The activities of any organization are associated with costs not only for the manufacture of products, provision of services or sale of goods, but also with costs for organizational, production and general economic needs. Accounting for these costs is necessary, since some of them are included in the pricing of the final product. To accumulate information about the costs of maintaining and operating the main production units, as well as additional structural divisions of the organization, account 25 “General production expenses” is used in accounting.

Using account 25 in accounting

Since account 25 collects information about the organization’s expenses, it is classified as active. The main feature of the account is the absence of balances both at the beginning of the reporting period and at the end. The zero balance is due to the distributive nature of the account. This means that the turnover accumulated during the reporting month is redistributed to other accounts by writing off, and at the beginning of the next period, with a zero balance, the newly spent funds are accounted for.

Costs must be generated for each structural unit of the enterprise.

Due to the lack of information about the initial and final balances, account 25 cannot be displayed in the enterprise’s balance sheet.

Account 25 is a necessary accounting item that helps to calculate and analyze all types of costs included in the production of products. This is especially true in the case when an enterprise produces a large range of product units, and it is not possible to take into account all indirect costs when determining the cost of a released unit.

If the product range is small and is reduced to one dozen product items, it is advisable to classify all indirect costs as main expenses and include them in accounts or.

Significance of the position for accounting

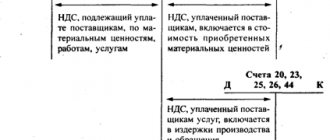

In accordance with the instructions for the Chart of Accounts, this position is intended to summarize information about the costs of servicing the key and auxiliary production processes. In this regard, it is logical to assume that all costs from position 25 are distributed across accounts 20 and 23.

On the debit side, this position corresponds with more than two dozen accounts. There are much fewer such correspondents in the credit sector. As for analytical accounting, it is carried out by individual structural divisions and cost items.

What is general production expenses?

Account 25 serves as a collection and distribution register of costs, so the following ODA must be taken into account here:

- depreciation of capital equipment and property used in production;

- repair and maintenance of fixed assets;

- payment of utilities and expenses for the maintenance, maintenance and repair of real estate;

- transportation costs;

- costs for additional services received from third-party suppliers and contractors;

- payment for insurance of equipment and premises;

- wages of primary production workers, engineering, technical and maintenance personnel (with deductions for insurance and other contributions);

- other general production costs.

What exactly to include in the number of general production expenses is decided by the management of the enterprise. It should be borne in mind that it is quite problematic to take indirect expenses as deductions when accounting for income tax. Therefore, it is advisable to increase the list of costs related to direct costs.

HIGHLIGHTS OF THE WEEK

01/30/20216:18 Special modes

Answers to questions from the Federal Tax Service for individual entrepreneurs on a patent

28.01.202118:01

Accounting and reporting

Five changes in the work of an accountant and one requirement from February 1, 2021.

01.02.202112:00

Personnel

Amounts of child benefits for 2021. Table

02.02.202110:57

Checks

Consolidated inspection plan for 2021 published

01.02.202110:01

Special modes

Reduce the patent for contributions: a notification form has appeared

PODCAST 4.12.2020

What has changed in taxes and reporting since 2021?

All episodes

Comments on documents for an accountant

Is it possible to apply NAP when assembling and selling computer systems?

02.02.2021 Federal legislation establishes a list of types of activities for which approximation is permitted...

The employer pays for the trip: is personal income tax charged?

02.02.2021 Personal income tax is not paid if the employer fully or partially finances the voucher, which allows...

Subsidy for coronavirus prevention: what other questions remain?

02/01/2021 The Federal Tax Service reminded under what conditions SMEs can receive a subsidy from the state.

‹Previous›Next All comments

How are overhead costs distributed?

When choosing a methodology for distributing ODA, it is necessary to take into account the specifics of production and the norms enshrined in the tax policy of the organization. There is a general formula for the distribution of general and general production expenses:

K (OPR) = OPR/B

K is the required coefficient, OPR is the amount of total expenses, B is the base to which all taken into account expenses are distributed.

Calculation using this formula gives a clear idea of how many rubles of ODA fall on 1 ruble of the distribution base. In this case, the choice of base should take into account the relationship between overhead costs and the final cost of a good, service or product of production.

Account 25 in practice: transactions for turnover (and account closure)

The general algorithm for using count 25 looks like this:

- During the billing period adopted in the accounting policy (for example, a month), debit business transactions are recorded on account 25, reflecting expenses related to production. The following wiring can be used for this:

- Dt 25 Kt 02 - to reflect depreciation;

- Dt 25 Kt 10 - to reflect the costs of materials;

- Dt 25 Kt 69, 70 - to reflect labor costs.

