How to use the calculator

Instructions for using the salary calculator

- Enter the monthly salary amount, number of days worked and month for salary calculation.

- Click "CALCULATE". The result will show the total accrued salary amount, how much of the salary will be personal income tax and the amount of salary minus personal income tax.

Is something not working? Having a problem? Take advantage of feedback

A salary calculator based on salary, including for an incomplete month worked, is a convenient service designed both for officials who calculate wages and for employees themselves who want to check the accuracy of calculations.

How to count correctly on our calculator

Enter the initial data

Next Previous

Step 1. Last name First name Middle name of the employee

This item is optional. The full name is entered at your discretion - convenient if the calculation results need to be printed on a printer.

Step 2. Choose a tax rate

By default, we have set a rate of 13% for all residents of the Russian Federation. A rate of 30% applies to non-residents of the Russian Federation.

Step 3. Select a calculation option

- Direct calculation: enter the amount of income from which all employer and employee taxes are calculated. As a result, we get the amount of salary that the employee should receive in hand.

- Reverse calculation: if we have the amount that an employee should receive in hand, then we can calculate what salary should be accrued to him. At the same time, all taxes are also calculated.

Step 5. Enter the salary amount

Here you must indicate the salary amount, depending on which method is chosen: direct or reverse.

Step 6. Indicate the employee’s income since the beginning of the year

This point may affect the correctness of the calculation, since if income from the beginning of the year exceeds 350 thousand rubles, then standard tax deductions no longer apply, however, deductions that do not depend on the payroll apply.

Step 7. Specify deductions

According to the Labor Code, a citizen has the right to use standard child deductions:

- 1400 rubles for the first and second child.

- 3000 on the 3rd and subsequent ones.

- 12,000 rubles for disabled children and 6,000 rubles if the deduction is applied by the guardian parent.

In a separate column, you can indicate a deduction that does not depend on the payroll received by the employee since the beginning of the year.

Attention! To receive a child deduction, an employee must write an application. It is necessary to take into account that the standard deduction for a disabled child is also summed up (Letter of the Ministry of Finance dated March 20, 2017 No. 03-04-06/15803).

Step 8. Regional coefficient and northern surcharge

If a citizen works in the northern regions, then it is necessary to indicate the amount of the bonus in the top line, for example, 1.25. The default value is 1.

The regional coefficient as a percentage is also indicated. The default value is 0, for 25% percent in the column we simply indicate 25.

Attention! In the column below the coefficients, you must indicate bonuses that do not participate in their calculation, if there is such an accrual.

Step 9. We indicate the amount of deductions to the Social Insurance Fund for accidents

By default, we have a coefficient set to 0.2. But it can be installed separately for each employer.

Step 10. Calculation

Now you can do the following:

- Calculate the salary based on the entered initial data.

- Reset entered data for a new calculation.

- Print the result.

Attention!

In order to re-calculate on the calculator, you need to reset the data, otherwise the result may be incorrect. Next Previous

We get the calculation

The “Payroll calculation” field displays data on the employee’s salary before and after taxation, tax deductions, northern allowances, and personal income tax is highlighted at the rate specified in the source data.

Next, in the “Taxes paid by the employer” field, the amounts that the employer pays at his own expense to the Pension Fund, Social Insurance Fund and Federal Compulsory Medical Insurance Fund are displayed. At the same time, the calculator takes into account regressive rates in the Pension Fund and the Federal Compulsory Medical Insurance Fund, if the payroll is indicated from the beginning of the year.

The “Total amount of taxes” field displays the total amount of taxes that the employer must pay to the budget from his own funds to the Pension Fund, FFOMS, Social Insurance Fund and the National Tax Service, as well as as a personal income tax tax agent at the specified rate from the employee’s funds.

Salary calculation

Salary, or otherwise, tariff rate, is not equivalent to wages. We can say that salary is a certain basic value, that is, the minimum wage established by the staffing table for a certain position for a certain time, without taking into account allowances and compensations.

It is these basic indicators that the calculator takes into account. To get the correct result, the calculator needs to know:

- salary size;

- number of working days in a month.

The calculator will convert working days into standard working hours and give the final amount (excluding compensation, bonuses, overtime, etc.) minus personal income tax.

The calculation algorithm corresponds to the formula TS / DM × RD = ZP, where:

- TS is the tariff rate;

- DM is the duration of a calendar month, that is, 30, 31 or 28/29 days;

- WP are working days worked in a particular month.

Attention! The calculator is provided for calculations based on standard hours. That is, the correct result can only be obtained based on 40 working hours per week (Article 91 of the Labor Code of the Russian Federation). This means that the calculator can be set to the condition of any number of days worked per month, but it is impossible to change the calculation with the condition, for example, of a 6-hour working day or overtime.

