Many people regularly travel on various assignments to other cities for work, and those who encounter this for the first time have a question: how is a business trip paid under the Labor Code of the Russian Federation? A business trip is an official trip by an employee of a company to another city or country to perform tasks. At the same time, there are types of work that involve constant travel, and therefore are not considered business trips. Today we will talk about how expenses are paid during a business trip, for what period compensation is due and what the procedure looks like in general.

Only an employee who is officially employed by the company, as confirmed by an employment agreement, can be involved in this type of activity. If a person cooperates with a company on the basis of another type of agreement, then a trip to another city will not be considered a business trip. In the case where funds are paid to such an employee, they will be considered as a salary supplement. Travel allowances include:

- daily expenses;

- living expenses;

- travel costs;

- food costs on a business trip;

- other expenses (luggage and its transportation, mobile communications, obtaining a visa, etc.).

Some daily travel expenses are reimbursed before the trip, while others are reimbursed upon return. If we talk about the registration of paid funds at the enterprise, then they relate to expenses for ordinary types of activities. Taxation is also carried out according to the standard scheme in the case when their size corresponds to the norm. Seconded persons are entitled to retain their jobs, and the amount of paid absence is calculated based on their salary.

Payment for business trips: according to average earnings, daily allowance

Last changes: June 2021 The presence of out-of-town suppliers and buyers, representative offices and branches without the status of legal entities, require enterprises to periodically travel employees to the territory of other settlements. With appropriate documentation and confirmation of the purpose related to the production activities of the organization, the trip is considered a business trip.

Accountants will have to answer the questions: when and how is a business trip paid? How is salary calculated on a business trip?

According to the Labor Code (LC) of Russia (Article 166), a business trip is a trip by an employee, by order of the employer, to another locality to perform a specific individual task for a certain period (concluding contracts, escorting cargo, participating in seminars and symposiums, checking the activities of subordinate organizations).

If it is of a traveling nature (geologists, truck drivers, shift work), then the trip does not qualify as a business trip. The Labor Code of the Russian Federation guarantees reimbursement of travel expenses (Article 167), and regulates the list (Article 168):

- by motor transport – means of transport for public use, with the exception of taxis.

- by rail - a compartment car of a passenger or fast train;

- by plane - economy class cabin;

- Payment for travel in the presence of supporting documents for actual expenses not exceeding the cost: by rail - a compartment car of a passenger or fast train;

- by plane - economy class cabin;

- by motor transport – means of transport for public use, with the exception of taxis.

- name of the organization or individual indicating the relevant individual data;

- prices per day, number of days and total cost.

- Expenses for renting premises - an invoice from the hotel containing the details: name of the organization or individual indicating the relevant individual data;

- information about the room provided and the range of services (if meals are included, it must be written on a separate line);

- prices per day, number of days and total cost.

- Daily allowance – reimbursed by the enterprise

Are weekends spent away paid?

Paying for a business trip on a day off has a nuance: an employee receives a salary for the specified dates if work events are planned for them, and there is a trip home or to the place where work functions are performed.

To calculate the number of days for which a specialist must receive payment, you need to receive from the business traveler:

- Tickets confirming departure and return dates.

- An official note with notes from the receiving party is an analogue of tickets for employees who traveled in their own car or who lost their tickets.

Daily allowances for weekends are paid in any case. The accountant finds the total duration of the trip (in days) and multiplies it by the amount of allowance specified in the company's internal regulations.

In addition to travel allowances, the specialist is entitled to an average salary. For Saturdays, Sundays and holidays that fall during a trip and involve work events, payment is doubled or single, but with the employee subsequently being provided with the appropriate amount of paid time off.

Free legal advice online

The involvement of lawyers in legal disputes is due to the need to fully protect the personal interests of citizens. As practice shows, citizens avoid legal assistance in order to save money, but in practice this is associated with high costs.

Even citizens with a lawyer's education do not always keep up with current changes in legislation, so it would be advisable to consult a qualified specialist.

The convenience is that consultation with a lawyer is free and online. Where and how to get free legal advice? is provided throughout the Russian Federation. Citizens, residents of the state, as well as non-residents of the country who temporarily reside in the Russian Federation can take advantage of the support. Moreover, lawyers can advise interested parties outside Russia, but only within the framework of domestic legislation.

Legal advice is provided free of charge online around the clock, regardless of weekends and holidays. The response time from specialists on the website is up to 15 minutes.

There is no need to register on the Internet portal and you can send a personal appeal anonymously. Attention! The online lawyer provides answers to questions and continues to support the client in the event of further difficulties. Legal advice can be obtained in the following ways:

- draw up a contact form for the feedback service;

- call the hotline.

- use the online chat service;

Online legal consultation can also be carried out via email.

