reporting. The average headcount is zero; personal income tax reporting shows the payment of tax.

But, if you really have no employees, there is only a single founder, you shouldn’t inflate the indicators either. Remember that the only founder who can work without an employment contract and receive dividends rather than salary is not taken into account in the average headcount.

Therefore, in such a situation, think in advance what is more profitable for you: indicate 1 or 0.

Inclusion of part-time employees in the SSC

The above formulas are designed for cases where all employees work full time (day or week). If the enterprise also has those who are employed part-time, then when including them in the SSC there are nuances.

Those working part-time must be counted in proportion to actual work hours. additional calculations must be made for part-time employees :

EXAMPLE

In a company, one employee works 4 hours a day, the second - 3 hours.

In June (21 working days) they worked together:

- (4 hours × 21 days) + (3 hours × 21 days)) = 147 hours.

Number of man-days with a 40-hour week for them in June:

- 147/8 = 18.37 man-days.

TSS for part-time workers = 18.37 / 21 = 0.875 = 1 (rounded).

IMPORTANT!

Employees who are transferred to part-time work on the initiative of the administration without obtaining written consent from them are counted as whole units.

Average and average number

The average number of employees of an enterprise is calculated in order to determine the taxation system. For example, an enterprise whose average number of employees during the tax period is one hundred and thirty people cannot be on a simplified taxation system. This indicator is also taken into account when calculating the single tax on imputed income for certain types of activities.

What is the difference between the average number and the average number? In addition to the average number of employees, the average number of employees of an enterprise also includes employees who performed work under civil contracts and external part-time workers - the sum of these three indicators will be the average number of employees of the enterprise. Information on the average number is indicated in statistical form No. P-4 “Information on the number, wages and movement of workers.”

You should also not confuse the payroll and average number of employees: how to calculate the average number of employees is explained in detail above, and in the payroll, each employee is counted as one whole unit for each calendar day.

ipinform.ru

List of employees

And we’ll have to start with what the payroll is. This is a list that includes all those accepted:

- for temporary work;

- under fixed-term contracts;

- for seasonal work;

- for a permanent job.

The payroll reflects all full-time employees - both those actually working and those who are absent, and it does not matter for what reasons they are absent: maternity leave, business trip, downtime, study leave, etc.

The list must also include the owner with whom the employment contract has been concluded. If there is no such agreement, then it is not included in the list.

Read in the berator “Practical Encyclopedia of an Accountant”

Who is included and who is not included in the list

Do not take into account external part-time workers and persons performing work under a civil contract when compiling a list of employees of your enterprise. External part-time workers are included in the payroll of their main employers, and persons with whom the GPA is concluded are not included in the staff. These contracts are not employment contracts.

How to calculate the average value for an incomplete period

The indicator for a period in which not all months included in it have been worked out is calculated by analogy with an incomplete month. It is necessary to add up the MSS in the same way for each month in which there were employees and divide by the total number of months included in the period.

EXAMPLE

The agricultural enterprise operates 6 months a year, for which it hires workers.

The average value for working months was:

- from April to June – 50 people;

- in July and August – 60 people;

- in September – 40 people.

It is necessary to calculate the MPV for the year.

TSS for less than a year = (3 × 50 + 2 × 60 + 40) / 12 = 25,83 = 26.

Part-time employment

After this, we calculate the number of hours worked by part-time employees per month. Working days falling during the period of illness or vacation of employees are included in the hours worked in the number of hours worked by them on the previous working day.

EXAMPLE In an organization, two employees, by agreement with the employer, work part-time - 6 hours a day, 5 days a week. There are 22 working days in September. One employee worked full time; the second worked fully on September 1 and 2, worked 5 hours on September 5, and was on vacation from September 6 to 30. The number of hours worked by part-time workers in September will be 244 hours (6 hours/day × 22 days + 6 hours/day × 2 days + 5 hours/day × 20 days).

After this, you can calculate the average number of part-time workers for each month using the formula:

| number of hours worked by part-time employees per month / usual working hours in the organization (in hours) | × | number of working days according to the calendar in the reporting month |

EXAMPLE An organization has an eight-hour day and a five-day work week. There are 22 working days in September. The number of hours worked by part-time employees is 244 hours. The average number of underemployed workers in September will be 1.39 people. (244 hours / (8 hours × 22 days)).

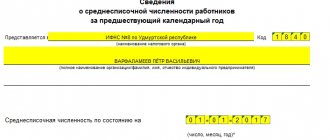

Filling out the reporting form

Having made all the calculations, you can proceed to filling out the form in detail. It is worth considering that the form should not have any blots or corrections; all columns should be filled out strictly according to the established pattern in block letters.

