Labor Code: business trips, payment

How are employee travel days paid: from average earnings or is the salary simply issued? As Art. 167 of the Labor Code of the Russian Federation, when an employee is sent on a trip, he is guaranteed the preservation of his job and average earnings (clause 9 of Regulation No. 749 of October 13, 2008), as well as reimbursement of expenses. Therefore, during his stay on a business trip, he should be paid such earnings.

Payment for business trips is usually made on payday. Accounting calculates the average amount that an employee could receive at his place of employment, and then issues it along with an advance or monthly payment.

What is average earnings

Average earnings (AE) is the average amount of wages, other payments and remunerations paid by the employer to the employee in the billing period.

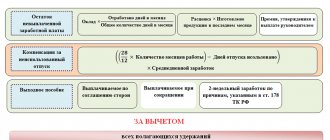

The procedure for calculating SZ is indicated in Art. 139 of the Labor Code of the Russian Federation and Government Decree No. 922 of December 24, 2007. Under any labor regime, the calculation of such wages for an employee is made based on the salary actually accrued to him and the time actually worked by him for the 12 calendar months preceding the period during which the average salary is retained for the worker . Average daily earnings are determined by the formula:

The average salary for a business trip is calculated using a simple formula: the average daily salary is multiplied by the number of days worked away from the main location:

Calculation example

Let's give an example: engineer Semyon Nikolaevich Petrov receives a monthly salary of 30,000 rubles. His annual income is 360,000. The average number of working days is 191 days per year. The business trip lasted 4 working days. The average daily income of an employee in this case: 360,000 / 191 = 1884 rubles. For the trip, Semyon Nikolaevich will receive 1884 × 4 = 7536 rubles.

Since all the days were work days, he will not lose anything in income.

Also, in addition to working hours, the head of the enterprise must pay the employee’s expenses during a business trip (for example, the cost of travel tickets, renting a hotel room, meals). Payment for travel allowances is made only if the employee has supporting documents confirming the expenses.

There is such a right

Not all employees have the right to receive sick leave benefits in the amount of 100% of average earnings, since the figure depends on the length of insurance coverage.

And sometimes such benefits are calculated based on the minimum wage. an additional payment for sick leave up to average earnings comes to the aid of such personnel .

In case of temporary loss of ability to work, the employee is paid sick leave benefits, calculated on the basis of average earnings. The calculation period is taken as two years preceding the year in which the insured event occurred.

The Social Security Fund limits the value at which days of absence are paid. So, in 2021, the maximum income for the billing period is equal to:

- Is sick leave considered income?

- What to do if you have extended sick leave for pregnancy and childbirth

- What to do if your employer does not accept electronic sick leave

- What to do if you are not given sick leave

- How many days does it take for sick leave to arrive from the Social Insurance Fund?

- What to do if the place of work is not indicated on the sick leave

- Are sick leave taken into account when calculating maternity leave?

- RUB 1.388 million / 730 day (number of days in 2015 + 2021) = 1901.37 rubles/day.

Amounts above these limits are not taken into account when calculating sick leave and are not paid. But the law does not prohibit the employer from making additional payments to the average salary on sick leave for the missing amount.

Remember: providing employees with such additional payment is the right, not the obligation of the employer!

Operating period for calculation

What period of work should be taken into account when calculating SZ for a business trip?

The calculation is based on the previous 12 months and the salary paid during this period. It is important to remember that only working days are taken into account, not calendar days.

If a worker is sent to a task in the first month of work at an enterprise, then his SZ will be calculated for the period from the first working day in the company to the first day of the trip (clause 7 of the Regulations, approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922).

The calculation includes payments provided for by the current wage system.

Excluded days

The period for calculating working days for determining SZ does not include:

- vacation days;

- days of illness confirmed by a certificate of incapacity for work;

- weekends and holidays;

- time of maternity leave;

- downtime due to the fault of the employer;

- vacation “at your own expense”;

- time of previous business trips;

- additional paid days to care for children with disabilities.

Calculation of SZ without taking into account the above periods is called with excluded days.

