Definition of part-time work

Part-time work is a reduced amount of time that an employee is willing to spend on performing his or her job duties.

The practice of part-time work exists in many companies, but it is not available to all employees, but only to people belonging to the following categories of citizens:

- employees on maternity leave and those wishing to leave it early;

- workers with disabilities and health problems;

- workers who combine work in several places at once;

- workers who are faced with difficult life circumstances that require a reduction in working hours;

- employees who wish to change working conditions if they have a positive labor reputation or long experience and length of service.

Obviously, to shorten the working day or week, you need at least a good reason. It is also worth considering that the maximum period of stay for a part-time employee should not officially exceed six months.

The decision to transfer an employee belonging to any of these categories to part-time work must be approved by both the employee and the employer. For example, an employee can work four or three days a week instead of the required five, or he can work six hours instead of eight according to the general rules of the Labor Code of the Russian Federation.

Only all this must be officially agreed upon with management and established in accordance with official regulations. In this case, the wage rate is cut and calculated based on the amount of salary, bonuses and other social benefits to the employee. Please note that a part-time employee has the same rights and benefits as other full-time employees. He is also provided with vacation within the period established by the employment contract and taking into account all vacation payments. An entry in the work book about part-time work is not provided: in this case, there is no need to put any notes in the document.

We will tell you in more detail about how to calculate wages for an employee who has decided to switch to part-time work.

What to write in an employment contract

Text of Art. 93 of the Labor Code of the Russian Federation does not make it possible to unambiguously determine how to formulate the conditions of a part-time working week in a contract or additional agreement. There is no consensus on this issue today.

Quite often, the personnel service indicates the monthly salary according to the staffing table for a full month, and then makes a note that payment is made in proportion to the time worked, and lists the conditions of the reduced work schedule (days of the week, hours). An employee who wants to determine the actual accrual amount for the month has to do this by calculation.

Note that Art. 57 of the Labor Code of the Russian Federation insists on the need to include the working conditions of a specific employee in the employment contract. Information about his remuneration should also be as specific as possible. Therefore, it is advisable to indicate in the document exactly the remuneration already calculated according to the individual work schedule, in addition, the schedule itself: “Working days - Monday, Wednesday, Friday”, “Working days - Monday, Wednesday, Friday, from 9 to 13 hours " and so on.

The latter position is defended by labor inspectorate officials both in official comments and when applying it in the practice of inspections of organizations. According to the logic of the regulatory authorities, the employee must be paid the amount specified in the employment contract. An employer may find itself in a situation where it is required to pay for a full working month, while the employee has only partially worked that month’s working time.

On a note! The concepts of “part-time” and “reduced” working hours are different. In case of part-time work, wages are calculated proportionally, and in case of reduced work, the employee generally receives the same salary as if he had worked the whole day or week (Article 92 of the Labor Code of the Russian Federation).

Procedure and formulas for calculating wages

To calculate wages for a part-time employee, let’s first familiarize ourselves with how wages are calculated in general.

There are two formulas for this. The first formula is called time-based. The procedure for calculating wages using this formula depends only on the time actually worked, and the amount of products produced during this period is not taken into account.

The second formula is piecework. Here it is considered unimportant how many products the employee produced during the time actually worked. Payments are made regardless of the volume of products produced.

The given formulas for calculating wages are used based on the employee’s form of remuneration.

If an employee is paid on a piece-rate basis , then the formula for calculating his wages will be as follows:

Salary = cost of production * volume of production for the specified period + bonuses + other additional payments - income tax - salary deductions (if provided).

If the employee is paid on a time basis , then wages will be calculated using the following formula:

Salary = salary * number of days actually worked + bonuses - income tax - salary deductions.

To calculate wages for part-time work, there are 4 formulas:

Formula for calculating wages for an incomplete month:

Salary = payments due / number of working days for the reporting period * actual time worked.

Formula for calculating wages per day worked:

Salary = payments due / number of required working days for the reporting period.

Formula for calculating salary for the year:

Salary = due amount of salary for the year / number of months / 29.3.

Formula for calculating salary taking into account vacation:

Salary = salary / total number of working days for the reporting period * number of days actually worked per month.

How to calculate salary for a full month

When calculating salaries, it is important to remember one simple rule. If during a month a person who works part-time did not take vacations, sick leave, did not go on a business trip or skip work, then for this month he must receive the salary specified in his employment contract. In this case, it does not matter how many working days and hours are listed according to the standard production calendar. By the way, a similar rule applies to employees who have full working hours.

Example 1: salary calculation for a full month

According to the company’s local regulations, with a 40-hour work week, the cashier’s salary is set at 60,000 rubles. Anna Mikhailova's employment contract states that she has been hired as a cashier. At the same time, she has a 10-hour work week with the following schedule: 2 working hours daily from Monday to Friday, Saturday and Sunday are days off. According to her employment contract, Mikhailova’s salary is 15,000 rubles. per month.

In January, February and March 2021, Mikhailova had no vacations, sick leave, business trips or absenteeism. She worked all working days for 2 hours. For January, February and March she was credited with 15,000 rubles. per month.