Mandatory documents

The main package of documents, within the framework of which the head of the company undertakes to establish a payment system or a separate salary for an employee, is established by law in the order “On the establishment of unified forms of the first accounting documentation of labor compensation.” The package of documents includes the following copies:

- An employment contract under which the amount of salary and the time of payment of an advance or part of the salary will be fixed.

- A document in the form of an order to hire an employee. Such a document is necessary because it must record: the amount of the employee’s salary, possible additional payments, as well as the start and end dates of the employee’s work.

- Time sheet.

- In the case of piecework wages, a corresponding document is also required. These documents can be in the form of acts of completed work.

- Additional orders on remuneration or discipline of an employee.

- Other additional documents that may influence the formation of an employee’s salary.

The variable selection of documents for specific requirements may include the following:

- Automated accounting based on working time sheets. This package of documents is determined for the use of automated recording of the presence of employees at the workplace. Also, this time sheet is often used in companies with installed reading systems that record the time an employee arrives and leaves the company’s location.

- Calculation of wages based on working time sheets. This is a single document that indicates the very fact of the employee’s performance of official duties. This method is used in accounting payment calculations.

- Payroll payroll. This method of salary calculation is used in the application of the document form T-49. If salaries are paid to bank cards, then the T-51 document form is used.

- Calculation report on the provision of leave. This type of settlement document is generated when it is necessary to calculate vacation payments to an employee.

- Payment document resulting from termination of an employment contract. This type of document is generated when it is necessary to calculate the amount of payment upon dismissal in order to take into account all unused payments of the employee during his employment. Such payments may include unused vacation pay, sick leave and other bonuses during the dismissal of an employee.

- Personal account. This type of documentation is necessary when you need to create a systematic record of all data on wages that were accrued or withheld for the calendar year.

- Employment invoice. This type of document is generated when hiring for a position is due only to the need to perform some specific work for a limited period.

Calculation example

Salary calculation for the 1st employee – director Legachev:

For convenience, in this salary calculation example, all calculation data are rounded to whole rubles.

- Payroll preparation

Legachev worked in full for the entire month; his salary consists of salary and bonus. There is no bonus in September.

Salary for September = 60000

- Accounting for deductions

Legachev has two children, for each he is entitled to a deduction of 1,400, but this deduction is valid until the salary, calculated from the beginning of the year on an accrual basis, reaches the maximum value of 280,000 rubles, from January 1, 2021 - 350,000. Legachev's earnings since the beginning of the year he has reached 480,000, which is more than the limit, so he does not receive deductions in September.

- Withholding personal income tax

Personal income tax is defined as 13% of (the amount of salary calculated in the first paragraph minus deductions).

Personal income tax = (60000 – 0) * 13% = 7800

Thus, Legachev will receive (60000 - 7800) = 52200Calculation for the 2nd employee - accountant Smirnova:

- Salary calculation

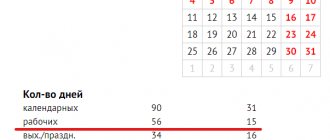

In September, Smirnova worked only 15 days, so the salary corresponding to the time worked will be determined as Salary * days worked / 21. The accountant is not entitled to a bonus.

Salary for September = 20000 * 15 / 21 = 14286

- Accounting for deductions

Smirnova has 1 child, her salary since the beginning of the year is 160,000 rubles, which is less than 280,000 rubles, she is entitled to a child deduction of 1,400 rubles.

- Withholding personal income tax

Personal income tax = (14286 – 1400) * 13% = 1675

Smirnova will receive (14286 – 1675) = 12611

Calculation for the 3rd employee - manager Petrov:

- Salary calculation

A month worked in full, plus Petrov received a bonus of 10,000

Salary for September = 25000 + 10000 = 35000

- Accounting for deductions

Petrov has three children, for the first two he is entitled to deductions of 1,400 rubles, for the third - 3,000 rubles, in addition, Petrov, as a veteran, is entitled to a deduction of 500 rubles. Total total deduction = 1400 + 1400 + 3000 + 500 = 6300.

- Withholding personal income tax

Personal income tax = (35000 – 6300) * 13% = 3731

Petrov will receive (35000 – 3731) = 31269

Calculation for the 4th employee - manager Serov:

- Salary calculation

Salary for September = 25000 * 20 days. / 21 days = 23810

- Accounting for deductions

Not allowed.

- Withholding personal income tax

Personal income tax = 23810 * 13% = 3095

Serov will receive 23810 – 3095 = 20715

Based on these data, the payroll form T-51 or payroll slip T-49 is filled out.

