When sending an employee on a business trip, the accounting department of an enterprise has a question: how to correctly mark in the time sheet the days that the employee spent on a business trip?

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

8 (800) 700 95 53

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

There are several circumstances in which the markings on a document will differ. Let's consider all the questions and nuances that arise in more detail.

How to mark a business trip on your timesheet?

When sending an employee on a business trip, the accounting department of an enterprise has a question: how to correctly mark in the time sheet the days that the employee spent on a business trip?

There are several circumstances in which the markings on a document will differ. Let's consider all the questions and nuances that arise in more detail.

Word of the law

A time sheet is a necessary document that should be in any organization.

It is necessary to document the days on which the employee carried out work in one way or another. In case of disputes, this document is regarded as evidence of the employee’s presence or absence at the workplace.

The report card can be used to control inspection bodies over the work performed at the enterprise.

For the absence of a document, the employer may be held liable.

Normative base

The employer is entrusted with the obligation to keep records of the time worked by employees, enshrined in Part 4 of Article 91 of the Labor Code of the Russian Federation.

The report card must be filled out according to forms No. T-12 and T-13.

Since the time sheet is a primary accounting document, it must contain the information provided for in paragraph 2 of Article 9 of Federal Law No. 402 “On Accounting”.

Labor Code of the Russian Federation

Federal Law No. 402-FZ

Time sheet (unified form T-12)

Form T-13

General rules for filling out the document

There are basic rules by which the timesheet should be filled out.

Let's look at them in more detail:

- Required to be completed within the billing period.

- At the end of the period, you need to indicate the hours the employee worked and the results for the first and second half of the month.

- Attendances and non-appearances must be recorded using the continuous recording method or using the deviation recording method.

- The top line must include a designation (for example, reporting to work, day off, etc.).

- The number of hours is indicated on the bottom line.

Business trip in time sheet

There are certain rules by which the days spent by an employee on a business trip are entered on the timesheet.

Let's consider all the questions and nuances that arise in more detail.

Designation

So, how to mark a business trip on a timesheet and what designation can be used for this?

When entering travel days on the timesheet, do not enter the clock.

According to Article 167 of the Labor Code of the Russian Federation, the employee retains his average earnings for the entire duration of the trip. Thus, there is no need to take into account the hours during which the employee works on a business trip.

The generally accepted designation for the days that an employee spends on a business trip is “K”.

How is it considered - a working day or a no-show?

A business trip is a trip by an employee to fulfill an official assignment away from his place of permanent work.

Thus, during the trip, the employee performs a separate official task, and not the labor function that is enshrined in the contract. Time spent on a business trip is not working time within the meaning of Article 91 of the Labor Code of the Russian Federation.

However, this time cannot be considered a failure to appear either, according to the provisions of Article 166 of the Labor Code of the Russian Federation.

Accordingly, a business trip must be allocated to a separate category of days with appropriate reflection in the primary documentation - the time sheet.

How to display correctly?

There are several circumstances in which the marks on the travel report card will differ.

Let's consider the main situations that employees of an enterprise's accounting department may encounter when entering alphabetic or numerical values in a timesheet.

If the trip falls on a weekend

Quite often there are situations when a business trip falls on a weekend.

A reasonable question arises - how to mark such business trips on the timesheet - as regular days off or as days spent on a business trip?

Let's consider several situations that may arise:

- The employee was on a business trip on his day off, but did not carry out work activities. In this case, you must enter code “B”.

- The employee worked on a day off while on a business trip. This aspect must be reflected in the report card with the letter code “РВ”.

If the employee goes to work on the last day of the business trip

The last day of a business trip is the date of arrival of the vehicle at the place of permanent work.

Let's consider the options that could be:

- If transport arrives at the place of work before 24 hours of the current day, the same day will be considered the day of arrival. The next day will be a regular weekend or workday depending on the employee's schedule. Example: An employee was brought in at 9:25 p.m. on May 18, 2021. Thus, May 18 will be the last business trip day.

- If the vehicle arrives after 24 hours, the next day will be considered the day of arrival. Example: An employee was brought in at 6:50 a.m. on May 20, 2021. May 20 will be the last business trip day.

It is impossible to oblige an employee to go to work on the last day of a business trip. He can do this only of his own free will.

Let's consider the situations:

- The employee does not go to work on the last day of the business trip. In this case, code “K” is entered in the report card for that day.

- An employee goes to work on such a day. Current regulations do not regulate what values to put on the timesheet and how to pay the employee for such a day. Double payment is not allowed. Consequently, the managers of the organization need to establish in local acts the opportunity to pay the employee both the average earnings and wages for the time worked in these conditions. Otherwise, the employee can only claim to maintain the average salary or only to receive payment for hours worked on the last day of the business trip.

If an employee goes on a trip while on sick leave

Current legislation does not allow the possibility of simultaneous payment of both wages and state disability benefits.

In this situation, an employee can only be allowed to go on a business trip with his written consent.

Thus:

- an employee cannot go on a business trip while on sick leave at the initiative of the employer;

- on personal initiative, the employee loses the compensation payment due to him due to disability, and code “K” is entered on the report card (as for a regular day on a business trip).

If the employee takes sick leave while performing a task

Periods of temporary disability that occur during a business trip are marked with two codes separated by a fraction - “K/B”.

