Home / Labor Law / Vacation

Back

Published: 06/15/2016

Reading time: 8 min

2

8782

In most cases, the final earnings of employees of most modern enterprises include not only the salary or tariff rate established at the conclusion of the employment contract, but also many other additional payments. These can be bonuses, various allowances and compensations, additional payments and other types of monetary rewards .

One type of such additional payments is financial assistance for vacation, provided in many budgetary institutions. It is worth familiarizing yourself in more detail with the procedure for its calculation and design features.

- Legislative regulation

- Who is it entitled to and in what cases is it issued?

- Calculation procedure

- Taxation

- Procedure for registration and drawing up an application How to make an application?

How is the provision of financial assistance during the next vacation regulated (article of the Labor Code of the Russian Federation, etc.)?

The Labor Code (hereinafter referred to as the Labor Code) does not explain the concept of material assistance if it is provided when an employee goes on his next annual paid leave.

This term is used in practice and is enshrined in other legal acts, which, as a rule, are local in nature. At the same time, the regulation of such payments follows from a number of labor legislation, including the Labor Code. See the material “Regulations on the provision of financial assistance to employees” for more details.

If such assistance is not actually a social benefit and is established as a supplement to the salary and other allowances, then its regulation is carried out in accordance with Part 1 of Art. 129 Labor Code, i.e. as a component of wages. In this case, this payment is established by a local legal act or follows from departmental regulations and depends on the results of the employee’s work activity or has a fixed amount and is paid in any case when the employee goes on annual leave.

At the same time Art. 40 of the Labor Code provides for the possibility of using a collective agreement at a specific enterprise or other organization, which is concluded between representatives of the employer and the workforce. This act regulates not just labor, but social and labor relations. According to Art. 41 of the Labor Code, such an agreement, among other things, may include conditions governing the possibility of providing employees with financial assistance due to certain circumstances. In this situation, assistance is a social benefit and is provided if the employee is in need.

In addition, the regulation of such payments to a certain extent is carried out by the norms of tax legislation concerning the rules for calculating the tax base and the amounts for which insurance payments are calculated - Art. 217 and 422 of the Tax Code (hereinafter referred to as the Tax Code). On a number of issues, it makes sense to apply the practice developed by the courts. One of the most significant in regulating the issue under consideration is the Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated May 14, 2013 No. 17744/12 in case No. A62-1345/2012.

The limit of financial assistance, not subject to personal income tax and insurance contributions, is 4 thousand rubles. in year.

The rules for calculating tax and insurance contributions from financial assistance, as well as the procedure for reflecting payments in accounting, were explained by ConsultantPlus experts. Get trial access to the system and proceed to a Typical situation with a calculated example.

Read how to reflect financial assistance in 6-personal income tax here.

Terminology according to the Labor Code of the Russian Federation

In every organization, regardless of whether it is budgetary or private, there is a regulated procedure for payments, both regular and one-time. This procedure must be carried out in accordance with the provisions of the Labor Code of the Labor Code of the Russian Federation.

The articles of the Labor Code of the Russian Federation do not contain a special term to designate vacation pay paid additionally. When we say “financial assistance for vacation,” most often we mean a regular or one-time payment of funds assigned to an employee not for time worked or performance of job duties, but for another reason. In this case, to go on vacation, supported by the goodwill of the employer.

How to apply for payment of financial assistance for annual leave ?

The procedure for paying funds on such grounds falls within the competence of Art. 129 of the Labor Code of the Russian Federation, according to which the employer can provide employees, in addition to wages, with a variety of support:

- social;

- incentive

Social benefits can be assigned in connection with any event that affects the material well-being of a subordinate, including the receipt of leave. It can be prescribed once a year or several times, at the discretion of the authorities.

Is it necessary to calculate personal income tax on financial assistance for vacation ?

An incentive payment differs from a social payment in that the fact of its accrual and/or size depends on the results of the employee’s work. The amount can be a percentage of the salary (tariff rate), or it can be fixed in the Regulations on the accrual of incentive payments, differentiated depending on various success factors, for example, the absence of penalties or the presence of any outstanding indicators.

