Why do you need an order?

It would seem that there is nothing simpler: cancel the business trip. Some enterprise employees actually believe that a verbal order from the head of the organization is sufficient for this, but this is not entirely true. The fact is that any action taking place within the company is always strictly regulated by various kinds of documentation. Business trips are no exception.

If the highest official of the organization decides to send one of his subordinates on a business trip, a corresponding order is issued about this. Based on it, all kinds of travel papers are subsequently drawn up, accounting and personnel operations are carried out, etc. Likewise, if a decision is suddenly made to cancel a trip, a new order must be issued that will launch the necessary process within the enterprise.

The consequence of the order is usually the cancellation of previously issued documents (travel certificates, passes, directions, etc.), surrender of tickets, funds issued for a business trip, etc.

How to write a memo for a business trip

There is no need to indicate the number of hours worked.

If an employee on a business trip was involved in work on a day off from his main place of work, then such a day must be shown in the report card with two codes at once - K and RV. This will mean that the employee worked on a business trip on a day off. It is necessary to indicate the number of hours worked on such a day if the employer gave instructions on the duration of work on a day off. It is clear that you need to pay for work on such days at double rates in accordance with Article 153 of the Labor Code of the Russian Federation.

After the employee returns from a business trip, he must draw up an advance report on the amounts spent on the business trip. The document indicates how much money was spent on the business trip.

Please note: it is mandatory to fill out an advance report in 2015. This requirement has been retained in the procedure for sending employees on business trips.

Supporting documents (checks, contracts, receipts, transport documents, etc.) must be attached to the report. Next, the employee submits an advance report to the accounting department. And based on the submitted documents, the business trip expenses incurred can be reflected in accounting and tax accounting and settlements can be made with the employee as an accountable person.

The fact that travel certificates were canceled in 2015 does not mean that other documents are no longer required to confirm expenses and the actual time an employee spends on a business trip.

The actual length of stay of the employee at the point of business trip must be determined by looking at travel documents, straining his eyes, presented by the employee upon returning from a business trip. If an employee travels to the place of business trip and (or) back to the place of work by personal transport (car, motorcycle), the actual period of stay at the place of business trip is indicated in the memo.

The memo should be filled out in any form and submitted upon return from a business trip to the employer along with supporting documents confirming the use of the specified transport for travel to the place of business trip and back (waybills, invoices, receipts, cash receipts, etc.).

That is, the memo must be attached to the expense report.

When traveling abroad, the travel time is determined by the marks in the passport (make a photocopy and attach it to the advance report). When sending an employee on a business trip to the territory of member states of the Commonwealth of Independent States, the date of crossing the state border of the Russian Federation will be determined by travel documents (tickets).

Thus, summarizing all of the above, it can be argued that there is no particular relief in the matter of proper documentation of business trips, despite the abolition of travel certificates, and for the seconded workers and accountants themselves it is also burdened.

Still, what a beauty it was with travel certificates: they noted the date of departure, at the place of business trip - they confirmed the date of arrival and departure, noted the date of return, and from there they “danced” further. Everything was simple and clear: how much daily allowance, travel, accommodation, and so on. Now sit and watch: tickets, what dates are there, memos, individual magazines. Who needs this, and most importantly, why?

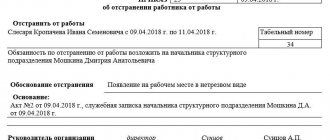

Who should sign the order to cancel a business trip?

Any order always comes from the main person of the enterprise - the director (or an employee temporarily performing his duties), accordingly, the document must first of all have his signature.

Also, all employees who are indicated in it (i.e., those who are directly affected by the order and those who are responsible for executing the order) must sign the order.

It is necessary to certify a finished order with a seal only when this is a condition expressed by the management of the organization.

Cancellation of daily allowances for business trips in 2018

In 2021, the Ministry of Finance issued order number 749, according to which the term daily payments during business trips in the Russian Federation is cancelled. If we are talking about foreign routes, then their size will remain the same. That is, on average, the total amount will be from 40 to 50 dollars in the US every day. It all depends on the specific receiving party.

Why was such a decision made? The Russian Federation needs additional budget revenues. At the moment, daily allowances not only reduced income from personal income tax, but also insurance premiums due to the lack of taxation.

Accounting for non-refundable tickets when canceling a business trip

If an employee purchased plane tickets and they are non-refundable, this will create certain problems. He may refuse to use the carrier's services, and the fee paid for the trip will not be approved. Even if a business trip was cancelled, the company may consider the price of non-refundable tickets due to other expenses.

In this case, you must have the following documents in your hands:

- An order that a business trip is postponed or not taken into account at all;

- Various documents that confirm the cost of tickets;

- A document that confirms that you purchased the ticket. This could be a certificate from the carrier company, an additional attachment to the ticket, etc.

Storing an order

Administrative documentation is subject to certain storage requirements. In particular, after creating an order and familiarizing all interested parties with it, the document should be filed in a folder with other similar acts. He must remain in it for the period specified in the company’s local papers or for the period established by Russian legislation.

After the relevance of this document expires, it can be transferred to the archive or destroyed (also in compliance with the procedure specified in the law).

Is employee consent required?

In order to send an employee (or several) on a business trip, the employer is not required to obtain his consent in advance. The manager’s orders may suit the employee or not, but he must obey his order if he does not want to lose his job.

Therefore, an order to change the timing of a business trip can also be issued without written consent. There are a number of exceptions to this rule. The Labor Code suggests that an employer can make such categorical decisions only if the employee does not belong to one of these categories:

- Women with children under 3 years of age.

- Single mothers and single fathers who have children under 5 years of age.

- A child under 5 years of age is under the care of an employee of either sex.

- Guardians or parents of a disabled child.

