Indexation usually refers to a planned increase in wages for all employees of an organization, caused by annual inflation and increased prices for essential goods. Timely indexation of salaries is the responsibility of the manager; for evading it, he can easily end up in court. The need to increase the level of real wages is set out in Article 134 of the Labor Code of the Russian Federation.

How to properly carry out indexing in an enterprise? What state laws and local acts regulate this process? And are private employers, along with budgetary organizations, obliged to worry about regular wage increases?

Inconsistent indexing

Salary indexation is the responsibility of companies by law, but there is still no uniform regulation for its implementation.

The ambiguity of the issue gives rise to many disputes leading to conflict situations between employee and employer, employer and regulatory authorities.

Due to the lack of a unified regulation for its implementation, the indexing mechanism is unclear:

- What exactly should be indexed: the constant component of the salary or the variable part too?

- What should be the frequency of indexing?

- What indicators should be taken to calculate the indexation coefficient?

- How to legally formalize such an increase in earnings?

Only one thing is clear: indexing must be carried out mandatory for all employees of the organization, without exception .

The procedure for recalculating average earnings during indexation

The duration of the time period, the income of which is subject to indexation in order to determine average earnings, depends on the moment when the salary increase occurred.

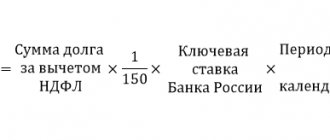

The formula for determining income for average earnings is the same for all cases of indexation.

EXAMPLE 1

The employee goes on vacation from 10/02/2021 to 10/15/2021, and on 08/01/2021 there was an increase throughout the company: his salary was increased from 30,000 to 42,000 rubles. The employee's income was:

- from 01.10.2020 to 31.07.2021 – RUB 325,000. salary and 85,000 monthly bonus, 161 days worked;

- from 01.08.2021 to 30.09.2021 – 83,500 rub. salary and 17,500 monthly bonus, 42 days worked.

The premium is calculated at a floating rate. This is not a guaranteed payment and therefore does not participate in indexation.

How to calculate average earnings taking into account indexation?

- We determine the indexation coefficient, since the premium is a variable value. We take into account only the salary: 42,000 / 30,000 = 1.4.

- Then from the above formula we obtain the calculated (indexed) income: 325,000 × 1.4 + 85,000 + 83,500+ 17,500 = 641,000 rubles.

- We determine the average daily earnings: 641,000 / (161+42) = 3157.64 rubles.

- Then vacation pay from 10/02/2021 to 10/15/2021 (14 days) will be: 3157.64 x 14 = 44,206.90 rubles.

When increasing at the end of the billing period, all payments for the billing period are indexed, and, accordingly, the entire average earnings. But if the increase took place during the period of accrual of the average salary, then it is necessary to index the already accrued amounts from the date of the increase until the day the time for saving income ends (clause 16, clause 17 of the Regulations on the average salary, letter of the Ministry of Labor of Russia dated August 18, 2015 No. 14- 1/B-623).

EXAMPLE 2

The employee goes on vacation from 10/05/2021 to 10/18/2021 for 14 days. The average daily earnings calculated before the start of the vacation is 2,451 rubles. However, on 10/04/2021, his salary, along with the rest of the employees, is increased from 32,000 rubles. up to 40,000 rub. How to recalculate vacation pay?

- We calculate the indexation coefficient: 40,000 / 32,000 = 1.25.

- We adjust the average daily earnings: 2451 × 1.25 = 3063.75 rubles.

- Amount of vacation pay, taking into account recalculation: 3063.75 × 14 = 42,892.5 rubles.

If a similar increase occurred in the middle of the holiday - from 10/12/2021 - then the decision on recalculation would be as follows:

2451 × 7 + 3063.75 × 7 = 38,603.25 rubles.

Read also

03.09.2020

Differences between salary increases and salary indexation

Many employers mistakenly believe that if they annually increase salaries at the enterprise, then there is no need to index wages.

