Night hours on a holiday: payment

Since both night work and work on holidays provide increased pay, night work on holidays involves the summation of the following additional payments:

- additional pay for working on holidays;

- surcharge for night work.

Let us remind you that increased payment is made for hours actually worked on a non-working holiday (Part 3 of Article 153 of the Labor Code of the Russian Federation). Specific amounts of payment for work on a holiday are established by an employment or collective agreement, but not less than double the amount (Part 1.2 of Article 153 of the Labor Code of the Russian Federation).

Additional payment for each hour of work at night (from 22.00 to 6 o'clock) is also made in the amounts established by the labor or collective agreement, but not less than 20% of the hourly tariff rate (salary calculated per hour of work) for each hour of work at night ( Part 1 of Article 96, Article 154 of the Labor Code of the Russian Federation, Government Resolution No. 554 of July 22, 2008).

We remind you that work on holidays can be replaced by an employee at his request by providing time for rest. Then work on a holiday is paid at a single rate. Moreover, if an employee worked on holidays in accordance with his schedule, then such work cannot be replaced with single pay and a day of rest (Recommendations of the Federal Service for Labor and Employment dated June 2, 2014).

Payment for night hours on a holiday: example

Here is an example of calculating payment for night work on a holiday.

Let’s assume that an employee’s hourly wage rate is 250 rubles. Payment for work on holidays is double, and additional payment for night work is 20% of the hourly rate.

In accordance with the schedule, the employee worked from 16:00 on 02/23/2018 to 09:00 on 02/24/2018.

Payment for time worked consists of the following amounts:

| Payment period | Calculation | Amount, rub. | Explanations |

| from 16:00 02/23/2018 to 22:00 02/23/2018 | 6 hours * 250 rubles * 2 | 3 000 | 6 hours of daily work on a holiday are paid double |

| from 22:00 02/23/218 to 00:00 02/24/2018 | 2 hours * 250 rubles * 2 + 2 hours * 250 rubles * 20% | 1 100 | 2 hours of night work on a holiday are paid double and include a 20% surcharge |

| from 00:00 02/24/2018 to 06:00 02/24/2018 | 6 hours * 250 rubles + 6 hours * 250 rubles * 20% | 1 800 | 6 hours of night work on Saturday (according to the schedule this is a working day) are paid at a single rate, taking into account a surcharge of 20% |

| from 06:00 02/24/2018 to 09:00 02/24/2018 | 3 hours * 250 rubles | 750 | 3 hours of daytime work on Saturday are paid at a single rate |

In total, payment for work at the specified time amounted to 6,650 rubles (3,000 + 1,100 + 1,800 + 750).

Recent comments

Categories

The only exception is the situation when, instead of cash payments, the employer provides subordinates with time off for overtime: in this case, additional payments are canceled. Art. 153 of the Labor Code of the Russian Federation, which regulates the specifics of remuneration on weekends or holidays, obliges additional payments to be made in at least double the amount:

- For employees working at hourly or daily tariff rates - at least one daily rate in accordance with the tariff;

- For employees working on a transaction basis - a minimum of double piecework wages;

- For employees receiving a salary in accordance with their official salary - at least one hourly or daily rate in excess of the salary, provided that the work was performed within the established number of working hours according to the monthly norm.

Which shifts are considered night shifts?

If at least one half of the working day is included in the night period, which means from 06 to 22 hours, then the entire shift is recognized as a night shift. When a person works from 16:00 to 03:00, the activity will not be considered night, because until 22:00 it is 6 hours - the majority of the shift.

In this case, payment at the night rate is made only for the hours that make up the night period. The rest of the time is remunerated at the daily rate. Before engaging an employee in such work, the employer must resolve the issue of such a possibility.

How to calculate holidays for January for watchmen example

Labor Code. In accordance with this article, work on weekends and non-working holidays is paid: · piece workers - at least at double piece rates; · employees whose work is paid at daily and hourly tariff rates - in the amount of at least double the daily or hourly tariff rate; · employees receiving a salary (official salary) - in the amount of at least a single daily or hourly rate (part of the salary (official salary) for a day or hour of work) in addition to the salary (official salary), if work on a weekend or non-working holiday was carried out on within the limits of the monthly working time standard, and in an amount of at least double the daily or hourly rate (part of the salary (official salary) for a day or hour of work) in excess of the salary (official salary), if the work was performed in excess of the monthly working time standard.