- An employee caring for a sick family member.

Moreover, the employee’s signature on the order may not mean that he agrees with all points of the document. This signature just means that he was familiar with the content. This legal subtlety is often used in legal proceedings between an employee and an employer.

For this reason, it will be necessary to obtain the employee's written consent to ensure that the employee's civil rights are respected.

Tags: accountant, personnel, tax, order, order to cancel a business trip, problems, expense

Non-refundable tickets

In a normal situation, when an employee flies safely on a business trip, the company takes into account the costs of purchasing a ticket for tax purposes as travel expenses on the basis of clause. 12 clause 1 art. 264 Tax Code of the Russian Federation. In a situation where a business trip did not take place, the costs that the company incurred in connection with the planned trip cannot be called travel expenses.

There is an option: write them off as a reduction in taxable profit as other expenses on the basis of subclause. 49 clause 1 art. 264 of the Tax Code of the Russian Federation or as non-operating expenses on the basis of sub. 20 clause 1 (other reasonable expenses) or clause 2 of Art. 265 of the Tax Code of the Russian Federation (losses received in the reporting period).

But how do local officials and tax authorities look at this?

If we turn to the official explanations, we will see that the Ministry of Finance is not against writing off in tax accounting expenses incurred in the event of cancellation of business trips (letters of the Ministry of Finance of the Russian Federation dated 09/08/2020 No. 03-03-06/1/78642, dated 07/03/2020 No. 03-03-06/1/57735, dated 05/18/2018 No. 03-03-07/33766). But the Federal Tax Service believes that in order to account for the costs of a canceled trip, the reason for the cancellation is important. Thus, if a business trip did not take place due to the fault of the employee (for example, due to a restriction imposed on him to leave Russia), then the company cannot take into account the expenses incurred when taxing profits on the basis of sub-clause. 12 clause 1 art. 264 of the Tax Code of the Russian Federation (letter of the Federal Tax Service of Russia dated January 29, 2020 No. SD-4-3 / [email protected] ). True, this letter does not provide complete clarity. Can it be understood as an absolute prohibition on accounting for expenses in such a situation or as a prohibition only as travel expenses?

We believe that the cost of a canceled business trip can be taken into account if the cancellation was due to valid reasons beyond the control of the company. However, it is possible that this option will not suit the tax authorities, who may claim that the costs of purchasing a ticket are not justified because the employee did not use the ticket.

If the employee was planning to be sent on a business trip abroad, then in addition to the above expenses, the company could also incur expenses for obtaining a visa and international passport. Can these expenses be taken into account when taxing profits? According to officials, it is impossible (letters of the Federal Tax Service of Russia dated November 25, 2011 No. ED-4-3/19756, dated May 6, 2006 No. 03-03-04/2/134).

Judicial practice is not encouraging with the abundance of such disputes, but the court decisions we discovered were, unfortunately, not in favor of the companies. For example, the Arbitration Court of the North Caucasus District in Resolution No. F08-6323/2015 dated September 14, 2015 indicated that the costs of purchasing a visa for an employee for intended trips for the purpose of concluding contracts and for other production purposes cannot be included as expenses for the purpose of calculation of income tax, since there is no fact of a business trip of a production nature.

How to draw up an order to extend an employee’s business trip (example)

What does the order to extend travel in 2021 look like? What to write in such an order? What is the deadline for issuing such an order to extend an employee’s business trip in 2021? By decision of the director, an employee may be sent on a business trip for a certain period of time to perform his official duties. However, the procedure for extending the period of a business trip is not established by the current legislation of the Russian Federation (Chapter 24 of the Labor Code of the Russian Federation, Decree of the Government of the Russian Federation of October 13, 2008 N 749). How to proceed then?

Follow the norms of the Labor Code of the Russian Federation on the extension of a business trip

The director decides to extend the business trip. The Labor Code of the Russian Federation, in principle, does not prohibit doing this. But to extend the period, written consent must be requested from some employees. Such employees in particular include (Part 2, Part 3 of Article 259, Article 264 of the Labor Code of the Russian Federation):

- women with children under three years of age;

- mothers and fathers raising children under the age of five without a spouse;

- guardians (trustees) of minors;

- employees with disabled children and employees caring for sick members of their families according to a medical report.

It is worth saying that when extending a business trip, the employer must compensate the employee for expenses for:

- nutrition;

- payment for accommodation (rented apartment, hotel, etc.);

- purchase (exchange) of a return ticket.

If the funds issued before departure are spent, the employer is obliged to transfer an additional amount.

Example of an order to extend a business trip

order to extend the business trip

There is no single form for an order to extend the period of a business trip. An order to extend a business trip must be issued in the form that the employer considers necessary (that is, in any form). In the order, record the reason for changing the duration of the business trip and the new deadline for the end of the business trip.

Despite the fact that the order to extend a business trip is written in free form, it must be issued in compliance with all office work rules, in particular, have the following details:

- The name of the organization that published it;

- Document's name;

- Date and number;

- Manager's signature.

Here's what a sample order to extend the period of a business trip in 2021 might look like:

What does the law say?

All personnel issues are resolved only through orders and instructions from the manager.

All order forms have a unified form and are approved by the State Statistics Committee of the Russian Federation Resolution No. 1 of January 5, 2004.

Normative base

In Art. 166 of the Labor Code of the Russian Federation discloses the concept of a business trip - this is a trip by an employee, by order of the employer, to another location to perform his direct work duties.

Another area should be understood as an area outside the municipality where this employee works.

An employee can only be sent by order of the manager. Consequently, the cancellation of a business trip is also formalized by order of the manager.

When is it needed?

An order to cancel a business trip is required when an order has been issued to send the employee on a business trip.

The employee has already been paid the travel allowance. Now he must return her.