About 20 years ago, pension savings were divided into savings and insurance parts. Previously, deductions that were withheld from salaries were used to pay old-age benefits. But with the advent of funded pensions, everything changed. Now additional funds are accumulated in individual accounts of investors. They can lie in both state and non-state PF. The amount of contributions from which the funded part of the pension is formed is 6% of each salary.

At the moment, funded pensions are not being replenished. This is due to the moratorium that was introduced in 2014. However, it is due to be suspended in 2021.

- 2 Who is entitled to receive funds from the funded part of the pension?

- 3 Receiving pension savings by inheritance

- 4 Where should I go?

- 5 Where to go to receive a pension

5.1 Required package of documents

- 5.2 How long to wait

Payment methods

In the laws of the Russian Federation you can find several types of payments of pension savings:

- one-time payments. The depositor receives the entire amount at once, i.e. in a single payment;

- urgent payments. Carried out monthly for a specific time (period of at least ten years);

- funded pensions. Funds are transferred monthly throughout the life of the pensioner;

- payment to heirs. A pension can be bequeathed. The heirs have the right to withdraw it from the account if the investor dies.

Pension savings are funds that are transferred to the Pension Fund during the course of a citizen’s working activity. He can do this independently or delegate the task to an employer.

Note! You can receive pension savings at your disposal only after finishing your working career.

Formula for calculating the increase

As mentioned earlier, a lump sum payment is provided if its amount does not exceed 5% of the total pension amount. Let's look at the calculations in more detail:

- The funded part of the pension must be divided by 234. This is the average number of months calculated for transferring funds (19.5 years). Let's take an arbitrary amount: 200 thousand. The monthly increase will be 200,000:234=855 rubles (rounded).

- The amount of the insurance part of the pension is 9,000 rubles. The total amount, taking into account the savings part, will be 9855 rubles.

- It is necessary to calculate what percentage of the total pension amount is the supplement. Divide 855 by 9855 and multiply by 100. The resulting percentage is 8.7.

Since 8.7% exceeds 5%, in this case a one-time payment is not allowed. But if the accumulated amount were 100 thousand, then the pensioner would receive funds in the form of an increase to the insurance pension, since the percentage would be 4.5.

Who is entitled to receive funds from the funded part of the pension?

In 2021, older investors began to become more actively interested in receiving a funded pension. This is probably due to the difficult economic situation. To receive a funded pension you need to meet only two requirements:

- have funds in a savings account at the Pension Fund or Non-State Pension Fund;

- reach retirement age.

Note! The law on raising the retirement age had no impact on the funded part of the old-age benefit. Therefore, men can receive payments at 60 years old, and women at 55 years old.

To receive a payment, only two conditions are required. But that is not all. It is also important to choose the method of receiving payments: a lump sum, for a certain period or until the end of your life. It all depends on the conditions. Lifetime or term payments can be received by a person who:

- has the required work experience - from 11 years for 2021;

- accumulated pension points in sufficient quantities - from 18.6 for 2020 (the higher the salary, the more pension points you can get; for example, if you receive 20,000 rubles a month, 2 points will accumulate in 1 year);

- receives payments amounting to less than 5% of the amount of the age insurance pension (in this case, the funds should have been transferred to the account in the period from 2002 to 2004).

If the investor does not meet at least one of these requirements, the payment will be made in a lump sum. That is, the person will receive the entire amount at once.

Attention! Starting from 2021, the terms for payment of the funded part of the pension have changed.

Now you can withdraw money only once every 5 years. Years earlier, payments were made annually.

Types of funded pension

As mentioned earlier, regular contributions to the savings account are made through employer contributions. However, for individuals engaged in entrepreneurial activities, contributions must be personal.

The insurance pension is “compensation” to pensioners for loss of ability to work. Only elderly citizens who have previously worked can count on such a pension.

The main distinguishing feature of a funded pension is the formation of savings through contributions.

Payments of savings savings are of 3 types: urgent, unlimited, one-time.

