Guarantees in case of liquidation of the organization

Many employers and employees do not know what payments are due upon dismissal during the liquidation of the enterprise.

Because of this, management regularly violates the rights of their subordinates, and the latter do not defend their interests. The relationship between the employer and the staff is regulated by the Labor Code of Russia (LC). The list of all guarantees and compensations to subordinates in the event of liquidation of an enterprise is given in Article No. 180 of the Labor Code of the Russian Federation.

If there is a threat of bankruptcy, the employer must take all measures to improve and stabilize the condition of the company. In case of dismissal due to a reduction in numbers or staff, he is obliged to offer his subordinates other vacant positions that suit them in terms of specialization, qualifications and health.

When a company is liquidated, labor relations are terminated with all employees, including minors and pregnant women, young mothers, and pensioners. Employees must be notified of the upcoming dismissal in writing and against signature, two months before the date of the planned reduction.

If desired, a subordinate can leave the company before the deadline. To do this, he needs to submit a corresponding application for consideration by management.

In case of closure of an organization, the management of the enterprise must make a full financial settlement with the employees. Employees are paid severance pay, wages for actual time worked, etc.

Failure to pay an employee when the statutory severance pay is reduced entails administrative liability for legal entities and officials.

Reasons for liquidation of the enterprise

The issue of liquidation can be raised both by the founders of the enterprise and by the controlling government bodies at the place of registration or business. That is, liquidation occurs either voluntarily or compulsorily. It is also possible for an enterprise to cease its activities during the bankruptcy process.

The reason for the forced liquidation of an enterprise is most often a systematic violation of the law. It occurs by a court decision, which is addressed by a government agency, whose representatives consider the violations to be sufficient to formalize the termination of the legal entity’s activities. In addition, there are special grounds - for example, exceeding the permissible number of company participants.

Liquidation by decision of the founders is carried out due to various circumstances. It may happen that the founders of the enterprise simply believe that the company has completely fulfilled its objectives. However, most often this happens due to financial problems. The initiative can come from both the center and their branches of the enterprise.

Is the company obligated to pay severance pay to employees?

Payment of severance pay is discussed in the Labor Code of the Russian Federation. In particular, article No. 178 of this regulatory document is devoted to it. The Labor Code of the Russian Federation states that in the event of a layoff, the employee must be paid severance pay.

It is a kind of monetary compensation for losses incurred in the event of early termination of employment due to the fault of the company’s management. It applies to main employees and part-time workers.

Failure to provide the amounts due to subordinates may result in a fine for the company management. But there are a number of situations in which monetary compensation upon dismissal is not due. They are given in article No. 181.1 of the Labor Code.

Severance pay is not paid when an employee is fired for disciplinary action. This is a kind of punishment for inaction or commission of an offense. There is also no severance pay for employees who are not officially employed. It is paid by the management of the enterprise at its discretion.

Features of dismissal during the liquidation of special groups of employees

For pregnant women and women on maternity leave (these are categories of workers who usually enjoy additional guarantees upon dismissal) no privileges are provided upon dismissal in the event that the enterprise ceases its activities. Labor legislation and judicial practice do not give any reason to believe that they have any advantages over the rest of the staff, which is quite logical, because the organization is being liquidated and ceases its activities completely. Management should inform employees that such women need to register with the social security authorities, since all payments in connection with pregnancy, childbirth, and child benefits will be assigned by this body, as well as paid. Payment of maternity payments must be made exactly within the period specified by law, no later than the last day of work.

Pensioners do not have additional benefits, unlike pre-retirees. As part of the pension reform, a rule has been approved that such citizens, having registered with the central pension center and in the absence of employment due to the fault of this organization, have the right to count on early assignment of maintenance from the state.

Part-time workers and seasonal workers, unlike the rest of the staff, do not have the right to count on compensation in full. They can only count on severance pay. Seasonal workers are generally warned according to the general rule, that is, 7 days in advance and are paid two weeks' wages. Severance pay is not paid to employees who have entered into a fixed-term contract (for a period of up to 60 days), and they are warned about the upcoming dismissal only 3 days in advance.

