Home / Labor Law / Payment and benefits / Wages

Back

Published: 05/04/2016

Reading time: 10 min

0

6712

Accounting accounts and payroll entries are the main accounting tool, with the help of which the method of double-entry data is implemented for various business transactions that occur in the company. For different types and groups of such operations, various accounts and postings are used.

It is worth considering a group of entries that are used when accounting for wages accrued and paid to employees, because wages are the most significant item of expense for almost every enterprise .

- Sequence of actions when accounting for salaries

- Settlements with company employees for wages

- Displaying accrued wages in transactions

- Displaying deductions made from wages in postings

How to organize accounting

The chart of accounts (Order of the Ministry of Finance No. 94n dated October 31, 2000) provides account 70 “Settlements with personnel for wages” to reflect accruals and payment of wages and deductions from it. Postings are generated using it when accruing salary in correspondence with other accounts. The account is passive, and its loan balance reflects the amount of wages the organization owes to its employees. The credit of the account reflects the accrual of fees for performing labor duties. The debit reflects a transfer from a current account or a posting for the payment of wages from the cash register, reflecting the amount of deductions.

Analytical accounting should be organized for each employee separately. This will allow you to receive up-to-date information on accruals and debts for each individual employee of the company at any time.

The main stages of organizing payroll accounting include:

- Calculation of wages.

- Calculation and accounting of deductions from salaries.

- Calculation of insurance premiums.

- Payment of wages.

- Transfer of personal income tax and insurance premiums.

The accountant repeats all stages every month, and individual entries are generated for each case. We will describe in detail everything an accountant needs to know in 2021 about the correspondence of accounts that are used most often.

ConsultantPlus experts examined how to reflect in accounting the wages overpaid upon dismissal of an employee, and the corresponding amounts of personal income tax and insurance contributions. Use these instructions for free.

Calculation of insurance premiums: postings

After accruing wages to the employees of the enterprise, its owner or accountant calculates and accrues insurance premiums for them, the amount of which is calculated on the basis of the rules established by law.

Most often, account 69 is used for these purposes, on the basis of which a number of auxiliary sub-accounts are opened, corresponding to a separate type of payment. When setting the amount of deductions, cost accounts must be taken into account. They can be designated by numbers from 20 to 26 and 44.

It is worth noting that if an institution or organization has several structural divisions, then the transfer of contributions is carried out taking into account the particular production area the employee is associated with.

Example:

The company accrued a salary of 550 thousand rubles for December 2021, including 300 thousand rubles for production workers. and for the management department - 150 thousand rubles.

According to the above conditions, transfers were made for social needs with a total value of 80 thousand rubles to the Pension Fund of the Russian Federation, including for workers in production - 60 thousand rubles and for the management department - 30 thousand rubles. Additionally, the social insurance fund amounted to 4200 and 2100 rubles.

As a result, insurance premiums were calculated, the posting of which shows the expenses for each department of the company:

- Dt 20 – Kt 69.01 – 60 thousand in the Pension Fund of the Russian Federation for workers in the production workshop

- Dt 26 – Kt 69.01 – 30 thousand in the Pension Fund of the Russian Federation for the salary of the management department

- Dt 20 – Kt 69.01 – 4200 transfers for injuries and danger of persons working in production

- Debit 26 – Credit 69.11 – 2100 transfers for injuries to employees of the company management department

- Debit 69.01 – Credit 51 – 90 thousand insurance payments are transferred to the state budget, the total amount to be transferred to the Pension Fund is reflected in the accounting documentation

- Debit 69.11 – Credit 51 – 6300 insurance transfers are transferred to the state budget, the posting reflects the amount of accruals to the Social Insurance Fund.

The company produces lumber, applies a simplified taxation system and enjoys preferential rates on insurance premiums.

