The optimal way to achieve economic efficiency from the work of a hired team is rhythmic and continuous work throughout the working day or shift. Interruptions and difficulties arise when the smooth flow of the process is interrupted for unforeseen good, or not so good, reasons. If the failure occurred due to the sluggishness or negligence of management, then the employee must understand that this is regarded as forced downtime due to the fault of the employer.

What is simple

Important! Please keep in mind that:

- Each case is unique and individual.

- A thorough study of the issue does not always guarantee a positive outcome. It depends on many factors.

To get the most detailed advice on your issue, you just need to choose any of the options offered:

- Use the online chat in the lower corner of the screen.

- Call: Federal number: +7 (800) 511-86-74

Everything related to working hours and rest periods is set out in chapters 15-19 of the Labor Code of the Russian Federation. Unfortunately, there is no clear definition of downtime in any of them. A brief description of what a downtime is and how to behave if it occurs is mentioned in Art. 72.2 TK. The meager clarification that this is a temporary suspension of production for various reasons, most often of an objective and irresistible nature, does not make it possible to unambiguously attribute this period to either working time or rest time.

The amount of payment for downtime depends heavily on proof of fault for its occurrence. That is why almost all employers strive, if not to shift responsibility onto the employee, then at least to prove that nothing depended on management. But judicial practice in this regard is inexorable. They include economic, technical, and organizational causes of production failure as the employer's fault. Circumstances independent of the will of the parties, most often, are recognized only as force majeure in the form of catastrophes, disasters or military actions, the presence of which is confirmed by documents from the Chamber of Commerce and Industry.

The courts also blame the management body of the company for the lack of full production capacity due to the economic crisis.

Indirectly, the code determines the form of liability of the director for downtime that arises as a result of insufficiently active and conscientious performance of the manager’s duties. Thus, Article 195 of the Labor Code allows the general meeting of participants to bring a negligent leader to disciplinary liability, and even dismiss him on this basis.

Causes and classification of downtime at work

In the understanding of regulations, downtime at an enterprise is an absolute or partial suspension of activities for a short or long period. The reasons for downtime can be external, caused by force majeure, or internal, related to the organization of work of a business entity.

Article 72.2 of the Labor Code of the Russian Federation identifies among the reasons:

- technological – change of technological process, modernization of fixed assets or reorganization of production cycles, introduction of new equipment;

- economic - a drop in consumer demand for manufactured products, supply interruptions due to financial problems of the enterprise and contractors, the publication of regulations prohibiting activities under old conditions or making production unprofitable;

- organizational – erroneously or untimely decisions that determine the activity on the provision of raw materials, equipment, termination or extension of contracts and agreements;

- technical – equipment malfunctions, breakdowns of office equipment, disconnection from power and heat supply sources, protracted major repairs and unforeseen decommissioning of fixed assets for modernization and routine repairs.

What is considered downtime due to the employer's fault? A simple situation - a power outage, which led not only to the shutdown of equipment, but also to the destruction of office equipment, can be attributed to circumstances beyond the control of the parties. But you can install uninterrupted devices and organize work for a short period.

Downtime at work can affect an individual, a group of people, a department, a branch or an entire company. The employee should report any breakdown of equipment that makes further performance of duties impossible to management in writing or orally. Failure to comply is equivalent to a violation of labor regulations, is punishable by disciplinary action and the specific employee is not paid downtime at the expense of the employer.

Decor

Worsening external economic factors, the destructive influence of natural disasters, or technological problems that make it impossible to continue working as usual, in themselves bring losses. In this case, management will be able to reduce costs if they correctly document the time of forced downtime due to the fault of the employer:

- Having received notification, in any form, about conditions that have stopped work, you need to make a decision to declare downtime as quickly as possible.

- Identify those at fault (the employee, the employer himself or force majeure);

- Determine the terms; if this is impossible, then the suspension is declared indefinite;

- Resolve the issue of the presence of workers affected by downtime at production;

- Issue an order, it must list all the above details, and also, preferably, explain the form and amount of payment (it depends on the reasons and those responsible);

- Under signature, familiarize the entire team or that part of it that is left without work with it.

- Offer affected employees to transfer to vacant positions while maintaining the average salary for the entire period of downtime.

- Transfer some employees to vacant positions not lower than their previous qualifications, without their consent, but for a period of no more than a month, Art. 72.2 TK.

