Who cannot be sent on a business trip

In a normal situation, management can send employees of a business entity without asking their consent, since a business trip is the performance of their job functions.

However, there are categories of citizens for whom business travel is either generally prohibited or requires written consent from them.

There is a ban on business trips for the following citizens:

- Women with an employment contract who are expecting a child.

- Employees of the enterprise who are minors. However, for these employees, if they work at the enterprise in creative professions (actors, singers, writers, journalists) and engage in professional sports, the restriction does not apply.

- Employees working for the company under an apprenticeship contract.

Certain categories of citizens can go on business trips, but their consent to this must first be requested in writing.

These include:

- Women working under an employment contract who have young children. Employees who are the only parent of a child under three years of age are also treated as such.

- Single workers working at the enterprise whose children are under five years old.

- People working in the company who have disabled children.

- Company employees who provide medical care to their family members.

- For employees with a disability group, if the expected work trip interferes with their recovery program.

Important!

HR specialists need to remember that before a business trip for these categories of workers, a request for their consent must be received during the process of registering a business trip. At the same time, obtaining their consent is not enough; the document must also contain information that they know about their right to refuse a business trip.

Many problems can arise when an internal part-time worker is expected to travel on a business trip. After all, there is no ban on sending him on a business trip. Questions arise about how time on a business trip should be reflected in his second job at the company.

The provisions of the law prohibit him from taking vacation at his own expense or paid annual leave during this period. In these cases, it is recommended to provide such an employee with additional paid leave to the annual one.

Duration of business trips

The duration of the upcoming business trip is set by the manager, who fixes this period at his disposal. The decision about what period an employee needs on a business trip is determined by him according to the production goals that are set for the employee and the time allotted for their implementation.

If the company's regulations require the issuance of a job assignment, then the duration of the business trip should also be included in this document.

Since sometimes it is impossible to accurately take into account all factors, the duration of a business trip can be extended or shortened. This situation is formalized by issuing a separate order from the company’s management.

Previous acts of law, which have now lost their force, stipulated that a business trip was considered a trip of more than one day and it could not be more than forty days. And if the period went beyond these established frameworks, then the personnel service had to formalize the transfer of the employee.

Currently, the Government Resolutions that have entered into force do not establish either a minimum or maximum period.

The question often arises when determining a business trip for employees whose work requires constant travel to perform their job functions.

Attention!

In this case, one should proceed from the concept of the business trip itself, and not confuse it with work, which, in accordance with the executed employment contract, is of a traveling nature. You should also distinguish between a business trip and a transfer to work in another area.

Business trip documents

Mandatory

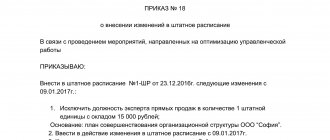

With the introduction of changes in the registration of business trips, currently only two documents have the status of mandatory use:

- An employer's order or instruction

is the main form that determines the direction, duration of a business trip, etc. Typically, a business trip order is issued on form T-9 or on company letterhead. organizations. - An advance report is a document with which an employee confirms expenses incurred during a trip with supporting documents attached. Compiled according to the AO-1 form.

Additional documents

To prepare these documents, it is necessary to mention in the company’s local acts:

- Travel certificate

- contains stamps from the receiving companies. You can use a single form, which will include a certificate, a job assignment, and an advance report. - Job Assignment

—Contains information about the work that needs to be done while traveling. Can be issued in form T-10a. - A task completion report

is a document that is drawn up by an employee upon returning from a trip. Includes an explanation of the work done during the trip. - Journal of employees going on a business trip

- serves to record employees who are going on trips; - Service note

- necessary to pay expenses if the employee uses personal transport.

Attention!

The use of these documents can be fixed, for example, in the regulations on employee business trips.

You might be interested in:

Regulations on employee business trips: how to draw up and approve them in 2021

Instructions for preparing an advance report

For reporting, the current legislation regulates a unified form, which is published under the number AO-1. The following information is consistently indicated on the front:

- Full name of the posted employee;

- his personnel number;

- full name of the position he holds;

- information about the primary document (in most cases this is a cash order or an extract confirming a money transfer);

- information about the amount of money remaining from the advance payment for the last business trip (if any).