For work on national holidays, make double payment regardless of the watchman’s work schedule. If an employee has expressed a written desire to receive an additional day off instead of double pay, then pay for work on holidays in a single amount. You will be charged double for processing. Consider the number of hours worked based on the total number of working hours in the month.

For example, if a watchman receives an hourly rate of 100 rubles for one hour of work, then separately calculate all working hours on night shifts, multiply by 100 and 20%. Calculate pay for day shifts separately. If the total calculation of working hours exceeded the general norm in the working month, based on the number of working days in a given month, multiplied by 8, then multiply all overtime hours by 200 rubles.

Calculation of wages of guards in two days for the month of June

What specific norms of the Labor Code of the Russian Federation must be followed when calculating payment for work on holidays and at night:

- Art. 96 Labor Code of the Russian Federation;

- Art. 154 of the Labor Code of the Russian Federation on payment for night work;

- Art. 153 of the Labor Code of the Russian Federation on payment on weekends and official holidays.

The last two articles should be considered in more detail. Yes, Art. 154 of the Labor Code of the Russian Federation indicates that each hour of work outside the established schedule must be paid at an increased rate, and it cannot be lower than the monetary base regulated by legal acts. The exact amounts of remuneration for night work are established by collective agreement, taking into account the opinion of representatives of the Trade Union and can only deviate to a greater extent. It is worth noting that, even if employees are employed on a shift schedule that involves working at night, they are still entitled to compensation for this, as well as additional payments for holidays.

Expert opinion

Of course, the legislator provides for the freedom of choice of the employer, who himself has the right to set the size of the increased coefficient, but it cannot be lower than the minimum threshold of 20%.

Lawyers advise you to independently calculate the amount of the night bonus or additional payment for overtime activities. As a result, when the salary or payslip arrives, everyone will be able to see whether the additional payment for the night has been accrued. Unfortunately, accountants often forget, do not take into account all the hours and accrue smaller amounts.

In order to get a complete picture of work at night, as well as the peculiarities of remuneration, you can watch the video:

Quite often, citizens have to work night shifts, this is especially true in uninterrupted production, where the presence of employees is necessary around the clock. The legislator clearly understands that such work negatively affects the health and social life of a citizen, therefore the norms of the Labor Code of the Russian Federation provide for a special payment procedure.

Top

Write your question in the form below

How is work paid at night on holidays?

Thus, he worked 8 holiday hours, which also occurred during the night time periods. The calculation will look like this: 300 (payment per hour of work) x 8 (number of hours worked) x 2 (double size) +2400 x 0.35 (surcharge coefficient) = 5,640 rubles. What is the procedure for paying for hours worked at night on public holidays? To attract employees to work at night or on holidays, if they do not have a shift schedule, the employer must issue a corresponding order or instruction in writing.

Sometimes the consent of employees belonging to special socially protected categories is required to work outside of working hours.

How is a watchman paid for work on holidays?

Specific amounts of payment for work on a day off or a non-working holiday may be established by a collective agreement, a local regulatory act adopted taking into account the opinion of the representative body of employees, or an employment contract. Non-working holidays are defined in Article 112 of the Labor Code. They apply to all categories of workers, including those who work on a staggered schedule.

That is, if an employee working in shift mode is brought to work on a holiday established by law (even if this day is defined in his schedule as a working day), then such work is always paid at an increased rate - no less than twice in accordance with Article 153 of the Labor Code. It should also be remembered that, at the request of an employee who worked on a day off or a non-working holiday, he may be given another day of rest.

Reducing night shifts

According to the general rule prescribed in the Labor Code, the night shift is reduced by an hour. For example, if an eight-hour workday is specified in an employment contract, then during a night shift it will be equal to seven hours. However, this principle has an exception; the rule does not apply to the following categories of employees:

- those hired to carry out activities at night, for example, subway repairmen;

- persons working reduced hours due to hazardous conditions or by agreement with the employer.

Read also: Refusal to accept a VAT return

The employer has the right not to reduce working hours, but this must be agreed upon with the workforce. For example, if working conditions allow for a long night shift and there is a need for a person to be present at work for eight hours.

Important! The employer's decision not to reduce hours on the night shift must be recorded in the company's internal regulations. The signatures of employees who will be subject to the provisions of the order must also be there.

