Home/Time off/For a business trip

From time to time it may be necessary to send an employee on a business trip. In a number of situations, a citizen will be able to get time off. The specifics of providing additional days off are regulated by the Labor Code of the Russian Federation. However, this is not always the case. To understand in advance whether an employee can qualify for time off for work done, it is worth familiarizing yourself with the latest information on the topic.

Is time off provided for a business trip - what does the law say?

In general, in the Labor Code there is no such thing as “time off”. But in practice, many employers and employees encounter it. Time off means an additional day off, which is provided to employees of an enterprise for overtime.

Moreover, if the employee’s working time falls on an employee’s day off, then he can receive compensation from his superiors in two formats:

- increased wages for this period;

- provision of additional days off - time off.

However, such compensation for a business trip can only be provided if the person actually worked on a day off.

In short: time off is usually provided for business trips on weekends. That is, the person had to work on his day off. Moreover, at this time he can only be on his way to the place of business trip or, conversely, returning from a business trip.

To receive time off, you will need to follow a work schedule during your business trip. Only then can you choose the format of your own compensation. Moreover, the right to choose remains with the employee himself (Article 153 of the Labor Code of the Russian Federation).

If the business trip falls on a weekend

- Payments made in accordance with Art. 153 of the Labor Code of the Russian Federation, relate to compensation payments included in wages. Wages are remuneration for work. And the key word here is “labor”. A train ride or plane ride can hardly be considered time when an employee is doing work.

- Wages are paid on the basis of documents confirming the amount of time worked by the employee. The question arises: how to determine the number of hours that should be paid in double amount, and on the basis of what document?

+ 1761.9 rub. = 1961.9 rub. Payments for employees specially sent to perform work during weekends are shown in the table: Employees - piece workers Employees with time-based pay Employees with monthly salary Double piece rate Double daily or hourly rate Single daily or hourly rate in addition to salary, subject to work within the monthly standard Double daily or hourly rate subject to work in excess of the monthly norm. Time off is provided to employees only by their decision with payment for a working day at a single rate.

Registration procedure

Let’s say a person, while on a business trip, was forced to perform his work duties even on a day off. Then, upon arriving home, he may wonder how to take time off for a business trip. The employee himself, and not his employer, should initiate the receipt. Step by step actions will look like this:

- Even during the trip, you need to take care of the safety of tickets or other travel documents that would confirm the cost of travel and the duration of the business trip itself.

- Compose a written application addressed to the director with a request to compensate for going to work during a business trip on your day off. The document must indicate which specific method of compensation the employee chooses - money or time off.

An employer cannot force its employee to refuse time off. But the employee himself can choose an alternative to an additional day of rest - receive double payment for the overtime.

Even before dispatch, the employee must familiarize himself with the text of the order on the basis of which he is sent on a business trip. It is important that the following is stated there: the fact of performing work duties on a day off, the possibility of receiving compensation by the employee.

Payment for business trips on weekends: procedure

The court agreed with the applicant's arguments, declared his dismissal illegal and reinstated him at work, and also imposed on the manager the responsibility for reimbursement of official expenses and forced absenteeism. In addition, the decision stated that a business trip on weekends, for which the employee is entitled to pay in the amount of double income, should be carried out only with the consent of the person himself, unless there are legal grounds for this specified in Art. 113 of the Labor Code of the Russian Federation.

This document clearly states the point of the business trip, its timing (start and end), and the time the employee will spend on the trip. An employee can confirm the time spent on a business trip by the marks (signature of the personnel officer, seal of the institution) on the travel certificate, as well as by the dates indicated on train, plane tickets, etc.

Is there time off for a business trip during working hours?

Most often, employees of organizations go on business trips during working hours. Moreover, all business trips are included in a person’s job responsibilities. This means that the law does not provide time off or increased pay for being on a business trip.

The only option to receive compensation in this case is if the day of the business trip falls on some national holiday. Then time off for a business trip on a weekday will be due. The procedure for providing it will be the same as if a business trip falls on a weekend.

