Who is entitled to receive maternity benefits in 2021

Maternity benefits (or maternity benefits) can be received by women preparing to become mothers and insured in the compulsory social insurance system. That is, contributions for temporary disability and in connection with maternity (VNiM) should be calculated from their wages. The following persons are considered insured:

- those who signed the employment contract;

- working as civilian personnel in military formations of the Russian Federation abroad.

Those who are not working have the right to count on payments under the BiR

- those dismissed due to the liquidation of the company, as well as women who completed their activities as individual entrepreneurs, notaries, and lawyers within 12 months before they were declared unemployed by the employment center;

- female military personnel and contract women in law enforcement, customs, fire service, etc.;

- Full-time students in educational and scientific organizations on a budgetary or commercial basis.

In addition, benefits can be received by individual entrepreneurs, notaries, and lawyers who have paid the entire amount of annual contributions to VNIM, calculated on the basis of the minimum wage, a year before the occurrence of the insured event.

Women applying for maternity leave must provide the employer or the relevant authority with a certificate of incapacity for work, which will serve as the basis for the payment.

Important! ConsultantPlus warns: Recalling a woman from maternity leave is not allowed (Letter of Rostrud dated May 24, 2013 N 1755-TZ). Labor legislation provides for the possibility of recalling an employee only from annual paid leave (Article 125 of the Labor Code of the Russian Federation). However, a woman can interrupt maternity leave on her own initiative. Let's consider several options for the development of events. Read more about how to deal with benefits when leaving maternity leave early in K+. This can be done for free.

Benefit amounts from January 1, 2021: table

Summarize. Let's compare benefit payments in 2021 and those that will be from January 1, 2021 in the table.

Partner news

The date of the rent payment act does not affect the VAT rate

After the transformation, the company loses the right to OC depreciation benefits

Innovations in the Law on CCP: non-cash payments to individuals

TOP 7 news of the week: SNILS cancelled. Pofstandart for accountants. May weekend.

The documents did not pass through the TKS

Changing a director in an LLC: step-by-step instructions for 2021

Fill out the 6-NDFL calculation for the first quarter correctly

For family reasons: will “temporary remote work” be legalized?

How to accurately calculate the accounting allowance

Since 2021, the employer has not paid workers money for maternity leave. This is done by the FSS. And the employer is only required to transfer documents and information to the fund for the calculation and payment of benefits.

For the list of documents, see the Ready-made solution from ConsultantPlus. Get a free trial and jump into the content.

As for calculating the benefit amount, in 2021 it occurs as usual.

The calculation formula can be presented as follows:

Allowance for BiR = Average daily earnings × Number of days of vacation for BiR.

The number of days of maternity leave in general cases is 140 days (70 days before childbirth and 70 after). The number of days increases with multiple pregnancies and complicated births. The doctor indicates the start and end dates of the period of incapacity for work, and based on them and the employee’s application for leave under the BiR, the accountant will calculate its duration.

Average daily earnings = Earnings for the previous two years / Number of days in the billing period.

Earnings for the previous two years include all amounts of salary, vacation pay, bonuses and other remuneration from which contributions to VNiM were calculated.

The denominator indicates the number of calendar days corresponding to two calculation years, minus those that the employee was on sick leave, maternity leave or parental leave.

Average earnings

To calculate the average income of an employee, you need to sum up all amounts that were subject to insurance payments and taxes. The following variables are taken into account:

- salary;

- bonuses;

- allowances

- vacation pay;

- financial assistance from 4000 rubles;

- one-time payments dedicated to dates.

The resulting amount must be divided by the number of days worked. However, there are limits. The maximum payment per day is 2150.68 rubles (data for 2021). When calculating, the maximum for 2021 (755,000 rubles) and 2021 815,000 rubles is taken. The numbers are added and divided by 730. It turns out 2150.68 rubles. To find out the full amount of payments, this number is multiplied by 140 days. As a result, the amount will be equal to 301,095.89 rubles.

