Author: Ivan Ivanov

The purpose of account 68 is to display information about fees accrued and paid by the enterprise and employees to the state budget. The rules for accrual and payment are regulated in the text of the Tax Code of the Russian Federation. The accountant records all obligations, for which calculations are subsequently made, after which the funds are transferred to the treasury.

The Standard Plan sets out the rules for maintaining records, which contains information on the company’s obligations to pay taxes and fees.

Definition and characteristics

Taxes are the amount of money, the amount of which is regulated by the legislation of the Russian Federation, which an organization of any form of ownership is obliged to pay to finance the state.

Such contributions are made by both individuals and legal entities. Payments can be:

- To the federal budget.

- To the region's treasury.

- To the local budget.

The first type includes income tax, VAT and excise taxes. Regional and local charges are assessed as rules for the use of property and land.

According to the method of payment, taxes and fees accounted for in account 68 can be divided:

- The amount of revenue from completed sales and sales of products is subject to VAT, excise and customs duties.

- From the cost of goods or services - tax contributions for the use of land, natural resources, water resources and property, as well as for vehicles and for the gaming business.

- Write-off of funds in accordance with the profit received - income tax of a legally registered entity. It is also used to display personal income tax taxes collected from employees. Depending on the chosen accounting mode, the amount of contributions also changes. For example, organizations operating under the simplified tax system are exempt from paying VAT, property contributions and personal income tax.

Personal income tax withheld from wages: posting

The personal income tax tax period is a calendar year, for which an individual is required to submit a declaration to the tax authority at the place of registration.

The tax is transferred by the employer no later than the day following the payment of income to the employee. At the end of the reporting year, employers submit a report to the tax authority at the place of registration in the form of $2$-NDFL for each employee by April 1 of the following year.

Can not understand anything?

Try asking your teachers for help

Since 2016, for employers - agents of personal income tax payers, a period has been established - a quarter. A new form of calculation of $6$-personal income tax has also been introduced. This form reflects information about employee income, accrued and withheld personal income tax amounts for the reporting period. This calculation must be submitted no later than the last day of the month following the previous quarter.

When determining the tax base of a taxpayer, all income that he received, both in cash and in kind, or the right to dispose of which he acquired, is taken into account, as well as income in the form of material benefits.

Figure 1. Types of income subject to personal income tax

Too lazy to read?

Ask a question to the experts and get an answer within 15 minutes!

The personal income tax rate in Russia is $13%$ of income. But for certain types of income the rate is different.

The personal income tax tax period is a calendar year, for which an individual is required to submit a declaration to the tax authority at the place of registration.

The tax is transferred by the employer no later than the day following the payment of income to the employee. At the end of the reporting year, employers submit a report to the tax authority at the place of registration in the form of $2$-NDFL for each employee by April 1 of the following year.

Since 2016, for employers - agents of personal income tax payers, a period has been established - a quarter. A new form of calculation of $6$-personal income tax has also been introduced. This form reflects information about employee income, accrued and withheld personal income tax amounts for the reporting period. This calculation must be submitted no later than the last day of the month following the previous quarter.

Note 1

Figure 1. Types of income subject to personal income tax

There is no single tax rate for personal income tax, but a system of tax rates.

35% - at this rate, the income of an individual received in the form of winnings and prizes worth more than 4 thousand rubles is taxed. Material benefit.

30% - income, excluding dividends, received by individuals who are not tax residents of the Russian Federation.

15% - income in the form of dividends received by individuals who are not tax residents of the Russian Federation.

9% - income in the form of dividends received by individuals who are tax residents of the Russian Federation.

13% - all other income received by individuals that are not listed at the above rates.

The tax amount is calculated as a percentage of the tax base corresponding to the tax rate.

Personal income tax amount = NB * St

An important feature of personal income tax calculation is that the personal income tax amount is determined in full rubles, i.e. tax amount is less than 50 kopecks. is discarded, and 50 kopecks. and more is rounded to the nearest ruble.

Payment of personal income tax depends on the calculation of personal income tax and who pays this tax.

For tax agents, the deadline for paying personal income tax is set no later than the day following the day of actual payment of income to individuals.

