Recommendations for calculating vacation pay in 2021 based on the new edition of the Labor Code of the Russian Federation

The Labor Code of the Russian Federation defines the basic rules for the provision, calculation and payment of leave. Article 114 of the Code establishes the right of employees to be granted annual leave of 28 calendar days. During the vacation, the employee retains his place of work and payment of average earnings. How to calculate vacation pay in a new way in 2021 and examples of calculation are given in the article based on these rules.

The amount of accrued vacation pay must be included in expenses in proportion to the vacation days that occurred in each reporting period. The amount of accrued vacation pay for annual paid vacation is included in income tax expenses in proportion to the vacation days falling on each reporting period.

Expenses for profit tax purposes are recognized in the reporting period to which they relate and are independent of the time of actual payment of funds. The date of expenses in the form of insurance premiums is the date of their accrual. (Letter of the Ministry of Finance N 03-03-РЗ/27643)

The duration of the annual basic paid leave is calculated in calendar days. Weekends, just like working days, must be included in the number of calendar days of vacation.

In cases where holidays occur during the vacation period, the end date of the vacation is postponed by the number of days that corresponds to the number of days of holidays.

Part one of Article 112 of the Labor Code of the Russian Federation establishes the following non-working holidays on the territory of the Russian Federation:

- January 1, 2, 3, 4, 5, 6, 7, 8 — New Year holidays;

- January 7—Christmas Day;

- February 23 - Defender of the Fatherland Day;

- March 8—International Women's Day;

- May 1 - Spring and Labor Day;

- May 9 - Victory Day;

- June 12—Russia Day;

- November 4 is National Unity Day.

Rules and length of service for vacation and calculation of vacation pay

There are certain provisions governing when an employee goes on vacation and the accrual of payments to him during his vacation. Everything must be taken into account so as not to accidentally violate the law and not disadvantage the employee.

New 2021 rules for calculating vacation pay

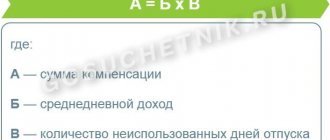

The system for calculating the amount due to an employee upon retirement for 28 (or more) days has long been established. In 2021, no new rules for calculating vacation pay have been created. As before, the process is regulated by Article 139 of the Labor Code of the Russian Federation and paragraph 4 of Decree of the Government of the Russian Federation of December 24, 2007 No. 922. The formula remains as follows:

Vacation pay = Average earnings per day * Number of vacation days

As before, when calculating vacation pay, it is necessary to take into account all the employee’s income related to the remuneration system. That is, wages, allowances, bonuses and additional payments. There is no need to take into account amounts assigned other than wages (for example, financial assistance or sick leave).

How long do you need to work for vacation?

In order to obtain this right, an employee must continuously work in the organization for at least 6 months. After this, he can request the standard 28 days for rest, or split this period into two or more parts.

The length of service includes only time worked under an employment contract. If an employee worked under a civil contract, then this time is not taken into account in the length of service. That is, such an employee does not have the right to leave until he switches to an employment contract and works under it for six months.

The following have the right to receive leave without working for 6 months (“in advance”) without the consent of the employer:

- minors;

- those who are going on maternity leave or have just returned from it;

- who have adopted a child under 3 months of age.

Other employees can also go on vacation “in advance,” but this will require an agreement with the employer. But you can only get annual paid leave in this way - other types (educational, maternity leave, etc.) are assigned only upon presentation of the relevant document.

At the same time, at any time convenient for the employee, leave can be taken by:

- husbands if their wives are on maternity leave;

- veterans and “Chernobyl victims”;

- husbands/wives of military personnel;

- part-time workers, provided that they also received vacation at their second job;

- heroes of the USSR, Socialist Labor, Russian Federation, holders of the Order of Glory or Labor Glory (full);

- honorary donors of the Russian Federation;

- exposed to radiation during testing of nuclear weapons at the Semipalatinsk test site;

- working in the Far North (or in regions equivalent to it), provided that they accompany a minor to enter a university or college in another region.