The advantages of the services of our law firm are due to the professional attitude of our specialists to their work, the receipt of regular training courses, as well as participation in official forums. This ensures that individuals and businesses can receive advice that complies with current legal provisions. Certificates are provided

Deadlines for payment of travel expenses

Contents When sending on a business trip, the employer is obliged, in addition to maintaining the employee’s average earnings, to reimburse him for the costs of renting housing, travel, accommodation, and also pay daily allowance for each day of the business trip.

These costs can be taken into account when calculating income tax only if they are economically justified and documented.

2015 introduced significant changes to the rules for registering official trips; travel certificates, log books for employees on these trips, and the need to draw up a work assignment and a report on its implementation were abolished. The procedure for confirming the time and fact of being on a business trip was also clarified. These changes have significantly reduced paperwork and made life easier not only for employers, but also for their employees.

But, apparently, not for long. Next year, the Ministry of Finance plans to amend the Government Resolution regulating the procedure for sending employees on business trips. In particular, we are talking about travel expenses: the Ministry of Finance proposes to abolish the daily allowance in 2021 altogether. It is assumed that these changes will affect only daily allowances for trips within Russia and will not affect foreign business trips.

The payments themselves, of course, will not be prohibited, but recognizing them for tax purposes as income tax with the adoption of these amendments will not work; in addition, income tax and insurance premiums will need to be calculated from the costs incurred.

It is worth noting that the regulatory authorities have not yet given official confirmation or comments on the adoption of these changes, so it is too early to say with confidence that they will be adopted. Therefore, it is worthwhile to dwell in detail on this year’s travel expenses.

On the territory of the Russian Federation Abroad

- Daily allowance;

- Directions;

- Accommodation;

- Other expenses approved by the employer

Additionally reimbursed:

- Costs for obtaining a passport, visa, and other mandatory travel documents;

By what standards are travel expenses reimbursed?

The organization itself establishes the standards and procedure for reimbursing travel expenses to an employee both for business trips within the Russian Federation and abroad in a local regulatory act, for example, in the “Regulations on Business Travel.”

The legislation establishes a standard only for the amount of daily allowance that is not subject to personal income tax, namely, the following daily allowances are not subject to personal income tax:

— for each day of a business trip in Russia in the amount of 700 rubles;

— for each day of a business trip abroad in the amount of 2,500 rubles.

All other travel expenses are taken into account when calculating income tax, tax under the simplified tax system in the amount in which they are established in the local regulatory act of the organization.

When are travel allowances paid to an employee?

When an employee is sent on a business trip, his place of work and average earnings are retained, and travel expenses are also paid (Article 167 of the Labor Code of the Russian Federation). Clause 9 of the Regulations on the specifics of sending employees on business trips, approved by Decree of the Government of the Russian Federation of October 13, 2008 No. 749 (hereinafter referred to as the Regulations on Business Travel), also states how business trips are paid, and stipulates that the same rules apply to business trips of part-time workers .

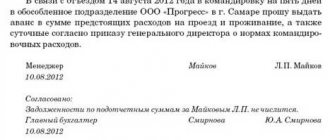

In order to send an employee on a business trip, there must be a written order from the manager indicating the place, purpose, duration of the business trip, as well as other data (Article 166 of the Labor Code of the Russian Federation). When we talk about a business trip, we can only talk about employees of the organization, that is, about persons who have entered into an employment contract. At the same time, part-time workers can also be sent on a business trip with the payment of travel allowances.

If an organization has entered into a civil contract with an individual, then even if the terms “business trip” and “per diems” are specified in the contract, the trip of an individual contractor is not a business trip under the law: there is no need to issue an order, calculate an advance, issue travel allowances.

By convention, payments may be provided that are equal to those for employees of the organization, but even in this case they will not be recognized as business trip expenses.

These will be payments to the contractor under the contract, where the parties independently determine the timing and amount of such payments. Unlike employees, the rules on issuing an advance and submitting an advance report will not apply.

Also, the exemption from personal income tax when paying for a business trip, established by clause 3 of Art. 217 of the Tax Code of the Russian Federation (Letter of the Ministry of Finance dated February 24, 2016 No. 03-04-05/10023). Payments can be divided into two parts - wages and travel expenses.

The general principle of reimbursement of expenses on a business trip is established by Part.

1 tbsp. 168 of the Labor Code of the Russian Federation, but the specific composition and amount of payments is established by the organization in a local act, which must indicate:

Labor Code: business trips, payment

How are employee travel days paid: from average earnings or is the salary simply issued? As Art. 167 of the Labor Code of the Russian Federation, when an employee is sent on a trip, he is guaranteed the preservation of his job and average earnings (clause 9 of Regulation No. 749 of October 13, 2008), as well as reimbursement of expenses. Therefore, during his stay on a business trip, he should be paid such earnings.