On the reverse side of the sheet, detailed information about each expenditure of the issued funds is written down:

- date of;

- serial number;

- name of the expenditure;

- the amount of money spent;

- name and details of the document confirming the fact of financial expenditure.

ADVICE! When drawing up a document, it is recommended to use an example of filling out an expense report. This will avoid making mistakes and inaccuracies, which, in turn, will help prevent further possible problems with the tax office.

The period for submitting such reports is regulated at the legislative level. The documentation must be provided to the accounting department of the enterprise within three working days from the date of the citizen’s arrival from the trip.

If these deadlines are violated, funds issued to the employee will be classified as debt. Accordingly, the employer will have the full right to recover the deficiency from the employee’s next payment of remuneration.

You may be interested in : Step-by-step instructions for applying for a business trip

How to arrange a business trip for an employee in 2019: instructions for an accountant

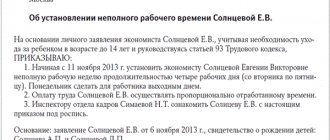

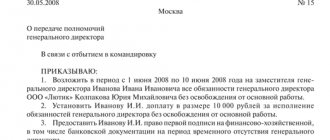

Step 1. Create a business trip order

In order to make a business trip order, you can use standard forms T-9, T-9a, or do it on company letterhead in a free style.

Previously, an official assignment was used to draw up an order, which was indicated as the basis. Now, in that column, data about the manager’s order, memo is recorded, or this field remains empty.

The employee for whom the order was drawn up gets acquainted with it and signs it.

Attention!

If you use your own transport for a business trip, then this must be included in the existing order, or an additional order must be issued.

Step 2. Issue money for reporting

When going on a business trip, the employee must receive funds from the cashier to pay for tickets, rental housing and other expenses, as well as daily allowance for each day of the trip.

The amount within which these expenses are paid must be established in a local act.

The basis for an employee to receive funds is a business trip order. Also, the employee himself can draw up a memo for the expected amount of expenses, but it must be signed by the manager.

When traveling within the country, funds in rubles can be issued from the cash register or transferred to a bank card.

Attention!

If a business trip abroad is required, then the daily allowance for the days when the employee will be in Russia is issued in rubles, and for the days of stay on the territory of a foreign state - in its currency.

See more details - Daily allowances for business trips abroad in 2021, norms and accounting.

Step 3. Create a travel document (if necessary)

If this step is specified in local regulations, then when a business trip is processed, you need to draw up a travel certificate. Depending on which form is used in the company, it may also include a report on the work performed, calculation of daily allowances, and travel assignments for the employee.

The need to compile a log of those departing on a business trip has also been abolished. Firms can continue to use it at their discretion. But first they need to secure the form of the magazine.

Typically, the log includes the following information:

- Personal information about the employee;

- The name of the company to which he is leaving;

- Name of the locality;

- Departure and arrival dates;

- A note indicating receipt of the report by the accounting department.

Attention!

The travel certificate has space for affixing stamps from the receiving party. But their presence is now not mandatory in the document, since the document is not mandatory.

Step 4. Complete and submit an advance report

Within three days from the fact of returning from the trip, the employee needs to write and submit to the accounting department an advance report on the AO-1 form. If this is indicated in the internal acts of the company, then along with the advance report it is also necessary to draw up and submit a report on the work done.

This is drawn up in any form, on a form that was created in the company, or for the report, column 12 is used in the official assignment form for a business trip T-10a, if it was created when the business trip was processed.

Documents are attached to the advance payment, with the help of which the employee can confirm the expenses incurred, they include:

- Documents used to rent accommodation for a trip - a hotel bill, a receipt that contains the number of days of stay and the cost per day, or a rental agreement for a private house or apartment.

- Documents that can be used to confirm travel to and from a business trip - tickets, boarding passes, checks, receipts for receiving a bed, etc.

- Documents confirming the hire of a taxi - checks, tickets, forms.

- An official note with a breakdown of expenses if the employee used personal transport - waybills, receipts from gas stations, etc.

- An official note when the employee cannot provide documents confirming accommodation or travel;

- Documents confirming other expenses (for example, a receipt for communication services).

Attention!

When submitting the expense report to the accounting department, the accountant makes a mark on the tear-off spine and hands it to the employee. This is necessary to confirm that the employee has submitted documents to the accounting department.