Attention! When calculating length of service, not the calendar year, but the working year is taken into account. If an employee was hired by the organization on March 1, 2018, then only on September 1, 2021 (after 6 months from hiring) he gets the opportunity to go on vacation.

The procedure for calculating vacation pay in 2021 - who is entitled to vacation pay, and what is taken into account in the calculation?

The general procedure for calculating payments for due vacation in 2021 has not changed. The accountant must be guided by the same Government Resolution number 922, which was approved on December 24, 2021.

At the moment, no other bills have been adopted.

Vacation payments can be accrued to a citizen of the Russian Federation who:

- Officially set up.

- Has an employment contract concluded with the employer.

- Worked for a full six months or a year. This point must be specified in the contract.

- Does not apply to exceptional categories of citizens for whom vacation cannot be replaced with compensation.

- Number of calendar days of vacation.

When calculating, you must take into account:

- Number of calendar days of vacation.

- Citizen's salary.

- Average daily earnings of an employee (SDE).

- Possible bonus payments and allowances.

- Personal income tax.

In addition, you should remember:

- The calculated coefficient by which the employee’s salary was indexed in 2021.

- Payment time is the last day of the month. Previously, it was the day when the payment was made, but now it’s different.

- Legal requirements: payment must be made before the employee goes on vacation, no later than 3 days before this moment.

Calculation formula:

To calculate cash payment for vacation you must:

- Determine the number of full days on the calendar that an employee is entitled to rest.

- Calculate his average earnings. To do this, divide the employee's annual total earnings by 12 months. If the specialist did not work for the full period, then the income is divided into a different number of months. For example, if you work for 7 months, your income is divided by 7.

- Divide the resulting amount by 29.3. This is the number of days on average per year. This figure has not changed for 2021.

- We multiply the number from the first point (the number of days the employee is entitled to rest) by the amount obtained in point 3.

- We receive the final payment amount.

Previously, we wrote in detail about the cases in which vacation pay is due.

Employee's rights to leave

Every employee has the right to rest. It must be provided by the employer every year and paid in accordance with the law. This right does not depend on where a person works, how his place of work is organized, and so on. Moreover, both an ordinary employee and a part-time employee, a seasonal worker and any other can take advantage of the leave. Except for those who have entered into a civil contract with the employer (for example, a contractor).

The right to maintain a position and average earnings

One of the main responsibilities of an employer to an employee going on vacation is to maintain his level of earnings and position. The boss does not have the right to send an employee on a walk without paying him vacation money (based on average earnings), or to fire him while he is on vacation.

It is worth remembering that vacation at your own expense is not paid for by the employer. If the period exceeds 14 days, all subsequent days away from the workplace will not be included in the length of service required to take a well-deserved annual rest.

Right to use vacation

An employee has the opportunity to rest for 28 days after working for at least 6 months for one organization. He can take it at any time after six months of accrual of experience, without violating the approved vacation schedule. But you can take time off “in advance” (before reaching six months), if the employer agrees to this.

In the case when a person works part-time, he has the right to receive leave from both jobs at once in accordance with Art. 286 Labor Code of the Russian Federation. Even if he has not been on one of them for 6 months yet, in this case the boss must provide the rest “in advance.”

An employee cannot be recalled from vacation if he does not agree to it. If agreed, the “non-time off” days still remain with the employee, and in the event of dismissal, the employer must compensate for them. In addition, even if the employee wishes, the following categories of citizens cannot return from vacation earlier:

- minors;

- pregnant women;

- working in dangerous or harmful conditions.

It is worth remembering that according to Art. 114 of the Labor Code of the Russian Federation, annual paid leave is not only an employee’s right. This is his direct responsibility. You can't refuse a vacation. It can be transferred to the next calendar year at your own request (in some cases regulated by the Labor Code of the Russian Federation and internal regulations of the organization). But only once - you can’t not go on vacation twice in a row. The employer has the right to consider a voluntary refusal to take leave a disciplinary violation and apply appropriate sanctions to the employee.

