Rules and terms for vacation pay of the Tax Code of the Russian Federation

In the general case, for income in the form of wages, the date of actual receipt of income is the last day of the month for which the employee was accrued income (clause 2 of Article 223 of the Tax Code of the Russian Federation).

However, for vacation pay, this date is defined as the day of payment of income (letter of the Ministry of Finance of Russia dated January 26, 2015 No. 03-04-06/2187). Let us remind you that the employer-tax agent is obliged to pay vacation pay to the employee no later than 3 working days before the start of the vacation (Article 136 of the Labor Code of the Russian Federation).

The date of withholding personal income tax will coincide with the date of payment of income, because the tax agent is obliged to withhold tax from the income of an individual upon their actual payment (clause 4 of article 226 of the Tax Code of the Russian Federation).

The deadline for transferring personal income tax from vacation pay, i.e., the deadline when the tax agent must transfer the personal income tax withheld from an individual, is the last day of the month in which the employee’s vacation pay was issued.

Vacation pay is considered received on the day of their payment, and the tax on these amounts must be transferred to the budget no later than the last day of the month in which they were paid (clause 1, clause 1, article 223, clause 6, article 226 of the Tax Code of the Russian Federation).

Need to tax

In any case, the average earnings per vacation are subject to personal income tax. Also, regardless of the taxation system that the company uses, the following must be accrued for the entire amount of vacation pay:

- contributions for compulsory pension (social, medical) insurance (Article 420 of the Tax Code of the Russian Federation);

- contributions for insurance against accidents and occupational diseases (clause 1, article 20.1 of the Federal Law of July 24, 1998 No. 125-FZ).

The amount of insurance premiums must be determined in the month in which vacation pay is calculated. Let's give an example. The employee goes on vacation on September 1, and vacation pay is accrued in August. In this case, it is in August that vacation pay is included in the base for insurance premiums (Article 424, paragraph 1 of Article 431 of the Tax Code of the Russian Federation, letter of the Ministry of Labor dated June 17, 2015 No. 17-4 / B-298).

Personal income tax must be withheld at the time of payment of vacation pay (subclause 10, clause 1, article 208, clause 4, article 226 of the Tax Code of the Russian Federation). What to write in 6-NDFL if vacation pay is paid on the last day of the month? We'll talk about this further.

Vacation pay due to an employee must be taken into account as part of labor costs (Clause 7, Article 255 of the Tax Code of the Russian Federation). If the company uses the cash method, then vacation pay must be included in expenses at the time of actual payment to the employee (subclause 1, clause 3, article 273 of the Tax Code of the Russian Federation).

Organizations that use the accrual method can write off vacation pay as expenses in the month they are accrued (clause 4 of Article 272 of the Tax Code of the Russian Federation).

An example of how vacation pay is reflected in 6-NDFL in 2020

Show vacation pay in 6-NDFL for the period in which they were paid. Do not include accrued but unpaid vacation pay in the calculation.

In Sect. 1 specify:

- in line 020 - all vacation pay paid in the reporting period, together with personal income tax;

- in lines 040 and 070 - personal income tax on paid vacation pay.

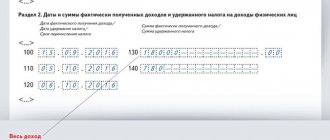

In Sect. 2 Show all vacation pay paid in the last quarter of the reporting period. Fill out separate blocks of lines 100 – 140 for all vacation pay paid on the same day, indicating:

- in lines 100 and 110 - the date of payment;

- in line 120 - the last day of the month in which vacation pay was paid. If it is a holiday, indicate the first working day of the next month;

- in line 130 - vacation pay along with personal income tax;

- in line 140 - tax withheld from vacation pay.

Do not show in section. 2 vacation pay paid in the last month of the quarter if the last day of this month is a holiday. Reflect them in section. 2 6-NDFL for the next quarter. For example, do not include vacation pay paid in December 2021 in section. 2 6-NDFL for 2021. After all, the deadline for paying tax on these vacation pay under Art. 226 of the Tax Code of the Russian Federation – 01/09/2020.

Example:

In December, two employees were on vacation. The first one started his vacation on December 3, the second one – on December 24th. Vacation pay paid:

11/29/2018 to the first employee - 47,000 rubles. Personal income tax from them is 6,110 rubles;

12/20/2018 for the second employee - 25,000 rubles. Personal income tax from them is 3,250 rubles.

Personal income tax on these vacation pay is transferred on the day they are paid.

The total amount of vacation pay paid for the 4th quarter is RUB 72,000. (47,000 rubles + 25,000 rubles), personal income tax from them is 9,360 rubles. (6,110 rub. + 3,250 rub.).