Calculation of holidays for watchmen

Download the order form Another document necessary for the correct registration of work on weekends is the order (order) of the manager to attract employees to work. Calculation of wages for school guards of the Labor Code of the Russian Federation, the employer can involve employees in work, subject to their consent and taking into account the opinion of the trade union (if there is one), if there is a need to perform unforeseen urgent work and the further functioning of the organization depends on this. In some situations, employees’ consent to work on weekends and holidays is not required - these are listed in Part 3 of Art.

113 Labor Code of the Russian Federation:

- An accident or disaster is a complex situation that may require the help of a large number of people.

Payment for holidays to guards

Working conditions on weekends and holidays Features of payment for work on weekends Calculation of wages for weekends and holidays with a piece-rate wage system Examples of calculating additional payments in organizations with a tariff wage system Extra pay on holidays and weekends with a salary system We arrange work on weekends correctly Working conditions on weekends and holidays Weekly rest and holidays free from work are an inalienable right of employees, but sometimes the production process requires their presence at the workplace on weekends and holidays. According to Parts 2 and 4 of Art. How to calculate the salary of guards working on a flexible schedule? Attention Author KakSimply! Security of private enterprises and government institutions is an important element of the overall functioning of the organization. Content

- 1 How to calculate a watchman's salary

- 2 Payroll for guards

- 2.0.1 Are additional days off provided to parents of a disabled child cumulative if they were not used?

- 2.1 DomOtvetov.ru - Answers to your questions Legal advice Labor law Payroll for watchmen

- 2.1.0.0.1 Latest comments

- 2.1.0.0.2 Popular

A watchman is a hired employee whose profession belongs to the general classification and has nothing to do with security guards working with a license allowing armed security of an enterprise. You can set any work schedule for a watchman, it depends on the conditions specified in the employment contract, and pay according to tariff categories 016-94.

Calculation of holidays for watchmen example

Salary excluding holidays: (21 - 4) × 1500 = 25,500 (rub.) Additional payment for work on holidays: 4 × 1500 × 2 = 12,000 (rub.) Total salary for an electrician for January: 12,000 + 25,500 = 37,500 (rub.) Calculations will look different in a situation where an enterprise uses an hourly rate to determine the salary. For example, turner S.B. Kuzmin worked 200 hours in September, of which 16 were on Saturday and Sunday. The hourly tariff rate at the plant is 200 rubles.

in an hour. How to calculate wages for watchmen Payment on weekends - an example of calculating this part of expenses would be useful for some employers to study. The information provided in the article will help you correctly calculate an employee’s salary if he is hired to work on weekends and holidays.

We talked about what is meant by night time in labor relations, who is not allowed to work at night, and how night work is paid, we talked about in our consultation. And we talked about payment for work on holidays in this material. How are night hours paid on holidays?

Here is an example of calculating payment for night work on a holiday.

Let’s assume that an employee’s hourly wage rate is 250 rubles. Payment for work on holidays is double, and additional payment for night work is 20% of the hourly rate.

In accordance with the schedule, the employee worked from 16:00 on 02/23/2018 to 09:00 on 02/24/2018.

Payment for time worked consists of the following amounts:

| Payment period | Calculation | Amount, rub. | Explanations |

| from 16:00 02/23/2018 to 22:00 02/23/2018 | 6 hours * 250 rubles * 2 | 3 000 | 6 hours of daily work on a holiday are paid double |

| from 22:00 02/23/218 to 00:00 02/24/2018 | 2 hours * 250 rubles * 2 + 2 hours * 250 rubles * 20% | 1 100 | 2 hours of night work on a holiday are paid double and include a 20% surcharge |

| from 00:00 02/24/2018 to 06:00 02/24/2018 | 6 hours * 250 rubles + 6 hours * 250 rubles * 20% | 1 800 | 6 hours of night work on Saturday (according to the schedule this is a working day) are paid at a single rate, taking into account a surcharge of 20% |

| from 06:00 02/24/2018 to 09:00 02/24/2018 | 3 hours * 250 rubles | 750 | 3 hours of daytime work on Saturday are paid at a single rate |

In total, payment for work at the specified time amounted to 6,650 rubles (3,000 + 1,100 + 1,800 + 750).