Olga Fedorova’s employment contract states that she was hired as a cashier on a 40-hour workweek with a salary of 60,000 rubles. In January, February and March 2021, Fedorova had no vacations, sick leave, business trips or absenteeism. For each of these months she was credited with 60,000 rubles.

How to calculate wages for a part-time employee

The wages of a part-time employee are calculated based on the number of hours actually worked. To make the calculation, it is necessary to divide the quantitative size of the minimum wage by the number of hours worked and multiply by the time of work. Let's look at a clear example of such a calculation.

Let’s say that a certain employee switched to a shortened working day: 5 days a week, 6 hours of work. The salary is 25 thousand rubles. In total, for a single month, the employee worked 125 hours per month (including all weekends and holidays). 167 hours per month is standard working time. So, now we calculate wages:

Salary = 25,000/167*125 = 18,712 rubles.

This is the amount of salary for a part-time working month.

Comments Calculation example

Example: June 2013, 8 days worked, salary 4,000 rubles. July 2013 - 9 days - 4500 rub. August 2013 - 9 days - 4500 rub.

Average daily earnings = (4000+4500+4500)/(8+9+9)=500 rubles. /day

If the company has a 5-day working week, then in June, July and August there were 19, 23 and 22 working days, respectively. That is, the average monthly number of working days = (19+23+22)/3=21, 333 days

Therefore, the average salary for calculating unemployment benefits = 500 * 21, 333 = approximately 10,666 rubles.

Sincerely, HR specialist Nadezhda Denisenko.

How is overtime paid for part-time work?

According to the Labor Code of the Russian Federation, the number of hours worked during part-time work should not exceed 40 hours per week. However, it happens that an employee spent more time on work than provided for in the employment contract and legislation. In this case, he is entitled to additional payments for overtime. It is only worth noting that, to begin with, management must agree without hesitation that this time was indeed overtime, and it has no claims to additional payment for overtime. But, alas, this happens extremely rarely. To do this, the employee must keep accurate records of hours worked, having previously obtained his written consent to this. This practice is not yet widespread in our country.

However, if an agreement on payment for overtime hours worked is reached, then for the first two hours the employee will receive payment at one and a half times the rate, and for subsequent hours - at double the rate.

It happens that an employee stays late at work of his own free will - in this case, no additional payments should be provided to him for this.

Rate the quality of the article. Your opinion is important to us:

Average wage for part-time work for calculating unemployment benefits.

Sections - Human Resources Department

Topics - Parental leave (maternity leave) - Dismissal, transfer, liquidation - Miscellaneous issues OK

Sincerely, HR specialist Nadezhda Denisenko.

— Resolution of the Ministry of Labor of the Russian Federation of August 12, 2003 N 62 “On approval of the Procedure for calculating average earnings to determine the amount of unemployment benefits and scholarships paid to citizens during the period of vocational training, retraining and advanced training in the direction of the employment service authorities”

Consultant's response published 01/19/2014 Legislation may change

- Comment

Free legal assistance

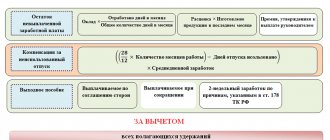

If there are incomplete months of work in a period, the following formula is used: Where N is the total number of months fully worked; D is the number of days of the month that was not fully worked; P is the total number of days fully worked. If there are holidays, it must be remembered that the amount of wages of an employee whose monthly salary is established does not in any way depend on the total number of non-working days in the month - holidays. This point is reflected in Article No. 122 of the Labor Code of the Russian Federation.

- vacation (annual, paid);

- various types of business trips;

- days of absence from work due to illness - confirmed by a certificate of incapacity for work;

- strikes (however, the employee himself should not participate in them).

25 Jul 2021 jurist7sib 108

Share this post

- Related Posts

- Date of approval of the vacation schedule for the next year

- What benefits are granted to inventors?

- One-time benefit from social security at the birth of a child

- Customs Declaration of Vehicles This is 2021

Calculation of average earnings - general rules

At the legislative level, the mechanism for calculating average earnings is established in the stat. 139 of the Labor Code of the Russian Federation and Government Decree No. 922 of December 24, 2007. It says here that a single calculation procedure applies for all employers. It does not matter in what area the organization operates, what its organizational and legal form is, what SOT (wage system) is adopted at the enterprise and what regime the specialist works under.

To calculate the average salary, you need to take into account all the employee’s income, according to the organization’s SOT, without taking into account the source of payment of funds. The list of income that is included in the calculation is given in paragraph 2 of PP No. 922. This is, for example, salary, including in non-monetary form; surcharges and allowances; bonuses; payments for working conditions, etc. Various social payments and others that are not provided for by the employer’s SOT are not taken into account (clauses 3, 5 of PP No. 922).

According to general rules, the average salary is calculated for 12 months. During this period, the employee's income is determined. This figure is then divided by the billing period. The number of days in the billing period may vary and depends on the purposes of calculating average earnings. If the goal is to accrue vacation pay, the formula is applied:

- SDZ (average daily earnings) = Income for 12 months. / 12 / 29.3.

In most other cases, the formula applies:

- SDZ = Income for the billing period / Number of days worked in the billing period.