NOTE! The procedure for calculating and paying financial assistance must be enshrined in the local regulations of the organization.

Form and content of an application for financial assistance for vacation, sample

An application for financial assistance for vacation does not have a legally established form. In this regard, its form can be either free or enshrined in the internal legal act of the organization. In this case, in any case, one should not forget about compliance with the rules of office work and the requirements of labor and tax legislation, since this is important, for example, for the correct calculation of corporate income tax and insurance premiums payable, as well as withholding personal income tax from workers.

Taking into account the practice of labor relations and the rules of personnel records management, the application must contain:

- data of the addressee (the official competent to make a decision on the payment of financial assistance);

- information about the employee who sent the application (name, birth details, registration address, position held in the organization, pension insurance certificate number and taxpayer number);

- grounds for payment - the reasons why the employee asks for assistance (depending on the specifics of its establishment at the enterprise);

- indication of the amount of payment (if permitted by internal regulations);

- information about the leave granted to the employee, including its time frame and date of departure (payment is made exclusively when annual leave is granted);

- date of referral and signature of the employee.

Specific rules for drawing up such a statement should be contained in the instructions for office work in the organization, as well as in the document regulating the issues of making financial payments. You can find a sample application for assistance when going on your next vacation on our website (after downloading, you can use it as a basis when drawing up your own version).

We arrange the issuance of financial assistance

Bonuses for vacation must be provided for by the organization’s local regulations, including labor and/or collective agreements, and regulations on the payment of financial assistance to employees.

However, the employer can provide it only on the basis of an application from a specific employee. There are no special requirements when compiling it: the main thing is to indicate who is addressing, to whom and for what reason. It is mandatory to have the date and personal signature of the applicant. Obviously, such an appeal must be drawn up in advance so that the employer has time to issue an order and order to pay the appropriate amount. After all, according to the law, vacation pay is transferred no later than 3 days before the start of the vacation. And so that the worker can receive an increase, he can ask for financial assistance at the same time as asking to go on vacation.

When is payment of financial assistance for vacation made?

The employer makes financial payments for vacation in accordance with the rules approved by the internal document of the enterprise (collective agreement or regulations on remuneration). In any case, in order to make a payment, it is important to comply with a number of conditions determined by current legislation and judicial practice (for example, the appeal ruling of the Krasnoyarsk Regional Court dated September 3, 2014 in case No. 33-8545/14), according to which it is necessary:

- establishment of such a payment in a written document with legal force (or the willingness of the employer’s representative to make such a payment if there is sufficient authority to do so);

- the location of the recipient of such assistance on the staff of the organization;

- providing the employee with annual paid leave (as a rule, the payment is one-time in nature and when the leave is divided, it is paid when the first part is provided);

- the employee writing a corresponding statement;

- existence of grounds for receipt if the payment is of a social nature and is not established for all employees without exception as an additional payment to the salary.

In the case where the obligation to pay financial assistance for vacation is enshrined in a regulatory legal act and/or internal act of the organization (including a collective agreement), the employer cannot refuse to provide it.

Find out also “Is financial assistance for vacation included in the calculation of vacation pay?”

Who is entitled to a lump sum payment for vacation?

Financial support can be provided to an employee not only for vacation, but in various circumstances if the employee finds himself in a difficult financial situation, related, for example, to the restoration of damage, treatment, organization of a wedding or funeral, due to the birth of a child, etc.

Any employed person who has worked in an institution for at least 6 months has the right to count on one-time financial assistance for vacation.

One-time financial support for vacation can be paid to an employee:

- In commercial enterprises.

- At municipal departments.

- In government agencies.

In any case, the procedure for calculating and paying such assistance at the company should not contradict legislative norms, labor agreements and collective agreements.

Since the need to accrue MP is determined by the federal law of the Russian Federation, its payment is mandatory for persons working in various fields of activity, including:

- In industrial production.

- In healthcare.

- In educational institutions.

- Working in the field of culture, social assistance. science, etc.