This is important to know: A one-time payment-compensation for those born before 1983 is 30 thousand rubles in 2021

Payment for business trips is usually made on payday. Accounting calculates the average amount that an employee could receive at his place of employment, and then issues it along with an advance or monthly payment.

Travel expenses reimbursement period

Question Good afternoon! An employee of the organization will go on a business trip at the end of April to participate in the conference.

We recommend reading: What are the limitations of lore for driver reference?

He bought his plane tickets in advance, paying with his bank card. Can we reimburse him for the costs of these tickets now or only after he returns from the conference and submits an advance report? Answer According to Art. 168 of the Labor Code of the Russian Federation, in the case of being sent on a business trip, the employer is obliged to reimburse the employee: - travel expenses; - expenses for renting residential premises; — additional expenses associated with living outside the place of permanent residence (per diem); - other expenses incurred by the employee with the permission or knowledge of the employer.

The procedure and amount of reimbursement of expenses associated with business trips to employees of other employers (not related to those mentioned in parts 2 and 3 of Article 168 of the Labor Code of the Russian Federation) are determined by a collective agreement or a local regulatory act, unless otherwise established by the Labor Code of the Russian Federation, other federal laws and other regulatory legal acts of the Russian Federation. Thus, labor legislation does not establish exactly when business trip expenses should be reimbursed, that is, before the start of the business trip or after its end.

Based on this, we can conclude that the organization can independently establish by an internal document (for example, a regulation on business trips) that the expenses incurred by the employee on a business trip are reimbursed by the organization upon its completion and after drawing up an advance report with all the necessary documents attached.

However, in accordance with clause 10 of the Regulations on the specifics of sending employees on business trips, approved by Decree of the Government of the Russian Federation of October 13, 2008 N 749 (hereinafter referred to as the Regulations), when sent on a business trip, an employee is given a cash advance to pay travel expenses and rental accommodation and additional expenses associated with living outside the place of permanent residence (per diem). 26 Regulations,

What other travel allowances are due to an employee?

In addition to average earnings, the employer must reimburse the employee’s travel and accommodation expenses at the business trip location. Reimbursement of expenses is made on the basis of provided supporting documents:

- air and train tickets;

- taxi receipts (when traveling from the airport to your destination, for example);

- receipts for the purchase of fuels and lubricants (if the employee, in agreement with the employer, travels by personal transport);

- hotel accounts;

- lease agreements for other types of housing.

Also, for each day of a business trip, the employer is required to pay daily allowance. The amount of daily allowance is determined by the commercial organization independently. Their size must be approved in a local regulatory act (order of the manager, regulations on business trips).

Business trip under the Labor Code of the Russian Federation

/Business tripWork activities can also be carried out outside the organization.

And upon return, according to paragraph.

The law allows employees to be sent on business trips.

Sending a citizen to another country or city must strictly comply with the provisions of the Labor Code of the Russian Federation. It records the procedure for registering a business trip and its maximum duration. Attention Violation of the provisions of the current legislation is fraught with negative consequences. Therefore, it is worth understanding in advance all the features of a business trip under the Labor Code of the Russian Federation. A business trip is a trip by a company employee to carry out an official assignment outside the permanent place of work.

This definition is enshrined in the Labor Code of the Russian Federation. Sending is carried out on the basis of the order of the employer. If a citizen holds a position that requires him to constantly perform work duties while traveling, this will not constitute a business trip. If a company sends an employee to perform a business assignment in another city or country, the action must be carried out in strict accordance with the procedure determined by the government of the Russian Federation.

The specifics of sending on a business trip and other nuances relating to it are enshrined in October 13, 2008. Note: If a citizen is sent to a structural unit of an organization that is located abroad or in another locality, this will also be considered a business trip. If an employee is sent to another city, in order to perform a job assignment, the following actions must be completed:

- Management issues a corresponding order.

- Upon returning from a trip, the employee fills out reporting documents.

- The citizen is provided with an advance.

The Labor Code establishes a wide range of guarantees and compensations. during the performance of an official assignment outside the main place of activity, it is carried out on the basis of the employee’s average income. The Labor Code divides business trips into two types - on the territory of Russia and outside the country.

Reimbursement of additional expenses related to business trips

The employer is obliged to reimburse travel costs to and from the business trip.

- For travel to the place of business trip;

- Issuance of travel tickets;

- Cost of linen on long-distance trains

You can also take into account the cost of a railway ticket for a luxury train, taking into account additional services (food, printed materials, bed linen, etc.) in the profit expenses, provided that they are included in the ticket price.