In this case, annual leave can be divided into two parts (or more, if the number of days allows) so that one of them is at least 14 days.

Right to extend leave

In some cases, the employee has the opportunity to slightly increase the rest period. Such situations include:

- Illness during vacation (if confirmed by a sick leave certificate, does not apply to the illness of an employee’s child).

- Performing government duties while on vacation.

You can also obtain permission for additional days of rest in other situations provided for by law and internal agreements/regulations of the organization. The list of such situations still remains open, so it is worth checking with the employer about a specific precedent.

Duration of vacation

The usual length of leave is 28 days. In this case, the employee, having agreed on his wishes with the employer, has the right to divide his vacation into several parts. It is important to remember that one of these parts must be at least 14 days (Read also the article ⇒ Vacation in working days in 2021 (an example of calculating vacation in working days)).

Vacation is counted in calendar days, and it does not matter whether weekends fall within this period.

Important! An employee can extend his vacation only due to holidays that fall during his vacation period.

| ★ Best-selling book “How to calculate vacation pay” (120 pages, practical examples, formulas and complex cases) > 3000 books purchased |

Compensation for unused vacation

In some cases, an employee has the right to receive money instead of vacation directly (or part thereof). But not all of them. It is impossible not to go on vacation, receiving instead a certain amount in addition to your salary.

An employee may request money in lieu of vacation if he:

- He quit without taking the required time off (Article 127 of the Labor Code of the Russian Federation).

- He does not want to rest for more than 28 days and is ready to write a statement so that the remaining vacation days are replaced with money (Article 126 of the Labor Code of the Russian Federation). But only on the condition that the annual leave is more than 28 days, and the employee is an adult and not a pregnant woman.

Employees who have worked for at least 11 months without a 28-day vacation can count on full compensation upon dismissal. Moreover, if the vacation was postponed, you must work 23 months to receive compensation for 56 days. But, if an employee is discharged as a result of entering active military service or due to a reduction, liquidation or suspension of the enterprise, its reorganization, then the minimum threshold for receiving full compensation for 28 days is reduced to 5.5 months. To receive money for 56 days, such an employee must work 18 months with the transfer of vacation from the first year.

If the employee worked for less than 11 months and quit for any other reason, then he has the right to proportional compensation according to the months worked. To do this, you need to divide the number of vacation days by 12 months.

When calculating length of service, just as in the case of obtaining the right to leave, working months/years are taken into account, not calendar ones. That is, to obtain the right to 100% compensation, 28 days in case of dismissal must be worked, for example, from March 1, 2021 to February 1, 2019 (11 months).

The second option covers almost all citizens with extended or additional leaves - be they for disability, seasonal (teachers) or for other reasons. Only “Chernobyl victims” and those working in harmful/dangerous conditions are not subject to this rule (additional leave).

In addition, two annual holidays cannot be combined to obtain compensation for anything greater than 28 days. Because each of them is taken into account separately. But if both exceed 28 days (let’s say 32 days each), then you can request to pay an additional 4 days from each period. But this right of the employee is not the obligation of the employer. Therefore, the latter has the right to refuse payment of money and send the applicant to “walk” for the prescribed number of days.

Attention! You cannot receive compensation for a vacation of no more than 28 days (even if it was not taken last year) in money! This is a serious violation that will lead to a fine for the employer under Part 1 of Art. 5.27 Code of Administrative Offenses of the Russian Federation.

Calculation of vacation pay taking into account sick leave and time off

Separately, it is necessary to consider cases of accrual of vacation pay, which are individual, because each employee can take a week of sick leave, or write an application for time off due to personal circumstances. Such periods should be subtracted from the above formula.