To receive MP, the enterprise must develop internal departmental regulations on remuneration and material incentives. But even if there is no such provision, the employee still has the right to submit a petition for financial assistance addressed to the director of the enterprise. If there are available funds, the director of the enterprise can positively resolve this issue.

A one-time payment for vacation is allocated once a year, when an employee goes on annual paid leave. If an employee divides his vacation into several parts, then assistance is allocated once during the first vacation.

If an employee quits without using his annual leave, he has the right to receive only compensation for unused vacation, but he does not have the right to count on the allocation of MP, since this MP is allocated only when taking leave. The only exception may be if this is reflected in the collective agreement.

Note. When an employee goes on vacation, followed by dismissal, in order not to lose the MP, it is better to apply for leave, receive the MP and only after that - 14 days before the end of the vacation - submit an application for payment.

Example of calculating a lump sum payment for vacation

The size of the one-time payment for vacation is usually displayed in the regulations on wages and material incentives. It can be fixed or determined by calculation and agreed with the management of the enterprise.

The amount may depend on the employee’s salary and the availability of available funds in the company’s budget. In any case, the amount of assistance cannot be more than double the salary. To accrue one-time assistance, an order from the director of the enterprise must be issued.

Let's look at an example of calculating such a payment:

Let's say an enterprise HR officer receives annual leave in accordance with the vacation schedule. His official salary is 55,000 rubles. The employment agreement with the employee contains a clause on the provision of one-time assistance dedicated to vacation in the amount of 35% of the salary.

Below is an algorithm for calculating the amount of one-time vacation assistance, summarized in a table:

| Payment calculation procedure | Calculation |

| Determining the amount of a one-time payment for vacation | 55,000 x 35/100 = 19,250 rubles |

| Determination of the tax base for payment of personal income tax from one-time assistance | 19,250 – 4,000 = 15,250 rubles |

| Calculation of personal income tax and the amount of insurance payments from one-time assistance | 15,250 x 0.13 + 15,250 x 0.22 = 5337.50 rubles |

| Calculation of the one-time payment amount after deduction of tax and contributions | 19,250 – 5,337.50 = 13,912.50 rubles |

| The amount of vacation pay together with one-time assistance will be: | 55,000 + 13,912.50 = 68,912 rubles 50 kopecks |

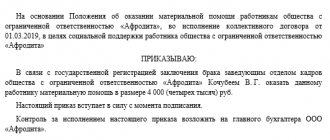

Order for financial assistance for vacation

The order of the head of the organization (as well as a branch or separate division), on the basis of which the employee is accrued the required financial assistance paid for vacation, must comply with the rules of office work. It is important to ensure that it contains:

- a list of legal acts on the basis of which the order is issued and the payment is made (taxation and calculation of insurance premiums will depend on this);

- information about the employee’s application, as well as a description of the circumstances (financial situation, going on vacation, etc.);

- an exact indication of the amount of assistance due;

- list of orders for accounting (need for accrual, timing of issuance, procedure for making payments, etc.);

- details of the internal act that allow it to be individualized (as a rule, date and serial number);

- signature of the manager or other authorized person;

- printing (if available and necessary).

In general, an order for financial assistance corresponds to the form of any other personnel order, differing only in content.

For a sample order for financial assistance, see here.

How to take into account financial assistance for vacation when calculating taxable profit? Find out the answer to this survey in ConsultantPlus by getting free trial access to the system.

What you need to know

Financial assistance from the employer is not required. And in accordance with the law, only those who have a similar clause stipulated in the enterprise’s collective agreement can apply for such benefits before going on vacation.

In local regulations, companies indicate not only the very fact of the possibility of receiving such a payment.

The following information regarding financial assistance is posted there:

- the amount of the one-time payment;

- under what conditions is financing provided?

The main reason for receiving help from an employer is writing an application. This must be done according to all the rules, so that the documentation is drawn up correctly and financial assistance is sent in accordance with the law.