For clarity, let’s summarize the data obtained in the example into a table for all 4 employees:

| Surname | Earnings since the beginning of the year | Salary | Exhausted days in September | Accrual salary | Deductions | Personal income tax | To payoff |

| Legachev | 480000 | 60000 | 21 | 60000 | 7800 | 52200 | |

| Smirnova | 160000 | 20000 | 15 | 14286 | 1400 | 1675 | 12611 |

| Petrov | 200000 | 25000 | 21 | 35000 | 6300 | 3731 | 31269 |

| Serov | 200000 | 25000 | 20 | 23810 | 3095 | 20715 | |

| Total | 133096 | 16301 | 116795 |

The amount indicated in the “Payable” column is subject to payment to the employee on the basis of the T-53 payroll (a sample of which can be downloaded here).

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Calculation of insurance premiums

Based on the final data obtained for all employees, we will calculate the insurance premiums that the organization will have to pay for its employees to the Pension Fund, Social Insurance Fund and Compulsory Medical Insurance Fund. Contributions will be calculated from the final accrued salary for the month.

Taxes and withholdings

The difference between earned and actually paid wages is the sum of various deductions, which can be divided into three groups:

- mandatory - by order of the judicial authorities on the basis of writs of execution (alimony, compensation for damage caused, fines);

- at the initiative of the organization’s management - for violations of labor legislation, or in case of damage to material belonging to this organization;

- at the request of the employee himself - for making non-cash payments when solving his everyday or social issues.

Also, the category of withholdings includes tax on an individual in the amount of the rate established at the time of calculation by special legislative acts.

To obtain accurate and not approximate calculations of wages, it should be borne in mind that the enterprise must have a duly approved staffing table, and must also maintain a time sheet.

Dear readers, the information in the article may be out of date, take advantage of a free consultation by calling: Moscow +7

, St. Petersburg

+7 (812) 317-70-86

or via the feedback form below.

- Previous entryIs the premium taxable - legal practice

- Next entryWriting off materials in construction - features of the procedure

× We recommend watching

How to calculate average earnings - calculation examples

How to calculate interest on a loan? Calculation of PSC, insurance payments and more

What is salary and how does it differ from salary?

Often, most employees do not see the difference between the concepts of salary and salary, which leads to a misunderstanding of the size of the final amount to be issued “in hand” on payslips. By signing employment contracts that reflect the salary amount, employees expect monthly remuneration in the same amount, without taking into account the impact of personal income tax on the final amount of money paid.

The official salary is a fixed standard amount used to calculate the salary of each employee. When using the salary system in the work of an institution, a staffing table must be formed, in which the rates and corresponding salaries for each position are fixed. If the total amount to be paid to an employee is less than the salary amount established by the employer, then the accounting department does not have the right to accrue it (Article 129 of the Labor Code of the Russian Federation).

The concept of salary is much broader and represents the total amount of money that is accrued and paid to an employee as remuneration for his work. It may include bonuses, incentives, compensation payments, advance transfers and a number of other personal additional payments for each individual employee. If an employee has questions about accrual, he can calculate manually or online. A standard salary calculation calculator can be found not only on the website, but also in the form of a table in Excel.

IMPORTANT!

The salary is often more than the salary! It includes the initial salary, bonuses, allowances, additional payments, regional coefficients and various incentive payments.

How to calculate personal income tax using an online calculator

The presented online form of the calculator has the ability to carry out two types of calculations:

- 1 - Determination of personal income tax based on the accrued amount of wages (the accountant has calculated the wages and it is necessary to calculate the tax to be withheld);

- 2 - Determination of the personal income tax already deducted from the amount issued in person (the worker received a salary and wants to understand the amount of the tax burden deducted from him).

To carry out the necessary calculations, you need to follow the steps suggested below:

Point 1. Select in field 1 the type of calculation that interests you. At the top of the online calculator, you need to mark the required calculation option (from accrual or from the salary issued in hand).

Point 2. Enter the amount of the salary (which was calculated by the accountant or which was given to the person) in field 2.

If you have no children under 18 years of age and are eligible for other types of benefits, you do not need to fill out anything else; the calculation results can be seen immediately at the bottom of the calculator.

If you have children or the right to other deductions, then additionally enter the data below.

Item 3. Enter the number of years of each child in field 3.

Clause 4. If you have the right to a benefit on the basis of clause 1 or 2 of clause 1 of Article 218 of the Tax Code of the Russian Federation, then enter its value (500/3000) in field 4.

The result of the online calculation is the amount of the deduction for children (if applicable), the amount of personal income tax (which should be deducted or which has already been deducted depending on the type of calculation chosen), as well as the salary accrued and to be paid out.

Average monthly labor calculation

There are many reasons why employers choose average monthly salary calculation. Often the main factors include:

- Calculation of vacation pay. Compensation for unused funds that were intended for the employee during vacation.

- Additional payments while maintaining the employee’s basic fixed rate.

- Payment for the employee's working time spent on downtime due to the fault of the employer.

- Compensation in case of staff reduction and termination of an employee’s employment contract. Funds are compensated on the occasion of weekend benefits.