For January – July no later than July 15 of the current year in the amount of ½ of the annual advance payment amount

For July – October no later than October 15 of the current year in the amount of ¼

For October – December no later than January 15 of the following year in the amount of ¼ of the annual advance payment amount

For individuals who received income that was not withheld by tax agents for personal income tax amounts

No later than July 15 of the year following the expired tax period in which this income was received.

The withholding of personal income tax from employee salaries is reflected in the debit of account 70 “Settlements with personnel for wages” and the credit of account 68 “Calculations for taxes and fees”, subaccount “Personal Income Tax”.

For example, when paying for work or services under the GPA. Then you need to make a posting Debit account 76 “Settlements with various debtors and creditors” - Credit account 68-NDFL.

Chart of accounts

Account 68, in accordance with the accounting rules, is active-passive, because at the end of the reporting period, a balance of any nature can appear on it, both debit and credit.

If the amount is on credit, this means that the enterprise has unfulfilled obligations to the state, and if on debit, then they were fulfilled in full during this period. All accrued fees are recorded as a credit item on the balance sheet, and all charges written off are recorded as a debit item.

Turnovers displayed by debit indicate the repayment of outstanding obligations or the amount of refunded VAT when purchasing goods from suppliers. Credit transactions indicate the formation of obligations and the amount of VAT payable in accordance with the presented invoice.

Debit

These items take into account the paid amounts of fees and VAT, which was written off from account 19. The following plan accounts are involved:

- Account 19 – VAT on purchased goods and materials. The amount of accrued tax on purchased values and services is displayed here.

- Account 50 - Cash transactions.

- Account 51 – Current accounts.

- Account 52 – Currency transactions on accounts.

- Account 55 – accounts opened in banks for a special purpose.

- Account 66 – repayment of debt on short-term obligations.

- Account 67 – write-off of funds to pay for debt obligations with a long maturity.

Credit

Relevant accounts:

- Account 08 — Funds spent on the purchase and operation of non-current assets.

- Account 10 – Materials purchased by the company.

- Account 11 – Animal resources on the balance sheet of the enterprise at the stage of growing and fattening.

- Account 15 – Procurement and acquisition of inventory items.

- Account 20 – Main production. The purpose of this account is to account for all the costs incurred by the organization to support production.

- Account 23 – Costs for auxiliary production are displayed.

- Account 26 – General expenses.

- Account 29 – Maintenance of production and business facilities. It records all expenses necessary to support the process.

- Account 41 – Products. Serves for maintaining records of inventory items that were acquired for the purpose of sale. It is used in situations where a company sells products that are not of its own production, and also if the organization does not include the cost in the total price, and the buyer reimburses it separately.

- Account 44 – Selling expenses. The costs of selling products and inventory items are taken into account.

- Account 51 – Operations carried out on current accounts.

- Account 52 – Actions with foreign currency accounts.

- Account 55 – Accounting for the movement of funds in special bank accounts.

- Account 70 – Repayment of debt on salary obligations to company employees.

- Account 75 – Payments to the founders of the enterprise, as well as accounting for contributions to the authorized capital.

- Account 90 – Designed to record information about the income and expenses of the company in the process of carrying out its main activity.

- Account 91 – Income and expenses of a different nature.

- Account 98 – Revenues expected in future reporting periods.

- Account 99 – Accounting for profits and losses of a company.

Subaccounts

Depending on the chosen form of tax accounting and the scope of the organization, subaccounts are applied to account 68. For each type of tax, a specific subaccount is provided:

- 68.01 – The amount of accrued personal income tax is fixed here. Both the company and the company’s employees – individuals – are obligated to pay it. Deduction occurs directly from the salary amount

- 68.02 – Accrued VAT.

- 68.03 – Excise duty on categories of products established by law.

- 68.04 – Income tax. The tax base is the income received during the reporting period.

- 68.05 – Payment of a fee for negative impact on the environment, most often assigned to hazardous industries.

- 68.06 – Land.

- 68.07 – For a vehicle listed on the organization’s balance sheet.

- 68.08 – For property. Calculated on the amount of funds owned by the company.

- 68.09 – Advertising fee.

- 68.10 – Taxes and fees that do not fall into the previous groups.

System of tax deductions for personal income tax

Legislative regulation of personal income tax is carried out on the basis of the Tax Code of the Russian Federation (Chapter $23$.)