- Within three days, notify the employment service, clause 2 of Art. 25 of Law 1032-1 Federal Law. This must be done if the entire enterprise has completely stopped work; being late can cost a fine of up to 5,000 rubles, Art. 19.7 Code of Administrative Offences.

- Enter notes about downtime in the working time sheet, form T-13. The accounting code is selected depending on the circumstances: the employer’s fault is indicated by the abbreviation RP or the numerical code 31.

- If the inability to work does not affect all employees, then this must be recorded in free-form acts, and then reflected in the time sheet.

The faster and more carefully the employer prepares all the documents, the more money the company will save on wages. If employees are not notified, and their payment is calculated in a reduced amount, then contacting the labor inspectorate is the least that can threaten the enterprise. It is also illegal to require employees to perform their duties during downtime, even when they are at work all day.

The greatest damage from downtime is caused to the enterprise, regardless of whether the employer is at fault.

The employer does not want to issue idle time

The likelihood that management will refuse to take measures to formalize downtime is very low. After all, it is the enterprise that suffers most from the suspension of production. Another issue is that unscrupulous bosses may try to convince workers to go on unpaid leave during economic difficulties.

It happens that this policy is implemented by a hired company manager, trying to hide the results of short-sighted decisions in the management of the enterprise. The team can protect itself by writing an appeal to the founders with a request to bring the head of the enterprise to disciplinary liability for allowing forced downtime due to the fault of the employer, Article 195 of the Labor Code of the Russian Federation. It can be handed over personally to the head of the meeting of participants or shareholders, or through the mediation of a trade union.

The arbitrariness of management, with the inaction of the management body of a commercial organization, can be suppressed by government agencies for supervision in the field of labor legislation: the labor inspectorate, the prosecutor's office and even the court. You just need to remember that government agencies will require evidence that workers are at work and cannot work fully due to the fault of the employer. Drawing up a collective complaint will be very helpful in protecting your own rights.

During downtime due to the fault of the employer, the employee has the right to count on 2/3 of the salary, minimum, art. 157 TK.

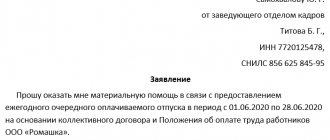

How to write an application

When downtime occurs as a result of global causes (economic shocks, disasters, etc.), management does not need additional notification. But there are situations when management simply cannot find out about troubles until subordinates report to them. This must be done if the breakdown is local, an accident occurs in a separate area, there are no raw materials or materials for work, equipment or the entire production is de-energized. Notification will also be required if downtime began due to the fault of an employee.

The application for forced downtime due to the fault of the employer does not have a legally established form, and therefore is drawn up arbitrarily. However, it would be more correct to title such a document “Report.” Whatever name you choose, you need to write down several very important points inside:

- in whose name the document is drawn up indicating the position, full name and name of the enterprise;

- description of what happened;

- time of first stop of work;

- causes and alleged culprits;

- It is mandatory to have the employee’s signature, as well as the date and time of handing over the paper to immediate superiors.

You can view an example of an application on our website (

)

To be fair, it must be said that the Labor Code of the Russian Federation does not oblige employees to declare the beginning of downtime in writing. Drawing up a paper, it is better to do it in two copies, will be more correct and calmer for the employee. Such actions are all the more relevant if continuation of work is impossible, since it poses a danger to life and health. After all, Art. 214 of the Labor Code simply obliges all employees to report this to senior management.

A notification handed over to management against signature will help the worker further prove his innocence, as well as confirm the fact of a timely contact with the employer.

Continuing to work in conditions hazardous to the health of the employee or other members of the team, without reporting this to superiors or after it, is illegal, Art. 214 TK.

Calculation of downtime and absenteeism at the expense of the employer 2019-2020

Labor Code of the Russian Federation (as amended on July 27, 2010)

Article 157. Payment for downtime

Downtime (Article 72_2 of this Code) due to the fault of the employer is paid in the amount of at least two-thirds of the employee’s average salary (as amended by Federal Law No. 90-FZ of June 30, 2006 - see. previous edition).

Downtime for reasons beyond the control of the employer and employee is paid in the amount of at least two-thirds of the tariff rate, salary (official salary), calculated in proportion to the downtime (as amended, entered into force on October 6, 2006 by the Federal Law of June 30 2006 N 90-FZ, see previous edition).