Important Concepts

Completing this application requires consideration of the basic concepts that will be used during the preparation of the document:

| Term | Designation |

| Material aid | Payment in hard cash, which is established by those who make the financing |

| Vacation | A time period that involves releasing a citizen from his work duties without violating labor discipline |

| Compensation | Funds that allow reimbursement of certain expenses or losses for an individual or legal entity |

| Public sector entity | An enterprise that operates with public funds - federal or local funding |

| Tax | A collection that is carried out to collect funds for carrying out activities that bring income and profit to a citizen |

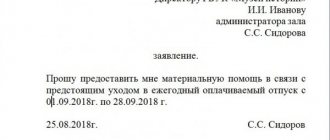

How to write an application for financial assistance for vacation (sample)

If this payment is provided by the employer, then before the start of the vacation the employee must draw up a corresponding application.

There are no specific deadlines for preparing the paper, but it must be submitted for registration before the start of the weekend. Usually they try to submit two papers at once - for leave and for financial assistance. At the same time, orders will be issued to them.

The application document will look like this:

The required structural and content parts of the form are:

| Employer information | You must indicate both the name of the company and the position, full name of the manager |

| Information about the applicant employee | His full name and position are posted here - it is important to indicate the full name |

| Document's name | It is expected to include the type of paper, in this case a statement |

| Main text of the form | It must contain a request - payment of the amount, on what basis the payment is provided and the amount of the benefit |

| Final part | It includes the date of drawing up the application - day, month and year in the form of numbers, as well as the signature of the employee - indicate the full name and place an autograph |

This concludes the preparation of the document. He should be transferred to the personnel department and there they will issue an order for him to pay a monetary benefit, if such is actually provided for by the acts of the enterprise.

Current standards

The main regulatory document in this area is the Labor Code of the Russian Federation:

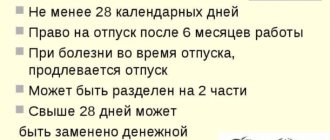

| In article 122 | This law states that every employee has the right to an annual number of days of rest - at least 28. The employer must pay for this period |

| Article 136 of the Labor Code of the Russian Federation | At the same time, the benefits for the employee are discussed in this article. It contains provisions on the order in which vacation payments are accrued and within what time frame a citizen must receive these funds. But you need to understand that this benefit is mandatory, unlike financial assistance |

| Article 135 | The same law regulates the second payment option. In it you can find information on how an employer can encourage its employees to work. And material reward is the most powerful motivator. To make it official, it must be recorded in local regulations |

| Article 144 | Provides the possibility of using other formulas for calculating wages. At the same time, the law establishes calculation rules that allow you to increase a citizen’s income, but not reduce |

Federal Law No. 79 “On the State Civil Service” establishes the possibility of guaranteed payments for vacation. This point is located in Article 50 of this legal document.

Is financial assistance available for leave upon dismissal?

Questions about the provision/non-provision of financial assistance, which is provided for vacation, often cause disputes between the parties to labor relations, as evidenced by the extensive practice of courts at various levels. The judicial authorities have generally developed a unified position regarding such disputes, which makes it possible to say definitively whether such a payment is due if a person resigns.

In particular, the Supreme Court of the Republic of North Ossetia-Alania, in its appeal ruling dated August 12, 2014 in case No. 33-943/14, clearly indicated that the plaintiffs cannot demand payment of financial assistance for their annual leave, since they were not on it , the rules for monetary compensation for vacations established in the relevant legal act do not provide for such payment. A similar position follows from the appeal ruling of the Kaliningrad Regional Court dated October 7, 2015 in case No. 33-4953/2015, according to which the plaintiff had the right to receive one-time assistance for her vacation, although she was on it for only 1 day, since the right to such payment is established by a number of regulations relating to the remuneration of state civil servants in the region.

A number of conclusions follow from the above:

- Upon dismissal from work, an employee can receive financial assistance only if it is provided for by legal acts or an employment contract.

- As a general rule, financial assistance for leave upon dismissal can be provided if the person actually goes on leave (at least for 1 day), as follows from the very name of the payment.

- Only if a legal act or agreement of the parties establishes the possibility of receiving financial assistance for vacation along with compensation for unused vacation, such a payment can be received by the resigning (dismissed) employee.

