Registration of labor relations in the proper form plays a significant role in the further process of labor activity. And if for employers shadow employment, along with risks, also has advantages - they save on taxes and contributions, simplify reporting, ignore the guarantees provided for by the Labor Code of the Russian Federation, then for workers informal employment is more associated with adverse consequences than with advantages.

By agreeing to such working conditions, a person may forget about paid leave, receiving payments during illness, or dismissal with severance pay. And even if the employer promises the applicant to respect his labor rights properly, despite the lack of official documentation, in most cases these assurances are unfounded.

Thus, legal employment is a guarantee of the employee’s financial stability in any life situations, since the Labor Code of the Russian Federation obliges employers to pay employees the average salary when certain circumstances occur.

The average salary indicator is needed to pay employees for periods of absence from the office, as well as to calculate a number of accruals. This value is used to calculate vacation pay, sick leave, payment for absence from the workplace due to a business trip or medical examination, for dismissal payments when staff are reduced, and also to calculate maternity benefits. But in order to make payments correctly, the accountant needs to know how to make calculations and what to take into account for these purposes.

The rules for calculating the average monthly salary in situations established by the Labor Code of the Russian Federation are unified (Article 139 of the Labor Code of the Russian Federation). Average daily earnings are used in calculations. However, depending on the situation, there may be special features, for example, when recording working hours in aggregate.

The specifics of the procedure for calculating the average salary are provided for by the regulation of the same name, approved by Resolution of the Cabinet of Ministers of the Russian Federation of December 24, 2007 No. 922 (hereinafter referred to as Regulation No. 922).

To calculate the average monthly accruals for paying sick leave and maternity leave, a different procedure is applied, approved by Resolution No. 375 of June 15, 2007 (hereinafter referred to as Regulation No. 375).

Billing period for calculating average earnings

Regardless of what kind of labor regime the company operates, the average monthly salary is calculated based on the salary actually paid to the employee and the production rate for the last 12 months (calendar) preceding the paid event (Article 139 of the Labor Code of the Russian Federation, clause 4 of Regulation No. 922). That is, the billing period for cases provided for by the Labor Code is 12 months.

In this case, calendar months are taken in full - from the 1st to the 30th (31st) day, and for the February period - from the 1st to the 28th (29th) day.

At the same time, Article 139 of the Labor Code of the Russian Federation allows the introduction of other periods. The main thing is that this is officially documented and does not worsen the situation of the staff.

When calculating the average amount of payments, individual days and the amounts of their payment are not counted (clause 5 of Regulation No. 922). These are the periods:

- maintaining the average salary for the employee. Exceptions include breaks provided to nursing mothers;

- receiving sick leave or maternity benefits;

- downtime due to the fault of the employer or for reasons beyond our control;

- inability to work due to a strike, provided that the employee did not participate in it;

- additional paid days off to care for children with disabilities;

- other cases of release from work duties with or without retention of payments.

Please note that we are talking about cases regulated by labor legislation. In other situations, for example, for calculating maternity and child benefits, the period will be different.

Business trip under the Labor Code of the Russian Federation

/Business tripWork activities can also be carried out outside the organization.

And upon return, according to paragraph.

The law allows employees to be sent on business trips.

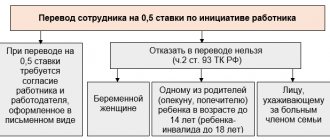

Sending a citizen to another country or city must strictly comply with the provisions of the Labor Code of the Russian Federation. It records the procedure for registering a business trip and its maximum duration. Attention Violation of the provisions of the current legislation is fraught with negative consequences. Therefore, it is worth understanding in advance all the features of a business trip under the Labor Code of the Russian Federation. A business trip is a trip by a company employee to carry out an official assignment outside the permanent place of work.

This definition is enshrined in the Labor Code of the Russian Federation. Sending is carried out on the basis of the order of the employer. If a citizen holds a position that requires him to constantly perform work duties while traveling, this will not constitute a business trip. If a company sends an employee to perform a business assignment in another city or country, the action must be carried out in strict accordance with the procedure determined by the government of the Russian Federation.

The specifics of sending on a business trip and other nuances relating to it are enshrined in October 13, 2008. Note: If a citizen is sent to a structural unit of an organization that is located abroad or in another locality, this will also be considered a business trip. If an employee is sent to another city, in order to perform a job assignment, the following actions must be completed:

- Management issues a corresponding order.

