Description of basic concepts

A shift work schedule is an order in which some workers are replaced by others to perform the same types of work. Moreover, each citizen works on a certain day of the week.

For example, there are two employees, and the schedule is two days after two. For one employee you can set the following as workers:

- For one week, Monday, Tuesday, Friday and Saturday.

- For the second week, Tuesday and Wednesday, Saturday, Sunday.

Such schedules are relevant if the production process at the enterprise does not tolerate long interruptions. Article 103 of the Labor Code of the Russian Federation controls this mode of operation.

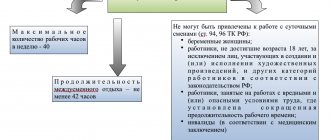

It is permissible to introduce two, three, or four shifts. When using this type of schedule, workers are divided into several groups at once. Each of them performs work on certain days and hours.

Work on the eve of the holiday

The duration of the working day (shift) preceding a non-working holiday is reduced by one hour (Article 95 of the Labor Code of the Russian Federation). In continuously operating organizations and in certain types of work where it is impossible to reduce the duration of work, the employee can choose: to receive either additional rest time or payment according to the standards established for overtime work.

If a day off is transferred to a working day, then the duration of work on the former day off must correspond to the duration of the working day to which the day off was transferred. For example, since the day off on February 24 was moved to a working day (November 3), the duration of work on February 24 (former day off) must correspond to the length of the working day to which the day off was moved (the working day on November 3 before the transfer was a pre-holiday day). In this regard, operating hours on February 24 were reduced by one hour.

Payment for holidays during a shift work schedule

Article 153 of the Labor Code states that holiday work shifts require a minimum of double pay. The calculation is carried out taking into account not the entire shift, but the hours that were actually spent performing duties at that moment. There are often shifts that move from one day to the next.

One scheme is used with standard salaries. Then you first need to calculate the average cost of labor for one day. Then the result is multiplied by 2.

Double payment: holidays in January 2021

In January 2021, Russians will have a holiday from the 1st to the 10th inclusive. Until January 8th there will be New Year holidays, and the 9th and 10th are Saturday and Sunday.

In January 2021, Russians will have a holiday from the 1st to the 10th inclusive. Until January 8th there will be New Year holidays, and the 9th and 10th are Saturday and Sunday. Will such a long vacation affect the salaries of Russians, and which holidays in January 2021 are paid double.

The holidays will continue in January next year two days longer than last year.

Examples of calculations using the two-by-two scheme

Let's look at one example that helps you understand how to pay for holidays, even if they are only part of the schedule.

There is a schedule according to which a subordinate works 12 hours for 16 days. Of the total, two holidays stand out. The rate for one hour of work is 150 rubles.

Two days with 12 hours of work are paid using the double tariff. We multiply 150 by 24 and multiply by 2. The result is 7200.

The rest have 14 days of 12 hours - standard single size. We simply multiply 14, 12 and 150. We get 25,200 rubles.

In total for May, the employee receives a salary consisting of two figures received earlier. The entire amount is issued in person minus income tax at a rate of 13%.

For information on calculating wages during a shift schedule, watch this video:

Religious holidays

The list of non-working holidays included only one religious holiday - Christmas. In order to avoid infringement of the rights of people belonging to other religions, the legislation of the Russian Federation allows individual constituent entities of its composition to establish non-working holidays on their territory for religious reasons. To do this, three conditions must be met:

- The date celebrated is a religious holiday.

- The religious organization submits applications to the authorities of the relevant region with a request to declare this day a non-working holiday.

- These authorities adopt a resolution in this regard and publish it in official sources.

- The law allows for the addition of holidays, implementing citizens' rights to freedom of expression of religion, but it prohibits the cancellation or postponement of non-working holidays provided for by federal law.

Rules for increasing the cost of work

Such increases are permissible for employees representing one of the following categories:

- When using the piecework payment option. That is, when the determining factor is the actual quantity of services and goods produced.

- With daily or hourly rates.

- Workers who receive a standard salary.

If an enterprise’s internal documents indicate a smaller amount of payment for holidays than usual, this is a direct violation of current legal requirements. Such decisions are easy to appeal when going to court.

In this case, an employee can choose to receive additional rest if he not only works on weekends and holidays, but also exceeds the established standards for labor results.

Compensation for work on a non-working holiday

According to Article 153 of the Labor Code of the Russian Federation, work on a non-working holiday is paid at least double the amount. Specific amounts of payment can be established by a local act, as well as a collective or labor agreement.

Instead of increased pay, the employee has the right to receive time off at a time convenient for him. In this case, the worked day off is paid in a single amount, and the rest day is not subject to payment. Please note: the employee’s salary for the month in which he takes time off does not decrease. After all, paying a single day off means that an employee receiving a salary is paid a single daily rate in addition to his salary. Thus, an employee who has chosen a day of rest, work on a day off or a non-working day is paid in a single amount, and in the month when the day off is taken, the full salary is paid.