In addition, it should be taken into account that Part 2 of Art. 127 of the Labor Code provides for the possibility of providing, by agreement of the parties, a dismissed employee (upon his personal application) with unused vacations, after which the legal termination of the employment relationship occurs. In this case, financial assistance, which is paid specifically for the vacation, must be provided without fail.

Read more in the material “Financial assistance upon voluntary dismissal.”

Who will be paid?

Vacation assistance can be paid to representatives of both government, budgetary and commercial structures. In the latter, the employer is not formally obliged to reward its employees with material. And yet, the article of the Labor Code of the Russian Federation (Article 41), which sanctifies collective agreements, gives employees the right to conclude similar agreements with their superiors, in which all issues regarding wages can be discussed (compensation, benefits, financial assistance of various types). According to Art. 135 of the Labor Code, commercial enterprises are allowed to adopt local acts on the payment of financial assistance in various situations (this includes vacation).

Important! According to Art. 57 of the Labor Code of the Russian Federation, financial assistance can be provided not only by a collective, but also by an individual agreement with an employee.

Unlike citizens working in non-state institutions, public sector employees (scientific, medical, cultural, social, educational employees) are more protected by law in terms of additional payments. An increase in their vacation pay in the form of financial assistance is mandatory and does not depend on the results of work or the functions performed by the employee.

According to Art. 135 of the Labor Code of the Russian Federation, additional payments (including financial assistance), together with local acts of the institution, are also established by the norms of federal legislation.

Separately, it is worth noting the category of employees of local governments and government agencies (regional and federal levels). For them, the Labor Code contains Art. 144, from which it follows that when paying representatives of the above structures, not only the Labor Code, but also other regulations are applied. These include the Law “On State and Civil Service”, which clearly states the right of employees to receive additional vacation payments (clause 6, part 5, article 50 of Federal Law No. 79).

Article 50. Remuneration of civil servants (Federal Law No. 79)

Important! This type of payment is applicable only to the main vacation or to one of its parts, that is, if the employee’s vacation is divided into two periods, he can receive financial assistance only for one of them (usually the first).

Otherwise, any employee of a state budgetary institution who:

- worked continuously for more than six months at this enterprise;

- goes on basic annual leave;

- I wrote and submitted an application for financial assistance in advance along with an application for vacation.

Please note that this financial support does not occur automatically when going on vacation, but based on the employee’s written application.

In cases where an employee intends to resign after a vacation, has not worked the required period of 6 months, or is on maternity leave, payment of financial assistance is not made.

Results

Thus, financial assistance when providing the next annual paid leave is paid in accordance with a local legal act or (in some cases) on the basis of regulatory legal acts (for example, in the case of municipal or state civil servants). It may take the form of a social benefit and depend on the occurrence of certain circumstances or act as a component of the salary paid in any case to the employee when going on vacation. As a general rule, such assistance can be provided only if you are actually on vacation, therefore, if you quit your job and receive compensation for unused vacations, it is impossible to receive it.

Sources:

- Tax Code of the Russian Federation

- Labor Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Key points of the question

Financial assistance from the employer is exclusively voluntary payment. And in this case, it is possible to obtain additional funding for the vacation. Initially, you should consider the rules that are prescribed in the regulatory documents of the organization - for example, in the collective agreement.

If there is data on payments there, then you can perform the remaining steps of the algorithm. Despite the fact that payments are not regulated in size by federal law, there are certain rules in accordance with which this procedure is carried out.

Payment is processed on the basis of full compliance with the documentary circulation. Since these payments are accounted for and taxes and insurance premiums can be paid on them.

Based on this, responsibility falls on both the employee - who needs to draw up documents on time, and the employer - who has to complete the paperwork in full.

Conditions of registration

In order to receive financial assistance, you must fill out an application for this type of financing. There is no legally established document. Therefore, the paper will be compiled on a completely free basis.