If there was overtime work during her period

If an employee worked overtime, the timesheet during a business trip is marked with the code “K/S” indicating the number of overtime hours.

Sample filling (example)

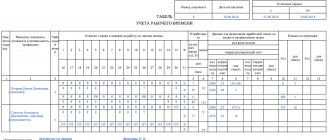

Let's look at an example of how to fill out a timesheet while working overtime on a business trip:

As can be seen from the example, on the 4th and 5th of the month Aliyeva S.G. I was on a business trip and overworked for a total of 4 hours.

How to close a document?

The timesheet should be closed after the end of the billing period with the employees of the enterprise. In most organizations, this is considered the last day of the month.

According to the general rules, you can close the timesheet on the last day of the billing period.

If you close earlier and mark the time sheet in accordance with the production calendar, it may turn out that some employee will get sick or take unpaid leave.

In such a situation, overpaid wages will have to be withheld from the accruals of the next billing period (in accordance with Part 2 of Article 137 of the Labor Code of the Russian Federation).

Employees of the company's accounting department must correctly fill out time sheets for employees on a business trip. This will allow you to make correct accruals, as well as avoid possible problems from regulatory authorities.

Source:

Word of the law

A time sheet is a necessary document that should be in any organization.

It is necessary to document the days on which the employee carried out work in one way or another. In case of disputes, this document is regarded as evidence of the employee’s presence or absence at the workplace.

The report card can be used to control inspection bodies over the work performed at the enterprise.

For the absence of a document, the employer may be held liable.

Normative base

The employer is entrusted with the obligation to keep records of the time worked by employees, enshrined in Part 4 of Article 91 of the Labor Code of the Russian Federation.

The report card must be filled out according to forms No. T-12 and T-13.

Since the time sheet is a primary accounting document, it must contain the information provided for in paragraph 2 of Article 9 of Federal Law No. 402 “On Accounting”.

Labor Code of the Russian Federation

Federal Law of December 6, 2011 N 402-FZ

Time sheet (unified form T-12)

Form T-13

General rules for filling out the document

There are basic rules by which the timesheet should be filled out.

Let's look at them in more detail:

- Required to be completed within the billing period.

- At the end of the period, you need to indicate the hours the employee worked and the results for the first and second half of the month.

- Attendances and non-appearances must be recorded using the continuous recording method or using the deviation recording method.

- The top line must include a designation (for example, reporting to work, day off, etc.).

- The number of hours is indicated on the bottom line.

Business trip on the timesheet

There are a number of rules for how to mark a business trip on a timesheet. Let's take a closer look at each of the nuances.

How is it designated?

How the trip is displayed and what designation is used has already been clarified. But you need to keep in mind that when filling out the document, hours are not entered.

In accordance with Art. 167 of the Labor Code of the Russian Federation, the employee receives accruals for the duration of the business trip as average earnings. Therefore, accounting for hours spent on travel is not required.

Find out how business travel is calculated.

Are you interested in reimbursement of expenses related to a business trip? Look here.

Is it considered a working day?

In order to understand how a business trip is assessed, it is necessary to define this concept. So, a business trip is a work trip of an employee for the purpose of carrying out assignments away from his place of permanent employment.

That is, the employee performs a specific task, and not the labor function specified in the contract.

In accordance with Art. 91 of the Labor Code of the Russian Federation, business trip time is not considered working time. But it also cannot be called a failure to appear, based on Art. 166 Labor Code of the Russian Federation.

Therefore, the work trip is allocated to a different category and is displayed on the report card.

On a day off

If a trip coincides with a weekend, the following situations may arise:

- The employee was on a business trip, but did not work. In this case, code “B” is entered in the report card.

- The employee was on a business trip and working, then the code “RV” is entered.

If an employee takes sick leave

According to the law, it is impossible, at the initiative of the employer, to send an employee who is on sick leave on a business trip.

If he himself expressed a desire to go on a trip, then it should be taken into account that there will be no sick pay. And in the report card, in this case, it is displayed under the code “K”.

It happens that an employee gets sick during a trip. Then the display is carried out using two codes.

Overtime

When an employee worked overtime, this is entered in the document as “K/S” indicating how many hours were worked.

But difficulties may arise in collecting documents proving this fact. You can ask for a certificate from the company where you worked directly. After this, the accountant will make the calculation.

What to do if an employee gets sick before or during a business trip?

It is quite possible to plan working hours, but it is impossible to predict who will go on sick leave and when. In the report card, sick days are marked with the letter “B”. And it depends on which letter is in the column - “K” or “B” - whether the employee’s salary or sick leave will have to be paid.

Let's consider two situations:

- The employee fell ill before the business trip, and the corresponding order had already been issued. You cannot force an employee to go on a business trip if he is on sick leave, but you can ask. And it will be better if he closes his sick leave before leaving - then all the days on the report card will be marked “K”.

- An employee fell ill while on a business trip. In this case, the days after the onset of the illness are marked “B” until the date the sick leave ends, even if it occurs after the end of the planned period of the business trip. In such a situation, it is assumed that the employee interrupted his work assignment due to illness.

It is important to understand that an employee cannot be on sick leave and on a business trip at the same time, just as he cannot receive temporary disability benefits and a salary at the same time.

How is it taken into account?

