Home / Labor Law / Payment and benefits / Wages

Back

Published: 05/13/2016

Reading time: 7 min

0

1052

When applying for a loan, the borrower is given a list of necessary documents that he must provide to the financial institution. One of the required documents in this list is a certificate in form 2-NDFL.

It is worth taking a closer look at what this certificate is, what information it contains, and in what other cases it may be required.

- What is it and what is it for?

- Structure Header

- Section 1

- Section 2

- Section 3

- Section 4

- Section 5

Normative base

As an independent type of reporting on the income of an individual, form 2-NDFL, as well as instructions for filling it out, were first introduced by Order of the Federal Tax Service of Russia dated October 30, 2015 N ММВ-7-11/ [email protected]

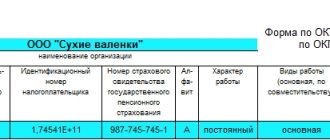

2-NDFL is an A4 format report compiled on the basis of accounting data on an employee’s income, subject to income tax at a rate of 13%, indicating the source of payment.

It contains the following information:

- Employer details (name of enterprise or individual entrepreneur, INN/KPP, phone number, OKTMO code).

- Employee details (full name, tax identification number, address, citizenship, date of birth, identification document code).

- Settlement part: information about earnings, deductions, personal income tax.

Results

Certificate 2-NDFL is a document submitted by a tax agent to the Federal Tax Service as a report on income paid to an employee and the tax withheld (or not withheld) from this income.

The certificate may also be required by the employee in respect of whom it was drawn up for submission to the Federal Tax Service, a bank, or another employer. For formation in 2021, the certificate form introduced in 2021 is used. At the same time, separate forms are provided for submission to the tax office and for issuance to the employee. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

What is it?

Income is indicated by breakdown for each month and by type of accrual. Most often this is a monthly salary, vacation pay, financial assistance, which is due to the employee, for example, once a quarter.

These payments are reflected in the certificate under different codes. Deductions that reduce the taxable estate are also detailed.

An amount determined by law is deducted from the total income, and then the remaining portion is subject to personal income tax. This tax is calculated and transferred to the budget by the enterprise, which in this case is the tax agent.

What deductions can you expect?

Deductions provided to workers can be grouped by type:

- Property , if real estate transactions took place.

- Standard . This includes deductions for children, disability, combat veterans, and liquidators of man-made accidents.

- Social if there are expenses for treatment and education spent on yourself or relatives.

- Investments arising in the process of transactions with securities.

The peculiarity of calculating personal income tax is that the employee’s income is taken into account as a cumulative total from the beginning of the calendar year.

This is dictated by a number of reasons. The employee's total income must be less than the amount determined by law.

In 2021 and 2021 it is 350,000 rubles.

Once the above limit is reached, tax breaks for children cease.

Validity period and liability measures

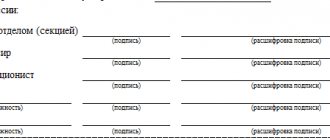

The legislation has not established a specific validity period for the earnings certificate. Before receiving it, the employee should check the period of its relevance with the organization where the document will be provided. Banks usually accept 2-NDFL certificates received no later than 10-30 before the date of application. Each credit institution has its own deadlines. The certificate is signed by the head or an authorized employee of the organization's accounting department.

The new 2-NDFL form, which has been used since 2021, does not provide space for printing. There is no mention of it in the Federal Tax Service order No. ММВ-7-11/ [email protected] There is no need to put it on the certificate (Federal Tax Service letter No. BS-4-11/2577 dated 02/17/16). This detail is optional. However, the presence of a print will not be considered an error.

Late submission of certificates is punishable by a fine (Article 126 of the Tax Code of the Russian Federation) in the amount of 200 rubles. for each overdue form. If the company has not reported in Form 2-NDFL, the Federal Tax Service has the right to go to court. In this case, the following sanctions apply:

- For individuals - 100-300 rubles;

- For managers - 300-500 rubles.

From January 1, 2021, if tax authorities discover errors in documents, the organization will be fined 500 rubles. for each incorrect form. The sanction will not be applied only if the tax agent independently discovers, corrects the inaccuracy and provides updated information before the inspector identifies the error. Submitting certificates ahead of schedule will not save the company from sanctions. For example, the tax office will discover an error in February, the organization will correct it in March, but will still be punished (clause 1 of Article 126.1 of the Tax Code of the Russian Federation).

For what period?