To confirm travel expenses, the employee must submit the following documents:

- Tickets (air, train, bus);

- Boarding pass (for flights);

- Itinerary/receipt and boarding pass (if purchasing an electronic ticket)

In case of loss of a ticket (boarding pass), confirmation can be a duplicate of the travel document, a copy of the copy requested from the transport company or another document containing information about the passenger, flight number, time of departure and arrival).

If the time of departure of the employee does not coincide with the start date of the business trip (for example, the employee left on Saturday and the start of the business trip on Monday), the Ministry of Finance in its Letter dated November 20, 2014 allowed to take into account these costs for profit tax purposes. If an employee remains at the place of business trip for a vacation, the cost of return travel cannot be included in income tax expenses.

Accounting for travel expenses for the purpose of taxation of profit is also possible in terms of costs when traveling to and from the place of business trip by taxi. It is better to register the possibility of using taxi services in a local act of the organization indicating the reasons why it is possible to use this type of transport, which may, for example, include the inability to complete assigned tasks due to interruptions in traffic, a busy work schedule, late departure, lack of other transport and etc.)

In this case, confirmation of expenses will be a memo, which will reflect the actual length of stay on the business trip. This note must be accompanied by documents confirming the use of transport: receipts for the purchase of fuel and lubricants, waybills, receipts, etc.) Also, the possibility of using personal transport should be specified in the local act of the organization.

Please note: If a citizen is sent to a structural unit of an organization that is located abroad or in another locality, this will also be considered a business trip.

For this purpose, a special travel invoice is drawn up, which lists in detail all possible expenses allowed by the company. For example, the document may indicate that the employer undertakes to pay for the travel of his subordinate after the fact, but the employee can only use a certain type of transport or the cost of the ticket should not exceed the permissible amount.

We suggest you read: Dismissal at the end of service

Thanks to the restrictions set, the employee will not be able to take advantage of the situation and book a luxury ticket to “splurge” on the road, and the employer, in turn, will be able to save money and avoid unexpected expenses.

Payment of daily travel expenses in 2016

→ → Update: November 15, 2021

In the current 2021, changes were expected in the regulation of payment of travel expenses, but this has not happened yet. At present, the legislation on payment of travel expenses continues to apply, as before, including daily allowances.

The concept of daily expenses as part of travel allowances is revealed. According to it, daily allowances are additional expenses caused by the stay of a posted employee outside his place of permanent residence, subject to reimbursement by the employer.

Essentially, per diem is a compensation payment to reimburse an employee for expenses caused by the performance of official functions outside the place of permanent work. They are aimed at covering the employee’s personal expenses during a business trip (for example, food, etc.). However, the employee is not required to report to the employer for these expenses. Regulations on the specifics of sending employees on business trips, approved.

(hereinafter referred to as the Regulations on Features), in paragraph.

11 determines that daily allowances are reimbursed to the employee for each day he is on a business trip, including weekends and non-working holidays, as well as for days en route, including the time of forced stop. However, sending an employee on a one-day business trip (or when he has the opportunity to return to his place of residence every day) does not entail the employer’s obligation to pay daily allowances.

Moreover, even including a provision about this in the local regulations on business trips in an organization will not make it legal, and the employer will bear the risks of taxation. However, if in the aforementioned local act on business trips these payments are called differently (for example, compensation for one-day business trips), the problem can be solved.

By law, the daily allowance is established only for budgetary organizations, but not for commercial ones. In them, the procedure for paying travel expenses must be determined by a collective agreement or a local regulatory act of the organization in accordance with (usually the Regulations on Business Travel or an order of the same name).

Payment for a business trip on a day off

Average earnings during a business trip are paid for working days, according to the organization’s schedule. Even if the business trip is long, only daily allowances are paid for days off. Average earnings in this case are not expected. After all, the employee does not work on weekends, but rests (clause 9 of the Business Travel Regulations).

There is an exception to this rule. If an employee nevertheless worked on a weekend or a holiday while on a business trip or was on the road, then during this time he must be paid as for work on a weekend. The Labor Code of the Russian Federation provides for two methods of payment for work on weekends and holidays:

- at a single rate of tariff if the employee takes an additional day off (time off);

- double the amount if the employee does not take time off.

Daily allowance. Procedure for payment and taxation of personal income tax

Ekaterina Annenkova, auditor certified by the Ministry of Finance of the Russian Federation, expert in accounting and taxation at the information agency Clerk.Ru.

Photo by B. Maltsev, IA "Klerk.Ru" The economic activities of organizations are not always limited to one region and, accordingly, for one or another official needs, company employees go on business trips to carry out official assignments.