Normative base

An employer who sends his employee on a business trip for the first time should be guided, first of all, by Chapter 24 of the Labor Code of the Russian Federation. In it you can find clarification on most fundamental questions regarding:

- The procedure for sending employees to other cities on instructions from their superiors;

- Ways to pay for their efforts and reimburse costs;

- Whether the task needs to be formalized in an order, a report on its completion, and whether time off is allowed for a business trip, and most importantly, when.

In addition to the direct norm, the Labor Code contains references to other federal laws and government regulations. In particular, the details of sending ordinary workers on a business trip are described in Decree 749. But how to organize a trip and allow military personnel to take time off for a business trip in 2021, you need to look in Law 76 Federal Law on their status and Decree 1237 on issues of service.

The need to work on weekends that fall during the business trip must be voiced by the employer and agreed with the employee in writing, Art. 99 TK

Features of the term “business trip”

When many employees mention a possible business trip, they have light romantic associations about a pleasant trip to another city at the employer’s expense. Sometimes the flair of dreams takes an employee away from true understanding and essence.

In fact, business travel is one of the ways to solve pressing problems by sending one or more specialists to places located outside the home enterprise. To establish new contacts or support certain processes taking place remotely, an employee can be “sent” either to a neighboring locality or thousands of kilometers from home and work, including abroad.

Business trip on weekdays and weekends

The most productive time for fulfilling an employer’s assignment is during the daytime hours. After all, most Russian enterprises work eight hours a day from Monday to Friday, from 8 a.m. to 7 p.m.

That is why management tries to organize a business trip at the beginning or in the middle of the week in order to optimize the time spent and the financial costs of paying for it. It is quite logical that time off for a business trip on a weekday is only possible if the assigned employee completed the task assigned to him longer than a normal working day. A prerequisite for this is that the posted worker has a written instruction from his superiors about the need to work overtime, Art. 99 TK.

It's another matter when a business trip covers weekends or holidays. If it takes more than a week to achieve a positive result, then the number of days spent away from home will inevitably include non-working days. Since labor legislation fully applies to the work of business travelers, a person in another city has the right to rest on Saturday and Sunday. It is clear that then there cannot even be a reason to talk about getting time off for a business trip on a weekend.

In fairness, it should be noted that there are a number of situations when this point receives a slightly different interpretation. The right to time off for a business trip on weekends appears to those who:

- Leaves or returns back on his allotted day of weekly rest;

- By order of the business trip, he was obliged to carry out the assignment without taking into account the day of the week.

Working hours on business trips are the responsibility of the employer. It is the manager of the seconded specialist who must determine how, when and how much his subordinate should work. The main thing is that the production of hours and methods of compensating for overtime do not violate the norms of the Labor Code of the Russian Federation.

Reflection of a business trip and time off for it in the report card

To record working time, a personnel specialist uses a special timesheet. It displays all information about weekends, vacations and business trips. To receive time off, it is necessary that the information be indicated on the report card.

Most often, being on a business trip is indicated by the letter “K” or the numbers “06”. Some organizations also use their own designations. But the time spent working on a business trip is not entered on the timesheet.

If a business trip falls on a weekend, it is usually indicated by the combination of letters “РВ” or otherwise. A code must also be entered indicating that the person was on a trip during the business trip. This provides grounds for receiving time off or additional pay. If there are no designations, then compensation will not be claimed.

It is important to understand that not all the days a person is on a business trip are working. If his work schedule has not changed (for example, he rests on weekends), then there will be nothing to compensate. In this case, all the employee is entitled to is per diem and reimbursement of living expenses.

Business trips for military personnel

Military personnel, with the exception of conscripts, are, in general terms, the same hired workers as civilian specialists. Their fundamental rights and obligations as employees are outlined in the Labor Code. But those distinctive points that turn the work of career officers and contract soldiers into real service are defined in the Law on this status 76 Federal Law and Decree 1237. There is also a mention that on a regular business trip not related to exercises, combat operations and duty, the normal length of the working week must be observed.

If, by order of the command, you had to stay late in the service, then it should be followed by time off for the business trip. The servicemen's overtime hours are summed up and then compensated, releasing them from duty for the accumulated number of days. At the request of the military man himself, he can be given time off for a business trip by adding these days to his annual leave, Art. 11 76 Federal Law.