- Upon returning from a trip, the employee fills out reporting documents.

- The citizen is provided with an advance.

The Labor Code establishes a wide range of guarantees and compensations. during the performance of an official assignment outside the main place of activity, it is carried out on the basis of the employee’s average income. The Labor Code divides business trips into two types - on the territory of Russia and outside the country.

Amounts included in the calculation of average earnings

What charges are taken into account in the calculations is briefly discussed in Art. 139 of the Labor Code of the Russian Federation: these are all payments within the framework of the company’s remuneration system. This issue is discussed in more detail in clause 2 of Regulation No. 922. It specifies what exactly is to be taken into account:

- wages, including piecework, as a percentage of sales, goods, commissions;

- monetary remuneration for civil servants;

- fees in media editorial offices;

- teachers' salaries for overload;

- allowances and additional payments, including for professional skills, combination, length of service, knowledge of other languages;

- payments related to working conditions;

- bonus accruals and remunerations made within the framework of the company’s remuneration rules;

- other types of salary payments.

Payments with social characteristics and that are not payment for work should be excluded from the calculation. We are talking about financial assistance, payment for travel, lunches, vacations, housing and communal services and other similar payments.

Deadlines for payment of travel expenses

Contents When sending on a business trip, the employer is obliged, in addition to maintaining the employee’s average earnings, to reimburse him for the costs of renting housing, travel, accommodation, and also pay daily allowance for each day of the business trip.

These costs can be taken into account when calculating income tax only if they are economically justified and documented.

2015 introduced significant changes to the rules for registering official trips; travel certificates, log books for employees on these trips, and the need to draw up a work assignment and a report on its implementation were abolished. The procedure for confirming the time and fact of being on a business trip was also clarified. These changes have significantly reduced paperwork and made life easier not only for employers, but also for their employees.

But, apparently, not for long. Next year, the Ministry of Finance plans to amend the Government Resolution regulating the procedure for sending employees on business trips. In particular, we are talking about travel expenses: the Ministry of Finance proposes to abolish the daily allowance in 2021 altogether. It is assumed that these changes will affect only daily allowances for trips within Russia and will not affect foreign business trips.

The payments themselves, of course, will not be prohibited, but recognizing them for tax purposes as income tax with the adoption of these amendments will not work; in addition, income tax and insurance premiums will need to be calculated from the costs incurred.

It is worth noting that the regulatory authorities have not yet given official confirmation or comments on the adoption of these changes, so it is too early to say with confidence that they will be adopted. Therefore, it is worthwhile to dwell in detail on this year’s travel expenses.

On the territory of the Russian Federation Abroad

- Daily allowance;

- Directions;

- Accommodation;

- Other expenses approved by the employer

Additionally reimbursed:

- Costs for obtaining a passport, visa, and other mandatory travel documents;

Formula for calculating average earnings

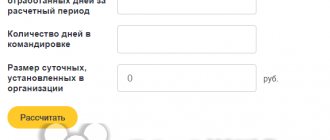

To determine the average amount of wage payments, average daily earnings are used. If a company takes into account working hours in aggregate, then another indicator is taken - average hourly earnings (clause 9 of Regulation No. 922).

Thus, the average salary is calculated using the formula: average earnings (AE) = average daily earnings x number of days of the paid period.

When recording working hours in total, another formula is used: average earnings (AE) = average hourly earnings x number of scheduled working hours in the paid period.

Calculation of average earnings

To do this, you need to know the average daily earnings (ADEW).

It is determined by the formula (does not apply to the calculation of vacations and compensation for unused vacation, as well as to the calculation of benefits): SDNZ = salary for days worked in the billing period / number of days worked.

To calculate vacation pay, which as a general rule is paid for calendar days and not working days, a different formula is used. We will talk about it below.

In practice, situations arise when an employee did not have wage payments during the required period or did not work. In this case, the calculation is carried out taking into account the following features:

- the average salary is determined based on the amounts accrued for the period preceding the settlement period and equal to it;

- if there was no salary at all in previous years, then you need to take accruals for days worked in the month the paid event occurred;

- if there were no payments at all, the tariff rate and salary (official salary) are used in the calculation.