According to the provisions of Article 166 of the Labor Code of the Russian Federation, a business trip is a trip by an employee by order of the employer for a certain period of time to fulfill an official assignment outside the place of permanent work*. *The place of permanent work should be considered the location of the organization (a separate structural unit of the organization), the work in which is due to labor agreement.

The place of work is a mandatory condition for inclusion in the employment contract in accordance with the provisions of Article 57 of the Labor Code of the Russian Federation. The specifics of sending employees on business trips are established by the Regulations

“On the peculiarities of sending employees on business trips”

, approved by the Decree of the Government of the Russian Federation of October 13, 2008.

No. 749. Please note: Business trips of employees whose permanent work is carried out on the road or is of a traveling nature are not recognized as business trips.

Based on Article 167 of the Labor Code of the Russian Federation, when an employee is sent on a business trip, he is guaranteed:

- maintaining your job (position) and average earnings,

- as well as reimbursement of expenses related to business trips.

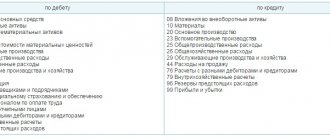

Expenses associated with business travel are:

- travel expenses;

- additional expenses associated with living outside the place of permanent residence (per diem);

- expenses for renting residential premises;

- other expenses incurred by the employee with the permission or knowledge of the employer.

The employer is obliged to reimburse the employee for all of the above expenses on the basis of the provisions of Article 168 of the Labor Code of the Russian Federation.

Deadline for payment of travel expenses

It is an axiom that any business trip is associated with expenses for the organization (individual entrepreneur).

When sending an employee on a business trip, he must be reimbursed for:

- daily allowance – additional expenses associated with living outside your permanent place of residence;

- travel expenses;

- other expenses incurred on a business trip in agreement with the administration.

- housing rental costs;

(for more details, see “Reimbursing employee travel expenses”). Daily allowance is a compensation payment to an employee related to staying outside his place of permanent residence. After all, an employee on a business trip must somehow eat and satisfy other daily needs.

Since the business trip occurs at the initiative of the employer, it is fair that he pays these expenses.

Daily allowances must be paid for all days spent on a business trip, including weekends and non-working holidays that fall during the business trip (for more details, see.

“Daily allowance is paid, including for weekends”

). The daily allowance should be paid in advance so as not to force the employee to spend his own money on the trip (for more information, see “Paying the daily allowance before leaving on a business trip”).

We recommend reading: Job interview in English dialogue

As for the specific deadline for paying daily allowances for business trips in 2021, it is not established by the Labor Code and other regulations governing the labor sphere. Therefore, determining the payment period remains at the discretion of the organization.

Having decided on the deadline for paying daily allowances before a business trip, you need to fix it in a local regulatory act of the organization, for example, an order from the head of the organization or the Regulations on business trips (for more information, see

“We are drawing up regulations on business trips (sample 2017)”

). Also, the payment period can be established in the collective agreement concluded with employees (Art.

168 Labor Code of the Russian Federation). The main thing is to pay the daily allowance in advance, before the start of the business trip. Otherwise, the organization (employer) may be fined for violating labor laws (for more details, see

“The employer may be fined for not paying daily subsistence allowances on time”

).

How is payment made if an employee gets sick on a business trip?

Payment of sick leave does not depend on whether the employee was on a business trip or not. You must pay for all days of incapacity for work. It should be taken into account that:

- daily allowances and housing rental expenses must be paid for all days of the business trip. The cost of housing is not paid only if the employee was in a hospital;

- During the period of incapacity for work, the average salary is not paid, but for the remaining days up to the date of the onset of incapacity for work it must be paid.

This is important to know: Certificate of Honor of the Ministry of Internal Affairs of Russia: payment

Deadline for payment of travel expenses

Update: November 15, 2021 Changes in the regulation of payment of travel expenses were expected in the current 2021, but this has not yet happened.

At present, the legislation on payment of travel expenses continues to apply, as before, including daily allowances.

The concept of daily expenses as part of travel allowances is revealed in Art. 168 of the Labor Code of the Russian Federation. According to it, daily allowances are additional expenses caused by the stay of a posted employee outside his place of permanent residence, subject to reimbursement by the employer.

Essentially, per diem is a compensation payment to reimburse an employee for expenses caused by the performance of official functions outside the place of permanent work.

They are aimed at covering the employee’s personal expenses during a business trip (for example, food, etc.). However, the employee is not required to report to the employer for these expenses. Regulations on the specifics of sending employees on business trips, approved. Decree of the Government of the Russian Federation dated October 13, 2008 N 749 (hereinafter referred to as the Regulation on Features), in paragraph.