The object of personal income tax is the income itself received by an individual. If income is received in foreign currency, then its value is calculated at the Central Bank exchange rate on the date the income was received.

Tax agents are employers who accrue income to their employees.

The personal income tax tax system provides for a system of tax deductions.

A tax deduction is an opportunity to return part of the funds paid towards personal income tax. A tax deduction can only be provided if the individual has income that is subject to personal income tax at a rate of $13%$.

Tax deductions can be of 4 types:

- Standard tax deductions:

- Property tax deductions

- Professional tax deductions

Social tax deductions

There is a deduction limit - this is the amount after which the tax deduction ceases to apply.

- The property tax deduction has a limit of up to $2,000,000 rubles (tax deductions for the purchase of an apartment, dacha, house.) Deduction from mortgage interest up to $3 million rubles, if an individual took advantage of a mortgage.

- The social tax deduction has a limit of up to $120,000 rubles for one’s own education, but not more than $50,000 rubles for the education of each of the children, brothers, sisters.

- The social tax deduction for treatment has a limit of up to $120,000 rubles.

- Social tax deduction for the entire amount of costs for expensive treatment.

All types of deductions must be confirmed by an individual taxpayer with certain documents.

Definition 2

Definition 3

There is a deduction limit - this is the amount after which the tax deduction ceases to apply.

- The property tax deduction has a limit of up to $2,000,000 rubles (tax deductions for the purchase of an apartment, dacha, house.) Deduction from mortgage interest up to $3 million rubles, if an individual took advantage of a mortgage.

- The social tax deduction has a limit of up to $120,000 rubles for one’s own education, but not more than $50,000 rubles for the education of each of the children, brothers, sisters.

- The social tax deduction for treatment has a limit of up to $120,000 rubles.

- Social tax deduction for the entire amount of costs for expensive treatment.

Personal income tax is a form of withdrawal of part of the income of individuals to the budget

Refers to federal taxes and is a direct tax.

Personal income tax taxation is regulated by Chapter 23 of the Tax Code of the Russian Federation.

Personal income tax taxpayers are individuals who are tax residents of the Russian Federation, as well as individuals receiving income from sources in the Russian Federation who are not tax residents of the Russian Federation.

Tax residents of the Russian Federation are individuals who stay on the territory of the Russian Federation for at least 183 calendar days over 12 consecutive months.

The object of taxation is income received by taxpayers:

- 1. From sources in the Russian Federation and outside its borders for individuals who are tax residents of the Russian Federation

- 2. From Russian Federation sources for individuals who are not tax residents of the Russian Federation

The tax base. Taxable period. Income not subject to personal income tax (tax relief).

When determining the tax base for personal income tax, all income the taxpayer receives, both in cash and in kind, is taken into account, as well as income in the form of material benefits received from saving interest on borrowed funds.

Based on this, the tax base for personal income tax is determined as the monetary expression of these incomes, but for income taxed at a rate of 13%, the tax base is determined as the monetary expression of such income subject to taxation reduced by the amount of tax deductions.

NB = D

NB = D – D' – NV

The tax period for personal income tax is a calendar year.

Income not subject to personal income tax:

- 1. State benefits with the exception of temporary disability benefits and benefits for caring for a sick child.

- 2. Scholarships paid to students.

- 3. Compensation payments within the established standards.

- 4. Financial assistance provided to an employee in connection with the death of members of his family or to family members of a deceased employee.

- 5. Material assistance provided to most or all employees not exceeding the amount of 4 thousand rubles. in year.

- 6. The cost of gifts, winnings and prizes does not exceed 4 thousand rubles. year.

- 7. Etc.

For personal income tax, there is a system of tax deductions for income taxed at a rate of 13%.

- 1. Standard tax deductions. Art. 218 NK. They are provided to taxpayers by tax agents (employers) on the basis of a written application and documents confirming the right to these tax deductions.

a. In the amount of 3000 rubles. Provided for each month of the tax period and applies to the following categories of taxpayers.

· Persons who received illness or disability due to the disaster at the Chernobyl nuclear power plant and the Mayak production association

· Persons from among the military personnel who received injuries or disabilities as a result of injuries received during the defense of the USSR and the Russian Federation.