An example of calculating average earnings during a business trip

An employee of an organization with a five-day work week was sent on a business trip from February 11 to February 17, 2021. The billing period is 12 months - from February 1, 2021 to January 31, 2021. During this period, the employee was sick for three days (from March 12 to March 14, 2021) and was on annual paid leave from July 2 to July 29, 2021.

During the billing period, the employee was paid:

- salary - 522,000 rubles;

- vacation pay - 39,400 rubles;

- sick leave benefit - 6,041.25 rubles.

Calculation:

- according to the production calendar from February 1, 2021 to January 31, 2021 there were 247 working days;

- the employee worked (247 workers - 3 days of sick leave - 20 days of vacation (working)) - 224 days;

- When calculating average earnings, wages for the pay period are included, but sick leave and vacation payments are not taken into account.

SDNZ: 522,000 rubles/224 days = 2,330.36 rubles.

SZ: 2,330.36 × 5 days of business trip (working) = 11,651.80 rubles.

Documentation of a business trip

It is important to remember that only a properly executed business trip can guarantee the preservation of wages and the covering of all necessary expenses associated with it. However, in practice, questions and disagreements often arise regarding reimbursement of travel expenses. In this case, our lawyer will help resolve most of the issues by providing a free online consultation.

So, travel allowances are paid on the basis of the following documents:

- Order to go on a business trip;

- A travel document with a note indicating arrival and departure from each destination (including the organization that sent the employee) with signatures of authorized persons and seals of the relevant organizations;

- Advance report, which describes in detail the receipt and expenditure of the amounts issued;

- Documents confirming the expenses incurred by the employee (tickets, invoices, checks, etc. For convenience, they are pasted on a sheet of paper and attached to the expense report);

- A time sheet for the period of work in which the business trip was made - to calculate wages for the days of departure.

The Ministry of Finance of Russia, when considering the issue of insurance premiums and personal income tax when compensating employees with a traveling nature of work for expenses associated with business trips, expressed the following opinion:

“In the absence of documents confirming employee expenses, the compensatory nature of these payments is lost and the indicated income is subject to personal income tax in the prescribed manner.”

Letter of the Ministry of Finance of Russia dated January 17, 2019 No. 03-15-05/1909

Next, we will consider in detail each of the payments due to a posted employee, indicating all the important nuances and possible controversial issues.

A posted employee is entitled to the following types of payments for work outside the permanent workplace:

Features of calculating average earnings for sick leave

The rules for calculating sick leave are determined by the regulation on the specifics of the procedure for calculating benefits for temporary disability, pregnancy and childbirth, and child care, approved by Decree of the Government of the Russian Federation of June 15, 2007 No. 375. To pay for sick leave, the average daily earnings are used (clause 15 of Regulation No. 375) . It includes all employee payments for which contributions to the Social Insurance Fund are accrued. The average salary is determined by the formula (Part 3, Article 14 of Law No. 255-FZ, Clause 15 (1) of Regulation No. 375): SRDNZ = earnings for the billing period / 730.

The billing period for the purpose of calculating benefits for sick leave is two calendar years preceding the year of illness (Part 1, Article 14 of Law No. 255-FZ, Clause 6 of Regulation No. 375). At the same time, the average earnings for each year are limited by the maximum value of the base for calculating contributions (Part 3.2 of Law No. 255-FZ, Clause 19 (1) of Regulation No. 375).

If over the last two calendar years the employee had no earnings or their amount did not exceed the minimum wage, then the average earnings are considered equal to the federal minimum wage established on the day of illness, taking into account regional coefficients (Part 1.1 of Article 14 of Law No. 255-FZ).

Calculation example

Monthly contributory payments to an employee who submitted sick leave in 2021 and 2021 were 60,000 rubles. During the billing period, earnings amounted to: 720,000 720,000 = 1,440,000 rubles.

The maximum base for calculating contributions to the Social Insurance Fund in 2019 is 865,000 rubles, in 2020 - 912,000 rubles. The employee’s earnings for each year of the billing period did not exceed the base limits.

We determine the average daily earnings: 1,440,000 / 730 = 1,972.60 rubles.

Payment of daily travel expenses in 2016

→ → Update: November 15, 2021

In the current 2021, changes were expected in the regulation of payment of travel expenses, but this has not happened yet. At present, the legislation on payment of travel expenses continues to apply, as before, including daily allowances.

The concept of daily expenses as part of travel allowances is revealed. According to it, daily allowances are additional expenses caused by the stay of a posted employee outside his place of permanent residence, subject to reimbursement by the employer.