The employer's obligation to record the time worked by employees is enshrined in Article 91 of the Labor Code of Russia.

The statements that are mandatory included in the working time sheet are presented by Federal Law No. 402 (clause 2, article 9).

The report card is drawn up at each enterprise (organization) using forms T-13 and T-12 approved by the Regulations of the State Committee of Statistics of Russia dated January 5, 2004. The same document clarifies exactly what information needs to be recorded in the report card.

Important! The choice of the form (form) on which time worked by employees of the enterprise will be recorded depends on the method of recording the activities of employees: if accounting is carried out in an automated way - form T-13, for manual recording, respectively, T-12.

To correctly enter information into the timesheet, each employee is assigned an individual number, which is entered in the document column.

The responsible person authorized to fill out the presented form is appointed from among the accounting department or personnel department , which are directly related to the calculation of wages for workers.

Each of these forms has columns and lines in which the following statements should be entered:

- Employee personnel number;

- The duration of the time period worked or the duration of unworked time;

- Number of working days for each employee;

- Reporting to work, being on business trips, attending advanced training, vacations, etc.

For the convenience of filling out the time sheet, symbols have been developed that are entered using digital and alphabetic methods.

What form is used to record working time?

All facts of the economic life of the organization must be recorded in the primary documentation. This obligation follows from the provisions of Art. 9 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ. Simultaneously with the adoption of this law, there was no longer a need to use unified forms for a number of primary documents.

In particular, Goskomstat Resolution No. 1 of January 5, 2004 provides unified forms of working time sheets T-12 and T-13. It is in these forms that data is displayed both on the worker’s attendance/absence at his workplace, and on the reasons for the absence. Now these forms are optional for use by organizations, i.e. it is allowed that the personnel department can develop its own form of report card.

In practice, most companies continue to use a time sheet in the T-12 form (if it is filled out by hand) or T-13 (if individual columns are automatically filled out). If necessary, these forms are adjusted taking into account the specifics of the company's activities.

In this case, in any case, the form of the primary document used must contain the details specified as mandatory in Art. 9 of the Law “On Accounting”:

- name of the document (in this case - “Working Time Sheet”);

- date of preparation of the report card;

- the name of the company where the timesheet is used to record employee working hours;

- columns for displaying attendance/no-appearance (indicating the reasons for non-appearance);

- indication of units of measurement (days and/or hours);

- name of the position and full name of the employee responsible for maintaining the schedule;

- signatures of persons authorized to approve the report card.

Only if all these details are present in the form of a report card can it be considered valid.

Which timesheet form is most convenient to use for filling out?

The form of the report card does not matter, you can choose the form approved by the Decree of the State Statistics Committee of Russia dated No. 1 (form T-12, form T-13), you can use the form approved by order of the Ministry of Finance of Russia dated No. 52n.

Form No. 52n (F.0504421)

Download

In general, if you work in a commercial organization, you can independently develop and approve your own form with your own alphabetic or numerical designations, no one prohibits this, the main thing is that it is in fact.

What is a business trip

The departure of specialists from the territory of the organization on official business and special assignments emanating from the company’s management, for a period until the completion of the task, is called business trips . Sending employees to work in other locations is a normal process in production .

During this time:

- activities important for production are carried out;

- jobs are saved;

- expenses associated with official activities are paid;

- the period of absence of the employee is taken into account in the worksheet.

Any person from the company’s staff can be sent on a business trip based on the employer’s order and a travel certificate. The employee must document:

- departure, arrival date, destination;

- fulfillment of production tasks;

- movement points.

Upon returning to the enterprise, the specialist will have to fill out an advance report , submit it to the accounting department, where they will check each expense item, and after approval by the employer, accruals will be made.

While staying at a third-party organization, the traveler needs to collect transport tickets, mark the time of arrival and departure, this data will be needed to provide evidence regarding targeted expenses, and the money spent during the trip will be reimbursed.

How to mark business travel days - designations

The days an employee spends performing an official assignment provided for by a business trip order must be recorded in the time sheet along with the time worked at the permanent workplace, since it is the presented document that allows for the calculation and settlement of payments to the posted employee.

The standard procedure for recording the days of a worker’s stay on a business trip in the time sheet is

recording the code “K” in the appropriate cell of the form.

In addition to the specified symbol, the posted worker may be given other accompanying symbols.

What should I bet on if the trip falls on a weekend?

In order to make correct financial settlements with a posted employee, you should keep records of days off worked on a business trip. To do this, put the letter “K” in the top cell and “B” in the bottom cell.

Regardless of whether the employee was performing part of a work assignment on the day of rest or was on the road (to the place of business trip or back), this time, in accordance with the law, is paid at double the rate of average earnings.

How to record sick leave for a posted worker?

If, during a business trip, a sick leave certificate was issued to the employee and the manager agreed to extend the duration of the trip for recovery and completion of the official task assigned by the order, the days on which the employee was on the trip and was sick are marked with the symbol “K” in the top line and the symbol “ B" at the bottom.

Sick leave for business travelers is paid on a general basis.

How is overtime work defined?

Excessive work time while on a business trip is noted in the time sheet as “K/S” and indicating the exact number of hours worked.

Overtime, as well as night work, are paid to posted workers in the same way as working hours at a permanent place of work.