By sending a specialist to work at a distance from his usual place of employment and residence, the employer, to some extent, invades his personal life. Therefore, it is worth immediately deciding how the loss of leisure time with family spent on fulfilling the employer’s instructions will be compensated. Often it is important for a person to receive not so much monetary compensation as time off for a business trip in order to devote it to his family.

Zinovieva Natalya Igorevna

Lawyer at the Legal Defense Board. Specializes in handling cases related to labor disputes. Defense in court, preparation of claims and other regulatory documents to regulatory authorities.

Still have questions on the topic Ask a lawyer

Getting time off on a business trip

When going on a business trip, some citizens want to get time off to get to know a new place or take a short vacation in another city. But it will not be possible to legally obtain time off during a business trip, because a person is sent there to perform important duties. The only thing an employee can count on is to spend time at his own discretion on his day off. True, if he is asked to work on weekends, he will have to fulfill his duties. But then you can receive compensation.

Should I have a day off after a business trip?

If no work activity was actually carried out, a standard mark is affixed. There is no payment for this day, but the person will be able to receive daily allowance and accommodation compensation. Time Off During Business Travel There is no provision in the law regarding the provision of time off during travel to perform an organizational assignment.

Representatives of interested parties from the Ministry of Finance and the Ministry of Labor of Russia objected to the satisfaction of the citizen’s demands. In court, they explained that the provisions of the contested regulatory legal act do not contradict the current legislation of the Russian Federation and do not violate the rights of workers sent on business trips.

How to calculate salary for travel time

Accountants often ask the question of how to correctly calculate the salary for a weekend or holiday spent by a business traveler on the road: based on an hourly or daily rate? In other words, do you need to pay for the exact number of hours spent traveling that day? Or can you calculate wages based on 8 working hours a day, and if the journey takes two days off, then multiply 8 hours by 2?

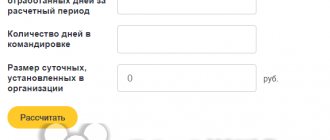

Calculate the salary of a posted worker using the web service Calculate for free

There is no exact answer either in the Labor Code or in other legal acts. We believe that both approaches are acceptable, since they do not contradict Article 153 of the Labor Code of the Russian Federation. It states that those who receive a salary must be paid for work on weekends and holidays at either daily or hourly double rates. This means that a company or entrepreneur has the right to choose any of these options and enshrine it in a local regulatory act, for example, in a regulation on business trips, or in a collective agreement.

Let's take a closer look at each of these options.

Payment based on the number of hours

This method of payment is familiar to accountants, because it is what is usually used in situations where a person spends weekends or holidays at his workplace. In relation to leaving or returning from a business trip, the “hourly” approach means that the time to be paid is determined on the basis of travel documents with departure and arrival stamps. Moreover, on the day of departure, the paid time is counted from the moment of departure until 24.00, and on the day of return - from 00.00 until the moment of arrival.

To calculate wages, the hourly tariff rate of the current month is used.

Example 1

When returning from a business trip, employee Sidorov boarded the train on Saturday at 6.00 and arrived at the destination station on the same day at 20.00. Sidorov’s place of residence is one hour’s drive from the station. The accountant determined that on Saturday Sidorov’s working time was 21 hours (from 00.00 to 20.00 plus 1 hour for the journey from the station to the house). Sidorov did not submit an application requesting additional time off instead of increased pay.

The standard working time in a given month for a 40-hour work week is 159 hours. Sidorov's salary is 50,000 rubles. The accountant calculated that Sidorov's hourly rate is 314.47 rubles. (RUB 50,000: 159 hours). For the time spent on the road when returning from a business trip, Sidorov was credited 13,217.4 rubles (314.47 rubles × 21 hours × 2).

Payment based on the number of days

This option requires less effort and time from accountants, since there is no need to calculate the exact number of hours on the road. Here, paid time is determined on the basis of 8 hours a day, and the daily tariff rate of the current month is used to calculate wages.

Example 2

Employee Kuznetsov went on a business trip on Sunday, the train departed at 15.00, and arrived at the destination station on the same day at 22.00. It took Kuznetsov two hours to get to the station.