"Chief Accountant". Appendix “Accounting in Production”, 2006, N 2 PAYMENT FOR THE GUARDIAN FOR NIGHT HOURS ON A HOLIDAY Holiday and night hours are paid at an increased rate. The article will discuss how to correctly calculate the amount of daily pay for a security guard worker for a period that includes both “night” and “holiday” hours at the same time. Amounts of additional payments Issues of remuneration are regulated by labor legislation. Yes, Art. 153 of the Labor Code of the Russian Federation provides for a norm according to which work on non-working holidays is paid at least double the amount. In addition, the time from 10 pm to 6 am is night time, and each hour of work at this time is paid at an increased rate (Articles 96, 154 of the Labor Code of the Russian Federation). In accordance with Art. 423 of the Labor Code of the Russian Federation, when calculating wages, existing regulations can be applied to the extent that does not contradict the Labor Code of the Russian Federation. Therefore, in this case, one can be guided by the Resolution of the State Committee for Labor of the USSR and the All-Union Central Council of Trade Unions No. 313/14-9 of August 6, 1990 “On remuneration of security workers at night.” It establishes an additional payment for guard security workers for night work in the amount of 35 percent of the hourly tariff rate (salary). Example. The enterprise is guarded around the clock. The guard duty hours are every other day. The work is performed on the basis of summarized working time recording. The shift begins at 20:00 on April 30 and ends at 20:00 on May 1. The hourly tariff rate is 50 rubles. Since the employee is entitled to three one-hour breaks for rest and food, including one break at night, he worked a total of 21 hours during this shift, which should be paid based on the hourly tariff rate: 50 rubles. x 21 hours = 1050 rub. Breaks for rest and meals (3 hours) are not paid. The time from 00:00 to 20:00 on May 1st is considered a non-working holiday. Since during this time there are three unpaid hours of breaks, the number of “holiday” hours will be 17 (20 - 3). The additional payment for them will be equal to: 50 rubles. x 17 hours = 850 rub. The employee worked seven hours at night (taking into account the exclusion of break time - one hour). The additional payment for this time is determined as follows: 50 rubles. x 7 hours x 0.35 = 122.5 rub. The total salary of an employee per shift will be: 1050 rubles. + 850 rub. + 122.5 rub. = 2022.5 rub. It should be noted that the specified amount is the minimum guaranteed by the Labor Code of the Russian Federation. The employer may increase the amounts of these additional payments, but does not have the right to reduce them. The specific amounts of the increase are established by him, taking into account the opinion of the representative body of workers, a collective agreement, and an employment contract. B.A. Chizhov Head of the Department for Social Services of Roszdrav Signed for printing 03/16/2006

So, you will find out:

At enterprises, there is sometimes a need for employees to work at night on holidays. Additional payment is required for work during this time. The minimum additional payment for night work is at least 20 percent of the hourly (daily) tariff rate or salary, according to Article 149 of the Labor Code. Work on a weekend or holiday is paid double. Therefore, we can say that for work on holiday night hours there are as many as two additional payments.

Calculation example

A clothing store had a large delivery of goods, but the sellers did not have time to open all the boxes and put the goods up for sale. In this regard, the administrator suggested staying late and working not until 22:00, but until 02:00 am. The hourly rate is 120 rubles. To calculate the amount of bonus for overtime work, you need:

The first two hours will be paid in the amount of 360 rubles.- Another 2 hours passed between 00:00 and 02:00. The salary is another 480 rubles.

- The total premium for 4 hours will be 840 rubles.

In addition, you need to calculate the night supplement, which is fixed at 20%. 120 multiplied by 20% = 24 rubles. 4 hours were worked at night, which means 96 rubles.

Based on the above information, the total salary increment will be 936 rubles.

What the Labor Code says about pay on weekend nights

Article 149 of the Labor Code states that when performing work in conditions deviating from normal, the employee is paid additional payments provided for:

- labor legislation - Labor Code of the Russian Federation;

- other regulatory legal acts containing labor law norms;

- a collective agreement signed by trade union representatives;

- agreements between employer and employees;

- local regulations or additions to the TD;

- employment contract.

The amounts of payments cannot be lower than those established by labor legislation (20%) and other regulatory legal acts containing labor law norms.

Part 1 of Article 96 of the Labor Code also defines night time. Night time is considered to be the time from 22:00 to 6:00. If night work falls on holidays, both types of guarantee surcharge must be provided by the employer.

