Salary- Tariff rate

- Awards

- Payment in kind

- Allowances and additional payments (for example, for work in harmful and dangerous working conditions)

- Pension payments

- Benefits (primarily, these include maternity payments)

- Student scholarships

There is no unified Federal law regulating the regional coefficient. For each region, this amount is set at the local level. You can read more about the regional coefficient in a separate article.

General concepts

The regional coefficient, as a factor in increasing the amount of benefits and wages, was introduced during the Soviet Union. The principles set out in Order No. 2 of the Ministry of Labor of the RSFSR of 1990 still apply.

Modern authorities have not abolished this surcharge, but have supplemented the rules and conditions for the appointment of the Republic of Kazakhstan with the following regulations:

- Article 315 of the Labor Code of Russia;

- Law of the Russian Federation No. 4520-1 of 1993.

Citizens permanently residing and working in the Far North and equivalent regions, residents of the Far Eastern Federal District and a number of other constituent entities of Russia have the opportunity to receive a bonus.

The regional coefficient and the northern supplement are close, but not overlapping concepts, since the second type of surcharge is calculated depending on the insurance experience and professionalism, that is, it is determined individually. RK is due to everyone who is employed in special areas. Moreover, even if a person lives in another place and works remotely, an increase in payments is mandatory, since the law specifies that it is tied specifically to the employer.

When determining the size of the Republic of Kazakhstan, authorities analyze the following parameters:

- climatic conditions, in particular, average temperature and precipitation;

- the impact of natural phenomena on the lives of citizens;

- infrastructure development and transport accessibility.

The size of the regional coefficient is not universal; it is determined by the living conditions in each region. But if it is installed, it must be used. Any actions by the employer aimed at reducing the amount of payment, for example, applying the Labor Code only in relation to salary, is a violation of the law.

It is important to know! The value of the regional coefficient varies from 1.15 to 2. The lowest indicator is in the Republic of Karelia and the Arkhangelsk region. The maximum size was recorded on the islands of the Arctic Ocean and in the Chukotka Autonomous Okrug.

Some features of use

According to the norms enshrined in Article 135 of the Labor Code of the Russian Federation, a worker’s salary contains three components:

- basic salary;

- compensation charges;

- incentive payments.

Salary and compensation payments are established by law and are mandatory when calculating earnings; therefore, in any case they will be subject to the application of the regional coefficient. But with regard to incentive payments, the situation is not clear, given that in some cases the company management can, at its own discretion, reward employees for their dedicated work on a one-time basis.

That is, if incentive payments are not stipulated in the local acts of the enterprise, the regional coefficient does not apply to them, but if additional payments are officially included in the total earnings, the regional coefficient is subject to application.

Accrual of bonus

For example, a bonus refers to an incentive payment, which is transferred to an employee only if the conditions for assigning the agreed payment are specified in the collective agreement or in the Regulations on bonuses, that is, they are officially recorded in a local act and, therefore, are included in the wages, in relation to which the regional coefficient is actually applied in full in accordance with Article 316 of the Labor Code of the Russian Federation.

Sick leave calculation

On the basis of Article 183 of the Labor Code of the Russian Federation, during the period of incapacity for work, the employee retains both his place of work and his earnings in the average amount, but as a percentage of the existing total length of service, determined by the norms of Federal Law No. 255 and depending on the grounds for providing sick leave.

In this case, the average earnings in the amount specified in Art. 7 Federal Law No. 255, namely 100% for work experience of more than 8 years and 80% for less than the specified period. And since the regional coefficient is already included in the average worker’s earnings, given that all accruals for the year are taken into account, the sick coefficient is not applied when calculating sick leave.

Pension

The procedure for calculating pension benefits is regulated by the norms of Federal Law No. 400, which provides for several types of benefits and a two-stage composition of the agreed payment. That is, initially the future pensioner has the right to count on an old-age or disability pension, depending on the number of pension points or labor loss group, and a fixed payment, the amount of which is determined on the basis of Article 16 of Federal Law No. 400.

So, in particular, the stipulated norm states that persons who have at least 15 years of work experience in the Far North and a total employment period of 25 to 20 years for males and females have the right to count on an increased amount of FBR, which, as of 02/01/2017 is 7207.67 rubles, while the size of the standard basic payment is 4805.11 rubles. That is, even at the stage of calculating pensions, northerners are initially given an increased pension amount in order to compensate for living in the northern regions.

