Home / Labor Law / Vacation

Back

Published: June 25, 2016

Reading time: 7 min

0

5014

Labor legislation guarantees working citizens the mandatory availability of days off. Depending on the regime, these may be generally accepted days of rest - Saturday and Sunday, or provided for by the work schedule.

Involving employees in the performance of official duties is prohibited by Art. 113 Labor Code of the Russian Federation.

However, unplanned circumstances may arise at the enterprise that require one or more employees to be called on a non-working day. In such a situation, it is permissible to involve the organization’s personnel to work on days off, subject to the necessary conditions:

- the presence of the employee’s consent expressed in writing (signature on the notice of call to work or under the order);

- mandatory provision of compensation for work outside normal hours in the form of an additional day off or increased pay.

If work on an odd day is due to emergency circumstances, then the consent of the employees is not required. In addition, certain categories of workers can work in their free time (weekends) on the basis of a collective agreement (this mainly applies to the creative intelligentsia) or an approved work schedule.

No circumstances can be the basis for involving minor employees and pregnant women to work on established days off.

- Procedure for calling to work on weekends

- How are you compensated for working on a day off? Payment order

- Transferring a day off to another time

- For employee

Rules for recruitment

An employee may be required to work on a weekend or holiday only if there are serious reasons for doing so. In accordance with Art. 113 of the Labor Code of the Russian Federation, such a basis is an order of the manager, issued in connection with the need for urgent and necessary work that could not be foreseen. As a rule, an employee has the right to refuse to go to work on a day off. However, there are cases when there is no right to refuse:

- during the liquidation of emergency situations, disasters, industrial accidents, etc.;

- to prevent accidents, destruction or damage to property;

- in the event of a natural disaster or its threat, in other cases when failure to perform work may lead to grave consequences in the form of harm to the life, health or property of citizens and organizations.

In some cases, working on weekends is allowed, taking into account the opinion of the elected body of the primary trade union organization.

Involvement to work on weekends and the employee’s consent must be in writing. There are no established forms for such documents, so each employer has the right to use its own form. The notice of hiring an employee must indicate:

- Full name of the employee, his position, name of the structural unit;

- basis for recruitment;

- the employee’s right to refuse to go on a day off, if any.

The employee must sign the notice to confirm that he has read its contents. It is advisable to provide a place for this at the end of the notice.

The employee’s consent to work on a weekend or holiday can be drawn up in the form of a separate document, or a place for it can be provided at the end of the notice of engagement. In any case, the employee must sign that he is familiar with the manager’s order and agrees (or disagrees) to go to work.

Registration of extracurricular work

The administration must warn the specialist of the intention to call him on the day of rest. The Labor Code did not resolve this issue. Therefore, the employer, at his own discretion, chooses the method of informing - possibly even oral notification.

However, in practice, written notice is often used. The procedure for using this form requires the following to be indicated in the document:

- the exact date of recruitment;

- period of work by time;

- reasons for unscheduled work;

- compensation options.

Expert opinion

Davydov Alexander Yurievich

Civil law consultant with 20 years of practice. Author of numerous articles on legal topics

The employee signs his consent. At the same time, the preferred form of compensation can be expressed. Now the company issues a corresponding order.

What an employee should check The order is an internal regulatory act with certain legal consequences. As soon as the subject puts a mark in the order about his notification with the content, he accepts the conditions put forward. Carefully read the papers that the employer asks you to sign.

This is important to know: Part-time work for women: terms of provision

How is it paid?

The Labor Code of the Russian Federation guarantees necessary compensation to employees working on weekends and holidays. The employee can choose its form - additional rest time, or an increased cash payment for time worked.

Article 153 of the Labor Code establishes that employees working on weekends and holidays are paid at least double the amount.

Expert opinion

Labor Lawyer Olga Smirnova

To calculate increased pay, not only salary is used, but also other compensation and incentive payments, if provided. The corresponding conclusion was made by the Constitutional Court of the Russian Federation in Resolution No. 26-P of June 28, 2021.