Calculation example for excluded days

This example considers the calculation of travel allowances with excluded days, which were the days of regular annual leave.

The business trip lasts from July 1 to July 3, 2021, 3 working days. To calculate, you need to take the amount of payments from 07/01/2018 to 06/30/2019. Monthly salary is 15,000 rubles:

- for the period from 07/01/2018 to 03/31/2019, the employee was accrued 135,000 rubles;

- From April 1 to April 30, the employee was on vacation, vacation pay amounted to 15,358 rubles. 36 kopecks;

- from May 1 to June 30 he received 30,000 rubles;

- the total amount of payments for 12 months will be 180,358 rubles. 36 kopecks

Actual salary received:

- RUB 180,358 36 kopecks – 15,358 rub. 36 kopecks = 165,000 rubles.

Since vacation time is not included in the calculation. For the period from 07/01/2018 to 06/30/2019, according to the production calendar, there are 247 working days. 22 of them occurred during vacation. There is no need to take them into account. All other days were worked in full by the employee. SZ will be calculated as follows:

- 165,000 / 225 working days = 733.33;

- 733.33 × 3 working days of business trip = 2199.99 rubles.

Remuneration for temporary replacement

The opinion of the forum administration may not coincide with the opinion of the forum participants.

The forum administration is not responsible for messages posted by forum participants. Chat is temporarily suspended! Hurry up to order! Work during parental leave and leave experience.

Filling out the work book of the dismissed employee in advance. You can fire someone for absenteeism, or you can fire them for “repeated failure to fulfill job duties.” What to choose? Relocation Order.

Amendments have been made to Art. Changes have been made to part Firmware, seal. Hurry up to order at old prices!

Our policy regarding the processing of personal data.

Remember me Registration Forgot your password?

Login as user. You can enter the site if you are registered on one of these services:. Use your account on .

Use your Odnoklassniki account.

Use your ontakte account to log in to the site. Use your Yandex account to log into the site. HR Forum. Personnel records management. Good day! Please tell me how to correctly formulate in the order the text about the additional payment for performing the duties of an absent employee, and whether it is necessary to write a specific amount if the following is: “to establish an additional payment for Vadim A.

Good day! Please tell me how to correctly formulate in the order the text about the additional payment for performing the duties of an absent employee, and whether it is necessary to write a specific amount if the following is: “to establish an additional payment for Vadim A.

Messages: Points: Registration: Quote Guest writes: is it necessary to write a specific size. Thank you, for example, if you agreed to an additional payment in the amount of the difference from the salary for a combined position, should you indicate the full amount of the salary, or just the difference? Nadezhda Beketova. Quote Guest writes: Please tell me how to correctly formulate in the order the text about additional payment for performing the duties of an absent employee.

Question: How to correctly calculate the salary for the period of performance of duties of a director who is on vacation?

The duties of the director were assigned to another employee by order with payment of the difference in salary. The substitute director and the director himself have different remuneration systems. The substitute's salary is rubles. The director's salary is 16 rubles.

Somova, accountant, Kolomna Answer: The Labor Code of the Russian Federation does not contain specific instructions on the remuneration system for temporary positions. In this case, the amount of the additional payment is established by agreement of the parties Art. It states that the replacement employee is paid the difference between his actual official salary, personal salary and the official salary of the replaced employee without personal allowance.

Temporary substitutes are awarded bonuses according to the conditions and in the amounts established by the position of the employee they replace.

Thus, the difference between the actual salary of the replacement person and the director’s salary will be 10 rubles. If the replacement was carried out from November 16 to November 27.

There were 20 working days in November, 10 of which were during the replacement period. The additional payment amount will be RUB. The calculation of bonuses depends on the bonus system adopted by the organization, which may establish a separate procedure for calculating bonuses for the difference in salaries when filling positions.

If there is no provision for bonuses at the enterprise, then the additional payment in the form of a bonus, the amount and conditions can be settled by agreement of the parties, Art. Since the order indicates the additional payment only in the form of a difference in salary, but does not say about the bonus, it means that the bonus is not accrued in addition to the recalculation. Signed for print Quote Guest writes: Combination.