Sample filling

What is regulated

When an employee goes on a business trip, documents remain with the company that sent him - an order from the employer, a business traveler’s ID issued and registered under the number.

The actions of management are regulated by legal provisions :

- Article 9 of Federal Law No. 402 specifies the rules for maintaining primary documents, these include a report card for employees visiting places of employment, it reflects the reasons for their absence from work.

- Article 91 of the Labor Code of the Russian Federation requires the employer to accurately record the time worked by personnel using forms T-12, T-13.

- Article 167 of the Labor Code of the Russian Federation indicates the preservation of the average salary for an employee performing a task outside the organization.

Please note that not all trips are considered business trips. The Labor Code of the Russian Federation states that movements of workers around the area during the day are considered traveling work, recording in the time sheet is carried out as on regular days worked.

Normative base

The timesheet is a mandatory document that is available in any company. It is needed to confirm that the work trip actually took place.

If a dispute arises, the document will serve as proof of the veracity of the employee’s words. The absence of a document is punishable in accordance with the legislation of the Russian Federation. In general, the regulatory framework in 2021 has not changed compared to 2021.

According to Part 4 of Art. 91 of the Labor Code of the Russian Federation, the employer must keep records of the time worked by the employee. There are special forms N - T-12, T-13.

A time sheet is an accounting document, and a primary one. It must contain information in accordance with paragraph 2 of Art. 9 FZ-402.

Symbols in the time sheet in 2021

The report card can use alphabetic or numeric codes to indicate a particular event, for example, attendance at work has the letter I or 01 in digital expression, absenteeism - PR or 24, additional days off without pay - NV or 28.

You can find the required code using the service we have prepared, or use the table. In the service, you will first need to select the type (form) of the timesheet that you use, and then the wording of the event for which you need to enter a code designation - the system will immediately show you the required alphanumeric code.

Timesheet codes (2019) - a complete list of alphabetic and numeric characters - are contained on the first page of Form T-12.

Unified uniform T-12

Download

It should be noted that the unified form T-12 can be used in any organization, regardless of the form of ownership, except for budgetary institutions.

In budgetary institutions, an accounting form is used, approved by order of the Ministry of Finance of Russia dated No. 52n, which uses other digital and letter designations in the working time sheet.

Registration of temporary disability in the report card

It may happen that during a business trip the employee becomes temporarily unable to work. He can issue a sick leave certificate. And then the employer is obliged to reflect sick leave on a business trip. This is necessary to reimburse travel expenses.

Here we apply the general rule - increase the number of columns. In one we put “K” (06), in the other “B” (19).

Thus, a business trip is reflected in the time sheet indicating the amount of time in hours and minutes only when it comes to recording work (travel time) on weekends and holidays.

Business trip in the time sheet - sample filling

Often, for production purposes, workers need to go to another city or country. Such a business trip is called a business trip. How to correctly take it into account in the report card? How to indicate that an employee fell ill during a trip? You will find answers to these and other questions in our article.

How to reflect a business trip on a time sheet?

The labor time register is an important document in an enterprise. The correctness of filling it out affects the amount of wages. Its accrual and payments are often checked by the tax office. At the same time, they raise and verify all related documents and recalculate the salary.

The essence of filling out the register is to correctly reflect the use of the employee’s working time . The table is filled out by code names, the decoding of which is indicated on the form itself.

The main filling requirements include:

- The need to fill it out in the current time mode, since wages are calculated on the basis of it;

- Appearances and non-appearances are entered using one of the methods: entering deviations or complete registration;

- Two lines are filled in - at the top they put a code designation, for example, I - report to work, K - business trip, etc.; At the bottom they put the number of hours worked. There are both code values.

Reflection in the work time sheet of a business trip is indicated by the letter code - K. It is noted as the day of the trip - the day of departure and the day of arrival home, days of downtime.

How to fill out a business trip in a time sheet?

The basis for sending an employee on a trip is an order from the enterprise. Business travel days can be counted based on: travel tickets; memo; the corresponding certificate.

Days of stay on a trip for production or business purposes are considered to be the following days:

- Departure and arrival;

- Working days;

- Weekends and holidays, if applicable;

- Sick leave.

How to fill out a simple work day is clear to everyone and there are no special questions about this - code K is indicated in the register. But what if the trip coincided with another event? All details of your stay must be displayed in the time register, as this affects the calculation of daily allowance. Let's look at examples.

The employee with the reporting documents provides sick leave - this is reflected in the register in two lines. In the top - K and in the bottom B - sick leave.

The employee left on Sunday evening - the day of the trip is considered the day of departure, that is, a day off. In the register it is indicated in the top line - K, in the bottom - B.

Payment of daily allowance and salary for a day off is at a double rate, in accordance with the legislation of the Russian Federation, compensation for the cost of a ticket is at its face value.

The employee returned from a trip on a weekend or holiday - the register also reflects - C/W, payment at a double rate. If an employee on a business trip worked on a weekend or holiday, fill out the timesheet as K/RV - working day off.

All weekends or working holidays are paid at a double rate, or the employee can take one day off, but the B or PB payment will be at the regular rate. An employee worked at night, for example, when eliminating an accident - designated as K/N.

At the same time, there must be written confirmation of activities at night in the form of a memo signed by the manager at the enterprise where the employee was seconded.