The employment relationship with the manager who is a member of the liquidation commission (or who is the sole liquidator) is terminated last, as well as with the employees involved in the liquidation. It is the liquidation commission or liquidator that are the governing bodies in the process of formalizing the termination of the enterprise’s activities. The bankruptcy process provides for other positions and governing bodies.

Calculation of the amount of severance pay

According to the first part of Article No. 178 of the Labor Code of the Russian Federation, upon dismissal, an employee is paid severance pay in the amount of average monthly earnings.

Severance pay in the amount of average earnings for 14 days is paid, in accordance with Article No. 178 of the Labor Code, upon dismissal under the following circumstances:

- the employee was called up for military service or sent to civil service;

- the employee refused to be transferred to another place of work due to his inappropriate health status;

- a subordinate who was previously in this position was reinstated;

- the employee, based on the results of a medical examination, was found to be completely unable to perform work activities;

- the subordinate refused to be transferred to work in another area;

- The employee decided to quit due to a change in the terms of the employment contract.

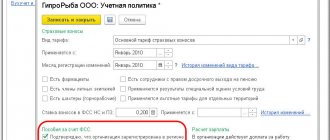

Calculation of severance pay upon liquidation of an organization is made on the basis of the employee’s income received during the year of employment. Total earnings are divided by 12 and then by 29.3. The amount received is multiplied by the number of days in the month for which the payment is calculated.

The calculation takes into account salary, annual and quarterly bonuses. Travel allowances, sick pay, vacation pay, and maternity pay are not taken into account. Also excluded are funds paid as material and social assistance.

An employee who has the right to receive severance pay is interested in whether compensation accrued when reducing personal income tax. In order to understand this situation, you need to refer to the provisions of the Tax Code.

According to this regulatory act, income tax is not withheld from compensation payments upon dismissal. But this rule applies only to an amount the amount of which does not exceed three months’ average salary.

For persons employed in the Far North, non-taxable personal income tax compensation is equal to six times earnings. In this case, insurance premiums are charged on severance pay. Their size increases proportionally with the increase in the amount of the payment.

Expert opinion

Irina Vasilyeva

Civil law expert

A former subordinate can count on receiving a salary while looking for a job. To do this, he must register with the Employment Center within two weeks after being laid off and not have an official place of work.

Dear readers! To solve your problem right now, get a free consultation

— contact the duty lawyer in the online chat on the right or call: +7 Moscow and region.

+7 St. Petersburg and region. 8 Other regions of the Russian Federation You will not need to waste your time and nerves

- an experienced lawyer will take care of all your problems!

Payments provided for in an employment or collective agreement

Payments provided for in an employment or collective agreement can be established both in the form of additional benefits and compensation, and in the form of increases in their amounts. However, for some categories of employees, for example, managers, their deputies, chief accountants of state or municipal institutions, restrictions on the amount of payments are established: the total amount of compensation paid to them cannot exceed the amount of their three times the average monthly salary (Article 349.3 of the Labor Code of the Russian Federation).

This material lists all payments upon liquidation of an enterprise in 2021, established by labor legislation. Compliance with the standards specified in the material, as well as a calm and respectful attitude between employees of the employer’s services and the employee being laid off, will avoid mutual claims and errors in calculations if the business was unsuccessful and led to the liquidation of the organization.

Legal documents

- Art. 81 Labor Code of the Russian Federation

- Art. 180 Labor Code of the Russian Federation

- Article 136 of the Labor Code of the Russian Federation

- Article 127 of the Labor Code of the Russian Federation

- Article 178 of the Labor Code of the Russian Federation

- Article 180 of the Labor Code of the Russian Federation

- Art. 140 Labor Code of the Russian Federation

- Decree of the Government of the Russian Federation dated December 24, 2007 N 922

- Art. 14 Labor Code of the Russian Federation

- Subclause 2 Clause 1 Article 20.2 of Law No. 125-FZ

- Art. 217 Tax Code of the Russian Federation

- Art. 422 Tax Code of the Russian Federation

- Art. 318 Labor Code of the Russian Federation

- Article 349.3 of the Labor Code of the Russian Federation

Rules for registration and sample order for payment

The Labor Code does not require the employer to compulsorily issue an order for the payment of severance pay, since such a sum of money should be automatically accrued to the employee upon dismissal due to the liquidation of the enterprise. But many directors of large companies still formalize compensation by order.