Each posting corresponds to a specific supporting document. In the case of the specified postings, the following will be applied accordingly:

- statement for calculating depreciation;

- invoices, limit-fence cards;

- accounting certificates for wages, time sheets.

- At the end of the billing period, account 25 is closed.

The accumulated turnover is written off as part of credit transactions to an account corresponding to the characteristics of the production to which general production expenses are allocated. In the general case, this is account 20. The posting used is: Dt 20 Kt 25. The main supporting document is the statement of registration and distribution of overhead expenses.

The use of postings on account 25 has a number of nuances that are worth considering.

Subaccounts

For the most structured accounting of general production expenses for account 25, it is advisable to open two auxiliary subaccounts:

- maintenance and operation of production lines and capital equipment;

- general shop expenses.

However, these subaccounts may not be enough. Account 25 includes accounting for general production and general business expenses of various types, and for more convenient management and formation of expenses, it is recommended to open additional sub-accounts for the type of ODA: wages, depreciation of fixed assets, payments to social funds, public services, raw materials, fuels and lubricants, etc.

A little about the classification of costs.

All production costs are included in the cost of individual types of products, works and services (including products manufactured to individual orders) or groups of homogeneous products. Depending on the methods of inclusion in the cost of certain types of products, costs can be direct and indirect. Direct costs are understood as expenses associated with the production of certain types of products (raw materials, basic materials, purchased products and semi-finished products, basic wages of production workers, etc.), which can be directly and directly included in the cost of goods. Indirect costs are those associated with the production of several types of products (maintenance and operation of equipment, workshop, general plant expenses, etc.), included in the cost of goods using special methods.

In the Basic Provisions for Calculating Product Costs at Industrial Enterprises[1], shop and general plant expenses are identified in the grouping of costs by item. Which of them should include “modern” general production costs? To answer the question, we will give a comparative description of these expenses.

| Expenses included in the cost of manufactured products | |||

| ⇓ | ⇓ | ||

| Shop expenses | Factory overhead | ||

| ⇓ | ⇓ | ||

| Costs of industrial and production structural divisions of the enterprise | Costs of enterprise management and production organization in general | ||

| ⇓ | ⇓ | ||

| Salaries of shop management staff; depreciation and costs of maintenance, current repairs of buildings, structures and equipment for general workshop purposes; costs of experiments, research, rationalization and invention of a workshop nature; costs of labor protection measures; other workshop costs associated with production management and maintenance | Salaries of plant management personnel with deductions; expenses for business trips and lifting expenses when moving employees, for official travel and maintenance of passenger vehicles; telephone expenses; costs of maintenance and ongoing repairs of buildings, structures and general plant equipment; taxes, fees and deductions, enterprise security costs | ||

It is clear from the diagram that general production expenses correspond to shop expenses in the interpretation of the Basic Provisions for Calculating Product Costs at Industrial Enterprises, while general general business expenses are indicated in the Instructions for the Application of the Chart of Accounts. Therefore, we will further consider shop expenses in the “calculation” document.

More detail.

On account 25 many of the costs of a production enterprise can be collected. Appendix 4 to the Basic Provisions for Calculating Product Costs at Industrial Enterprises provides a fairly detailed list of shop costs. Moreover, both production and non-production costs are highlighted.

| Shop costs (overhead costs) | |||

| ⇓ | ⇓ | ||

| Production costs | Non-production expenses | ||

| ⇓ | ⇓ | ||

| Maintenance of the workshop management apparatus and other workshop personnel; depreciation, maintenance, current repairs of buildings, structures, equipment; innovation, inventions; tests; occupational Safety and Health; wear and tear of low-value equipment | Losses from downtime, damage to material assets in workshops, underutilization of parts, components and technological equipment; shortage of material assets and work in progress (less surplus); etc. | ||

The following recommendations apply to both types of shop costs. Their total value is included in the cost of gross and marketable output of the enterprise through the cost of work and services performed by auxiliary shops for the main production. That is, some indirect expenses are included in others ( Debit 23 Credit 25

), located closer to direct costs (

Debit 20 Credit 23

) for production. In fact, this is not entirely true, because depending on the specifics of production, costs can be attributed from account 25 directly to account 20 without using account 23.

This is partly confirmed by the Basic provisions for calculating the cost of production at industrial enterprises. Shop costs, as a rule, are distributed among various types of products in proportion to the sum of the basic salary of production workers (without additional payments under progressive bonus systems) and the costs of maintaining and operating equipment. In certain industries, shop costs can be distributed in proportion to the amount of basic costs without the cost of raw materials, materials and semi-finished products. The conditions for using one of the above methods at enterprises in the relevant industries are established in industry instructions.