· Persons directly involved in testing nuclear weapons and eliminating radiation accidents.

· Disabled WWII

b. In the amount of 500 rubles. Provided for each month of the tax period and applies to the following categories of taxpayers.

· Heroes of the USSR and the Russian Federation, as well as persons awarded the Order of Glory of three degrees.

· Participants of the Great Patriotic War

· Persons who were in the city of Leningrad during its siege

· Former concentration camp prisoners

· Persons who donated bone marrow to save the lives of other people

· Disabled people since childhood, as well as disabled people of 1st and 2nd disability groups

· Persons who performed international duty in the Republic of Afghanistan and other countries where hostilities took place.

· Persons who, by agreement, participated in hostilities on the territory of the Russian Federation

· And etc.

c. In total 400 rubles. Provided for each month of the tax period until the taxpayer’s income, calculated on an accrual basis from the beginning of the year, does not exceed 40,000 rubles. in the month in which income exceeds the specified limit, the standard tax deduction is not provided. Applies to all other categories of taxpayers who are not included in the standard deductions of 3,000 and 500 rubles.

If a taxpayer has the right to a standard tax deduction for himself in more than one amount, then he is provided with one tax deduction, but at the maximum amount.

d. In the amount of 1000 rubles. Provided for each month of the tax period until the taxpayer’s income, calculated on an accrual basis from the beginning of the year, does not exceed 280 thousand rubles. and applies to every minor child or full-time student under 24 years of age who is dependent on the taxpayer.

- 2. Social tax deductions art. 219. Provided to taxpayers on the basis of a written application when submitting a tax return to the tax authority at the end of the tax period and documents confirming the actual costs of providing this tax deduction.

a. In the amount of actual expenses incurred, but not more than 25% of the amount of income received during the tax period and transferred by the taxpayer to charitable purposes.

b. The amount paid by the taxpayer in the tax period for his studies in educational institutions. In the amount of expenses actually incurred for your training, but not more than 120 thousand rubles. for the tax period.

c. In the amount paid by the taxpayer-parent for the education of their children under the age of 24 in the amount of expenses actually incurred for these purposes, but not more than 50 thousand rubles. for each student child in total for both parents.

d. In the amount paid by the taxpayer in the tax period for treatment services provided by medical institutions of the Russian Federation, as well as for the treatment of a spouse, his parents and children under the age of 18 in the amount of actual expenses incurred, but not more than 120 thousand rubles. for the tax period.

e. In the amount of additional insurance contributions paid by the taxpayer during the tax period for the funded part of the labor pension, but not more than 120 thousand rubles. for the tax period.

- 3. Property tax deductions art. 220 Tax Code of the Russian Federation. Provided in the amount of income received by the taxpayer during the tax period from the sale of residential houses, apartments, dachas, garden houses, land plots owned by the taxpayer for less than 3 years in the amount of income received from the sale of this property, but not more than 1 million rubles. If the taxpayer sold other property owned for less than 3 years, then a property deduction will be provided to him in the amount of income actually received from the sale of this property, but not more than 250 thousand rubles. If the right to the specified property owned by the taxpayer is 3 years or more, then the property deduction is provided in the full amount received from the sale of this property.

The amount spent by the taxpayer on new construction or purchase of housing in the Russian Federation. Provided in the amount of actual expenses incurred, but not more than 2 million rubles. This deduction is provided once in the life of the taxpayer, but before it is fully used

Income tax is paid by individuals - tax residents of the Russian Federation, as well as non-residents who receive income from sources in the Russian Federation.

Tax residents of the Russian Federation include individuals who are actually on the territory of the Russian Federation for at least 183 days in 12 consecutive months. The tax period for personal income tax is a calendar year.

The object of income taxation for resident individuals is any income received both from sources in the Russian Federation and abroad; for non-resident individuals - only income received from sources in Russia.

The tax base includes all income of the taxpayer received during the tax period.

- received in cash;

- received in kind;

— received in the form of material benefits;

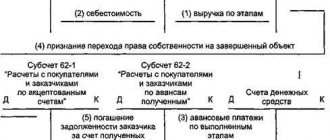

Postings including VAT

Subaccount 68.02 is responsible for displaying information on the calculation and payment of VAT. It is calculated based on the documents provided - issued and accepted invoices. For example, the company Yunost bought goods from the company Sovest for a certain amount. The seller company issued an invoice to the client.