Let's consider a hypothetical situation. For example, employee Ivanov took sick leave for the period April 2-12, 2021, missing ten days of work. There are only 30 days in April, which means Ivanov was at work for 19 days of April. The total calculation of calendar days looks like this:

(29,3/30)*19 = 18,55

We substitute the result obtained into the above formula to obtain the value of Ivanov’s average daily earnings:

SDZ = salary / (11*29.3+18.55)

In addition, during the employee’s work, his salary may be subject to indexation, which means that this coefficient should also be displayed in our calculations. It can be found by dividing the amount of salary after the increase by the amount of salary before the indexing procedure.

The amount of vacation pay depends on the number of days off you took.

For example, for 10 months Ivanov received a monthly salary of 20,000 rubles. Then the company increased remuneration for its employees, as a result of which Ivanov began to receive 25,000 rubles. Ivanov did not go on sick leave and did not ask for days at his own expense throughout the entire year. Based on all available data, the indexation coefficient is calculated by simply dividing 25,000 by 20,000, that is, 1.25. If we substitute it into the formula, the calculations of average daily earnings will take the following form:

(10*20000*1,25+2*25000)/12/29,3 = 853,24

Multiplying this value by the number of days of Ivanov’s vacation, we get the amount that he will need to be credited. For example, if Ivanov goes on vacation for 28 days, he needs to pay 23,890 rubles and 78 kopecks.

How employers cheat with vacation

In connection with the crisis, organizations and entrepreneurs often seek to reduce costs for employees, getting maximum output from them. In this case, illegal methods are often used. How to avoid being deceived when calculating vacation pay or vacation?

Failure to provide full leave

An employer may not send an employee on vacation at the time allotted to him (according to the application and/or schedule), especially if the employee has not worked the full pay period. The authorities may motivate this by the fact that he has not yet “earned” a full term.

This is not true. After 6 months of continuous work, according to Art. 122 of the Labor Code of the Russian Federation, a person already has the right to a full 28-day rest.

Incomplete payment of vacation money

In some cases, management may try to save on vacation pay by paying only part “upfront” and the other part later. This is an illegal decision, since the full amount due to the employee going on vacation must be paid at least three days before the start of the vacation.

According to Art. 124 of the Labor Code of the Russian Federation, even if part of the money has not been paid, the employee has the right to demand that annual paid leave be postponed. But at the same time, the employer can pay vacation pay in installments, starting long before the employee’s rest time.

Payment of part of the vacation pay after the start of the vacation is allowed only in one case - if the employer is not yet able to calculate the exact amount (for example, if part of the employee’s exact earnings for the last working month is not yet known, since the vacation begins on the 1st day of the new month).

No indexation of vacation pay in case of salary increase

An organization may simply “forget” to index the average salary for the billing period if the salary was raised. But, according to clause 16 of the Decree of the Government of the Russian Federation of December 24, 2007 No. 922, when rates are increased in the cases provided for in the clause, it also entails a recalculation of vacation pay.

Accountants especially suffer from such “forgetfulness” in relation to women on maternity leave. And this is a direct violation of Art. 132 of the Labor Code of the Russian Federation, being an infringement in the field of remuneration

How to correctly calculate vacation pay: calculation examples

To get the total amount that the organization is obliged to pay to the employee before his leave, it is necessary to calculate the average earnings. It includes all types of payments, regardless of their sources - additional payments, bonuses for labor, bonuses for length of service and conditions, and so on. You can get it from the actual time worked and wages for the last 12 calendar months.

The calculation of vacation pay does not take into account sick leave and payments for disability, travel allowances, financial assistance, compensation for wages and food.

So, to get the amount of vacation pay, you need to carry out several manipulations. For example, in the calculations, let’s take an employee who was not sick and did not take vacation at his own expense, and whose average annual earnings (AE) is 360 thousand rubles.