Step 5. Return unused amounts to the cashier (if any remain)

If, upon returning from a trip, an employee has money left over, he must return it to the cashier within 3 days from the date of his preparation of the advance report. A cash receipt order is provided for this operation.

According to the law, the employer has the right to withhold this amount from the employee’s salary, but only if a month has not yet passed since the end of the period for voluntary return. When a month has passed, it is possible to make a deduction only by drawing up a court decision.

You might be interested in:

An employee took a taxi on a business trip - is it possible to deduct these expenses?

The employee may also voluntarily agree to have the debt deducted from their salary. To do this, he needs to write a statement. Based on this document, a retention order is created. It must be remembered that the amount of funds withheld cannot exceed 20% of the salary accrued for that month.

Step 6. Compensate for overspending by the employee (if necessary)

A situation may arise that during a trip an employee spent more money than he was given. In this case, you must first check his expense report. If the expenses were justified, then they are subject to compensation by issuing funds from the cash register according to an expense cash order.

To determine the validity of the overspending, it is necessary to examine:

- Whether the costs were incurred for urgent reasons;

- Are there documents for these costs, and are they drawn up correctly;

- Correct writing of the expense report.

Attention!

Excess amounts must be issued within three days from the date of submission of the report. Otherwise, the employee has the right to go to court to recover from the employer not only these amounts, but also interest for their use.

If the organization is unable to repay the entire amount, it is advisable to draw up a repayment schedule, which must be signed by both parties.

Accounting for travel expenses.

KVR and KOSGU to reflect business trip expenses

From January 1, 2019, the rules for applying the budget classification of the Russian Federation are established by Orders of the Ministry of Finance of the Russian Federation No. 132n and No. 209n (hereinafter referred to as Procedure No. 132n and Order No. 209n).

The instructions on the procedure for applying the budget classification of the Russian Federation, approved by Order of the Ministry of Finance of the Russian Federation dated July 1, 2013 No. 65n, ceased to be valid from that date.

According to Order No. 132n, reimbursement of expenses related to business trips, as in 2021, should be made in relation to employees of state (municipal) institutions in accordance with KVR 112 “Other payments to the personnel of institutions, with the exception of the wage fund.” But when choosing KOSGU codes, it is necessary to take into account the following innovations provided for by Order No. 209n:

| Type of expenses | Sub-article KOSGU | |

| In 2021 | In 2021 | |

| Expenses for payment of daily allowance | 212 “Other payments” | 212 “Other non-social payments to staff in cash” |

| Travel expenses to the place of business trip and back to the place of permanent work | 212 “Other payments” | 226 “Other works, services” |

| Expenses for renting residential premises | 212 “Other payments” | 226 “Other works, services” |

| Other expenses incurred by the employee with the permission or knowledge of the employer | 212 “Other payments” | 226 “Other works, services” |

| Compensation for the use of personal transport on a business trip | 212 “Other payments” | 222 “Transport services” |

As you can see, only the procedure for applying KOSGU in relation to expenses for the payment of daily allowances has remained unchanged - they still fall under subsection 212. The rules for accounting for other travel expenses have changed. This is due to the fact that in international statistical practice, the corresponding payments are not considered as payments in the interests of employees, but belong to the category of expenses made by the employee for the purpose of performing work duties. Therefore, legislators decided to move operations for reimbursement of expenses associated with business trips (for travel, accommodation, other expenses related to the performance of official assignments on a business trip), as well as for payment of compensation for the use of personal transport on a business trip, from subarticle 212 “Other payments” ( 2018) in Article 220 “Payment for work and services” (2019) of KOSGU (see Letter of the Ministry of Finance of the Russian Federation dated June 29, 2018 No. 02-05-10/45153).

As for the expenses incurred by institutions within the framework of concluded agreements (contracts) for the purchase of travel tickets and payment for the rental of residential premises on business trips, they, similar to the rules in force in 2021, are included in CVR 244 “Other procurement of goods, works and services” and are reflected in accounting under subarticles 222 “Transport KOSGU, respectively.