The topic is read by guests: 1, users: 0, of which hidden: 0. Cart 0 items worth 0 rub. Electronic newspaper on personnel records management News of labor legislation Summer easy course on the basics of personnel records management for beginners - Notifications about discounts and promotions Site news.

Mini-test “Carrying over annual paid leave.”

Take the test All site tests. Books on personnel records management.

Log books and registration. Our policy regarding the processing of personal data All rights reserved.

Remember me. Forgot your password?

Magazine “HR Practitioner” Subscription rub. HR Forum HR Forum.

HR records management Payment for the performance of duties We welcome you to the forum of HR professionals and newcomers to HR, dear colleagues!

Our forum has already answered more than most of the questions.

Please be mutually polite. Our forum is for pleasant professional communication, cooperation and mutual assistance. Vadim A V. Nadezhda Beketova V.

To pay the difference in salaries during the period of leave of the head of the department, are bonuses awarded to employees of budgetary organizations - for length of service, personal bonus, hazard bonus and on what basis?

Entire site Legislation Standard forms Judicial practice Explanations Invoice Archive In accordance with Resolution of the Ministry of Labor of Russia dated 03/04/1993 N 48, which approved Explanation dated 03/04/1993 N 4 “On the procedure for establishing additional payments and allowances for employees of institutions, organizations and enterprises receiving budgetary funding » the amount of additional payments and bonuses of an incentive nature, including for the performance of work not included in the scope of the employee’s main duties, within the limits of funds allocated for wages, are determined independently by institutions, organizations and enterprises receiving budgetary funding.

The amounts of additional payments and bonuses for employees are not limited to maximum amounts and are determined depending on the quality and volume of work performed by them.

It should be borne in mind that the qualifications of employees and the complexity of the work they perform (the presence of a qualification category, honorary title, academic degree, etc.) are taken into account in the rates and salaries determined on the basis of the Unified Tariff Schedule.

Additional remuneration for performing the duties of temporarily absent employees (in our case this is exactly the situation) is guaranteed by Article 87 of the Labor Code of the Russian Federation.

Employees who, at the same enterprise, institution, organization, along with their main work stipulated by the employment agreement (contract), perform the duties of a temporarily absent employee without being released from their main job, are paid additionally for performing the duties of a temporarily absent employee (hereinafter referred to as - additional payment for replacement). Thus, current legislation guarantees additional payment, and not payment of the difference in salaries. This fact is essential for calculating additional payments that can be established for employees in their main profession (position).

The amount of additional payments for performing the duties of temporarily absent employees is established by the administration by agreement of the parties.

In this case, you should pay attention to the following: 1) if the duties of managers are assigned to their deputies or assistants, no additional payments are made, since the very duties of the positions of deputies and assistants, as well as their status, imply the performance in the absence of managers (supervisors) of them responsibilities; 2) since the cost estimate of a budgetary organization (payroll fund) provides for allocations based on the staffing structure of the organization based on official salaries, allowances and additional payments established for employees, then additional payments for the performance of duties of temporarily absent employees (in particular, those on vacation and receiving average earnings from the same fund) can only be allocated to wage fund savings achieved as a result of the release of workers (vacancies), illness of workers (state social insurance benefits are paid from the Social Insurance Fund, not the wage fund) or leaves of employees without pay. Otherwise, without additional appropriations, the budget organization will exceed labor costs, which is not allowed under budget financing conditions. Thus, employees performing the duties of temporarily absent employees may be given an additional payment by order of the administration for performing additional work (responsibilities) without limiting the amount, but in compliance with the regime of saving budget allocations and reasonable payment for additional work (responsibilities).

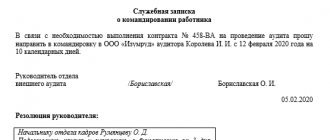

The replacement is formalized by order of the manager, indicating the profession (position) being replaced, the amount of additional work, the amount of additional payment and the period.