Double payment is made for the time actually worked on a weekend or holiday:

- if you worked a whole day, then you are paid for a full day or a shift;

- If the work took several hours, payment is made based on their number.

Local acts of the employer organization or a collective agreement with employees may provide for more favorable compensation conditions compared to those established by law. However, it is prohibited to worsen the situation of workers in this way.

Double payment is accrued only for days established as days off in accordance with internal labor regulations, or holidays. If work is carried out on an additional day of rest to which a particular employee is entitled, this day is not subject to double pay.

Depending on the type of payment to employees, the calculation of compensation has some features.

Salary

Salaried employees receive no less than a single rate in excess of their salary (daily or hourly), if the work was performed within the monthly working hours, and no less than a double rate for overtime in excess of the monthly standard;

An example of calculating additional pay for working on a day off

The salaried employee worked 180 hours in a month, including 5 hours on weekends and holidays. His monthly working hours are 175 hours. The employee's salary is 30,000 rubles per month.

The hourly wage rate for such an employee will be: (30,000 rubles * 12 months) / 1979 hours (standard working hours for a 40-hour week in 2021) = 181.91 rubles / hour.

Since the monthly working hours have been exceeded, for work on weekends and holidays the employee will receive an additional payment in the amount of 181.91 rubles * 2 for each hour of such work. The total additional payment will be 1819.1 rubles.

If the monthly standard working time was not exceeded, the additional payment would be made in a single amount, and for each hour of time worked on weekends the employee would receive 181.91 rubles in excess of the salary, for a total of 909.55 rubles.

Piecework

Employees working on a piece-rate basis receive at least double the rate (daily or hourly);

An example of calculating additional pay for working on a day off

An employee works as an assembler of finished products, the payment for each is 100 rubles. In a month he collected 350 items. Moreover, 10 products were assembled on the weekend.

The additional payment for working on a day off will be: 10 products *100 rubles for each *2 = 2000 rubles.

Payment for products excluding work on days off will be: 350 products * 100 = 35,000 rubles

The total amount of payments to the employee will be 37,000 rubles.

Tariff rates

For workers paid at daily or hourly rates, this rate is doubled.

An example of calculating additional payment for work on a weekend or holiday for piece workers

The employee's hourly rate is 200 rubles per hour. During the month he worked 173 hours, of which 6 hours were worked on a holiday.

The additional payment for working on a holiday will be: 200*2*6 = 2400 rubles.

The basic wage will be: (173 – 6) hours * 200 rubles / hour = 33,400 rubles.

The total amount of payments for this month is 35,800 rubles.

To simplify calculations, use our calculators, which will allow you to calculate the surcharge automatically.

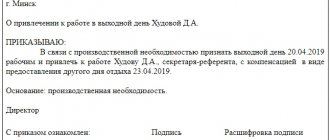

Making an order

Having received the employee’s written consent to be hired to work on a day off, the employer can issue a corresponding order. There is no general form for it.

Expert opinion

Davydov Alexander Yurievich

Civil law consultant with 20 years of practice. Author of numerous articles on legal topics

Sometimes an employer may decide that it is not necessary to issue an order. This occurs due to the employer’s reluctance to keep double records of work on a day off or provide him with an additional day off.

However, this practice is quite destructive and fraught with unpredictable consequences.

In judicial practice, the vast majority of such conflicts are resolved not in favor of the employer. As a rule, it is not difficult for an employee to prove the fact of working on a legal day off. The evidence base can be witness testimony, documents, oral instructions from the employer, etc.

Resolving such conflicts in court in favor of the employee is fraught with certain consequences for the employer in the form of large fines. To avoid such consequences, you should complete all necessary documents in a timely and correct manner.

Payment for holidays during a shift work schedule

Shift schedule may differ from standard work with two days off on Saturday and Sunday. This implies a number of features regarding payment for weekends and holidays.

According to Art. 95 of the Labor Code of the Russian Federation, the working day preceding a holiday should be shortened by 1 hour. If, due to the shift schedule and the characteristics of the enterprise, such a reduction in working hours is impossible, employees work this hour overtime. Such work is compensated either by the provision of rest time in an equal or greater amount, or by a monetary payment calculated as payment for overtime work (i.e., a regular payment increased by no less than one and a half times according to Article 152 of the Labor Code of the Russian Federation). Read more about overtime compensation issues here.