Example of a time sheet for a business trip

The time register according to the rules of maintenance is a simple document. When filling it out, it is important to pay attention to detail and reflect all information.

As well as the employees themselves, they must understand the rules for calculating their salaries and maintaining paperwork in order to provide the necessary documentary evidence - memos about working at night, sick leave, submitting a travel certificate and an advance report on time.

Business trip in timesheet sample download

Business trip day – K, is considered as a full working day, including taking into account travel and downtime. Therefore, when summing up the total hours in the timesheet, these days must be counted as full working days.

Download a sample of filling out a timesheet with travel days

When is a business trip not included on the time sheet?

Not every trip is considered a business trip. This definition is prescribed in the Labor Code of the Russian Federation. Day trips or local drives do not qualify. Not marked in the report card with code K, trips lasting one day, traveling work. They are reflected in the accounting table, like a regular working day, through the letter code Y.

Labor Code of the Russian Federation in the latest edition

If you have questions, consult a lawyer

You can ask your question in the form below, in the online consultant window at the bottom right of the screen, or call the numbers (24 hours a day, 7 days a week):

- +7 Moscow and region;

- +7 St. Petersburg and region;

- +7 all regions of the Russian Federation.

Source:

Filling out the working time sheet correctly

Labor legislation obliges employers to keep records of time worked by employees. Organizations, regardless of legal status, and individual entrepreneurs must take into account hours worked. Especially for this purpose, the State Statistics Committee has developed and approved forms of the Time Sheet N T-12 and N T-13.

ConsultantPlus FREE for 3 days

Get access

We will provide instructions for filling out, which will help you correctly reflect the data and use the timesheet rationally.

Why do you need a time sheet?

The working time sheet, approved by Resolution of the State Statistics Committee dated January 5, 2004 No. 1, helps the personnel service and accounting department of the enterprise:

- take into account the time worked or not worked by the employee;

- monitor compliance with the work schedule (attendance, absence, lateness);

- have official information about the time worked by each employee for calculating wages or preparing statistical reports.

It will help the accountant confirm the legality of accrual or non-accrual of wages and compensation amounts for each employee. The HR officer must track attendance and, if necessary, justify the penalty imposed on the employee.

A time sheet refers to the forms of documents that are issued to an employee upon dismissal along with a work book upon his request (Article 84.1 of the Tax Code of the Russian Federation).

It is worth noting that the unified forms of timesheets N T-12 and N T-13 are not required for use from January 1, 2013. However, employers are required to keep records (Part 4 of Article 91 of the Labor Code of the Russian Federation).

Organizations and individual entrepreneurs can use other ways to control the time employees spend at work.

But in fact, the form format developed by Gostkomstat is quite convenient and continues to be used everywhere.

Who keeps the time sheet in the organization

According to the Instructions for the use and completion of forms of primary accounting documents:

- the work time sheet for 2021 is compiled and maintained by an authorized person;

- the document is signed by the head of the department and the HR employee;

- after which it is transferred to the accounting department.

As we can see, the rules do not establish the position of the employee who keeps the time sheet. Management has the right to appoint anyone to perform this task. To do this, an order is issued indicating the position and name of the responsible person.

If an order to appoint such an employee is not issued, then the obligation to keep records must be specified in the employment contract. Otherwise, it is unlawful to require an employee to keep records. In large organizations, such an employee is appointed in each department.

He fills out the form within a month, gives it to the head of the department for signature, who, in turn, after checking the data, passes the form to the personnel officer.

The HR department employee verifies the information, fills out the documents necessary for his work based on it, signs the time sheet and passes it to the accountant.

In small companies, such a long chain is not followed - the accounting sheet is kept by a personnel employee, and then immediately transferred to the accounting department.

What is the difference between forms N T-12 and N T-13 Timesheets?

Two approved forms of topics differ; one of them (T-13) is used in institutions and companies where a special turnstile is installed - an automatic system that controls the attendance of employees.

And the T-12 form is considered universal and contains, in addition, an additional Section 2. It can reflect settlements with employees regarding wages.

But if the company conducts settlements with personnel as a separate type of accounting, section 2 simply remains empty.

Filling out a time sheet

There are two ways to fill out the timesheet:

- continuous filling - all appearances and absences are recorded every day;

- filling in by deviations - only lateness and no-shows are noted.

Let us give as an example instructions for filling out the T-13 form using the continuous filling method.

Step 1 - name of the organization and structural unit

At the top, enter the name of the company (full name of the individual entrepreneur) and the name of the structural unit. This could be a sales department, a marketing department, a production department, etc.

Step 2 - OKPO code

OKPO is an all-Russian classifier of enterprises and organizations. Contained in Rosstat databases, it consists of:

- 8 digits for legal entities;

- 10 digits for individual entrepreneurs.

Step 3 - document number and date of preparation

- The document number is assigned in order.

- The date of compilation is usually the last day of the reporting month.

Step 4 - reporting period

Time sheets are submitted per month - the period from the first to the last day of August in our case.

Step 5 - employee information

A separate line is filled in for each department employee.

- Serial number in the report card.

- Last name and position of the employee.

- A personnel number is assigned to each employee and is used in all internal accounting documents. It is retained by the employee for the entire period of work in the organization and is not transferred to another person for several years after dismissal.