The wiring looks like this:

- D 19 Kt 60 – a record of accrued (input) VAT is recorded.

- D 68.02 Kt 19 – the required amount is written off.

If the company sells goods, then the wiring will be different:

D 90.03 Kt 68.02.

In such situations, the invoice is issued within a certain period. In the course of the enterprise’s activities, the amount of VAT on subaccount 68.02 is accumulated in debit for deduction, and in credit for payment. For the final calculation, it is necessary to find the difference between these two indicators - this will be the amount to be repaid for VAT obligations.

Postings Dt 68 and Kt 68, 19, 51 (nuances)

Naturally, the accounting department must have reasons for this. Firstly, such a basis may be the order of the manager, mentioned above. Secondly, this may be an order from the manager for a one-time payment of money. Thirdly, it could be his resolution (such as “pay”, “issue”) on some document (memorandum, invoice, etc.). A resolution can be put forward not only by the manager, but also by another person (deputy manager, chief engineer, branch manager, etc.). Other persons may give orders for the issuance of accountable amounts only if they are authorized to do so by order of the manager. In general, you should immediately clearly define the range of documents on the basis of which the accounting department issues expense vouchers for the issuance of accountable amounts.

Power of attorney

If a company issues a power of attorney to an employee, then he acts on behalf of his company, and all documents that he receives from other companies will be issued in the name of the company he represents. He will receive both a delivery note and an invoice (which will allow VAT to be offset). If an employee does not have a power of attorney, for other companies he is a private person. All this employee can count on is cash receipts and sales receipts. In either case, these expenses can be accepted by the business, but the accounting entries are slightly different. These differences will be shown in the journal entry table.

The power of attorney is issued in one copy, registered in a special register of powers of attorney and handed over to the employee, and the accountant remains with the spine of the power of attorney, which indicates all its details. Since the employee represents his home company in another organization, the power of attorney remains in that organization. When the employee returns to the employer, the accountant will make a note on the counterfoil of the power of attorney that the order has been completed.

The power of attorney indicates the date of its issue and validity period. If the power of attorney does not indicate a validity period, then such a power of attorney is valid for 1 year from the date of issue. If the power of attorney does not indicate the date of its issue, then such power of attorney is invalid. To receive material assets, power of attorney form No. M-2 has been approved (approved by Resolution of the State Statistics Committee of the Russian Federation dated October 30, 1997 No. 71a).

Date added: 2015-10-28; | Copyright infringement

Accounts | Four types of business transactions | Dt 50 Kt 51 1000 rub. | Who can tell an accountant | About company registration | About signatures and seals | Responsibilities of a cashier | Cash book | About cash register equipment (CCT) | Payment orders | mybiblioteka.su - 2015-2018. (0.009 sec.)

Correspondence

Basic typical wiring:

- D 68 Kt 19 – The total volume of contributions transferred to the state budget including VAT. The basis document (DO) is a payment order.

- D 68 Kt 50/51, 52, 55 – Repayment of existing debt by transferring funds through a banking institution or in cash. DO – payment order.

- D 70, 75 Kt 68 – Write-off of funds from wages and income of company employees to pay personal income tax. DO – payslip.

Calculations for contributions to the state budget:

- D 99 Kt 68 – Accounting for the amount of income tax. DO – settlement certificate.

- D 70 Kt 68 – Accrued personal income tax. The basis is a statement of calculation type.

- D 90 Kt 68 – VAT, excise taxes and indirect taxes are displayed. DO – certificate issued by an accountant.

- D 91 Kt 68 – Description of operating expenses, i.e. obtaining financial results. DO – settlement certificate or acceptance certificate.

Verification of information for each type of contribution on mutual settlements is carried out separately. For this purpose, account 68 is used, which allows you to break down the information according to the types of taxes. To calculate the fee based on the enterprise's profit, the budget levels and the type of fees paid - repayment or accrual, fine or penalty - are taken into account.

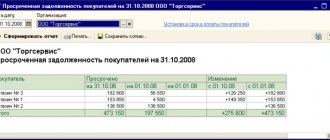

In which accounts is personal income tax reflected? Personal income tax accounting

Any operation carried out by an organization in the course of business activities must be reflected in accounting. Amounts of personal income tax are no exception, that is, personal income tax amounts calculated and paid to the budget must also be reflected in accounting.