The rules for applying this type of supplement to the income of citizens are described in the following video:

The procedure for calculating the regional coefficient

The parameter being studied is calculated on a certain list of payments provided to citizens. Let's look at the list in more detail:

- wage;

- additional payments from the employer, in particular, for length of service;

- compensation for night shifts, overtime and employment in difficult conditions;

- bonuses and additional payments accrued monthly and at the end of the year;

- payment of sick leave.

It is important to know! As for part-time workers and seasonal workers, they are also entitled to a bonus if they performed their duties in certain regions and were officially employed.

List of payments to which the regional coefficient does not apply:

- Transfers before vacation - when forming them, information about the citizen’s actual salary is used, where the Republic of Kazakhstan has already been taken into account.

- Material support for citizens, as well as one-time bonuses, if they are not specified in the company’s internal regulations, labor and collective agreements.

- Business travel allowances if the trip is to a region where the multiplying factor does not apply.

- Northern supplement, since it is a separate payment that increases the actual income of citizens.

When calculating wages and all other types of payments, company management must apply an increasing percentage. Vacation pay is not subject to a regional coefficient.

Let's look at how the payroll coefficient is calculated:

- Citizen K works in the Komi Republic, where the regional coefficient is set at 1.25.

- For May 2021, he received a salary (30,000), a bonus (15,000), compensation for sick leave (8400) and financial assistance (2500).

- All payments, with the exception of the last one, are subject to increase by 1.25 at the expense of the Republic of Kazakhstan.

- As a result, the salary, taking into account salary, bonus and compensation for temporary disability, will be 66,750 rubles.

It is important to know! An income tax of 13% will also be deducted from this payment, so citizen K will receive 58,072. If the employee were entitled to the northern bonus, then it would be calculated only from the salary and would not be subject to increase.

Using the coefficient

There are certain reasons that led to the state officially establishing additional northern charges and benefits.

They are associated with difficult working conditions and climate, which leads to certain inconveniences for the residents of these territories, so payments and benefits serve as a kind of compensation. Namely:

- residents of the northern regions have the right to retire earlier, since it is statistically calculated that the life expectancy of people in such regions is lower;

- difficult climatic conditions also serve as a basis for additional charges;

- Since many areas do not have developed logistics, it is difficult to deliver the necessary goods there, which leads to rising prices and an increase in the cost of living, and additional payments compensate for this difference.

Also see "Northern surcharges and district coefficient in 2021".

Is the regional coefficient for vacation pay calculated or not?

From June 1, 2021, he goes on annual leave for 28 days, how to calculate his vacation pay, is it necessary to calculate the regional coefficient?

Let’s assume that every month of the last year has been worked in full, the monthly salary is the same and equal to the salary.

Calculation:

Depending on the region of the Ural region, the increasing coefficient can be equal to:

- 15 – Kurgan, Sverdlovsk, Orenburg, Chelyabinsk regions;

- 20 – Garinsky, Taborinsky, Krasnovishersky, Gainsky, Cherdynsky districts.

For the city of Chelyabinsk the coefficient is 1.15.

Should such regional indicators be taken into account when calculating vacation pay?

Didn't find the answer to your question in the article?

Get instructions on how to solve your specific problem. Call now:

here and get an answer in 5 minutes

It's fast and free!

In which regions is the regional coefficient applied?

Regional coefficient is a special coefficient that increases the salaries of employees in certain regions of the country (Article 316 of the Labor Code of the Russian Federation). The leadership of the constituent entities of the Russian Federation and municipalities has the right to increase its value by paying the difference from their own budget. The regional coefficient is calculated on the salary regardless of the person’s total length of service and length of service in the region where the coefficient applies. This is the difference between the regional coefficient and the northern surcharge.

The specificity and inaccessibility of the region directly affects the amount of the increasing coefficient applied to wages (Article 315 of the Labor Code of the Russian Federation). You can see the list of areas with unfavorable natural conditions in 2021, in which the regional coefficient is applied, here. The criteria for assessing terrain and the coefficients assigned to them are established by Resolution of the USSR Council of Ministers of November 10, 1967 No. 1029.

The rules for applying northern coefficients are established by the Government. In practice, higher coefficient sizes may be used. In any case, employers' costs for payment are taken into account in labor costs.

When allowances are not included in the calculation

Is there a regional coefficient for vacation pay? The coefficient is not used in vacation pay calculations, since it was previously calculated when calculating wages. The coefficient cannot, in fact, be used when calculating any payments based on an average earnings base, since the benefit has already been included in the employee’s income. Re-calculation of the coefficient amount will be unlawful.