What is the amount of the minimum benefit for BiR in 2020-2021

Average daily earnings, determined based on salary data for the previous two years, should not be lower than average daily earnings, determined based on the minimum wage. The minimum average daily earnings will be needed if the woman did not have a salary in the accounting years or her earnings for the full month turned out to be below the minimum wage.

Average daily earnings 2020min = minimum wage 2020 × 24 / 730.

Having calculated this expression, we find that the minimum average daily earnings for the BiR benefit in 2021 is equal to 398.79 rubles.

In 2021, taking into account the new minimum wage (RUB 12,792), the formula will be as follows:

Average daily earnings 2021min = minimum wage 2021 × 24 / 730.

This means that the average earnings in 2021 will be 420.56 rubles.

Thus, for a vacation lasting 140 calendar days, the minimum benefit is:

- in 2021 will be 55,830.60 rubles;

- in 2021 - RUB 58,878.40.

If the vacation lasts 156 days:

- the minimum for 2021 will be at RUB 62,211.24,

- 2021 - 65,607.36 rubles.

If the vacation duration is 194 days:

- the minimum for 2021 is 77,365.26 rubles,

- 2021 - RUB 81,588.64.

Amount of minimum maternity leave in 2020

When determining the amount of the minimum possible maternity benefits, one should be guided not only by Law No. 255-FZ, but also by the Regulations on the specifics of calculating benefits (approved by Decree of the Government of the Russian Federation dated June 15, 2007 No. 375). With regard to the calculation of the minimum wage for compulsorily insured persons, the Regulations prescribe:

- apply a regional coefficient to the amount of this minimum (clause 11(1));

- the minimum wage value corresponding to the start date of maternity leave should be spread over 24 months and divided by 730 days (clause 15(3));

- do not take into account the fact of working part-time (clause 16).

For those who are voluntarily insured, the calculation of the average daily benefit amount will be different (clause 15.4 of the Regulations):

- the regional coefficient for the minimum wage is not used here;

- The amount of daily benefits is determined by dividing the federal minimum wage by the number of calendar days in the month the maternity leave begins.

What will be the minimum amount of maternity payments in 2020? The minimum wage has been increased to 12,130 rubles from 01/01/2020. Calculation from it will give the following values of the minimum average daily benefit:

- for compulsorily insured persons - 12,130 × 24 / 730 = 398.79 rubles;

- for voluntarily insured persons (in relation to months with the largest number of calendar days in them) - 12,130 / 31 = 391.29 rubles.

The full amount of the minimum maternity payment in 2021, as in previous years, depends on the duration of maternity leave, which in a standard situation is 140 calendar days. With it, the minimum maternity leave is equal to:

- for compulsorily insured persons - 398.79 × 140 = 55,830.60 rubles;

- for voluntarily insured persons - 391.29 × 140 = 54,780.60 rubles.

However, these amounts may be further reduced if the woman does not use maternity leave in full or is the adoptive parent of a newborn.

How is the maximum allowance for BiR calculated in 2020-2021?

Average daily earnings should not exceed the value calculated on the basis of the value of the maximum bases established for calculating insurance premiums for VNiM for the accounting years.

Average daily earnings max = (Previous base 1 + Prev base 2) / 730 (clause 3.3 of Article 14 of Law No. 255-FZ).

That is, if the years 2021 and 2018 are included in the calculation of maternity benefits, then the highest value of average daily earnings is determined as follows:

Average daily earnings 2020max = (865,000.00 + 815,000.00) / 730 = 2301.37 rubles.

When calculating earnings for 2021, the values of the maximum base for 2021 and 2021 are taken:

Average daily earnings 2021max = (912,000.00 + 865,000.00) / 730 = 2434.25 rubles.

The maximum limitation is due to the fact that for amounts exceeding the limits, contributions to VNiM are not accrued or paid.

Thus, the maximum in BiR for a standard maternity leave of 140 days will be:

- in 2021 - RUB 322,191.80;

- in 2021 - RUB 340,795.

For an extended one of 156 days:

- in 2021 - RUB 359,013.72;

- in 2021 - RUB 379,743.

For an extended one of 194 days:

- in 2021 - RUB 446,465.78.