The fact is that increasing salaries and indexing earnings are two different things. After all, the salary can be increased for one or all employees. Some will receive an increase of 10% of their salary, while others will receive a 50% increase. When the salary is increased, an order is issued, a new staffing table is approved, and additional agreements to employment contracts are signed. The purpose of increasing the salary is to interest a specific employee in further cooperation.

The purpose of wage indexation is to bring workers’ earnings into line with current consumer prices and thereby, at a minimum, maintain their quality of life at the same level.

Wage indexation, in contrast to salary increases, is carried out at the same time for all employees by the same factor.

Implementation procedure

It must be set out in a document that guides the enterprise when carrying out indexation. When it is carried out for the first time, a corresponding normative act is adopted. Employees must review the document and sign to confirm this.

If an employee is just being hired, then he must be familiarized with the indexation document immediately so that he has an idea of the procedure for its implementation. The Employment Agreement also records information about it, and when wages change, the corresponding changes in it are recorded in an additional agreement.

That is, the order of indexing will be as follows:

- A local act is adopted indicating the conditions for its implementation, or amendments are made to an existing one.

- Employees are familiarized with this document.

- The manager issues an order to carry out indexation.

- Staff are also familiarized with it.

- The staffing table, to which changes have been made, is approved.

- An additional agreement is added to the employment contract with instructions on changes in remuneration.

There are two main methods of indexation; it can be either retrospective, that is, taking into account the rise in prices or inflation over the past period, or expected, that is, carried out in advance, taking into account the expected rise in prices.

Salary indexation: recommendations

Due to the lack of a unified procedure, we recommend that in order to comply with labor legislation, all organizations adopt an internal document regulating the procedure for indexing wages. This will protect companies from trouble in the event of an audit of compliance with labor law standards and will allow performers to have a clear understanding of its procedure.

Points that a local regulatory act on indexing should contain:

- Frequency of salary indexation: monthly, quarterly, every six months, annually. It is not advisable to carry out indexation once a month or quarter, since this is a very labor-intensive process, especially in enterprises with a large staff. It is important that indexation is carried out at least once a year, for example, annually from January 1.

- Indexation level. Due to the uncertainty of the issue, it is permissible to link this coefficient:

- to the consumer qualification index for a specific period in the region where the company is located or in Russia as a whole;

- to the officially recognized federal or regional inflation level;

- to increase the national or regional subsistence level for the working population;

- to an increase in the minimum wage in the whole country or region.

If none of these indicators are satisfactory, then there is no indication anywhere that it is impossible to establish a specific coefficient by which wages will be regularly indexed.

It is important that a document regulating the indexation of earnings be developed and approved and its requirements be fulfilled unquestioningly .

Employer's liability

In connection with violations of labor legislation committed by the employer, employees also have the right to apply to the state labor inspectorate of a constituent entity of the Federation with a request to conduct an unscheduled inspection to ensure compliance with labor legislation.

Since employers are required to index wages, ignoring such an obligation may result in administrative liability under Part 1 of Art. 5.27 Code of Administrative Offenses of the Russian Federation:

“Violation of labor legislation and other regulatory legal acts containing labor law norms, unless otherwise provided by parts 3, 4 and 6 of this article and article 5.27.1 of this Code, entails a warning or the imposition of an administrative fine on officials in the amount of one thousand to five thousand rubles; for persons carrying out entrepreneurial activities without forming a legal entity - from one thousand to five thousand rubles; for legal entities - from thirty thousand to fifty thousand rubles.”

If the employer continues to brazenly violate the requirements of the Labor Code of the Russian Federation regarding salary increases, then if the violation is detected again within a year from the date of imposing an administrative penalty for the same violation, administrative liability will increase.

What components of earnings need to be indexed?

To carry out mandatory indexation of wages, it is enough to index its constant part - salary, tariff rate, piece rate. In most companies, all other parts of earnings - allowances, bonuses, as a rule, are tied as a percentage to the constant component. Therefore, their increase will naturally lead to an increase in everything else.