Correspondence invoices for accounting for travel expenses

Due to changes that have occurred in the procedure for applying KOSGU codes, expenses associated with business trips are reflected in accordance with instructions No. 162n, No. 174n, No. 183n in the following account correspondences:

- Business trip payments in cash:

| State institutions | Budget institutions | Autonomous institutions | |||

| Debit | Credit | Debit | Credit | Debit | Credit |

| Funds were issued to the employee against account from the institution’s cash desk... | |||||

| ...to pay daily allowance | |||||

| 1 208 12 567 | 1 201 34 610 | 0 208 12 567 | 0 201 34 610 | 0 208 12 000 | 0 201 34 000 |

| …to pay for travel, rental accommodation and other expenses | |||||

| 1 208 26 567 | 1 201 34 610 | 0 208 26 567 | 0 201 34 610 | 0 208 26 000 | 0 201 34 000 |

| The employee was given compensation from the institution's cash desk for the use of personal transport on a business trip | |||||

| 1 208 22 567 | 1 201 34 610 | 0 208 22 567 | 0 201 34 610 | 0 208 22 000 | 0 201 34 000 |

| The employee returned the unused balances of accountable amounts issued... | |||||

| …to pay daily allowance | |||||

| 1 201 34 510 | 1 208 12 667 | 0 201 34 510 | 0 208 12 667 | 0 201 34 000 | 0 208 12 000 |

| …to pay for travel, rental accommodation and other expenses | |||||

| 1 201 34 510 | 1 208 26 667 | 0 201 34 510 | 0 208 26 667 | 0 201 34 000 | 0 208 26 000 |

- Non-cash payments for business trips:

a) using employee salary cards:

| State institutions | Budget institutions | Autonomous institutions | |||

| Debit | Credit | Debit | Credit | Debit | Credit |

| Accountable amounts have been transferred to the employee’s salary card... | |||||

| ...to pay daily allowance | |||||

| 1 208 12 567 | 1 304 05 212 | 0 208 12 567 | 0 201 11 610 | 0 208 12 000 | 0 201 11 000 0 201 21 000 |

| …to pay for travel, rental accommodation and other expenses | |||||

| 1 208 26 567 | 1 304 05 226 | 0 208 26 567 | 0 201 11 610 | 0 208 26 000 | 0 201 11 000 0 201 21 000 |

| Compensation for the use of personal transport on a business trip was transferred to the employee’s salary card | |||||

| 1 208 22 567 | 1 304 05 222 | 0 208 22 567 | 0 201 11 610 | 0 208 22 000 | 0 201 11 000 0 201 21 000 |

b) using the institution’s payment (debit) card:

| State institutions | Budget institutions | Autonomous institutions | |||

| Debit | Credit | Debit | Credit | Debit | Credit |

| Accountable amounts have been transferred to the institution’s settlement (debit) card... | |||||

| ...to pay daily allowance | |||||

| 1 210 03 561 | 1 304 05 212 | 0 210 03 561 | 0 201 11 610 | 0 210 03 000 | 0 201 11 000 |

| 1 208 12 567 | 1 210 03 661 | 0 208 12 567 | 0 210 03 661 | 0 208 12 000 | 0 210 03 000 |

| …to pay for travel, rental accommodation and other expenses | |||||

| 1 210 03 561 | 1 304 05 226 | 0 210 03 561 | 0 201 11 610 | 0 210 03 000 | 0 201 11 000 |

| 1 208 26 567 | 1 210 03 661 | 0 208 26 567 | 0 210 03 661 | 0 208 26 000 | 0 210 03 000 |

| Unused balances of accountable amounts transferred... | |||||

| …to pay daily allowance | |||||

| 1 201 23 510 | 1 208 12 667 | 0 201 23 510 | 0 208 12 667 | 0 201 23 000 | 0 208 12 000 |

| 1 304 05 212 | 1 201 23 610 | 0 201 11 510 | 0 201 23 610 | 0 201 11 000 | 0 201 23 000 |

| …to pay for travel, rental accommodation and other expenses | |||||

| 1 201 23 510 | 1 208 26 667 | 0 201 23 510 | 0 208 26 667 | 0 201 23 000 | 0 208 26 000 |

| 1 304 05 226 | 1 201 23 610 | 0 201 11 510 | 0 201 23 610 | 0 201 11 000 | 0 201 23 000 |