Step 6 - information about attendance and number of hours

To fill out information about employee attendance and absence, abbreviated symbols are used. You will find a list of them at the end of the article in a separate paragraph. In our example for employee Petrov A.A. 4 abbreviations used:

- I - attendance (in case of attendance, the number of hours worked is recorded in the bottom cell);

- On a weekend;

- K - business trip;

- OT - vacation.

Step 7 - total number of days and hours for the month

- In the 5th column indicate the number of days and hours worked for every half month.

- In the 6th column - the total number of days and hours for the month.

Step 8 - information for payroll

The payment type code determines the specific type of cash payment, encrypted in numbers. For a complete list of codes, see the end of the article. The example uses:

- 2000 - salary (wages);

- 2012 - vacation pay.

- Corresponding account is an accounting account from which costs for a specified type of remuneration are written off. In our case, the account for writing off salaries, travel allowances and vacation pay is the same.

- Column 9 indicates the number of days or hours worked for each type of remuneration. In our case, the days of attendance and business trips are entered in the top cell, and the days on vacation are entered in the bottom cell.

If one type of remuneration (salary) is applicable to all employees during the month, then the code of the type of payment and the account number are written at the top, columns 7 and 8 are left empty, indicating only the days or hours worked in column 9. Like this:

Step 9 - information about the reasons and time of no-show

Columns 10–12 contain the code for the reason for absence and the number of hours of absence. In our example, the employee was absent for 13 days:

- 3 days - due to a business trip;

- I was on vacation for 10 days.

Step 10 - signatures of responsible persons

The accounting sheet is signed at the end of the month:

- employee responsible for maintenance;

- head of department;

- personnel worker.

How to mark vacation on a time sheet

Before marking vacation on your time sheet, it is important to know the following points:

- what type of leave to indicate;

- vacation period - from what date to what date the employee rests;

- what method is used to fill out the timesheet - continuous or only deviations are recorded?

Different types of leave are indicated in the report card by the following abbreviations:

| FROM | regular paid vacation |

| OD | additional paid |

| BEFORE | administrative (without saving salary) |

| U | educational with salary retained |

| UV | on-the-job training (shortened day) |

| UD | educational without saving salary |

| R | for pregnancy and childbirth |

| coolant | child care up to 3 years old |

| OZ | without saving the salary in cases provided for by law |

| DB | additional without saving salary |

When using both methods of filling out a timesheet, a vacation symbol is affixed for each day the employee is absent. It’s just that when using the continuous method, the remaining days are filled with turnouts (conditional code “I”), and when using the method of taking into account deviations, they remain empty.

Other designations and codes in the table

We present the letter designations used in the time sheet in the form of tables.

Presence at the workplace:

| I | work during the day |

| N | at night time |

| RV | work on weekends and holidays |

| WITH | overtime |

| VM | on a rotational basis |

Business trips and advanced training:

| TO | business trip |

| PC | off-the-job training |

| PM | advanced training with a break from work in another area |

Absence from work:

| B | temporary disability (sick leave) with payment of benefits |

| T | temporary disability without benefit payment |

| Champions League | shortened working hours in cases provided for by law |

| PV | forced absenteeism due to illegal removal (dismissal) |

| G | failure to appear in connection with the performance of state (public) duties |

| ETC | absenteeism without good reason |

| NS | part-time mode |

| IN | weekends and public holidays |

| OB | additional paid day off |

| NV | additional unpaid day off |

| ZB | strike |

| NN | unknown reason for absence |

| RP | downtime due to the employer's fault |

| NP | downtime due to reasons beyond anyone's control |

| VP | downtime due to the employee's fault |

| BUT | suspension from work (paid) |

| NB | dismissal without retention of salary |

| NZ | suspension of work in case of delay in salary |

We present only the main digital codes of types of remuneration (The full list is in the Order of the Federal Tax Service of Russia dated October 13, 2006 N SAE-3-04 / [email protected] ):

| 2000 | labor payments (salary, remuneration) |

| 2010 | payments under civil contracts |

| 2012 | vacation pay |

| 2300 | sick leave benefit |

| 2530 | payment in kind |

| 2760 | financial assistance upon dismissal and retirement |

| 3020 | interest on deposits |

In what cases is the NN code used?

The NN code, or the absence of an employee for unknown reasons, is entered every time and as long as the employee is not at work and the responsible person does not have documents about the reasons for his absence. Even if the manager of the absent person swears that the employee is absent (PR code), do not rush to put this code in the primary accounting documents, wait until the person brings a document explaining his absence, otherwise it may happen that the time sheet with the wrong the code will be provided to the accounting department, and later it turns out that the employee was absent for a good reason, and then changes will have to be made to the primary accounting documents.

Who should keep track of working hours and who should be responsible for it?

If the organization is small, one person can keep time records.

If the structure of the enterprise is significant, it is advisable to appoint a responsible person in each division.

All responsible persons, regardless of their number, are appointed by orders for the main activities in order to avoid various kinds of misunderstandings.

Responsibility for the completeness and correctness of filling out the timesheet lies with the person authorized by the order.

The head of the department is responsible for the timely submission of timesheets to the accounting department.

The employer is responsible for everyone.

