Registration has become easier

Also, by Decree of the Government of the Russian Federation of December 29, 2014 No. 1595, adjustments were made to certain legal acts regulating the performance of official assignments outside the place of work. Innovations are aimed at optimizing the flow of documents in the organization, reducing and simplifying such document flow.

Thus, since January 2015, the mandatory requirement has been abolished:

- on issuing a travel certificate to an employee;

- formalization of the official assignment in writing.

According to the newly established rules, the fact of being on a business trip is confirmed by tickets and/or other travel documents.

It is also possible for an employee to use personal transport for business purposes (on a business trip). To confirm such expenses, he must provide reporting documents: receipts, cash receipts, statements, waybills, etc.

The main goals of changes in business travel arrangements in 2017 and earlier were:

- simplification of document flow when sending on a business trip;

- improving the form of the report based on the results of completing the task by order of the employer.

In addition, according to the new rules, an employee sent on a business trip is not required to provide his superiors with a written report on the trip.

Stage 2: preparation of travel documents

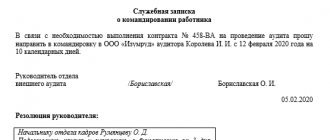

After determining the candidacy for dispatch and calculating the duration of the trip, an internal order is issued in writing - an order or instruction on sending on a business trip.

The order can be issued arbitrarily; it is important that the text makes it clear who the head of the organization is, who exactly is being sent, where and for how long. To issue an order, the unified form No. T-9 can also be used (if several employees are sent on business, form No. T-9a).

The text of the order specifies the duration of the business trip.

The purpose and objectives of the trip can be stated in the text. The person who has the authority to send employees on a business trip has the right to sign the order. It is also necessary for the traveler to familiarize himself with the order against signature - it is very useful, especially if the employee has low executive discipline.

If the internal company travel regulations require the execution of an official assignment, then it can be filled out in free form or according to the unified form No. T-10a. The job assignment specifies:

- last name, first name, patronymic of the seconded employee;

- place and duration of the trip;

- the purpose and tasks to be completed;

- contents of the report based on its results.

The assignment indicates the purpose and objectives of the business trip

The travel certificate is issued in form No. T-10, the following entries are made in it:

- about an employee sent on a business trip;

- about the duration of the business trip;

- about the place and purpose of the trip.

Notes are also made here about arrival and departure to destinations.

The certificate contains marks indicating arrival (departure) at the destination

The final stage is to prepare an estimate for the trip, this paper is signed by the chief accountant and manager. A cash order is issued using it and the amount required to purchase a ticket, pay for housing and stay during the entire trip is issued in advance. An advance is issued before the trip; failure to issue money before departure is considered a violation of the law.

On the day of departure, an entry is made in the business trip log about the employee being sent. The date of departure and arrival are counted towards the duration of the business trip, so presence at the workplace on these days is determined by the decision of management.

During all days of a business trip, a mark (K) or a digital code (06) is entered in the work time sheet in form No. T-13; the hours worked are not entered. The time sheet for the posted employee is filled out on the basis of the travel order. Non-working days and holidays falling on business trip dates are marked with the code РВ (or 03). This is necessary when calculating wages on weekends and holidays.

Working days of the traveler are marked with code (K), weekends and holidays (RV)

Key document in 2021

According to the same decree of the Government of the Russian Federation (No. 1595 of December 29, 2014), in 2021 business trips are issued on the basis of a written decision of the employer - an order, a directive. These changes to business travel in 2021 should already become a habit.

Keep in mind: business trips now include not only business trips on the instructions of the employer outside the place where the employee performs his official duties, but also trips to a structural unit of the enterprise (branch, representative office, etc.). It is located separately at a different address, in a different locality. Including within the administrative territory in which the employer’s organization is registered.

For more information about this, see “A separate division of an organization: what is it?”