How to reflect in accounting

The accrual of wages is reflected in the credit of account 70. Corresponding accounts when calculating wages reflect the direction of cost accounting depending on the labor functions performed by the employee. Also, the credit of account 70 reflects the accrual of fees for the time the employee is absent due to illness or vacation.

| Debit | Credit | |

| Posting of payroll for employees of main production | 20 | 70 |

| Workers of auxiliary production | 23 | 70 |

| Employees of departments serving the main production | 25 | 70 |

| Posting payroll to management personnel | 26 | 70 |

| The construction work of the new administrative building is being carried out on our own. | 08 | 70 |

| Calculated salaries of employees of a trade organization | 44 | 70 |

| Calculated payment for certificates of incapacity for work at the expense of the employer (the first three days) | 20, 25, 26, 44 | 70 |

| Calculated payment for certificates of incapacity for work at the expense of the Social Insurance Fund | 69 | 70 |

| Reflects accrued payments that are not directly related to work activities (for example, an employee’s anniversary bonus) | 91 | 70 |

| If a reserve is formed for vacation pay | ||

| A deduction was made to the reserve on the date when wages were accrued | 20, 25, 26, 44 | 96 |

| Vacation pay accrued | 96 | 70 |

Transferring wages to bank cards: how to avoid mistakes

Unread

Law and practice / Salary and social insurance

Can an employer oblige employees to receive wages via bank cards?

- No, he can not.

Can an employee receive his salary into a bank account he opens on his own?

- Yes maybe.

Does an employee need to write an application for salary transfer to a bank card?

- Yes need.

Paying wages using bank cards is becoming an increasingly common way of paying staff. This is due to the fact that non-cash payments to employees allow employers to significantly reduce costs when working with cash. However, do you always correctly establish in personnel documents the conditions for transferring wages in non-cash form?

Why you can’t force your salary to be transferred to cards

The procedure, timing and place of payment of wages are regulated by Article 136 of the Labor Code.

The salary is paid to the employee, as a rule, at the place where he performs the work or is transferred to the bank account specified by the employee. The conditions for calculating wages are determined by a collective or labor agreement.

Thus, as a general rule, an employee must receive wages in cash at the organization’s cash desk.

When deciding to pay wages using bank cards, you should determine all the necessary conditions in the collective agreement or think about including them in employment contracts with employees.

Remember that you cannot force an employee to open an account and receive a bank card. By virtue of Article 421 of the Civil Code, citizens are free to enter into an agreement and coercion to enter into an agreement is not allowed.

Civil legislation gives the employer the opportunity to open a bank account in the interests of a citizen (Article 846 of the Civil Code of the Russian Federation)1. However, the employee may waive his rights under such an agreement, and the employer will not be able to transfer wages to the account opened for him. In addition, by virtue of Article 859 of the Civil Code, the employee can terminate the contract and close the bank account at any time.

The employer must remember that even in cases where the collective agreement provides for a non-cash method of transferring wages, the employee’s refusal to conclude a bank account agreement and receive a card is not a violation of labor discipline and cannot be the basis for the imposition of any penalties. If, at the same time, the employer decides not to pay such an employee’s salary in cash, this is considered a delay in wages and will entail financial liability to the employee in accordance with Article 236 of the Labor Code.

What terms should be included in contracts with employees?

you will find a court decision obliging the employer to compensate the employee for moral damages for delayed wages

Most organizations that use non-cash payments to employees work within the framework of so-called salary projects.

The employer enters into an agreement with the bank, according to which the bank undertakes to issue and service bank cards, open accounts with a special regime, and credit funds to the accounts of its employees on behalf of a legal entity. The employer draws up payment documents and, as a general rule, pays for the bank’s services.

As we have already noted, Article 136 of the Labor Code allows the employer to determine the conditions for transferring wages in non-cash form either in a collective agreement or in an employment contract. Each organization has the right to decide for itself in which of these documents to establish the procedure for non-cash payments.

As a rule, general, fundamental provisions are prescribed in the collective agreement, and they are disclosed in more detail in employment contracts with employees (see sample).

