Office management is a living, constantly changing area, into which new terms come every now and then. Recently, entrepreneurs, accountants and employees have come across the increasingly common concepts of “gross salary” and “net salary”. These terms indicate completely different amounts of the same salary.

How to organize office work and document flow in an organization?

We will try to explain below how to figure out what the differences between these phenomena are, whether it is possible to calculate one, knowing the other, how to navigate, what exactly is meant when offering this or that form of wages.

Origin of names

Initially, the terms “gross” and “net” go back to Latin, but their economic use is determined by their meanings in English.

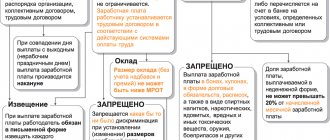

How are wages ?

Where does "gross" come from?

The word “gross” in English, where it came from in our economic vocabulary, has been used in the context of money since the 16th century. It transferred its meaning of “something general, total, total” to the calculation of finance. There are several meanings of this concept.

- "Gross". In the 16th century, English businessmen used the expression “gross profit,” that is, total profit not cleared of gross expenses and tax components. Today, instead of it, “total profit” is more typical for the English language. Thus, the first meaning of the epithet “gross” in the entrepreneurial sphere is similar to the Russian definition of “gross”.

- "Wholesale". Another meaning of this term, also going back to its “universality”, is transactions related to the trade in large quantities of goods - “gross”. In English, buy “by the gross” means a wholesale deal.

- "No deductions." The total composition of the salary, before the deductions required by law are made from it, is also “gross”. This is the meaning used in modern entrepreneurial vocabulary.

Question: Is it legal to index wages every 10 years, while increasing wages by 1%? View answer

What about "net"

In Russian transcription, the word “no” in relation to salary does not sound very optimistic. But you need to take into account the English meaning of this word, which originates from the Italian “netto”, which means “pure”.

Along with the term “gross profit”, the antonymous “net profit” was also used, which, in turn, meant net profit, from which all consumable components were already excluded.

Today, the term “net” in relation to wages means the amount received by the employee in person.

Definitions of salary types

Salaries for hired personnel in Russia consist of the following components:

- salary;

- various allowances, if provided for by law and the employment contract;

- bonus or other incentive (if provided and/or deserved).

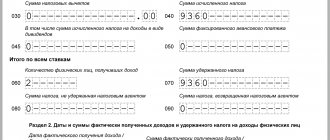

Wages constitute the main form of income for individuals, therefore they are subject to income tax - personal income tax. This factor is the determining factor in the difference between “gross” and “net” wages.

Gross salary in accounting refers to the amount of remuneration for an employee’s work, which includes all components of the salary, including personal income tax. Colloquial synonyms – “Salary according to documents”, “dirty salary”, “black salary”, “gross”.

Net-salary is a monetary amount from which all mandatory tax payments (NDFL) are excluded, that is, the amount of money received by an employee as payment for labor (at the cash register or on a bank card). Colloquial synonyms: “salary in hand”, “clean”, “white salary”.

"Gross"

The term “gross” is used to refer to the level of an employee’s salary, which represents the full amount of money spent by the employer on paying the employee.

It comes from a word found in different versions in many European languages, which means “large”, “full”, “gross”. When considering the amount of remuneration for workers, it should be borne in mind that in the Russian Federation, as in most other developed countries, the income of citizens, including wages, is subject to taxes. Therefore, the “Gross” salary is not at all the amount of money that the employee will receive in his hands: on the contrary, taxes that must be paid on wages in accordance with current legislation will be deducted from this amount.

In the Russian Federation, to determine the amount of wages that corresponds to the definition of “gross”, it is necessary to add to the salary established for the employee in accordance with the staffing table the value of the so-called regional coefficient, which is an addition to the salary applied in the case of work in difficult climatic conditions.

In world and Russian practice, there are also other terms used to denote the amount of remuneration before taxes. So, one of the options for its designation is the term “brutto” or “gross”. In addition, in Russian this amount of wages is sometimes called “dirty”.

How to avoid getting confused as an employee

The documents formalizing the relationship with the employer indicate the gross salary, that is, the official salary. This happens because it is the employer who is obliged to be a tax agent for his subordinate - to calculate and deduct the required amount of taxes from all wages even before they are paid to the employee himself, and also to report this to the tax authorities.

Sometimes the “gross” amount is indicated in hiring advertisements - after all, a more impressive amount is more attractive to applicants, and not everyone knows the meaning of the term. Thus, formally the advertisement does not contain false information, while the employee will receive a significantly smaller amount than he read.

IMPORTANT! If you are attracted by the number in the advertisement indicating the size of your future salary, do not rush to rejoice at the generous offer; check whether the employer means “gross” or “net”.

What is net in salary

There is another term - net or net salary, which is the exact opposite of “blurred” earnings. If the employer says that the salary is net, this means the amount of salary that the employee will receive in hand after the employer has withheld all taxes and other fees. In posted vacancies, this concept is also characterized by a special salary or salary in hand, which means that this is the amount you will manage every month. Otherwise called net earnings or net earnings.

There is a special formula that helps determine the net salary, what is it? To determine the amount of net earnings, it is necessary to subtract from the gross indicator the amount of tax deductions that are established by the current fiscal legislation.

"Black" and "white"

It is no secret that black and white salaries are also popularly referred to as the amount “in the envelope” and the legal salary, respectively. An entrepreneur can pay “gross” to staff, and reflect a smaller amount in documents in order to reduce insurance payments and taxes for themselves. At first glance, it is more profitable for an employee to receive an amount from which personal income tax is not collected monthly. However, in fact, by not transferring the necessary funds to the Pension Fund, the employer “robs” the employee’s future pension. In addition, “black wages” is an economic crime, and if detected by tax authorities, it is seriously punishable.