The simplified business trip procedure does not require extensive paperwork, however, changes introduced to the legislation require more thorough documentary evidence of the costs incurred. This is done in order to control the financial activities of the enterprise. As a consequence, there is a complication in accounting for the property and financial position of the organization and its results.

Cost structure

Accounting transactions and reports on travel expenses are subject to the requirements of the Law; business trips in 2021 were not affected by changes in the structure of expenses. This still includes:

- earnings calculated on the basis of the average daily salary for the entire period of the official trip;

- payment for tickets for travel to the destination in the forward and return directions by air, railway, bus (except for taxi);

- compensation for expenses for the use of a subordinate’s own car when performing an official assignment as part of a business trip;

- hotel expenses (accommodation fees) or rental expenses;

- additional costs (this may include shoe repair, dry cleaning of clothes, purchase of goods and components for equipment, entertainment expenses).

Compensation for living expenses occurs in 2 ways:

- according to the documents provided - receipts, invoices;

- management allocates a clearly fixed amount established by the internal rules of the enterprise.

Also see “Regulations on business trips: what the 2017 model should be.”

The main change in 2021

Please note that the main change for business travel in 2021 affected daily allowance rates, which were not previously established for insurance premiums.

From January 1, 2021, insurance premiums are not charged only for a certain fixed amount of daily allowance:

- 700 rubles – for business trips within the Russian Federation;

- 2500 rubles – for foreign business trips.

However, please note that the Labor Code of the Russian Federation does not contain any restrictions on the employer’s right to set certain daily allowance rates when sending personnel on business trips to perform official assignments.

In 2021, an enterprise can independently determine the amount of daily allowance, which is also provided for in Art. 346.16 of the Tax Code of the Russian Federation (subparagraph 13, paragraph 1), and enshrine them in their internal acts. In this case, the organization deducts insurance premiums from the difference between the standard and the actual amount of daily allowances issued.

For more information about this, see “How per diem is assessed in insurance premiums from 2021.”

If you find an error, please select a piece of text and press Ctrl+Enter.

How to process a business trip in 2021 in accordance with the rules of labor legislation? What changes in the law should employers be aware of?

In modern business conditions, we can say with confidence that among large companies there are no those who do not send their employees on business trips. Their purpose may be the conclusion of an important contract, representation, sales of products, training, procurement... However, for whatever purpose the employer sends an employee on a trip, he must adhere to the accepted ones established by labor legislation.

The current labor code defines a business trip as a trip by an employee at the direction of the employer. Moreover, it lasts for a certain period of time necessary to fulfill the official assignment. Such an assignment can only be carried out outside the place of permanent work, which is why the need for a business trip arises.

Registration of a business trip: changes in labor legislation

Changes in labor legislation in 2021 did not bring significant changes to the procedure for registering a business trip. They only affected the procedure for calculating insurance premiums from certain daily allowance amounts.

The employer is prescribed a certain limit from which contributions are not deducted. So, for example, for trips around Russia it is 700 rubles. If you travel abroad, the minimum daily allowance from which contributions are not calculated is set at 2,500 rubles. At the same time, the legislator does not limit companies in calculating daily allowances, but only charges an insurance premium for the difference between the funds issued and the established limit.

Changes in labor legislation in 2015 had a much stronger impact on the procedure for registering business trips. Russian Government Decree No. 749, issued in October 2015, significantly simplified document flow by eliminating the use of a number of previously mandatory documents. These include: travel certificate and official assignment. Note that this resolution makes them optional for registration, but does not prohibit employers from using them in internal document flow along with other documentation.

What documents are not needed for a business trip?

Note!

The Government of Russia, by its resolution of December 29, 2014 No. 1595, abolished the need for an official assignment and a travel certificate. This rule has been in effect since January 8, 2015. At the same time, Articles 8 and 22 of the Labor Code give the employer the right to prescribe certain features of business trips in local regulations. If the employer deems it necessary, he can determine in the internal act of the company that drawing up a travel certificate and work assignment is necessary. In this case, employees will draw up documents in the manner established by the employer.

