Night work according to the Labor Code of the Russian Federation

The operating mode of enterprises in many sectors of modern production and the service sector dictates the expediency of a round-the-clock work schedule.

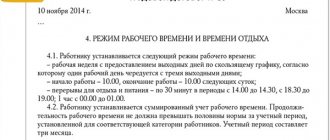

In this regard, there is a need for legal regulation of night work of employees providing such a schedule. The Labor Code defines the time between 22:00 and 6:00 as night time (Article 96). In general, the legislator sets the duration of night work to be 1 hour less than normal. This reduction does not require working out in subsequent periods. However, the Labor Code of the Russian Federation provides for situations where the duration of night work can be equal to normal:

- employee employment in a shortened work week;

- hiring an employee to work at night;

- objective requirements of working conditions or shift work with a 6-day working week.

An example of calculating payment for night work was given by ConsultantPlus experts. Get trial access to the system and upgrade to the Ready Solution for free.

Night shift from a legal point of view

Additionally,

the duration of working hours on the night shift for workers in creative professions (theater performers, members of circus troupes and film crews, media workers) is regulated by the terms of the labor or collective agreement, as well as local regulations.

Article 96 of the Labor Code of the Russian Federation provides an explanation according to which the definition of a night work shift includes labor activities carried out in the time period from 22-00 in the evening to 06-00 in the morning. Thus, if the majority of an employee's working time falls within the specified hours range, the work is considered to be night work. According to this article, the duration of a work shift at night should be one hour less than during the daytime. If daytime work hours are 8 hours, it is acceptable to set a seven-hour work schedule for night work without having to work the missing hour. In some cases, the reduction of working hours at night may not occur when:

- The worker was originally hired to work at night.

- The employee is involved taking into account reduced working hours.

- Employees work in shifts with one day off per week.

Night work is not allowed: legislative restrictions

Legislation limits the possibility of night work or introduces special permitting procedures for certain workers due to their age, marital status or health status.

It is prohibited to use the labor of pregnant women and adolescents under 18 years of age at night (Article 96 of the Labor Code of the Russian Federation).

With the written consent of the employee, the employer may use the following labor during night employment:

- women who have children under 3 years of age;

- disabled people (for this group there must be no medical contraindications);

- single parents and guardians with children under 5 years of age;

- parents with disabled children;

- workers who, according to a medical certificate, are caring for seriously ill family members.

Workers from the listed groups have the right to refuse night work. And if they agree, they must confirm in writing that they have been notified by their employer of their legal right not to work at night.

In the timesheet, indicate the letter code “H” or the numeric “02”; in the cell below, indicate the number of hours worked at night.

What does the Labor Code say?

Article 96 of the Labor Code determines that night work can take into account the hours that fall between 10 pm and 6 am. Only if more than 50% of a person’s time at work falls during this period, his work is considered night and has additional pay.

Under current laws, a standard night shift is 60 minutes shorter than a day shift. For example, if the staffing schedule specifies 8 hours, work after 10 p.m. is set to 7, and the missing time is not required to be worked.

In some cases, the employer is required to reduce hours at night, including:

- the employment contract specifies the person’s night work type;

- the employee initially works on a reduced schedule;

- employees work in shifts and have one day off per week.

The legislation establishes some nuances and restrictions on work at night:

- When reducing work on night shifts, the employer does not have the right to impose sanctions on employees or reduce wages. The change is considered complete.

- A night shift can be the same length as a day shift if the company's operations require employees to perform their duties full time, or if employees work shifts 6 days a week.

- The law establishes a list of citizens who are prohibited from being involved in night shifts, regardless of their duration or duties.

- Some employees can be involved in night shifts only after receiving written consent, providing them with an order for familiarization and allowing them to refuse without imposing sanctions or fines.

- If the enterprise employs employees of the media or creative professions, the night regime is stipulated in the collective labor agreement. In some cases, confirmation from the commission about the need to introduce a night shift is required.

Payment for night hours during a shift work schedule: legal norms, nuances

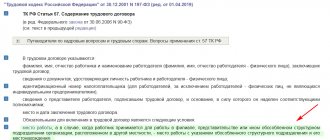

Salaries for work performed between 10 p.m. and 6 p.m. are paid at an increased rate (Article 154 of the Labor Code of the Russian Federation). The legislator establishes the following norm: an hour of working time at night should cost more than an hour of work under normal daytime conditions. The minimum coefficient of increase in pay is established by the Government of the Russian Federation based on the recommendations of specialists from the Russian Tripartite Commission for the Regulation of Social and Labor Relations.

Today, the coefficient is at least 20% of the amount of payment for an hour of daytime work for each night hour in accordance with Decree of the Government of the Russian Federation dated July 22, 2008 No. 554.

Important! If the employer is willing to compensate for a large amount of additional payment, this should be reflected in the collective agreement.