You cannot do without an order in the following cases:

- the benefit is accrued in a larger amount than provided for by labor legislation;

- the employee submitted an application to the employer for payment of the next severance pay due to the fact that he was not employed after the expiration of two months from the date of dismissal.

It is necessary to draw up an order for the payment of compensation, which is provided for in agreements (collective, labor) or a local act of the company, but is not specified in federal legislative documents.

The order is issued in free form. It must contain information about the employee (full name, place of work, structural unit) and the reason for his dismissal. It is not necessary to specify the date of payment of benefits, since it is established by labor legislation. All persons specified in it must be familiarized with the order against signature.

A sample order for the payment of severance pay to employees due to a reduction in headcount is available.

Documentation of dismissal of employees

The notice of the upcoming layoff is drawn up in any form, but it is necessary to convey the necessary information to the employee and receive a mark of familiarization with it. References to labor legislation are desirable. Familiarization with the documents and strict adherence to the procedure are mandatory, even if management believes that the state does not plan to challenge the administration's actions in court.

The order is drawn up in a unified or free form; it is necessary to display information about the dismissal, the grounds, and compensation made in connection with this. It is also recommended to comply with the rules of office work, indicate details of documents, positions, adherence to the general form and structure of the document, etc.

Entries in the work book are made as follows:

The employment contract was terminated due to the liquidation of the organization, paragraph 1 of part one of Article 81 of the Labor Code of the Russian Federation.

Other types of compensation

In addition to severance pay, employees who are dismissed due to liquidation of the organization are entitled to other types of monetary compensation. Such payments are fixed at the legislative level.

Redundant employees are provided with:

- compensation for unused annual basic and additional leaves;

- sick leave benefit. It is calculated based on the provided certificate of temporary disability. Payment of money is carried out at the expense of the Social Insurance Fund;

- compensation for early termination of an employment contract. The payment is accrued for all days that remain before the expiration of the two-month period from the moment the employee is notified of the layoff;

- average earnings for the period of employment, but not more than two months in a row from the date of dismissal in general cases. If the former subordinate does not find a job after this time and brings a certificate from the employment center as confirmation, then the benefit will be paid for the third month.

A collective or individual labor agreement or other local acts may provide for other types of monetary compensation to employees in the event of a reduction in numbers or staff.

Features of calculating average daily earnings

There are features of calculating the average daily wage, in particular:

- if a person quits on the last day of the month, average earnings are calculated for the last 12 months, including the period of dismissal. This position is set out in the letter of Rostrud dated July 22, 2010 N 2184-6-1;

- if a person did not work for the entire billing period (was ill or was on maternity leave, etc.), then the billing period must be replaced by 12 calendar months preceding the last month when the person went to work. Reason: letter of the Ministry of Labor dated November 25, 2015 N 14-1/B-972.

After the first month from the date of dismissal, the employer does not make any payments to the laid-off employee.

What payments are due to pregnant women and women on maternity leave under the Labor Code of the Russian Federation?

When an enterprise is liquidated, all employees are subject to dismissal, including pregnant women, women on maternity leave, young mothers with a child under three years of age.

They are notified of the upcoming layoff two months in advance in accordance with current legislation. When an organization is closed, such categories of employees have the right to receive maternity benefits and maternity benefits in full.

They are required to be paid compensation for unused annual leave. Severance pay is also provided. The calculation is based on average earnings. If the employee worked for less than 6 months before the liquidation of the enterprise, then the amount of maternity leave cannot be less than the minimum wage.