11 determines that daily allowances are reimbursed to the employee for each day he is on a business trip, including weekends and non-working holidays, as well as for days en route, including the time of forced stop. However, sending an employee on a one-day business trip (or when he has the opportunity to return to his place of residence every day) does not entail the employer’s obligation to pay daily allowances. Moreover, even including a provision about this in the local regulations on business trips in an organization will not make it legal, and the employer will bear the risks of taxation.

However, if in the aforementioned local act on business trips these payments are called differently (for example, compensation for one-day business trips), the problem can be solved. By law, the daily allowance is established only for budgetary organizations, but not for commercial ones.

In them, the procedure for paying travel expenses should be determined by a collective agreement or a local regulatory act of the organization in accordance with Art.

167 of the Labor Code of the Russian Federation (usually this is the Regulation on Business Travel or an order of the same name).

Daily expenses

Like all expenses, travel allowances can only be taken into account if they have an economic justification and documentary evidence.

Documentary evidence after cancellation of travel permits includes:

- The employer's decision to send an employee on a business trip in writing.

To fill out an order, you can use a unified form or develop your own, subsequently securing it in your accounting policies.

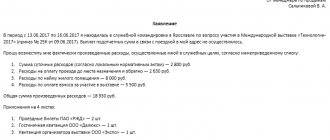

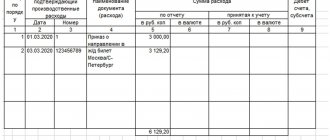

- Employee's advance report on amounts spent, approved by the manager

The specified document must be prepared and submitted to the manager no later than three days from the date of return to the place of work.

In case of failure to submit an advance report, the manager has the right, after a month, from the end of the period allotted for the return of the advance, to withhold the funds issued to the employee against the report. But this can only be done with the written consent of the employee himself. In case of refusal, the amount can only be recovered through the court.

If these funds are not withheld, insurance premiums must be charged for their amount. If, after a lapse of time, the employee provides a report and documents confirming expenses, the organization has the right to recalculate the base for calculating insurance premiums, as well as the amount of accrued and paid contributions. Also, in the absence of a report and supporting documents, personal income tax will have to be assessed on the amount of funds issued to the taxpayer.

- Documents confirming actual expenses incurred, in particular:

- For housing;

- Directions;

- Other expenses

Also, the taxpayer (organization) must confirm the period of stay of its employee on a business trip. It is determined by travel documents, if they are lost, then by housing rental documents. If they are missing, then according to documents containing confirmation of the receiving party about the timing of the employee’s stay (arrival and departure) at the place of business trip.

- women raising children under 3 years of age;

- persons who are guardians of minor children;

- workers who raise children under 5 years of age without the help of a spouse;

- citizens whose family has a disabled child or a relative suffering from a serious illness and in need of care.

IMPORTANT If an employer draws up an order without obtaining the consent of the above categories of citizens, this will be a direct violation of the norms of the Labor Code of the Russian Federation.

- are paid in the amount of 50% of the norm for business trips abroad, if the business trip is carried out outside the Russian Federation (clause 20 of the Regulations on the specifics of sending employees on business trips).

Personal income tax is not withheld from daily allowance amounts not exceeding 700 rubles. for each day of a business trip in the Russian Federation and 2500 rubles. for each day of a business trip abroad (clause 3 of Article 217 of the Tax Code of the Russian Federation). Insurance premiums are not charged for the entire amount of daily allowance within the limits established by the local regulatory act of the organization (Part 2 of Article 9 of Law No. 212-FZ). Reimbursement of expenses related to business trips According to Art.

This normative act approved the “Regulations on the specifics of sending employees on business trips.”

Also, the payment period can be established in a collective agreement concluded with employees (Article 168 of the Labor Code of the Russian Federation). The main thing is to pay the daily allowance in advance, before the start of the business trip.

- for travel to and from your destination,

- airport service fees, commission fees,

- expenses for travel to the airport or train station at places of departure, destination or transfers,

- for baggage transportation,

- living expenses,

- expenses for communication services,

- fees for issuing (receiving) and registering a service foreign passport,

- fees for issuing (receiving) visas,

- costs of exchanging cash or a bank check for cash in foreign currency.

As you can see, this list is closed. The manager is interested in what the law has to say about this from the point of view of the legal basis. For a person sent on a business trip, this fact is also important, since he has to live away from home and family. The generation that entered working life back in the days of the Soviet Union, which still continues to work today, remembers well that on the basis of Instruction No. 62 adopted by several departments of the USSR on April 07, 1988, a maximum period of business trip within the Union republics was provided for - 40 days.

Category: News

In general, as a rule, a few days before the business trip (if you need to purchase train tickets), the day before the business trip, or they can give it on the day of the business trip. It all depends on the organization and procedure for issuing money to the account. If for some reason the money was not issued before the business trip, it will be issued to you upon presentation of an advance report on the use of funds spent on the business trip (daily hotel accommodation and travel costs).