Essentially, per diem is a compensation payment to reimburse an employee for expenses caused by the performance of official functions outside the place of permanent work. They are aimed at covering the employee’s personal expenses during a business trip (for example, food, etc.). However, the employee is not required to report to the employer for these expenses. Regulations on the specifics of sending employees on business trips, approved.

(hereinafter referred to as the Regulations on Features), in paragraph.

11 determines that daily allowances are reimbursed to the employee for each day he is on a business trip, including weekends and non-working holidays, as well as for days en route, including the time of forced stop. However, sending an employee on a one-day business trip (or when he has the opportunity to return to his place of residence every day) does not entail the employer’s obligation to pay daily allowances.

Moreover, even including a provision about this in the local regulations on business trips in an organization will not make it legal, and the employer will bear the risks of taxation. However, if in the aforementioned local act on business trips these payments are called differently (for example, compensation for one-day business trips), the problem can be solved.

By law, the daily allowance is established only for budgetary organizations, but not for commercial ones. In them, the procedure for paying travel expenses must be determined by a collective agreement or a local regulatory act of the organization in accordance with (usually the Regulations on Business Travel or an order of the same name).

Subtleties of calculating average earnings for vacation pay

The guarantee of paid vacation is provided for in Art. 114 Labor Code of the Russian Federation. It says that during the main vacation, workers retain their average earnings. Since this case is provided for by the Labor Code of the Russian Federation, the procedure provided for in paragraph 2 of Regulation No. 922 is applied here.

For vacation accruals, the average salary includes payments named by the company’s remuneration system. The period for calculation will be 12 calendar months before the vacation month (clause 4 of the provisions). If an employee goes on vacation in June, then for calculations the period of time is taken from June 1 of last year to May 31 of this year.

As a rule, vacation is granted in calendar days (Article 115 of the Labor Code of the Russian Federation). To pay for such vacations, the average earnings are determined by the formula (clause 9 of the regulations): SZ = average daily earnings x number of calendar days of vacation.

To determine the average daily earnings, the indicator of the average monthly number of calendar days is used, equal to 29.3 (clause 10 of the regulation). However, the exact formula depends on whether the employee has fully worked the months of the pay period or not.

Months worked out in full (clause 10 of the regulations):

SDNZ = salary for the pay period (minus unaccounted amounts) / 12 / 29.3

Calculation example.

The employee was granted additional paid leave from January 20 to January 22, 2021. He worked out the entire billing period from January 1, 2021 to December 31, 2021. The salary for the billing period amounted to 600,000 rubles.

SDNZ amounted to: (600,000 rubles / 12 / 29.3) = 1,706.50 rubles.

SZ per month: 1706.50 × 3 (vacation days) = 5,119.50 rubles.

There were shortcomings in the months (clause 10 of the regulations):

SDNZ = salary for the billing period / (29.3 x number of fully worked months, number of days in unworked months).

Number of days in unworked month = 29.3 / (by the number of calendar days of the month x by the number of calendar days falling within the time worked in a given month).

Calculation example

The employee goes on a two-week vacation from January 11 to January 24, 2021. The billing period is January 1–December 31, 2020. The calculation includes 530,000 rubles.

During this period the employee did not work:

- 7 calendar days - in February (vacation);

- 7 days - in December (sick leave);

- 2 calendar days in March, 30 calendar days in April, 3 calendar days in May (presidential non-working days from March 30 to April 30, from May 6 to 8, 2021);

- March 2–29, 2021 and October 1–31, 2021 – business trip.

Thus, the employee worked fully for 6 months: January, June, July, August, September, November.

We count the number of days in months that are not fully worked:

- February: (29.3 / 29 days x (29 days - 7 days)) = 22.23 days;

- March - excluded from the calculation, since the employee did not work there at all (non-working days and business trips);

- April - non-working days throughout the month;

- May - (29.3 / 31 days x (31 days - 3 days) = 26.46 days;

- October - business trips are excluded from the calculation;

- December - (29.3 / 31 days x (31 days - 7 days) = 22.68 days.

SDNZ: 530,000 rubles / (29.3 × 6 months 22.23 days 26.46 days 22.68 days)) = 2,144.27 rubles.

NW: RUB 2,144.27 x 14 days = 30,019.78 rubles.