Registration of cancellation or reduction of additional payment for replacement is also carried out by order of the enterprise. Due to the fact that the amount of additional payment for replacement is determined by agreement of the parties, taking into account the volume of additional work performed, other types of additional payments to which the employee is entitled in his main profession (position) (including additional payment for length of service, personal allowance, additional payment for harmfulness) are not charged for additional payments for combinations, and this is not provided for by current legislation. Whether an employee has the right to a personal additional payment, or an additional payment for harmfulness, or the presence of a long work experience can be taken into account when establishing the amount of additional payment for replacement.

As for the production of a hazard bonus for working on a personal computer, it should be noted that the current legislation does not provide benefits for employees directly related to working on personal computers for working conditions (see, for example, Letter of the Federal Fund for Compulsory Medical insurance dated 02/09/1996 N 577/91-I “On benefits for working on personal computers”, based on the Fund’s appeal to the Russian Ministry of Labor). The administration of enterprises, in turn, is responsible for creating normal working conditions for workers whose work is associated with personal computers. To create normal working conditions, one should be guided by the Temporary Recommendations of the Labor Research Institute for Improving Working Conditions for Operators Behind Displays (1986), as well as the Temporary Sanitary Standards and Rules for Computer Center Workers, approved by the USSR Ministry of Health (1988), which stipulate requirements for organization of workplaces, rational work and rest schedules, etc.

At the same time, on the basis of Article 5 of the Labor Code of the Russian Federation, the administrations of enterprises, institutions and organizations have the right to establish, at their own expense, additional, in comparison with the legislation, labor and social benefits for employees of a collective or certain categories of employees. In budgetary institutions and organizations, funds received from the provision of paid services not related to entrepreneurial activities (for example, in educational institutions) or funds received from engaging in entrepreneurial activities can be used for such purposes. Budget funds cannot be used to provide additional benefits.

Thus, one should question the legality of making additional payments for work on a personal computer if it is carried out at the expense of budgetary allocations. The procedure for paying for temporary replacement can be illustrated with the following example. Example.

The head of a department of a budgetary organization (official salary according to the staffing table is 850 rubles) has been granted annual leave of 24 working days until November 27 from November 1. The employee, in addition, has the right to receive a bonus for length of service in the amount of 30%, as well as a bonus for complexity, tension and special work hours in the amount of 20% of the official salary. According to the staffing structure, the position of deputy chief or assistant is not provided.

During the vacation, the duties of the chief are assigned to a senior employee of the department (official salary according to the staffing table - 680 rubles). The employee is also paid: a long service bonus - 25%, a personal bonus - 250 rubles. At the expense of funds received from permitted paid activities, the employee is given an additional payment for work on a personal computer in the amount of 12%.

When establishing the amount of additional payment for replacement, the following must be taken into account: 1) the amount of savings in the budgetary organization's wage fund achieved on the date of the department head's departure on vacation. All staff positions in the organization are filled. Let’s say that during the year, according to the payroll using the Social Insurance Fund, employees were sick for only 82 person-days, as a result of which savings on temporarily vacant positions of 4,100 rubles were achieved in the wage fund; 2) the salary of the head of the personnel department according to the wage fund for the missing 24 days of vacation (or about 20 workers according to a five-day workweek schedule) will be about 1215 rubles, and based on the official salary - 810 rubles.

3) the additional payment for replacement should be limited to 4100 rubles.

(otherwise there may be an overexpenditure on the wage fund) and 810 rubles.

(additional payment for length of service and allowance for special work modes are targeted in nature, therefore they are not recommended for calculation) provided that the employee is entrusted with performing responsibilities in the amount of 100% of the work. Exceeding the amount of 810 rubles. will mean the fact that the replacement payment will exceed the salary of the head of the department provided for in the staffing table, which is purely theoretically unlikely and undesirable.

Considering the fact that theoretically it is impossible to entrust the replacement employee with 100% of the work as a supervisor, the administration made an initial decision to establish an additional payment of 70%, that is, 570 rubles. (810 x 70%). However, due to the employee’s right to a personal allowance, and the fact that fulfilling the duties of a department head also involves developing documents on a PC, the amount of the additional payment has been increased to 700 rubles.