Based on this, the regional coefficient is not used in calculating the following payments:

- Leave due to study (this leave does not apply to work in special regions).

- Annual vacation pay (the benefit has already been applied in salary calculations).

- Material payments representing social assistance in unfavorable cases or illness.

- Anniversary and professional incentives.

- Donor payments (donation is not a labor activity, but is considered the fulfillment of a public duty).

The regional coefficient applies to all residents of regions with harsh climatic conditions. The bonus is not ignored when an employee goes on vacation. However, the coefficient is not used in the calculation of vacation pay, since the amount is already included in the employee’s income when calculating his salary.

For those citizens who carry out their labor activities in areas that are regions of the Far North or equivalent to them, wages are calculated at an increased rate. Workers who carry out their work activities in those areas where additional payment for work in certain areas is carried out are wondering whether the regional coefficient is calculated on vacation pay.

What is the regional wage coefficient?

Working under special conditions should be rewarded. Employees are entitled to additional pay for performing duties in the most severe climatic conditions. That is why all employers must act within the framework of the law and apply the regional coefficient to payments that will be accrued in addition to the salary.

If interest charges depending on the location are not used, the employer will incur financial, criminal or administrative liability.

What payments are subject to the regional coefficient?

It is calculated primarily on salary, as well as on everything that is part of the actual monthly earnings (bonuses, allowances, other incentive payments). The Labor Code of the Russian Federation establishes territories where organizations are located in arrears up to the minimum wage, this is a compensation payment or an incentive to pay extra to their employees.

The Russian government recommends paying an allowance in accordance with the established procedure to residents of the Far North regions, as well as territories that are equivalent to them. For example, such territories include many areas of the Krasnodar and Khabarovsk Territories.

It is also possible to use additional payments for employees for those who work in the following areas:

- alpine;

- anhydrous;

- deserted.

If a territory falls under several grounds for bonuses at once, then exclusively the largest percentage is selected for employees.

Is the regional coefficient included in the minimum wage in 2021?

At the moment, it is not part of the minimum wage, but is accrued at this minimum amount. The law states that all employees are guaranteed minimum payments. Conditions do not affect this in any way.

Therefore, if allowances are included in the minimum wage amount, the employee’s rights will be violated. Accordingly, working in conditions with negative factors would not be rewarded in any way. Thus, it must be added to the minimum wage, and not included in this amount.

conclusions

When calculating vacation pay, the regional allowance is taken into account, but not directly, but indirectly. That is, the calculated vacation payment does not need to be multiplied by the provided increasing percentage, since it has already been taken into account earlier when calculating earnings, on the basis of which the vacation payment is calculated.

Depending on the region, the coefficient may differ, but it is not taken into account when directly calculating vacation pay.

The article describes typical situations. To solve your problem , write to our consultant or call for free:

+7 (499) 490-27-62 — Moscow — CALL

+7 — St. Petersburg — CALL

+8 ext.849 — Other regions — CALL

For those citizens who carry out their labor activities in areas that are regions of the Far North or equivalent to them, wages are calculated at an increased rate. Workers who carry out their work activities in those areas where additional payment for work in certain areas is carried out are wondering whether the regional coefficient is calculated on vacation pay.

What coefficient are we talking about?

Before determining whether there is a regional coefficient for vacation pay, let’s get acquainted with its essence.

The regional coefficient is an indicator by which the calculated remuneration for the work of an employee working in an area with special climatic and environmental conditions is multiplied. The list of such localities was approved by a normative act that was adopted a long time ago, but is still used today - Resolution of the Council of Ministers of the USSR dated January 3, 1983 No. 12.

The regional coefficient can be supplemented with various bonuses, for example, for work experience in areas with difficult climates. But both the premiums and the coefficient are set independently of each other. The bonus, calculated as a percentage of the salary, is simply added to the salary, which is increased due to the coefficient. Regional coefficients and bonuses are paid by the employer at his own expense (by budgetary organizations - at the expense of appropriations provided for by law).

The magnitude of the coefficient in question may vary. It usually depends on the degree of complexity of working conditions in a particular area. In the coldest regions of Russia, the coefficient can reach 2 (as, for example, in the Chukotka Autonomous Okrug), in warmer regions it can slightly exceed 1 (for example, in the Perm Territory - 1.15 or 1.2, depending on the municipality).

