General salary provisions

The Labor Code of the Russian Federation deciphers the concept of wages (Wages) in Article 129. This article states that Wages are remuneration for work. Its size depends on the qualifications of the worker himself, as well as the complexity, quality and quantity of work done.

The structure of the PO is as follows:

- main part (OS);

- compensation payments (WSS);

- incentive payments (SV).

OS can be conditionally considered basic due to the fact that its payment is carried out according to the official salary in accordance with the time worked.

Water supply and sewerage services are carried out when work is carried out in conditions different from normal or usual ones. This category may include payments under special conditions.

Table: compensation payments and their amount

| Reasons for the emergence of water and wastewater services | Calculation of the payment amount |

| Working overtime for the first two hours of work | One and a half hourly wage rate |

| Working overtime for subsequent working hours | Double hourly wage rate |

| Night work (from 22:00 to 06:00) | Additional payment for each hour of work of at least 20% of the salary per hour of work |

| Work on holidays and weekends | One-day part of the salary within the monthly norm and a double part of the salary when working in excess of the monthly norm |

| Combining professions, increasing the volume of work, performing the duties of a temporarily absent employee | According to the written agreement of the parties |

| Difficult and harmful working conditions | Up to 12% of salary |

| Particularly difficult and harmful working conditions | Up to 24% of salary |

| Working in special climatic conditions | Regional coefficients |

| Labor in desert and waterless areas | Odds |

| Work in high mountain areas | |

| Work experience in the Far North, | Percentage allowances |

| Work in the southern regions of the Far East | |

| Labor activity in the Krasnoyarsk Territory | |

| Experience in the Irkutsk and Chita regions | |

| Work in the Republic of Buryatia | |

| Work experience in the Republic of Khakassia |

In addition to salary, an employee can receive various additional payments for his work.

SV - various incentive allowances and additional payments, the purpose of which is material incentives. Every exemplary employee at least once in his career received a bonus for successfully completed work. The psychological factor of such a payment is that a person feels important in the eyes of management and begins to work better.

Salary is a certain amount of remuneration for the work duties performed by an employee. Payments for performing labor functions are usually calculated for one calendar month.

Basic salary is the minimum wage for a state or municipal employee in accordance with his qualifications. Therefore, the higher the qualifications of the employee, the higher his base salary will be.

The main difference between a salary and a basic salary is that a regular salary is assigned to non-governmental organizations, while a basic salary is determined for employees working in government agencies.

A completely different category of remuneration can be called an advance. An advance is partial labor costs for the first half of the month (Labor Code of the Russian Federation, Article 136). Therefore, if an employer pays salary once a month, this is a direct violation in accordance with the Labor Code of the Russian Federation.

Advance is a colloquial term familiar to both employees and employers; you will not find it in the Labor Code of the Russian Federation.

It is worth highlighting such a concept as the minimum wage (minimum wage). The minimum wage is a fixed amount established by the state. The salary assigned to an employee cannot be lower than this amount. The value of the concept under consideration is also needed to calculate various benefits at the expense of the Social Insurance Fund.

From January 1, 2018, the minimum wage is 9,489 rubles, and from May 1, 2018, the minimum wage will increase to 11,163 rubles.

Video: minimum wage

https://youtube.com/watch?v=i5I9TZBulXw

The maximum amount of wages for employers can be any: the manager sets a different amount of wages for the employee at his discretion (not lower than the minimum wage, of course). The only point will be the fact that every year the state sets the maximum indicator for labor protection for the purpose of calculating Social Security benefits and Pension Fund contributions. This year you need to adhere to the limit of 876,000 rubles. When calculating FSS benefits, this indicator is a cash limit, and therefore, the employer will not be able to pay the employee a benefit amount greater than that established. Pension Fund contributions, on the contrary, will be lower if during the year the amount of earnings exceeds this limit.

I would also like to note the fact that employers use various forms to pay labor costs, which are initially negotiated with the employee and documented. Based on the chosen form, the salary will be accrued in a certain way: piecework (the value does not depend on the volume, the time spent on work is taken into account) or time-based (the time factor does not matter, the volume of work is important).

What is taken into account when calculating?

Today, two types of fees are most often practiced:

- Time-based . The first provides for a salary determined by the contract for the time worked - hour, day, month. Often a monthly rate is used. In this case, the final amount depends on the time worked during a certain period of time. It is used mainly when calculating salaries for employees on whom the amount of product created does not depend - accountants, teachers, managers.

- Piecework . Depends on the amount of product created over a certain period. Often used in factories. It has several subspecies, which we will consider a little later.

Thus, time-based wages stipulate that the head of the enterprise or other official is required to maintain and fill out a time sheet. It is drawn up according to form No. T-13 and is filled out daily.

It should note:

- number of working hours worked during the day;

- exits “at night” – from 22:00 to 6:00;

- out during non-working hours (weekends, holidays);

- omissions due to various circumstances.

Piece payment requires the availability of a route map or work order for a certain amount of work. In addition, the following are taken into account: sick leave, orders for bonuses, orders for the issuance of financial assistance.

After being hired, each accountant must keep analytical records of wages and record it in form No. T-54. This is the so-called employee personal account. The data specified in it will be taken into account when calculating sick pay, vacation pay and other types of benefits.

You can find out how vacation pay is calculated from this article.

The Labor Code of the Russian Federation provides for a minimum monthly salary of 5,965 rubles. The employer has no right to set payment below this amount. For more information on this topic, read the article - What is the minimum wage in Russia.

The procedure for calculating and calculating salaries

If an employee receives remuneration for his work in the form of a salary, then the payroll accountant uses the following algorithm of actions:

- The established salary is divided by the number of working days in a month.

- The resulting amount is multiplied by the number of days actually worked in the month.

- 13% personal income tax is deducted from the amount received. The total amount is given to the employee in person or transferred to the card.

Accountant L.V. Sidorova receives a salary every month in accordance with the established salary of 25,000 rubles. Let's find out what amount will be accrued to the accountant after working a full working month.

25,000 x 13% = 3,250 rub. — personal income tax amount.

25,000 – 3,250 = 21,750 rubles. — the total salary amount that will be accrued to L.V. Sidorova over the past month.

Calculation of salary for an incomplete month worked

Engineer S.V. Ivanov worked for less than a full month, as he was hired on September 11, 2021. His salary is 30,000 rubles. It is necessary to find out what amount should be accrued to S.V. Ivanov for September (there are 21 working days in the month).

30,000 rub. / 21 days = 1428.57 rub. - the amount that is accrued to the employee for a working day.

1428.57 x 15 = 21,428.55 rubles. — salary amount before deduction of personal income tax.

21,428.55 x 13% = RUB 2,786. - Personal income tax.

21,428.55 – 2,786 = 18,642.55 rubles. — the amount to be transferred to S.V. Ivanov on the map for September 2021

Calculation of the premium

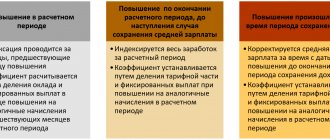

When approving the bonus, the calculation algorithm should remain the same, but with a slight amendment.

- The salary is divided by the number of working days.

- The resulting amount is multiplied by the number of days worked.

- The bonus amount is added to the amount received.

- The total amount (salary + bonus) is subject to personal income tax.

Secretary N.V. Seliverstova was approved for a bonus of 3,000 rubles. for July 2021. The secretary's salary is 15,000 rubles. You need to find out the amount of salary accrual for the month N.V. Seliverstova.

15,000 + 3,000 = 18,000 rub. — amount of salary and bonus for July 2017

18,000 x 13% = 2,340 rubles. - Personal income tax.

18,000 – 2,340 = 15,660 rubles. — accrual amount for July 2017

Calculation of salary taking into account the regional coefficient

Salary is calculated somewhat differently for those employees who receive additional payment due to working in unfavorable conditions. It is known that in this case the regional coefficient, and in some cases also a percentage premium, is included in the calculation.

For work in unfavorable climatic conditions, the employee receives special salary bonuses

The regional coefficient is regulated by the following regulations:

- Article 316 of the Labor Code of the Russian Federation lists the regions where coefficients are used;

- Law of the Russian Federation dated February 19, 1993 No. 4520–1 “On state guarantees and compensation for persons working and living in the Far North and equivalent areas” regulates the conditions for calculating the coefficient.

The value of the regional coefficient directly depends on the territory in which the employee’s labor activity is carried out. The largest coefficient is set for personnel in Yakutia, the Sakhalin region, Chukotka and the Arctic Ocean (the coefficient is 2%). The regional coefficient acts as compensation for unfavorable climatic conditions.

The surcharge and the regional coefficient are different concepts, since they have different methods of calculation. The bonus increases the salary by a certain percentage, which depends on the area of employment and length of service. Regional coefficient is an indicator that is awarded to employees in certain areas.

The calculation algorithm taking into account the regional coefficient will look like:

- Salary calculation (salary divided by the number of working days and multiplied by the actual days worked).

- The resulting amount is multiplied by a coefficient or percentage premium.

- The total amount is subject to personal income tax.

Installer S.R. Gavrilov works in the Nenets Autonomous Okrug (coefficient is 1.8). Salary S.R. Gavrilov is 50,000 rubles. without taking into account the coefficient. You need to find out how much the accountant will charge the installer if he worked only 5 days in August 2021.

50,000 / 23 working days = 2,173.91 rubles. — salary amount for one day.

2,173.91 x 5 = 10,869.55 rubles. — salary amount 5 days before tax deduction and coefficient increase.

10869.55 x 1.8 = 19,565.19 rubles. — the accrual amount taking into account the coefficient.

19,565.19 x 13% = 2,543 rubles. - Personal income tax.

19,565.19 – 2,543 = 17,022.19 rubles. — total accrual amount for August 2021

Determination of salary for overtime work

There are situations when an employee has to stay late at work to fulfill his official duties. Each employee has the right to demand payment for such overtime, since the Labor Code of the Russian Federation is on his side. The calculation of the surcharge itself is quite simple:

- We determine how many hours the employee must work during the billing month.

- We calculate how much the employee actually worked.

- We calculate the average hourly rate: divide the salary by the average monthly number of working hours.

- We multiply the average hourly rate by the number of overtime hours: the first two hours are 1.5 times the payment amount, and the subsequent hours are double the amount.

Manager L.V. Odintsov, with a salary of 30,000, worked more than expected in September 2017: 2 times he was late after work for 2 hours in order to fulfill the sales plan. Naturally, you need to pay for the processing, and before you pay, you need to calculate it correctly.

There are 21 working days in September, which is 168 working hours (21 x 8). The manager, in accordance with the time sheet, worked 172 hours, resulting in 4 hours of overtime (172 – 168).

The average monthly hours in 2021 is 162.42.

30,000 / 162.42 = 184.71 rubles. — average hourly rate of the manager.

184.71 x 2 x 1.5 = 554.13 rub. — amount of additional payment for the first two hours.

2 x 184.71 x 2 = 738.84 rub. — amount of additional payment for the next two hours.

554.13 + 738.84 = 1,292.97 rubles. — total amount of surcharge for September 2021.

An order to involve an employee in overtime work must contain proper justification for such actions by the employer

Involving an employee in overtime work must be formalized in the form of an order. An order and a time sheet are documents with which an accountant can calculate the amount of additional payment.

Calculation of salary for going out on a holiday

Sometimes an employer asks you to go out to work on a holiday. As a general rule, the manager is obliged to pay double for this time.

Video: payment for overtime and work on days off

For example, courier I.A. Kolosov worked 176 working hours in September, and was supposed to work 168. Overtime was 8 hours, because I.A. Kolosov went to work on Saturday. The courier's salary is 20,000 rubles, the average monthly number of hours is 162.42.

20,000/162.42 = 123.14 rubles. — average hourly courier rate.

123.14 x 8 x 2 = 1,970.24 rubles. — additional payment for working on a day off.

The nuances of paying salary for going out at night

For those citizens who are forced to perform their work at night (22:00 to 06:00), an increase of no less than 20% of the tariff rate for each hour of such work is provided.

If an employee is required to work at night, he must receive increased pay for this

Mechanic L.S. Antipov went to work at night from 00:00 to 02:00. The mechanic's salary is 50,000 rubles.

50,000/162.42 = 307.84 rubles. — average hourly rate L.S. Antipova.

307.84 x 20% = 61.57 rubles. — percentage increase to the average hourly rate of 20%.

307.84 + 61.57 = 369.41 rubles. — salary amount per hour at night.

369.41 x 2 = 738.82 rubles. — the total amount taking into account the night supplement that will be charged to L.S. Antipov for going out at night.

Advance payment calculation

According to Art. 136 of the Labor Code of the Russian Federation, wages must be paid to the employee every half month. Consequently, one salary payment is made at the beginning of the month, the other in the middle. Which of these payments will be called an advance and which directly as a salary depends on the local regulations adopted by the employer. A pay slip is not prepared separately for the advance payment, but when the salary is paid, this amount is reflected in the general pay slip.

There are two main ways to calculate the advance.

- Percentage of salary.

- Proportional to time worked.

Each organization independently selects and approves the option that is most acceptable for a particular company.

The essence of the first option is that a fixed percentage of the salary is used (for example, 40% of the salary). This amount cannot be underestimated and it is better to take into account additional payments and allowances when calculating (letter of the Ministry of Labor No. 11–4/ОOG-718 dated 04/18/2017).

Secretary L.V. Denisova receives a salary of 20,000 rubles. The company pays an advance in the amount of 40% of the salary. Let's calculate how many L.V. Denisova will receive it in her hands within a month.