To begin with, calculate the employee’s average monthly earnings (ASM). To do this, earnings for the year must be divided into 12 months. In formula form it looks like this:

SMZ = SZ / 12

where, SMZ is the average monthly salary of an employee ; SMZ is the average salary for the year

SMZ = 360,000 / 12 SMZ = 30,000 rubles.

Now that the average monthly earnings are known, we can calculate the employee’s average daily earnings. To do this, you need to divide the SMZ by a factor of 29.3 (the average number of days in a month):

SDZ = SMZ / 29.3 SDZ = 30,000 / 29.3 SDZ = 1023.89 rubles.

where, SDZ is the employee’s average daily earnings

That is, an employee earns almost 1,024 rubles per day. Now, in order to calculate the amount of vacation pay (OTP) due to him, you need to multiply this amount by the number of days of vacation (Days):

OTP = SDZ * Days OTP = 1023.89 * 28 OTP = 28668.92 rubles.

where, OTP is the amount of vacation pay

An employee who goes on vacation after honestly working 12 months will receive exactly this amount of vacation pay.

It is worth remembering that vacation pay must be paid no later than three calendar days before the first day of rest. This includes weekends and holidays. In this case, vacation pay is necessarily taxed!

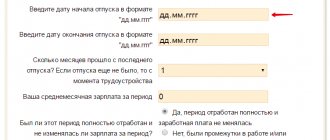

In case the employee has not worked for 12 months

Sometimes it happens that an employee wants to go on vacation without working the full pay period (12 months by default). In this case, the employee did not work out the entire pay period. And it is necessary to calculate his vacation pay based on the number of calendar days he worked. For example, a person worked for 6.5 months (KM) and during this time received 195 thousand rubles (SZ).

It is necessary to calculate how many days the employee worked in full months (DPM). To do this, you need to multiply the fully worked months (OM) by the average number of days in them (the generally accepted coefficient is 29.3):

DPM = OM * 29.3 DPM = 6 * 29.3 DPM = 175.8 days.

where, DPM is the number of days worked in full months

After this, you need to find out how many days the employee worked in an incomplete month (DNM). To do this, it is necessary to divide the coefficient 29.3 by the total number of days in the month not fully worked (CD) and multiply by the number of days worked in the month (ODM). Let's say an employee worked half of February in a non-leap year.

DNM = 29.3 / CD * ODM DNM = 29.3 / 28 * 14 DNM = 14.65 days.

where, DNM is the number of days worked in an incomplete month KD is the total number of calendar days of this month ODM is the number of days worked in the month

Now it’s time to calculate how many days the employee worked in total (OD). To do this, you need to add up both of the resulting results - days in full (DPM) and incomplete (DNM) months.

OD = DPM + DNM OD = 175.8 + 14.65 OD = 190.45 days.

where, OD is the sum of days worked

After this, it is enough to calculate the average daily earnings (ADE). To do this, in this case, you need to divide your earnings for 6.5 months by the number of days worked:

SDZ = 195,000 / 190.45 SDZ = 1023.89 rubles.

where, SDZ - average daily earnings

And multiply the average daily earnings by the number of vacation days (Days, standard - 28 days) to get the amount of vacation pay (OTP):

OTP = SDZ * Days OTP = 1023.89 * 28 OTP = 28668.92 rubles.

where, OTP is the amount of vacation pay

The employee must receive this amount when going on vacation, provided that he has worked an incomplete pay period. Using the same principle, you can recalculate vacation pay for those employees who were sick or on unpaid leave. It is enough to recalculate each month in which days were missed, using the formula for DNM, and add the results obtained with the number of days in fully worked months.

Upon dismissal

If an employee does not take his allotted leave upon dismissal, he has the right to compensation for this time in cash.

Let's say an employee worked for 11 months, after which he decided to quit. At the same time, he did not go to rest. In this case, the amount of compensation (AC) is calculated based on the average daily earnings (ADE) for the billing period, multiplied by the number of non-vacation days (ND).