For example, in an employment contract you can fix: - the conditions for transferring wages to the employee’s account, which was already opened before starting work; - the procedure for obtaining several bank cards of different payment systems (for example, both VISA and MasterCard);

— the use of motivational tools related to the issuance of a salary card (for example, an employee can issue a credit card on preferential terms, etc.), etc.

Why do you need a statement from an employee?

The employee must indicate the account to which his salary will be transferred (part three of Article 136 of the Labor Code of the Russian Federation).

It follows from this rule that neither the conditions for the transfer of wages, enshrined in a collective or labor agreement, nor a bank account agreement within the framework of a salary project are sufficient grounds for paying wages to an employee in this regard.

Funds transferred to a bank account that is not designated by the employee are not legally considered wages.

The employee must indicate the bank account details when submitting the application, and he has the right to indicate any account opened in his name and change the details of this account.

Thus, wages can be transferred in non-cash form to a bank card only on the terms of a collective agreement and (or) an employment contract with the employee (additional agreement to the contract), as well as on the basis of the employee’s application for the transfer of wages according to the details specified by him.

If these conditions are not met, this is considered a violation of current labor laws. Which will entail administrative liability for the employer in accordance with Article 5.27 of the Code of Administrative Offenses (a fine in the amount of 30,000 to 50,000 rubles or administrative suspension of activities for up to 90 days).

Often in practice, employees refuse to switch to a cashless payment system. The reasons are completely different: from the habit of receiving money at the cash register to the desire to oppose your opinion to the wishes of the employer. As we have already said, you cannot force employees to get a bank card, but you can convince them to do so.

How? Let's look at several advantages of salary cards that can win employees over to your side: - security of storing funds (an employee can instantly block a lost bank card, thereby preventing third parties from accessing the money on it); - speed and accessibility of receiving cash; - access to funds on the card 24 hours a day; - payment for goods and services in Russia and abroad; - the ability to top up a mobile phone account, pay for housing and communal services and make money transfers; - control over all operations using the Mobile Bank system ;— access to preferential loans;

— the possibility of receiving additional payments (pensions, social benefits, etc.) to the bank card.

We transfer personal data to the bank

When concluding bank account agreements, the employer sends the bank personal data of employees, copies of their documents and information about the procedure for translating their names into Latin, and sometimes information about average earnings.

It must be remembered that the processing of personal data (in this case, transfer to third parties) is permitted only with the written consent of the employee (Clause 1, Article 6 of the Federal Law “On Personal Data”) (see.

sample).

| On practice | In law |

| Very often in practice, when giving the bank an order to credit funds to employees’ accounts, employers forget to take into account the time required to carry out the relevant banking operations (from one to three banking days). | Wages must be paid at least every half month (Article 136 of the Labor Code of the Russian Federation). In this case, the day of payment of wages for non-cash payments is the day the funds are credited to the employee’s account. Therefore, the employer should contact the bank and clarify how long it takes to carry out banking transactions. |

What happens if…

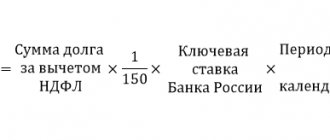

Employers often make this mistake, forgetting that the organization is liable for late payment of funds to the employee’s account, just as for delayed payment of wages. For such a violation, the employer will pay interest on amounts not transferred on time for each day of delay (Article 236 of the Labor Code of the Russian Federation).

Remember the main thing

Note the experts who took part in the preparation of the material:

Olga ABASHNIKOVA, leading HR administration specialist at BDO Unicon Business Service (Moscow):

— To pay wages in non-cash form, the employer must first stipulate this in the collective agreement and (or) employment contract with the employee

.

Secondly, he needs to receive an application from the employee with the bank details to which the salary should be transferred.

In this case, the employee has the right to indicate any account opened in his name and change the details of this account.