The form characterizing the average number of employees contains several columns that must be filled out:

- organization or individual entrepreneur identification code;

- number of pages - indicated as 001;

- identification of the tax office to which reporting is submitted;

- full name of the company with its legal form or full name of an individual entrepreneur;

- the day the completed form is sent;

- average number of employees;

- the full name of the person preparing and submitting the form and his signature;

- seal of the organization (if available).

The calculation of the SCH is necessary for the tax authorities to determine the taxation of the company. Reporting must be provided regularly and in a timely manner at least once a day. Late submission of reporting or refusal to submit it threatens business owners with liability and a fine in the amount provided for by the Tax Code of the Russian Federation.

Accountants of enterprises may also fall under administrative liability. That is why, when filling out the form, you should strictly follow all the rules and regulations, and submit reports strictly within the established time period.

Calculation of the SCH, if there are full-time and part-time employees

Separately, we should dwell on how to calculate the average payroll for a period if the organization employs employees with different working hours - full-time and part-time.

In this case, to determine the SCH for the period, you need to separately calculate the monthly SCH indicators for full-time and part-time employees. Then add up all the obtained values for the period and divide by the number of months in the period.

EXAMPLE

Let the company from the previous example employ, in addition to part-time employees, 19 more full-time employees. Over the year, the picture with personnel did not change: 12 months, the average number of employees with full time was 19, with part-time work – 1.

TSS for the year for all = (19 × 12 + 1 × 12) / 12 = 20.

Calculation of the number of employees

In order to determine the value of the average number of full-time employees of a company, it is necessary to calculate the indicator of the payroll of employees.

The legislative basis will be orders and instructions from statistical bodies.

The documents regulating the calculation of the number of employees on the payroll are:

- Instructions adopted by the Decree of the USSR State Statistics Committee in 1987 (hereinafter referred to as the Instructions);

- Order of Rosstat No. 357 dated August 3, 2015;

- Rosstat Order No. 498 dated October 26, 2015;

- Order of Rosstat No. 536 of August 27, 2014.

The headcount is a significant indicator not only for the purposes of generating and submitting reporting forms to authorized bodies, but is also successfully used for analytical calculations. Thus, with its help, companies and entrepreneurs have the opportunity to calculate how effectively the attracted personnel work in the organization, what the dynamics of wages are.

When determining this value, it is important to know that not all employees can be taken into account in the calculations.

The instructions establish categories of working citizens who appear in determining the number of payrolls of a company, as well as those who cannot be involved in calculating this indicator.

In accordance with the Instructions, the calculation of the payroll includes:

- Workers performing their professional duties at their workplaces, including periods when workers were actually on site, but did not work due to downtime;

- Employees who are on official business trips by order of the manager while maintaining their salary and position;

- Personnel on sick leave for the entire period of validity of the sick leave until the day of actual recovery and return to the workplace or dismissal for health reasons;

- Employees who are hired by the organization on a part-time, part-time or half-time basis in accordance with the approved staffing schedule. In this case, each employee will be counted as a whole unit, regardless of whether the employee was at the workplace full time or not. This group does not include personnel who are required by law to have a reduced working day;

- Employees on an executive term in accordance with Art. 70 of the Labor Code of the Russian Federation, starting from the first day of being in the workplace;

- Remote employees;

- Citizens who were sent by the organization to improve their qualifications in educational institutions;

- Employees who are assigned to perform labor functions by the company outside the main location of the company, that is, shift workers;

- Personnel on one of the legally permitted types of leave: annual, additional or leave at their own expense;

- Employees who, in accordance with current legislation, are on maternity leave and parental leave for up to one and a half years. This category also includes employees who were hired by the organization temporarily to replace absent employees;

- Employees caught absenteeism;

- Employees who are under investigation in connection with search activities.

In accordance with the Instruction under consideration, a certain category of workers that should be excluded from the calculation. These include external part-time workers, employees, and employees who were hired to perform one-time work. The full list is presented in the Instructions approved by the Resolution of the USSR State Statistics Committee.

If the LLC has no employees

If a legal entity has no employees, there are two options. In the first option, a person who is not the founder holds the position of general director, has an employment contract with the company and receives a salary. In this case, the director is the only employee of the enterprise, and therefore zero reporting of the LLC does not apply. In the second option, the founder independently performs the functions of a director. Opinions vary on this matter. From the point of view of the Federal Service for Labor and Employment, the founder of an organization is not its employee, since an employment contract cannot be signed by one person, both on the part of the employee and on the part of the employer (Rostrud letter No. 177-6-1 dated 03/06/2013) . This means that zero reporting is submitted.