- Payment of travel expenses within the framework of contracts (agreements) concluded by the institution:

| State institutions | Budget institutions | Autonomous institutions | |||

| Debit | Credit | Debit | Credit | Debit | Credit |

| Payment was made within the framework of concluded agreements (contracts)… | |||||

| ...travel tickets | |||||

| 1 302 22 834 | 1 304 05 222 | 0 302 22 834 | 0 201 11 610 | 0 302 22 000 | 0 201 11 000 0 201 21 000 |

| ...renting a living space | |||||

| 1 302 26 834 | 1 304 05 226 | 0 302 26 834 | 0 201 11 610 | 0 302 26 000 | 0 201 11 000 0 201 21 000 |

| Paid travel tickets have been received at the institution's cash desk | |||||

| 1 201 35 510 | 1 302 22 734 | 0 201 35 510 | 0 302 22 734 | 0 201 35 000 | 0 302 22 000 |

| Paid travel tickets were issued for reporting to the employee from the institution's cash desk | |||||

| 1 208 22 567 | 1 201 35 610 | 0 208 22 567 | 0 201 35 610 | 0 208 22 000 | 0 201 35 000 |

- Acceptance of travel expenses for accounting:

| State institutions | Budget institutions | Autonomous institutions | |||

| Expenses taken into account... | |||||

| ...to pay daily allowance | |||||

| 1 109 xx 212 1 401 20 212 | 1 208 12 667 | 0 109 xx 212 0 401 20 212 | 0 208 12 667 | 0 109 xx 212 0 401 20 212 | 0 208 12 000 |

| …to pay for travel, rental accommodation and other expenses | |||||

| 1 109 xx 226 1 401 20 226 | 1 208 26 667 | 0 109 xx 226 0 401 20 226 | 0 208 26 667 | 0 109 xx 226 0 401 20 226 | 0 208 26 000 |

| ...to pay compensation for the use of personal transport and travel tickets on a business trip | |||||

| 1 109 xx 222 1 401 20 222 | 1 208 22 667 | 0 109 xx 222 0 401 20 222 | 0 208 22 667 | 0 109 xx 222 0 401 20 222 | 0 208 22 000 |

It should be noted that the Ministry of Finance has currently prepared changes to Instruction No. 183n, which are planned to be implemented from 01/01/2019. According to them, autonomous institutions will indicate the KOSGU codes in the 24th - 26th digits of their account numbers, similarly to budgetary institutions.

A budgetary cultural institution sent a group of 10 workers on a business trip for 5 days. They were given daily allowances in the amount of 5,000 rubles from the cash register. and money for hotel accommodation - 20,000 rubles. The travel is paid by the institution in cash under an agreement concluded with the carrier. Travel expenses amounted to 30,000 rubles. Travel tickets are accepted for accounting as monetary documents and are issued to employees before the trip. All expenses are included in the cost of services for the main type of activity; the operations were carried out as part of the implementation of a state task.

>Travel expenses for KVR and KOSGU

In most cases, travel expenses are reflected according to KOSGU 212 and KVR 112. Let's consider different situations in accounting.

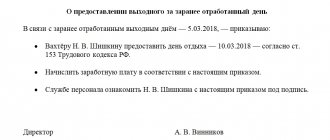

Is it possible to send an employee on a day off?

Sometimes a trip means that an employee must begin performing duties in a new place on Monday. To do this, he needs to go on a business trip on his day off.

This point must be agreed upon with the employee himself - in order to complete a business trip on a day off, it will be necessary to issue an order that the business trip will begin on a day off, and the employee must give written consent to this. In such an order, it is necessary to indicate the working hours for a given day - this step is necessary in order to eliminate disputes about payment for such days.

For example, if the train leaves several hours before midnight, then the order must indicate that only these hours are subject to payment. Otherwise, the employer will need to compensate the entire day. And this will have to be done either double or single, but with an additional day for rest.

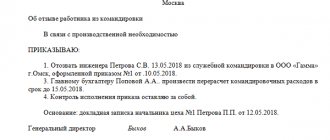

Can I extend or reschedule my business trip?

The laws do not contain a prohibition on extending the period of an existing business trip, or postponing a future one, but for which all the necessary documents have already been drawn up. However, at the same time, not a single regulatory act contains instructions on how exactly this can be done correctly.

If you need to extend an existing business trip, then it is best to issue an order for this. It is drawn up in any form, but in addition to the mandatory details, it must indicate the reason why the trip is being extended, as well as the new end date.

