28.08.2019

0

64

5 minutes.

A citizen must perform official duties for the period established by law, a collective agreement or other local act. At the initiative of the head of the organization, an employee may be called to an additional shift to complete current affairs at the enterprise. Federal legal documents provide for monetary compensation for overtime work. The calculation of remuneration depends on the working hours, the system for calculating monthly income and the number of hours of unscheduled activities.

Article 152 of the Labor Code: what's new?

The rules for overtime pay have long been firmly established. Some cardinal and massive changes in Art. 152 of the Labor Code of the Russian Federation was not introduced from the very beginning of the Labor Code.

The only innovation in recent years has been a special procedure, different from that provided for in Article 152, of compensation for overtime work for employees of some organizations associated with the upcoming 2017–2018 football events in our country. – 2021 FIFA Confederations Cup and 2018 FIFA World Cup. This order is enshrined in Art. 11 of the law of 06/07/2013 No. 108-FZ.

How are overtime hours compensated?

In organizations not associated with big football, overtime is compensated at the employee’s discretion:

- increased salary;

- additional rest.

For monetary compensation, the Labor Code of the Russian Federation establishes a minimum payment: one and a half times for the first 2 hours, double for all subsequent hours.

The duration of the rest must be no less than the processing time. In this case, time worked in excess of the norm is paid in the usual single amount.

These are all legal minimums. The organization has the right to increase pay or increase rest time.

Payment for work in excess of established standards

The procedure for paying overtime work is prescribed in Article 152 of the Labor Code of the Russian Federation. According to this article, payment for excess work can be determined by labor, collective agreements or labor regulations. If the amount and procedure for payment are not specified in these documents, compensation is made in accordance with the Labor Code of the Russian Federation.

The Labor Code of the Russian Federation stipulates the following:

- the first two hours of overtime are paid in an amount that should not be less than 1.5 times the size;

- subsequent hours of work above the norm are paid in an amount that should not be less than double the amount.

Also, Article 152 establishes that, at the request of the employee, compensation can be expressed not in cash, but in the form of additional rest. The hours provided for rest must correspond to the time spent on overtime work. In this case, the issue of providing rest must be agreed upon with the head of the organization.

What should you pay extra for?

Increased pay is due in cases where, at the initiative of the employer, the employee works longer than his working day (shift) lasts, and in the case of cumulative accounting, he works more working hours than the normal number of hours during the accounting period.

In order to correctly determine the scale of processing, strict accounting of the time worked by each member of the workforce is necessary.

Overtime does not include and, accordingly, is not paid additionally:

- delays at work on the initiative of the employee himself. They do not pay extra for them and do not provide time off (see letter of Rostrud dated March 18, 2008 No. 658-6-0);

- overtime of personnel with irregular working hours. They are entitled to additional leave for excess expenses.

You can learn more about it from the article “Additional leave for irregular working hours .

Work where working conditions deviate must be paid at an increased rate

Determining the specific amount of wages should not only be based on the quantity and quality of labor, but also take into account the need for a real increase in wages when working conditions deviate from normal (Resolution of the Constitutional Court of the Russian Federation of December 7, 2021 N 38-P, Determination of the Constitutional Court of the Russian Federation Federation dated December 8, 2011 N 1622-О-О).

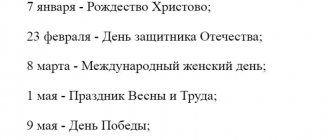

About working on holidays and weekends

Everyone has the right to rest, and those working under an employment contract are guaranteed the length of working hours established by federal law, weekends and holidays, paid annual leave - the Labor Code of the Russian Federation, in order to provide employees with a real opportunity to use the weekends and non-working holidays provided for by law for rest, introduces a general ban on work on such days. At the same time, Article 113 of this Code lists exceptional cases when hiring is allowed, but only if certain conditions are met, including a written order from the employer and, as a rule, the written consent of the employees.