- in 2021 - RUB 427,244.50.

Calculation of maximum maternity benefits

We compare the amount of earnings for each year with the legal limit: in 2021 – 755,000 rubles, in 2021 – 815,000 rubles, in 2021 – 876,000 rubles. If annual earnings are greater than the specified limit value, then to calculate the benefit we take the maximum value.

The maximum amount is limited by the earnings limit, above which social security contributions are not accrued (see above for limit values).

The maximum amount of the maternity subsidy in 2019 for 140 days will be 301,095.20 rubles. = (755,000 + 815,000) / 730 days x 140 days.

The maximum amount of the BiR benefit in 2021 for 140 days will be 282,493.40 rubles. = (718,000 + 755,000) / 730 days x 140 days.

If the total insurance period is less than 6 months, the maximum amount of maternity benefits for each calendar month is not higher than the minimum wage.

The average daily earnings received cannot be greater than the daily earnings

, based on the size of the “maximum base for calculating insurance premiums.”

Please note: even if there was a replacement of years in the calculation period, the limit value is considered for the two years preceding the date of leaving on the current maternity leave.

For maternity leave in 2021, the maximum value of average daily earnings is:

(755,000 + 815,000) / 730 days = 2,150.68 rubles.

If, during the recalculation, we received a value of average daily earnings higher than the maximum, then we take the maximum value for calculation.

For an employee whose total length of service (all, i.e., throughout her life) is less than 6 months, it is important to take into account the following feature:

An insured woman with less than six months of insurance experience is paid a subsidy under the BiR in an amount not exceeding the minimum wage for a full calendar month (taking into account coefficients). We are talking about regional coefficients, if they are established (the basis of clause 3 of Article 11 of Law No. 255-FZ).

After checking for the minimum and maximum, we obtain the average daily earnings, which we will use in calculating the amount of subsidies for the BiR.

What is the amount of other payments to pregnant women and those giving birth in 2020-2021?

Russian legislation, in addition to the BiR benefit, has provided for additional payments intended for pregnant women and those who have already given birth and reimbursed by the Social Insurance Fund.

These are the benefits:

- For registration at a medical institution in the early stages of pregnancy. From February 1, 2021, its value increased to 708.23 rubles.

- One-time payment for the birth of a child. It was also increased from the specified date to RUB 18,886.32.

- For child care up to 1.5 years old - as well as the BiR benefit, determined on the basis of information about the recipient’s earnings for the previous two years. It indicates the minimum for 2021: 7,082.85 rubles. no matter what the child's age is. The maximum is determined on the basis of average daily earnings, calculated on the basis of the maximum values according to the calculation bases for contributions to VNiM. In 2021 it is 29,600.48 rubles. per month. Find out how this benefit is calculated from the article.

For the amounts of “children’s” benefits for other periods, see the directory from ConsultantPlus. Trial access to this and other system materials can be obtained free of charge.

NOTE! The employer has the right, at his own expense, to pay financial aid to a pregnant or already established mother in any amount approved by the order of the enterprise, regulations on wages or other local regulations.

Maternity leave

To calculate the maximum maternity leave in 2021, we will decide on the registration of maternity leave. It all starts with the fact that a pregnant woman registers at the hospital. The doctor predicts the date of birth. The sheet is prescribed around the thirtieth week of pregnancy. On its basis, a woman can go on maternity leave and receive maternity benefits. You can go on maternity leave later, or receive a certificate of incapacity for work after childbirth and transfer it through relatives to the organization. A simpler solution would be to issue a sick leave certificate with a specific date of departure in order to prepare management for your situation.

Results

Maternity benefits are provided to all women insured in the compulsory social insurance system.

It is calculated based on data on earnings and hours worked for two calendar years preceding the insured event. By calculation, the maximum and minimum for this benefit are calculated for each year. Starting from 2021, maternity payments are made by the Social Insurance Fund, and the employer only provides it with the information and documents necessary for calculating and transferring benefits. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Expectant mother's vacation

Leave or maternity leave in connection with pregnancy and childbirth is a paid period provided to a woman for recovery. According to the law, this time begins at the 30th week of pregnancy, and in case of multiple pregnancy, at the 28th week.