But for employees who have entered into an employment contract for a period of up to two months, compensation is provided only in cash - no less than double the amount. Such employees do not have the right to receive an additional day of rest in exchange for increased pay (Article 290 of the Labor Code of the Russian Federation).

When double pay is replaced by rest

In some situations, subordinates have the right to demand time off instead of double remuneration for holidays worked. The decision in each case is individual and depends on how much time has actually been worked up to the present moment.

Such demands cannot be made only by those who usually work overtime. The same applies to the use of a shift schedule.

conclusions

Main conclusions:

- Holidays (hours) of work are subject to double payment, regardless of what schedule the person works. Payment can also be made in larger amounts if the employer has established this by internal regulations (the law does not establish additional restrictions).

- Payment for work on calendar days off (Saturday and Sunday) with a shift work schedule is made in a single amount, since the days off for such employees are “floating”.

- The shift work schedule allows for work in two, three and four shifts, at the discretion of the employer as production needs arise.

Correction of shift schedule

During the operation of an enterprise, situations may arise when an already drawn up and agreed upon shift schedule has to be changed. How, then, can this be formalized and put into practice?

First of all, you need to inquire about the employees’ consent to perform their duties on a different schedule. If they do not mind, you need to immediately get their signature to familiarize yourself with the new dates of return to work. In these cases, the mandatory monthly interval for reporting is not required (Article 72 of the Labor Code of the Russian Federation).

If the need for correction is identified in advance, changes can be made to the schedule without the consent of the employees, in accordance with Art. 74 Labor Code of the Russian Federation. In order to thoroughly change the data in the schedule, you need to give people the opportunity to receive information about the adjustment 60 days before it is entered, and familiarize themselves with the specific provisions for signature, as required, at least a month in advance.

If employees do not agree to accept the changes, then they can be dismissed on this basis (clause 7, part 1, article 77 of the Labor Code of the Russian Federation). Challenging such a dismissal in court will be doomed for the employee if the employer proves that he made changes as part of organizational measures. In this case, you need to act according to the following algorithm:

- issue an order to adjust the schedule, which provides the reasons for the changes (for example, the requirements of a new production process);

- inform employees 2 months in advance;

- give employees a month to familiarize themselves with the new provisions of the schedule;

- conclude an additional agreement with them to the employment contract (or fire those who disagree).

Division into shifts

To work on a shift schedule, all personnel are divided into work groups (teams, shifts), each of which will work during one time period allocated to them. They perform their work sequentially; the purpose of such an organization is to eliminate pauses in the production process.

The Labor Code of the Russian Federation does not give clear recommendations on the division of workers into shifts. There is no minimum limit for group composition. Therefore, by default, based on the definition of “group of employees” used in the legislation, it follows that in order to introduce a shift schedule, the staff must have at least three employees, since it is impossible to work two shifts in a row (two work in different shifts, and the third is on vacation).

The number of shifts is also not limited by law. In practice, enterprises most often choose a two- or three-shift option, less often a four-shift option. An employer can divide a day into any number of shifts, depending on the number of its personnel and the nature of the work.

Schedule according to shift schedule

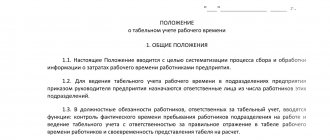

The employer develops and approves this document in addition to current regulations. It should take into account the following nuances:

- the number of shifts into which working time is divided;

- start and end times of each shift;

- lunch breaks and shift changes (if any);

- the order in which the shifts alternate;

- rest regime between shifts;

- shift composition and transfer possibilities for workers;

- procedure in case of emergency situations (for example, no-show of a shift worker).

The form for drawing up such a schedule can be arbitrary, but most employers use a unified work time sheet, where in columns 1-6 they note the features of the shift schedule.

is approved as an additional agreement to the collective agreement. But if the organization has not concluded a collective labor agreement, then the schedule can be issued as a separate regulatory act or act as an annex to the internal regulations.

Coordination of the drawn up schedule is mandatory (this is required by Article 371 of the Labor Code of the Russian Federation):

- with a trade union organization, if it operates at the enterprise;

- with any employee representative body (for example, a general meeting).

Time of preparation: it is not necessary to approve the schedule for the entire working period at once; any time period is acceptable: a month, a quarter, or any stage of the accounting period. It is not necessary to have a single constant schedule; corrections and changes are allowed.

Employees must be familiarized with the schedule no less than 30 days before its introduction (Part 4 of Article 103 of the Labor Code of the Russian Federation). This must be documented in writing, that is, confirmed by the employee’s handwritten, dated signature on the appropriate document.

Sample shift work schedule