Since August 2015, the employer may also not fill out the logbook for employees leaving on business trips. This right was granted to him by Government Resolution No. 771, adopted on July 29, 2015.

What is considered a violation of business travel regulations?

When arranging a business trip, the employer must be guided by the current legislative norms. In accordance with them, his responsibilities include:

- Maintaining the employee’s average earnings;

- Maintaining your place of work and position;

- Payment of employee expenses related to the purchase of travel tickets, rental of living quarters, as well as additional expenses.

Failure to fulfill these obligations by the employer is considered a gross violation of the Labor Code and entails certain liability for the employer.

Duration of the trip

Please note that at the moment the legislation does not stipulate the maximum period for which an employee can spend on a business trip. According to current legislation, it can last as long as desired: from several weeks to several years.

At the moment, a business trip is considered to be any trip by an employee by order of the company’s management that lasts more than one day. If its duration is one day, registration follows the same rules, however, the employee’s daily allowance is not accrued.

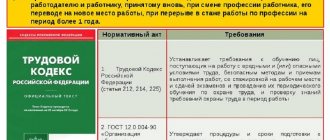

Which employees cannot be sent on business trips?

Any employer has the legal right to send an employee who constantly works in the same place on a business trip. For employees with a traveling nature of work (couriers, truck drivers), this is not a mandatory procedure. These rules do not apply to specialists engaged under a civil contract.

In addition, it is necessary to remember that there are categories of employees who cannot be sent on business trips or can only be sent with their written consent.

Reference

The first category includes:

- pregnant employees;

- employees during the period of validity of the apprenticeship contract (except for cases related to training);

- minors (except for employees of a number of creative professions and athletes);

- specialists working under the terms of civil law agreements.

When sending the following categories of employees, the employer must obtain their written consent, and also make sure that they have no medical contraindications:

- women with children under 3 years of age;

- single mothers or fathers with children under 5 years of age;

- parents of disabled children;

- workers caring for sick relatives (if there is a medical certificate);

Arranging for a business trip in 2021: step-by-step instructions

Arranging for a business trip requires compliance with a huge number of necessary formalities. In some cases, it is convenient to use the method of step-by-step registration of a business trip, which will make it possible to take into account all the nuances and not violate labor laws.

- We determine the purpose of the trip, its timing and place of travel.

- We issue the corresponding order according to the unified form T-9, approved by the State Statistics Committee, or the internal form of the organization, approved by local regulations.

- We record the fact of sending an employee in the accounting log. We enter into the document the full name of the seconded specialist, the name of the company to which he is sent, and his destination. If a unified form of the logbook for posting employees is used, put a dash in the line about the travel certificate.

- We fill out the time sheet (according to the unified form T-12 and T-13 or the approved internal form of the company). Business trip days are marked with code K. If an employee performed a business trip on his day off, we mark this day with codes РВ and К.

- We prepare an advance report in form AO-1.

- Upon the employee’s return, we hand over this document to him for completion and transmission to the accounting department within 3 days. If the specialist returned on a holiday or weekend, the transfer period is counted from the 1st working day after the day of return.

- We check the availability of documents confirming expenses (checks, receipts, receipt orders, contracts) and the fact of being on a business trip (railway or air tickets).

Changes in business trips from 2015 to 2017

Until 2015, the old Decree on the regulation of business trips was in force, which was repealed when new legal norms came into force.

The introduced innovations are largely aimed at reducing the volume of required documents when sending on business trips.

Now the business entity independently decides which documents it will draw up during a business trip. He must enshrine his decision on document flow in the Regulations on business trips and other local acts of the enterprise.

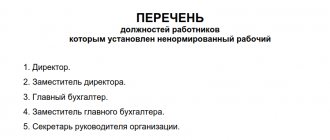

Required documents:

- The law requires that when sent on a business trip, a business trip order must be issued.