The use of the method of calculating personal income tax cumulatively for the entire calendar year allows the employee to adjust the accrual of income tax during the year if additional grounds for changing it arise. For example, the birth of a child in the family or the cost of treatment.

The company's accountant will be able to take this into account in the current year, that is, within one tax period from January to December inclusive.

A reduction in income tax can be achieved through legalized tax benefits - deductions.

The application of the standard deduction is described in detail in Article 218 of the Tax Code of the Russian Federation.

Important! The next amendments to the “Tax Code of the Russian Federation (Part Two)” dated 08/05/2000 N 117-FZ as amended on 12/28/2017 were legalized from 01/01/2018.

The legislator has identified several categories of employees who have received the right to standard deductions:

- 3,000 rubles per month for Chernobyl victims (1988-1989), including civilian employees and military personnel.

- 3,000 rubles monthly - participants in Operation Shelter (1988-1990), liquidators of the consequences of events at the Mayak Production Association and territories along the Techa River bed (1957-1961); participants in nuclear tests and combating their consequences; military personnel who became disabled in groups I, II and III due to wounds and injuries received during the performance of military duty to defend the USSR and the Russian Federation.

- 500 rubles monthly - heroes of the USSR and Russia; disabled people since childhood, as well as disabled people of groups I and II; bone marrow donors; residents displaced due to the consequences of radiation disasters.

The most common is the standard child deduction provided to parents or guardians:

| No. | Child's birth order | Standard deduction for a child, rubles |

| 1 | Firstborn or only child | 1400 |

| 2 | Second child | 1400 |

| 3 | Third and subsequent children | 3000 |

An additional 12,000 rubles are excluded from taxation for parents of minor disabled children or full-time students with group I or II disabilities under 24 years of age. For guardians, the standard deduction in this case is 6,000 rubles.

Important! The chance to take advantage of the standard deduction remains until the child reaches 18 years of age; for full-time students studying at universities and graduate schools, the period has been extended to 24 years.

Find out whether it is possible to submit 2-NDFL without a TIN. In what cases is a 2-NDFL certificate needed? Detailed information on the issue is presented in this material.

Procedure for providing a certificate

The organization is required to report in Form 2-NDFL on the income of all employees (document feature “1”) before April 1 of the reporting year. Certificates with attribute “2” must be submitted before March 1 of the following year. They are compiled for those persons from whose earnings it is not possible to withhold tax. For example, an employee received financial support in connection with the adoption of a baby, which is not subject to personal income tax.

From the beginning of 2021, 2-personal income tax can be presented in two ways.

- On paper through a company representative (no more than 25 pieces). The certificates are accompanied by 2 copies of the register of information on income, one of which is for the tax office. After checking the data, the inspector and a representative of the organization draw up two protocols for receiving information. One receives the company's authorized representative in person or by mail within ten working days, the second remains with the Federal Tax Service.

- In electronic form via the Internet. With this option, duplicate data on paper or electronic media is not needed. One file must include a maximum of 3000 certificates.

The next day after sending the information, the Federal Tax Service will send a notification of its receipt, and 10 days later - a reception protocol and register. The latter records all certificates that have passed control. Documents with errors must be corrected and only those must be retaken.

The organization may cancel an incorrectly drawn up certificate. To do this, you need to indicate in it the adjustment number 99. In such a document, before sending it to the Federal Tax Service, only the employee’s data is indicated; all indicators with numbers must be reset to zero. The protocol will confirm the acceptance of the canceled documents. All tax values in it are zero. After receiving it, you can prepare and send the “correct” certificate to the tax office.

Table. Differences in filing form 2-NDFL.

| Sign | For employee | For the Federal Tax Service |

| Legislation | clause 3 art. 230 Tax Code of the Russian Federation, art. 62 Labor Code of the Russian Federation | clause 2 art. 230 Tax Code of the Russian Federation |

| Grounds for provision | Written statement | Duty by law |

| Submission deadline | 3 working days | Until April 1 next year |

| Number of copies | Unlimited | 1 form per employee |

| Delivery method | On paper or by mail | On paper or via the Internet |

“Non-standard” subtleties of the “children’s” deduction

Difficulties can be caused by the situation with the use of personal income tax benefits by a parent who has a dependent disabled child.

According to the position of the Ministry of Finance in Letter No. 03-04-06/15803 dated March 20, 2021, parents of a special child should count on two types of deductions at once: a regular “children’s” one and an additional one for the child’s disability.

Let's look at an example.