About wages on holidays and weekends

In order to compensate employees for increased labor costs caused by an increase in working hours and a reduction in rest time, which is necessary, first of all, to restore strength and performance, Article 153 of the Labor Code of the Russian Federation establishes that work on a day off or a non-working holiday is paid no less than double size:

- for piece workers - no less than double piece rates;

- employees whose work is paid at daily and hourly tariff rates - in the amount of at least double the daily or hourly tariff rate;

- employees receiving a salary (official salary) - in the amount of at least a single daily or hourly rate (part of the salary (official salary) for a day or hour of work) in excess of the salary (official salary),

- if work on a weekend or non-working holiday was carried out within the limits of the monthly working time norm, and in an amount of at least double the daily or hourly rate (part of the salary (official salary) for a day or hour of work) in excess of the salary (official salary), if the work was performed in excess monthly working hours (part one).

Specific amounts of payment for work on a weekend or non-working holiday may be established

- collective agreement,

- local regulations,

- employment contract (part two).

Increased payment is made to all employees for hours actually worked on a weekend or non-working holiday, and if part of the working day (shift) falls on a weekend or non-working holiday, the hours actually worked on a weekend or non-working holiday are paid at an increased rate ( from 0 hours to 24 hours) (part three).

Are there any restrictions on overtime work?

Of course there is.

Overtime should not be part of the system. An employer can only occasionally engage an employee additionally.

Overtime should not exceed 4 hours for 2 consecutive days and 120 hours per year.

Violation of the norms is punishable by an administrative fine on the organization and its officials under Part 1, and in case of repeated violation - under Part 4 of Art. 5.27 Code of Administrative Offenses of the Russian Federation.

Read about restrictions on overtime work in the article “When is it permissible to hire an employee to work overtime?” .

Procedure for calculating payment for overtime work

In accordance with Article 152 of the Labor Code of the Russian Federation, the coefficients used in calculating compensation are established. The employer, on the basis of local regulations, has the right to increase the amount of remuneration. When paying for an unscheduled schedule, weekends and holidays are not taken into account.

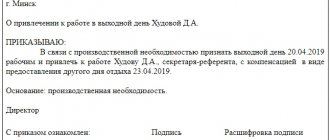

Document flow

Compensation is issued on the basis of the employee’s written consent and an issued order. The head of an enterprise does not have the right to force an employee to perform job duties overtime. The procedure for involving a citizen in unscheduled work activities:

- Drawing up a notice on behalf of the director of the company about the assignment of overtime work.

- Drawing up a memo by an employee agreeing to perform job duties on an additional shift.

- Issuance of the corresponding order.

- Entering data into the time sheet.

To be recruited to work with his own approval, a citizen needs to draw up a memo based on a notice issued by the employer in the name of a subordinate. The written consent must indicate the purpose of calling the employee, the reason, date and time of the additional shift, and the type of compensation. Based on the documents received, an order is issued to assign overtime work. A citizen can begin his duties only after familiarizing himself with the paper. After unscheduled activities are carried out in the HR department, a time sheet is filled out for additional accruals at the end of the reporting period.

Payment calculation

Labor Code Article 152 regulates the calculation of monetary remuneration for overtime work. To determine the amount of unscheduled time spent on shift, the head of the organization must keep records of the duration of performance of official duties. Factors influencing payment calculation:

- working hours;

- monthly salary calculation system;

- number of unscheduled hours worked.

The schedule may involve a five-day work week or a shift with alternating days off. According to federal law, the normal work schedule involves performing job duties for 40 hours over 7 days. An organization may use a salary or hourly income accrual system. To establish the duration of excess time, days of vacation, unpaid rest, and time off for family reasons should be excluded. Only periods actually worked are taken into account. To calculate monetary remuneration, it is necessary to determine the employee’s hourly pay, taking into account the average monthly earnings for a five-day week:

- amount of profit / number of working days / shift duration;

- income / annual working hours in hours;

- salary / planned shift duration per month according to the production schedule.

Payment for overtime hours according to the Labor Code is made by multiplying the employee’s earnings for 60 minutes by a factor of one and a half or double, depending on the length of the irregular day. Unscheduled time in a five-day week is determined at the end of the month. The head of the enterprise independently sets the basic amount of earnings. By decision of the employer, payment for overtime may include a bonus and other compensation and benefits.

With a shift schedule, the calculation of monetary remuneration is carried out every quarter or half a year in connection with the establishment by the organization of a summary record of citizens’ time worked every 3-6 months. To determine hourly income, the amount of quarterly profit is divided by the number of working hours over 180 days. The amount of remuneration can be determined for the period actually worked during each shift or based on accounting results. The difference lies in the coefficient by which the profit is multiplied in 60 minutes.