Let’s say an employee who has worked for two years resigns, transferring the rest from the first year to the next. In this case, he is entitled to 56 days of vacation. During the last billing period, he earned 360 thousand rubles (according to the calculations above, he receives 1023.89 rubles per day). Then you will need to pay:

SK = SDZ * ND SK = 1023.89 * 56 SK = 57337.84 rubles.

where, SK - amount of compensation ND - number of days not taken off

Such compensation is due to a person who has never taken a vacation in two years and decided to quit.

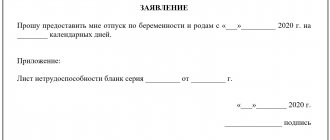

Maternity and annual leave

Maternity leave can be combined with annual leave, combining them in two options:

- First annual, then immediately – sick leave for pregnancy and childbirth, followed by maternity leave.

- Immediately after the end of parental leave for a child under 3 years of age, the annual leave begins. But in this case, the period of parental leave is reduced to 1.5 years.

In both cases, the amount of vacation payments is calculated in exactly the same way as for planned annual leave.

Even if it was taken after maternity leave, the amount of vacation payments must be calculated based on the average salary of the last working (not maternity leave!) year. Therefore, it makes no difference in what combination you use maternity leave and vacation - the amount will be the same. The only difference is time.

When salary changes

If the company’s salary was raised before the employee’s vacation, it is necessary to recalculate the average earnings on the basis of which vacation pay is calculated.

First you need to calculate the salary increase factor (SIC). To get it, you need to divide the new salary (NO) by the old one (SO). Let’s assume that the employee’s old salary was 25,000 rubles, and the new one was 30,000 rubles. In this case, the coefficient will be as follows:

KPO = NO / SO KPO = 30000 / 25000 KPO = 1.2

where KPO is the salary increase coefficient

After this, you can recalculate (index) the employee’s average earnings. There are three options:

- The salary increased in the billing period (RP). In this case, you need to multiply all payments from the beginning of the RP to the month in which the salary increased by the resulting KPO coefficient.

- The salary increased after the end of the pay period, but before the first day of vacation. The entire average salary of the RP is multiplied by a coefficient.

- The salary increased when the employee had already gone on vacation. The portion of vacation pay remaining at the time of introduction of new salaries is multiplied by a coefficient.

After indexing according to one of the three options, you will get the exact amount of vacation pay that the employee going on vacation should receive.

How are vacation pay calculated upon dismissal?

In accordance with current legislation, upon dismissal, an employee must receive, among other required payments, compensation for vacation unused at the time of termination of the employment contract. The law does not provide for any set amounts of compensation, and the amount of payment is determined depending on the average salary of the employee for the past annual period.

Another indicator that is necessary to understand how vacation pay upon dismissal is calculated is the number of vacation days “earned” by the employee by the day of termination of the employment contract.

Thus, the amount of vacation pay upon dismissal is determined by multiplying the employee’s average daily salary for the past accounting year by the number of vacation days earned but not used by the employee.

For example, how to calculate vacation pay if the average daily salary of an employee is 682.6 rubles? Let’s say that after the last vacation and before dismissal, the employee worked for 6 months, that is, he has already “earned” 14 days of rest (half of the standard 28-day vacation). We count:

- 682,6 × 14 = 9 556,4.

- 9,556.4 rubles – compensation for unused vacation, which must be paid to the employee upon termination of the employment contract.

To summarize, we can say that labor legislation in the field of determining calculations of the number of vacation days due to an employee by the day of dismissal is imperfect. One of the calculation methods was established by a regulatory act of the 30s of the last century, which is valid to the extent that it does not contradict modern legislation. Another method is proposed in advisory form and is largely criticized. However, each employer has the right to choose for his organization one of the available calculation methods. The main thing is to remember that any inaccuracies in calculations (fractional values, etc.) should be interpreted to the benefit of the employee.

Did you like the material? Share with your friends.