Where to submit UTII-2?

You need to notify the tax office of your desire by submitting a standard UTII-2 application form.

This form must be submitted:

- at the business address in respect of which special tax will be paid;

- at the entrepreneur's registered address.

If an individual entrepreneur transfers to UTII an activity that does not have a specific address for implementation, then a branch of the Federal Tax Service is selected according to registration. Examples of such types of activities include delivery or distribution trade, passenger or freight transportation, and advertising in transport.

An individual entrepreneur is not obliged to inform the tax office at his residence address about doing business on the “imputation” if he reported this information to the department at the place of its implementation.

Application by individual entrepreneurs

The Tax Code of the Russian Federation in paragraph 2 of Article 246.26 describes in which cases an entrepreneur may have the opportunity to work with UTII. Since the legislation limits the range of types of businesses that are allowed to keep records under this scheme.

The main areas of business that are allowed imputation are:

- retail trade;

- services in terms of veterinary medicine and household needs;

- parking lots, car washes, repairs and maintenance of motor vehicles;

- companies engaged in the transportation of passengers and cargo transportation using vehicles;

- catering establishments;

- creation, distribution, placement of advertising materials;

- temporary provision of housing and services related to accommodation;

- services that involve assistance in the transfer of commercial and land plots for rent.

In order to have more complete and accurate information about these types of business, you should refer to the local laws of each region. Since it is the government that regulates this area and may differ slightly from federal law.

Sample of filling out an application according to the UTII-1 form

With the help of imputation, three payments are replaced at once, which are used for individual entrepreneurs and LLCs:

- Personal income tax for business activities;

- property tax for an individual if personal property is involved in the business;

- value added tax.

Deadline for filing UTII-2

You must submit the completed UTII-2 no later than 5 days (working days) from the start of doing business that is subject to a special tax.

This period must be observed by the merchant, otherwise the fine will be a fairly significant amount of 10,000 rubles. In addition, carrying out business in an imputed mode without filing a UTII-2 application is the reason for additional liability in the amount of 10% of the income received for a given period of time from the activity that should have been transferred to “imputement”. The minimum possible fine is limited to 40,000 rubles. This responsibility is enshrined in the tax code (1st paragraph 116th article).

Failure to submit an UTII-2 application for tax authorities means that the individual entrepreneur does not want to voluntarily work for UTII and, in the absence of notification of the transition to the simplified tax system, the businessman is considered to be working under the general classical tax regime.

Based on the received UTII-2 application, tax specialists prepare a notification confirming the fact of registration of the individual entrepreneur as a UTII payer. A period of 5 days is allotted for this action, during which the notification is transmitted to the merchant.

Submitting an UTII-2 application is a mandatory action for the voluntary application of the UTII regime.

The voluntary procedure has been in effect since the beginning of 2013. If the company by the end of 2012 applied the “imputed” regime and submitted a corresponding application to the tax office, then re-submit it after 2013. not required. If work on UTII was carried out until the end of 2012, but the tax office was not informed about this through an application, then this action must be completed next year in order to be able to voluntarily work on the “imputation”.

When and where can I write an application to switch to UTII?

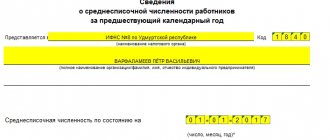

To switch to UTII, a person registered as an individual entrepreneur must fill out an application in the UTII-2 form (KND code 1112012) and send it to the tax authority. Time frames vary depending on the situation.

When registering an individual entrepreneur, it is impossible to submit an application to switch to UTII. It will be accepted only if the simplified tax system or PSN is used.

- If, during registration, the individual entrepreneur could not decide and the OSN was applied to him, then after 5 working days from the date of filing the application, you can switch to UTII. The application can be submitted at any time during the year.

- Payers to OSNO have the right to switch for the same type of activity to UTII within a year without restrictions on dates according to the letter of the Federal Tax Service dated November 11, 2013 No. ED-4-3/20133.

- When switching from the simplified tax system, you should know that the “imputation” will only be valid for the next year. Therefore, the application should be submitted within the first five working days of the new year, that is, no later than January 15.

- When registering an additional type of activity, an entrepreneur can combine different taxation systems. For example, carrying out retail trade, providing services to the population for equipment repair. Services can be transferred to UTII at any time.