Downtime caused by the employee is not paid.

About the beginning of downtime caused by equipment breakdown and other reasons that make it impossible for the employee to continue to perform his job functions, the employee is obliged to inform his immediate supervisor or another representative of the employer (part additionally included on October 6, 2006 by Federal Law of June 30, 2006 N 90- Federal Law).

If creative workers of the media, cinematography organizations, television and video crews, theaters, theatrical and concert organizations, circuses and other persons involved in the creation and (or) performance (exhibition) of works, in accordance with the lists of works, professions, positions these workers, approved by the Government of the Russian Federation taking into account the opinion of the Russian Tripartite Commission for the Regulation of Social and Labor Relations, for any period of time do not participate in the creation and (or) performance (exhibition) of works or do not perform, then the specified time is not downtime and may be paid in the amount and manner established by a collective agreement, a local regulatory act, an employment contract (part additionally included on October 6, 2006 by Federal Law of June 30, 2006 N 90-FZ; as amended, entered into force on March 30, 2008 Federal Law of February 28, 2008 N 13-FZ, see previous edition).

Article 220. Guarantees of the right of workers to work in conditions that meet labor protection requirements

The state guarantees workers the protection of their right to work in conditions that meet labor protection requirements.

The working conditions provided for in the employment contract must comply with labor protection requirements.

During the suspension of work in connection with the suspension of activities or a temporary ban on activities due to violation of state regulatory requirements for labor protection through no fault of the employee, his place of work (position) and average earnings are retained. During this time, the employee, with his consent, may be transferred by the employer to another job with remuneration for the work performed, but not lower than the average earnings for the previous job (as amended as amended on August 12, 2005 by Federal Law of May 9, 2005 N 45-FZ; supplemented on October 6, 2006 by Federal Law of June 30, 2006 N 90-FZ - see previous edition).

If an employee refuses to perform work in the event of a danger to his life and health (except for cases provided for by this Code and other federal laws), the employer is obliged to provide the employee with another job while such danger is eliminated (part supplemented from August 12, 2005 by the Federal Law of May 9, 2005 N 45-FZ; as amended, put into effect on October 6, 2006 by Federal Law of June 30, 2006 N 90-FZ - see previous edition).

If providing another job for objective reasons is impossible for an employee, the employee’s downtime until the danger to his life and health is eliminated is paid by the employer in accordance with this Code and other federal laws.

If the employee is not provided with personal and collective protective equipment in accordance with established standards, the employer does not have the right to require the employee to perform work duties and is obliged to pay for downtime arising for this reason in accordance with this Code.

An employee’s refusal to perform work in the event of a danger to his life and health due to violation of labor protection requirements or from performing heavy work and work with harmful and (or) dangerous working conditions not provided for in the employment contract does not entail bringing him to disciplinary liability .

In the event of harm to the life and health of an employee during the performance of his job duties, compensation for said harm is carried out in accordance with federal law.

In order to prevent and eliminate violations of state regulatory requirements for labor protection, the state ensures the organization and implementation of state supervision and control over their compliance and establishes the responsibility of the employer and officials for violation of these requirements (as amended, entered into force on October 6, 2006 by the Federal Law of June 30, 2006 N 90-FZ, see previous edition).

Article 139. Calculation of average wages

For all cases of determining the amount of average wages (average earnings) provided for by this Code, a uniform procedure for its calculation is established (part supplemented from October 6, 2006 by Federal Law of June 30, 2006 N 90-FZ - see the previous edition).

To calculate the average salary, all types of payments provided for by the remuneration system are taken into account, applied by the relevant employer, regardless of the sources of these payments (as amended by Federal Law of June 30, 2006 N 90-FZ - see .previous edition).

In any mode of operation, the average salary of an employee is calculated based on the salary actually accrued to him and the time he actually worked for the 12 calendar months preceding the period during which the employee retains his average salary. In this case, a calendar month is considered to be the period from the 1st to the 30th (31st) day of the corresponding month inclusive (in February - to the 28th (29th) day inclusive) (as amended, entered into force on October 6 2006 Federal Law of June 30, 2006 N 90-FZ - see previous edition).

Average daily earnings for vacation pay and compensation for unused vacations are calculated for the last 12 calendar months by dividing the amount of accrued wages by 12 and by 29.4 (average monthly number of calendar days) (as amended as amended on October 6, 2006 Federal Law of June 30, 2006 N 90-FZ, see previous edition).