But you need to take into account that if at an enterprise, allowances and bonuses are fixed in labor, collective agreements or in the Regulations on remuneration in a specific figure, then their indexation in this case will not entail the indexation of allowances and bonuses. And then the indexation of earnings will be partial. Therefore, it cannot be assumed that due to rising consumer prices, workers did not lose wages.

Therefore, in organizations in which the payment of allowances and bonuses is made in fixed amounts, it is advisable to include them in the local regulatory document on earnings indexation in order to carry out full indexation.

Dependence of wages on the selected indexation coefficient

When choosing a coefficient on the basis of which the organization will periodically adjust employee salaries, it is necessary to first calculate what workers will be able to receive for their work in the end.

Example #1. Options for calculating salary indexation

Let's consider how an employee's earnings will change in 2021 at Alpha LLC compared to 2015, provided that he meets all planned targets and does not violate the work schedule. For clarity, we summarize the calculation results in the table below.

In 2015, Ivanov received a salary of 30,000 rubles. Every month he receives a bonus of 15% for fulfilling the plan and 5% for the absence of violations of labor regulations.

Let's calculate the salary for various salary indexation coefficients (options 1-3).

Salary recalculation takes place annually on January 1, his salary is indexed to the level: (click to expand)

- Option 1: Minimum wage set for the new year compared to last year.

- Option 2: at the officially planned inflation rate for the next year

- Option 3: by the earnings indexation coefficient established in the organization -1.05.

Ivanov’s earnings in 2015, taking into account allowances, will amount to 36,000 rubles.

Calculation according to Option No. 1

The minimum wage in the Russian Federation in 2015 was 5,965 rubles. For 2021 it is set at 6204 rubles.

Therefore, the coefficient of increase in earnings depending on the increase in the minimum wage will be:

6204 / 5965 = 1,04

Ivanov’s earnings in 2021 under option 1 will increase by 4%:

36000 x 1.04 = 37440 rubles

Calculation according to Option No. 2

For 2021, the authorities have set an inflation rate of 6.4%. Earnings will also increase by this percentage:

36000 x 1.064 = 38304 rubles

Calculation according to Option No. 3

In 2021, earnings under the 3rd option will be:

36000 x 1.05 = 37800 rubles

| Option | Earnings in 2015, in rubles | Earnings 2021, in rubles | Amount of real increase in wages, rubles |

| Option 1 | 36000 | 37440 | 1440 |

| Option 2 | 36000 | 38304 | 2834 |

| Option 3 | 36000 | 37800 | 1800 |

The example clearly shows that the level of wage indexation directly depends on the chosen indexation indicator.

Dependence of the amount of wages on the chosen indexation coefficient and the adopted method of material incentives for workers

Employee incentives can be made either as a percentage of salary, tariff rate or piece rate, or be a constant value.

Example #2. Calculation of salary indexation with bonuses and allowances

Let's consider a situation where Ivanov is not given monthly bonuses as a percentage of his salary, but is paid a fixed bonus of 6,000 rubles for the same indicators. And we will accept that only salaries are indexed at the enterprise. We will leave all other data unchanged.

The result of the event is shown in the table below. (click to expand)

| Option | Earnings 2021, in rubles | Amount of real increase in wages, rubles |

| Option 1 | 37200 | 1200 |

| Option 2 | 37920 | 1920 |

| Option 3 | 37500 | 1500 |

From this example it is obvious that with this method of bonuses and indexation of only salaries, workers seriously lose in earnings.

Choosing an indexation coefficient as a way to protect workers' rights

We looked at only 2 examples. In fact, there are many options. The conclusion suggests itself. The level of indexation depends on the specific parameters prescribed in the Regulations on remuneration and material incentives, and in the regulatory act on indexation of earnings.

The team of any enterprise has the opportunity to influence the level of indexation through the remuneration system and its indexation indicator.

The employer can direct its responsibility in the direction it needs to go, increasing the interest of employees and reducing staff turnover.