How is maternity money paid and when does it arrive after submitting documents?

The payment of maternity benefits can be carried out by:

- An organization that employs a woman.

- Territorial body of the Social Insurance Fund of the Russian Federation.

Payment of benefits must be carried out within strictly established periods. If the money arrives late, the employer will be held responsible.

Calculation of sick leave for pregnancy and childbirth

Sick leave for pregnancy and childbirth is not difficult to calculate; for this, the following formula is used: the amount of money earned for the two previous years (in 2021 this is 2021 and 2017) is divided by the number of days worked (the total number of working days in the specified period is 730) and multiplied by the number days of sick leave (140, 156 or 194).

There are maximum possible amounts of earnings that are subject to insurance contributions and from which the benefit amount can be calculated: this is 718,000 rubles for 2021 and 755,000 rubles for 2021.

In addition, the amount of earnings from which the benefit is calculated cannot be lower than the minimum wage; from May 1, 2021, this figure is 11,163 rubles.

Accordingly, the maximum sick leave for pregnancy and childbirth in 2021 will be : (718,000+755,000)/730x140=282,493.40 rubles, for complicated pregnancy (718,000+755,000)/730x156=314,778.08 rubles, for multiple pregnancies (718,000+ 755000)/730x194=391454.80 rub.

When calculated based on the minimum wage, payments will be : (11163x24)/730x140=51380.38 rubles, in case of complicated course: (11163x24)/730x156=57619 rubles, in case of multiple pregnancy: (11163x24)/730x194=71198.53 rubles.

Unemployed women who are registered receive a payment in the amount of 613.14 rubles. until February 1, 2021, and 628.47 rubles. from February 1, 2018 per month.

Female students receive payments in the amount of a standard scholarship, and military personnel receive a monetary allowance, which varies depending on the region and type of military service.

Maternity benefit calculator

Read instructions

| Vacation period (140-194 days) |

| Estimated years: |

YEAR

YEAR

| Regional coefficient, % | Less than 6 months experience |

| Average daily earnings |

Total benefit amount:

How to apply for maternity leave

You need to apply for maternity leave through your employer, and the payment itself is made at the expense of the Social Insurance Fund.

A pregnant employee needs to take the following steps to apply for B&R benefits:

- Register with a medical organization. This could be an antenatal clinic.

- Obtain a certificate from a doctor confirming the fact that the woman is registered. In addition, the document reflects the duration of pregnancy.

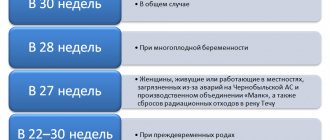

- At the 29th week of pregnancy, receive a certificate of incapacity for work.

- Contact your employer with the collected package of papers.

The required package of documents includes the following papers:

- statement;

- certificate of income for the last two years of work;

- details of the bank account to which payments will be received;

- a certificate issued by a doctor.

If a woman wishes to perform her job duties after the 30th week of pregnancy, it is important to take into account that wages and B&R benefits are not paid at the same time.

How many days does it take for maternity benefits to be paid after filing sick leave? The benefit will be assigned to the woman within ten calendar days. The date of payment of funds depends on the method of provision of securities:

- Through the employer. In this case, the benefit will be paid along with the next salary.

- Through social security. Payment will be made either through the post office or through a bank no later than the 26th day of the month following the month in which the documentation was received.

What is the amount of the minimum benefit for BiR in 2020-2021

Average daily earnings, determined based on salary data for the previous two years, should not be lower than average daily earnings, determined based on the minimum wage. The minimum average daily earnings will be needed if the woman did not have a salary in the accounting years or her earnings for the full month turned out to be below the minimum wage.

Average daily earnings 2020min = minimum wage 2020 × 24 / 730.

Having calculated this expression, we find that the minimum average daily earnings for the BiR benefit in 2021 is equal to 398.79 rubles.

In 2021, taking into account the new minimum wage (RUB 12,792), the formula will be as follows:

Average daily earnings 2021min = minimum wage 2021 × 24 / 730.

This means that the average earnings in 2021 will be 420.56 rubles.

Thus, for a vacation lasting 140 calendar days, the minimum benefit is:

- in 2021 will be 55,830.60 rubles;

- in 2021 - RUB 58,878.40.

If the vacation lasts 156 days:

- the minimum for 2021 will be at RUB 62,211.24,

- 2021 - 65,607.36 rubles.

If the vacation duration is 194 days:

- the minimum for 2021 is 77,365.26 rubles,

- 2021 - RUB 81,588.64.

When must the employer pay the money?

When are maternity benefits accrued after taking sick leave? If the package of documents was transferred to the employer, the amount of the benefit will be calculated within 10 days. As for the payment of money, this will happen on the day of issuance of the next salary according to the organization’s schedule.

The current legislation of the Russian Federation does not allow partial issuance of funds. The amount must be credited to the employee’s account in full.

There are several options for transferring funds:

- Through the organization's cash desk.

- To a personal account in one of the financial organizations.

