Form T-49 payroll form

• Download the current T-49 form (Excel format).• Download sample T-49.

Payroll is a document that is drawn up when accruing and paying salaries through the cash desk. The T-49 form is used, in addition to which, when issuing wages, an expense cash order (RKO) is also issued.

Form T-49 is filled out based on information from the working time sheet. For each employee, all accruals and deductions are indicated, as well as the total amount of salary that he should receive.

Payroll form 0301009

The payroll form 0301009 according to OKUD (this code has the form T-49) can be used by any enterprise (except for budgetary and state-owned enterprises), as well as individual entrepreneurs using hired labor.

The payroll is used to calculate wages and issue them. The source for filling out the payroll sheet is the work time sheet and orders establishing the salary (tariff rate). Also, the amounts of deductions and the result of mutual settlements between the employee and the employer are entered into the payroll. To obtain this information, the accountant needs to check the employee’s personal card, where such information may be indicated, and also get acquainted with other documents.

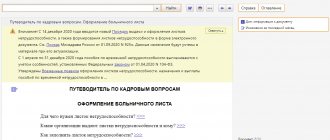

For information on what an employer should do if it is not possible to withhold personal income tax from an employee’s income, read the article .

”

Questions

Legislation is not always interpreted unambiguously. In this regard, inconsistencies arise that lead to errors.

Below are some topics that require special attention.

Is it made for an advance?

To process the payment of salaries for the first half of the month, it is enough to draw up a T-53 payroll, and T-49 is prepared only for full payment.

Statement or RKO?

An expense cash order is required for issuing amounts not related to the wage fund. In addition, it can be used for single payments, for example, when only one employee receives a bonus.

So, a payroll sheet is necessary for issuing rewards to employees in cash. It contains all the information to calculate the final amount of earnings and is filled out once a month.

Payroll form 0504401

State (state-owned, budgetary) enterprises must use payroll form 0504401. It was approved by order of the Ministry of Finance of Russia dated March 30, 2015 No. 52n. Unlike the payroll, which can be used by all other organizations and individual entrepreneurs, there are no special columns with the tariff rate and the amount of time worked.

Sources for filling out the payroll of state-owned enterprises are also the time sheet (it is kept in a different form, not like all other employers) and other documents.

An example of preparing a payroll statement

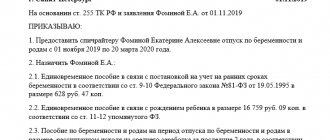

The first part of the document includes basic information about the organization:

- Its name,

- name of the structural unit or department for which salaries are calculated (if any),

- company code according to OKPO (All-Russian Classifier of Enterprises and Organizations),

- date of filling out the statement and document number for internal document flow.

The following is entered in the statement in words:

- the amount of money issued from the cash register in the form of wages,

- date of issue,

- the period for which it is issued (here you need to indicate its start and end date).

Finally, this part of the document must be signed by the top persons of the company: the manager (or an employee authorized to act on his behalf), as well as the chief accountant.

Below is the main part of the document, which is formatted as a table.

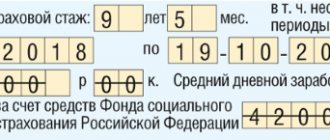

In the first column, the employee’s number is entered in order, in the second - his personnel number (located in his personal card), in the third - his position (in accordance with the staffing table). The fourth indicates the tariff rate at which the employee works (or salary). From the fifth to the seventh - the number of days he worked (strictly based on the data reflected in the time sheet).

If necessary, in the table you need to note the number of weekends and holidays on which the person also went to work (for which double wages are paid) or put dashes here.

The following columns are devoted directly to the calculated amount of wages. The eighth column records how much is accrued to the employee in accordance with the tariff rate. The ninth indicates the size of the bonus (but only if there is a special order or instruction from the director of the company). The tenth column contains data on payments for sick leave, from 11 to 13 - all other amounts. If some types of accruals are missing, dashes must be placed in the required cells. In the fourteenth column you should indicate the total amount of the accrual.