According to the documents provided to the accounting department, it is known that the employee’s family has three young children, the youngest of whom has a registered disability. The salary for the month of January was 50,000 rubles. An employee is entitled to a monthly benefit in the amount of four standard deductions for children: 1,400 rubles each for the two older children, and two deductions for the youngest (3,000 rubles, since this is the third child, and 12,000 rubles, since the child is disabled).

- Total amount of all benefits: 1400+1400+3000+12000=17800 rub.

- Taxable weight: 50000-17800=32200 rub.

- Personal income tax amount: 32200 x 13% = 4186 rubles.

- To be paid in person: 50000-4186=45814 rubles.

When raising a child in a single-parent family, the tax deduction is multiplied by two.

It is accrued twice as much even if the second parent refuses to use this tax benefit.

Certificate 2-NDFL for a new place of work

Income tax calculation is carried out cumulatively during the calendar year, that is, in the process of forming the tax base, earnings for the previous month are added to the income of the previous period. The amount of tax benefits entitled to an employee by law also increases monthly.

To correctly calculate the tax base, the HR department or accounting department at the new place of work has the right to demand 2-NDFL from the previous employer.

Based on it, data on income and deductions will be entered and taken into account from the beginning of the calendar year.

Why do they require it?

It is in the interests of the employee himself to convey the necessary information to the accounting department of the enterprise.

In some cases, a 2-NDFL certificate is necessary:

- when applying for a loan from a bank;

- when preparing a package of documents for a mortgage;

- if there is a need to adjust personal income tax at the end of the tax period and independently apply to the tax authority for recalculation in form 3-NDFL.

A sample of filling out 2-NDFL for a foreign citizen is in our material. You can learn about how financial assistance is reflected in the 2-NDFL certificate from this article.

How to fill out the 2-NDFL register? Details here.

Where and who issues it?

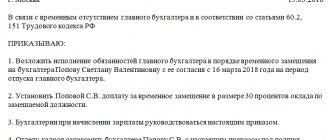

A 2-NDFL certificate upon dismissal of an employee is prepared by the accounting department. Usually it is included in the set of documents issued to employees upon final payment.

An employee can independently contact the accounting staff for registration of 2-NDFL. The deadline for its preparation is three days.

When is it not needed?

In some cases, it is not necessary to provide a 2-NDFL certificate:

- If an employee begins a new career in January, that is, from a new tax period.

- If a person did not officially work anywhere in this calendar year before entering a new position.

- If the employee does not claim statutory rebates, that is, income tax will be charged on all earnings.

Is it analogous to a certificate of earnings?

Form 2-NDFL is a tax document that primarily reflects the accrual of income tax. In the income section, only those amounts from which personal income tax is withheld are indicated.

However, an employee may also receive payments that are not subject to income tax, such as child benefits.

The entire income portion of the employee is recorded in the earnings certificate, which is regulated by Order of the Ministry of Labor of Russia dated April 30, 2013 N 182n.

It can be obtained for any period.

Social security authorities usually require a certificate of income for the last three months.

Thus, certificate 2-NFDL is an independent document reflecting income tax calculations for a specific employee within the calendar year.

To ensure the reliability of information about income and deductions, employees, with rare exceptions, are required to provide 2-NFDL for a new job when hired.

Attention!

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

That's why FREE expert consultants work for you around the clock!

- via the form (below), or via online chat

- Call the hotline:

- 8 (800) 700 95 53

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

Personal income tax (personal income tax)

Who needs certificate 182n and why?

The form is designed to provide information about the employee's earnings and the amount of time worked over the past two years. The main purpose of certificate 182n is to confirm the average earnings and number of days worked by the employee. This information is provided to the Social Insurance Fund and serves as the basis for calculating:

- temporary disability benefits (sick leave);

- maternity benefits;

- benefits for child care up to 1.5 years.

To calculate benefits, information is required for the last 2 years (clause 1, part 14 of the Law of December 29, 2006 No. 255-FZ “On Mandatory Social Insurance...”). If the employee worked at the same enterprise, then the accountant will not have problems providing information. And if a citizen changed his place of work, he will need to submit a calculation from his previous employer.

Certificate form 182n, current in 2021

It happens that it is impossible to obtain a certificate from a previous place of employment, for example, due to the liquidation of the company. Then you should submit a request to the Pension Fund branch at the place of registration of the employer. The request form was approved by Order of the Ministry of Health and Social Development of Russia No. 21n dated January 24, 2011.