You can use this version of the document:

The paper must consist of several structural parts:

| Information about the employer, manager and employee-applicant | — |

| Please provide assistance | Indicating the amount, duration of leave, and grounds for issuing such assistance |

| Final part | Contains information about the date the paper was filled out and the applicant’s signature |

The next step is to fill out an order for payment of funds. It has this form:

Budgetary institutions

State organizations that are financed from the budget can count on full provision of material assistance. In this case, the procedure for providing payments is regulated at the legislative level.

The algorithm itself will be the same as in the case of other organizations:

| Applying for assistance | This must be done before the start of your vacation - it is best to apply for vacation and assistance at the same time |

| Drawing up an order | The employer accepts the papers and, based on them, if funds are available, calculates the payment |

| Getting funding | Payment is usually made at the same time as vacation funds are issued. |

To whom and when is it paid?

Financial assistance can be paid for treatment or recovery in a sanatorium. It is often issued on the occasion of the birth of a child, the death and funeral of a close relative, or the personal wedding of an employee.

It is often paid to employees on vacation as financial support. Such assistance performs a motivational function. It encourages subordinates to work more productively and efficiently.

Financial assistance for annual paid leave is provided to citizens who need it. The employer personally decides who will receive financial assistance for the vacation. But there are general rules by which an employee is assigned a monetary payment.

The general rules are given below:

- the possibility of providing financial assistance does not depend on the position of the subordinate and the volume of tasks he performs;

- Payments are made to those employees who have worked for the company for at least six months. It is after this period that the subordinate has the right to go on basic leave;

- such financial support is provided once a year;

- assistance is paid at the request of the employee, expressed in the form of a written application addressed to the head of the company;

- the amount of funds is determined by the employer personally.

The following categories of employees cannot apply for financial assistance:

- employees who take leave with subsequent dismissal;

- subordinates who joined the company less than 6 months ago. They are not entitled to vacation. Accordingly, financial support that coincides with this event cannot be paid either;

- women taking maternity and child care leave. Expectant or new mothers are entitled by law to other types of benefits.

Writing example

If the company does not have a letterhead, then it is worth asking the accounting department or the manager’s secretary for an example of such a document. This will help you avoid making serious mistakes. A sample application for financial assistance for vacation, completed in free form, is given below.

To the Director of LLC "Vkusnyashka"

senior sales manager

Vasilyeva Victoria Alexandrovna

Statement

In connection with the upcoming annual leave from December 2 to December 29, 2019 and in accordance with the collective agreement, I ask you to provide me with financial assistance in the amount of 50% of my salary.

11/27/2019 (signature) V.A. Vasilyeva

Expert opinion

Mikhailov Vladislav Ivanovich

Lawyer with 6 years of experience. Specializes in family law. Knows everything about the law.

The deadline for filing an application for financial assistance for vacation is not established at the legislative level. Therefore, an employee can provide such a document to management at any time.

It's fast and free!

Dear readers! To solve your problem right now, get a free consultation

— contact the duty lawyer in the online chat on the right or call:

How to calculate the payment amount?

The amount of financial assistance is usually specified in the collective agreement.

It can be specified as a specific amount of money or as a percentage of wages. Also, financial support is sometimes determined in proportion to the time worked by the employee. A similar calculation procedure makes sense when paying assistance to subordinates who were employed by the company less than six months ago and are entitled to early leave.

For employees of enterprises financed from the state budget, the amount of financial assistance for vacation is fixed by Order of the Ministry of Labor of Russia No. 163N and should be equal to two monthly salaries. Many employees are interested in whether financial support for vacation is taxable. It all depends on the amount of financial assistance.

If the payment does not exceed 4,000 rubles per year, then it is not subject to personal income tax. If financial assistance is more than 4,000 rubles, then taxes and insurance premiums are paid on it. This is stated in Articles 217 and 422 of the Tax Code of Russia. There are also types of financial support for employees that are subject to personal income tax in a different manner.

Taxes are not paid on financial aid if it is provided in the following cases:

- for payment of medical services confirmed by documents;

- persons affected by a natural disaster or emergency;

- for pensioners upon the death of a family member;

- a citizen entitled to receive targeted social assistance paid from extra-budgetary and budgetary funds;

- persons affected by the terrorist attack.