A very popular question is: is the regional coefficient taken into account when calculating vacation pay? Let's start looking for an answer to this by considering those payments for which this coefficient is calculated in principle (and find out whether such payments include vacation pay).

Is the regional coefficient for vacation pay calculated or not?

If you want to find out how to solve your particular problem, contact a consultant: The concept of the regional coefficient was developed back in the USSR, when the country's leadership needed to develop the sparsely populated areas of the RSFSR.

It was at this time that coefficients were adopted for the northern parts of the republic that significantly increased wages.

Currently, the amount of payments is regulated by Resolution 216 of the Government of the Russian Federation of 2006.

In addition, information about regional coefficients is also contained in the Labor Code of Russia (Article 316), which determines the terms and other nuances associated with these social payments.

Payment of a one-time benefit upon dismissal of a military serviceman

(Review of legislation and judicial practice of the Supreme Court of the Russian Federation for the fourth quarter of 2005 (approved.

Average earnings are determined based on a unified procedure. When calculating the average salary, all payments that are applied by a given employer are included in accordance with the remuneration system. In this case, the sources of these payments do not matter, i.e.

by resolution of the Presidium of the Supreme Court of the Russian Federation of March 1, 2006)

Is the Ural coefficient calculated for dismissal benefits by agreement of the parties if: 1.

it is indicated as “average monthly benefit”; 2. in the exact amount? Is personal income tax withheld from the payment of such benefits? Thank you!

Consequently, the regional coefficient is subject to calculation on the amounts due to the employee as wages.

Part 1 of Art. 129 of the Labor Code of the Russian Federation stipulates that wages (employee remuneration) are remuneration for work depending on the employee’s qualifications, complexity, quantity, quality and conditions of work performed, as well as compensation payments (additional payments and allowances of a compensatory nature, including for work in conditions deviating from normal ones, work in special climatic conditions and in areas exposed to radioactive contamination, and other compensation payments) and incentive payments (additional payments and incentive allowances, bonuses and other incentive payments).

Severance pay (average monthly pay, compensation upon dismissal) in case of dismissal by agreement of the parties, provided for in the employment contract, is not remuneration

What coefficients can be applied when calculating vacation pay in 2021 - 2021?

When calculating vacation payments, the employer can apply 3 coefficients:

1. Fixed coefficient established by Art. 139 of the Labor Code of the Russian Federation and corresponding to the conditional number of days in a full month. Until 2014, a higher value of 29.4 was used. In 2020-2021, the vacation pay ratio is 29.3. This coefficient is set by the state and can be changed if the number of weekends and holidays increases or decreases.

The indicator under consideration roughly corresponds to the average number of days in a month that do not fall on public holidays.

For example, 2021 has 366 days. Of these, 14 are holidays. If these are subtracted from 366 and the result divided by 12, the result is 29.34, which is comparable to the established value of 29.3.

2. Salary increase factor.

In the cases provided for in clause 16 of the Regulations “On the specifics of the procedure for calculating the average salary”, approved by Decree of the Government of Russia dated December 24, 2007 No. 922, a special increasing coefficient is applied when calculating the employee’s vacation pay.

3. Regional coefficients.

In cases provided for by law, these coefficients significantly increase earnings, on the basis of which vacation pay is calculated.

Let's study the features of using these coefficients in more detail.

What is the application of the regional coefficient when paying severance pay?

By virtue of Art. 148 of the Labor Code of the Russian Federation, remuneration for work in areas with special climatic conditions is made in the manner and amounts not lower than those established by labor legislation and other regulatory legal acts containing labor law norms.

Part 1 of Art. 129 of the Labor Code of the Russian Federation stipulates that wages (employee remuneration) are remuneration for work depending on the employee’s qualifications, complexity, quantity, quality and conditions of work performed, as well as compensation payments (additional payments and allowances of a compensatory nature, including for work in conditions deviating from normal, work in special

whether the regional coefficient is calculated on the amount of severance pay paid upon dismissal of an employee by agreement of the parties.

If the payment is calculated differently, for example, in a fixed amount or based on the size of the salary, we believe that a regional coefficient is calculated on it.

We wrote more about it in the material at the link. In Art. Art. 146 and 148 of the Labor Code of the Russian Federation, the emphasis is placed on the fact that workers are paid at an increased rate. Consequently, the regional coefficient is subject to calculation on the amounts due to the employee as wages.

At the same time, we recommend that the agreement on termination of the employment contract directly reflect the fact that the payment is subject to a regional coefficient.