- Compensation for employee disability.

- Compensation for employee travel time.

Thus, monthly payments are made if the employee requests a certificate of income, as well as other data. There are also additional compensations that are not included in the list of main reasons:

- Local material payment in the form of assistance. This payment is relevant during the period of sick leave or vacation pay.

- Reimbursement of funds for the costs of food, travel, housing and communal services.

- Compensation of funds in case of maternity leave for the period of the beginning of motherhood and temporary incapacity for work in this regard.

- Allowance for caring for a child under 1.5-3 years of age.

- Financial benefit for funeral.

Some material payments are made not by the organization, but by the social insurance fund with which a particular company cooperates. To do this, the head of the organization must submit a corresponding application for the employee to this fund.

To calculate the average monthly earnings for the past calendar year, you need to subtract the listed social benefits or material compensation from the amount of accruals. Then the resulting figure must be divided by the number of days worked by the employee. The calendar month includes the period from the 1st to the 31st.

In order to determine the average salary of an employee, you need to use the amount of remuneration and working hours according to the calendar.

The amount of wages is the amount that should have been accrued for 12 months. However, if the employee did not work all the days, then only those worked are counted. Working hours are determined by the sum of calendar days divided by 12. Thus, the salary calculation amount should look like this:

Wed salary = payment for a certain period/time worked.

As a result, the average monthly salary is calculated using the following formula:

salary = salary for the year / total number of days on average.

To calculate the average daily salary, you need to use the following formula:

average daily salary = (basic payments + additional) / (12*29.3).

29.3 is the total average number of days in a month, which is established by law.

If an employee is dismissed, compensation for unworked or unused vacation periods must be added to his salary. In this case, the average monthly salary is replaced by calculating the total time worked.

Reverse salary calculation

In addition to the above formula for calculating salaries, there is another way to determine it from the opposite. Reverse salary calculation is designed for employees who do not know how their salary is calculated. That is, if a person receives 15,000 rubles in his hands and does not know how much he is initially credited, then to determine the initial amount he needs to use the reverse method. It's no secret that the final rate is determined by subtracting all existing calculations from the established salary and, accordingly, by adding additional payments. If you calculate reverse wages without taking into account possible additional payments and calculations, then you need to use a formula where IIT and OPV are subtracted from the salary, resulting in the final amount.

According to established legislation, OPV is 10%, that is, in order to determine it, you need to multiply the salary amount by 10%. When calculating wages from the reverse, the average annual minimum wage is also taken into account, since it is necessary for calculating personal income tax.

Knowing all the necessary indicators, a person can easily calculate his salary from the reverse; to do this, he needs to determine the average annual minimum salary in the country and the personal income tax. So, what is a reverse salary - this is the full amount that is accrued to the employee before all mandatory contributions are withheld from it and increments are accrued. Accordingly, reverse wages may be of interest to a person only when he wants to know, for example, how much is being deducted from him per month.

Payroll fund

The totality of all expenses, including bonuses, allowances, compensation for the salaries of personnel of any organizational structure, represents the wage fund.

This indicator is used to guide the analysis of the expenditure of funds on employee benefits.

With its help, costs are adjusted and optimized, salaries and rates are regulated.

All payments of pensions and insurance contributions provided for by legislative acts are calculated from the amount of the wage fund, which is calculated based on the planned time for work, the volume of production, according to tariff and piece rates.

Deadlines established for the payment of wages

The question of the timing of payment of wages is one of the most important. The twenty-first chapter of the Code contains basic information regarding this point. The rights and responsibilities that all interested parties must fulfill are also defined. Article 136 of the Code gives an unambiguous answer to when, within what time frame and how many times wages must be paid. It is issued twice a month, every fifteen days. The employer is legally obligated to ensure strict compliance with this requirement. He has the right to set his own payday. Corresponding entries about this must be made in the employment contract, as well as in all documents regulating the activities of the enterprise.

Currently, the requirement to maintain a gap of fifteen days is strictly regulated. Any enterprise that does not comply with it is considered to have violated the payment deadlines. Managers in this case bear both personal and legal responsibility. In accordance with the Code, the payment of an advance and wages is considered a violation, since at present an advance is not a legal form of payment of monetary remuneration. And payment according to the “advance-salary” formula is outdated and illegal.

By definition, an advance is a conditional cash equivalent. It does not comply with the requirements of the Code to account for all payments and deductions included in wages. Consequently, today, in order to meet the deadlines for issuing wages, the employer is forced to calculate it twice a month in compliance with all the requirements of the Code. Naturally, situations inevitably arise when it is impossible to literally comply with the requirements of the law to meet deadlines. Especially if the payday falls on a weekend or holiday. For this reason, the Code prescribes the rules for issuing wages on pre-holiday and pre-weekend days.