Indefinite

Already based on the name, we can say that the presented type of pension payment is issued to a citizen during his lifetime. Due to the impossibility of determining at what age a particular person will die, the average life expectancy for the country, obtained on the basis of statistical data, is taken as the basis.

The monthly benefit amount is subject to annual adjustment.

Urgent

The word “urgent” in the pension system implies the payment of funds over a certain period, which is determined by the elderly citizen himself. However, according to the regulatory legal act, conditions regarding the term of urgent payments have been approved, namely not < 10 years.

Most pensioners prefer this type of payment, since the amount of monthly payments in shorter periods is higher than in the open-ended form.

One-time

There is another type of receiving this type of pension, which involves a lump sum (at one time) payment. However, specific categories of citizens whose age meets the requirements have the right to implement this form of payments.

Receiving pension savings by inheritance

Receiving the pension savings of an insured citizen is a situation that needs to be dealt with separately. There are some nuances here. After all, inheriting money is not possible in all cases. Heirs can claim the investor's pension if he was assigned:

- lump sum payment;

- urgent payment;

Unfortunately, if a citizen was supposed to receive a funded pension for the rest of his life, it will not be possible to receive it by inheritance.

Inheriting pension savings is the same as if you were left a house or car. It's quite simple. Before death, the investor could include savings in the will. Then the funds will go to the persons listed in it. If a will has not been drawn up, the pension will go to first-degree relatives. That is, savings will be divided between the spouse, children and parents. If there are no close relatives, the funds will go to the second-line heirs. These include brothers and sisters, grandparents, grandchildren and granddaughters. And so on.

Conditions for receiving the insurance part of the pension

The conditions for calculating insurance benefits include:

- reaching the age mark for males of at least 65 years, for females - from 60 and above;

- earned minimum insurance period – 15 years or more;

- availability of a pension coefficient of 30 points and above.

Article on the topic: How to fill out section 3 on personalized information about insured persons

In connection with the reform of pension legislation being carried out in the country, the age and coefficient indicators are increasing gradually, with the achievement of the above marks by 2024.

Certain categories of recipients may receive payments ahead of schedule. This applies to the following persons:

- workers employed in harmful or dangerous work and who have earned the length of service established by law;

- women with over 37 years of experience and men over 42 years of age, with the right to assign payment of the insurance portion according to age two years earlier.

In addition to age indicators, the insurance part of pension payments may be assigned in connection with disability or loss of a breadwinner.

The applicant receives the right to receive insurance benefits if the conditions provided for this are met, immediately upon reaching the established age limit, upon assignment of a disability group or loss of a breadwinner.

Where should I go?

To receive material funds from the testator’s pension account, the heirs should contact the Pension Fund and Non-State Pension Fund. Depending on where the deceased relative’s money was kept. When applying to a pension fund, you are required to submit a package of documents. You will need to take with you:

- death certificate of the depositor (a copy can be obtained from the registry office at the place of residence of the deceased);

- a document that confirms the existence of a family relationship between the investor and the heir.

The time to apply to the pension fund is limited to six months. As in all other situations, it is important to enter into an inheritance within six months. Otherwise you will have to go to court.

Payment calculation procedure

In order to calculate the amount that will be available for reimbursement from a funded pension, you need to know the amount that is available for receipt in a special account in the Pension Fund of the Russian Federation or a non-state pension fund - the address for applying for this information depends directly on where exactly the pension funds are located. accumulation of a potential recipient of a funded pension.

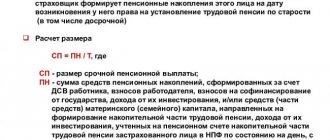

Once this amount is known, it is possible to set the monthly payment amount. The following calculation is made using the formula:

Amount of monthly payments = PN/T, where PN is the total amount of monthly savings, T is the period in which payments will be made.

The planned payment period is the period during which payments will be made to pension recipients based on statistical information on average life expectancy. Currently, this period is 20 and a half years, which in terms of months is equal to 246 months.