However, this opinion has opponents, based on the fact that from a legal point of view, in this case, the employment contract is not concluded with oneself, but between a legal entity and an individual.

When to calculate the average headcount

When preparing reports

Submission of annual information to the Federal Tax Service

Every year, all companies and individual entrepreneurs with employees are required to submit information on the average number of personnel to the tax office.

The information form was approved by order of the Federal Tax Service of Russia dated March 29, 2007 No. MM-3-25/174. The deadline is no later than January 20 of the current year for the previous year. If an organization opens a separate division, it must report the average headcount to the Federal Tax Service at the location of the head office. The report takes into account all employees: head office and branches.

Preparation and submission of forms 4-FSS and RSV

Most companies pay insurance premiums.

The company must report on contributions for compulsory insurance against accidents and occupational diseases using Form 4-FSS. Organizations submit payments for pension insurance contributions using the DAM form. In Form 4-FSS and in the DAM calculation, you must indicate the average number of personnel.

To report on paper

Despite the fact that most companies have already completely switched to electronic reporting, there are still small firms for which purchasing programs for submitting electronic reporting is an unreasonable expenditure of money.

As of the beginning of 2021, only those companies whose average headcount does not exceed 10 people, inclusive, can report on paper. All others report only electronically.

From 2021, even the smallest companies are required to switch to electronic reporting format. True, they will have the opportunity to submit reports via the Internet - on the tax office website.

To apply benefits and switch to a special regime

The Tax Code has many rules and restrictions, to comply with which you need to know the average number of employees.

Tax benefits that depend on the average number of employees

| Tax | Article of the Tax Code of the Russian Federation | Benefit |

| VAT | Subclause 2 of clause 3 of Article 149 of the Tax Code of the Russian Federation | The following are exempt from VAT: sales of goods, works, and services by public organizations and unions of disabled people, if disabled people and their representatives make up at least 80 percent of the staff. Sales of goods, works and services by organizations whose authorized capital consists entirely of contributions from public organizations of disabled people, if the average number of disabled people is at least 50 percent, and their share in the wage fund is at least 25 percent. Sales by state and municipal unitary enterprises, if the average number of disabled people is at least 50 percent, and their share in the wage fund is at least 25 percent. |

| Profit | Article 259 of the Tax Code of the Russian Federation | IT companies can take into account the costs of purchasing a computer (without depreciation) if the average number of employees for the reporting period is at least 50 people. |

| Profit | Article 264 of the Tax Code of the Russian Federation | Companies in which disabled people make up at least 50 percent and the share of their labor costs is at least 25 percent can write off expenses for the social protection of disabled people. |

| Property tax | Article 381 of the Tax Code of the Russian Federation | Organizations and unions of disabled people, among whose members at least 80 percent are disabled, are exempt from tax - in relation to property used by them to carry out their statutory activities/ |

| Land tax | Article 395 of the Tax Code of the Russian Federation | Organizations and unions of disabled people, in which disabled people and their representatives constitute at least 80 percent, are exempt from land tax - in relation to land plots used by them to carry out their statutory activities |

The right to use special regimes depending on the number of personnel

| Special mode | Article of the Tax Code of the Russian Federation | Requirement |

| simplified tax system | Article 346.12 of the Tax Code of the Russian Federation | Organizations whose authorized capital consists entirely of contributions from public organizations of disabled people are not entitled to apply the simplified tax system if the average number of disabled people on the payroll is at least 50 percent, and their share in the wage fund is at least 25 percent. |

| UTII | Article 346.26 of the Tax Code of the Russian Federation | Organizations and individual entrepreneurs whose average number of employees for the previous calendar year exceeds 100 people are not entitled to switch to paying a single tax. |

Individual entrepreneur without employees

The position of the legislative bodies regarding individual entrepreneurs without employees is unambiguous and boils down to the fact that an individual entrepreneur, being an employer, does not have the right to perform this function in relation to himself. This point of view is reflected in the letter of Rostrud No. 358-6-1 dated 02/27/2009 and in the letter of the Ministry of Finance No. 03-11-11/665 dated 01/16/2015. Thus, an individual entrepreneur does not have the right to regard himself as a staff member when submitting reports. This is explained by the fact that the legislation does not provide for the conclusion of a bilateral agreement, which is an employment contract (Article 56 of the Labor Code of the Russian Federation), with oneself. Accordingly, the law does not allow an individual entrepreneur to assign himself the payment of wages. The Tax Code specifies whether it is necessary to submit a zero average salary in the RSV or not: an individual entrepreneur without employees does not submit reporting forms if he does not have hired employees in the billing period (Article 80 of the Tax Code of the Russian Federation).