First page design

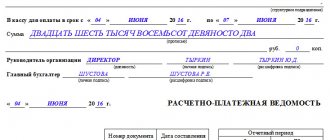

- First of all, on the title page you must indicate the full name of the enterprise (in accordance with the registration documents), as well as the structural unit for which the statement is being drawn up (if there is one).

- Next, you need to enter the code according to the general classification of organizations and the number 70 in the “Corresponding account” column.

- Then the validity period of this statement is indicated, which must be at least 5 days from the moment of its signing (Regulation of the Bank of Russia No. 373-P dated 10/12/2011).

- It is imperative that the total amount accrued to employees for the calculated period be entered in the corresponding line of the first page of the payroll, both in digital and written form.

- After this, you must indicate the date of preparation of the payroll, as well as its serial number according to the internal document flow.

- The last thing that needs to be written on the title page of Form T-53 is the period for which the payment is made. Here you need to indicate specific dates.

Now visually:

Documents for issuing salaries for the first half of the month

The advance is part of the salary, so the basis for issuance will be the same documents as for the payment of wages:

- staffing schedule;

- a document containing personal data, including information about bonuses (length of service, size of the regional coefficient, tax deductions, length of service);

- time sheet;

- management orders: for regular leave, for bonuses, for leave without pay, for providing financial assistance, withholding accountable amounts, etc.;

- sick leave;

- in some cases - an application for an advance;

- payslip or other payment form.

The main document for calculating the amount of advance payment and wages is the time sheet. This document must be maintained by the responsible person (timekeeper) daily. The document reflects data on the time actually worked and the reasons for absence from work.

The accountant will need additional documents (orders, sick leave) to verify that the timesheet has been filled out correctly.

Based on the data, wages are calculated and information is issued in writing to the employee about accrued wages and its components (payslips).

Next, funds are issued on the basis of a payroll or other form.

Many business entities issue payslips once a month when calculating wages for the entire period. Formally this is not true.

Art. 136 of the Labor Code of the Russian Federation says that the employer is obliged to provide information to the employee when paying wages, which means twice a month - when issuing an advance and the balance.

Terms and procedure for advance payment.

Payment through a credit institution

Issuing an advance through a bank greatly simplifies accounting. To complete the transaction, a payment order is issued for the payment of funds.

First, a register is compiled listing recipients, their bank details and amounts to be issued. Based on the register, a payment order is drawn up.

The main condition when issuing a payment order is to correctly indicate the details of the recipient and the payer.

After the payment has been made, the payment order along with the register is stored according to the general rules for storing accounting documents. Employees do not need to sign the register.

We also recommend reading: is an advance payment due if the employee was on vacation?

Cash at the company's cash desk

There are strict rules for issuing cash at the company's cash desk.

The advance can be paid both using cash receipts and using a special payroll.

The form of this document is approved by the State Statistics Committee, but can be developed by an economic entity independently.

The unified form T-53 is easy to fill out and contains all the necessary details.

How to issue a payment document?

The statement can be compiled both for the entire organization and for a separate division of the enterprise.

Each payroll has a serial number and is recorded in a special journal.

The title page of the T-53 statement form indicates the name of the economic entity and structural unit if the payment is made for a separate section, workshop, and so on.

The column “corresponding account” indicates the number of the accounting account to which the expenses will be allocated (20, 44, etc.).

The column “to the cash desk for payment on time” indicates the period during which the money will be at the cash desk for payment of the advance. The law sets a three-day period, after which the balance of the money is deposited and returned to the bank. The period is indicated from the date of issue to the end date of payment, inclusive (for example, from February 16, 2021 to February 18, 2019). Accounting for deposited salaries.

The total advance amount is indicated in words and figures. Do I need to withhold personal income tax from the amount?

This is followed by the signatures of the manager and chief accountant with a transcript.

In field T-53 of the payroll, to indicate the billing period, the first half of the calendar month for which the advance is issued is indicated - from the first to the fifteenth.

The content of the document contains a list of employees indicating the serial and personnel numbers, surnames and initials.

The amount to be paid is indicated next to each name. Having received the advance, the employee signs the statement.

If the employee does not receive cash within three days, the funds are deposited with the appropriate mark. After three days, the issued and deposited amount is entered in the statement. The person issuing the money (cashier) signs the form.

Based on form T-53, the accountant issues a cash order, the number of which is entered in the statement.

After this, the payment document T-53 is registered in the journal and stored in the general order of accounting documents.

and a sample of filling out the T-53 form

Form of a standard form of payroll T-53 – word.

Filling out when issuing a salary advance - excel.

An example of filling out when paying wages for the second half of the month -.

This is what the completed sample looks like:

Filling out the second sheet

The size of the payroll directly depends on the number of employees working at the enterprise - the more there are, the longer this document will be. The number of payroll sheets must be indicated in the appropriate column.

- The first column of the main table of the statement is reserved for the serial numbering of employees.

- The second is for entering a personnel number (this data is stored in the personal cards of the organization’s employees).

- The third contains the full names of the salary recipients (it is better, in order to avoid possible confusion, to do this with a full decoding of the name and patronymic).

- In the fourth column, the enterprise accountant enters the amount of funds accrued for disbursement for each individual person (in numbers).

- In the fifth column, each employee must sign for receipt of wages.