The recovery period is divided into three categories:

- for 140 days – 1 child, if the birth was without complications;

- for 156 days –1 child if there were complications during childbirth;

- for 194 days – pregnancy with 2 or more fetuses.

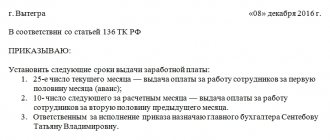

Employees going on maternity leave receive a one-time benefit. The start date for deduction of payments is the disability certificate issued in the accounting department, which confirms the starting point of the maternity leave. One-time accrual is made within 10 days after the provision of sick leave.

Maternity payments in 2021 to workers

During preparation for childbirth, the mother retains her position, and the employer transfers contributions to the Pension Fund. Therefore, leave for accounting and labor is included in the total length of service.

Working mothers in the 30th week of pregnancy are issued a b/sheet. It must be sent to the employer. The accountant will calculate the amount of the B&R benefit for the entire period of incapacity.

The amount depends on the salary that the employee received over the past 2 years. In this case, only the days when the woman received full earnings are taken into account. This means that sick leave, time spent on another maternity leave and some other points are not included in the calculation. But a woman can submit an application to replace the reporting period with previous years if at least 1 day of the last maternity leave falls within the time period under consideration. As a result, the payment amount will be the highest.

Then the total amount of earnings is divided by the number of days in the reporting period. The resulting value is compared with the smallest and largest allowable amount.

If a woman officially works for 2 or more employers, then she can receive payments from each of them. In the case of adoption of an infant under 3 months of age, benefits are accrued from that moment until the expiration of 70 days. If several babies are accepted into the family at once, then this period will increase to 110 days.

The process of calculating payments is worth considering using a specific example. So, a working woman, whose name is Olga, took out the 1st maternity leave for 140 days from January 24 of this year. The accountant will calculate the allowance as follows:

- Olga’s salary for the past year is 539,000 rubles, for 2021 – 530,000 rubles. This is the basis for calculating average daily earnings.

- In 2021, she took 21 working days of sick leave. In 2021 it was fully operational.

- Total income – 1,069,000 rubles.

- Days worked – 710.

- Average daily income – 1505 rubles. 63 kopecks

- The amount of the B&R payment will be equal to the average daily income multiplied by the number of days on sick leave. In this case, 1505.63*140 = 210.788 rubles. 20 kopecks

This amount is not more than the fixed maximum, equal to 282.106 rubles. 70 kopecks, so Olga will receive maternity payments in full.

When the BiR leave ends, which will last until June 12, she needs to start applying for child care benefits. To calculate it, a special formula is used:

1505 rub. 63 kopecks (average daily income) * 30.4 (365 days / 12 months) * 0.4 (40% of salary) = 18,308 rubles. 46 kopecks

The amount received will be credited to her every month.

But that is not all. Olga will receive a benefit for early access to the antenatal clinic - 613 rubles. 14 kopecks Currently the amount is 628 rubles. 47 kopecks The increase was established from 02/01/2018.

Maternity payments in 2021 for non-working people

If we look at the laws, we can see that non-working women are not mentioned in the list of persons entitled to maternity benefits. This is due to the fact that these benefits are a kind of compensation for lost wages that the mother could have received if she had not given birth.

But there are exceptions:

- Dismissed due to the liquidation of the enterprise.

- Non-working female students receive an allowance in the amount of a scholarship. And it doesn’t matter whether a woman studies on a paid or free basis, the main thing is that she is enrolled full-time.

From the above it follows that the majority of non-working mothers are not entitled to these payments. But the state did not leave this category of the population without support and provided other types of benefits for it.

Every pregnant woman is entitled to certain types of social assistance, regardless of whether she works or not. After the birth of the baby, she can receive 2 types of benefits:

- Baby care.

- Regional benefit.

The last category is assigned in accordance with regional laws. The amount depends on which constituent entity of the Russian Federation the mother lives in.

When a baby is born, an unemployed woman can go in 2 ways:

- Continue receiving unemployment funds.