Employees whose work is paid at daily and hourly tariff rates, work on a non-working holiday is paid in the amount of at least double the daily or hourly tariff rate (Part 1 of Article 153 of the Labor Code of the Russian Federation).

Amount of payment for night hours on holidays

Let's look at an example. Ivanov works at the company at an hourly rate of 300 rubles. Suppose an employee had to go to work from 22-00 on January 1 to 6-00 on January 2. In this case, the calculation of the surcharge will be as follows: 300 * 8 * 2 + 2400 * 0.35 = 5640. In this case, the coefficient for the surcharge is 35% (this is stated in the local act of the enterprise), and the payment for hours is doubled.

At some enterprises, all earnings for hours worked during night holidays are doubled, but if the employer works at a budget enterprise, then such extravagance can lead to sanctions. To prevent this from happening, this point should be spelled out separately in a local regulatory act or a collective labor agreement signed by a trade union.

Rules for bringing to work

To bring an employee to work at night, his prior notification and consent is required.

Night work, like other irregular working conditions, requires prior notification of workers and obtaining their consent. The exception is cases when night work is scheduled. In this case, the employee’s signature in the employment contract or in the annex to it is sufficient (if the change in work mode occurred after employment).

If the need to stay at work after 10 p.m. appears sporadically and is not related to the work schedule, you need to draw up an order. Before doing this, you must obtain the employee's consent to do this. To do this, a document is drawn up in which the employee confirms with his signature his readiness to go to work at night. An order is issued based on this document.

It indicates the full name of the employees, the time and date of unscheduled work, and the payment procedure. All employees specified in the order must also sign to confirm familiarization. In the future, based on this order, the accounting department will make the necessary additional payments.

Employee consent is not required for overtime work, including at night, in the following cases:

- when it is necessary to prevent an accident or eliminate its consequences;

- when the organization’s activities are related to the defense of the state;

- when the consequences of natural disasters are eliminated;

- when work is related to providing people with necessary communications and household services: electricity, heat supply, gas, etc.

Payment procedure for night hours on holidays

Since an employee who works at night and on holidays is entitled to certain additional payments, it is necessary that several documents be drawn up. In accordance with Part 8 of Art. 113 of the Labor Code of the Russian Federation, the involvement of employees in work on weekends and non-working holidays in all cases must be carried out by written order of the employer.

An order or instruction is drawn up by the employer in the form established by the document flow. It includes:

- first name, last name and patronymic of the employee;

- schedule;

- the period of the work schedule when it will be valid;

- information on the formation of additional payments for work at night and on holidays.

In some cases, employees must provide written consent to work on night holidays. This:

- women with children under three years of age;

- disabled people;

- workers with disabled children;

- workers caring for sick family members;

- mothers and fathers raising children under the age of five without a spouse.

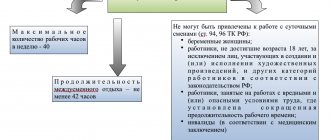

There are also those who should not work at night, even with written consent. This:

- workers under 18 years of age

- pregnant women

In the timesheets, the day when the employee worked at night and on holidays is marked “RV” and (or) the digital code “03”.

An organization has the right to provide in its local regulations double remuneration for work on a weekend or non-working holiday. This right of organization is granted by Art. 153 of the Labor Code of the Russian Federation (specific payment amounts and payment procedures are determined by the organization itself), and Art. 135 of the Labor Code of the Russian Federation (the remuneration system is determined in local acts drawn up by the organization). If the documents do not stipulate the right of employees to double pay, the coefficient for the “night” surcharge should be at least 20%.

How to organize work at night according to the Labor Code of the Russian Federation?

How is work paid on a shift schedule?

Night time is considered to be the period from 22-00 to 06-00. For a number of people there are restrictions when working at night.

It is prohibited to work at night:

- pregnant women;

- minors.

The following may be employed at night only with written consent:

- mothers with children under 3 years of age;

- disabled people of all working groups;

- parents of disabled children

- persons who care for sick family members with a medical certificate;

- single mothers and single fathers up to the age of 5 years;

- guardians of children under 5 years of age.

In this case, the employer is obliged to inform them, against signature, of the right to refuse to work at night.

With a shift schedule, the night shift is reduced by 1 hour compared to the day shift without further work.