How to convert gross to net

Let’s say the vacancy indicates a gross salary - this means the salary that the accounting department will give to the employee, and additional deductions that the organization will make for him. To understand how much you will receive in your hands, clarify what the employer means by the term. Most often, this is salary plus income tax. In 2020 it is 13% for residents. To calculate the amount in hand, you need to subtract 13% taxes from the indicated figure.

Let’s say the vacancy indicates a “gross” amount of 50,000 rubles. Every month you will receive 50,000 - 13% = 43,500 rubles.

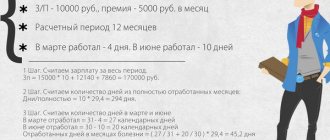

We count “gross” and “net”. Specific calculation examples

Since the difference between these types of payroll is directly related to income tax, its rate matters. For residents of the Russian Federation - the majority of employees who receive monthly salaries - it is 13%. If the salary is paid to a non-resident, 33% will have to be deducted from it monthly.

Therefore, knowing any of the indicators, you can calculate the required amount.

Let's look at specific numbers for Russian resident employees.

For example , the amount of gross salary specified in the employment contract is 100 thousand rubles. This means that the employee will receive 100,000 minus 13% every month, that is, the net salary will be 87 thousand rubles.

The calculation is the other way around: the employee received 15,800 rubles on his salary card. How can I find out how much income tax my employer has deducted from me? To do this, divide the net salary by a coefficient of 0.87 (100%-13% personal income tax), and then compare the resulting values. So, 15800 / 0.87 = 18161, and then subtract 18161 – 15800 = 2361. Thus, the monthly amount of personal income tax is 2,361 rubles.

What is gross salary and salary net

Gross salary is the amount of salary that will be regularly accrued to the employee for the performance of his labor functions. From the specified amount of earnings, personal income tax will be withheld in the amount of 13%, so the employee will not receive the specified amount in hand. Gross salary is also sometimes called “dirty”.

Often, future employees believe that by indicating the gross salary, the employer wants to deceive them: after all, this value is greater than what the employee will actually receive. In fact, by indicating a gross salary, the employer does not violate the law, and under certain conditions, an employee can receive a gross salary without having it reduced by tax.

In order to understand the size of his future income, an employee should take into account some nuances. So, in the indicated gross salary value, not only the monthly salary can be indicated, but also bonuses and allowances . Moreover, in fact, the amount of employee income may change taking into account annual and quarterly bonuses.

Before applying for a job, an employee should become familiar with the company's current remuneration system. It may be specified in a collective agreement or other local legal act. Particular attention should be paid to the procedure for calculating and paying bonuses: what criteria does the employer follow when calculating the bonus, what is its size (is there a minimum value).

You also need to take into account that employees are paid not only on a time-based basis, but also on a piece-rate basis, as a certain percentage for the amount of work completed.

Why does it make sense for an employee to know the gross salary? After all, the tax rate on income from the performance of labor functions is the same for all employees and is 13% (according to paragraph 1 of Article 224 of the Tax Code). The employer, as a tax agent, is obliged to withhold and transfer the amount of personal income tax to the budget. But still, the gross salary indicator is more informative than the net salary indicator.

The fact is that many employees can count on receiving tax deductions, which reduce the tax base and allow them to receive a larger salary. Thus, employees are entitled to social deductions provided for minor children. To receive them, the employee must contact the employer with an application under Art. 218 Tax Code.

Employees are also entitled to property deductions when purchasing an apartment. They can receive their full salary until the amount of unwithheld taxes reaches 260 thousand rubles. (according to Article 220 of the Tax Code).

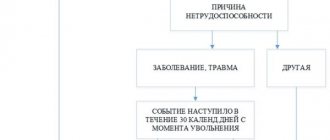

Often, employers pay part of the salary “in an envelope” in order to reduce the tax burden. After all, in addition to personal income tax, the employer is obliged to pay pension and insurance contributions from the employee’s earnings, pay sick leave and maternity leave, pay for downtime and forced absenteeism according to average earnings. In this case, the salary value in the advertisement is completely uninformative.

The amount of salary after taxes is also called "net" . This definition comes from the English net, or "ultimate". The difference between gross and net wages is personal income tax of 13%.

A question of benefit

Employees often ask which salary is more profitable, “gross” or “net”. Meanwhile, this formulation of the question is not entirely correct, since this is in fact the same value, the same indicator, simply presented in different forms. The amount of the salary expressed in “gross” is numerically greater than in “net”, but this is not important for the employee, since he will still receive the amount of money from which income tax has already been deducted, no matter how it is reflected in the financial documentation and employment contract.

NOTE! If you are a future or currently employed employee and are faced with the terms “gross” and “net” in relation to your potential salary, do not miss this important point so as not to experience disappointment, having received at the end of the month significantly less than you expected, and absolutely legal.

Which salary option is more profitable?

This and similar questions are often asked on job seeker forums.

This formulation of the question is not entirely correct, since both terms represent two sides of the same salary.

If we consider two vacancies, where one indicates the gross salary level and the second net, the option in which the Net indicator is higher is more economically profitable for the applicant. First, you need to calculate the amount of the “net” salary for the vacancy where the gross salary is indicated and then compare. So, a net salary of 45 thousand will be more profitable than a gross salary of 50. This is exactly the case when more does not mean better.