Anna BARANOVA, analyst of the online salary calculation service “Eureka” SKB Kontur (Ekaterinburg):

— If an employee categorically does not agree to receive a salary in non-cash form, he may not write an application to transfer money to the card

. In this case, the employer is obliged to pay wages in cash through the cash register on time.

Salary deductions

Deductions from wages are reflected in the debit of account 70. The main ones are:

- personal income tax;

- alimony, other deductions under writs of execution;

- contributions to a trade union organization;

- compensation to the enterprise for damage or loss.

| Debit | Credit | |

| Personal income tax calculated | 70 | 68 |

| Payments under writs of execution (alimony, fines) are withheld | 70 | 76 |

| Amounts of compensation for shortages and damages due to the fault of the employee are withheld | 70 | 73 |

| Upon dismissal, payment for unworked vacation days is withheld, reversal | 96 (20, 25, 26, 44) | 70 |

Read more: Calculation and withholding of alimony

Payment of wages

Salaries, at the employee’s request, are issued to him in cash or by bank transfer. Regardless of whether it is transferred to the card or issued from the cash register, the posting of paid wages is generated by the debit of account 70.

| Debit | Credit | |

| Salaries were paid from the bank account to employee cards | 70 | 51 |

| Salary posting issued from cash register | 70 | 50 |

| Alimony and other deductions under writs of execution have been paid | 76 | 51 |

Personal income tax and insurance premiums: calculation and payment

From payments to employees, employers are required to calculate and transfer to the state:

- personal income tax (the rate for residents is 13% on incomes not exceeding 5 million rubles, 15% on higher incomes);

- insurance premiums (22% - OPS, 5.1% - Compulsory Medical Insurance, 2.9% - OSS).

IMPORTANT!

For 2021, reduced rates of insurance premiums for small and medium-sized businesses have been retained: 10% - compulsory insurance, 5% - compulsory medical insurance, 0% - compulsory insurance for payments exceeding the minimum wage.

To generate entries for accounting tax payments, the chart of accounts provides account 68, and for the calculation and accounting of insurance premiums - account 69.

| Debit | Credit | |

| Personal income tax calculated | 70 | 68 |

| Insurance premiums have been calculated | 20, 23, 25, 26, 44 | 69 |

| The withheld personal income tax was transferred to the budget | 68 | 51 |

| Insurance premiums transferred to the budget | 69 | 51 |

Read more: Deadlines for personal income tax payment

Read more: Basic information about insurance premiums

Paying salaries through a bank (bank cards)

There are several options for transferring wages to bank cards:

Regardless of which option is chosen, the accountant’s actions in the program will be as follows: create a statement to the bank, transfer wages, pay personal income tax.

Let's look at each action with an example.

Step-by-step instruction

Step-by-step instructions for creating an example. PDF

Start of example:

- Advance payment;

- Payroll

Payment of wages according to the salary project

To pay wages within the framework of a salary project, it is necessary that in the program:

- The Salary Project was created: an element was introduced Salary Projects

- In the Employees directory, Salary Payment is indicated - According to the salary project PDF.

- The personal accounts of employees were entered in the Employees or using the document Entering personal accounts in the section Salaries and Personnel - Salary Projects - Entering Personal Accounts.

Learn more about Payroll Project Preparation

Formation of payroll statements

The formation of a statement for salary payment is drawn up in the document Statement to the bank, transaction type For salary project in the section Salaries and personnel - Salary - Statement to the bank - Statement - For salary project.

Please pay attention to filling out the fields:

- Type of payment - Salary , since it is the salary that is transferred at the end of the month.

- Month —the month the salary is calculated and paid to the employee.

- Salary project - a salary project drawn up with the bank, selected from the Salary Projects .

By clicking the Fill , a tabular section is formed with the data for payment based on the results of the specified month:

- For payment - the balance of the accrued amount for which a statement has not previously been generated.

- Personal account number - personal account number within the salary project.

The document does not generate a posting to the Accounting and Tax Accounting .