In 6-NDFL for 2021, vacation pay is reflected as follows:

Vacation pay paid on December 20, 2018, in section. 2 6-NDFL for 2021 do not need to be shown. These vacation pay will be reflected in section. 2 6-personal income tax for the 1st quarter of 2021

Source: General Ledger

My-nalog.ru

The reporting time for the first half of 2021 has arrived. I would like to provide you with an example of how vacation pay is reflected in the 6-NDFL report for the 2nd quarter of 2021.

The 6-NDFL report form was approved by order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11/ [email protected] (as amended on January 17, 2018). .

The 6-NDFL report itself is not very complicated and consists of a title page and two sections: No. 1 and No. 2. But, as practice shows, many questions arise around the topic of reflecting the amount of leave in section No. 2 of the report for the 2nd quarter of 2021 . The fact is that the deadline for paying personal income tax on the amount of vacation pay (if they were paid in June) is July 2, 2021. And this is already the third quarter.

Let's figure out together how to correctly reflect certain amounts. I will now give an example with simple salary amounts to make it easier to understand. And using this example, I will show the procedure for filling out the 6-NDFL report, both section No. 1 and section No. 2.

So, our example - accrued wages in the following amount: January 2021 - 20,000 rubles, February 2021 - 20,000 rubles, March 2021 - 40,000 rubles, April 2021 - 40,000 rubles, May 2021 - 40,000 rubles, June - 32,000 rubles salary and 8,000 rubles vacation pay. Vacation pay was paid on June 19, 2018. The amount of vacation pay in hand was = 8,000 - 13% of 8,000 = 6,960 rubles.

Total, the total amount of income accrued for the six months = 200,000 rubles, the total amount of personal income tax = 13% of 200,000 rubles = 26,000 rubles.

Salaries for June will be paid on July 5, 2021. Salaries for March 2021 were paid on April 5, for April - on May 4, for May - on June 5.

Now let’s move on to the “Three Dates” rule - in the second section of 6-NDFL we reflect only those amounts for which three dates fall in the second quarter of 2021.

Three dates are the date of payment of income, the date of withholding personal income tax, the date of transfer of tax (not the actual date of payment of tax to the budget).

If at least one of the three dates falls in another quarter, we can safely remove this amount from the report for the 2nd quarter and will show it in the next report.

In our example, two payments do not fall under the “Three Dates” rule: wages for June and vacation pay.

Salary for June 2021 Income payment date – 07/05/2018 Tax withholding date – 07/05/2018 Tax payment deadline – 07/06/2018

All dates already refer to the third quarter of 2021 and we will show the payment of wages for June in the 6-NDFL report for the 3rd quarter of 2021.

Vacation pay The date of payment of income is 06/19/2018 The date of tax withholding is 06/19/2018 The deadline for transferring tax is 07/02/2018 (because June 30 fell on a day off).

And we will not show the amount of vacation pay in the report for the 2nd quarter of 2021.

Now let's show it all “in pictures”...

Section No. 1 On line “020” we show the total amount of accrued wages for the first half of 2021 (in our example this is 200,000 rubles).

An example of filling out section No. 1 of the 6-NDFL report

On line “040” we show the total amount of accrued personal income tax for the six months - 200,000 rubles x 13% = 26,000 rubles. On line “070” we show the amount of personal income tax withheld as of the reporting date. Basis - letter of the Federal Tax Service of Russia dated November 29, 2016 No. BS-4-11/ [email protected] ().

That is, the amount of personal income tax that we will withhold from wages for June (32,000 x 13% = 4,160 rubles) is not included in line “070”, because we will withhold tax only in the month of July.

Please note that the difference between 26,000 and 21,840 = 4160 is not reflected on the “080” line.

Section No. 2 Look at the picture to see what dates and amounts we show.

An example of filling out section No. 2 of the 6-NDFL report

On line “130” we show the amount of wages including personal income tax, but not the amount “in hand”, be careful.

I hope that I have shown you all the difficult aspects of filling out this report. If you have any questions and need advice on your data, write to me.

Clarifications regarding the correct reflection of vacation pay in 6-NDFL

Share this post for your friends:

Friend me:

Rules for reflecting vacation pay in ambiguous situations

Vacation pay was paid after the employee went on vacation

- line 100 – date of payment of vacation pay;

- line 110 – the same date as on line 100;

- line 120 – the last day of the month in which vacation pay was paid*;

- line 130 – amount of income;

- line 140 – amount of tax withheld.