With an established work week of 6 days, the duration of work on the day preceding the weekend should not be more than 5 hours.

The rules on compensation for work on weekends apply only in cases where the employee went to work on his day off or on a holiday. Additional payment is not made if, according to internal labor regulations, a day off, but not a holiday, was a working day for a particular employee. For example, when an employee works on Saturday with days off on Sunday and Monday, no additional payment is made for working on Saturday.

However, if Saturday turns out to be an official holiday, it must be paid double or a day off must be provided. Judicial practice has confirmed that an employee’s work on a holiday is subject to double payment, even if his shift fell on that day according to the approved schedule (see, for example, the Appeal ruling of the Trans-Baikal Regional Court in case No. 33-1976-2013 of June 11 2013).

Ways to notify about work activity

How is work on a day off paid? This depends on a number of circumstances.

The organization has the right to independently determine the form in which the employee will be notified of the need to work on a day off. The most common form is a proposal or notice.

The notification document must specify the reasons for going to work, time and date, and compensation options. After reviewing the document, the employee endorses the document with his signature.

If necessary, you can specify the chosen method of payment for work on a day off. If the choice falls on an additional day off, but the employee cannot specifically indicate the date, then in the future he will write another application.

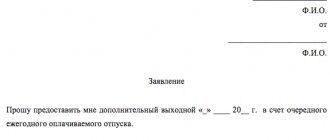

Time off or pay

Instead of receiving increased pay, an employee may ask for an additional day of rest (time off) for working on a weekend or holiday. In this case, the employee does not receive double pay, and the day of rest is not subject to payment (Part 4 of Article 153 of the Labor Code of the Russian Federation). In this case, the salary for the corresponding month must be paid in full. The corresponding position is confirmed by a number of letters from the Russian Ministry of Labor (for example, letter dated March 11, 2013 No. 14-2/3019144-1157).

Replacement of monetary compensation with time off is made only at the request of the employee. The employer has no right to impose it in any form.

Even if work on a day off took only a few hours, the employee who chose the day off is given a full day of rest. This follows from a number of letters from Rostrud of the Russian Federation (for example, dated March 17, 2010 No. 731-6-1). The reason is that the employee sacrificed his full rest due to unplanned work. Therefore, a few hours will not be enough to make up for the losses.

The leave of absence is documented by the employer’s personnel order. There is no established form for such orders, so you can use any form accepted by the organization. It must indicate:

- last name, first name, patronymic and position of the employee;

- the basis for granting a day off;

- The employee must be familiarized with the order and signed, so it is advisable to provide this in the form of the order.

Sample application for time off

to CEO

Alpha Beta LLC

Ivanov V.P.

From: senior engineer Petrova I.Yu.

Application for time off

Based on Part 4 of Article 153 of the Labor Code of the Russian Federation, in connection with work on a non-working holiday - January 2, 2021, I ask you to grant me a day of rest (time off) on January 14, 2021.

Date, signature.

Sample order for granting time off

Limited Liability Company "Alpha Beta"

ORDER

No. 01010-K

January 13, 2021

On granting a day of rest (time off)

Based on Part 4 of Article 153 of the Labor Code of the Russian Federation in connection with the involvement of senior engineer Petrova I.Yu. to work on a non-working holiday - January 2, 2021, provide her with a day of rest without pay on January 14, 2021.

Reason: order No. 01017-K “On hiring on a non-working holiday” dated December 26, 2021, statement by I.Yu. Petrova dated December 30, 2021.

General Director Ivanov V.P. /signature/

I have read the order:

senior engineer Petrova I.Yu. /date, signature/

When is a positive response not required?

There are situations provided for by law when his consent is not required to involve an employee in work unscheduled. These types of circumstances include:

1. Preventing the occurrence of a disaster or eliminating the consequences of an accident that has already occurred.

2. Prevention of accidents at work.

3. The need to carry out urgent work, the need for which arose due to the declaration of martial law or a state of emergency in a certain area.