To account for personal income tax, account 68 “Calculations for taxes and fees” is used, on which the “NDFL” subaccount is opened. When personal income tax is calculated for payment to the budget, it is reflected in the credit of account 68. Personal income tax in correspondence with the income accounts of an individual.

Transactions for accrual of personal income tax are presented in table 2.1

Table 2.1 Postings for personal income tax

Founders' dividends are subject to a personal income tax rate of 9%.

Ivanov I.A., who is the founder, received dividends in the amount of 50,000 rubles. Personal income tax = 50,000 * 9% / 100% = 4,500 rubles.

Personal income tax entries for dividends are presented in table 2.2.

Table 2.2 Personal income tax entries for dividends

The company received a short-term loan from V.A. Ivanov in the amount of 200,000 rubles. Interest on the loan amounted to 10,000 rubles.

A rate of 13% applies to interest income from a short-term loan.

Personal income tax = 10,000 * 13% / 100 = 1300

Table 2.3 Entries for accounting for personal income tax on a short-term loan

Ivanov received a salary including a bonus of 30,000 rubles. Ivanov has the right to a deduction of 500 rubles, and he also has one child. Salary minus deductions is taxed Salary minus deductions is subject to a tax rate of 13%.

Personal income tax = (30000 - 500 - 1400) * 13% / 100 = 3653 rubles.

Ivanov will receive a salary in the amount of = 30,000 - 3653 = 26,347 rubles.

The postings are presented in table 2.4.

Table 2.4 Postings for accounting for personal income tax from wages.

* From dividends - on account 75 “settlements with founders”;

* From wages - on account 70 “settlements with personnel for wages”;

* From financial assistance - on account 73 “settlements with personnel for other operations”;

* From income of a civil nature - on account 76 “networks with different debtors and creditors”;

* From income in the form of interest on a short-term or long-term loan - on accounts 66 “settlements on short-term loans and borrowings” or 67 “settlements on long-term loans and borrowings”.

Personal income tax or personal income tax is a fee that is paid by almost every Russian citizen, if he is a taxpayer and has his own identification number assigned by the tax service. In addition to Russians, this tax is also removed from non-residents who have income from sources located within the Russian Federation.

Any enterprise, organization and even individual entrepreneur can be tax agents, that is, intermediaries between the state treasury and an individual, from whom the tax will be paid. The main functions of such agents include calculation, reporting, retention, etc.

This scheme works if the tax agent is the source of income for the main taxpayer. In other words, the enterprise withholds personal income tax from the wages of its employees and transfers it to the budget.

Before the tax service, agents undertake to transfer this fee on the day of payment of wages (day to day) and regardless of the form in which the money will be issued (cash or transfer to a bank card).

The tax amount is calculated on an accrual basis, that is, from the first day of the reporting year to the last day of the current month and is withheld at the legal address of the agent, not the taxpayer.

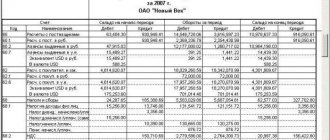

Turnover balance sheet

A balance sheet (SAS) is an accounting document that contains information about the status of accounts as of the first day of the reporting period (month, quarter or year). It also contains information about the receipts and expenditures of funds at this time, as well as the status at the end of the reporting period. SALT can be monthly, quarterly and consolidated (12 months).

In the SALT for account 68, information is indicated on the balance at the beginning of the period for the debit and credit positions, the turnover of funds according to the instructions for their purpose, and then the results for D and Kt are summed up, with the subsequent withdrawal of the balance.

Features of accounting with examples and postings are presented below.

Personal income tax withheld from the amount of dividends: posting

When withholding personal income tax from the amount of dividends paid, the entries will depend on whether the recipient of the dividends is an employee of the organization or not.

| Situation | Wiring |

| The recipient of the dividend is an employee of the company paying the dividend | Debit account 70 - Credit account 68-NDFL |

| The recipient of the dividends is not an employee of the company paying the dividends | Debit of account 75 “Settlements with founders” - Credit of account 68-NDFL |