- To a plastic bank card.

If the transfer is delayed due to the fault of the employer, the employee may demand compensation. This is discussed in detail in Article No. 236 of the Labor Code of the Russian Federation. If you notify the labor inspector about the violation of deadlines, the organization will be required to pay a fine. According to the Code of Administrative Offences, its amount will range from 20,000 to 50,000 rubles.

If the company cannot pay maternity benefits due to lack of funds in the current account, then the payment will be made by the territorial body of the insurer. You can find out the name of the insurance company in the compulsory medical insurance policy.

Terms for reimbursement of maternity benefits from the Social Insurance Fund

After receiving a package of documents for reimbursement of the amount of benefits paid, the FSS reviews it and makes a decision within such a time frame:

- No more than 10 days, most often within 5 working days, provided that all documents are prepared correctly.

- For 3 months, if additional verification of the information provided is required.

If a company has financial problems and the employer cannot pay maternity benefits in advance, then the funds are transferred directly by the social insurance fund.

When do maternity departments of the Social Insurance Fund pay?

According to the Decree of the Government of the Russian Federation No. 294 of April 21, 2011, there are several regions in which the “pilot project” operates. It allows working women to receive maternity benefits directly from the Social Insurance Fund, and not through the employer.

The application must be written for the Social Insurance Fund, and all attached documentation must be submitted to the employer.

How long will maternity benefits be paid after taking sick leave? When the employer receives all the required papers, he will send them to the Social Insurance Fund within five days. Employees of the organization are given 10 days to make a decision on payment. If the answer is positive, the funds will be transferred by the 26th of the next month to the employee’s bank account.

According to the current legislation of the Russian Federation, you can apply for maternity leave within 6 months after the end of maternity leave. If the deadlines are missed, this will not allow the employee to receive payments.

Payment of maternity benefits by the employer

Only women have the right to receive maternity benefits provided by the employer. It cannot be received by her husband or other relative. Benefits are provided to all pregnant and postpartum women at their place of employment. If a girl quits or changes companies, she can receive benefits at any permanent job where she has been employed within the last two years.

Note! If a girl continues to work during pregnancy, she cannot receive benefits. In this case, the payment period is shifted. In such a situation, maternity leave is assigned from the moment the application and sick leave are submitted.

To apply for benefits, the employer must submit an application for maternity leave and a certificate of incapacity for work. But that is not all. If a woman has changed her job over the past two years, she will also need a salary certificate in form 182n from her previous organization.

Deadlines for transferring benefits

The benefit payment period is 10 calendar days. They count from the moment the employee submits all the necessary documents. According to the law, the head of the organization is obliged to transfer funds during this period. The entire amount is paid in one lump sum. That is, for the entire period of maternity leave. In the future, the Social Insurance Fund will compensate the employer for the amount paid.

New benefit payment rules

The Social Insurance Fund is conducting an experiment that operates in some regions. It involves a different scheme for paying maternity benefits. Maternity benefits are calculated and transferred not by the employer, but by the Social Insurance Fund. In the regions participating in the new social insurance project “Direct Payments”, receiving a cash payment involves the following scheme:

- the woman submits all documents to the employer. This applies to sick leave, salary certificates (if necessary) and applications for maternity leave. However, it is filled out for social insurance;

- the employer submits the documents to the Social Insurance Fund. The organization where the woman works must do this within 5 days;

- The FSS is considering the application. Making a decision on granting benefits takes 10 calendar days;

- The FSS transfers benefits. A woman can receive the money due until the 26th of the month following the application. The payment is transferred to a bank account, the details of which must be indicated in the application for maternity leave. Money can also be sent by postal order.

The Tver, Tambov, Samara and Rostov regions, Khabarovsk Territory and other regions are taking part in the “Direct Payments” pilot project. The full list can be found on the FSS website.

Can maternity payments be delayed due to the fault of Social Insurance Fund employees?

Social Insurance Fund employees may delay maternity benefits if the employee’s employer pays social benefits to the fund in bad faith. Difficulties are guaranteed to arise on the part of the Social Insurance Fund if the enterprise where a woman works is declared bankrupt or has a zero balance. In this case, payments are calculated and made based on the minimum odds.

An employee can protect her interests through court, but it must be taken into account that this will take a lot of time. Moreover, it is not a fact that the court's decision will be in favor of the applicant.

How to issue a certificate of incapacity for work during pregnancy before maternity leave?

Issuance procedure

To receive sick leave, there must be sufficiently serious reasons - various injuries or symptoms of a disease. If the doctor of the relevant medical institution gives the go-ahead to issue a sick leave certificate, then all that remains is to guess the desired date. Regular sick leave is paid as follows: 3 days are paid by the employer, and the remaining days are paid from the Social Insurance Fund.

Documents that may be needed to open a sick leave: passport and medical insurance. The sheet itself can be received in one day, and the maximum period for which the document is issued can be up to 30 days.