The document on changing the tax regime is submitted by the entrepreneur to the tax office:

- at the place of carrying out activities subject to UTII;

- to one of the Federal Tax Service Inspectors located in the same territory (city), if there are several objects and they are controlled by different inspections. In this case, all objects are indicated in the Appendix;

- to all INFS, which have jurisdiction over objects when they are located in different municipalities.

An individual entrepreneur engaged in distribution trade, cargo and passenger transportation, as well as transport advertising, has the right to submit an application for the transition to UTII only to the inspectorate that is located at the place of registration of the entrepreneur.

Form UTII-2

For 2021 The UTII-2 form prepared by Federal Tax Service Order No. MMB-7-6/ [email protected] dated 12/11/12 is current. This form has been in effect since March 17, 2013, when the use of the special regime in question became voluntary for taxpayers.

There is no need to attach any accompanying or supporting documentation to the application; to work under the imputed regime, it is enough to submit a completed application form on time. An exception is the case when UTII-2 is filled out by a representative of the entrepreneur, who must document his legal right to perform actions related to filing an application for the individual entrepreneur. In this case, the merchant needs to issue a power of attorney for his representative and attach a copy of it to UTII-2. You must have the original power of attorney with you so that, if necessary, you can present it along with your passport as confirmation of the assigned powers.

The form contains page 001, which is the title part of the document, and an appendix that provides information about all types of business transferred to the payment of a single tax on imputed income.

General requirements for registration of UTII-2 are given in the 9th appendix to the specified tax order. The filling procedure is in the 10th appendix. This form is used exclusively for individual entrepreneurs. Legal entities wishing to work on “imputation” inform the tax office using the standard UTII-1 form, approved by the same order of the Federal Tax Service.

Features of conducting business as an individual entrepreneur on UTII

Tax Code in paragraph 4. Article 346.26 determines that single tax payers are exempt from paying a number of other mandatory payments. In particular, entrepreneurs with respect to income from activities subject to UTII are exempt from the following taxes:

- personal income tax;

- VAT;

- for property not included in the list specified in clause 7 of Article 378.2 of the Tax Code.

An individual entrepreneur has the right to apply other taxation systems simultaneously with “imputation”, while maintaining appropriate separate accounting. All types of activities for which UTII is calculated should be taken into account separately.

Let us clarify that accounting is not mandatory for entrepreneurs who pay tax on imputed income. They also do not need to keep a book of income, expenses and business transactions.

Rules for filling out UTII-2

There are certain requirements for completing the application that individual entrepreneurs must take into account when entering indicators in the UTII-2 fields.

Design requirements:

- When filling in manually, black or blue ink is used (various shades are possible) - the letters are written in capitals, printed;

- Data is entered into the fields, starting from the leftmost field;

- Cells without indicators are filled with dashes;

- It is possible to fill out the application on a computer - font 16-18 Courier New;

- When printing UTII-2, filled out on a computer, there may be no cell boundaries, and dashes are not necessary;

- It is prohibited to use corrective tools to edit and correct errors in filling out;

- You cannot print an application on both sides of one sheet, you cannot damage the sheets of UTII-2 in the process of fastening them.

UTII-2 can be used by an entrepreneur not only to submit information about the transfer of an activity to UTII, but also to make changes to previously submitted information.

If the transition to “imputation” is made from the middle of the year, then the single tax is calculated in proportion to the number of days of actual work on UTII.

Rules and procedure for filling out

The application can be made in writing or electronically in two copies , one of which is submitted to the tax authority, and the second remains with the applicant. When handwriting a document, use capital printed characters and a black or blue ballpoint pen. Information must be entered from the beginning of the line, making dashes in empty columns.

The form includes 2 pages:

- The title page includes the TIN, tax structure code, initials of the entrepreneur, ORGNIP number, date of start of using the system (DD.MM.YYYY). When submitting an application in person, the applicant enters the value “1” in the information confirmation column, signs, and enters the date and contact phone number. If the application is submitted by a representative, then in the information confirmation column the value “2” is entered, the TIN and initials of the authorized person, the name of the documentation confirming the authority of the representative are indicated.

- When filling out the second page, the following actions are performed: indicate the TIN, page number;

- business activity codes are entered;

- mailing address;

- information about the location of the business (regional code and index);

- date of compilation and signature of the person responsible.