The standard working time in a given month for a 40-hour work week is 21 days. Kuznetsov’s salary is 60,000 rubles. The accountant calculated that Kuznetsov’s daily rate is 2,857.14 rubles. (RUB 60,000: 21 days). For the time spent en route on a business trip, Kuznetsov was credited 5,714.28 rubles (2,857.14 rubles × 1 day × 2).

Labor Code of the Russian Federation

The Labor Code of the Russian Federation does not contain the concept of “time off”. In practice, the definition refers to the time that is provided to a citizen for rest for a previously worked period of time. Article 167 of the Labor Code of the Russian Federation describes the situation when a day off coincides with the period of being on a business trip. Something like this can happen:

- directly at the place of work;

- during the journey to the place of work;

- the citizen was specifically sent to perform an official task during his legal vacation.

Regardless of where he is, a person must adhere to a work schedule. The employee is paid the average salary according to the employer's standards. If a citizen is forced to go to carry out an assignment from an employer by order of the company, after returning back he has the right to claim compensation. According to Decree of the Government of the Russian Federation No. 742, the moment of departure is the date of departure of the vehicle from the locality in which the citizen carries out permanent work activities. The moment of arrival will be considered the date of arrival.

For your information

Fixes the possibility of receiving an alternative reward. A person has the right to apply to an employer for double pay. Payment is provided based only on the actual time worked.

After arriving from a business trip, is there a day off?

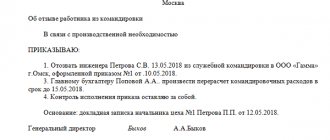

The issue of going to work on the day of poisoning and returning from a business trip must be agreed upon in advance with the employer, clause 4 of Resolution 749. Order on time off When the plan for carrying out activities on a business trip is known in advance, the employee’s consent to overtime work and his written request on the form of compensation for such work have been obtained (vacation or double average daily rate), the order to be sent on a business trip is drawn up taking into account the date of time off for work on a business trip.

If everything did not happen according to the preliminary plan, then, after the specialist returns, an order is issued to compensate for labor in excess of the monthly norm with extra days of rest. Peculiarities of working on business trips for women The Labor Code, although it prohibits discrimination against workers based on gender, still identifies women with special needs as a separate group.

If an employee stays after a business trip for personal reasons, at whose expense are the return tickets?

L.M. Zolina, author of the answer, Zolina consultant for accounting and taxation at Askon

QUESTION

An employee is sent on a one-day business trip to another city on Friday (before the day off). Payment for tickets to the business trip city at the expense of the company. The employee decided to stay on his personal business for the weekend in the city of his business trip.

Questions:

- At whose expense is the return ticket purchased?

- Taxation of return ticket.

ANSWER

Sending an employee on a business trip is formalized by order. The employee must follow the employer's instructions, including the dates of departure for a business trip and return. Consequently, the employee was obliged to return from a business trip on Friday. Weekends in your situation are not included during a business trip.

However, if, according to the work schedule, Saturday and Sunday are days off for an employee, then with the consent of the employer, the employee can return from a business trip not on Friday, but on a day off. The time of the business trip in this case will not change, it will be a one-day business trip, but the organization purchases a return ticket at its own expense as for returning from a business trip.

But even if you agree with the manager on the date of return from a business trip on a day off, you cannot exclude the possibility that during tax control measures, payment of the cost of a return ticket may be qualified by the inspectors as payment by the organization of the ticket not in connection with the business trip, but in the interests of the employee. As a result, the cost of the ticket will be recognized as the employee’s income in kind, subject to personal income tax, received from the organization, but not as reimbursement of travel expenses from the place of business trip to the place of permanent work.

If the issue of returning from a business trip has not been agreed upon with the manager, the cost of a return ticket after the end of the business trip cannot be recognized as a reasonable expense and taken into account for tax purposes. The employee must purchase a return ticket at his own expense.

An employee has the right to write a statement to the manager with a request to pay for travel after the weekend, and the manager has the right to refuse him on legal grounds.