Details in the materials of the Personnel System: Situation: How to calculate the regional coefficient for work in the Far North The right to a coefficient For employees working in the regions of the Far North and equivalent areas, pay a salary taking into account the regional coefficient (Article 316 of the Labor Code of the Russian Federation). Both main employees and part-time employees have the right to the regional coefficient (Art.

285 Labor Code of the Russian Federation). In addition to employees who constantly work in the regions of the Far North and equivalent areas, employees who periodically work in the Far North on a rotational basis also have the right to receive a regional coefficient (Article 302 of the Labor Code of the Russian Federation).

Guidelines for implementation

Labor Code of the Russian Federation Decree of the Government of the Russian Federation No. 216 The legislation of the Russian Federation clearly defines the size of the regional coefficient for all regions located wholly or partially in the territory of the Far North and areas equivalent to it.

In some cases, the lands of one federal subject have different coefficients.

For example, the cities of Arkhangelsk and Severodvinsk have different amounts of payments, although they are in the same region and located at a short distance from each other.

Such moments were adopted back in the days of the Soviet Union and had the goal of attracting the population to certain cities of the country.

Questions and answers – TsNIIEUS

You can find out what rules apply for calculating and paying the regional salary coefficient in this section of the article:

- In addition, below you will receive information about the specifics of calculating this payment for part-time, seasonal and remote workers.

- The accounting department must draw up the regional coefficient separately in its documents when calculating wages and other benefits to employees, indicating this amount in a new line.

- In addition, information about the amount and rules of accrual are indicated in the employment and collective agreement.

- This is necessary to determine the rights and social guarantees of the employee, as well as to clarify the components of his salary.

- No less important is the provision on remuneration of company employees, which should include information about this social payment if the company is located in regions that apply this coefficient.

- The regional coefficient is calculated based on the amount the citizen must be paid according to the employment contract.

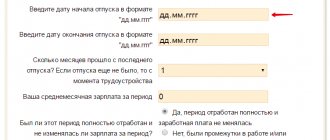

Calculation of average daily earnings

To calculate compensation for unused vacation upon dismissal of an employee, personnel officers multiply the unused days by the average daily earnings for the last 12 calendar months of work.

To calculate the average daily earnings, the amount of accrued wages and other payments for the last 12 months is divided by 12 and by 29.3 - this is the average monthly number of calendar days. 29.3 is a legally established constant. If during the last year the employee was on vacation or on sick leave, then the amount of salary is divided not by 12, but by the sum of full months worked multiplied by 29.3, and the number of days in partial months.

Vacation pay calculation parameters

Billing period

It is usually taken to be a year - in this case, the employee’s total earnings for this time are taken, and based on it, the average daily income is calculated, according to which vacation pay will be calculated.

If the employee has worked for a shorter period, the pay period will accordingly be reduced to this period. Taking into account all days worked, the average earnings will be displayed.

Application of coefficients

As already mentioned, they are included directly in earnings, therefore, they are initially included in the figures used to calculate vacation pay. The same applies to travel allowances and sick leave payments. However, sometimes the coefficient is not reflected directly in earnings, and then an adjustment will need to be made for it. And here an important point should be noted: in contrast to them, a coefficient will not be accrued for bonuses that are one-time in nature.

How the regional coefficient and the northern bonus are calculated

To correctly calculate the northern allowance, the following aspects must be taken into account:

- This is a fixed additional percentage of the established salary. It is important to note that the district coefficient is not taken into account;

- Accrued only for labor payments (does not apply to additional bonuses, travel compensation and other allowances);

- Regardless of the type of enterprise (state or commercial), the organization is required to make contributions to employees.

The bonus must be paid monthly and is due to everyone who works in the Far North. This is due to the fact that a person spends more of his resources on performing work duties, and the cost of living is higher.

The amount of additional payments also depends on the following aspects:

- employee age category;

- work experience;

- specifics of local conditions.

When developing the coefficient, the entire area was divided into separate categories based on the severity of climatic conditions.

Even when taking into account the northern surcharge, the coefficient may differ depending on the region. For example, employees working in Chukotka, Magadan and islands in the Arctic Ocean must receive 1/10 of the established salary.

Every six months, the amount of the premium increases by 10% until it reaches the equivalent of 100%. Regarding other regions included in this category, the calculation procedure is carried out by analogy. Once the 60% bar is reached, you can qualify for the next 10% increase a year later.