Rules for filling out the document

When filling out the timesheet, you must take into account the general rules:

- The document must be completely completed within a month after the work trip.

- At the end of the period, all working hours are taken into account.

- All attendances and absences must be recorded on the report card.

- The line at the top contains the following designations: day off, business trip.

The timesheet is necessary for accounting calculations. In this case, the following requirements are put forward for the document:

- It is allowed to keep it on paper and then sign it in the accounting department.

- Can be filled out electronically with the appropriate signature.

- When making corrections in the report card, you must indicate the date when the changes were made and your last name.

- Upon withdrawal, a copy must be made and provided to the accounting document flow.

The table contains the following data:

- What is the name of the document and the date when it was compiled.

- What is the name of the organization?

- Lines – these show whether the employee showed up for work or not.

- What is the unit of measurement (hours and days).

- Who is responsible for maintaining the document?

- Signatures of approvers.

If at least one of the points is missing, the document is considered invalid.

Please note that the days of travel are considered to be:

- departure and arrival;

- labor;

- weekends, holidays if there is a coincidence;

- sick leave.

Not every work trip is recognized as a business trip. Those that are carried out within 1 day and are not displayed by area. They are entered in the accounting table under the code - I.

How to display correctly?

We have already figured out how to indicate the days spent on a work trip. But HR workers often have difficulty filling them out. Looking at the examples, you can understand how to display correctly.

First example:

Ivanov A.V. works at LLC "RiK" as a manager and he was on a work trip from now on. 4 and 5 – days off and no work. Therefore, the days are entered in the timesheet as - B, the rest - K.

Second example:

Mamantov A.G. works at Mir LLC as a welder. From now on, he was going on a business trip to work in a new branch of the company. 1, 6, 7, 8, 9 are days off, but Mamantov worked. These days are entered in the report card as “RV”, and 2, 3, 4, 5, 10, 11 – K.

Read about travel expenses abroad.

Does an employee have the right to refuse a business trip? Information here.

How to pay for a business trip on weekends? Details in this article.

Sample

Each personnel employee has a sample business trip in the time sheet. It is presented in the table:

As you can see, on the 3rd and 6th of Muslimova M.P. I was on a business trip and worked for about 4 hours.

A sample of the T-12 working time sheet is here,

A sample time sheet, form T-13, is here.

The timesheet must be filled out correctly. If you make a mistake, there may be problems with various services in the future.

registration of a business trip in a time sheet

An employee’s stay on a business trip must be recorded in the work time sheet, without which it will be difficult to prove the work trip and calculate wages. The designation of a business trip in the time sheet must be done by the employer or an employee of the enterprise’s accounting department in accordance with Part 4 of Article 91 of the Labor Code of the Russian Federation.

You can find out how to mark a business trip on your report card by studying Article 91 of the Labor Code of the Russian Federation.

The time spent by an employee on a business trip cannot be designated either as working hours or as missed work days, so a business trip is usually designated with the special designation “K” .

In fact, a business trip can be defined as a work assignment not at the place of main work activity. In the timesheet, business trips must be separated into a separate category with a special designation.

Payment for working hours of business travelers

Payment for the duration of a business trip is made according to the employee’s average earnings during the period spent on a business trip, so the number of hours worked by the employee does not need to be indicated.

However, if overtime hours were worked on a business trip, they must be paid additionally and are indicated in the timesheet by the abbreviation “KS” . In this case, it is necessary to indicate the number of hours worked in excess of the norm and pay them in accordance with the employee’s average hourly wage.

At the same time, just like during normal working hours, overtime hours must be paid in excess of the norm in accordance with the employment contract with employees and the Labor Code.

An example of a business trip designation on a time sheet can be viewed below.

Sick leave on a business trip

An employee may get sick even during a business trip and then he will have to take sick leave.

The time spent on a business trip that a person spent on sick leave is not noted as regular business trip days, but has a special designation “K/B” .

Payment for time spent on sick leave on a business trip is made based on the same principles as payment for regular sick leave.

If an employee is on sick leave during a business trip, the employer cannot oblige him to travel, but must assign the work to another employee.

However, on his own initiative, an employee can go on a business trip even while on sick leave if he writes a special statement.

If an employee voluntarily goes on a business trip while on sick leave, the days of sick leave during which he performed work duties are not paid, but only the days spent on a business trip are paid. An employer has no right to pay for the same working day twice.

Weekends on a business trip

Even while on a business trip, an employee has the right to use legal days off. However, if a business trip involves urgent work, the employee can also work on a day off.

Weekends on which the employee went to work are indicated in the work time sheet as a special o and are paid at an increased rate in accordance with the terms of the employment contract.

Read more about how a business trip on a day off is paid on our website.

Weekends on which the employee did not carry out work activities while on a business trip are indicated in the work report card with a special abbreviation “B” .

How a business trip is noted in the time and attendance system - see the video:

Last day of the trip

The last day of a business trip is the day the employee arrives back. Depending on the time of arrival on the last day of the business trip, the employee can also go to work on his own initiative.

note

The daily allowance for a business trip is determined by the employer. The maximum amount for a business trip in Russia, which is not subject to personal income tax, is 700 rubles, abroad - 2500 rubles. Read more in this article

If the employee arrived in the city before 24 o'clock in the afternoon, this day will be considered the last day of the business trip; if the arrival takes place in the morning of the next day, the business trip should be closed tomorrow.