Optional documents that are drawn up at the discretion of the organization:

- Travel certificate.

- Service assignment.

- Business trip report

- As well as keeping a log of employees who departed and arrived on business trips remains at the discretion of the administration.

In this regard, another change was the procedure for determining daily allowances for business trips. If the organization does not use a travel certificate, then it must determine the time of departure and arrival of the employee, as well as the duration of the business trip in days, based on the travel documents submitted to him, receipts for payment for housing, checks for the purchase of fuel, etc.

Attention! An employee can also submit a memo or report addressed to the management, in which he declares the timing and period of the business trip in the absence of relevant documents, and if the manager accepts and approves it, then this document can also serve as confirmation in this case.

What documents will be needed to register a business trip?

The list of documents required for registration of a business trip, as well as their samples, is contained in the current labor legislation. If regular business trips of subordinates are a regular practice in the organization, it is advisable to develop the company’s own Business Travel Regulations. This document must contain all the details: the amount of daily allowance, rules for reimbursement of expenses, etc. This local regulatory act determines all the nuances of processing business trips in a specific organization.

Reference

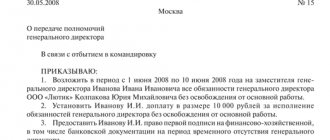

Order to send an employee on a business trip

This document is drawn up according to the unified order form No. T-9 or T-9a (for two or more employees). It is filled out by the HR employee. Until 2015, the issuance of such an order required the presence of an official assignment. Registration of a business trip in 2017 no longer requires its presence; therefore, the employer can formulate the goals and objectives of the trip directly in the order.

Mandatory information recorded in the document includes: full name of the seconded specialist, structural unit, position, purpose and timing of the trip, destination. Sometimes the sources of payment for travel expenses and the necessary additional conditions are also indicated.

Travel certificate

This certificate serves as evidence of the employee’s legal absence from the workplace and accompanies him throughout the entire work trip. Despite the fact that its registration has become optional since December 2014, many employers still use it for the convenience of processing business travel. For this document, there is a unified form recommended by the State Statistics Committee - form T-10. It is filled out by a representative of the HR or accounting department in one copy. The basis is the corresponding order for the organization.

The front side of the document contains information about the organization, date and number of the order, data of the seconded specialist, information about the destination and goals. During the trip, the certificate indicates the dates of arrival and departure at each location. Marks are made from the receiving companies, which are certified with the seal and signature of their managers. Upon the employee’s return, the document is transferred to the accounting department along with an advance report and a report on the completion of the task.

Service assignment

This document is not mandatory, but is still present in the document flow of many organizations, because significantly simplifies the procedure for registering a business trip.

The employer can use form T-10a, recommended for use by Resolution of the State Statistics Committee of the Russian Federation No. 1.

Reference

The document contains:

- full name and details of the company;

- document number and date of its preparation;

- Full name of the employee and his personnel number;

- department and position held;

- place of business trip;

- dates and duration of the specialist’s stay on the trip;

- exercise;

- report on the completion of a business trip;

After returning, the specialist must agree on the task with the head of the department and submit it to the organization’s accounting department for drawing up a report and reimbursement of travel expenses.

What has changed in travel arrangements?

Changes in legislation regarding the preparation of documents when sending specialists affected the completion of:

- travel certificate;

- travel log;

- official assignment;

- trip report.

Now the requirements to fill them out have been canceled. The Labor Code of the Russian Federation and the Regulations on Business Travel do not say anything about these documents, which were previously considered mandatory.

However, if the head of the company considers it necessary to maintain such documentation and introduces such a rule into the internal regulations on business trips, then the following must be prepared:

- travel certificate;

- official assignment;

- business trip registration log (a record is made about the traveler).

After returning, the employee submits a trip report.

The following must be completed:

- order to go on a business trip;

- advance travel report.

The order is issued by the manager, the document is signed by an official authorized to send employees on a business trip. And the traveler prepares an advance report after his return. An important point: if the duration of the trip changes, an additional order is issued to extend the duration of the trip or cancel it.