The average daily earnings for payment of vacations granted in working days, in cases provided for by this Code, as well as for payment of compensation for unused vacations, are determined by dividing the amount of accrued wages by the number of working days according to the calendar of a six-day working week.

A collective agreement or local regulatory act may provide for other periods for calculating average wages, if this does not worsen the situation of workers (part supplemented from October 6, 2006 by Federal Law of June 30, 2006 N 90-FZ - see previous edition) .

The specifics of the procedure for calculating average wages established by this article are determined by the Government of the Russian Federation, taking into account the opinion of the Russian Tripartite Commission for the Regulation of Social and Labor Relations.

Article 394. Making decisions on labor disputes regarding dismissal and transfer to another job

If dismissal or transfer to another job is recognized as illegal, the employee must be reinstated in his previous job by the body considering the individual labor dispute.

The body considering an individual labor dispute makes a decision to pay the employee the average salary for the entire period of forced absence or the difference in earnings for the entire period of performing lower-paid work.

At the request of the employee, the body considering an individual labor dispute may limit itself to making a decision to recover in favor of the employee the compensation specified in part two of this article.

If the dismissal is declared illegal, the body considering the individual labor dispute may, at the request of the employee, decide to change the wording of the grounds for dismissal to dismissal of one’s own free will.

If the wording of the grounds and (or) reasons for dismissal is recognized as incorrect or not in accordance with the law, the court considering an individual labor dispute is obliged to change it and indicate in the decision the grounds and reasons for dismissal in strict accordance with the wording of this Code or other federal law with reference to the relevant article , part of an article, paragraph of an article of this Code or another federal law.

If the dismissal is declared illegal and the term of the employment contract has expired at the time the dispute is being considered by the court, then the court considering the individual labor dispute is obliged to change the wording of the grounds for dismissal to dismissal upon expiration of the employment contract.

If, in the cases provided for by this article, after declaring the dismissal illegal, the court makes a decision not to reinstate the employee, but to change the wording of the grounds for dismissal, then the date of dismissal must be changed to the date of the court’s decision. If, by the time the said decision is made, the employee, after a contested dismissal, has entered into an employment relationship with another employer, the date of dismissal must be changed to the date preceding the day of commencement of work for this employer.

If the incorrect formulation of the grounds and (or) reasons for dismissal in the work book prevented the employee from taking another job, then the court decides to pay the employee average earnings for the entire period of forced absence.

In cases of dismissal without legal grounds or in violation of the established procedure for dismissal or illegal transfer to another job, the court may, at the request of the employee, make a decision to recover in favor of the employee monetary compensation for moral damage caused to him by these actions. The amount of this compensation is determined by the court.

Decree of the Government of the Russian Federation dated December 24, 2007 No. 922

In accordance with Article 139 of the Labor Code of the Russian Federation, the Government of the Russian Federation decides:

1. Approve the attached Regulations on the specifics of the procedure for calculating average wages.

2. The Ministry of Health and Social Development of the Russian Federation shall provide clarifications on issues related to the application of the Regulations approved by this Resolution.

3. Decree of the Government of the Russian Federation of April 11, 2003 No. 213 “On the specifics of the procedure for calculating average wages” (Collected Legislation of the Russian Federation, 2003, No. 16, Art. 1529) shall be declared invalid.

Chairman of the Government of the Russian Federation V. ZUBKOV

Approved by Decree of the Government of the Russian Federation of December 24, 2007 N 922

Regulations on the specifics of the procedure for calculating average wages

1. This Regulation establishes the specifics of the procedure for calculating average wages (average earnings) for all cases of determining its size provided for by the Labor Code of the Russian Federation (hereinafter referred to as average earnings).