- The sixth column is intended for entering references to documents for cash settlements (this could be powers of attorney, statements from employees, etc.) If there are no separate notes on employees, then this column can be crossed out.

In the line below the table, you must once again indicate in numbers and in words the total amount of funds accrued for issuance

Form T-51 - pay slip: procedure for application and completion

The document form in question is used to reflect only payroll. To reflect payments through the enterprise's cash desk, in this case, payroll T-53 is used. If the company uses the T-49 payroll sheet to reflect the accrual of employee benefits, then this excludes the use of forms T-51 and T-53.

The form can be filled out by hand, or it can be filled out on computer media using appropriate software for accounting accounting transactions (for example, the 1C family). Information on accruals and deductions is provided for each employee separately.

Data on accrued wages is filled in based on the following primary documents:

- time sheets;

- employment contracts;

- bonus orders;

- documents on absence from work (paid and unpaid). For example, sick leave, vacation orders, etc.;

- orders for other payments.

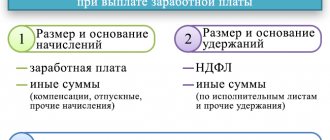

After calculating the amounts to be accrued, the amounts withheld from the salary are calculated: personal income tax, alimony, professional contributions, etc. The last column of the tabular part of the document shows the amount to be paid to the employee (payroll statements can be found at the end of the article).

Director's visa on form T-53

Without the signature of the head of the company, the T-53 payroll will not be considered valid, therefore, after filling out all its points and before transferring it to the cashier for issuing wages, the company’s accountant is obliged to submit it to the director for signature.

And one more signature will need to be placed after all funds have been paid to employees. The chief accountant of the enterprise will have to check the payroll and, if there are no violations, also sign it.

Frequency of filling

In most cases, employees are paid twice a month. Such conditions are specified in the Labor Code of the Russian Federation; for violating it, the company risks incurring administrative liability. Moreover, the first payment is considered an advance payment (usually a percentage of the salary), and the second payment is considered the main payment (the remaining part of the amount). Thus, a simple payslip will be issued for the advance (it indicates the amount that was paid in the first half of the month).

Form T-51 serves to illustrate and document the main part of the payment of wages to employees of the institution.

The column “Retained and credited” in the tabular part of the document must also take into account the advance part - data from the first paper.

Corrections in payroll

In general, according to the rules for filling out a payroll form T-53, the cashier, before starting to issue funds on the payroll, is obliged to check whether everything in it is drawn up correctly.

If any errors are found, then this document must be returned to the accounting department for revision.

But sometimes situations arise when, for some reason, it is no longer possible to reissue the payroll. In this case, inaccurate information must be carefully crossed out, the correct information must be written on top, and the correction must be certified by the signatures of all the same employees who signed the initial version of the statement. Here you need to indicate the date of correction. If everything is done in accordance with these recommendations, the document will not lose its legal force.

How to close a payroll

This stage is the final one. After the payroll has expired (five days), the cashier must formalize its closure. Moreover, this must be done even if wages were not issued to all employees. To close the statement you need:

- Write the word “deposited” opposite the names of those employees who did not receive the money due to them according to this statement;

- Count the funds issued and those that were deposited. Enter this information on the last sheet of the statement;

- Confirm the statement with a signature;

- Write out a cash order. In it you need to write the amount of funds issued, then enter the order number in the statement.

After this entire procedure has been completed, the statement must be submitted again to the accounting department.

Sample of filling out a payroll form T-53

Front side

Filling out a document begins with its header. In it you need to enter the name of the organization and the code assigned to it according to the OKPO directory. If the salary sheet shows the salary of a specific department of the company, then its name must be indicated in the column below. If the issuance is carried out by a general list, then a dash is placed there.

In the right table, under the codes, the correspondence account is entered.

Next, you need to indicate for what days this statement will be valid. After this period, the document will need to be closed and the outstanding funds will need to be deposited.

Next, you need to enter the total amount to be issued on the statement, first in words and then in the form of numbers.

The document must be signed by the director and chief accountant with transcripts.

To the right of the document name there are columns in which you need to indicate the serial number of the document and the date of its execution. Next, the period for which the salary is paid must be indicated.

Reverse side

On the reverse side of the statement there is usually a table for entering data on employees:

- The first column contains the row number in order.

- In the second, the employee’s personnel code.

- In the third - his full name.

- In the fourth column, the amount that needs to be issued is entered in numbers.

- The fifth column serves to certify the fact of issue - there the employee personally signs when receiving funds.

- The sixth column is for reference, in which the cashier can make the necessary notes. For example, indicate information about the power of attorney if the money is not received personally by the employee, but by his authorized person.

Attention! In the event that the employee has not received the amounts due according to the statement, then at closing the o.r. is entered in the “Signature” column.

The last line in the table is used to summarize the monetary amounts.

You might be interested in:

Online salary calculator for [year] year

If the document includes several sheets, then their total number must be indicated below.

The next step is to indicate in words and figures the amount that was issued to the employees, as well as the amount to be deposited. Next, the cashier puts his signature and position.

In the next line you must indicate the details of the expense order issued for the statement.

The document is completed with the signature of the responsible person, who must check the form after closing and confirm with his signature that there are no errors in it.