So, if the daytime lasts from 8 am to 20-00 pm and is 12 hours, the night one from 20-00 will last until 7-00, with payment for the missing hour.

In production that does not allow downtime, the night shift can be equal to the day shift.

In addition, night hours are not reduced for workers hired to work at this time of day.

It is also possible to maintain the duration of the shift at night with a 6-day work week with one day off. All these provisions must be reflected in the contract, annex to it or an additional agreement.

About the duration and standard hours for a shift schedule.

What the law says

The night work regime itself is regulated by a number of articles of the Labor Code (LC RF). Features, conditions and payment for work at night are stipulated by Articles 96 and 154 of the Labor Code of the Russian Federation. From what hour is work activity considered as such? Labor legislation determines that night hours are considered to be the period of time that starts from 10 pm to 6 am.

It also stipulates categories of citizens who are not allowed to work at such times. This includes:

- Pregnant;

- Minors (the only exceptions are those who create works of art).

There are also categories of employees whose involvement in the night shift is permitted by law, but only with their written consent (the procedure for their involvement is stipulated by labor law):

- Employees with disabled children;

- The disabled themselves;

- Employees caring for patients;

- A parent raising one or more children under 5 years of age.

If people included in these categories of persons refuse to go to work, they cannot be forced to work without consent, and these absences cannot be considered absenteeism under the law,

The Labor Code also regulates the duration of the night shift. The work shift should be 1 hour shorter than the day shift. This provision is controlled by Article 96 of the Labor Code of the Russian Federation. Also, the duration is reduced by another 1 in all cases except the following:

- If the employee works on a reduced schedule;

- The employee was initially hired on the night shift (for example, a watchman should not work on a reduced schedule);

- When working in shifts (according to a 6 to 1 schedule);

- Due to production or working conditions.

conclusions

A night on a holiday during a shift schedule is paid at a summed rate - no less than double the salary (tariff hourly rate) plus 20% for night work.

The employer has the right to increase additional pay both for work on public holidays and for work at night.

The article describes typical situations. To solve your problem, write to our consultant or call for free:

Moscow - CALL

+7 St. Petersburg — CALL

8 Other regions - CALL

It's fast and free!

Many manufacturing enterprises have established a shift work schedule, implying work not only during the day, but also at night; the most common options are such modes as “day/night/48 hours of rest”, or “every other day”. Regardless of the principle on which the regime and routine are based, the Labor Code of the Russian Federation obliges payment for work at night at an increased rate, because this is not considered work under normal conditions.

Below is an example where the employer incorrectly calculated the paid time, and the employee managed to obtain unpaid money:

Maksimenko S.A. employed at Alliance LLC as a salesperson. The organization operates around the clock, staff work schedule is day/night/48. In February, the work shift of Maksimenko S.A. fell from 20 o'clock. 00 min. 22nd to 08:00 00 min. 23rd. The manager paid only for work time from 00 o'clock. 00 min. until 06 o'clock 00 min., i.e. only night hours. Maksimenko S.A. filed a complaint with the Trade Union, and the commission came to the conclusion that the employer violated the Labor Code norms, because Work at night and on holidays must be paid separately.

Thus, even if the employee’s shift occurs at night, and the date is a holiday, the employer must pay wages according to separate items: for night hours and for holidays.

It also happens that you have to involve employees who work on a daily daytime schedule to work at night. Most often this occurs when it is necessary to eliminate the consequences of an accident at an enterprise, take inventory, etc. To do this, the manager must issue an order to hire people to work on a day off, containing the following information:

- In this connection, employees must go to work at night or on their day off;

- Date and time when it is necessary to be present at the workplace after hours;

- An order to pay double for the required number of hours;

- Signature of the director, accountant and persons involved in overtime work at night or on weekends.

Shift work schedule

This work schedule assumes the introduction of two or more shifts at the enterprise.

As a rule, this is due to the need for long-term operation of the enterprise, for example, around the clock. In this option, employees will have some of their shifts at night. The procedure for paying compensation for work after ten in the evening is standard: the total number of hours that the employee spent at the place of duty after twenty-two hours is considered. The indicator is multiplied by the premium coefficient.

With a fixed salary

It is often easier to calculate additional pay for employees who are paid hourly. It is enough to multiply the indicator by the surcharge coefficient. When it comes to employees with a fixed salary, you first need to calculate the average hourly income in a particular month. To do this, wages are divided by the number of hours spent at work.