Postings according to the document

The document generates the posting:

- Dt 70 Kt 51—payment of wages.

Paying salaries to employees' personal cards

To pay wages not within the framework of a salary project, but to an employee’s personal card, it is necessary that the Employees directory be filled out as follows PDF:

- Salary payment - To a bank account .

- The employee's personal account has been entered using the Fill in bank account .

Reflection in reporting 6-NDFL

In Form 6-NDFL, payment of wages is reflected in:

Section 1 “Generalized indicators”:

- pp. 070 - 13,761 , amount of tax withheld.

Section 2 “Dates and amounts of income actually received and withheld personal income tax”: PDF

- page 100 - 05/31/2018 , date of actual receipt of income;

Reflection of PO transactions in accounting registers

Forms of registers for recording business transactions are developed and approved by a commercial organization independently. They must ensure that they can obtain up-to-date information about the company's assets and liabilities at any time.

As mentioned above, the payroll accounting register is required to provide detailed data for each employee. It is also advisable to detail the data on the types and amounts of charges, deductions and payments. Such detailed accounting is organized in an independently developed form or using the T-54 form, approved by the State Statistics Committee in Resolution No. 1 of 01/05/2004. The basis for calculating wages and filling out registers for its accounting are:

- time sheets;

- employment contracts;

- bonus orders;

- vacation orders;

- writs of execution and statements of deductions;

- other documents on labor standards and remuneration.

Form T-54

Also, according to Article 136 of the Labor Code of the Russian Federation, the employer is obliged to notify staff about accruals and deductions before transferring wages. This can be done by issuing a pay slip to the employee. Its form should be clear and allow the employee to know about accruals, deductions and amounts to be received. The organization has the right to inform an employee both on paper and in electronic form, for example by sending a payslip by email.

Pay slip form:

Read more: Procedure and deadlines for issuing pay slips

Step-by-step payroll in 1C 8.3 for beginners

In this article we will look step by step at the entire cycle of payments to employees for labor in 1C 8.3 Accounting: advance payment, payroll and final payment for the month with payment of personal income tax to the budget.

You will learn:

- how salary and personnel records are kept in 1C Accounting 8.3;

- what document is used to document the calculation of wages and contributions;

- where to print payslips;

- how to withhold personal income tax from accrued wages;

- how to create a bank statement and pay advances and salaries to employees;

- when to pay personal income tax to the budget.

How to calculate salaries in 1C 8.3 Accounting step by step for dummies

On January 31, the Organization calculated and accrued wages for January for the following employees:

| Tab. No. | FULL NAME. employee | Days worked | Hours worked | Accrued | Deductions for personal income tax |

| 1 | Druzhnikov Georgy Petrovich | 20 | 159 | 60 000 | — |

| 2 | Trofimova Lyubov Andreevna | 10 | 80 | 30 000 | 1 400 |

| Total | 90 000 | 1 400 |

At the same time, personal income tax is calculated and insurance premiums are calculated.

According to the collective agreement, salaries are paid twice a month: on the 25th and 10th.

On February 9 (postponed from February 10), wages were paid for the second half of the month. On the same day, personal income tax was paid to the budget.

Download step-by-step instructions for dummies on how to calculate salaries in 1C 8.3 Accounting PDF

See also Advance calculation in 1C 8.3 Accounting step by step

Setting up settlements with an employee

Monthly advance payment is made to employees before wages are accrued. The advance date is established by a collective or employment agreement. In our example, this is the 25th number.

Payments to employees are made:

- cash from the cash register;

- transfer to bank cards: for salary projects;

- to personal cards of employees.

In our example, we will transfer the advance to the employee’s personal card. To make this possible, let’s set up a method for paying it off the Employees directory You can go to the directory from the section:

- Directories - Salaries and Personnel - Employees;

- Salary and Personnel - Personnel records - Employees.