2. To calculate average earnings, all types of payments provided for by the remuneration system and applied by the relevant employer are taken into account, regardless of the sources of these payments. Such payments include:

a) wages accrued to the employee at tariff rates, salaries (official salaries) for the time worked;

b) wages accrued to the employee for work performed at piece rates;

c) wages accrued to the employee for work performed as a percentage of revenue from sales of products (performance of work, provision of services), or commission;

d) wages paid in non-monetary form;

e) monetary remuneration (salary) accrued for hours worked to persons holding government positions in the Russian Federation, government positions in constituent entities of the Russian Federation, deputies, members of elected local government bodies, elected officials of local government, members of election commissions operating on a permanent basis;

f) salary accrued to municipal employees for time worked;

g) fees accrued in editorial offices of mass media and art organizations for employees on the payroll of these editorial offices and organizations, and (or) payment for their labor, carried out at the rates (rates) of author's (production) remuneration;

h) wages accrued to teachers of primary and secondary vocational education institutions for hours of teaching work in excess of the established and (or) reduced annual teaching load for the current academic year, regardless of the time of accrual;

i) wages, finally calculated at the end of the calendar year preceding the event, determined by the remuneration system, regardless of the time of accrual;

j) allowances and additional payments to tariff rates, salaries (official salaries) for professional excellence, class, length of service (work experience), academic degree, academic title, knowledge of a foreign language, work with information constituting state secrets, combination of professions (positions) , expanding service areas, increasing the volume of work performed, team management and others;

k) payments related to working conditions, including payments determined by regional regulation of wages (in the form of coefficients and percentage bonuses to wages), increased wages for hard work, work with harmful and (or) dangerous and other special conditions labor, for night work, payment for work on weekends and non-working holidays, payment for overtime work;

l) remuneration for performing the functions of a class teacher to teaching staff of state and municipal educational institutions;

m) bonuses and rewards provided for by the remuneration system;

o) other types of wage payments applicable to the relevant employer.

3. To calculate average earnings, social payments and other payments not related to wages (material assistance, payment for the cost of food, travel, training, utilities, recreation, etc.) are not taken into account.

4. The calculation of the average salary of an employee, regardless of his mode of work, is based on the salary actually accrued to him and the time actually worked by him for the 12 calendar months preceding the period during which the employee retains his average salary. In this case, a calendar month is considered to be the period from the 1st to the 30th (31st) day of the corresponding month inclusive (in February - to the 28th (29th) day inclusive).

Average daily earnings for vacation pay and compensation for unused vacations are calculated for the last 12 calendar months.

5. When calculating average earnings, time is excluded from the calculation period, as well as amounts accrued during this time, if:

a) the employee retained his average earnings in accordance with the legislation of the Russian Federation, with the exception of breaks for feeding the child provided for by the labor legislation of the Russian Federation;

b) the employee received temporary disability benefits or maternity benefits;

c) the employee did not work due to downtime due to the fault of the employer or for reasons beyond the control of the employer and employee;

d) the employee did not participate in the strike, but due to this strike he was not able to perform his work;

e) the employee was provided with additional paid days off to care for disabled children and people with disabilities since childhood;

f) the employee in other cases was released from work with full or partial retention of wages or without payment in accordance with the legislation of the Russian Federation.

6. If the employee did not have actually accrued wages or actually worked days for the billing period or for a period exceeding the billing period, or this period consisted of time excluded from the billing period in accordance with paragraph 5 of these Regulations, the average earnings are determined based on from the amount of wages actually accrued for the previous period, equal to the calculated one.

7. If the employee did not have actually accrued wages or actually worked days for the billing period and before the start of the billing period, the average earnings are determined based on the amount of wages actually accrued for the days actually worked by the employee in the month of occurrence of the event that is associated with the retention average earnings.

8. If the employee did not have actually accrued wages or actually worked days for the billing period, before the start of the billing period and before the occurrence of an event associated with maintaining the average earnings, the average earnings are determined based on the tariff rate established for him, salary (official salary ).

9. When determining average earnings, average daily earnings are used in the following cases:

to pay for vacations and pay compensation for unused vacations; for other cases provided for by the Labor Code of the Russian Federation, except for the case of determining the average earnings of workers for whom summarized recording of working time is established.

The average employee's earnings are determined by multiplying the average daily earnings by the number of days (calendar, working) in the period subject to payment.

Average daily earnings, except in cases of determining average earnings for vacation pay and payment of compensation for unused vacations, are calculated by dividing the amount of wages actually accrued for days worked in the billing period, including bonuses and remunerations taken into account in accordance with paragraph 15 of these Regulations, by the number of days actually worked during this period.

10. Average daily earnings for payment of vacations provided in calendar days and payment of compensation for unused vacations are calculated by dividing the amount of wages actually accrued for the billing period by 12 and by the average monthly number of calendar days (29.4). If one or more months of the billing period are not fully worked out or time is excluded from it in accordance with paragraph 5 of these Regulations, the average daily earnings are calculated by dividing the amount of actually accrued wages for the billing period by the sum of the average monthly number of calendar days (29.4) , multiplied by the number of complete calendar months, and the number of calendar days in incomplete calendar months.