Vacation pay must be issued no later than three days before the employee goes on vacation (Article 136 of the Labor Code). But even if the money was paid out late, the date of income does not change - this is the day the vacation pay is actually issued.

If vacation pay is paid late, then give the employee compensation - at least 1/150 of the Central Bank rate (Article 236 of the Labor Code). This payment is not subject to personal income tax, so do not include it in your calculations.

Vacation pay was issued on the last day of the month

- line 100 – date of payment of vacation pay;

- line 110 – the same date as on line 100;

- line 120 – the last day of the month in which vacation pay was paid*;

- line 130 – amount of income;

- line 140 – amount of tax withheld.

Income in the form of vacation pay is recognized on the date of payment, and personal income tax is transferred on the last day of the month in which the money was given to the employee (clause 6 of Article 226 of the Tax Code, letter of the Ministry of Finance dated March 28, 2018 No. 03-04-06/19804).

Paid vacation pay for vacations that transfer from one month to another

- line 100 – date of payment of vacation pay;

- line 110 – the same date as on line 100;

- line 120 – the last day of the month in which vacation pay was paid*;

- line 130 – amount of income;

- line 140 – amount of tax withheld.

The employee receives income in the form of vacation pay on the day the money is paid (subclause 1, clause 1, article 223 of the Tax Code). It doesn’t matter what days the rest falls on. Fill out the payment in one block of lines 100–140 in the period when the vacation pay was issued.

Vacation followed by dismissal

Vacation pay:

- line 100 – date of payment of vacation pay;

- line 110 – the same date as on line 100;

- line 120 – the last day of the month in which vacation pay was paid*;

- line 130 – amount of income;

- line 140 – amount of tax withheld;

Salary:

- line 100 – last working day before vacation;

- line 110 – the same date as on line 100;

- line 120 – the next business day after the date on line 110;

- line 130 – amount of income;

- line 140 – amount of tax withheld.

Read also

23.03.2017

Filing 6-NDFL

The form has been used since the beginning of 2021 and is submitted quarterly by all persons using hired labor. The calculation includes information on those individuals who were paid income of various types (including dividends).

There are 4 periods for which you need to report using 6-NDFL:

- I quarter

- 6 months

- 9 months

- Year

For the first three periods, this calculation must be submitted no later than the last day of the next month. For the year 6-NDFL must be submitted before April 1 inclusive of the next year.

The form must be submitted to the Federal Tax Service office where the company was registered as a tax payer.

Both electronic and paper forms for filing 6-NDFL are provided, while the paper format is available only for persons with less than 25 employees in respect of whom payments of various types were made. If there are 25 or more of them, then the calculation must be filled out and submitted exclusively in electronic format. Similar rules apply to other personal income tax reporting. Both the electronic and paper forms are included in the appendices to the above order.

Reflection of sick leave in the calculation of 6-NDFL

Before talking about how the amount of sick leave transferred to personnel is reflected in the 6-NDFL tax report, it is necessary to determine what types of disability benefits are subject to income tax and require reflection in the calculation.

Tax legislation requires that all temporary disability benefits, with the exception of maternity benefits, be subject to income tax.

When reflecting sick leave in the calculation of 6-NDFL, it is necessary to pay attention that the date of receipt of income (payment to the employee) in the form of sick leave and the date of tax withholding must coincide, that is, line 100 = page 110, due to the fact that, in accordance with Art. . 4 of the Tax Code of the Russian Federation, tax is withheld when sick leave is paid to an employee.

However, the employer does not have the obligation to separately transfer personal income tax for each employee’s sick leave. To calculate income tax with the budget, it is enough to sum up all the amounts of tax payable for a calendar month and transfer them to the treasury in one payment. If the last day of personal income tax calculations falls on a weekend or holiday, the tax should be transferred on the next business day.

Example of filling out 6-NDFL with vacation pay

Title page

Filling out the fields on the title page is identical to filling out other reports and declarations:

- Fill in information about the TIN, KPP, name, OKTMO of the reporting person;

- When the calculation indicators change, the adjustment number is entered; when the initial submission is made, dashes are added;

- The presentation period corresponds to the time period for which the company reports (21, 31, 33 and 34 - for the first quarter, 6, 9 months and a year, respectively);

- Year – enter the year corresponding to the period specified in the previous field.

Sections 1 and 2

The first section reflects generalized indicators for all employees in terms of amounts paid and income tax calculated from the beginning of the year. These figures are reflected for each individual tax rate in fields 010-050. Fill out as many sheets with the first section as necessary to fully reflect the data on all bets.

Fields 060-090 reflect the total indicators for all bets; fill them out once on the first page of the first section.