After this, corrections are made to all business trip documents - the old date is crossed out with one line so that it can be easily read, and the new date is indicated on top.

Then the employer must calculate the daily allowance and funds to pay for housing for the new term, and transfer this amount to the employee on the card, by postal order or in another way. It is prohibited to force an employee to use personal funds for these purposes, even if they are subsequently reimbursed.

Attention!

Postponement of the date of an issued business trip is also issued by a separate order. It states the reason for the postponement and the new start and end dates.

You also need to make corrections in all completed documents, crossing out old dates and entering new ones. There is no need to recalculate payments - after all, only the dates of the trip change, and not its duration.

Features of registration of a foreign business trip

Traveling abroad has its own significant features. This is due, first of all, to the fact that the employee spends foreign currency there. Therefore, the expense report provided must include the amount in both domestic and foreign currency. In addition, all documentation must be translated into Russian. The translation must be carried out on a separate sheet, and not in certain papers. It can be done either by the translator himself or by the employee, if he meets certain documents.

As for the rest of the procedure, all approvals and acceptance of the report are similar to the procedure for registering a business trip within the country.

Is it possible to combine a vacation with a business trip?

The law defines that annual paid leave is a period during which an employee is completely relieved from performing his duties. And if the employer needs to process a business trip during the period when the employee is on vacation, he must be recalled from vacation.

When performing this procedure, it must be taken into account that according to the Labor Code there are types of employees who are absolutely prohibited from being recalled. In addition, the employee must sign a written consent to the recall.

If it becomes necessary to recall an employee to go on a trip, you must do the following:

- Issue an order that will recall the employee from vacation;

- On the order, the employee must give written consent by checking the words “I do not object” in the column.

- Issue an order to go on a business trip.

- Provide daily allowances and other funds to cover expenses.

You also need to take into account that recall from vacation requires mandatory amendments to the vacation schedule. Therefore, it is important to immediately discuss with the employee at what time he will take the remaining unused days. If he wishes to go on annual leave immediately upon returning from a trip, this will need to be arranged again.

Attention!

Another important point that should not be forgotten is the recalculation of vacation pay. This can be omitted if the employee wants to take rest days immediately upon return, and these days are included in the current month. Otherwise, the excess amount will need to be returned to the cashier, or counted against daily allowance or future vacation pay.

Reflection of postings for travel expenses

The employee is given cash in advance to cover expenses during a business trip. The fact of issuing cash from the company's cash desk is reflected by the accounting entry:

- Dt 0 208 12 560 Kt 0 201 34 610.

When an employee returns from a business trip, he must report to the institution’s accounting department within 3 days. Writing off business trip expenses depends on what goals were set for the employee:

if the costs are related to the main activity -

- Dt 0 109 xx 212 Kt 0 208 12 000;

if the costs are not related to the main activity -

- Dt 0 401 20 212 Kt 0 208 12 000.

It happens that a debt is formed according to the advance report. This happens if an employee has overspent or, conversely, saved and must return the remainder of the advance to the cashier. Relevant wiring:

the debt is paid to the employee through the company’s cash desk –

- Dt 0 208 12 560 Kt 0 201 34 610;

debt is withheld from salary -

- Dt 0 302 11 830 Kt 0 304 03 730;

the employee returns the advance funds to the cash desk -

- Dt 0 201 34 510 Kt 0 208 12 660.

The amount of business trip expenses indicated in the advance report is reflected in the postings:

daily expenses, travel, accommodation –

- Dt 0 401 20 212 Kt 0 208 12 660.

If payment for travel expenses is made by the organization and not by the employee, then the following entries are used:

reflection of hotel services, purchase of travel tickets -

Midsection of businessman holding airplane tickets. horizontal shot.

While on a business trip, the employee acts on the instructions and in the interests of the employer. Accordingly, the employer is obliged to take all measures to ensure that the traveling employee does not suffer losses. Therefore, labor legislation includes several provisions that regulate compensation for employees on such trips (including the payment of daily allowances, even for a business trip of one day).

In particular, the organization is obliged to pay for accommodation during the specified period (even if the business trip lasts only one day: details of this option). This is a basic guarantee for the employee. However, when an organization pays for accommodation on a business trip, it follows a number of rules that you should know.