The number of calendar days in an incomplete calendar month is calculated by dividing the average monthly number of calendar days (29.4) by the number of calendar days of this month and multiplying by the number of calendar days falling on the time worked in this month.

11. Average daily earnings for payment of vacations provided in working days, as well as for payment of compensation for unused vacations, are calculated by dividing the amount of actually accrued wages by the number of working days according to the calendar of a 6-day working week.

12. When working on a part-time basis (part-time, part-time), the average daily earnings to pay for vacations and pay compensation for unused vacations are calculated in accordance with paragraphs 10 and 11 of these Regulations.

13. When determining the average earnings of an employee for whom a summarized recording of working time has been established, except for the cases of determining the average earnings for paying for vacations and paying compensation for unused vacations, the average hourly earnings are used.

Average hourly earnings are calculated by dividing the amount of wages actually accrued for hours worked in the billing period, including bonuses and remunerations taken into account in accordance with paragraph 15 of these Regulations, by the number of hours actually worked during this period.

Average earnings are determined by multiplying average hourly earnings by the number of working hours according to the employee’s schedule in the period subject to payment.

14. When determining the average earnings for payment of additional educational leaves, all calendar days (including non-working holidays) falling during the period of such leaves provided in accordance with the educational institution’s certificate are subject to payment.

15. When determining average earnings, bonuses and remuneration are taken into account in the following order:

monthly bonuses and rewards - actually accrued in the billing period, but no more than one payment for each indicator for each month of the billing period;

bonuses and remunerations for a period of work exceeding one month - actually accrued in the billing period for each indicator, if the duration of the period for which they are accrued does not exceed the duration of the billing period, and in the amount of the monthly part for each month of the billing period, if the duration of the period for which they are accrued exceeds the duration of the billing period;

remuneration based on the results of work for the year, a one-time remuneration for length of service (work experience), other remunerations based on the results of work for the year, accrued for the calendar year preceding the event - regardless of the time the remuneration was accrued.

If the time falling within the billing period is not fully worked or time is excluded from it in accordance with paragraph 5 of these Regulations, bonuses and remunerations are taken into account when determining average earnings in proportion to the time worked in the billing period, with the exception of bonuses accrued for actual hours worked. time in the billing period (monthly, quarterly, etc.).

If an employee has worked an incomplete working period for which bonuses and rewards are accrued, and they were accrued in proportion to the time worked, they are taken into account when determining average earnings based on the amounts actually accrued in the manner established by this paragraph.

16. When tariff rates, salaries (official salaries), and monetary remuneration increase in an organization (branch, structural unit), the average earnings of employees increase in the following order:

if the increase occurred during the billing period, payments taken into account when determining average earnings and accrued in the billing period for the period of time preceding the increase are increased by coefficients that are calculated by dividing the tariff rate, salary (official salary), monetary remuneration established in the month of occurrence the case associated with maintaining average earnings, on tariff rates, salaries (official salaries), monetary remuneration established in each month of the billing period;

if the increase occurred after the billing period before the occurrence of an event that is associated with maintaining the average earnings, the average earnings calculated for the billing period increase;

if the increase occurred during the period of maintaining average earnings, part of the average earnings is increased from the date of increase in the tariff rate, salary (official salary), monetary remuneration until the end of the specified period.

When increasing average earnings, tariff rates, salaries (official salaries), monetary remuneration and payments established to tariff rates, salaries (official salaries), monetary remuneration in a fixed amount (interest, multiple), with the exception of payments established to tariff rates, are taken into account. salaries (official salaries), monetary remuneration in a range of values (percentage, multiple).

When average earnings increase, payments taken into account when determining average earnings, established in absolute amounts, do not increase. 17. The average earnings determined to pay for the time of forced absence are subject to increase by a coefficient calculated by dividing the tariff rate, salary (official salary), monetary remuneration established for the employee from the date of actual start of work after his restoration to his previous job, by the tariff rate, salary (official salary), monetary remuneration established in the billing period, if during the forced absence in the organization (branch, structural unit) tariff rates, salaries (official salaries), monetary remuneration were increased.

At the same time, in relation to payments established in a fixed amount and in an absolute amount, the procedure established by paragraph 16 of these Regulations applies.