Thus, the legislator establishes a two-pronged approach to the principle of calculating remuneration for work at night:

- on the one hand, the state guarantees a minimum level of extra pay for night work;

- on the other hand, the legislator invites the parties to labor relations to agree on the use of higher additional payments, enshrining such an agreement in the local regulatory legal act.

The following is accepted as the basis for calculating the amount of remuneration for shift work:

- monthly salary;

- or daily (hourly) rate.

When, when working on a shift, the accounting period for the summarized accounting of working hours is 1 month, the employer, as a rule, uses the monthly salary for calculations. In this situation, the number of hours worked, which should not differ from the norm according to the production calendar, as well as the number of hours worked in conditions other than normal (for example, at night) are subject to separate control.

For more information about recording working hours, see the article “Working time sheet - form T-13 (form).”

If the accounting period is more than 1 month, for example 2 months, then it is quite possible that in the 1st month of work the normal working hours will not be observed, and the deviation will be compensated by working hours in the 2nd month, so that the duration of the actual working hours for the accounting period the period was normal (Article 104 of the Labor Code of the Russian Federation).

If the salary system is used for calculation, each month is paid in the same amount equal to the monthly salary. An employee receives the same reward for different amounts of work, which is wrong. The choice of calculation principle based on the daily (hourly) rate in this case is more logical.

For the working time schedule and the procedure for drawing it up, see the article “How to correctly draw up a working time schedule?”

Thus, the rules for calculating payment for night hours during a shift work schedule are as follows:

- based on the data from the working time sheet, the number of night hours worked is recorded (it is important to note that the calculation takes into account the number of hours falling in the period from 22 to 6 o’clock);

- the cost of an hour is determined based on the adopted system;

- an increasing factor is applied, which is at least 20% of the cost of an hour of daily labor (its actual amount is determined in the employer’s legal regulations).

Compensation calculated based on piecework

When work is subject to piecework payment, the bonus for night working hours is calculated based on the rate established for the piecework worker. To calculate the amount to be paid, you need to multiply the following indicators:

- Number of hours worked at night.

- Piece rate for one hour.

- A supplement expressed as a percentage of the hourly rate.

Example 2. Tensor LLC determined a piece rate payment for the manufacture of one product - 10 rubles. For a month, turner Akimov Yu.G. turned 1200 items, working 5 hours at night. His hourly tariff rate is 50 rubles/hour. According to the regulations on remuneration at Tensor LLC, the additional payment for night work is 40% of the hourly rate.

Main part of salary:

- 10 rub./pcs. x 1200 = 12,000 rub.

- 5 hours x 50 rub./hour x 40% = 100 rub.

Total amount for the month:

- 12000 rub. + 100 rub. = 12100 rub.

How night work is paid: actual additional payments for work in industries

In the current practice of paying for work at night, in many industries industry agreements are used, which establish a surcharge coefficient of 40% (federal industry agreement on the road sector, mechanical engineering complex, etc.).

And although this contradicts the literal reading of the norm of the Labor Code of the Russian Federation, which indicates that the source of establishing additional pay can be a collective agreement, it is important to understand that the agreement protects the rights of the employee and will certainly be taken into account in the event of a labor dispute.

How to pay for a night shift worked by an employee on a holiday or day off? The answer to this question is in ConsultantPlus. Get trial access to the system and get the opinion of K+ experts for free.

Supplement for night work

Government Decree No. 554 states that the minimum additional payment for night work is twenty percent of the employee’s hourly rate.

If his income is not formed at the rate of sixty minutes, then the monthly salary should be divided by the number of hours worked. The company has the right to set its own bonuses, but not less than twenty percent, in order to make night work more attractive for employees. Thus, in some industries the rate for a night shift is one and a half times higher than for a day shift.

Attention! The amount of the bonus for night work should be fixed in the company’s internal documents, for example, in a collective agreement.

Decree of the Government of the Russian Federation of July 22, 2008 N 554 “On the minimum amount of increase in wages for work at night”

Results

Night work is classified by the legislator as work performed in conditions other than normal, therefore, the performance of labor duties during the period established by the Labor Code of the Russian Federation as night time is paid at an increased rate.

The legislator regulates the minimum amount of additional pay for night work. The actual amount of the additional payment is established in the collective agreement between the employer and employees.

Sources:

- Labor Code of the Russian Federation

- Decree of the Government of the Russian Federation dated July 22, 2008 No. 554

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Taxation

All income received by citizens is taxed. Extra pay for night work is no exception. The accountant makes contributions to the Pension Fund and the Tax Service from his entire salary .

Consequently, the employee does not need to independently report to the authorities about the additional profit received. Working at night is a common practice. It is stated at the legislative level that a bonus is provided for work after ten in the evening. The minimum additional payment is twenty percent for each hour in accordance with the employee’s average hourly salary.

Read also: VAT from January 1, 2021