If the manager decides to pay for the employee’s travel back after the end of the business trip, then these expenses cannot be taken into account for profit tax purposes, and the amount of payment (reimbursement for the cost of tickets) is subject to personal income tax and insurance contributions.

JUSTIFICATION

According to Article 166 of the Labor Code of the Russian Federation, a business trip is a trip by an employee by order of the employer for a certain period of time to carry out an official assignment outside the place of permanent work.

Clause 3 of the Regulations on the peculiarities of sending employees on business trips, approved by Decree of the Government of the Russian Federation of October 13, 2008 N 749, states that employees are sent on business trips on the basis of a written decision of the employer for a certain period of time to carry out an official assignment outside their place of permanent work.

Based on Art. 168 of the Labor Code of the Russian Federation, in the case of being sent on a business trip, the employer is obliged to reimburse the employee, in particular, travel expenses.

In accordance with paragraphs. 12 clause 1 art. 264 of the Tax Code of the Russian Federation, an employee’s travel to the place of business trip and back to the place of permanent work is included in other expenses taken into account when taxing profits.

The question of the legality of recognizing as expenses the cost of travel from the place of business trip to the place of permanent work (return travel) in the case where, by agreement with the employer, the posted employee remains at the place of business trip for the weekend after the end of the business trip, is not regulated by law.

At the moment, specialists of the Ministry of Finance of Russia have formed the following approach to this problem (Letters of the Ministry of Finance of Russia dated 09/03/2012 N 03-03-06/1/456, dated 08/05/2008 N 03-04-06-01/246): when assigning costs to pay for the employee’s travel to the place of business trip and back to the expenses taken into account for tax purposes of the profits of organizations, it is necessary to take into account that these costs would have been incurred in any case, regardless of the length of the employee’s stay at the destination. Thus, regardless of the time spent at the destination, the costs of purchasing a travel document for the employee’s travel from the place of business trip to the place of permanent work can be taken into account as expenses for corporate income tax purposes if the date of departure of the employee from the place of business trip to the place of permanent work coincides with the date on which the above travel ticket was purchased, as well as if the delay in the departure of the business traveler from the place of business trip (or the earlier departure of the employee to the destination) occurred with the permission of the manager, confirming in accordance with the established procedure the expediency of the expenses incurred.

If, after the end of a business trip, an employee of an organization uses days off at his own discretion without agreement with the manager, the expenses for paying for the employee’s travel do not meet the criteria for recognition of expenses provided for in Article 252 of the Tax Code of the Russian Federation, since the organization in this case pays for the return of the employee not from a business trip.

In accordance with paragraph 1 of Art. 210 of the Tax Code of the Russian Federation, when determining the tax base, all income of the taxpayer received by him, both in cash and in kind, or the right to dispose of which he has acquired, is taken into account, as well as income in the form of material benefits, determined in accordance with Art. 212 of the Tax Code of the Russian Federation.

At the same time, according to Art. 41 of the Tax Code of the Russian Federation, income for the purposes under consideration is recognized as economic benefit received by the taxpayer in cash or in kind, determined in accordance with the provisions of Chapter. 23 of the Tax Code of the Russian Federation and taken into account if it is possible to assess it and to the extent that such benefit can be assessed.

The start and end days of an employee’s business trip should be considered the days indicated in the order sending the employee on a business trip (taking into account the travel time).

In a letter dated September 22, 2009 N 03-04-06-01/244, the Ministry of Finance of the Russian Federation expressed the opinion that the payment by an organization for an employee of a ticket with an arrival date later than the end of the business trip indicated in the business trip order is his income received in kind. The cost of the said ticket is subject to taxation in accordance with the provisions of Art. 211 of the Code.

At the same time, it should be noted that there is another, not so categorical point of view on the issue of imposing personal income tax on the cost of return travel in a situation where the employee was delayed at the place of business trip with the permission of the employer for personal reasons. Thus, the Letter of the Ministry of Finance of Russia dated August 10, 2012 N 03-04-06/6-234 states: if an employee remains at the place of business trip, using weekends or non-working holidays, the organization does not pay for travel from the place of free time from work to the place of work. will lead to economic benefits.