Next, in the fifteenth table you need to enter information about the income tax that is withheld from the employee (in the amount of 13% of the total amount of income), in columns 16 to 18 - all other types of deductions (advances, penalties, etc.). In column number 19 the debt (if any) owed by the enterprise to the employee is entered, and in column 21 the final amount to be paid is entered. Its value is calculated simply: from the sum of all charges (column 14), the amount of deduction (column 15-18) is subtracted and the amount of debt is added (column 19).

Finally, the employee for whom the information was entered must sign opposite each line.

After the table of the document is completely filled out, the entire amount of money that is issued to employees in the form of wages is indicated below in words. Then the statement is signed by the cashier and the accountant of the enterprise.

Is it possible to have a payroll

Since 2013, it has been allowed at the legislative level to develop your own forms of primary documents. This also applies to payroll. However, most business entities prefer not to engage in independent development, but of payroll statements. After all, it’s convenient - such a payroll sheet is already ready for use. You can download it on our website completely free of charge in 2 formats.

Moreover, enterprises can change the location and composition of the details of such a primary document as a payroll statement , as a result of which it may differ noticeably from the template. But the main thing is that the mandatory details are preserved (as required by the Law “On Accounting” dated December 6, 2011 No. 402-FZ).

Such details should include:

- name of the enterprise or full name of the individual entrepreneur;

- the name of the document and the date of its preparation (for example, “payroll statement dated January 25, 2017”);

- the contents of the business operation (since this is a payroll statement, then there must be a salary calculation and information about its payment);

- the measurement value of a business operation and the unit of measurement (in this case, rubles);

- signatures with a transcript of the full name and position of the persons responsible for carrying out the business operation.

Read about what types of existing business operations are divided into in the material “Main types of business operations in accounting.”

Who compiles the statement and its applicability

The responsibility for calculating wages rests with the accountant of the payroll department.

If it is missing, then any other accountant, economist, director, etc. can calculate remuneration. It is these specialists who, when calculating remuneration, draw up the primary documents for calculating salaries, including the payroll. The company has the right to use a form approved by the statistical authorities, or on its basis to build its own, taking into account the specifics of its activities.

The payslip can be drawn up manually on forms purchased from a printing house, which is typical for small businesses. However, it is more efficient to prepare it in accounting programs, where filling is done programmatically with calculations carried out automatically.

The use of form T-51 also presupposes the use of form T-53. The second document is the registration of payment of remuneration to the company's employees. This principle of calculating and paying salaries is typical for enterprises that are not small businesses, in which accounting is kept in full.

Attention! For organizations that are considered small enterprises, it is more effective to use a form such as a payroll in Form 49. The execution of a single document becomes possible due to the small number of employees in order to simplify and optimize accounting.

The payroll is the main source of information for calculating personal income tax and insurance premiums for compulsory types of insurance, as well as for filling out all necessary tax reports.

Payslips are stitched together from month to month with documents attached to them, which include calculations of vacation pay, disability benefits, etc.

Where to get a sample payroll slip T-49 and rules for filling it out

A sample document of form 0301009 can be downloaded from the link below free of charge. After downloading it, you will need to fill out all the information about the company and print the resulting form. In total, this statement in the tabular part has 23 columns, for filling which the accountant is responsible.

The header of this document indicates: the name of the enterprise and its OKPO code; amount to be paid; signatures of the manager and chief accountant with the date of signing; the name of the document, as well as its number and date; and, of course, the reporting period.

The tabular part of the payroll statement contains the following data:

- serial number;

- personnel number and position of the recipient of funds;

- salary (tariff rate);

- hours worked (data from the time sheet);

- the amounts of accruals and deductions, as well as the final amount to be paid;

- Full name of the employee and a column for his signature.

Let's take a closer look at the order of filling out the lines at the bottom of the statement. This indicates how much money was paid and who made the payment, as well as how much money was deposited due to the fact that the employee did not receive the funds due for payment. The number and date of the cash receipt order, full name and full name are also indicated. and the signature of the accountant who checked the document, and the date of this check.