All expenses (except for daily allowance) must be documented (tickets indicating the cost of travel, an invoice from the hotel, a check confirming payment of the bill for accommodation). Well, a travel certificate or a business trip assignment - depending on what the organization issues to the employees being sent.

The advance report must be accompanied by documents confirming the expenses incurred (travel documents, including boarding pass, route/electronic ticket receipt, baggage receipt, BSO, sales and cash receipts, etc.).

We invite you to read: Additional leave to normal maternity leave

For the period from 07/01/2015 until July 31, 2019, the employee was on vacation at his own expense.... Payment for goods by a third party How to take into account payment for goods (works, services) by a third party?

✒ Accounting with the debtor - the buyer of goods (works, services) In case of OSN, payment for the goods (works, services) you purchased does not affect the tax....

According to it, daily allowances are additional expenses caused by the stay of a posted employee outside his place of permanent residence, subject to reimbursement by the employer.

Regulations on the specifics of sending employees on business trips, approved. Decree of the Government of the Russian Federation dated October 13, 2008 N 749 (hereinafter referred to as the Regulation on Peculiarities), in clause 11, determines that daily allowances are reimbursed to the employee for each day of a business trip, including weekends and non-working holidays, as well as for days on the road, including forced stop time.

The following documents are used to register a business trip:

- an official or production task, which takes the form of either a contract or a detailed instruction. For example, visiting the construction site of a production facility in order to monitor the progress of its construction;

- an intradepartmental or corporate order for personnel, which indicates the official being sent on a business trip, the purpose of the trip, the timing and rate of payment. The order must be drawn up in accordance with existing document flow standards and must be entered in the order book;

- if necessary, a travel certificate or a special card is issued (for example, like a press card for journalists) with all the necessary details, seal, photograph and signature of the company management. Also, the travel certificate must indicate the time of departure of the employee to the place of execution of the travel assignment, as well as a note on the time of his return;

- pay slip signed by the employee for the issuance of travel expenses.

In some cases, arranging a business trip may require, for example, letters from counterparty companies with requests to send a company employee on a business trip, for example, to service equipment installed by the company at a client company.

In particular, such documents include:

- a complete written report on the completed travel assignment, indicating all facts directly or indirectly related to the performance of production functions;

- travel certificate with mandatory marks on the time of arrival or departure from the place of assignment;

- an advance report, which indicates all expenses incurred by the employee, ranging from transportation, accommodation, and ending with expenses associated with the implementation of production activities;

- all payment documents that can confirm the expenses incurred by the employee - receipts, checks, invoices related to the execution of the travel assignment. As a rule, for this you need to provide a binder or folder with the original payment documents (sometimes it is enough to glue all the checks onto sheets of paper).

In addition to the listed documents, the traveling employee may attach documents in digital format, including video and photographic materials, confirming the employee’s performance of his duties during the business trip.

In private companies, such standards may be established based on accepted business practices and average travel costs in the commercial industry.

In government organizations, travel expense standards are set either by federal or regional authorities.

The legislation of the Russian Federation establishes only a lower limit for the payment of travel expenses, which are taken into account when calculating and paying personal income tax.

In particular, the following travel allowance limits have been established for companies and organizations of any form of ownership:

- expenses for travel expenses within the territory of the Russian Federation are set at 700 rubles for each day of a business trip;

- travel expenses when traveling outside the Russian Federation are set at 2,500 rubles for each day of stay outside the Russian Federation. The start time of payment for travel allowances in foreign currency or in terms of national currency is set according to the time of actual crossing of the border of the Russian Federation.

Duration of business trips and their payment in accordance with the norms of the Labor Code of the Russian Federation

Nowadays, the computer revolution (Internet, telephone) provides enormous opportunities for successful communication on work issues with partners and colleagues at any distance. However, there are production issues that require the personal presence of an employee.

To do this, his management sends him on a business trip. And if previously the legislation limited its period, now it is not clearly defined.

Any dispatch of an employee to carry out an official assignment within the country or abroad, in accordance with the laws of Russia, must be properly formalized and agreed upon with the employee himself.

Back in Soviet times, the law approved a limit on the travel period, which was no more than 40 days, and for certain specialties (builders, installers) a long-term business trip lasting up to a year was stipulated.

Today the Labor Code does not limit the number of travel days. Even before it begins, the deadlines are adjusted by the employer depending on the volume of work and its complexity (PP 749).

The beginning of the business trip period should be considered the day of departure, and the date of arrival is regarded as its end. If transport is delayed en route, the business trip will be extended by this time.

This period also includes holidays and weekends, which are paid at a double rate.

If the amount of payment is not increased by the employer, then an additional day off must be issued for the employee.