However, this settlement mechanism can only be used if we are talking about an urgent payment mechanism. If an application has been made for a one-time reimbursement of the amount, then it is paid one-time and is not subject to calculations.

Where to apply to receive a pension

To receive a pension, you must submit a request to the pension fund. You must contact the organization where the savings were formed. There are several ways to submit a request.

- Personally. To do this, you should collect a package of documents and contact the Pension Fund or Non-State Pension Fund. There is no need to look for a branch near your place of residence. Anyone can submit a request.

- Through MFC. Multifunctional centers are located throughout the city. It is better to make an appointment with a specialist in advance. This will save time and avoid standing in line.

- Through the Pension Fund website. An option for those who keep money in a state fund. To do this you need:

- register on the PFR website (pfrf.ru);

- register with the ESIA (click the “Register with the ESIA” button);

- go to the “Electronic Services” section;

- log into the “Citizen’s Personal Account”;

- click on the section “Pensions and social benefits”;

- Click on the “Submit an application for...” button (select your preferred payment option).

- Through the portal "State Services". This option is also suitable for Pension Fund depositors. To apply you need:

- go to the State Services portal (gosuslugi.ru);

- select the “Services” section;

- go to the “Authorities” tab;

- click on the “PFR” button;

- select from the list.

- By mail. To do this, you need to send a request to the pension fund, which was involved in the formation of the funded part of the pension.

Note! You can entrust the receipt of funds to an official representative. This could be a guardian or an employer. Also, a representative with a power of attorney has the right to contact the pension fund in person.

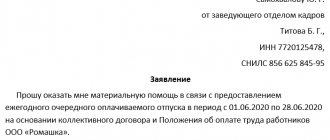

Required package of documents

The application is completed using a special form. It can be found on the Internet. The following documents are attached to the application:

- depositor's passport;

- SNILS;

- a receipt that confirms the accrual of the pension.

If the need arises, pension fund employees may request additional documents.

How long should I wait

The period for consideration of an application for a lump sum payment is up to 30 days from the date of submission of documents, for a fixed-term and funded pension - up to 10 days. The decision with approval or refusal is sent to the investor by mail. Therefore, you must indicate your actual residential address in your application.

The timing of payment also depends on the method of receipt:

- when assigning a funded pension, for the first time the investor will receive payment before the 15th of the next month. That is, if a positive decision was made on September 10, 2021, the money will be credited to the account before October 15, 2021;

- when a lump sum payment is assigned, the funds will be received by the investor within 30 days after approval of the application.

Receiving a funded pension

You can receive pension savings in several ways (the exception is payments to heirs):

- Post office:

- personal visit to the branch at your place of residence;

- postman to your home.

For both options, a specific date is set for making cash payments.

- Personal account.

Payments are made through the cash desk of a bank branch. Transfer of money can also be made to a bank card account, which can be cashed out at any convenient time.

- An organization specializing in the delivery of pensions.

Delivery and payment terms are established by analogy with Russian Post: payments themselves are made at the company’s branch or by its courier.

Savings amount: how to find out online?

Today, most services are provided via the Internet. With its help you can find out the size of your pension savings. To do this, you can use the State Services portal. To receive an extract from your savings pension account, you must prepare your passport and SNILS.

- Log in to your personal account on the State Services portal.

- Go to the "Services" section.

- Go to the “Authorities” tab.

- Select "PFR".

- Click on the “Pension Savings” section.

All information about the savings account will be provided within a couple of minutes. The extract will be available in your personal account. If necessary, it can be printed on a printer.

Note! This method is suitable only for investors who keep their cash savings in the Pension Fund. If your pension is formed in a non-state pension fund, you must contact your organization directly.

How to collect the insurance part of your pension

If there are appropriate grounds for receiving the insurance part of the pension, the citizen can begin to process these payments. Next - more details about how to apply for benefits and what papers you need to take for a visit to the Pension Fund.

Article on the topic: Features of pension and life insurance for pensioners

Who is entitled to payment?