In what case is the unified statement T-49 used?

Payroll T 49 is used by an entity in the case where it simultaneously calculates wages and subsequently makes payments.

This document differs from the T-12 form in that it does not provide columns for deciphering work time data for each day.

However, its most important advantage is that this form combines sections on accrual and payment of remuneration to employees. That is, this document allows you to visually check the calculation of wages, their payment, calculated taxes, as well as the amount of debt incurred.

But a significant disadvantage of this statement is that it contains a large amount of information, so it is not used in organizations with a large number of employees.

Attention! In addition, the use of such a document assumes that payment of wages will be made in cash, that is, through the company’s cash desk. Therefore, such a salary sheet does not apply when salaries are transferred to cards

Business entities in these cases can use payroll form T-51. Payments are processed either in the form of a transfer register or in separate payment transfers.

In this regard, payroll has been used less frequently lately; many are switching to payroll projects and abandoning it.

Most payroll programs include this form. It is formed on the basis of timesheets, which are verified by relevant specialists, as well as information on the amount of payment from the staffing table or employment contract.

Attention! Data on the accrual of vacation pay and disability benefits should be indicated in this document on the basis of separate calculations in total amounts for each person. Here the personal income tax amounts are calculated, which is then summed up for all employees and transferred to the budget

The completed forms are transferred to the company’s cash desk, and according to them, employees receive their salaries on time

Here the personal income tax amounts are calculated, which is then summed up for all employees and transferred to the budget. The completed forms are transferred to the company’s cash desk, and according to them, employees receive their salaries on time.

Are corrections allowed in the statement?

When checking compliance with an enterprise's cash discipline, fiscal authorities pay special attention to documents with corrections or obvious errors. After all, having declared a document invalid, inspectors can impose a large fine on the company.

Therefore, if an error was discovered in the payroll sheet, and this was done before the start of payment of salaries to employees, then it is best to immediately replace the document with a new one. But if payments have already begun, and replacing the document is problematic, then the error found must be carefully crossed out and the correct data written on top. In this case, the signature of the accountant and the director with a transcript, as well as the date the correction was made, must appear in place of the correction.

It would be better to additionally draw up an accounting certificate in which to describe the essence of the error and the reason for the correction.

For information on how to issue such a certificate, read the article “Accounting certificate - procedure and writing sample.”

Rules for registering

Organizations have the right to choose whether to use the unified T-49 form or a document form developed on their own (it must be recorded in local regulations). But still, many business entities use a unified form, since it has a convenient structure.

The statement can be prepared in printed or handwritten form. It must be signed:

- CEO;

- Chief Accountant;

- the accountant who compiled the statement;

- cashier;

- employees receiving wages.

If some employees have not received their salaries for some reason, in the payroll in the T-49 form, Fr. is placed next to their names. The total amount of salary deposited should be shown at the end of the statement.

Read also: Salary payment deadlines

Results

Payroll forms (0504401 for state-owned enterprises and 0301009 for others) are designed to reduce document flow at the enterprise. After all, if the salary is paid in cash through the company’s cash desk, then it is easier to calculate and record the fact of payment in a single document. Replacing two documents (payroll and payroll) with one unified one is a real saving of time and consumables. In addition, you will have to process and store fewer documents.

The statements are compiled in the accounting department and transferred to the cash desk for payment of wages. After the payments are completed (and no more than 5 days are given for this), the statement is closed, signed by the cashier and transferred back to the accounting department along with cash documents. If the enterprise does not have a cashier, then the calculation and issuance of funds is carried out by the person entrusted with such functions.

The head of the enterprise is responsible for both the correct maintenance of accounting and the legality of operations, therefore his signature is required: he signs the document when transferring it to the cashier.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Payment terms according to the document

The T-51 form is not directly involved in issuing wages - its functions are only to determine it. However, on the basis of this document, pay slips can be drawn up, according to which employees will be paid.