There are employers who determine the duration of the trip based on travel documents. If you use your own transport, the employee must provide a memo.

If tickets are not available, you can use documents from the hotel or rental agreement. When registering for a trip abroad, the documents are translated into Russian.

The duration of the business trip is determined by the employer in consultation with the employee. To determine the deadline

Calculation of average salary during a business trip

Determining the billing period Calculating the days worked in the billing period Determining the amount of earnings for the billing period How to take into account bonuses If the salary was increased during the billing period Determining the average daily earnings Multiplying the average daily earnings by business trip days

If an employer sends an employee on a business trip, days of absence are paid according to special rules. The employer must pay the average wage for these days. This is stated in Article 167 of the Labor Code of the Russian Federation.

Errors in calculating the average salary when paying for employee business trips are among the TOP 5 errors that we identify based on the results of the salary calculation audit. And all because there are many nuances in this issue that should not be missed.

This article will discuss how to calculate the average salary for business travelers and avoid mistakes.

It is necessary to calculate according to the rules that are prescribed in the Regulations on the specifics of the procedure for calculating average wages, approved by Resolution No. 922 of December 24, 2007.

The calculation formula looks like this:

Accruals for the billing period/Days worked for this period

Here is a step-by-step algorithm for calculating the average salary during a business trip.

Step 1: Determine your billing period

This is 12 months before the beginning of the month in which the employee went on a business trip. For example, if a business trip began on March 5, 2019, then the billing period is the period from March 1, 2021 to February 28, 2021.

If the employee started working less than a year ago, you need to take the months worked. And if a person is sent on a business trip immediately after being hired, that is, in the same month, then the billing period is the interval from the first day of work to the first day of the business trip (clause 7 of the Regulations). Well, if an employee is sent on a business trip on the first day of work, then he must be paid based on his salary (clause 8 of the Regulations).

When should travel allowances be paid by law?

/ / / , A business trip is a great opportunity not only to earn more money, but also to see another city or country. The main advantage of this type of work is that all costs are paid by the company that sent its subordinate on the trip, and the payment of travel allowances is an adequate and self-evident issue that worries many employees.

Conflicts often arise regarding the components on the basis of which the calculation is made and, of course, the timing of receiving money.

Contents of the article

As a rule, a business trip is an initiative of the employer and therefore must be fully provided for by him. The manager is obliged to retain his subordinate’s workplace and compensate for all incurred costs associated with travel and work in another city.

The director's responsibilities include:

- pay daily allowances (the employee’s income is recalculated taking into account the increase in pay);

- pay for accommodation, meals and other additional services for the entire period of stay in another city;

- pay wages (the amount is calculated for all subsequent days of stay and work outside the company’s territory, including time spent on travel);

- compensate for other costs associated with work processes (travel, translation services, restaurant services, etc.).

Important! Payment of travel expenses does not include payment for housing and an increase in daily earnings in the event that the employee can return to his home at the end of his work.

According to the standards specified in Article 168 of the Labor Code of the Russian Federation, the employer must pay all expenses associated with travel and stay in another city. For this purpose, a special travel invoice is drawn up, which lists in detail all possible expenses allowed by the company. For example, the document may indicate that the employer undertakes to pay for the travel of his subordinate after the fact, but the employee can only use a certain type of transport or the cost of the ticket should not exceed the permissible amount.

How to take into account per diem expenses when paying taxes?

The employer does not withhold personal income tax on daily allowances that do not exceed the limit, and also does not reflect them in tax returns.

On funds exceeding the limits, it is necessary to calculate tax and contributions to the Pension Fund and the Social Insurance Fund (with the exception of contributions for injuries). They are subject to reflection in forms 2-NDFL and 6-NDFL.

Table 2. Taxation of daily allowances in excess of the norm in 2020:

Calculations must be made at the end of the month the employee submits an advance report based on the results of the business trip. All supporting expenses incurred in connection with the performance of the official assignment are attached to it. This:

- any document confirming the rental of residential premises (hotel bill, payment receipts, agreement with a private person), which must indicate the number of days of stay in this premises and the cost of one day of accommodation;

- travel documents issued to a business traveler along the route to the destination and back (tickets, coupons, etc.);

- other documents confirming expenses incurred in connection with the trip.

According to the letter of the Federal Tax Service dated December 3, 2009 No. 3-2-09/362, the expenditure of daily allowances does not need to be documented.

Amounts of daily allowance paid in excess of the established limit are subject to personal income tax and contributions. The employer is obliged to calculate them and pay them to the budget. If this requirement is not met, the tax authority applies penalties in the amount of 20% of the lost amount of tax and contributions (Articles 122, 123 of the Tax Code of the Russian Federation).