Even if an employee arrived in the city early in the morning, the employer cannot force him to go to work on the last day of the business trip. According to the law, one working day cannot be paid twice.

Hours of work will be indicated on the time sheet as travel hours marked “K” .

Thus, the time worked at the place of main work on the last day of the business trip will not be taken into account when calculating wages.

Source:

Features of filling out the timesheet

According to Art. 9 Federal Law No. 402 “On Accounting”, the time sheet is a primary accounting document and contains relevant information reflecting cases of employee attendance or non-appearance at the workplace, indicating the reasons. To be completed by an authorized employee every day, in accordance with the relevant instructions.

report card can be found here.

Samples of filling out timesheets

Rules

Rules for drawing up a timesheet:

- The timesheet is designed for entering information during the billing period. Typically this period is a month.

- After the end of the period, you need to enter the number of hours worked by the employee, as well as the results separately for the first and second parts of the month.

- When registering attendances and absences, it is necessary to use the complete registration method or the deviation registration method.

- In the top line above each column their designations are indicated, for example, attendance at work, day off, and so on.

- The number of hours is entered in the bottom line.

Marking time sheets for business trips has some peculiarities caused by the possibility of ambiguous interpretation of labor law norms. Consequently, the time sheet during a business trip is filled out according to special rules.

- Firstly, in this case there is no need to note the number of hours. This is due to the condition stated in Article 167 of the Labor Code of the Russian Federation that the employee retains the right to receive average daily earnings for the entire duration of the official trip, and for this, counting hours is not required.

- On the other hand, during a business trip, the employee is away from his main place of work; he performs a separate work assignment, and does not fulfill obligations under the employment agreement. Therefore, from this point of view, business trip time is not working time (Article 91 of the Labor Code of the Russian Federation). However, this cannot be called absenteeism.

Weekends and overtime on a business trip

The day the employee spent on a business trip, Fr. Difficulties may arise when filling weekends, sick days or overtime hours. In this case, an administration or accounting employee may encounter the following situations:

- The day off falls on one of the business trip days, but the employee does not work on that day. The report card is marked with code “B”.

- The business traveler worked at his host company on his day off. The report card is written “R/V” or “K/V”.

The specifics of how holidays are reflected in timesheets are regulated by Resolution No. 749 of October 13, 2008. To confirm the fact of working on a day off, an appropriate order and the employee’s written consent to work on a day off are required. Work on weekends is paid twice as much.

At some enterprises, the entire period of a business trip is based on an order to be sent on a business trip, and the fact of working on a day off when calculating wages is confirmed by other documents.

In general, the time sheet allows you to simplify the calculation of wages, and absences due to illness, business trips and absenteeism are taken into account when calculating wages with the help of relevant orders, instructions, sick leave, and certificates.

Overtime activities require mandatory indication of overtime hours. In this case, only overtime hours are indicated in the bottom line. To confirm processing, you need a certificate from the place of travel.

An example of filling out a timesheet for overtime work

| Serial number | Full name of the employee, position personnel number | Notes on attendance and non-appearance | |

| 4 | 5 | ||

| 15 | Alieva Svetlana Gennadievna, commercial director, 154 | C/S | C/S |

| 2 | 2 | ||

Reflection of the last day

Filling out the last day of a business trip on the timesheet also has its own characteristics. According to the law, the last day is the day of return by transport to the place of main work. Wherein:

- If you arrive before 24:00 of the current day, this day is considered the last day. If a worker is next, then the business traveler should go to work as usual. If tomorrow is a day off, then you need to go to work after it.

- If transport arrives after midnight, then the day of arrival will be the next day.

Note:

- Example 1 . The employee arrived at his permanent work address at 21-30 on May 14. Accordingly, May 14 becomes the last day of the business trip. I have to go to work on May 15th.

- Example 2. An employee was brought in at 6.15 on May 12. May 12 is the last business trip day. Going to work on the morning of May 15th.

An employee can go to work on the same day if he so desires, but the employer has no right to force him.

Notes on the time sheet regarding the last day of the trip:

- The employee does not come to work. The report card is marked with code “K”.

- He goes to work.

You should be guided by local legal acts, since the current labor legislation does not provide any guidance on such a case.

If the management of the enterprise has secured the opportunity to pay the employee both the last day of business trip and the average salary at the workplace, then the employee will receive double payment. In other cases, the employee will receive either his one-day salary or pay for a day on a business trip.

While on sick leave

A difficult situation arises when an employee goes on a business trip while on sick leave. This is done only with his consent. That is:

- The manager does not have the right to send an employee on a business trip with sick leave.

- If the employee himself agreed to the trip, then he loses the right to compensation under the certificate of incapacity for work. This is noted on the report card as a regular business trip day: “K”.

- If sick leave is issued while on a business trip, the report says: “K/B”.

At the end of the billing period, you need to close the timesheet.

It is not recommended to close before the end of the last day, since situations are possible when one of the employees suddenly gets sick or goes on unpaid leave. There will be an excess payment of funds in the form of wages, which will have to be withheld from accruals for the subsequent period (Part 2 of Article 137 of the Labor Code of the Russian Federation).

The formation of a time sheet in “1C: Accounting 8” is shown in the video below: