Employers often have questions regarding the calculation and accrual of vacation pay to employees. In most cases, this is due to ignorance of the current legislation. It is important for company managers to follow the procedure for paying vacation pay. Otherwise, there is a possibility of being held accountable for violating the law.

New payment rules under the Labor Code

Relations between employers and employees are regulated by the Labor Code (LC). The government of the country regularly makes amendments to this regulatory document. Certain adjustments were made in 2021. It is useful for business managers and their subordinates to know the procedure for paying vacation pay, taking into account the latest changes.

This will help employers act within the law and eliminate the possibility of penalties being imposed on them. Knowledge of the Labor Code will enable employees to timely detect violations of labor rights and protect their interests.

In July 2021, Federal Law No. 231 was adopted. According to it, the period for notifying the employer about changing the details for calculating wages and vacation pay has been increased for employees. Management must now be notified no later than 15 calendar days before the next payment of the amount of money.

Law No. 34 of March 18, 2021 introduced an electronic form for transmitting information on labor and civil relations. In this regard, a new draft TC is being prepared. The government wants to make it possible to apply for leave electronically. This will simplify the document flow procedure.

In 2021, it is planned to introduce new rules regarding the procedure for paying vacation pay to employees. They relate to the deadline for issuing the amount of money. According to the ninth paragraph of Article No. 136 of the Labor Code of Russia, vacation must be paid to the employee no later than three days before it starts. This is the current rule. The Labor Code does not directly say which days we are talking about, calendar or working days.

The explanation is given in Letter of Rostrud No. 1693-6-1 dated July 30, 2014. According to it, the period is calculated in calendar days. For example, if an employee’s vacation starts on Monday, then the payment should be made on Thursday-Friday.

In 2021, the country's government plans to introduce the following change to the Labor Code: make payments at least three working days before the start of the vacation. Violation of this rule will result in a fine.

If a subordinate goes on vacation on Monday, then the money should be credited to him no later than Wednesday (with a standard five-day work schedule). This innovation is beneficial for employees, since they will receive vacation pay earlier.

In this case, certain difficulties may arise for the accounting department, which will have to make calculations in a shorter time. It is also planned to introduce changes to the Labor Code of the Russian Federation regarding filing an application for exemption from work. Today, according to the rules, an employee must notify the employer of going on unscheduled paid leave two weeks in advance.

This is necessary so that the accounting department has time to perform calculations and accrual of money. In 2021, it is planned to allow subordinates to notify management about vacation 1-2 days before it starts. In this case, payment must be made within three working days from the date of receipt of the application.

Similar wording will appear in the new edition of the Labor Code: in the tenth part of Article No. 136. It should be noted that it will apply to preferential categories of employees.

In 2021, certain amendments were made to the Labor Code. Changes are planned for 2021. They relate to the procedure and features of the calculation and payment of vacation pay.

How to calculate length of service for main leave if there was a month of absence for family reasons

An employee of the company took vacation at his own expense twice for a total duration of 30 days. How to take this month into account when calculating length of service for the purpose of annual basic leave?

By virtue of Part 1 of Art. 121 of the Labor Code of the Russian Federation , the maximum duration of leave at one’s own expense, which is taken into account in the length of service required for the main leave, cannot exceed a 14-day period.

Days beyond this duration (in the case under consideration - the remaining 16-day period) are not included in the length of service. The end of the working year must be shifted to the period of absence of the worker, deleted from the length of service.

In this case, in the vacation order (form No. T-6, form according to OKUD 0301005), in the column responsible for the working period, the date is entered in the following order. For example, instead of “from June 1, 2021 to May 31, 2020,” to “from June 16, 2021 to June 15, 2021.”

It should be taken into account that the period of downtime is also included in the length of service.

More details in the letter of the State Labor Inspectorate in Moscow dated 06/04/2020 No. 77/10-20669-OB/18-1299.

Source:

"Accountant's Time"

Heading:

Labor law

vacation vacation vacation schedule dividing vacation into parts extending vacation

Sign up 6825

9750 ₽

–30%

When does an employer pay for vacations and when not?

The employer pays the employee for vacation if this is provided for by current legislation or a collective agreement. According to Article No. 114 of the Labor Code of Russia, subordinates are annually granted exemption from work for rest, while retaining their place and position. This period is subject to payment.

In addition to the main vacation, there are also additional ones. They can also come with content. Required for employees who work in harmful and dangerous conditions, on irregular schedules, in the Far North and equivalent areas.

Enterprise managers have the right to expand the list of preferential categories to provide additional compensated leave at their discretion.

Article No. 116 of the Labor Code is devoted to annual additional leave. Exemption from work is also granted to persons who are receiving their first higher education (for passing the exam, writing and defending a thesis), and young mothers. This is stated in articles 173, 255 of the Labor Code of the Russian Federation. All days spent on such leave are subject to payment.

Upon written application, an employee may be given an exemption from work for family reasons and other valid reasons. This is discussed in Article No. 128 of the Labor Code of the Russian Federation. Such vacations are not subject to payment by law. But management may, at its discretion, retain the employee’s average earnings or pay him financial assistance.

As a rule, this applies to situations where an employee takes time off due to the death of a relative.

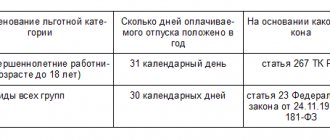

Unpaid additional leave in accordance with the Labor Code is granted to the following categories of persons:

- working disabled people;

- WWII participants;

- working pensioners;

- citizens who receive a second higher education.

Exemption from work is given on the occasion of a personal marriage or the birth of a child.

What is included in compensation

By agreement with the employer, employees have the right to expect reimbursement of the following types of expenses:

- payment for tourist services;

- vouchers to sanatoriums, resorts;

- other types of recreation within the Russian Federation.

The budget of expenses paid by the enterprise is limited to 50 thousand rubles. The employee can spend these funds on himself, his spouse and his own children under the age of 18. It is allowed to include in reimbursable expenses payment for a child’s travel package until he reaches the age of 24 if he is a full-time student at an educational institution. Expenses are reimbursed in the amount of 50 thousand rubles for each family member. For example, if a family has 2 children, the amount of paid expenses will be 200 thousand rubles.

How many days before going on annual leave are paid according to the Labor Code of the Russian Federation?

Every employee has the right to annual paid leave. Its minimum duration is 28 calendar days. For this period, the average salary is maintained.

According to the current rules established by the Labor Code of the Russian Federation, money is paid for three calendar days (as with other types of leave with pay).

Dear readers! To solve your problem right now, get a free consultation

— contact the duty lawyer in the online chat on the right or call: +7 Moscow and region.

+7 St. Petersburg and region. 8 Other regions of the Russian Federation You will not need to waste your time and nerves

- an experienced lawyer will take care of all your problems!

The procedure for granting regular annual paid leave

Regular annual paid leave and the procedure for its provision are prescribed in Art. 122 Labor Code of the Russian Federation. It states that regular labor leave must be provided by the employer annually. In the first working year, an employee can claim days of rest no earlier than after six months of work. However, there are reservations when, for special privileges, the procedure for granting it can be formalized earlier, and the employer does not have the right to refuse this request:

- minors;

- an employee became the adoptive parent of a baby under 3 months of age;

- pregnant women before maternity leave or childcare and immediately after it ends.

After the first year, in the second and subsequent years, the labor vacation period can be granted in any order.

Rules for issuing/transferring funds to an employee according to the law

Payment of vacation pay is carried out in accordance with a number of rules. The employer is responsible for the timely accrual of funds to the employee before the upcoming release from work. Therefore, the manager needs to know how vacation pay is paid when a subordinate goes on vacation.

Money can be provided in cash. In this case, the employee must go to the company’s cash desk. Cashless payment is more convenient. With this payment option, funds are transferred to the salary card. The entire due amount of money must be paid in full within the period prescribed by law.

Employers need to know the current provisions of the Russian Labor Code, and also be prepared for the innovations that the government of the country is planning.

Leave without pay

The following citizens can count on leave without pay:

- 35 days – children of war, participants of the Second World War;

- 14 – people of retirement age;

- 60 – employees with serious illness or disability;

- 5 days – provided to all employed citizens if there is a good reason (death of a relative, birth of a child, marriage).

This list is not final. Every year the Government of the Russian Federation adopts regulations. They add new categories of workers entitled to leave without pay.

The vacation period without payment of earnings is used by working students. To exercise this right, a citizen must present a certificate of challenge from an educational institution.

Documenting

Leave is provided to the employee in accordance with the approved schedule. Extraordinary release from work is also acceptable. The employee’s right to the first vacation arises six months after being hired at the enterprise.

But some employees, by law, can take a leave of absence from work before the expiration of this period. In such cases, the subordinate must submit an application to management for consideration. An order is issued based on this document. It is drawn up on standard form T-6 or T-6a.

The order is drawn up by the personnel officer or secretary. The order can be issued in free form or on a standard form. Based on it, marks are made in the employee’s personal card, personal account, and vacation pay is calculated. A note-calculation is drawn up to grant the employee exemption from work.

Last news

Since the issue is extremely important in practice, it is especially worth paying attention to information sources. How is vacation paid in 2021 under the Labor Code? Changes and latest news must be monitored on reliable resources: these are the websites of the State Duma, the Government, executive bodies of the constituent entities of the Russian Federation, official media.

Inaccurate information may cause errors and disputes with government agencies. For example, last year news spread that from October 1 a new procedure for determining the date of issuance of vacation pay was being introduced, while the Ministry of Labor bill had not even been submitted to the State Duma.

How is the amount to be paid calculated?

When determining the amount of vacation pay, you must adhere to a number of rules. They are established by the Regulations approved by Decree of the Government of Russia No. 922 of December 24, 2007.

The calculation of the amount of money to pay for vacation is carried out in accordance with the following algorithm:

- the billing period is determined. In general cases, it is equal to the 12 months that precede the vacation;

- all payments and periods are divided into two groups, which are included and which are not taken into account in determining the amount of vacation pay. Salary and quarterly or annual bonuses are taken into account. Travel allowances, social benefits, compensation and other accruals that do not relate to the wage system are not taken into account;

- the average salary is determined. To do this, total income is divided by 12;

- the average income of the employee is adjusted (if necessary). A correction factor is used for this;

- the average daily wage is calculated;

- the amount of vacation pay is determined. To do this, daily income is multiplied by the duration of release from work.

The following factors influence the amount to be paid:

- seniority;

- total duration of vacation;

- salary amount;

- change in salary, tariff rate over the last 12 months.

Minimum wage for vacation pay

There is often a question about how vacation pay should be paid in 2021, taking into account the latest changes in the minimum wage law. This rule is relevant for workers whose earnings for the year were less than the current minimum wage, which now changes every year and is equal to the cost of living for the 2nd quarter of the previous year.

According to clause 18 of the Regulations, the average monthly salary should not be lower than the minimum wage. Therefore, according to the explanations of specialists from the labor and employment service, if an employee’s earnings were less than the minimum wage, it is necessary to calculate payment for days of annual long rest based on the minimum wage in force during the period of his vacation.

What is a correction factor and when to apply it?

If the employee is paid a basic salary, then determining the average salary for calculating vacation pay is simplified: the monthly salary is divided by 29.3.

But in the reporting period, the level of income may be different. For example, an employee could be demoted or promoted. Accordingly, his salary or tariff rate will change. Wages could also be indexed.

In order for the amount of the cash payment to be comparable to the salary in the month the employee went on vacation, his income for the previous 12 months is multiplied by an adjustment factor. The value of this indicator is calculated for each month of the reporting period.

Use the following formula: K=O2/O1, where:

- O2 is the salary after the increase;

- O1 is wages before indexation, changes in salary or tariff rate.

Difficulties with providing leave at the expense of the employer

Note 1. The cost of the tour cannot exceed 6 percent of the employee’s total salary for the year. If a person receives, for example, 30,000 rubles a month, then he will not see any travel package worth 50,000 rubles. The maximum he can count on is 21,600 rubles.

The law is only useful to those lucky ones who officially earn more than 70,000 rubles a month. This category of employees can count on a trip worth 50,000 rubles.

However, this nuance occurs if the company has one employee. If there are more, then 6% is counted from the general wage fund.

Nuance 2. Why do you think all summer trips to Adler have not yet been sold out? The thing is that the costs that management incurs when providing a trip at the expense of the employer turn out to be greater than the potential tax savings.

The employer is obliged to charge insurance premiums for the amount of the voucher, that is, in fact, it will not cost the declared amount of 50,000 rubles, but 30 percent more. The employer will pay this 30 percent neither to the employee nor to the tour operator, but to the budget.

Personal income tax must be withheld from the cost of the paid trip, because compensation for vacation is, in fact, the employee’s income. If you do not withhold tax, then you cannot deduct the cost of the trip from profit.

30 percent is paid to funds (pension fund, compulsory health insurance fund, social insurance fund) and 13 percent tax. A total of 43 percent. In this case, companies pay 20 percent of profits. And what is the employer’s incentive to send an employee on vacation at his own expense?

What to do if the employer did not pay the money on time?

If the head of the company does not give his employee vacation pay on time, then the latter has the right to write an application to transfer the days of release from work to another period.

This is stated in Article No. 124 of the Labor Code of Russia. If an employer does not pay a subordinate within the period established by law, then he can be held liable. To do this, the employee must contact the Labor Inspectorate with a complaint. But we must take into account that this authority cannot oblige the company’s management to repay the debt to the employee.

If an appeal to the Labor Inspectorate does not give the desired result, the management refuses to pay vacation pay, then it is necessary to file an application with the court . You can also contact the prosecutor's office. The text of the claim must describe the current situation in detail.

It is advisable to have copies of the vacation schedule and the order granting exemption from work on the occasion of paid leave. It is also worth attaching a payslip to the application, which shows that the due amount has not been paid in full.

After receiving the application, an investigation into the case will begin. Based on its results, the head of the company who violated labor laws will be required to pay a fine and make a full financial settlement with the employee. Also, a subordinate can demand in court from management] compensation for moral damage[/anchor].

Expert opinion

Irina Vasilyeva

Civil law expert

When going to court, it is important to have a good evidence base of the employer’s guilt in relation to the personnel of the enterprise.