The second section provides the actual dates for receiving income, withholding personal income tax and transferring it, indicating the corresponding amounts.

Filling out the fields of the 1st and 2nd sections

| Field | Index |

| Section 1 | |

| 010 | The income tax rate, if employees were paid only wages and vacation pay, then one rate of 13% applies. |

| 020 | Income for all individuals since January of the current year, taking into account the following points:

Salary and vacation pay are taxed at the same rate, and therefore can be summed up and reflected in this field as a total value. |

| 025 | If dividends were paid, along with wages and vacation pay, their amount is shown in this field. |

| 030 | The total amount of personal income tax deductions. |

| 040 | The amount of income tax calculated as a percentage of the amount of income from field 020, taking into account the required deductions. |

| 045 | Personal income tax in relation to accruals reflected in field 025. |

| 050 | The total amount of advance payments in a fixed amount for foreign employees, by which the calculated personal income tax is reduced. |

| 060 | The number of employees to whom accruals were made in the time period for which the calculation is completed. |

| 070 | Total personal income tax withheld for all rates. |

| 080 | Not withheld, but calculated tax. |

| 090 | Personal income tax returned by the company to employees due to excessive withholding. |

| Section 2 | |

| 100 | The moment of actual payment of income. When determining this date, you need to be guided by Art. 223. The Tax Code of the Russian Federation, indicating which day is recognized as the actual payment in relation to various types of income:

Since the payment dates for salaries and vacation pay are different, they should be separated by filling out fields 100-140 separately for each type of income. |

| 110 | The moment when income tax is withheld from accrued income. When filling out this field, you should take into account the following tax clauses - clause 4 of article 226 and clause 7 of article 226.1. It has been established that personal income tax should be withheld by the date on which the income itself was paid. |

| 120 | The point at which a company pays its calculated income tax. In this case, you should focus on clause 6 of article 226 and clause 9 of article 226.1:

|

| 130 | Total income corresponding to the date from field 100. |

| 140 | Total tax withheld on the day specified in field 110. |

If in the 1st section the indicators are reflected in total from the beginning of the year, then in the 2nd section only those transactions that were present in the last 3 months are included.

Letter of the Federal Tax Service No. BS-4-11/5106 dated March 24, 2016 explained that in the 2nd section you need to include information about those incomes, the dates of withholding and transfer of personal income tax for which fall in the last 3 months. That is, if the date of accrual of income falls on the last quarter, but the tax on it is not transferred in this quarter, then there is no need to reflect such income in the 2nd section.

An example might serve as an explanation:

The March salary was accrued on March 31, paid on April 6, and the tax was paid at the same time.

When making payments for the first quarter. in the 1st section, the March salary will be included in field 020. It is not entered in the 2nd section, but will be reflected in the calculation for the half-year.

Example:

Begemot LLC has two employees; for the first quarter they were paid the following amounts:

- salary for January 60,000 – 05.02;

- vacation pay for one of the employees 15,000 – 15.02;

- salary for February 45,000 – 04.03;

- salary March 60,000 – 05.04.

Personal income tax was transferred on the same day when the salary was paid. Personal income tax on vacation pay is transferred on February 29.

Since personal income tax was transferred from the March salary in April, data about it will not be included in the 2nd section, but will be taken into account in the 1st section.

Example of filling out 6-NDFL with vacation pay

Example of reflecting sick leave

SPARTA LLC has 4 employees; for the second quarter they were paid the following amounts:

- Salary for April 120,000 rubles – May 04

- Salary for May – 120,000 rubles – June 05

- Sick leave for an employee 8,000 rubles – May 13

- Salary for June 120,000 rubles – July 4

The tax must be transferred to the treasury on the day of payment of wages. Wages for June must be reflected in the first section of the calculation, but not indicated in the second.

Rice. 2 Sample of filling out sick leave in calculation

When analyzing the difficulties associated with how to reflect vacation and sick pay in 6-NDFL, it is necessary to turn to tax legislation, which defines the basic principles characterizing the calculation and filling out of 6-NDFL with vacation and sick pay.

The regulatory framework that determines how to reflect vacation pay in 6-NDFL (see example above) is the Tax Code of the Russian Federation, the Labor Code of the Russian Federation and Letters of the Ministry of Finance of the Russian Federation.

Similar articles

- Recalculation of vacation pay in 6-NDFL: is clarification needed?

- 6-NDFL for individual entrepreneurs without employees

- An example of how vacation pay is reflected in Form 6-NDFL

- How to reflect carryover vacation pay in 6 personal income taxes

- Date of personal income tax withholding in 6 personal income tax