20,000 x 40% = 8,000 rub. - the amount of the advance that the secretary received on the 25th.

20,000 – 2,600 = 17,400 rubles. — salary amount after deducting personal income tax from the amount.

17,400 – 8,000 = 9,400 rubles. - Secretary L.V. Denisova will receive a monthly salary after deducting the advance and personal income tax.

This calculation method is easy to use, but the actual time worked remains without attention, which threatens to be overpaid in the event of an employee’s early dismissal.

The regulations on remuneration, establishing the terms of payment of salary, are drawn up taking into account the nuances of the business of a particular company

The second option is more complicated, but it is recommended by the Ministry of Labor (letter No. 14-1/10/B-660 dated 02/03/2016). In this case, the first half of the month (from the 1st to the 15th) is used for calculation in accordance with the working time sheet, which means that the advance amount will not be fixed. If an employee worked only two days in the first half of the month, he is still entitled to an advance, otherwise the company will face a fine. If the employee is sick during the first half of the month, the company has the right not to pay the advance.

Driver S.V. Petrov works a regular five-day shift with a salary of 25,000 rubles. The company uses the method of calculating the advance in proportion to the time worked. In the first half of September S.V. Petrov was absent for 3 days (he took leave at his own expense). Let's calculate the advance amount.

In the first half of September there are 11 working days (until the 15th inclusive). The driver worked 8 days (11 – 3). There are 21 working days in September.

25,000/21 = 1,190.47 - the amount of salary for one day.

1,190.47 * 8 = 9,523.76 rubles. — advance amount for September 2017

It is important to remember that the advance payment does not need to be subject to insurance premiums and personal income tax. All contributions and taxes on the salary must be accrued and paid in full when issuing the salary for the month.

Salary deductions

The most basic and universal withholding is the personal income tax (13% of the salary).

In some cases, the employer has the right to withhold a certain amount of money from the employee’s salary

Personal income tax and deductions under executive documents are mandatory deductions from an employee’s salary. Law No. 229-FZ includes a list of such documents:

- performance list;

- court order;

- agreements on payment of alimony (notarized);

- certificates of labor dispute commissions;

- acts of bodies exercising control functions on the collection of funds;

- judicial acts on administrative offenses;

- resolution of the bailiff;

- acts of other bodies.

The employer's initiative is also the basis for deductions, but only with the written consent of the employee (Article 137 of the Labor Code of the Russian Federation). Withholding may be made in the following cases:

- unearned advance payment issued to the employee on account of the salary;

- unspent and unreturned advance payment issued for a business trip and other purposes;

- amounts paid in error;

- labor disputes regarding the employee’s failure to fulfill official duties;

- used but unworked vacation days upon dismissal of an employee;

- compensation for damage due to the fault of an employee.

Management can deduct from an employee’s salary only 20% with each salary payment until the entire amount is paid (Article 138 of the Labor Code of the Russian Federation).

Sample application from an employee to withhold alimony from salary

An employee may express a personal desire to deduct from the salary in the form of an application. The employer, in turn, can give consent, but is not obliged. Deductions at personal request can be different: voluntary insurance, union dues, loan repayment, charity, etc.

Tariff system of remuneration

The basis of the tariff system is the use of a tariff schedule, which specifies the amount of remuneration for certain positions, taking into account the complexity of the work performed and other conditions. The elements of the tariff system are as follows:

- grid - a scale connecting digits with coefficients;

- discharge;

- coefficient;

- bid;

- TKS - tariff and qualification directory of positions.

The tariff rate is fixed by local regulatory documents, which should not contradict the Labor Code of the Russian Federation. The same positions are required to have the same salaries. Bonuses and incentives may be different due to several points (Article 132 of the Labor Code of the Russian Federation):

- complexity;

- qualification;

- quality;

- labor costs.

The worker who performs the simplest operations is always assigned the first rank. If an employee grows professionally, then his rank will also increase.

The use of a tariff system has a beneficial effect in those organizations that welcome the implementation of various plans. To improve labor performance, it is necessary to reward employees with bonuses.

Calculation formula and examples

Time-based wages provide for payment of labor according to the time worked and the employee’s salary.

It is calculated as follows:

For monthly salary:

ZP=O*CODE/KD, where

- ZP – salary excluding taxes;

- О – fixed salary per month;

- KOD – days worked;

- KD – number of days in a month.

For hourly/daily fixed salary:

ZP=KOV*O, where

- ZP – salary excluding taxes;

- KOV – amount of time worked;

- O – salary for one unit of time.