The salary for November of a senior employee will be: official salary - 680 rubles; Long service bonus - 170 rubles. (680 x 25%); personal allowance - 250 rubles; additional payment for working on a PC - 81 rubles.

60 kopecks (680 x 12%); additional payment for replacement - 700 rubles; Total: 1881 rub.

60 kopecks. Signed for publication on December 15, 1999 “Accountant Consultant”, 2000, N 1

Payment for a business trip on a day off

Average earnings during a business trip are paid for working days, according to the organization’s schedule. Even if the business trip is long, only daily allowances are paid for days off. Average earnings in this case are not expected. After all, the employee does not work on weekends, but rests (clause 9 of the Business Travel Regulations).

There is an exception to this rule. If an employee nevertheless worked on a weekend or a holiday while on a business trip or was on the road, then during this time he must be paid as for work on a weekend. The Labor Code of the Russian Federation provides for two methods of payment for work on weekends and holidays:

- at a single rate of tariff if the employee takes an additional day off (time off);

- double the amount if the employee does not take time off.

Procedure for payment of additional payments and allowances

Supplements to wages are the desire of the employer; he pays them of his own free will. If last month a certain amount for production was added to the salary, but not next month, then there is no point in filing a complaint with the regulatory authorities.

Additional payments are made not at the request of management, but as required by regulatory documentation. If the employer does not pay additional amounts, for example, for harmful work, you can complain about him to the labor inspectorate, the prosecutor's office or the court.

In what cases is the employer obliged to pay bonuses?

There are certain categories of employees to whom employers are required to pay monthly bonuses. Their amount will not always be the same, but they must be accrued. This:

- Teachers. The monthly amount depends on the progress of students, on various types of extracurricular activities conducted by the teacher, etc. The amount of additional payment is determined on the basis of the assessment sheet.

- Librarians. Active work with readers, an increasing number of subscriptions, etc. are encouraged.

- Teachers and other preschool employees. Each preschool educational organization has its own bonus fund. 60% of it is distributed among the teaching staff, the remaining 40% among other employees.

- Cultural workers.

- Doctors, etc.

Compensation payments may be made subject to the following conditions:

- Difficult and harmful working conditions. Their “severity and harmfulness” are determined by the results of the assessment.

- Climate. Russia is divided into several climatic zones, each of which includes specific federal subjects. Based on this, additional funds are added to wages.

- Conducting work at night. Certain categories of workers, such as pregnant women, should not work at night.

- Transportation and forwarding of dangerous goods.

- Other legal grounds.

Important! The normal work schedule in Russia is 5 every 2 days. But there are productions that cannot be stopped, and you have to work under unusual working conditions. Additional payments are also made for this.

Employer's liability

Supplements are incentive payments that he makes at his own request. He is not obliged to report to his employees for them. He can explain to one employee why another has a larger additional payment. He can, but he doesn't have to.

If the manager of the enterprise decides that this month he will not reward his employees for a job well done, he may not do so. Even if there is a complaint to the regulatory authorities and, as a result, an inspection, the employer will not be held accountable.

But, if he decides not to pay, for example, “northern” to those people who work in the appropriate climate, this is not only a reason for complaint, but also a reason for prosecution. It is necessary to contact the labor inspectorate, the prosecutor's office or the court. The employer will be obliged not only to make all payments, but also to accrue compensation for them and pay it.

In addition, he will have to pay a fine for non-compliance with labor laws.

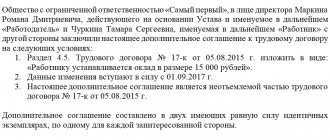

Additional payment up to average earnings

It happens that the salary calculated using the algorithm presented above is lower than the actual salary that the employee would have received if he had not been sent on a trip. The organization has the right to establish other methods of remuneration for an employee on a business trip. For example, it can be established that if the calculated average earnings turn out to be less than the salary, then the employee is paid additionally to the usual level of remuneration. This procedure must be reflected in local regulations. Then the cost of additional payment to the salary can be taken into account as part of the company’s expenses.