There are often situations when the director of a company refuses to pay a pregnant woman or a woman on maternity leave the amount of money due to her. Management explains this by the lack of capital in the account of the bankrupt enterprise. In this case, the employee must contact the labor inspectorate, prosecutor's office or court.

Higher authorities will conduct an investigation and oblige the employer to pay the pregnant woman or maternity leave the required benefit in full.

In order to continue to receive money for the baby after layoffs, a woman needs to contact the Social Protection Committee. It is this organization that will continue to deal with the calculation of benefits for the care of a child under one and a half years of age.

Dismissal procedure during liquidation

The entire staff, all employees, even those who are on sick leave or maternity leave, can be dismissed due to termination of operations. Each employee must be personally notified in writing two months in advance of the upcoming layoff. This is provided for in Art. 180 of the Labor Code of the Russian Federation as a certain guarantee for dismissed employees. The manager must arrange for such forms to be recorded with a receipt stamp as evidence of timely notification.

Also, according to this norm, the employer can dismiss the employee before the expiration of the specified period of two months, but only with his written consent. In this case, an additional compensation payment is made in the amount of the employee’s average earnings, calculated in proportion to the time remaining before the expiration of the notice period.

Otherwise, the dismissal procedure is no different from the usual one.

Established amounts of payments due

In case of cancellation of the business, each worker must receive payments equal to the average monthly earnings. It should be understood that the amount of this payment may differ from the amount of wages. This is explained by the fact that the procedure for calculating wages differs from the calculation of these payments.

In some cases, the amount of funds issued may be lower than that of the rest of the organization's personnel. As a rule, workers engaged in seasonal work face this situation. In the case of these individuals, the total amount of compensation is calculated based on two-week average earnings. This type of compensation is paid from the company's budget. At the time of preparation for liquidation measures, the company’s management must calculate the total amount of funds due to dismissed specialists.

Regulations for staff reductions

The procedure for reducing staff in an organization is strictly regulated by the Labor Code of the Russian Federation. It takes place in several stages:

- The first step is to determine the list of positions that are subject to staff reduction.

- An order is issued that contains the timing of the reduction and the number of jobs that are subject to reduction.

- The employer does not have the right to decide independently, without relying on labor legislation, which employees are laid off. When downsizing, preference should be given to employees with high qualifications and labor productivity.

- No later than two months before the date of reduction established by the order, the employee must be notified in writing individually. The notification sheet must be signed and dated by the employee. A notice of dismissal given at a general meeting has no legal force. This is a violation of the regulations.

- The employer must notify the employment service authorities and the trade union organization in writing about the planned reduction.

- The employer offers the employee available vacancies at the enterprise.

- On the last working day, the employee is given a work book with all the necessary entries. In case of refusal to receive a work book, personnel department employees send it by registered mail to the employee’s place of residence.

- The employee retains his average salary after termination of the contract for the next two months. If an employee joined the employment exchange within 14 days after the termination of the employment relationship, his average earnings are retained for another month.

In the case where the productivity of several employees is the same, but you need to leave one, preference should be given to:

- employees who have two or more dependent family members;

- workers who no longer have working family members, and this income is the main means of subsistence;

- an employee who was injured at this enterprise;

- disabled people of WWII and combat;

- employees who improve their skills in this area without interruption from production.

Liquidation of LLC when to fire the chief accountant

In especially difficult cases, business owners come to the conclusion that it is easier to liquidate an unprofitable enterprise, fire employees and managers, so as not to aggravate the deplorable state of affairs. How to fire the director of an LLC And on the last day of work, the chief accountant must be paid a salary and compensation for unused vacation (he will probably count it for himself), and also be issued a work book and other “dismissal” documents (Art.

At the initiative of the employer This happens if the employee has violated discipline, causing damage to the enterprise through his actions, for example, when writing off valuable property that was useful. In addition, a specialist can be fired if there is a change of owner - if the new manager decides to hire another chief accountant. He will be paid severance pay in the amount of three months' earnings.