Let's look at an example:

Tatyana Ivanovna has a monthly salary of 15,000 rubles. There were 21 working days in a month, but since she took vacation at her own expense, she worked only 15 days. In this regard, she will be paid the following amount:

15,000*(15/21)=15,000*0.71= 10,714 rubles 30 kopecks.

Second example:

Oksana Viktorovna works with a daily salary of 670 rubles. She worked 19 days this month. Her salary will be:

670*19 = 12,730 rubles.

As you can see, the formula for calculating wages for this type of payment is very simple.

Payment of wages

The procedure for paying salary, place and timing are fully disclosed in Art. 136 Labor Code of the Russian Federation. The article states that the payment of remuneration for labor must be accompanied by notification to the employee of the payment in writing. Here are the main points of the document:

- components of the salary for the corresponding period;

- information about other amounts (vacation, compensation, etc.);

- amount and basis of deductions;

- total amount to be paid.

Typically, an employer uses a payslip to notify an employee of wages and any deductions.

A monthly payslip with information on payments and deductions must be issued to all employees

The employee must receive a salary where he performs his job duties or at the credit institution that he indicated in the application. All conditions for receiving remuneration must be specified in a collective or employment agreement.

An employee’s application to transfer salary to a card with bank details is usually written in companies that have a salary project in the bank

The salary must be paid every half month. Payment dates are specified in the company’s internal regulations or in the employment contract with the employee. Payment must be made no later than 15 days after accrual. If the salary payment falls on a weekend or holiday, the payment must be made the day before.

Video: about the procedure for receiving wages by an employee

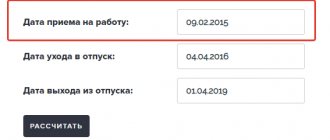

If an employee has recently been employed, then he should be given a salary on the same dates as all other employees. It doesn’t matter how long the new employee has worked: 2 days or 2 weeks. If, in the near future after employment, all employees are paid an advance, then the new employee is also entitled to an advance for the number of days worked, and if a salary is paid, then the salary is due in proportion to the time worked.

Payment procedure and calculation of delays

According to the same legislation, wages must be paid at least 2 times a month. They provide an advance payment, which is issued in the middle of the month, and the actual salary.

The advance on average ranges from 40 to 50% of the total amount of payments, the rest of the payments are issued at the end of the month. Usually this is the last day of the month; if it falls on a weekend, it is the last working day of the month. If wages are not paid on time, the employer is obliged to pay a fine.

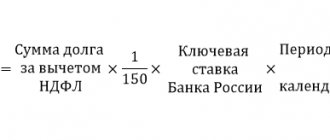

In addition, compensation is provided for the employee, which is issued upon his request and is 1/300 of the rate for each day of delay.

Receiving salary by proxy

Sometimes a person cannot show up for work and receive a salary in person. Such situations often occur in those organizations where cash payments to employees predominate. The way out of this situation will be to draw up a power of attorney for another person who will be able to receive the money in full and transfer it personally.

The power of attorney is drawn up in free form, but the document must contain the following information:

- date and place of compilation;

- passport details of the principal and attorney;

- an order to receive a salary at the enterprise's cash desk;

- validity;

- signature of the principal and attorney;

- employer's note on document certification.

It is important to remember that the power of attorney does not need to be certified by a notary; certification by the head of the organization will be sufficient.

Power of attorney of the principal for receipt of salary by an attorney from the cash desk

After meeting all the above conditions, the responsible person can safely transfer money from hand to hand to the attorney.

Salary calculation example

As of August 1, Ivanov’s salary was 25,000 rubles. In the summer, from August 15, he was transferred to a higher and paid position as a specialist and his salary was increased to 30,000 rubles.

There were 23 working days in August:

from the beginning of the month to August 14 there were 10 slaves. days; from August 15 to August 31 there were 13 slaves. days. The accountant calculated the salary for each month of these periods. For the time period from August 1 to August 14 (taking into account the old official salary), the accountant calculated the amount:

25,000 rub. : 23 days for 10 days = 10,869 rub.

From August 15 to August 31 the following amount was released:

RUB 30,000: 23 days. for 13 days = 16,956 rub.

Total salary for August was:

RUB 10,869 plus 16,956 rub. = 27,826 rub.

Example No. 2

An employee works in shifts and is paid an hourly rate. His salary depends on the number of hours at the workplace and the standard working hours. The driver of Master LLC Pirogov has a cumulative time record. The accounting period is 1 month, the hourly rate is 180 rubles. The norm for August is 184 hours. However, from August 18 to 25, the driver took a vacation at his own expense. For this period, based on the work schedule of this employee, there were 48 workers. hours. This means that his norm was 136 hours. That's how long he worked.