Attention! The head of the organization independently decides whether to pay for overtime work in accordance with the Labor Code, taking into account the time spent performing job duties during a separate shift, or to summarize the hours for the quarter.

Piece workers' wages depend on the number of units produced. The accrual of overtime is influenced by the volume of work performed, taking into account its quality, complexity in a given period and the time of the unscheduled shift. To calculate, the amount for each manufactured part is multiplied by the number of products produced and one and a half or double indicator, determined by the duration of the irregular schedule. With an hourly wage system, the amount of compensation depends on the number of hours worked. The coefficient remains the same as when calculating remuneration for employees with a fixed salary. This method is used if the organization uses the summarized accounting method.

Is overtime work on weekends and holidays?

No is not.

Payment for work on weekends and holidays is made according to its own rules - no less than double the amount (Article 153 of the Labor Code of the Russian Federation).

About the features of “holiday” pay when working in shift conditions, read the article “Payment for holidays during a shift work schedule .

When calculating overtime, they first find out whether the extra-limit time applies to weekends and holidays, and only then include it in the calculation - so as not to overestimate the amount of the surcharge, increasing it for two reasons at once.

Commentary on Article 153 of the Labor Code of the Russian Federation

The amount of payment for work on weekends and non-working holidays (for the period from 0 to 24 hours) cannot be lower than that established in Part 1 of this article.

Payment for work on weekends and non-working holidays for employees who have a fixed salary has certain specifics. Such employees are paid for work on holidays or weekends:

- not less than a single hourly or daily rate in addition to the salary, if work on such a day is included in the standard working hours for a given month;

- no less than double the daily or hourly rate in addition to the salary, if the work on such a day was carried out in excess of the monthly working hours.

In order to determine whether to pay single or double pay for work on weekends and non-working holidays for employees whose salary is established, it is necessary to find out whether the work on the holiday was carried out within or in excess of the monthly working hours. This depends on the specifics of the organization’s activities, and the norm of working days and hours established by the production calendar does not matter.

According to paragraph 1 of the explanation of the State Committee for Labor of the USSR and the Presidium of the All-Union Central Council of Trade Unions dated 08.08.1966 N 13/P-21, which, according to Art. 423 Labor Code continues to operate, work on holidays:

1) is performed within the monthly working hours and is paid in a single amount:

— in continuously operating organizations;

— organizations using summarized recording of working hours. Let us recall that summarized recording of working time, in particular, can be used during shift work, in organizations using a rotational method of organizing work, as well as on public transport;

2) is performed in excess of the monthly working hours and is paid double in all other organizations, regardless of whether the working days in a particular month are fully worked or not.

Work on weekends and non-working holidays is not considered overtime if it does not exceed the duration of daily work established by the internal labor regulations for this category of employees. Hours worked beyond this duration are considered overtime. However, work during such hours is paid at the same rate as work on a holiday, i.e. no less than double the amount for each hour of overtime work.

Specific amounts of payment for work on weekends and non-working holidays in accordance with Part 2 of the commented article are established by the employer not independently, but by a collective agreement, a local regulatory act adopted taking into account the opinion of the representative body of employees, or an employment contract, which corresponds to the basic principles of labor law a combination of state and contractual regulation of labor relations and other relations directly related to them, social partnership, including the right to participation of workers, employers, and their associations in the contractual regulation of labor relations and other relations directly related to them.

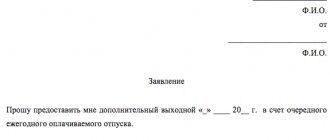

With the consent of an employee who has worked a day off or a non-working holiday, he may be given another day of rest. In this case, work on a holiday is paid in a single amount, but a day of rest is not subject to payment.

The Labor Code also provides for the possibility of payment for work on weekends and non-working holidays for a number of categories of creative workers on the basis of an employment contract, collective agreement or local regulatory act of the organization. List of professions and positions of creative workers in the media, cinematography organizations, television and video crews, theaters, theatrical and concert organizations, circuses and other persons involved in the creation and (or) performance (exhibition) of works, the specifics of their labor activity are established by Trudov Code of the Russian Federation, approved by Decree of the Government of the Russian Federation of April 28, 2007 N 252.