There is no longer any need to obtain a travel permit

The employee is familiarized with orders to be sent on a business trip, to extend its duration, or to be recalled from a business trip against signature. Before issuing the order, the employee is notified of the change in the duration of the assignment.

Manager's order on business trips in 2021

An employee can be sent on a business trip only by written order of the manager. This is where the documentation of the business trip in 2017 begins.

Such an order can be made in the form of an order assigning a business trip. The need for this document is dictated by the norms of labor and related legislation (part 1 of article 166 of the Labor Code of the Russian Federation and paragraph 2 of paragraph 3 of the Regulations on business trips, approved by Decree of the Government of the Russian Federation of October 13, 2008 No. 749).

As follows from these norms, a business trip is considered to be a trip by an employee by order of management. In this case, by his order, the head of the company confirms the official nature of the business trip.

Please note that there is a category of employees whose work is traveling. Trips of such employees are not considered official and do not require a separate order for each trip (Part 1 of Article 166 of the Labor Code of the Russian Federation).

You can issue a business trip order using the unified form No. T-9 (approved by Resolution of the State Statistics Committee of the Russian Federation dated 01/05/04 No. 1) or develop your own form. How our experts did it, see the example below.

We remind you that from January 1, 2013, companies are no longer required to use unified document forms. This became possible after paragraph 4 of Article 9 of Federal Law dated 06.12.11 No. 402-FZ came into force.

We recommend reading:

- Is it possible to send a foreigner on a business trip?

- Business trips in 2021: answers to questions

- The correct waybill will justify the cost of fuel and lubricants and the driver’s salary

- The employee went on a business trip on a day off

Regulations on the specifics of sending employees on business trips

Regulation No. 749 on business trips was approved by Decree of the Government of the Russian Federation No. 749 of October 13, 2008, it addresses the main issues governing the sending of employees on business trips. Thus, the regulation determines that the employee’s place of work is considered to be the location of the company where he works, and if the employee is sent to a separate division of the company, which is located in a place other than the location of the company, this trip is considered a business trip. But if the work of a company employee is of a traveling nature, then the business trip is not recognized as a business trip.

The duration of the business trip is determined by the employer, guided by the volume and complexity of the work to be done by the employee. The period when the employee is actually on a business trip is determined by the tickets that the employee provides upon return. Thus, the day of departure on a business trip is considered the day of departure of the vehicle (train, plane, etc.) that the employee travels to the destination, and the day of the employee’s return is determined in the same way.

Is it necessary to draw up a travel certificate in 2017?

Documentary registration of a business trip in 2017 does not necessarily require the preparation of a travel certificate (subparagraph “c”, paragraph 2 of the Decree of the Government of the Russian Federation of December 29, 2014 No. 1595). But the company can design it at its own discretion (sample below).

Until this time, the need to issue a travel certificate was directly written in paragraph 7 of the Regulations. The certificate confirmed the length of the employee’s stay on a business trip. It indicated the date of arrival at the destination and the date of departure from there.

In addition to a travel certificate, neither the Labor Code nor the Regulations on Business Travel require the mandatory preparation of a work assignment and an employee report on its implementation.

But do not forget that the employer has the right to adopt local regulations (LNA) within its competence, which may prescribe the need to prepare these documents (Part 1, Article 8, Paragraph 7, Part 1, Article 22 of the Labor Code of the Russian Federation).

In his LNA, the employer can also prescribe the procedure for drawing up travel documents, determine their form and content. And such regulatory acts of the employer are mandatory for application (part 2 of article 5, paragraph 4 of part 2 of article 21, part 1 of article 189 of the Labor Code of the Russian Federation).

The magazine “Salary” will help you avoid mistakes when preparing personnel documents. When you subscribe to the magazine now, you receive several bonuses at once. Select a bonus and a convenient subscription option here.