- Replace the first category of payments with a care allowance.

You should know that the law specifies the rule - in order to accrue money, it is necessary that the non-working woman be registered in the same place where the baby was born.

Needy families where the mother does not officially work are entitled to assistance in the form of a set of products for the baby from the dairy kitchen for 2 years. If there is no kitchen nearby, then parents can count on monetary compensation equal to the price of the food. The exact amount depends on regional legislation.

Low-income families below the poverty line can receive cash benefits for minor children. The exact amount depends on the number of children and local authorities. The national average is approximately 300 rubles. for 1 baby. Such assistance is awarded if the average per capita income is less than the subsistence minimum (SL) fixed in the region.

If both parents are unemployed, then payments are due to each. If only the mother does not work, then only she can apply for help. It is believed that only unemployed family members take care of children.

Money continues to accrue if the teenager has entered a university or vocational education institution. The mother receives payments until the child finishes studying.

To receive government support, a woman must send an application and the required papers to the social security authorities.

An example of calculating maternity benefits based on the minimum wage

Lawyer Stepanova A.S. is pregnant with her first child. Worked in the organization for 7 months. I had no earnings in 2021 or 2021. The birth took place without complications.

The conditions are the same, but the employee is pregnant with twins, and the birth was complicated.

The employee is pregnant with one child, the birth was without complications. In 2021 and 2021, I worked under an employment contract and had a small income:

In this case, the benefit must be calculated in two ways:

Then choose the largest benefit amount.

Since maternity leave according to the minimum wage is greater than the benefit calculated based on average earnings, the employee will receive 55,831.23 rubles.

The following articles will help you calculate benefits in other situations:

Registration procedure

The procedure in accordance with which benefits are assigned and paid is enshrined in Part 5 of Article 13 of Federal Law No. 255 of December 29, 2006. Additionally, this aspect is regulated by Order of the Ministry of Labor of the Russian Federation No. 668n dated September 29, 2020.

Maternity leave: concept and legal regulation of its provision

Read

Is it possible to work officially on maternity leave and how to register for early return to work

More details

Who is entitled to maternity benefits and how to correctly calculate the amount of maternity benefits

Look

When and where to contact

In order to receive maternity payments in full, it is important to take into account the deadlines established for submitting documents. You must contact your employer or the Social Insurance Fund no later than 6 calendar months from the end of your maternity leave.

Package of documents

The list of documents that will be needed to process the payment is enshrined in Part 6 of Article 13 of Federal Law No. 255. It includes:

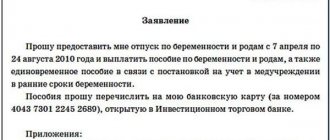

- Application for granting benefits.

- State-issued sick leave certificate or its number, if the document was issued in electronic form.

- Certificate of income for two years preceding the year of maternity leave (if necessary).

- Application for changing years for calculating benefits.

Direct payments

If the company did not participate in the FSS pilot project, then the obligation to pay benefits rested with the employer. Accordingly, the woman had to provide all the necessary documents (certificate of incapacity for work, application and salary certificates from other employers) directly to the accounting department of the enterprise. In the application, in addition to basic information, she was required to indicate the desired method of payment of benefits, as well as bank account details. An order and other documents were not required for the calculation and payment of benefits. The money was transferred to the employee’s account by the employer, who then submitted the necessary documents to the Social Insurance Fund and received appropriate compensation.

From January 2021, all companies registered in the Russian Federation switched to working on the principle of direct payments and stopped participating in the calculation of maternity benefits.

In accordance with Federal Law No. 478 of December 29, 2021, the obligations of policyholders to calculate and pay benefits (including maternity benefits) were cancelled. From January 1, 2021, their function is only to transfer the documents necessary for registration and settlement to the regional offices of the Social Insurance Fund.

Maternal or family capital in 2021. How to get a certificate and what amount to expect

Read

How to calculate maternity leave correctly? Timing of maternity leave and its duration

More details

Who is entitled to maternity benefits and how to correctly calculate the amount of maternity benefits

Look