How is overtime paid to “shift workers”?

If it was not possible to organize a shift schedule without overtime, overtime must be paid at an increased rate. In this case, one should be guided by clause 5.5 of the Recommendations on the use of flexible working time regimes, approved by Resolution of the State Committee for Labor of the USSR and the Secretariat of the All-Union Central Council of Trade Unions dated May 30, 1985 No. 162/12-55. It requires payment at one and a half times the first 2 hours, which fall on average on each working day of the accounting period, and at double the rate for all other over-limit hours.

For an example of calculation and other nuances of shift pay, see the article “What does a shift work schedule mean under the Labor Code of the Russian Federation (nuances)?” .

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Article 152 of the Labor Code of the Russian Federation. Overtime pay (current version)

1. Overtime pay rules have remained the same for decades.

2. The amounts of increased wages provided for in this article when involved in overtime work (see commentary to Article 99) are a minimum guarantee. They are applied in cases where a collective agreement, local regulation, or employment contract does not establish higher pay.

It is necessary to pay attention to the fact that for the local act establishing the amount of payment for overtime work, there is no procedure for taking into account the opinion of the representative body of employees; therefore, it is adopted solely by the employer.

3. The established rules for payment of overtime work also apply to employees with irregular working hours, if for some reason they are not granted additional leave (see commentary to Article 119).

4. In accordance with established practice (confirmed by decisions of courts of general jurisdiction and the state labor inspectorate), overtime work must be paid at an increased rate in all cases where the employee was actually involved in its implementation, regardless of the employer’s compliance with the procedure for engaging in overtime work.

5. When recording working time in aggregate, the first two hours of overtime of each working day (shift) are paid at one and a half times, and not the accounting period as a whole. Regardless of what kind of working time recording is established in the organization, overtime should be considered time outside the duration of the working day (shift) established by the schedule.

This conclusion was made by the Supreme Court of the Russian Federation (Determination dated December 27, 2012 N APL12-711) when considering a specific case with reference to the Recommendations for the application of flexible working time regimes in enterprises, institutions and organizations of sectors of the national economy, approved. joint Resolution of the USSR State Committee for Labor No. 162 of May 30, 1985 and the Secretariat of the All-Union Central Council of Trade Unions No. 12-55.

These Recommendations (clause 5.5) established that in the case of overtime work performed by persons with normal working hours, transferred to flexible working hours (GW), hourly accounting of these works is kept in total in relation to the established accounting period (week, month), t .e. Only hours worked in excess of the standard working hours established for that period are considered overtime. Their payment is made in accordance with current legislation: in the amount of one and a half times for the first two hours, falling on average for each working day of the accounting period; double the amount for other overtime hours.

At the same time, letter from the Deputy Director of the Department of Wages, Labor Safety and Social Partnership of the Ministry of Health and Social Development of Russia dated August 31, 2009 N 22-2-3363, in which it was proposed to pay overtime hours in the amount of one and a half for the first two hours of work in excess of the normal number when recording working hours together working hours for the accounting period and double the amount for all other hours, was criticized and was actually disavowed. As the Supreme Court of the Russian Federation rightly noted, this letter does not have a normative nature.

6. Compensation for overtime work, at the request of the employee, can be provided in the form of additional rest time (time off). Since this is an exception to the general rule, an employee who wishes to receive compensation in the form of additional rest time must notify the employer in writing. The duration of rest time is determined by agreement of the parties, but cannot be less than the time worked overtime. It seems fair to determine the duration of rest time in relation to the rules for paying overtime work, i.e. in one and a half or double times, depending on the duration of work in excess of the established working hours.

The time for using time off is also determined by agreement of the parties.

Comment source:

Rep. ed. Yu.P. Orlovsky “COMMENTARY ON THE LABOR CODE OF THE RUSSIAN FEDERATION”, 6th edition ACTUALIZATION

ORLOVSKY Y.P., CHIKANOVA L.A., NURTDINOVA A.F., KORSHUNOVA T.YU., SEREGINA L.V., GAVRILINA A.K., BOCHARNIKOVA M.A., VINOGRADOVA Z.D., 2014