When establishing a different procedure for calculating payment for time spent on a business trip, you must remember that the Labor Code of the Russian Federation prohibits employers from worsening the position of the employee (Articles 8 and 9 of the Labor Code of the Russian Federation). After calculating remuneration for a business trip, the accountant will have to compare the result obtained with the value of the SZ, calculated according to the rules established in the Labor Code of the Russian Federation. After all, a situation may arise when the amount calculated according to the internal procedure turns out to be less than the SZ determined according to the rules described above.

In this case, the employee should be compensated for the difference between the average earnings due during the business trip according to the rules of the Labor Code of the Russian Federation, and the remuneration determined in accordance with the internal procedure for paying for business trips. It is necessary to stipulate this clause in an employment (collective) agreement or other local act, for example, in the Regulations on the remuneration of employees of the organization.

Additional payment with difference in salaries calculation

The amounts of additional payments and bonuses for employees are not limited to maximum amounts and are determined depending on the quality and volume of work performed by them.

It should be borne in mind that the qualifications of employees and the complexity of the work they perform (the presence of a qualification category, honorary title, academic degree, etc.) are taken into account in the rates and salaries determined on the basis of the Unified Tariff Schedule. Additional remuneration for performing the duties of temporarily absent employees (in our case this is exactly the situation) is guaranteed by Article 87 of the Labor Code of the Russian Federation.

What other travel allowances are due to an employee?

In addition to average earnings, the employer must reimburse the employee’s travel and accommodation expenses at the business trip location. Reimbursement of expenses is made on the basis of provided supporting documents:

- air and train tickets;

- taxi receipts (when traveling from the airport to your destination, for example);

- receipts for the purchase of fuels and lubricants (if the employee, in agreement with the employer, travels by personal transport);

- hotel accounts;

- lease agreements for other types of housing.

Also, for each day of a business trip, the employer is required to pay daily allowance. The amount of daily allowance is determined by the commercial organization independently. Their size must be approved in a local regulatory act (order of the manager, regulations on business trips).

Accounting for travel allowances

Accounting for settlements with seconded employees is kept on account 71 “Settlements with accountable persons” (Chart of Accounts, approved by Order of the Ministry of Finance dated October 31, 2000 No. 94n).

Documented travel expenses are taken into account as part of the current period's expenses in expense accounts. Postings for recording travel expenses

| Contents of operation | Debit | Credit |

| An advance was issued for a business trip | 71 | 50, 51 |

| Business trip expenses are included in expenses | 25, 26, 44 | 71 |

| Unspent accountable amounts were returned | 50, 51 | 71 |

What taxes do you need to pay on business trip payments?

Average earnings paid during a business trip are subject to personal income tax and insurance contributions in the same way as regular wages. But on reimbursed expenses for travel and accommodation, neither personal income tax nor insurance premiums are paid.

A special taxation procedure has been established for daily allowances. Thus, daily allowances within the limits of the standards are not subject to personal income tax or insurance contributions. The standards are established by paragraph 3 of Article 217 of the Tax Code of the Russian Federation:

- 700 rubles - for each day of a business trip in Russia;

- 2500 rubles - for each day of a business trip abroad.

Amounts of daily allowance in excess of the standards are subject to personal income tax and insurance premiums.

In order to recognize the payment of travel allowances as expenses taken into account when calculating income tax, it is necessary that they be justified and documented. If you have all the documents confirming payment for travel and accommodation, and the daily allowance is established in the LNA, then there are no obstacles to recognizing tax expenses.

How to determine the amount of additional payment for an employee on vacation

The smallest and largest amounts of a fixed amount are not fixed by law. The parties have the right to independently discuss currency incentives.

- the actual number of days worked is calculated;

- the amount of payments that has been accrued by this time is recorded;

- average earnings are multiplied by the number of days the employee is entitled to rest.

- the average wage is calculated based on the number of days according to the calendar of the period worked;