Obviously, these circumstances are few and far between and, fortunately, occur quite rarely. Therefore, in most cases, it will be necessary to obtain the voluntary consent of the employee to involve him in work on a legal day off or holiday.

Working on a weekend while on a business trip

If an employee was sent on a long business trip, part of it may fall on weekends or holidays. The following payment rules apply:

- If the day of departure or arrival of an employee falls on a weekend or holiday, this day is subject to double payment. The employee was forced to go on a business trip instead of rest, so payment is necessary;

- in cases where an employee did not work on a day off, although he was on a business trip, this day is not subject to payment. This rule applies if the employee, even on a business trip, adheres to the usual work schedule (for example, 5/2 with days off on Saturday and Sunday);

- If an employee worked on weekends and holidays, these days must be paid double. To avoid any doubts, it is necessary to directly indicate in the order sending an employee on a business trip whether he is expected to work on weekends or holidays or not.

We hope you found this article helpful. The materials provided above are for informational purposes only and do not replace legal advice. Contact a specialist if you have any questions.

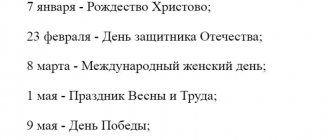

When to celebrate is decided from above

The legislation provides for an officially approved schedule of holidays, which are non-working days in our country. The list of days off is approved annually.

If an employee needs to work on one of the holidays or weekends during a five-day work week prescribed in the contract, then the employee has the right to receive extraordinary paid time off or pay for work at a double rate.

How is work on a day off paid? Let's explore the topic in more detail.

What days are considered non-working days?

The labor legislation of the Russian Federation establishes two types of non-working days: weekends and holidays.

Days off are provided to employees on a weekly basis. With a five-day work week, the employee must have at least two free days. The general non-working day for the country is Sunday, the second day is set by the employer independently. In most cases, both days are placed side by side.

Non-working holidays mark the celebration of national holidays, of which there are seven: Christmas, Defender of the Fatherland Day, March 8, May 1, Victory Day, Russia Day and National Unity Day. These days are non-working days regardless of what day of the week they fall on.

Stage 4 Registration of a time sheet

The employer is required to keep records of the time actually worked by each employee. Information about the employee’s use of a day of rest for work on a non-working holiday must be recorded in the time sheet.

To record the time actually worked by the employee until January 1, 2013, all employers used a time sheet for recording working hours and calculating wages or a time sheet for automated processing of accounting data, unified forms No. T-12 or No. T-13 of which were approved by a resolution of the State Statistics Committee of Russia dated January 5, 2004 No. 1.

After January 1, 2013, taking into account the requirements of Federal Law dated December 6, 2011 No. 402-FZ “On Accounting,” unified forms are used by public sector organizations. Commercial organizations must use their own forms of primary accounting documents for recording labor and its payment, in particular forms of time sheets. When developing their forms of personnel documents, employers - commercial organizations can take previously used unified forms as a basis, reworking them at their discretion.

In our example, working time recording is shown using form No. T-13.

Please note: in the time sheet, another day of rest granted to an employee should be indicated by the same code as a “regular” day off. In our example, this is code “B”. It is not allowed to use the code “NV” (additional day off (without pay)) in a situation where the employee is given not an additional, but another day of rest, as this will lead to a violation of labor legislation on providing the employee with compensation for work on non-working days. holiday.

When to take time off?

You can take time off either in the current month, when you went out on a free day, or at any other time. The law does not provide strict restrictions in this regard.

Let's give an example: an employee worked one working Saturday in August, but in the same month he did not go on vacation. In this case, his earnings will be equal to his full salary plus one day of compensation.

If an employee expresses a desire to take time off in September, then in both August and September he will have his full salary without any deductions.

Expert opinion

Davydov Alexander Yurievich

Civil law consultant with 20 years of practice. Author of numerous articles on legal topics

All of the above calculations are made based on actual time worked. If the standard has not been worked out, then the calculation is made according to the Labor Code, taking into account each specific case.