18. In all cases, the average monthly earnings of an employee who has worked the full working hours during the billing period and fulfilled labor standards (job duties) cannot be less than the minimum wage established by federal law.

19. For persons working part-time, the average earnings are determined in the manner established by these Regulations.

How is it paid?

Art. brings certainty to the question of how forced downtime due to the fault of the employer is paid. 157 TK. The amount of payments and the fact of their implementation greatly depend on the circumstances:

| Circumstances that led to the onset of downtime. | Payment method. |

| The break in work began due to the employer’s short-sightedness (economic, organizational, etc.) | 2/3 of the average salary. |

| The failure occurred due to force majeure (accident, any form of natural disaster, consequences of sabotage actions of third parties) | 2/3 “bare” salary |

| Work stopped due to culpable actions of an employee | Not paid at all. |

The first two points, upon quick examination, are very similar, but not at all the same. For those who receive a salary consisting solely of the tariff rate, it really does not matter whose fault the problem arose. Whatever precedes the start of downtime, the team’s employees will receive the same amount of payments.

Another question is enterprises that regularly pay bonuses, allowances, and additional payments based on work results. In this case, the employer will be interested in convincing employees of their own innocence and the influence of force majeure circumstances. After all, this is precisely what will allow you to pay two-thirds of the tariff rate, and it can be very small compared to the final amount of accrual in the payroll.

The Labor Code establishes a unified approach to calculating the average salary in all cases mentioned in this document (Article 139 of the Labor Code). For example, downtime occurred in August 2021. The salary is 10,000 rubles, the monthly bonus is 50% of the salary. To simplify calculations, we can assume that the amount of accruals has not changed over the previous 12 months, then payment for 10 days of downtime will be:

(10,000+5,000)*12/12/29.3*10 days*2/3 = 3,412.97 rubles - payment for forced downtime due to the fault of the employer;

10,000/12/12/29.3*10 days*2/3 = 2275.31 rubles – the amount of payments if the suspension of work occurred for reasons beyond our control.

As you can see, the temptation to save on payments for the employer is very great, so management will insist in every possible way that they had no opportunity to influence the circumstances. If employees, against the backdrop of financial losses, have reasonable doubts about the employer’s honesty, the Labor Inspectorate or the court will help assess the seriousness of the reasons.

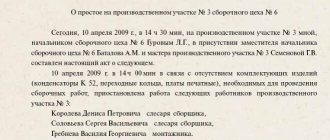

How to draw up a deed

The created simple commission draws up. The commission must include representatives of:

- company administration;

- trade union committee;

- labor collective.

They draw up a document on the company’s letterhead, certify it with signatures and register it in the journal of outgoing documentation. After this, the act becomes the basis for issuing an order.

The situation is much simpler with notifying the administration about the downtime of individual employees for various reasons. Employees are required to notify management by writing a note or notice of downtime due to the fault of the employer.

Sample:

What does the employee do?

Some workers tend to simplify the situation in the event of an unexpected interruption in work. Whatever the reason for the downtime and no matter how long it lasts (half a day or six months), the employee is obliged to be present on site every day, at the hours established by the employment contract. And although the code does not directly say this, it does not include these hours during the period of legal rest (Article 107 of the Labor Code). In this situation, the conclusion should be drawn: what is not permitted is prohibited.

To be fair, it is worth saying that the employer can mention the obligation to be present at work in the order. There he has the right to both force him to stay in place and allow him to stay at home all this time. The fact that the order does not indicate the need to be present on the territory of the enterprise will not be a permission to miss work. In the event of unauthorized leaving of the workplace or missing days as a result of unfounded conclusions, the employee should not be surprised that he will become a candidate for dismissal for absenteeism, Art. 81 TK.

The need to be present at production during forced downtime due to the fault of the employer may be dictated by:

- the likelihood of emergency situations occurring, then the team on site will be able to quickly eliminate all negative consequences or prevent them altogether;

- the possibility that the reasons for the downtime will disappear suddenly (for example, the electricity supply will be connected), and therefore the time for the start of the resumption of work cannot be predicted;

- the employer is simply not inclined to pay employees the average for their absence from work.

All employees, even if they do not have the opportunity to perform their job functions, must remain on the territory of the enterprise or its structural unit; they will be able to leave the workplace only if such relief is fixed in the downtime order or collective agreement.