During the initial examination, the document is issued for no more than 10 days; upon a second visit, the period can be extended depending on the doctor’s diagnosis.

A special medical commission can extend sick leave for up to a year if the patient has a serious illness or injury that will require long-term treatment.

How to take sick leave for a pregnant woman if she is not sick is described here.

What determines the amount of payment?

If the employee’s experience is more than 8 years, then he receives 100% of the salary. When the experience is from 5 to 8 years, then payment of 80% of earnings is provided. If a person works for less than 5 years, then he is entitled to 60% of the income. For work experience of up to 6 months, sick leave is calculated based on the minimum wage.

The length of service is calculated according to the entries in the work book. If a person has lost it, then the length of service can be calculated using employment contracts and certificates from previous places of work. If all this data is not available, then the necessary information is requested from the Pension Fund office.

Calculation formula

Formula for calculating sick leave:

Amount of benefit = Average daily income * Number of days of temporary disability * Amount of benefit.

Average daily earnings are calculated by dividing the amount of accrued earnings in the billing period by 730. To calculate average earnings, you must take all payments for which insurance premiums were calculated for the last 2 calendar years.

The benefit amount is indicated as a percentage and depends on the person’s length of service.

What to do if benefits are not paid on time

In how many days will maternity leave arrive? The legislation of the Russian Federation establishes payment deadlines that must be complied with by employers. Otherwise, management will be held liable in accordance with Article No. 236 of the Labor Code of the Russian Federation.

If the employer does not transfer the funds within the prescribed period, then interest will be charged for each day of delay.

The amount of compensation for delay can be found in the employment contract or collective agreement.

What to do when maternity benefits on sick leave are not transferred? If an employee does not receive benefits within the established time frame, she can file a claim in court. However, it is worth considering that this will lead to certain expenses (for example, legal fees).

If the payment is delayed by the Social Insurance Fund, the employer must transfer the required amount to the employee’s account. All expenses will be reimbursed to him in the future.

When and who issues this benefit?

Sick leave for pregnancy and childbirth is issued by a doctor at the antenatal clinic where the woman is registered. This occurs at 30 weeks of pregnancy. Its duration is 140 days, so the payment amount is significant. As soon as the document is issued, it should be given to the human resources department or accounting department. It is better to clarify by phone whether a personal appearance is required or whether one of your relatives can bring the ballot. At the same time, find out what the deadlines for paying maternity benefits on sick leave are. This will show that you have the issue under control.

The procedure and conditions for payments in connection with pregnancy and the birth of a child are determined by Order of the Ministry of Health and Social Development of Russia dated December 23, 2009 No. 1012 n (as amended on May 4, 2016). The law sets clear deadlines for transferring money to pregnant women or women who have recently given birth.

However, this period directly depends on the date of application for benefits.

A woman has the right to submit documents immediately after receiving a certificate of incapacity for work at the antenatal clinic, or apply for payments after the birth of the child.

The general period for submitting documents is 6 months from the date of the end of maternity leave.

Important points

- Payment of maternity benefits is carried out before the onset of childbirth.

- To apply for benefits, you must receive a certificate of incapacity for work.

- The length of maternity leave is influenced by the number of children, as well as the woman’s condition. The minimum period is 140 days, the maximum is 194 days.

- Maternity pay is calculated based on average monthly earnings. However, the total amount cannot exceed the maximum insurance base.

- Female students apply for benefits at their place of study.

- Only a pregnant woman or an adoptive mother can count on receiving maternity leave.

- If the employee’s income is less than the minimum wage and her work experience is less than six months, then maternity leave is calculated based on the minimum wage. It is important to understand that in this case the payment will be minimal.

- If a woman does not have an official place of employment, then she must submit documentation to the social security authority.

How is the maximum allowance for BiR calculated in 2020-2021?

Average daily earnings should not exceed the value calculated on the basis of the value of the maximum bases established for calculating insurance premiums for VNiM for the accounting years.

Average daily earnings max = (Previous base 1 + Prev base 2) / 730 (clause 3.3 of Article 14 of Law No. 255-FZ).

That is, if the years 2021 and 2018 are included in the calculation of maternity benefits, then the highest value of average daily earnings is determined as follows:

Average daily earnings 2020max = (865,000.00 + 815,000.00) / 730 = 2301.37 rubles.

When calculating earnings for 2021, the values of the maximum base for 2021 and 2021 are taken:

Average daily earnings 2021max = (912,000.00 + 865,000.00) / 730 = 2434.25 rubles.

The maximum limitation is due to the fact that for amounts exceeding the limits, contributions to VNiM are not accrued or paid.

Thus, the maximum in BiR for a standard maternity leave of 140 days will be:

- in 2021 - RUB 322,191.80;

- in 2021 - RUB 340,795.

For an extended one of 156 days:

- in 2021 - RUB 359,013.72;

- in 2021 - RUB 379,743.

For an extended one of 194 days:

- in 2021 - RUB 446,465.78.

- in 2021 - RUB 427,244.50.