Find out more about who is entitled to these payments. The possibility of receiving an insurance pension applies to the following persons:

- Russian citizens who participated in the pension insurance system and regularly made contributions to the Pension Fund;

- disabled relatives of the above persons in cases provided for by law;

- foreigners and stateless persons registered in the Russian Federation on a permanent basis and who have received the right to these payments on an equal basis with Russian citizens.

The listed categories of persons can receive the insurance part of the pension if the above conditions for age, length of service, and also in the presence of other grounds providing such an opportunity are met.

Where to contact

To receive an insurance pension, you must contact the following authorities:

- PFR branch located at the applicant’s place of residence;

- in the MFC - acting as an intermediate link and providing assistance to citizens in communicating with government agencies.

An alternative option involves remote registration of benefits by submitting an application electronically through the State Services portal. To do this, you must first obtain an account and log in to the resource. Documents in paper form are provided after consideration of the electronic application to the Pension Fund branch.

It is also possible to send documents by mail.

What documents are needed to obtain

The submitted application is accompanied by the following documentation:

- the applicant's civil passport;

- work book and other documentary evidence of insurance experience;

- a certificate of the average monthly salary received for the previous 60 months in a row, based on the results of labor activity before 2002;

- SNILS certificate.

Depending on the basis for receiving the insurance portion of payments, it may be necessary to provide a death certificate of the breadwinner, a disability certificate and an MSEC conclusion, and other papers. The need to provide additional documents to the applicant will be indicated by the Pension Fund or MFC employee accepting the papers.

If the work book does not contain information about individual periods of work, the data can be restored by providing a certificate from the relevant employer or in court, subject to the availability of witness testimony confirming the specified fact of employment.

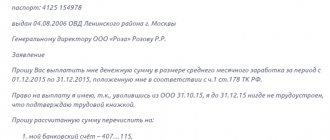

A retirement application is drawn up on a standard form, indicating the following information:

- names of the authority where the papers are submitted;

- information about the applicant;

- presence of Russian citizenship;

- residence addresses abroad if a foreigner is applying for a pension;

- registration address in the Russian Federation and actual place of residence;

- telephone number and passport details;

- gender

Related article: Features of voluntary pension insurance

A sample application can be downloaded here.

The document allowing you to receive payments is confirmed by the personal signature of the applicant and the current date is indicated.

You can get acquainted with an example of a completed application on the official website of the Pension Fund or obtain a document at a branch of this fund.

Appointment and payment terms

The period for review by the Pension Fund of the submitted documents for receiving benefits is within 10 days, excluding weekends and holidays.

Note! The process of processing documents submitted for retirement may be suspended for up to three months if the papers attached to the application are insufficient and it is necessary to provide additional documentary evidence from previous places of work.

Is it possible to increase pension savings?

Pension Fund depositors could increase their savings by joining the state co-financing program. It was quite profitable. Cash deductions were multiplied by two if the account received from 2,000 to 12,000 rubles. in year. However, today the program is available only to investors who joined it in 2014.

If you want to increase your savings, the only option is to transfer funds to a non-state pension fund. Today, there are a large number of funds that allow you to draw up personal pension plans. The increase in savings occurs due to investments that the fund makes for you.

Note! Independent deduction of funds to the pension fund allows you to receive a tax deduction of 13% (but not more than 15,600 rubles)

- Author: ozakone

Rate this article:

- 5

- 4

- 3

- 2

- 1

(3 votes, average: 3.3 out of 5)

Share with your friends!

Who is entitled to a lump sum payment?

A one-time payment is a cash payment of all the funds accumulated by a pensioner and investment income in one amount, without breaking it down over a certain period.

Such a payment is due and is paid not to everyone, but to types of citizens who fall under the following parameters:

- Citizens of the Russian Federation;

- Persons who have pension savings in their account;

- People who were insured in accordance with the Federal Law: 167-FZ of December 15, 2001.

In addition, until the receipt of an old-age pension, only the following can receive a lump sum insurance payment:

- Persons upon recognition of disability of groups 1, 2, 3;

- In case of loss of a breadwinner.