The value in the Salary payment will determine what form the statement will take:

- Statement to the cash register - if the Cash ;

- Statement to the bank transaction type By salary project - if selected By salary project ;

- Statement to the bank transaction type To employee accounts - if the value To bank account .

In our example, we will select To a bank account : this means that the advance will be transferred to the employee’s personal card.

Statement to the bank

Let's create a document Statement to the bank, transaction type To employee accounts . It is available from the section Salaries and Personnel - Salaries - Statements to the bank.

Click the Statement to select the desired type of transaction - To employee accounts :

In the created document, you need to pay attention to filling out the fields:

- Payment type - Advance ;

- Month - the month for which the advance is transferred, in our example - January .

Clicking the Fill will automatically fill in the tabular part of the statement. In the To be paid , the advance amount specified in the salary settings for the entire organization or in the Hiring document for the employee will be entered.

More details about advance settings

Upon completion of filling, we will post the document using the Post or Post and close button .

Advance payment

When an advance is transferred to an employee, the transaction must be reflected in 1C. To do this, we will draw up the document Write-off from the current account transaction type Transfer of wages to an employee . It can be created directly from the document Statement to the bank the Pay statement button .

The document Write-off from the current account will be filled in automatically. Make sure to fill out the fields:

- Date – date of the bank statement confirming the transfer of funds to the employee’s card;

- Type of operation - Transfer of wages to an employee ;

- Recipient - the employee to whom the advance is transferred;

- Amount —advance amount;

- Expense item - Payment of wages .

Postings

Wiring is generated:

- Dt 70 Kt 51 - payment of wages.

More information about advance payment

Calculation of wages and insurance premiums

Salaries are paid on the last day of the month. The operation is reflected in the Payroll document in the Salaries and Personnel section - Salary - All accruals - Create button - Payroll.

In the form we indicate:

- Salary for - January : month for which wages are calculated.

By clicking the Fill , the table section automatically displays all employees for whom there is data for payroll with already calculated data.

Tabular part

- Employee - an employee for whom wages are calculated. Selected from the Employees directory .

- Days - the number of days worked according to the Production calendar ;

- Hours - the number of hours worked according to the Production calendar ;

- Accrued - the total amount of accruals for the employee. The link in the Accrued displays a detailed description of all accruals for the employee in the additional form.

Only monthly accruals specified in the Hiring . In our example, only Payment based on salary . Along with Payment based on salary, this could be, for example, a monthly bonus or additional payment for irregular working hours.

If necessary, the Days , Hours and Accrued can be adjusted manually.

In January 2021, with a five-day working week (40 hours), there are 17 working days, 136 hours.

With Druzhnikov G.P. The employment contract was drawn up until January 2018.

Employee Trofimova L.A. has been operating since January 18, 2021, so it has 10 working days and 80 hours according to the production calendar.

Salary of Trofimova L.A. — 51,000 rub.

Accrued for January - 51,000 rubles / 17 days * 10 days = 30,000 rubles.

Druzhnikov G.P. the salary is accrued in full: he has fulfilled all the working hours.

If, in addition to monthly payments, additional payments need to be accrued, then you must use the Accrue .

More information about accrual settings

- tax is the amount of personal income tax withheld from wages. By clicking on the link in the personal income tax , a calculation is revealed - a table showing the employee’s income for the current tax period from the beginning of the year and the deductions provided.

In our example, the employees do not have any deductions provided. Personal income tax is calculated at 13% of the total monthly income.

- Premiums - the amount of calculated insurance premiums. Contributions are calculated for each employee. It can be viewed via the link in the Contributions in the additional form.

Learn more Insurance premium settings

Documenting

A payslip is a document that an employee must receive monthly in paper or electronic form. You can check all accruals, deductions and payments for an employee that will be reflected on the payslip directly in the Accruals of the Payroll document .