Every company should have a wage policy. In addition, the order must establish certain dates on which payment must be made. The law states that this must happen at least twice a month. The period between days of issue should not exceed 14 days.

It is not prohibited to make payments more often (for example, once every 10 days or every week).

In addition, the date on which the advance payment of wages is paid should not be later than the 30th day of the month, and the remaining part of the salary - before the 15th day of the month following the settlement month.

Important! If the salary is issued in cash from the cash register, then the payment period cannot be more than 5 days, including the day the funds are received from the account to the cash desk. Based on the data contained in the payslip, the following accounting entries are made:

For basic salary, bonus, sick leave and vacation pay, they look like this:

Based on the data contained in the payslip, the following accounting entries are made. For basic salary, bonus, sick leave and vacation pay, they look like this:

| Debit | Credit | Operation |

| 20 | 70 | Accruals have been made for employees of primary production |

| 23 | 70 | Accrual for auxiliary production workers |

| 25 | 70 | Accrual for employees performing general production duties |

| 26 | 70 | Accrual for employees with administrative functions (management, accountants, etc.) |

| 44 | 70 | Payment to employees who are engaged in trade |

| 91 | 70 | Accrual for employees who do not directly participate in production activities |

The employee may also be entitled to other payments:

| Debit | Credit | Operation |

| 96 | 70 | Accrual of vacation pay from reserve funds |

| 69 | 70 | Accrual of sick leave from social insurance funds. Such an entry is not made if the region has switched to direct sick pay payments. |

| 84 | 70 | Material assistance was issued |

The payslip also takes into account the amounts that must be withheld from the employee’s earnings.

| Debit | Credit | Operation |

| 70 | 68 | Withholding personal income tax from earnings |

| 70 | 76 | Making other deductions (alimony) |

Sample of filling out a payslip according to form T-51

Front part

You must begin entering data on the form from the title page. The name of the company is recorded there, as well as the code assigned to it according to the OKPO directory. The statement can be compiled for a specific department. In this case, its name must be written in the column that follows. If the form is issued for all employees of the company, then a dash must be indicated in this column.

Next to the name of the document, its number in order, the date when the form was filled out, and the period of the reporting period for which the calculation was made are written down.

Back part

The main table is located on the back of the form. It is necessary to enter information about the calculation of wages and deductions from it. This side must be filled out line by line, with only one line assigned to one employee.

Column 1 includes continuous line numbering throughout the document.

In columns 2-4 you need to write down personal information for each employee. This data is usually transferred from their personal cards. So, in column 2 the assigned personnel number is rewritten, in column 3 - the last name and initials, in column 4 the position in which he works is entered.

Column 5 records the employee's salary or his hourly rate.

Columns 6 and 7 are intended to indicate the number of days worked during the reporting period. The information must be transferred here from the working time sheet.

In this case, the number of working days worked is entered in column 6, and the number of weekends and holidays when the employee performs work duties is entered in column 7. It is necessary to carry out such a division, because according to the law, weekends or holidays must be paid at double the rate.

Columns 8-12 together form the “Accrued” block. At the same time, columns 8 to 11 indicate various types of accruals for the specified period (basic salary, bonuses, vacation pay, dismissal pay, sick leave and others). And in column 12 it is necessary to summarize all accruals.

In turn, columns 13-15 are combined into the “Retained and Credited” section. Thus, in column 13 the amount of personal income tax to be withheld from the employee is entered, in column 14 - the total amount of tax benefits provided.

Attention! If it is necessary to indicate a larger number of deductions (for example, alimony, compensation for material damage, etc.), then the number of columns can be increased. Column 15 is the total amount of deductions from the employee.

If on the date of calculation of wages for the new period the employee or company has a debt, then columns 16 and 17 should be used to indicate its amount. The total amount of salary to be paid out is recorded in column 18.

This completes filling out the form. The employee who was involved in its preparation signs the document, indicating the position and decoding.