Here you can find a free form and a sample of how to fill it out.

Corrections are not allowed ; in case of any errors, the form must be re-done. Finally, all sheets should be numbered and their number indicated on the title page.

The procedure for filling out the document is discussed in detail in the following video:

Sample of filling out UTII-2

Each page of UTII-2 must contain the entrepreneur’s TIN, which is indicated at the top of the form. In addition, each page is numbered in order, starting with the first title page. The number of completed sheets depends on the number of activities transferred to “imputation”.

Their list is given in the appendix, on one sheet of which you can indicate information on three types of business. If an entrepreneur needs to transfer a larger number to the imputed regime, then additional application sheets are filled out.

On the title page (first page) of UTII-2 the total number of completed pages of the application to the application is indicated.

The order of filling out the fields of the first page

| Field name | Explanations for filling |

| TIN | Placed on each page in accordance with the certificate issued by the tax office upon registration of an individual as a taxpayer. |

| Tax code | Corresponds to the code of the department to which UTII-2 is submitted - at the place of business or at the place of registration. |

| Full name IP | Last name, first name and patronymic of the entrepreneur in full - as indicated in the passport, without abbreviations. If there is no patronymic name, it is not registered. The information is given line by line. |

| OGRNIP | It is taken from the certificate issued by the tax office when registering an individual as an individual entrepreneur. During this procedure, the individual entrepreneur is assigned a personal registration state number. |

| date | The date, month and year in digital form when the entrepreneur began working for UTII. |

| The application has been compiled... | The number of sheets in the annex to the application filled with information about the types of activities (if their number does not exceed three, then one sheet is drawn up). For example, if one sheet of the application is drawn up, then the indicator in question is written in the format “1 – -”. |

| Copies of documents for... | The number of documents attached to the application confirming the legality of the compiler of UTII-2 to put his signature on the form. The application can be filled out and signed not only by the individual entrepreneur himself, but also by his representative. In the second case, documents are required indicating that the representative has such powers, for example, a power of attorney. |

| Reliability and completeness of information... | Put “1” if UTII-2 is filled out by the individual entrepreneur himself, “2” if his representative. If “1”, then the entrepreneur’s signature, telephone number (taking into account the locality code) and the date of signing are placed below. If “2”, then the full name of the representative, his TIN, telephone number, as well as details of a power of attorney or other document confirming the right to represent the interests of the merchant are written below. Phone numbers are written without spaces or omissions. |

Procedure for filling out the fields of the Appendix

| Field name | Explanations for filling |

| Activity code | Taken from the appendix to the Procedure for filling out the UTII declaration. This field is required. |

| Address | The address for conducting the specified type of activity or the address of the place of residence, if it is impossible to accurately determine the address for carrying out certain types of activity. |

| Signature | Signature of the compiler of UTII-2, confirming the accuracy of the reflected data. |

If an individual entrepreneur is engaged in several different areas of business, or they are located at different addresses, then in the appendix to UTII-2 it is necessary to explain at what address to register the merchant as a UTII payer.

In this case, the tax specialist focuses on the address indicated first in the list. Therefore, the entrepreneur must be the first to enter the type of activity that has the address at which registration will be carried out.

On the first page there is a place to record the fact of registration of the applicant as a UTII payer. When a tax specialist, on the basis of the received application, performs the necessary actions in connection with the registration of an individual entrepreneur as an “imputed person,” a record will be made in this subsection about the executor, as well as the date of registration.

Section 1 of the UTII declaration 2021

The results obtained for section 2 are transferred to section 1, where for each OKTMO (page 010) the amount of tax payable is indicated (page 020).

The declaration for the 2nd quarter of 2021 should be submitted to the Federal Tax Service no later than July 20, 2018.

Let's fill out the UTII declaration for the 2nd quarter of 2021 based on the initial data:

LLC "Svetly Put", engaged in shoe repair, has a contingent of 4 people. The basic profitability of the activity is 7,500 rubles, the physical indicator is the number of employees, K1 = 1.868, K2 = 1.0.

In the reporting period (2nd quarter), insurance premiums were paid in the amount of 22,800 rubles. You can reduce the amount of UTII by 50%. We will fill out the UTII declaration, calculating the tax taking into account the insurance premiums paid.