Payslips for sending to employees can be printed in the section Salaries and personnel - Salary - Salary reports - Payslip. PDF

The payslip in form T-51 can be printed using the Payslip (T-51) in the Salaries and Personnel - Salaries - Payroll Reports - Payslip (T-51) section. PDF

Preparation of payment

You can pay your monthly salary directly from the Payroll by clicking the Pay .

The program automatically generates the following documents:

- Statement to the bank type of operation To employees' accounts , since, according to the example, employees' salaries are transferred to personal cards;

- Payment orders transaction type Transfer of wages to an employee - for transfer of wages to each recipient;

- Payment order transaction type Payment of tax - for the transfer of personal income tax to the budget.

Using the link Payment orders 2 (paid 0), you can upload the generated payment orders to the bank:

Salary payment

When we receive confirmation from the bank about the payments made, we create documents Write-off from the current account type of operation Transfer of wages to an employee for each employee. This can be done in different ways:

- from the document Statement to the bank the Pay statement button ;

- from the Payment order using the link Enter a debit document from the current account ;

- by uploading documents from the Client-Bank program or directly from the bank, if the 1C: DirectBank service .

The document will be filled in automatically. Make sure to fill out the fields:

- Date - the date of the bank statement on which the payment was made;

- Type of operation - Transfer of wages to an employee ;

- Recipient - the employee to whom the salary is transferred;

- Amount —salary amount paid;

- Expense item - Payment of wages .

Payment of personal income tax to the budget

Personal income tax must be paid to the budget no later than the next day after the employee’s income is paid. As a rule, personal income tax is transferred simultaneously with the payment of wages. In our example, a payment order for the payment of personal income tax was prepared and sent to the bank along with salary payments.

Let's create a document - off from the current account transaction type Tax payment from the Bank and cash desk section - Bank - Bank statements - Write-off button.

In the form we indicate:

- Transaction type - Tax payment .

- Tax - personal income tax when performing the duties of a tax agent .

- Type of liability - Tax .

- for - January 2018 , the month of accrual of income (salaries).

Learn more about reflecting personal income tax payments to the budget

Accrual example: calculation and postings

Let's look at an example of the procedure for generating entries for debt to an employee for accrued remuneration for wages for work and its payment. LLC "Company" employs two people. The organization is engaged in wholesale trade, and wage entries for the director and all other employees are generated and assigned to account 44. Salaries are paid on the 10th of the next month. On the same day, personal income tax and alimony are transferred. Insurance premiums were transferred on December 14, 2020.

Manager Petrov P.P. pays alimony according to the writ of execution - 25% of the salary. Everyone is tax residents, that is, the personal income tax rate for everyone is set at 13%. The organization pays insurance premiums at regular rates (22% - OPS, 5.1% - Compulsory Medical Insurance, 2.9% - OSS). All employees are paid salaries via bank cards.

| FULL NAME. | Job title | Accrued based on salary | Sickness benefit (all payment at the expense of the Social Insurance Fund) | Personal income tax | Alimony | To payoff | Insurance premiums | ||

| OPS | Compulsory medical insurance | OSS | |||||||

| Ivanov I.I. | Director | 40 000 | 10 000 | 6 500 | 43 500 | 8 800 | 2 040 | 1 160 | |

| Petrov P.P. | Manager | 30 000 | 3 900 | 6 525 | 19 575 | 6 600 | 1 530 | 870 | |

| Total | 70 000 | 10 000 | 10 400 | 6 525 | 63 075 | 15 400 | 3 570 | 2 030 | |

The accountant will generate the following accounting records:

Entries for payroll and taxes for January 2021

| Sum | Debit | Credit | |

| January 31, 2021 | |||

| Salary accrued | 70 000 | 44 | 70 |

| Disability benefits | 10 000 | 69 | 70 |

| Personal income tax withheld | 10 400 | 70 | 68 |

| Child support withheld | 6 525 | 70 | 76 |

| Insurance premiums accrued (15,400 + 3,570 + 2,030) | 21 000 | 44 | 69 |

| February 10, 2021 | |||

| Salary paid | 63 075 | 70 | 51 |

| Alimony payments listed | 6 525 | 76 | 51 |

| Personal income tax paid to the budget | 10 400 | 68 | 51 |

| February 15, 2021 | |||

| Insurance premiums listed | 21 000 | 69 | 51 |

Postings for transferring salaries to cards

By Sergey Mashkov / May 30th, 2021 / Copyright / No Comments

Together with the payment order for the payment of wages, the employer must send a document for the transfer of income tax.