Read also: Employee personal card form T-2

After calculating this indicator, the procedure for calculating the premium is standard.

During a business trip

The fact that a person works outside the office does not affect the remuneration procedure.

If his work occurs at night, the employee has the right to count on additional payment. As for travel time, the employer is not obliged to increase the rate per hour, but this is often included in travel allowances.

Overtime at night

If an employee has a shift schedule and part of the work time falls at night, then he is additionally paid only compensation. In cases where, at the request of the employer, a person is delayed at the place of work after ten in the evening, he must also be given an overtime bonus. Its calculation is as follows:

- for the first two hours of delay, the hourly rate is multiplied by fifty percent;

- over the subsequent time - doubles.

Healthy! In addition to the coefficient for overtime work, an allowance is also made for night time. As a result, it turns out that the delay is quite profitable.

On holidays

At the legislative level, incentives are provided for work on holidays.

The tariff increase factor is two. That is, a person receives 1,000 rubles for a shift, and 2,000 rubles for work on May 9th. If part of the shift occurred at night, the premium will be calculated from the increased tariff.

Examples of calculations

Several rules for calculating allowances for night work have already been discussed above. Let's look at some difficult but common situations.

Payment for night hours at a fixed salary

Let us assume that an employment contract has been concluded with citizen Gavrilenko, under which a shift work schedule is established, with some shifts at night. The employee's salary is 25,000 rubles.

To calculate the night shift bonus, you need to know three indicators:

- Rate per hour. Determined by dividing income by the total number of hours worked in a month: 25,000/170 hours. The hourly rate is 147 rubles;

- The number of hours worked by the employee per month at night. Let's say that in our example there are sixty of them;

- The amount of the bonus for night work established by the company is twenty percent.

By multiplying the three indicators, it turns out that the additional payment for night work will be 1,764 rubles.

Payment for night hours to hourly workers for overtime work

Let’s say citizen Nikonenko works in a company with an hourly rate of one hundred rubles. In a month, she worked 176 hours, although the staffing table indicated 172, that is, she overworked 4 hours. For them, she will be paid an additional payment of 700 rubles, since the first two hours are multiplied by one and a half, and the subsequent ones by two.

As for the extra pay for night time, in the month after ten in the evening the woman worked 36 hours, the company’s standard bonus is 20%. The additional payment will be 720 rubles.

Payment on weekends at night: what does the Labor Code of the Russian Federation say?

According to the norms of the Labor Code of the Russian Federation, for night work, employers are required to pay their subordinates at least 20% of the daily salary or tariff rate. Work on holidays and weekends is paid separately at double the rate, so employees actually receive two additional payments.

If the working conditions of employees deviate from normal, i.e. they have to perform their duties at night, when calculating additional payments, they must be guided by the following standards:

- Labor Code of the Russian Federation and other acts containing labor standards, but not contradicting the Code;

- A collective agreement certified by a representative of the Trade Union organization;

- Labor agreements concluded with personnel;

- Addendums to employment contracts with employees;

- Local documents of the organization.

Payment for work at night and on holidays is regulated by different articles of the Labor Code of the Russian Federation; accordingly, employees are entitled to both types of additional payments. So, according to Art. 96 of the Labor Code of the Russian Federation, “night time” should be understood as the period from 22:00. 00 min. until 06 o'clock 00 min. For example, if an employee works from 8 p.m. 00 min. until 08 o'clock 00 min. the next day, then the time from 8 to 10 pm is paid at the usual rate, and from 22 o'clock. until 06 o'clock in the morning - double.

What specific norms of the Labor Code of the Russian Federation must be followed when calculating payment for work on holidays and at night:

- Art. 96 Labor Code of the Russian Federation;

- Art. 154 of the Labor Code of the Russian Federation on payment for night work;

- Art. 153 of the Labor Code of the Russian Federation on payment on weekends and official holidays.

The last two articles should be considered in more detail. Yes, Art. 154 of the Labor Code of the Russian Federation indicates that each hour of work outside the established schedule must be paid at an increased rate, and it cannot be lower than the monetary base regulated by legal acts. The exact amounts of remuneration for night work are established by collective agreement, taking into account the opinion of representatives of the Trade Union and can only deviate to a greater extent.