Personal income tax is withheld from the employee on the cost of producing a plastic card, as well as a commission for re-production or restoration.

An employee may ask to transfer his salary to another person’s card, indicating in the application the necessary details, the amount (you can transfer not all of the salary, but part of it), as well as the payment period. Postings for salary payments to a bank card:

- Debit 70 Credit 51 – employee’s salary transferred

- Debit 68 Personal Income Tax Credit 51 – income tax for the employee is transferred to the budget

- Debit 91.2 Credit 51 – bank commission for transferring funds to employee cards

Example: An organization accrued wages to employees in the amount of RUB 523,457.

Postings for salary payments to an employee’s card

Info

All this is established by articles 22, 136, 142, 192 of the Labor Code of the Russian Federation.

Therefore, if there is no application, and also when the employer does not have the opportunity to transfer wages by bank transfer, then give the money in another way - in cash.

This way you will not violate labor laws and fulfill the obligations of the employer. Bank cards to which salaries can be transferred are:

- settlement (debit) with overdraft.

Using a payment (debit) card, an employee spends money only within the amount in his account.

Important

Using a card with an overdraft, the employee also spends money within the amount in the account.

Attention

However, if the amount in the account is not enough, then the expenses are covered by the bank.

The terms of the overdraft are stipulated in the agreement with the bank.

Transferring wages to an employee’s card in 2018

P and dated June 19, 2012 No. 383-P. The list of documents required to conclude an agreement for the issuance and servicing of salary cards is established by the bank.

d.) (clause 3.1

Instructions of the Bank of Russia dated May 30, 2014 No. 153-I). After receiving the issued cards from the bank, they must be distributed to employees against signature.

The procedure for transferring salaries to employee cards depends on whether the salary is transferred to the accounts of one or several employees.

To transfer salaries to the accounts of several employees, submit to the bank:

- register for transferring funds to employees;

- payment document(s).

Documents can be prepared both in paper and electronic form (p.

Issuing bank cards for salary payments

The method of paying salaries by transferring to an employee’s card has proven to be the best.

This article will tell you what you need to remember when paying staff by bank transfer, and what rules to take into account when completing the transaction.

Is there any benefit to transferring salaries to employees' cards? Settlements with staff, in which there is no cash, prevail in most companies. For private citizens, the benefits are as follows:

- There is no need to carry a decent amount of money with you;

- There is no need to wait in line at the organization's cash desk;

- Flexible system of communication with credit institutions;

- Convenient payments for utility bills and much more.

The banking system annually improves the system for protecting the personal data of its clients.

Transferring salary to card

VAS-19914/13 and the resolution of the Federal Antimonopoly Service of the East Siberian District dated July 4, 2014 No. A69-3060/2013. Federal Tax Service of Russia in a letter dated September 3, 2014

№ OA-3-17/2962 confirmed the judges' conclusions. Situation: is it possible to issue salaries in cash if, according to local documents, salaries are issued by bank transfer to employee cards? Answer: yes, you can.

Moreover, even if your local documents provide exclusively for non-cash payments, you do not have the right to force an employee to receive earnings in this way.

How to reflect salary payments to an employee’s bank card in accounting

You can pay wages by bank transfer only after you have received an application from an employee indicating his bank details.

Even when there is no such statement, wages still need to be paid.

If you ignore this requirement, the employer will be punished.

In addition, employees have the right to stop working if their salaries are delayed for more than 15 days.