It is worth noting that, even if employees are employed on a shift schedule that involves working at night, they are still entitled to compensation for this, as well as additional payments for holidays. The only exception is the situation when, instead of cash payments, the employer provides subordinates with time off for overtime: in this case, additional payments are canceled.

Art. 153 of the Labor Code of the Russian Federation, which regulates the specifics of remuneration on weekends or holidays, obliges additional payments to be made in at least double the amount:

- For employees working at hourly or daily tariff rates - at least one daily rate in accordance with the tariff;

- For employees working on a transaction basis - a minimum of double piecework wages;

- For employees receiving a salary in accordance with their official salary - at least one hourly or daily rate in excess of the salary, provided that the work was performed within the established number of working hours according to the monthly norm. Double payment is made if processing exceeds the monthly norm.

Thus, labor legislation allows increased additional payments for overtime work, but they must be made at double the rate. Also, the law does not prohibit the establishment of increased additional payments for work on holidays and weekends, however, this must be reflected in local acts of enterprises: labor or collective agreements, additional agreements to them, etc.

Payment for night hours on holidays: what is the amount of additional payments?

To understand the principle of calculating additional payments for night work, it is worth familiarizing yourself with a more detailed example:

Pavin S.Yu. works at Master LLC at an hourly rate of 300 rubles. By order of his manager, he had to go to work on January 1 (an official holiday) from 20:00. 00 min. until January 2, 06:00 00 min. Thus, he worked 8 holiday hours, which also occurred during the night time periods. The calculation will look like this:

300 (payment per hour of work) x 8 (number of hours worked) x 2 (double size) +2400 x 0.35 (surcharge coefficient) = 5,640 rubles.

Calculation of salary at night

If you decide to calculate the amount yourself, you need to know:

- Hourly rate. You can also calculate it yourself. To do this, the monthly salary is multiplied by 12 to obtain the salary for the year. The number of working hours per year is calculated. If there are 40 hours in a week, then a citizen works 1970 hours per year. The calculated annual salary is divided by the number of hours and the hourly rate is obtained.

- Number of hours worked at night. This information can be seen in the accounting sheet; it is maintained by the employer.

- Increased coefficient. You should pay attention to the percentage; it may differ from that established by the Government of the Russian Federation.

Knowing these indicators, you can easily and quickly calculate the amount of additional payment for night work. Use the formula:

Additional payment = hourly rate x number of hours x established %

What is the procedure for paying for hours worked at night on public holidays?

To attract employees to work at night or on holidays, if they do not have a shift schedule, the employer must issue a corresponding order or instruction in writing. Sometimes the consent of employees belonging to special socially protected categories is required to work outside of working hours. Which citizens are:

- Women raising children under three years of age;

- Disabled people and employees with dependent disabled children;

- Subordinates caring for elderly or sick family members;

- Employees raising a child under 5 years of age alone.

It is also worth highlighting categories of citizens who, by law, cannot be involved in work at night, even with their written consent:

- Minor employees;

- Pregnant women.

Particular attention should be paid to the time sheet, because... It is on him that the correct payment for the hours worked of each employee depends. As a rule, heads of departments or personnel officers are responsible for maintaining this document, but other employees can also be appointed responsible at the direction of the manager. On days when employees worked during non-working and holiday hours, you must enter the code “03” or the letter “RV” on the timesheet, both options are considered correct.

Due to the fact that the law allows additional payments for overtime work, organizations can independently establish increased payments, which must be reflected in local regulations. If the minimum payments established by the Labor Code of the Russian Federation are not made to employees, they can contact several competent organizations:

- Trade union (if employees are members of this body);

- State Labor Protection Inspectorate;

- Court.

When applying as evidence, you can use salary certificates, witness statements and other facts confirming the systematic violation of labor laws by the employer. Based on the results of the inspection, an order or court decision will be issued to him, on the basis of which a fine will be imposed on violators, as well as an obligation to pay unpaid money for certain periods of work.

Overtime at night

Sometimes an employer asks an employee to stay at the duty station to complete the stated plan/finish all the work. In such a situation, it becomes necessary to charge a premium for overtime work. It is calculated like this:

- The first two hours of work are paid as full 3.

- All subsequent time is paid at double rate.

Note! For an increased workload, in addition to the salary, a person also receives a bonus for overtime activities, as well as a night rate of pay. Thus, a delay at work is quite profitable, because the salary consists of three components.